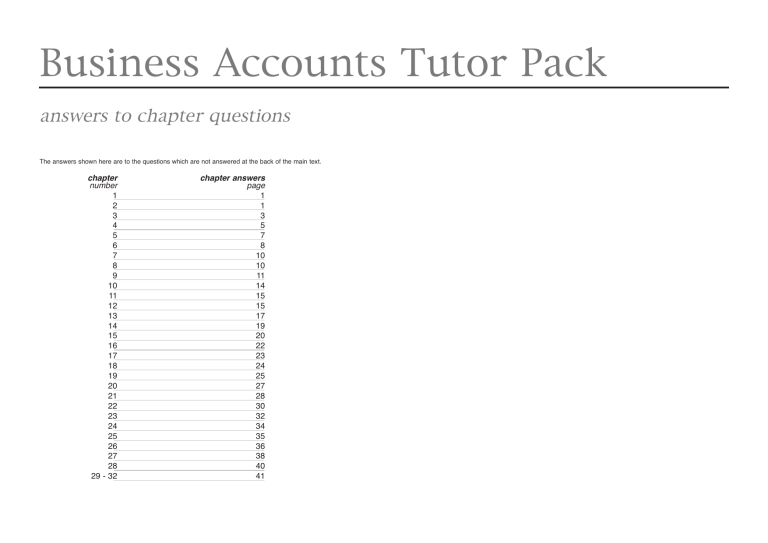

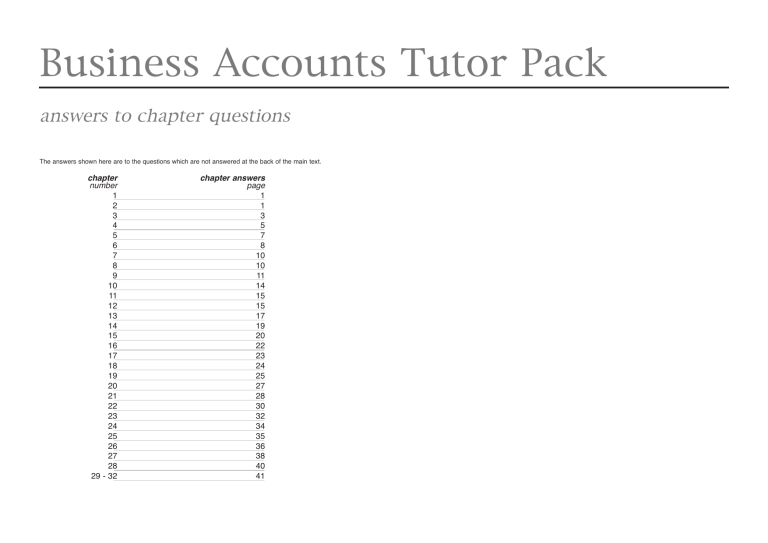

Business Accounts Tutor Pack

answers to chapter questions

The answers shown here are to the questions which are not answered at the back of the main text.

chapter

number

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29 - 32

chapter answers

page

1

1

3

5

7

8

10

10

11

14

15

15

17

19

20

22

23

24

25

27

28

30

32

34

35

36

38

40

41

© Osborne Books Limited 2012

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted

in any form or by any means, electronic, mechanical, photo-copying, recording or otherwise, without the prior

consent of the publishers, or in accordance with the provisions of the Copyright, Designs and Patents Act 1988,

or under the terms of any licence permitting limited copying issued by the Copyright Licensing Agency, 90

Tottenham Court Road, London W1P 9HE.

Osborne Books is grateful to Roger Petheram for checking the answers.

All answers are the responsibility of the publisher.

Published by Osborne Books Limited

Tel 01905 748071

Email books@osbornebooks.co.uk

www.osbornebooks.co.uk

1.6

CHAPTER 1 What are Business Accounts?

1.2

•

•

•

•

•

1.3

•

•

•

1.5

•

initial recording of transactions

recording financial transactions in primary accounting records, or books of prime entry

double-entry accounts system

transfer from primary accounting records into the double-entry book-keeping system of accounts in

the ledger

•

trial balance

extraction of figures from all the double-entry accounts to check their accuracy

•

final accounts

production of a profit and loss account and a balance sheet

Information from the accounting system includes:

•

purchases to date

•

sales to date

•

expenses to date

•

debtors – total amount owed to the business, and individual debtors

•

creditors – total amount owed by the business, and individual creditors

•

assets owned

•

liabilities owed

•

profit during a particular period

•

1.4

documents

processing of prime documents relating to financial transactions

•

2.1

Capital Account

Dr

Computer Account

Cr

Rent Paid Account

Cr

Wages Account

Cr

Dr

Bank Loan Account

Cr

Dr

Commission Received Account

Dr

Drawings Account

20-1

6 Feb

financial accountant

– preparation of final accounts

– negotiation with Inland Revenue on taxation matters

– for a limited company, preparation of final accounts which comply with the Companies Act 1985

Dr

cost and management accountant

– obtains information about recent costs of the business, and costs of products/services

– estimates costs for the future, and prepares budgets

– prepares reports and makes recommendations to the owner(s)/managers

20-1

8 Feb

auditors – external

statutory audit addressed to the shareholders of a limited company certifying that the accounts show

a 'true and fair view' of the business and comply with the legal requirements of the Companies Act

1985

Dr

20-1

12 Feb

25 Feb

auditors – internal

internal checking and control procedures of the business in which they are employed

20-1

•

•

•

Business entity – the accounts record and report on the financial transactions of a particular

business, and not the owner's personal financial transactions.

assets – items owned by a business; liabilities – items owed by a business

debtors – individuals or businesses who owe money in respect of goods or services supplied by the

business; creditors – individuals or businesses to whom money is owed by the business

20-1

23 Feb

purchases – goods bought, either on credit or for cash, which are intended to be resold later; sales –

the sale of goods, whether on credit or for cash, in which the business trades

credit purchases – goods bought, with payment to be made at a later date; cash purchases – goods

bought and paid for immediately

asset of van increases by £6,000

asset of bank decreases by £6,000

asset £11,000 – liability £3,000 = capital £8,000

Dr

Money measurement – the accounting system uses money as the common denominator in recording

and reporting all business transactions; thus the loyalty of a firm's workforce or the quality of a product

cannot be recorded because these cannot be reported in money terms.

•

asset of bank increases by £3,000

liability of loan increases by £3,000

asset £11,000 – liability £3,000 = capital £8,000

20-1

20-1

(b)

asset of computer increases by £4,000

asset of bank decreases by £4,000

asset £8,000 – liability £0 = capital £8,000

CHAPTER 2 Double-entry Book-keeping: First Principles

In addition, there are likely to be advertisements for book-keepers to carry out various aspects of business

accounting.

(a)

