Federated Money Market Funds' Exposure to International Debt

advertisement

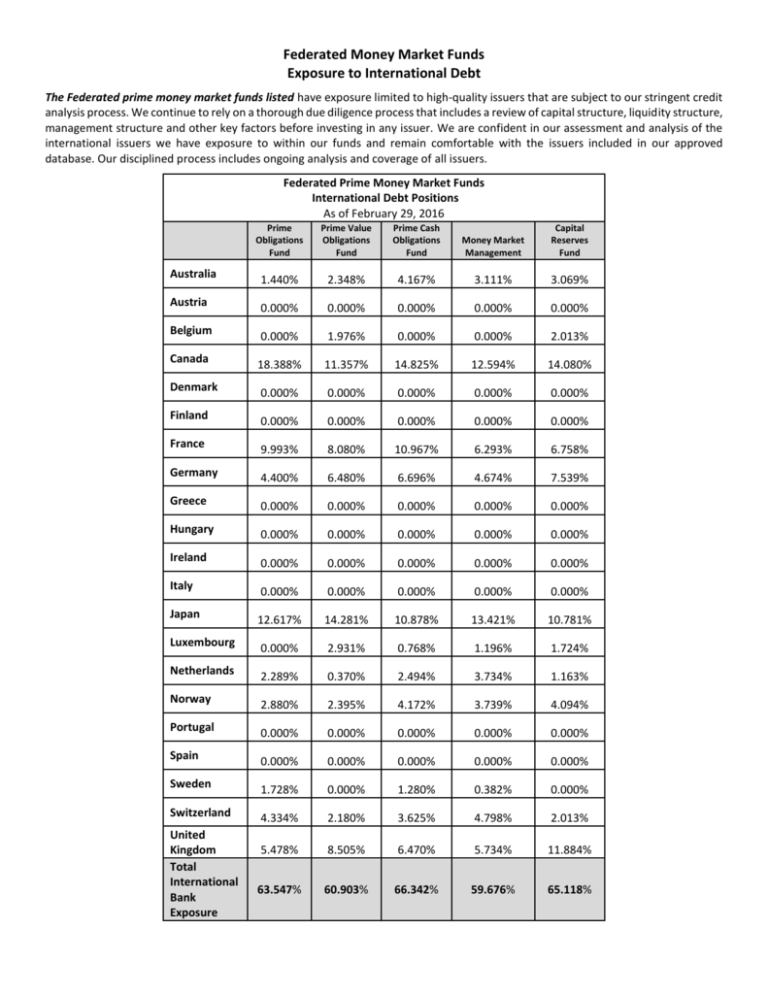

Federated Money Market Funds Exposure to International Debt The Federated prime money market funds listed have exposure limited to high‐quality issuers that are subject to our stringent credit analysis process. We continue to rely on a thorough due diligence process that includes a review of capital structure, liquidity structure, management structure and other key factors before investing in any issuer. We are confident in our assessment and analysis of the international issuers we have exposure to within our funds and remain comfortable with the issuers included in our approved database. Our disciplined process includes ongoing analysis and coverage of all issuers. Federated Prime Money Market Funds International Debt Positions As of February 29, 2016 Prime Obligations Fund Prime Value Obligations Fund Prime Cash Obligations Fund Money Market Management Capital Reserves Fund Australia 1.440% 2.348% 4.167% 3.111% 3.069% Austria 0.000% 0.000% 0.000% 0.000% 0.000% Belgium 0.000% 1.976% 0.000% 0.000% 2.013% Canada 18.388% 11.357% 14.825% 12.594% 14.080% Denmark 0.000% 0.000% 0.000% 0.000% 0.000% Finland 0.000% 0.000% 0.000% 0.000% 0.000% France 9.993% 8.080% 10.967% 6.293% 6.758% Germany 4.400% 6.480% 6.696% 4.674% 7.539% Greece 0.000% 0.000% 0.000% 0.000% 0.000% Hungary 0.000% 0.000% 0.000% 0.000% 0.000% Ireland 0.000% 0.000% 0.000% 0.000% 0.000% Italy 0.000% 0.000% 0.000% 0.000% 0.000% Japan 12.617% 14.281% 10.878% 13.421% 10.781% Luxembourg 0.000% 2.931% 0.768% 1.196% 1.724% Netherlands 2.289% 0.370% 2.494% 3.734% 1.163% Norway 2.880% 2.395% 4.172% 3.739% 4.094% Portugal 0.000% 0.000% 0.000% 0.000% 0.000% Spain 0.000% 0.000% 0.000% 0.000% 0.000% Sweden 1.728% 0.000% 1.280% 0.382% 0.000% Switzerland 4.334% 2.180% 3.625% 4.798% 2.013% 5.478% 8.505% 6.470% 5.734% 11.884% 63.547% 60.903% 66.342% 59.676% 65.118% United Kingdom Total International Bank Exposure The Federated municipal money market funds listed have no direct exposure to the international sovereigns shown in the table below. Any indirect exposure is limited to municipal variable rate demand notes, commercial paper and tender option bonds with high‐quality bank names as credit enhancement. These structured municipal securities and bank names are subject to our stringent credit analysis process. We continue to rely on a thorough due diligence process that includes a review of capital structure, liquidity structure, management structure and other key factors before investing in any issuer. We are confident in our assessment and analysis of the international bank names we have exposure to within our funds and remain comfortable with the names included in our approved database. Our