general mills (gis) - University of Oregon Investment Group

advertisement

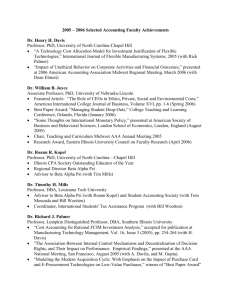

UNIVERSITY OF OREGON INVESTMENT GROUP October 17, 2008 Consumer Goods GENERAL MILLS (GIS) BUY Stock Data Price (52 weeks) Symbol/Exchange Beta Shares Outstanding Average daily volume (3 month average) Current market cap Current Price Dividend Dividend Yield 21.50 billion 64.42 1.72 2.70% Valuation (per share) DCF Analysis Comparables Analysis Current Price $91.93 $52.22 $63.24 51.00 – 72.01 GIS/NYSE 0.62 333.7 million 3,534,360 Summary Financials Revenue Income 2008 Actual $13,652.1 million $1,294.7 million BUSINESS OVERVIEW General Mills had its start in two flour mills that processed grains in the 1860s. The company revolutionized the milling industry by producing enhanced flour. Brand strength and iconic trademarks have allowed General Mills to be one of the most recognizable household names. From cereals to yogurt to ice cream, General Mills has excelled at manufacturing and marketing a diversified product line. At the turn of the millennium, General Mills focused greatly on international expansion and is currently experiencing accelerated growth in European countries. The company generated $13,652.1 million in revenue in 2008 and expects to continue growing at about the same rate in fiscal year 2009. In this report I recommend a buy based on qualitative factors that give the company a positive outlook and through quantitative analysis of the DCF and comparable analyses. Covering Analyst: Richard Reynolds Email: rreynol4@uoregon.edu The University of Oregon Investment Group (UOIG) is a student run organization whose purpose is strictly educational. Member students are not certified or licensed to give investment advice or analyze securities, nor do they purport to be. Members of UOIG may have clerked, interned or held various employment positions with firms held in UOIG’s porfolio. In addition, members of UOIG may attempt to obtain employment positions with firms held in UOIG’s portfolio. General Mills university of oregon investment group http://uoig.uoregon.edu PRINCIPAL PRODUCTS General Mills has a variety of products that include cereals, refrigerated yogurts, frozen pastries, and grain foods. The company generates revenues from a commodity-based product line. Thus, it is important for the company to have a large volume of sales to create strong revenues throughout the year. The product line is always expanding either by developing new products or by reinventing current products to fit consumer needs. Popularity of different product lines differs from various regions in the world. While the United States has the most sales in breakfast cereals, yogurts, instant soups, and frozen dough products (i.e. pizza, frozen waffles), in other countries, grain snacks and super-premium ice creams have sold best. Almost every product is licensed by General Mills and thus the company has full rights to their trademarks and the promotional mediums (such as the cereal mascots) that are linked with various products. Some of the various trademarks are as follows: Cereals: Cheerios, Wheaties, Lucky Charms, Chex, Kix, Cocoa Puffs, Cookie Crisp, and Cinnamon Toast Crunch Yogurt: Yoplait, Trix, Yoplait Kids, Go-GURT, Yo-Plus, and Colombo Dough Products: Pillsbury, Golden Layers, Toaster Strudel, Forno de Minas, Wanchai Ferry, Frescarini Dinner Products: Betty Crocker, Hamburger Helper, Tuna Helper, Old El Paso, Green Giant, and Potato Buds Grain Snacks: Nature Valley, Fiber One, Fruit Roll-Ups, Fruit By The Foot, Chex Mix, Gardetto’s and Bugles Dessert Mixes: Betty Crocker, SuperMoist, Warm Delights, Bisquick, Gold Medal, and Creamy Deluxe Frozen Pizza: Totino’s Jeno’s Pizza Rolls, Pillsbury Pizza Pops, and Pillsbury Pizza Minis Others: Progresso, Haagen-Dazs, Pop-Secret, Cascadian Farm, and Muir Glen In addition to trademarks through General Mills’ base product line, the company has invested in joint trademarks with other companies as well. Examples of this include the TV character Dora the Explorer to use as a mascot “endorsement” for products such as breakfast cereals. Some companies allow their trademarks to be used in such ways as to create entirely new products such as Reese’s Puffs cereal. The use of joint trademarks has allows both companies to enjoy profits from other industries that may not be related to the company’s current industry. As with the Reese’s Puffs cereal, General Mills excels at creation of Breakfast Cereals while M&M/Mars excels at the creation of candy snacks. Lastly, General Mills leases out their own trademarks to other companies to generate joint ventures with such companies. This method of revenue generation is found on the income statement under joint ventures. The company has licensed out some of their trademarks including the Green Giant, and the Pillsbury Doughboy to other companies such as Nestle and J.M. Smucker Company. Since profits are generated by the borrower, General Mills receives after-tax royalties from the company leasing the use of the trademark. Fiscal year 2008 saw $110.8 million in joint revenue profits, up 52.4% from the previous year. PRODUCT SALES Retail Growth General Mills has seen rising growth rates in international markets as well as American markets. From 2007 to 2008, General Mills saw a 6.83% growth rate in the United States, a 20.50% growth internationally, and a 10.64% growth through foodservice and catering operations. Overall, there was a 9.73% growth in revenues