asset of bank increases by £8,000

capital increases by £8,000

asset £8,000 – liability £0 = capital £8,000

1

£

Bank

Bank

Bank

Bank

£

2,000

£

750

£

425

380

£

£

Bank

£

200

20-1

1 Feb

Bank

20-1

£

20-1

20-1

20 Feb

20-1

£

7,500

£

20-1

20-1

14 Feb

Cr

£

Bank

Bank

£

2,500

Cr

£

145

Cr

£

Dr

20-1

28 Feb

2.3

Dr

20-5

1 Aug

15 Aug

20 Aug

25 Aug

Bank

Van Account

£

20-1

6,000

Cr

£

Capital

S Orton: loan

Office fittings

Commission received

Bank Account

£

20-5

5,000

3 Aug

1,000

7 Aug

250

12 Aug

150

27 Aug

Computer

Rent paid

Office fittings

S Orton: loan

Cr

£

1,800

100

2,000

150

Bank

Cr

£

5,000

Capital Account

£

20-5

1 Aug

Dr

20-5

Dr

20-5

3 Aug

Dr

20-5

7 Aug

Dr

20-5

12 Aug

Dr

20-5

27 Aug

Dr

20-5

17 Aug

Dr

20-7

1 Nov

7 Nov

23 Nov

25 Nov

28 Nov

Dr

20-7

3 Nov

Dr

Bank

Bank

Rent Paid Account

£

20-5

100

Cr

£

20-7

10 Nov

Commission Received Account

£

20-5

10 Aug Cash

25 Aug Bank

Cr

£

200

150

20-7

12 Nov

Cash Account

£

20-5

200

17 Aug

Cr

£

100

Drawings

Bank

Office Fittings Account

£

20-5

2,000

20 Aug Bank

Cr

£

250

Bank

Sally Orton: Loan Account

£

20-5

150

15 Aug Bank

Cr

£

1,000

Cash

Drawings Account

£

20-5

100

Dr

Dr

20-7

14 Nov

Dr

20-7

15 Nov

Bank

Bank

Bank

Bank

Commission received

20-7

1 Nov

Photocopier

Office premises

Business rates

Office fittings

Wages

Bank

Bank

£

75,000

Cr

£

20-7

7 Nov

Bank

£

£

70,000

Office Premises Account

Cr

Rates Account

Cr

Office Fittings Account

Cr

£

130,000

20-7

£

3,000

20-7

£

1,500

20-7

25 Nov

Bank

£

200

£

300

20-7

18 Nov

23 Nov

Drawings

Bank

£

125

100

20-7

15 Nov

28 Nov

Cash

Bank

£

300

200

Cash Account

£

125

20-7

£

250

20-7

Wages Account

£

£

Drawings Account

Dr

Cr

Bank Loan Account

20-7

Dr

20-7

20 Nov

£

2,500

130,000

3,000

1,500

250

Cr

£

2,500

£

Cash

Cr

Photocopier Account

Commission Received Account

20-7

18 Nov

2

20-7

3 Nov

10 Nov

12 Nov

14 Nov

20 Nov

Dr

20-7

Cr

£

£

75,000

70,000

100

200

200

£

20-7

Dr

Bank Account

Capital Account

Dr

Cr

£

Commission received

Capital

Bank loan

Cash

Office fittings

Commission received

20-7

Computer Account

£

20-5

1,800

Dr

20-5

Dr

20-5

10 Aug

2.5

Cr

Cr

Cr

£

Cr

£

2.6

20-7

1 Nov

3 Nov

7 Nov

10 Nov

12 Nov

14 Nov

20 Nov

23 Nov

25 Nov

28 Nov

Bank Account

Debit

£

75,000

Capital

Photocopier

Bank loan

Office premises

Rates

Office fittings

Wages

Cash

Office fittings

Commission received

70,000

100

200

200

Credit

£

2,500

130,000

3,000

1,500

250

Balance

£

75,000

72,500

142,500

12,500

9,500

8,000

7,750

7,850

8,050

8,250

Dr

20-2

22 Oct

Dr

Dr

Dr

Dr

Dr

Dr

Dr

Dr

Dr

Dr

Dr

20-2

25 Oct

3.5

CHAPTER 3 Double-entry Book-keeping: Further Transactions

3.1

Bank Account

Dr

20-2

1 Oct

4 Oct

8 Oct

12 Oct

18 Oct

30 Oct

Capital

Sales

Sales

K Smithson: loan

Sales

Sales

20-2

£

Dr

Dr

20-2

20-2

1 Oct

Bank

Bank

Bank

£

200

90

250

Purchases

Purchases

Purchases

Delivery van

Wages

Bank

Bank

Bank

Bank

Bank

J Smithson: Loan Account

£

20-2

12 Oct

Dr

20-2

26 Apr

Bank

Cr

£

Bank

Wages Account

£

20-2

375

Cr

£

Purchases Account

£

20-2

200

250

Cr

£

Wyvern Producers Ltd

A Larsen

Purchases returns

Bank

Purchases returns

£

2,500

£

Dr

20-2

5 Apr

Cr

Dr

20-2

7 Apr

12 Apr

22 Apr

£

150

125

155

110

Dr

20-2

Cr

£

2,000

3

Wyvern Producers Ltd

£

20-2

50

2 Apr Purchases

150

£

45

A Larsen

20-2

4 Apr

Sales Account

£

20-2

5 Apr

7 Apr

12 Apr

28 Apr

Dr

20-2

Cr

20-2

20-2

4 Oct

8 Oct

18 Oct

30 Oct

£

200

90

250

4,000

375

Cr

Sales Account

£

Dr

20-2

9 Apr

20 Apr

Cr

Purchases Account

Dr

20-2

20-2

2 Oct

6 Oct

14 Oct

22 Oct

25 Oct

Capital Account

Dr

20-2

2 Oct

6 Oct

14 Oct

£

2,500

150

125

2,000

155

110

Dr

20-2

2 Apr

4 Apr

Bank

Delivery Van Account

£

20-2

4,000

Sales

Sales

Sales

Pershore Patisserie

Purchases

Cr

£

250

Pershore Patisserie

Bank

Bank

Cash

Cr

£

150

175

110

100

Pershore Patisserie

£

20-2

150

15 Apr Sales returns

22 Apr Bank

Bank Account

£

20-2

175

20 Apr

110

30 Apr

125

Cr

£

200

Cr

£

25

125

Wyvern Producers Ltd

Amery Scales Ltd

Cr

£

150

250

Purchases Returns Account

£

20-2

9 Apr Wyvern Producers Ltd

26 Apr A Larsen

Cr

£

50

45

Dr

20-2

15 Apr

Dr

20-2

17 Apr

Dr

20-2

30 Apr

Dr

20-2

28 Apr

Dr

20-2

29 Apr

3.6

Dr

20-3

2 Jun

7 Jun

23 Jun

Dr

20-3

6 Jun

18 Jun

Pershore Patisserie

Amery Scales Ltd

Cr

£

Weighing Machine Account

£

20-2

250

Cr

£

Bank

Amery Scales Ltd

£

20-2

250

17 Apr Weighing machine

Sales

Cash Account

£

20-2

100

29 Apr

Cash

Wages Account

£

20-2

90

Cr

£

Purchases Account

£

20-3

350

400

285

Cr

£

Designs Ltd

Mercia Knitwear Ltd

Designs Ltd

Purchases returns

Bank

Designs Ltd

£

20-3

100

2 Jun

250

23 Jun

Sales Account

£

20-3

4 Jun

5 Jun

10 Jun

12 Jun

20 Jun

Dr

20-3

Dr

20-3

4 Jun

12 Jun

28 Jun

Sales Returns Account

£

20-2

25

Sales

Sales

Wyvern Trade Supplies

Bank Account

£

20-3

220

18 Jun

175

300

Wages

Purchases

Purchases

Dr

20-3

5 Jun

20 Jun

Dr

20-3

10 Jun

Dr

20-3

15 Jun

Dr

20-3

26 Jun

Cr

£

350

285

Bank

Cash

Wyvern Trade Supplies

Bank

Cash

Designs Ltd

Cr

£

250

3.7

Rent paid

Sales

Wyvern Trade Supplies

Cr

£

400

Wyvern Trade Supplies

£

20-3

350

15 Jun Sales returns

28 Jun Bank

Cr

£

50

300

Sales Returns Account

£

20-3

50

Cr

£

Rent Paid Account

£

20-3

125

Cr

£

Cash

Transaction

(a)

(c)

(d)

(e)

(f)

(g)

(h)

Cr

£

100

80

Mercia Knitwear Ltd

£

20-3

80

7 Jun Purchases

Purchases returns

(b)

4

Cr

£

125

Purchases Returns Account

£

20-3

6 Jun Designs Ltd

17 Jun Mercia Knitwear Ltd

Dr

20-3

17 Jun

Cr

£

90

Cr

£

220

115

350

175

180

Sales

Sales

Dr

20-3

Cr

£

250

Cash Account

£

20-3

115

26 Jun

180

Account debited

Account credited

bank

sales

purchases

purchases

L Harris

Teme Traders

sales returns

bank

cash

bank

Teme Traders

sales

purchases returns

L Harris

D Perkins: loan

bank

4.4

CHAPTER 4 Business Documents

4.3

INVOICE

INVOICE

DEANSWAY TRADING COMPANY

JANE SMITH, FASHION WHOLESALER

Unit 21, Eastern Industrial Estate, Wyvern, Wyvernshire, WY1 3XJ

Tel 01927 354172 Fax 01927 354173

VAT REG GB 0745 4731 41

invoice to

Excel Fashions

49 Highland Street

Longton

Mercia LT3 2XL

deliver to

as above

quantity

5

3

4

description

Dresses

Suits

Coats

terms

2.5% cash discount for full settlement

within 14 days

Net 30 days

Carriage paid

E & OE

invoice no

account

your reference

2451

date/tax point

today

price

30.00

45.50

51.50

unit

each

each

each

total

150.00

136.50

206.00

The Model Office, Deansway, Rowcester, RW1 2EJ

Tel 01908 765314 Fax 01908 765951

VAT REG GB 0745 4672 76

invoice to

The Card Shop

126 The Cornbow

Teamington Spa

Wyvernshire WY33 0EG

deliver to

as above

discount

%

net

quantity

description

0.00 150.00

0.00 136.50

0.00 206.00

5

100

250

492.50

terms

2.5% cash discount for full settlement

within 14 days

Net 30 days

Carriage paid

E & OE

GOODS TOTAL

VAT

TOTAL

* £492.50 x 97.5% x 20% = £96.03 VAT

Note: Students can complete details for telephone, fax, VAT registration number and order number