disciplined process includes ongoing analysis and coverage of all issuers. Federated Municipal Money Market Funds International Bank Positions As of February 29, 2016 California Municipal Connecticut Municipal Cash Trust Cash Trust Florida Municipal Cash Trust Michigan Municipal Cash Trust 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% 1.480% 7.474% 4.703% 10.428% 14.398% 1.586% Denmark 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Finland 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% France 0.438% 1.147% 0.000% 0.000% 0.000% 0.000% Germany 12.815% 9.712% 11.333% 7.934% 11.131% 0.000% Greece 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Hungary 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Ireland 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Italy 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Japan 2.399% 2.775% 4.420% 0.000% 0.000% 11.710% Netherlands 3.923% 0.436% 0.000% 0.000% 0.000% 0.000% Norway 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Portugal 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Spain 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Sweden 0.000% 0.000% 0.000% 0.000% 0.000% 0.000% Switzerland 0.000% 0.827% 1.578% 0.000% 0.908% 0.000% United Kingdom 2.698% 4.139% 0.555% 2.578% 5.331% 9.442% Total International Bank Exposure 23.753% 26.510% 22.589% 20.940% 31.768% 22.738% Municipal Obligations Fund Tax-Free Obligations Fund Austria 0.000% 0.000% 0.000% Australia 0.000% 0.000% Belgium 0.000% Canada Past performance is no guarantee of future results. An investment in money market funds is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in these funds. Comments as of February 29, 2016 and are subject to change based on market conditions and other factors. These views should not be construed as a recommendation for any specific security. Current and future portfolio holdings are subject to risk. The holdings percentages are based on net assets at the close of business on February 29, 2016 and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement purposes. For more complete information, visit FederatedInvestors.com or contact your Federated representative by calling 1-800-341-7400 for a summary prospectus or prospectus. You should consider the fund’s investment objectives, risks, charges, and expenses carefully before you invest. Information about these and other important subjects is in the fund’s summary prospectus or prospectus which you should read carefully before investing. Federated Securities Corp., Distributor Federated is a registered trademark of Federated Investors, Inc. 2016 © Federated Investors, Inc. Federated Investors, Inc. Federated Investors Tower 1001 Liberty Avenue Pittsburgh, PA 15222-3779 FederatedInvestors.com 1-800-341-7400 44043 (3/16)