from 2007 to 2008. This growth rate can be attributed to the increasing market share General Mills is obtaining overseas. (See detailed sales figures in Appendix F.) Important to the business is the retailers who are the direct sellers of goods General Mills produces. General Mills acts as a manufacturer, not a retailer. Thus, it is important for the company to have strong relations with the supermarkets and stores that sell its goods. While General Mills does the marketing for its products through television ads and promotional coupons, it is the retailers’ responsibility to make sure items are displayed according to General Mills’ specifications. Larger retailers are generally “audited” by a vendor representative who inspects displays and product orientation to confirm correct placement and storage of General Mills’ products. 2 General Mills university of oregon investment group http://uoig.uoregon.edu Segment Growth General Mills not only analyzes its overall growth but also the growth and decline in its segmented product lines. The company does individual analyses on both US and international markets. Highest product percentage growth has been seen in the snacks segment. From 2007 to 2008, General Mills’ snack segment has grown 12.3%. Smallest growth was observed in the Big G category which includes the breakfast cereals General Mills produces. Growth for Big G products from 2007 to 2008 was 4.9%. However, growth in this segment was up from previous year (fiscal 2006 to 2008 saw only 1.6% growth in the Big G category). This was due to the introduction of another brand of Cheerios and introduction of new Fiber One cereals. Small Planet Foods actually saw a negative growth mainly due to the higher prices of products in this category (a category that contains some super-quality foods). This can be attributed to the downturn in the national economy which in turn has caused US citizens to budget more. As for international growth, sales have seen the most increase in sales performance for the Old El Paso and Haagen-Dazs brands. These two brands have dominated the European markets and have become key players in both the Mexican cuisine and ice cream industries. Sales growth in Canada can be mostly attributed to more favorable exchange rates. Actual volume sales in Canada grew only marginally compared to American sales. Asian markets saw a 25% growth mainly due to double digit sales growth of Haagen-Dazs in the region as well as high growth in Wanchai Ferry brand dumplings in China. Lastly, sales growth in Latin America and South Africa was due to introduction of Diablitos brands in Venezuela and pricing adjustments made to current products sold in these regions. RECENT NEWS 10/13/2008 – Cheerios to Promote Reading For the last seven years, Cheerios has helped children by encouraging them to read through its book giveaway during the October 13th – October 19th “Give a Child a Book Week”. General Mills plans to give away over five million books to promote reading. The company is working in conjunction with the nonprofit called First Book, a company that strives to aid in the development of children learning to read. Five books have been selected to be included in Cheerios boxes. These books include Duck for President, Monkey and Me, and Diego’s Wolf Pup Rescue. – Business Wire 10/8/2008 – MSG Cut from Progresso Soup Recipe The chemical monosodium glutamate has been removed from the Progresso Soup recipe due to attacks from Campbell’s new Select Harvest product line which criticized Progresso’s use of MSG in their soups. It is likely that this change will help maintain General Mills’ market share in the canned soup industry as people grow more conscious of food ingredients and negative side effects MSG has on the body. – Associated Press 3 General Mills university of oregon investment group http://uoig.uoregon.edu 9/23/2008 – General Mills Named Top Company for Working Mothers Working Mother Magazine has named General Mills again for the 13th year as the top company for working mothers. This is due to pay, flexibility, child care, as well as yoga classes for post-natal mothers, and a fitness center on campus. – St. Paul Business Journal 9/22/2008 – New Products and Good Margins Drove 2008 Profits The continual development of new products and maintaining strong margins has been the business model of General Mills in 2008 and it plans to continue this model to maintain healthy growth during fiscal 2009. Fiscal year 2008 brought forth a 24% increase in stock price due to the company’s strong business model. Additionally, sales were driven by additional sales venues. Dollar stores helped drive up sales by providing a new point of sale to more economical shoppers. – St. Paul Business Journal 8/13/2008 – General Mills to Sell Pop Secret to Diamond Foods General Mills gave confirmation that it plans to sell its popcorn brand Pop Secret to Diamond Foods and expects to receive $160 million proceeds after transaction fees. Pop Secret is currently considered the #2 product in the $900 million US microwave popcorn category. The transaction should occur in fall of the 2009 fiscal year. – Business Wire INDUSTRY Industry Overview General Mills along with other companies in the non-durable food items industry are prone to certain factors that affect their profitability. The biggest input cost for this industry is the cost of raw materials. All food items must derive from some kind of organic matter which is either taken straight from agricultural