96.03*

588.53

5

Assorted rubbers

Shorthand notebooks

Ring Binders

invoice no

account

your reference

8234

date/tax point

today

price

unit

5.00

4.00

0.50

box

10

each

total

25.00

40.00

125.00

discount

%

GOODS TOTAL

VAT

TOTAL

* £190.00 x 97.5% x 20% = £37.05 VAT

Note: Students can complete details for telephone, fax, VAT registration number and order number

0.00

0.00

0.00

net

25.00

40.00

125.00

190.00

37.05*

227.05

4.5

Dr

20-4

10 Feb

10 Feb

24 Feb

24 Feb

STATEMENT OF ACCOUNT

Dr

TO

account

J Wilson

date

1

3

10

23

28

20-Mar

Mar

Mar

Mar

Mar

date

no.

details

8119

CN345

8245

debit

£

Balance b/d

Invoice

Cheque

Credit Note

Invoice

210.00

180.00

AMOUNT NOW DUE

4.6

Dr

20-4

2 Feb

16 Feb

Dr

20-4

G Lewis

G Lewis

Purchases Account

£

20-4

200

160

Sales Account

£

20-4

4 Feb

7 Feb

20-4

4 Feb

3993

31 March 20--

credit

£

145.00

50.00

Dr

20-4

7 Feb

balance

£

145.00

355.00

210.00

160.00

340.00

Dr

20-4

12 Feb

20 Feb

Dr

Dr

Dr

Dr

Dr

Sales

£

240

L Jarvis

G Patel

340.00

6

150

240

20-4

2 Feb

16 Feb

L Jarvis

20-4

12 Feb

12 Feb

G Patel

20-4

20 Feb

20 Feb

20-4

10 Feb

24 Feb

Bank

Discount allowed

Bank

Discount allowed

G Lewis

G Lewis

Dr

Discount Allowed Account

£

L Jarvis

G Patel

£

3

6

Cr

£

200

160

360

Bank Account

£

147

234

Purchases

Purchases

Discount Received Account

20-4

Cr

£

L Jarvis

G Patel

Sales

£

150

G Lewis

Dr

20-4

12 Feb

20 Feb

Cr

£

150

240

Bank

Discount received

Bank

Discount received

£

190

10

152

8

360

20-4

10 Feb

24 Feb

20-4

G Lewis

G Lewis

Cr

£

147

3

150

Cr

£

234

6

240

Cr

£

190

152

Cr

£

10

8

Cr

£

Dr

20-9

20 Jan

31 Jan

CHAPTER 5 Balancing Accounts – the Trial Balance

5.1 (a) and (c)

Dr

20-9

1 Jan

11 Jan

12 Jan

22 Jan

1 Feb

4 Feb

10 Feb

12 Feb

19 Feb

25 Feb

1 Mar

Capital

Sales

Sales

Sales

Balance b/d

Sales

Sales

Rowcester College

Sales

Sales

Balance b/d

Capital Account

£

20-9

1 Jan

Dr

20-9

Dr

20-9

4 Jan

2 Feb

1 Mar

Dr

20-9

5 Jan

15 Feb

1 Mar

Bank

Bank

Balance b/d

Bank

Bank

Balance b/d

Dr

20-9

7 Jan

25 Jan

Comp Supplies Ltd

Comp Supplies Ltd

1 Feb

24 Feb

Balance b/d

Comp Supplies Ltd

1 Mar

Bank Account

£

20-9

10,000

4 Jan

1,000

5 Jan

1,250

20 Jan

1,450

31 Jan

13,700

6,700

2 Feb

1,550

15 Feb

1,300

27 Feb

750

28 Feb

1,600

1,100

13,000

5,300

Balance b/d

Rent paid

Shop fittings

Comp Supplies Ltd

Balance c/d

Rent paid

Shop fittings

Comp Supplies Ltd

Balance c/d

Bank

Shop Fittings Account

£

20-9

1,500

28 Feb Balance c/d

850

2,350

2,350

Purchases Account

£

20-9

5,000

31 Jan Balance c/d

6,500

11,500

28 Feb

5 Feb

27 Feb

28 Feb

Bank

Balance c/d

Purchases returns

Bank

Balance c/d

Dr

20-9

31 Jan

Balance c/d

28 Feb

Balance c/d

13,000

Rent Paid Account

£

20-9

500

28 Feb Balance c/d

500

1,000

1,000

11,500

5,500

17,000

17,000

Cr

£

500

1,500

5,000

6,700

13,700

500

850

6,350

5,300

Balance c/d

Cr

£

10,000

Cr

£

1,000

1,000

Cr

£

2,350

2,350

Dr

20-9

16 Jan

Sales

1 Feb

26 Feb

Balance b/d

Sales

1 Mar

Dr

20-9

27 Jan

Cr

£

11,500

11,500

Dr

20-9

17,000

17,000

7

Balance b/d

Rowcester College

Comp Supplies Limited

£

20-9

5,000

7 Jan Purchases

6,500

25 Jan Purchases

11,500

150

1 Feb Balance b/d

6,350

24 Feb Purchases

5,500

12,000

1 Mar Balance b/d

Sales Account

£

20-9

4,550

11 Jan

12 Jan

16 Jan

22 Jan

4,550

11,150

1 Feb

4 Feb

10 Feb

19 Feb

25 Feb

26 Feb

11,150

1 Mar

Bank

Bank

Rowcester College

Bank

Balance b/d

Bank

Bank

Bank

Bank

Rowcester College

Balance b/d

Rowcester College

£

20-9

850

27 Jan Sales returns

31 Jan Balance c/d

850

750

1,050

1,800

1,050

12 Feb

28 Feb

Bank

Balance c/d

Sales Returns Account

£

20-9

100

Purchases Returns Account

£

20-9

5 Feb Comp Supplies Ltd

Cr

£

5,000

6,500

11,500

6,500

5,500

12,000

5,500

Cr

£

1,000

1,250

850

1,450

4,550

4,550

1,550

1,300

1,600

1,100

1,050

11,150

11,150

Cr

£

100

750

850

750

1,050

1,800

Cr

£

Cr

£

150

(b)

(d)

5.2

Name of Account

Bank

Capital

Rent paid

Shop fittings

Purchases

Comp Supplies Limited

Sales

Rowcester College

Sales returns

Name of Account

Bank

Capital

Rent paid

Shop fittings

Purchases

Comp Supplies Limited

Sales

Rowcester College

Sales returns

Purchases returns

Trial balance as at 31 January 20-9

Dr

£

6,700

500

1,500

11,500

750

100

Trial balance as at 28 February 20-9

Dr

£

5,300

Cr

£

1,050

100

26,800

850

48

2,704

3,200

90

1,174

1,500

9,566

Four from:

•

Error of omission

•

Reversal of entries

•

6,500

4,550

21,050

Trial balance of Jane Greenwell as at 28 February 20-1

Dr

£

Name of account

Bank

Purchases

Cash

Sales

Purchases returns

Creditors

Equipment

Van

Sales returns

Debtors

Wages

Capital (missing figure)

10,000

21,050

1,000

2,350

17,000

5.5

Cr

£

•

•

•

10,000

Business transaction completely omitted from the accounting records. For example, cash sale omitted

from both cash account and sales account.

