Multinational Finance and International Risk Management

advertisement

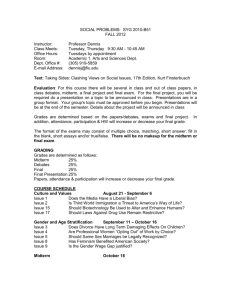

MULTINATIONAL FINANCE AND INTERNATIONAL RISK MANAGEMENT 國際金融與危機管理 NATIONAL TAIWAN UNIVERSITY SPRING 2010 FRIDAY 1130 - 1430 INSTRUCTOR: CHARLES CHANG (VISITING SCHOLAR) DESCRIPTION: The course investigates issues that arise when businesses are run or investments are made in an international setting. It focuses first on the issue of currency risk and the impact of it on multinational corporations and investing practices. It explores the many factors contributing to exchange rate determination, examines currency risk from both transaction and translation perspectives, and discusses currency derivative markets and hedging strategies. The course then shifts its focus to a critical exploration of the state of and difference between capital markets around the world. Students will gain hands-on experiences in the subtle but substantial complexities that arise when doing business and investing outside of a single, well-developed economy. At this point in the curriculum, applications to and case(s) in the hospitality industry will be explored. Importantly, the course focuses on group discussion and presentations of handson research and modeling. TEXT: Kirt Butler. Multinational Finance. Thomson 2004 [3rd edition] Factiva (Wall Street Journal, Financial Times) GRADING: The following is a tentative blueprint for how grades will be assigned. Please keep in mind that this is VERY tentative: PARTICIPATION HOMEWORK/CASES MIDTERM FINAL 5 OR SO MARCH 26 JUNE 18, 25 10% 30% 30% 30% Homework will be assigned almost every other week. Though virtually all assignments are group projects, they are meant to be done independently unless otherwise stipulated and will be due at the beginning of class one week after they are assigned. Cases and questions are designed to be as realistic as possible. As such, they will often not have a single correct answer. The intuition used for and logical progression of each solution should be well-formed and discussed. As always, all work must be shown to receive credit. Whenever spreadsheet solutions or presentations are required, physical presentation will be a significant portion of the final grade. At all times throughout the 1 course of this semester, students will be held to both the spirit and regulation of the Code of Academic Integrity. For the purpose of group assignments, students will be allowed to form their own groups of 3. Groups will be assigned a group grade and all members of the group will receive that same group grade. Division of work responsibilities, completion of individual tasks, and any internal disputes must be resolved by the group members. All members of the group will be expected to contribute to and present during any and all case presentations. Each class session will attempt to build on the material previously covered. Therefore, missing even a single class can adversely affect your ability to keep up with coursework. You are expected to attend all classes. If, for some reason, you must miss a class, it is your responsibility to make sure that you inform yourself of what was discussed in the class before you come to the next class. In addition, you are expected to be on time for each class. Since this class will very much be centered around discussion of cases and examples, critical examination of theoretical and intuitive ideas, mutual learning, and participation will be essential to the learning process. The midterm is scheduled for March 15 from 7:30PM to 10:30PM and will be closed book, closed notes. However, you will be allowed to bring a one-page formula sheet to the exam. For carrying out the computation necessary for answering exam questions, you are allowed to use standard financial or graphing calculators. You may NOT use palm devices, laptops, or any other computational device with spreadsheet capabilities. Any violation of this policy will be dealt with as a violation of the Code of Academic Integrity. The Final project presentations will take place May 3 from 7:30PM to 10:30PM. FURTHER, PLEASE NOTE THAT NO EXCEPTIONS WILL BE MADE FOR THE MIDTERM OR FOR THE FINAL. NO MAKE UP EXAMS WILL BE OFFERED. 2 VERY TENTATIVE SCHEDULE: Week 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Topic Introduction to International Markets and Exchange Risk: Discussed are the state of the world’s major economies, the International Monetary System, and impact of currency risk. Exchange Rate Determination: Classical models of exchange rates will be examined. Included will be interest rate and purchasing power parity arguments, concepts in macroeconomics and balance of trade. Practical 1. Exchange Rate Determination Cont’d: Financial models of exchange rates including sticky prices and fixed exchange collapse models will be discussed. A microstructure approach to exchange rates will be previewed via a brief introduction to the ideas of inventory and information driven demand. Exchange Rate Determination Cont’d: The microstructure approach as well as hybrid approaches to exchange rates will be examined. Potential for improvements to exchange rate modeling will be discussed. Currency Risk: Impact of exchange rate fluctuation is studied. Transaction and translation risk will be explored. Case 1 Currency Derivatives: Currency derivatives and their application towards hedging currency risk will be discussed. A variety of differing techniques as well as the downfalls and residual risks of each will be critically examined. Transaction Risk: Risk involved with transactions and differential costs are investigated. Case 2 (due end of Week 9). Midterm: Topics summarized and midterm. Translation Risk: The effects of accounting translation and functional currency are illuminated in the context of earnings management. Operation Risk: Operational methods of hedging and issues of multinational corporation matrix hedges will be discussed. Importantly, tax concerns will be addressed. Investing in International Markets: ICAPM and the impact of the existence of a global market portfolio will be introduced. Home bias will be discussed as well the potential gains/losses associated with proper use of global markets for diversification. Cohort Presentations: Student cohorts will report findings on country risk followed by discussions of relevance/investment possibilities and firm-level concerns. Topics included will be lack of market completeness (and hedging product availability), the lack of access to private capital, the non-existence of risk-free sovereign debt and flight to quality, and emerging and controlledcurrency market concerns. Summary Concerns: Final discussions of portfolio construction details and concerns as well as functional modeling of the firm-level exchange translation management dilemma will be presented. Final Case Presentations 3