Debit and credit entries on the wrong side of the two accounts concerned. For example, cash sale

entered wrongly as debit sales account, credit cash account.

Mispost/error of commission

Transaction entered to the wrong person's account. For example, a sale of goods on credit to A T

Hughes has been entered as debit A J Hughes' account, credit sales account.

Error of principle

Transaction entered in the wrong type of account. For example, cost of petrol for vehicles has been

entered as debit motor vehicles account, credit bank account.

Error of original entry (or transcription)

Amount entered incorrectly in both accounts. For example, sale of £45 entered in both sales account

and the debtor's account as £54.

Compensating error

Two errors cancel each other out. For example, balance of purchases account calculated wrongly at

£10 too much, compensated by the same error in sales account.

CHAPTER 6 Division of the Ledger – Primary Accounting Records

5,500

11,150

6.2

150

Date

20-2

26,800

1 Feb

2 Feb

15 Feb

19 Feb

Cr

£

28 Feb

Details

Purchases Day Book

Invoice

Folio

Net

VAT

Gross

£

£

£

Softseat Ltd

961

320

64

384

Quality Furnishings

529

160

32

192

720

144

864

Net

VAT

Gross

PRK Ltd

Softseat Ltd

Totals for month

068

80

984

160

16

32

96

192

1,250

730

144

1,442

Date

20-2

8 Feb

14 Feb

18 Feb

25 Feb

6,000

9,566

28 Feb

8

Details

Sales Day Book

Invoice

Folio

£

£

£

High Street Stores

001

440

88

528

Carpminster College

003

320

64

384

Peter Lounds Ltd

High Street Stores

Totals for month

002

004

120

200

1,080

24

40

216

144

240

1,296

Dr

20-2

28 Feb

PURCHASES LEDGER

Balance c/d

Softseat Ltd

£

20-2

576

1 Feb

19 Feb

576

1 Mar

Dr

20-2

Dr

20-2

8 Feb

25 Feb

1 Mar

Dr

20-2

14 Feb

Dr

20-2

18 Feb

Dr

20-2

28 Feb

Sales

Sales

Balance b/d

576

Purchases

Quality Furnishings

£

20-2

15 Feb Purchases

Cr

£

192

SALES LEDGER

High Street Stores

£

20-2

528

28 Feb Balance c/d

240

768

768

Sales

Sales

Carpminster College

£

20-2

384

Cr

£

Purchases Day Book

Purchases Account

£

20-2

720

Sales Account

£

20-2

28 Feb

Purchases Day Book

Balance c/d

20-2

18 May

23 May

28 May

31 May

Sales Day Book

Balance b /d

M Roper & Sons

Wyper Ltd

Wyper Ltd

M Roper & Sons

Wyper Ltd

M Roper & Sons

Totals for month

Details

M Roper & Sons

Wyper Ltd

M Roper & Sons

Totals for month

Purchases Day Book

Invoice

562

82

86

580

91

589

Folio

PL 302

PL 301

PL 301

PL 302

PL 301

PL 302

Dr

20-2

18 May

28 May

31 May

Cr

£

216

Credit

Note

82

6

84

Folio

PL 302

PL 301

PL 302

Purchases Returns

Balance c/d

Purchases Returns

Purchases Returns

Balance c/d

9

VAT

£

38.00

40.00

42.00

36.00

48.00

19.60

Gross

£

228.00

240.00

252.00

216.00

288.00

117.60

1,118.00

223.60

1,341.60

Net

VAT

Gross

21.60

129.60

£

30.00

40.00

38.00

108.00

PURCHASES LEDGER

£

6.00

8.00

7.60

£

36.00

48.00

45.60

Wyper Ltd (account no 301)

£

20-2

48.00

1 May Balance b/d

832.00

4 May Purchases

10 May Purchases

21 May Purchases

880.00

Cr

£

100.00

240.00

252.00

288.00

880.00

M Roper & Sons (account no 302)

£

20-2

36.00

1 May Balance b/d

45.60

2 May Purchases

565.00

18 May Purchases

25 May Purchases

646.60

Cr

£

85.00

228.00

216.00

117.60

646.60

1 Jun

216

Net

£

190.00

200.00

210.00

180.00

240.00

98.00

Purchases Returns Day Book

1 Jun

Cr

£

1,080

72

Details

Dr

20-2

23 May

31 May

Cr

£

Value Added Tax Account

£

20-2

144

28 Feb Sales Day Book

72

216

1 Mar

Date

768

Cr

£

GENERAL LEDGER

31 May

Cr

£

768

Peter Lounds Ltd

£

20-2

144

Dr

20-2

Dr

20-2

28 Feb

28 Feb

Balance b/d

Date

20-2

2 May

4 May

10 May

18 May

21 May

25 May

Cr

£

384

192

576

Cr

£

96

£

Dr

20-2

PRK Ltd

20-2

2 Feb

Purchases

Purchases

6.3

Balance b/d

Balance b/d

880.00

565.00

GENERAL LEDGER

Dr

20-2

31 May

Purchases Account

£

20-2

1,118.00

Purchases Day Book

Dr

20-2

31 May

1 Jun

Balance b/d

CHAPTER 7 Value Added Tax

7.2

Value Added Tax Account

£

20-2

223.60

31 May Purchases Returns Day Book

31 May Balance c/d

223.60

Purchases Day Book

• £12.00

• £14.40

202.00

amount of

VAT

• £10.56

•

•

•

7.3

£6.64

£0.96

£2.26

(a) and (b)

20-0

31 Mar

31 Mar

31 Mar

(c)

Purchases Day Book

Sales Returns Day Book

Balance c/d

Dr

Cr

£

108.00

Cr

£

21.60

202.00

223.60

VAT-exclusive

amount

£2.00

£1.76

£0.16

£0.80

735

28

1,204

1,967

20-0

1 Mar

31 Mar

31 Mar

1 Apr

Balance b/d

Sales Day Book

Purchases Returns Day Book

Balance b/d

Balances b/d

Wild & Sons Ltd

Bank

A Lewis Ltd

Harvey & Sons Ltd

Wild & Sons Ltd

Bank

Year 6

1 Mar

3 Mar

8 Mar

11 Mar

13 Mar

22 Mar

25 Mar

29 Mar

31 Mar

31 Mar

£1.89

£

20-7

1 Aug

1 Aug

11 Aug

12 Aug

21 Aug

29 Aug

29 Aug

Dr

Date

£8.80

£5.54

£0.37

Details

Folio

C

C

Disc

allwd

£

20

15

Cash

Cr

£

805

1,120

42

1,967

1,204

At the end of March 20-0, the Value Added Tax account has a credit balance of £1,204. This amount is

owing to HM Revenue & Customs and will be paid at the end of the three-month VAT period, together

with VAT due for the subsequent month(s) of the VAT quarter.

*

10

Details

Balances b/d

Sales*

Sales

Bank

Sales

Bank

Sales

Sales*

S Britton

D F Pratt

1 Apr Balances b/d

Cash Book

Bank Date

£

£

276 4,928

398

500

1,755

261

595

275

35 1,051 7,937

361 3,217

8.4

£12.00

£1.10

Date

1 Sep Balances b/d

£10.00

£2.40

Value Added Tax Account

Dr

8.3

Cr

£

Purchases Returns Account

£

20-2

31 May Purchases Day Book

Dr

20-2

CHAPTER 8 Cash Book

Folio Discount

allowed

£

C

C

30

50

80

Cash

20-7

5 Aug

8 Aug

11 Aug

18 Aug

22 Aug

25 Aug

27 Aug

28 Aug

29 Aug

31 Aug

Cash Book

Bank Date

£

£

106 3,214

100

950

1,680

150

1,800

150

2,108

200 2,000

720

1,160

706 13,632

423 8,259

Year 6

2 Mar

5 Mar

9 Mar

11 Mar

16 Mar

18 Mar

20 Mar

22 Mar

26 Mar

27 Mar

30 Mar

31 Mar

31 Mar

31 Mar

Details

T Hall Ltd

Wages

Cash

F Jarvis

Wages

J Jones

Salaries

Telephone

Cash

Balances c/d

Details

Rent

10674

Cleaning expenses

Purchases 10675

Cash

10676

Postages

Telephone 10677

Stationery

Cash

10678

Misc expenses

Wages

10679

Electricity 10680

D Coyne

10681

F Cox

10682

Balances c/d

Folio

Disc

recd

£

24

C

33

C

57

Cr

Cash

Bank

£

£

541

254

436

361

1,051

500

457

628

2,043

276

275

3,217

7,937

Cr

Folio Discount Cash Bank

received

£

£

£

250

35

1,200

C

150

50

168

128

C

150

70

2,000

106

45

855

26

494

423 8,259

71 706 13,632

An alternative way of showing the transactions of 3 March and 29 March is to record the full amount of sales in the debit

cash column, and then to show the amount banked as a separate transfer, ie debit bank, credit cash.

8.6

Date

Dr (Receipts)

20-7

12 May

12 May

13 May

13 May

14 May

15 May

15 May

16 May

Details

Balances b/d

Sales

Sales

T Jarvis

Sales

Cash

Sales

Wyvern District Cncl

Cr (Payments)

Date

20-7

12 May

13 May

14 May

15 May

GL

GL

SL

C

GL

SL

Shop rent

GL

Terry Carpets Ltd

Bank

£ p

£ p

205.75

168.00

270.00

643.75

PL

GL

Cash

£ p

28.80

C

250.00

Wages

GL

314.20

16 May

Balance c/d

£ p

546.00

155.00

768.00

Bank

Longlife Carpets Ltd

825.30

Disc

allwd

3,104.75

Sales

£ p

£ p

91.00

455.00

28.00

140.00

128.00

640.00

45.00

225.00

7.50 292.00

1,460.00

2.50

250.00

560.45

VAT

5.00

CHAPTER 9 Petty Cash Book

Sales Sundry

ledger

£ p

9.2

£ p

715.45

•

•

•

155.00

560.45

Security and confidentiality aspects of petty cash

•

•

PL

50.75

643.75

Bank

Disc

recd

£ p

£ p

363.55

4.65

291.50

4.30

255.50

–

2,194.20

3,104.75

8.95

VAT Purchases Purchases Sundry

ledger

•

255.50

•

24.00

•

£ p

£ p

£ p

363.55

4.80

291.50

4.80

–

655.05

On taking over, check that the petty cash book has been balanced and that the amount of

cash held agrees with the balance shown in the book.

Start each week with the imprest amount of cash which has been agreed with the office

manager.

Keep the petty cash secure in a locked cash box, and keep control of the keys.

Provide petty cash vouchers (in numerical order) on request.

Pay out of petty cash against correctly completed petty cash vouchers ensuring that:

–

the voucher is signed by the person receiving the money

–

a receipt (whenever possible) is attached to the petty cash voucher, and receipt and

petty cash voucher are for the same amount

–

•

Folio

Stationery

Cash

GL

Details

15 May

16 May

Folio

£ p

•

314.20

•

•

593.70

Write up the petty cash book (including calculation of VAT amounts when appropriate); it is

important that the petty cash book is accurate.

Store the completed petty cash vouchers safely – filed in numerical order. They will need

to be kept for at least six years in the company’s archives, together with completed petty

cash books.

The office manager will carry out a surprise check from time-to-time – the cash held, plus

amounts of completed petty cash vouchers, should equal the imprest amount.

At the end of each week (or month) balance the petty cash book and draw an amount of

cash from the cashier equal to the amount of payments made, in order to restore the

imprest amount.

Prepare a posting sheet for the book-keeper with the totals of each analysis column, so that

he/she can enter the amount of each expense into the double-entry system.

Present the petty cash book and cash in hand for checking by the office manager.

Deal with any discrepancies promptly, eg:

–

a receipt and petty cash voucher total differing

–

a difference between the cash in the petty cash book and the balance shown in the

petty cash book

–

Transfers to general ledger

•

discount allowed column total of £7.50 is debited to discount allowed account

•

discount received column total of £8.95 is credited to discount received account

•

Value Added Tax columns, the total of £292.00 is credited to VAT account, while the total of £4.80 is

debited to the VAT account

•

sales column total of £1,460.00 is credited to sales account

•

sundry column – the individual payments are debited to shop rent account, £255.50, stationery account,

£24.00, and wages account, £314.20

•

•

The transactions in the columns for sales ledger and purchases ledger are respectively credited and debited

to the individual accounts of the debtors and creditors.

11

the voucher is signed by the person authorising payment (a list of authorised

signatories will be provided)

a difference between the totals of the analysis columns and the total payments column

in the petty cash book

Where discrepancies and queries cannot be resolved, they should be referred to the office

manager.

Remember that all aspects of petty cash are confidential and should not be discussed with

others.

9.3

petty cash voucher

description

9.4

date

Postage on urgent parcel of spare parts to

Evelode Supplies Ltd

VAT

signature

authorised

Jayne Smith

today

No. 851

amount (£)

Receipts Date

£

Year 8

4

45

120.00 1 Jun

4

45

2 Jun

4

80.00 1 Jun

6 Jun

45

9 Jun

14 Jun

16 Jun

A Student

18 Jun

Documentation will be a post office receipt for £4.45, being the amount of postages paid.

petty cash voucher

description

date

Airmail envelopes

VAT

signature

authorised

Tanya Howard

today

20 Jun

24 Jun

25 Jun

27 Jun

No. 852

28 Jun

amount (£)

2

00

2

0

2

00

40

40

200.00

57.00

143.00

A Student

Documentation will be a till receipt (or handwritten receipt) from the stationery shop for £2.40.

12

Details

Balance b/d

Bank

Postage

Rail fare

Petrol

Cleaning materials

S Lancaster

Petrol

Postage

Petrol

Total

payment

£

5.20

5.20

12.70

8.50

Balance c/d

Balance b/d

Bank

12.70

10.00

14.30

6.70

12.40

19.20

30 Jun

£

18.30

W Rose

Postage

ANALYSIS COLUMNS

Postage Travelling

£

13.20

Petrol

1 Jul

number

Rail fare

30 Jun

1 Jul

Voucher

7.70

14.80

143.00

57.00

200.00

19.60

£

8.50

£

10.00

14.30

6.70

7.70

Vehicle Cleaning

13.20

25.90

Ledger

£

18.30

12.40

14.80

50.00

19.20

10.00

37.50

Petty Cash Book

9.7

Receipts Date

£

125.00

20-7

2 Jun

2 Jun

3 Jun

3 Jun

4 Jun

4 Jun

5 Jun

5 Jun

5 Jun

6 Jun

103.68

6 Jun

6 Jun

228.68

125.00

7 Jun

Details

Balance b/d

Postages

Travel expenses

Postages

Envelopes

Window cleaning

Taxi fare/meals

Post/packing

Taxi fare/meals

Pens/envelopes

Dr

20-7

6 Jun

Analysis columns

£

VAT Postages

£

123

124

£

6.35

6.35

3.25

3.25

13.25

125

126

4.64

127

0.77

12.00

128

2.00

24.00

129

4.00

12.10

130

0.60

21.60

131

£

6.49

103.68

3.60

1.08

12.05

8.50

18.10

Travel

Meals

£

£

20-7

6 Jun

Sundry

Office

20-7

3.87

8.00

12.00

10.00

8.00

31.25

20.00

Petty Cash Book

Postages Account

Petty Cash Book

£ p

18.10

20-7

Travel Expenses Account

Bank

Cash

£ p

£ p

20-7

6 Jun

Date

5.41

22.28

20-8

5 Feb

Details

S Kahn

5.00

16 Feb S Groves

60.00

Cr

1 Mar

Cr

£ p

Petty Cash Book

Meals Account

£ p

20-7

20.00

Cr

£ p

13

Balance b/d

£

Bank Date

£ 20-8

3,250.60

88.25

140.00

335.85

1 Feb

1 Feb

5 Feb

5 Feb

1,140.00 16 Feb

220.00 16 Feb

435.55 19 Feb

26 Feb

65.00

£ p

20-7

£

26 Feb C Bentley

£ p

£ p

31.25

Folio Discount Cash

allowed

12 Feb B Shean

26 Feb Cash sales

Cr

Petty Cash Book

Cash

£ p

Petty Cash Book

103.68

Cash Book

10 Feb Cash sales

20-7

£ p

CASH BOOK

Cash book

Dr

3.00

12 Feb H Shanks

£ p

12.05

Cr

20-7

Cr

Bank

£ p

9.9

10.00

228.68

Value Added Tax Account

£ p

22.28

13.25

125.00

GENERAL LEDGER

Sundry Office Expenses Account

Petty Cash Book

Dr

Balance b/d

Dr

20-7

6 Jun

Total

Payment

Cash received

Dr

20-7

6 Jun

No

Balance c/d

Dr

20-7

6 Jun

Voucher

Dr

5,610.25

1,930.55

28 Feb

Cr

Details

Balance b/d

Folio Discount Cash

received

£

Petty cash

£

Bank

£

1,598.55

169.60

Insurance

120.50

Rent

240.00

Motor expenses

120.00

Purchases

390.55

Purchases

990.50

Drawings

Balance c/d

50.00

–

1,930.55

5,610.25

Receipts

£

Date

20-8

30.40

1 Feb

169.60

1 Feb

number

Bank

Refreshments

5 Feb

Postage stamps

10 Feb

Sundry expenses

12 Feb

Cleaner's wages

16 Feb

Postage

19 Feb

84.40

Voucher

Balance b/d

5 Feb

200.00

PETTY CASH BOOK

Details

Refreshments

19 Feb

Sundry expenses

28 Feb

Balance c/d

1 Mar

34

35

36

37

38

39

39

Total

payment

Sundry

£

£

ANALYSIS COLUMNS

Cleaning

Postage &

Refreshments

£

£

£

expenses

Stationery

15.30

22.90

12.45

20.00

12.45

12.50

22.45

10.00

115.60

84.40

10.00

22.45

10.4

22.90

20.00

12.50

20.00

35.40

15.30

(a)

Dr

20-7

1 Jan

13 Jan

1 Feb

37.75

cheque no. 001354

cheque no. 001355

Less: outstanding lodgement

G Shotton Limited

Balance b/d

Balance at bank as per cash book

Cash Book (bank columns)

£

300

162

89

60

40

651

20-7

2 May

14 May

29 May

16 May

31 May

31 May

P Stone

867714

Alpha Ltd

867715

E Deakin

867716

Standing order: A-Z Insurance

Bank charges

Balance c/d

428

JANE DOYLE

BANK RECONCILIATION STATEMENT AS AT 1 MAY 20-7

unpresented cheque:

cheque no. 867713

outstanding lodgement

Balance at bank as per bank statement

£

Balance at bank as per cash book

Bryant & Sons

1 Jun

Less:

P GERRARD

BANK RECONCILIATION STATEMENT AS AT 31 JANUARY 20-7

P Reid

Balance b/d

Cash

C Brewster

Cash

Cash

Add:

200.00

Cash Book (bank columns)

£ p

20-7

Balance b/d

415.15

23 Jan Direct debit: Omni Finance

BACS credit: T K Supplies

716.50

31 Jan Balance c/d

1,131.65

Balance b/d

923.70

Add: unpresented cheques

20-7

1 May

7 May

16 May

23 May

30 May

Balance at bank as per cash book

Balance b/d

(b)

Dr

(b)

22.45

CHAPTER 10 Bank Reconciliation Statements

10.3

(a)

Cr

£ p

207.95

923.70

1,131.65

Balance at bank as per cash book

Add:

Less:

312.00

176.50

unpresented cheque

E Deakin cheque no. 867716

outstanding lodgement

cash

Balance at bank as per bank statement

£

488.50

1,412.20

335.75

1,076.45

14

80

380

54

326

BANK RECONCILIATION STATEMENT AS AT 31 MAY 20-7

(c)

923.70

£

300

£

428

110

538

40

498

Cr

£

28

50

110

25

10

428

651

10.5

CHAPTER 11 An Introduction to Computer Accounting

11.5

MEMORANDUM

TO:

........................................

DATE:

.........................................

FROM:

SUBJECT:

2.

3.

4.

5.

6.

7.

•

jobs may be threatened and redundancies may occur

•

possible bad effects to health caused by sitting in front of a computer all day: RSI

•

Accounts Clerk

Bank Reconciliation Statements

the need for retraining

(Repetitive Strain Injury), back problems, radiation and eye damage from computer

screens

(b) Potential benefits:

Reconciliation of the bank statement balance with that shown in the cash book is carried out at

the month-end as follows:

1.

(a) Objections:

•

potential for updating IT skills through training

•

better career prospects

•

From the bank columns of the cash book tick off, in both cash book and bank statement:

• the receipts that appear in both

•

• the payments that appear in both

Identify the items that are unticked on the bank statement and enter them in the cash book

on the debit or credit side as appropriate. These will be things such as BACS receipts,

standing order and direct debit payments, bank charges and interest, unpaid cheques

debited by the bank. However, if the bank has made a mistake by debiting or crediting our

account in error, don’t enter them in the cash book; instead, notify the bank for them to

make the correction.

possible increase in pay for skilled work

job satisfaction through automation of manual processes

CHAPTER 12 Final Accounts

Balance the bank columns of the cash book to find the up-to-date balance.

Start the bank reconciliation statement with the balance brought down figure shown in the

cash book.

12.2

In the bank reconciliation statement:

•

•

add the unticked payments shown in the cash book – these are unpresented cheques

deduct the unticked receipts shown in the cash book – these are outstanding lodgements

The resultant money amount on the bank reconciliation statement is the balance of the

bank statement.

Vehicle

Date the reconciliation statement and file it away for future reference. Note that, if the

balances of the cash book (bank columns) and the bank statement were not identical at the

beginning of the month, then you will need to refer to the previous bank reconciliation

statement prepared at the end of last month. Items appearing on that bank reconciliation

statement must also be ticked off at step 1. Anything remaining unticked will be included in

this month’s reconciliation statement (step 5).

A Student

15

12.5

12.6

CLARE LEWIS

TRADING AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 DECEMBER 20-4

£

Sales

Opening stock

Purchases

16,010

96,318

112,328

13,735

Less Closing stock

Cost of Goods Sold

Gross profit

Less expenses:

Salaries

Heating and lighting

Rent and rates

Sundry expenses

Vehicle expenses

18,465

1,820

5,647

845

1,684

Net profit

BALANCE SHEET AS AT 31 DECEMBER 20-4

Fixed Assets

Vehicles

Office equipment

£

Current Assets

Stock

Debtors

Less Current Liabilities

Creditors

Value Added Tax

Bank overdraft

Working Capital

NET ASSETS

FINANCED BY

Capital

Opening capital

Add Net profit

Less Drawings

12,140

1,210

4,610

£

13,735

18,600

32,335

17,960

capital

£

144,810

(a)

purchase of vehicles

(c)

wages and salaries

(b)

(d)

98,593

46,217

(e)

(f)

(g)

(h)

28,461

17,756

12.7

(a)

(i)

9,820

5,500

15,320

(ii)

(iii)

(b)

(i)

(ii)

14,375

29,695

(iii)

25,250

17,756

43,006

13,311

29,695

rent paid on premises

legal fees relating to the purchase

of property

re-decoration of office

installation of air-conditioning in office

wages of own employees used to build

extension to the stockroom

installation and setting up of a new

machine

•

Weighing equipment for business use

•

Legal fees relating to extension

Extension to business premises

Revenue expenditure

•

•

Payment of local authority rates

Sales assistants' wages

Revenue receipt

•

Rent received from sub-letting office space

•

Sales assistants' wages (shown here in trading account because it is a direct selling expense,

Trading account

rather than a general profit and loss account expense)

Profit and loss account

•

•

Rent received from sub-letting office space

Payment of local authority rates

Balance sheet

•

Weighing equipment for business use

•

Legal fees relating to extension (shown in balance sheet, and added to the cost of the premises,

•

Extension to business premises (added to the cost of the premises)

because it is an expense which relates to the improvement of fixed assets, rather than a general

profit and loss account expense)

16

revenue

expenditure

Capital expenditure

•

£

expenditure

13.4

CHAPTER 13 Accruals and Prepayments

13.1

(a)

(b)

(c)

Expense in profit and loss account of £56,760; balance sheet shows wages and salaries accrued

(current liability) of £1,120.

Expense in profit and loss account of £1,800; balance sheet shows computer rental prepaid (current

asset) of £150.

TRADING AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 DECEMBER 20-9

Opening stock

Purchases

Less Closing stock

Cost of Goods Sold

£

70,000

Rent and rates £10,250 – £550

Electricity

Telephone

Salaries £35,600 + £450

Vehicle expenses

Net profit

290,000

4,700

Less Long-term Liabilities

Mortgage

NET ASSETS

9,700

1,820

36,050

65,580

(b)

20-7/20-8

£

2 Jun

Bank

500

1 Dec

Bank

500

28 Aug

10 Feb

17

Drawings Account

Dr

Bank

Bank

50,000

12,600

2,500

1,250

66,350

1,370

67,720

45,750

13,970

59,720

2,000

57,720

Less drawings

64,420

£

10,000

57,720

FINANCED BY:

Capital

Opening capital (missing figure)

Add net profit

3,100

13,750

550

3,250

900

Working Capital

130,000

£

4,760

540

380

390

6,070

Less Current Liabilities

Creditors

Bank

Accrual (wages)

350,000

Gross profit

Less expenses:

£

420,000

280,000

60,000

£

Current Assets

Stock

Debtors

Prepayment (insurance)

Cash

SOUTHTOWN SUPPLIES

Sales

H EGGLETON

BALANCE SHEET AS AT 28 FEBRUARY 20-8

Fixed Assets

Freehold property

Motor vehicles

Machinery

Fixtures and fittings

Expense in profit and loss account of £2,852; balance sheet shows rates prepaid (current asset) of

£713.

13.2

(a)

500

500

2,000

20-7/20-8

28 Feb

Cr

Capital

£

2,000

2,000

Capital Account

Dr

20-7/20-8

28 Feb

28 Feb

Drawings

Balance c/d

£

20-7/20-8

57,720

28 Feb

2,000

59,720

1 Mar

1 Mar

Cr

£

Balance b/d

Profit and loss account

Balance b/d

45,750

BALANCE SHEET AS AT 30 JUNE 20-9

13,970

59,720

57,720

Fixed Assets

£

£

Land and buildings

100,000

Vehicles

83,500

Office equipment

13.6

JOHN BARCLAY

Sales

£

£

Less Sales returns

Purchases (less £250 goods for own use)

Less Purchase returns

Net purchases

Less Closing stock (30 June 20-9)

Cost of Goods Sold

599,878

3,894

63,084

Office expenses

Vehicle expenses

Discount allowed

Net profit

864,321

346

Bank

861,575

Less Current Liabilities

Creditors

Value Added Tax

Accrual

Working Capital

592,127

Less Long-term Liabilities

Bank loan

4,951

NET ASSETS

274,399

1,197

142,812

52,919

10,497

1,250

64,666

78,146

284,896

75,000

209,896

FINANCED BY:

33,601

Capital

122,611

Opening capital

38,144

3,187

74,328

Prepayment

269,448

Add Discount received

Salaries

£

659,068

66,941

66,941

Debtors

595,984

Gross profit

Less expenses:

Stock

2,746

Net sales

Opening stock (1 July 20-8)

23,250

206,750

Current Asets

TRADING AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 30 JUNE 20-9

£

Add net profit

Less drawings (plus £250 goods for own use)

197,543

76,856

18

155,000

76,856

231,856

21,960

209,896

14.4

CHAPTER 14 Depreciation of Fixed Assets

14.3

(a)

Dr

20-8

1 Jan

1 Oct

1 Oct

20-9

1 Jan

(b)

Balance b/d

Disposals account

(part-exchange allowance)

Bank

(balance paid by cheque)

20-9

9,500

20-8

1 Oct

31 Dec

27,000

Cr

Disposals account

Balance c/d

Disposals account

Balance c/d

£

7,200

3,000

10,200

£

20-9

20-8

1 Jan

31 Dec

20-9

1 Jan

Vehicles account

Profit and loss account

(profit on sale)

20-8

1 Oct

1 Oct

12,700

Balance b/d

Profit & loss account

Balance b/d

Fixed assets

Vehicles

£

Cost

15,000

Less expenses:

Vehicle running expenses

Rent and rates

Office expenses

Wages and salaries

Provision for depreciation: office equipment

vehicle

Cr

£

7,200

3,000

10,200

£

£

Dep’n to date

3,000

1,480

5,650

2,220

18,950

1,000

3,000

Net profit

BALANCE SHEET AS AT 31 DECEMBER 20-8

Cr

Vehicles account

(part-exchange allowance)

Prov for dep'n account

£

6,250

71,600

77,850

8,500

Less Closing stock

Cost of Goods Sold

Gross profit

Add Discount received

3,000

Balance sheet (extract) of Rachael Hall as at 31 December 20-8

(d)

Sales

Opening stock

Purchases

£

Disposals Account – Vehicles

£

12,000

700

£

12,000

15,000

27,000

Provision for Depreciation Account – Vehicles

Dr

20-8

1 Oct

31 Dec

£

12,000

5,500

£

15,000

Balance b/d

Dr

20-8

1 Oct

31 Dec

(c)

Vehicles Account

JOHN HENSON

TRADING AND PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED 31 DECEMBER 20-8

£

5,500

Fixed Assets

Office equipment

Vehicle

7,200

12,700

Current Assets

Stock

Debtors

Bank

£

Net

Less Current Liabilities

Creditors

Value Added Tax

12,000

Working Capital

NET ASSETS

FINANCED BY:

Capital

Opening capital

Add Net profit

Less Drawings

19

£

Cost

10,000

12,000

22,000

£

Dep'n to date

1,000

3,000

4,000

£

122,000

69,350

52,650

285

52,935

32,300

20,635

£

Net

9,000

9,000

18,000

8,500

5,225

725

14,450

3,190

1,720

4,910

9,540

27,540

20,000

20,635

40,635

13,095

27,540

14.5

CHAPTER 15 Bad Debts and Provision for Bad Debts

SIMON ADO

TRADING AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 OCTOBER

£

Sales (work done)

Opening stock

Purchases of materials

180

3,415

3,595

190

Less Closing stock

Cost of Goods Sold

Gross profit

Add Discount received

Less expenses:

Advertising

Telephone

Motor expenses

Provision for depreciation: van

tools and equipment

90

710

580

2,000

300

Net profit

BALANCE SHEET OF SIMON ADO AS AT 31 OCTOBER

Fixed Assets

Van

Tools and equipment

Current Assets

Stock

Prepayments

Cash

Less Current Liabilities

Creditors

Bank overdraft

Working Capital

NET ASSETS

FINANCED BY:

Capital

Opening capital

Add Net profit

Less Drawings

£

Cost

8,000

3,000

11,000

£

Dep'n to date

2,000

300

2,300

15.1

£

19,480

•

•

3,405

16,075

200

16,275

Profit and loss account (expenses)

debit bad debts written off, £210

provision for bad debts, £500

Credit

Balance sheet

debtors £20,000, less provision for bad debts £500, net debtors £19,500

15.3

WONG PAU YEN

TRADING AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 AUGUST

£

Sales

Opening stock

Purchases

Less Purchases returns

Net purchases

£

Net

6,000

2,700

8,700

Less Closing stock

Cost of Goods Sold

Heat and light

Wages and salaries

Rent and rates

Motor expenses

Sundry expenses

900

1,200

93,300

50,100

51,300

1,300

50,000

43,300

1,400

19,660

6,370

1,340

6,040

plant and machinery

2,000

Provision for bad debts

340

vehicles

455

9,155

2,960

12,595

15,555

6,400

9,155

51,000

Gross profit

Less expenses:

£

94,600

1,300

Net sales

Provision for depreciation:

175

£

Less Sales returns

3,680

12,595

190

120

320

630

85

90

•

1,280

38,430

4,870

20

15.5

BALANCE SHEET AS AT 31 AUGUST

Fixed Assets

Plant and machinery

Vehicles

£

Cost

20,000

10,000

30,000

Current Assets

Stock

Debtors

Less Provision for bad debts

8,500

340

Prepayment

Bank overdraft

1,690

NET ASSETS

6,000

14,000

10,880

19,120

4,880

5,120

Capital

Add Net profit

Less Drawings

£

Less Sales returns

Opening stock

Purchases

1,300

Carriage inwards

Less Purchases returns

Net purchases

8,160

Less Closing stock

Cost of Goods Sold

191,200

21,480

3,600

188,800

210,280

24,900

Discount received

2,090

Reduction in provision for bad debts

Less expenses:

2,380

21,500

14,000

Salaries

53,300

Carriage outwards

Insurance

Bad debts

24,230

Bank interest

4,870

29,100

21,500

6,000

3,420

2,400

720

3,200

Loan interest

2,600

Loss on sale of vehicle

Provision for depreciation:

vehicles

office furniture

Net profit

21

4,160

Telephone

Discount allowed

7,600

400

149,360

Rent

Electricity

185,380

146,870

Add income:

7,540

332,250

1,200

Gross profit

1,190

£

337,200

4,950

Net sales

FINANCED BY:

Opening capital

£

Sales

9,920

4,660

Working Capital

Net

100

Creditors

Accruals

Dep'n to date

D MARTIN

TRADING AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 DECEMBER YEAR 6

£

360

Cash

Less Current Liabilities

£

2,700

750

5,000

1,000

99,250

50,110

Stock

Debtors

Less Provision for bad debts

3,500

25,000

195,000

31,400

Prepayments

1,570

Cash

Less Current Liabilities

Creditors

Accruals

Bank overdraft

Working Capital

–

160,000

13,500

181,500

10,000

29,830

4,780

600

60,110

7,880

6,160

7,000

21,040

Loan from D Samson

194,570

FINANCED BY:

Capital

Opening capital

184,460

Add Net profit

50,110

234,570

Less Drawings

depreciation at 20% pa (years 3, 4 and 5)

book value at date of sale

sale proceeds

loss on sale (debited to profit and loss account)

39,070

220,570

26,000

NET ASSETS

cost price (1 January, year 3)

6,500

24,900

Less Long-term Liabilities

Loss on sale of vehicle:

15,000

40,000

194,570

£

5,000

3,000

2,000

1,250

750

22

20-1

Current Assets

10,000

160,000

£

Net

ALAN HARRIS

Office furniture

£

Dep'n to date

EXTENDED TRIAL BALANCE

Freehold premises

Motor vehicles

£

Cost

16.1

Fixed Assets

CHAPTER 16 The Extended Trial Balance

30 JUNE 20-2

BALANCE SHEET AS AT 31 DECEMBER YEAR 6

(b)

CHAPTER 17 The Regulatory Framework of Accounting

17.1

•

•

•

•

Going concern concept

This presumes that the business to which the final accounts relate will continue to trade in the foreseeable

future. The trading and profit and loss account and balance sheet are prepared on the basis that there is

no intention to reduce significantly the size of the business or to liquidate the business. If the business was

not a going concern, assets would have very different values, and the balance sheet would be affected

considerably.

(a)

Opening stock

17.6

This requires that, when a business adopts particular accounting methods, it should continue to use such

methods consistently over a number of accounting periods. In this way, direct comparison between the

final accounts of different years can be made.

Date

Examples: The continued use of a particular depreciation method, eg straight-line. The method of stock

valuation used. The treatment of capital and revenue expenditure.

Prudence concept

Year 3

This concept requires that final accounts should always, where there is any doubt, report a conservative

figure for profit or the valuation of assets. To this end, profits are not to be anticipated and should only be

recognised when it is reasonably certain that they will be realised; at the same time, all known liabilities

should be provided for.

(1.2)

adjustment of incorrect stock value

12 items @ £15 each = £180 – £80 recorded

items omitted from physical stock take, cost price

Revised stock valuation at 1 January Year 7

Closing stock at 31 March Year 7

Balance from ledger (31 March Year 7)

(2.1)

reduction to net realisable value

(2.2)

correction of undercast on stock sheet

(2.3)

reduction to net realisable value: £190 – £150

Revised stock valuation at 31 March Year 7

18,660

53,190

Gross profit

Consistency concept

Balance from ledger (1 January Year 7)

71,850

Cost of Goods Sold

Examples: The accrual of an expense in profit and loss account which has been used in the accounting

period but not yet paid for. The prepayment of an expense for the next accounting period. The recording

of opening and closing stocks in the trading account. The use of debtors' and creditors' accounts to record

amounts owing to the business, or owed by the business.

(1.1)

54,200

Less Closing stock

Accruals concept

This means that expenses and revenues are matched so that they concern the same goods and the same

time period.

1 Sep

3 Sep

6 Sep

£

7 Sep

17,300

8 Sep

100

17,400

10 Sep

250

15 Sep

17,650

16,200

54,610

(a)

STORES LEDGER RECORD

Quantity

Balance

40

100

70

150

Receipts

Price

£

11.00

12.00

14.00

11.50

Value

£

24 Sep

3,000

28 Sep

18,700

(40)

18,660

30 Sep

23

12.00

Price

£

Value

£

980

1,725

2,400

Quantity

30

571

12.363

989

11.865

712

90

11.865

1,068

11.865

475

740

170

120

70

11.963

837

11.00

10.571

12.00

11.412

11.412

440

740

1,200

1,940

1,369

120

11.412

1,369

190

12.363

2,349

110

14.00

12.363

110

12.363

260

11.865

200

160

11.50

11.865

980

1,360

1,360

1,725

3,085

2,373

11.865

1,898

70

11.865

830

270

11.963

70

200

Note: rounding may cause some figures to differ; these should have no material effect

300

10.571

150

60

10.00

£

70

70

80

Value

£

300

70

11.412

Price

10.00

100

50

Balance

30

40

40

200

Issues

1,200

18 Sep

15,700

Quantity

440

17 Sep

(500)

£

107,800

17,650

Purchases

Example: fixed assets are valued at cost, less accumulated depreciation to date.

Opening stock at 1 January Year 7

£

Sales

Examples: A provision for bad debts – the debtors have not yet gone bad, but it is expected, from

experience, that a certain percentage will eventually need to be written off as bad debts. The valuation of

stock at the lower of cost and net realisable value in order to give the lower valuation for the final accounts.

17.4

TRADING ACCOUNT FOR QUARTER ENDED 31 MARCH YEAR 7

200

11.865

12.00

11.963

830

2,400

3,230

2,393

(b)

(d)

VEE LIMITED

TRADING ACCOUNT FOR SEPTEMBER YEAR 3

Sales:

£

130 units at £14 each

£

4,160

Opening stock

5,980

300

Purchases

6,745

Less Closing stock

2,393

4,652

1,328

31 Dec

Stock

20-8

Trading

Stock valuation at 31 December 20-8

transferred to trading account

Folio

Dr

GL

22,600

£

Cr

Date

31 Dec

Details

Profit and loss

Telephone expenses

Transfer to profit and loss account

of expenditure for the year

Folio

Dr

GL

890

GL

Details

31 Dec

Profit and loss

20-8

Salaries

Accruals

Transfer to profit and loss account

of expenditure for the year

Photocopying expenses

GL

Prepayments

31 Dec

Drawings

£

Motoring expenses

Transfer of private motoring to

drawings account

22,600

GL

80

1,240

Cr

£

1,240

1,240

Folio

Dr

GL

200

Folio

Dr

GL

175

Folio

Dr

500

GL

£

Cr

£

200

(f)

Date

Details

31 Dec

Drawings

20-8

Cr

£

Purchases

Goods taken for own use

by the owner

890

GL

£

Cr

£

175

(g)

(c)

Date

1,160

Details

£

(b)

20-8

GL

Date

20-8

GL

Profit and loss

£

(e)

(a)

Details

Dr

of expenditure for the year

CHAPTER 18 The Journal

Date

31 Dec

7,045

Cost of Goods Sold

Folio

Transfer to profit and loss account

Gross profit

18.2

Details

20-8

1,820

260 units at £16 each

Date

Folio

Dr

GL

23,930

GL

GL

£

23,930

Date

Details

31 Dec

Profit and loss

GL

- fixtures and fittings

GL

20-8

Cr

£

22,950

Provision for depreciation

Depreciation charge for year on

980

fixtures and fittings

23,930

24

£

Cr

£

500

(h)

Date

20-8

31 Dec

Details

Disposals

Machinery

Provision for depreciation account

Folio

Dr

GL

5,000

GL

£

– machinery

GL

3,750

Bank

CB

2,400

VAT

GL

Disposals

Disposals

Profit and loss

Disposals