venues or created by chemical processes in labs. Depending on the food being sold, there may be more processes needed to create the food item for sale. For example, a frozen dinner would take more processing power than an all-natural granola bar. Since late-stage foods take more processing power, they are generally sold at a higher price. Suppliers and retailers are both important players in this industry. Not only do food manufacturers have to consider the cost of raw materials, but they must also consider a price point for both wholesale and retail. Pricing is crucial to the success of a food item. Generally, items are placed strategically in grocery stores. Thus, a customer who is not brand loyal will tend to either buy based on economical value or quality with almost no thought process in the grocery store. Ergo, it is the goal of manufacturers to create brand loyalty so that customers do not consider alternative items when shopping. While the end-user may be people who buy the goods for personal consumption, the actual customer of General Mills and other food manufacturers are the retail stores and wholesalers. One of the largest retailers for this industry is Wal-Mart. In the 2008 fiscal year, Wal-Mart accounted for 27% of all sales in the US segment for General Mills. The majority of customers in this industry are venues such as supermarkets and discount stores. However, another portion of the customer base includes bakeries and convenience stores. Industry Growth While new products are constantly be produced or reinvented by manufacturers, there has been a shift towards consolidation that will likely continue in the future. One driver of industry growth is grocery retailer industry growth. Without venues to sell products in, the non-durable food items cannot reach the end-user. As retailers continue to expand to European, Asian and Latin American nations, it is likely that the food manufacturers will continue to experience growth as well. S.W.O.T. ANALYSIS Strengths One of the largest strengths behind the success of General Mills is brand loyalty. General Mills has been able to market their products in such a way that end-user customers have created a psychological “no alternatives” mentality when shopping. The brands that have become staple consumer foods are Cheerios, Chex, Yoplait Yogurt, Pillsbury, and Betty Crocker. In addition to brand loyalty strength, General Mills has a high awareness factor for their products. Their brands such as Cheerios and 4 General Mills university of oregon investment group http://uoig.uoregon.edu Pillsbury have become almost iconic in households. Even if a customer is not brand loyal and shops through impulse buying, the brand awareness itself may play a role in which item the customer chooses. Familiarity with brands is due to the marketing strength General Mills has. Weaknesses The only weakness General Mills faces is the slow reaction time the company has generally had when faced with a changing industry trend. For example in the previously stated MSG case (found in the Recent News section), General Mills took a reactive position rather than a proactive one when faced with consumer trends. As end-users continue to become more health conscious and environmentally aware, it will be important for General Mills to assess its position when confronted with such issues and determine what kind of proactive strategy to take. Opportunities Joint ventures have been and will continue to generate opportunities for General Mills. Although joint ventures accounted for less than 1% of total revenues in 2008, the company has taken up this opportunity and sales growth through this revenue generating strategy has rapidly increased. General Mills currently works in conjunction with Cereal Partners Worldwide and Nestle to create joint venture opportunities. By expanding this method of selling products or promoting their brands, General Mills can continue to see sales growth in the future. Threats Although it may seem as if the food manufacturing industry will always thrive due to the obvious human need of food, many threats plague the food manufacturing industry. Reduction of population growth is one of the most important unavoidable threats facing the food manufacturing industry. Demand for food is dependent on the growth of national and global population. If population slows in growth or mortality rates increase, then the food manufacturing industry simply cannot grow due to current levels of saturation, especially in the US market. Consumer trends contribute to threats that face General Mills. Often times, fads or trends cause food manufacturers to take reactive response to such changes in the market. Reduction in demand for one product or an increased demand in a specialty product may cause a food manufacturer to have a difficult time adjusting their inventory levels based on dependence of suppliers and streamline processing capacity. Safety of food items is very important in the food manufacturing industry. Not only does food get inspected by agencies such as the FDA, but batches of food must adhere to quality control guidelines set forth by General Mills. A recall of food items based on the questionability of safety can be very costly for General Mills. PORTER’S 5 FORCES ANALYSIS Supplier Power - Medium Raw materials used in food processing are usually bought from farms. While various suppliers exist in bountiful quantity, General Mills must consider overall customer demand and raw material pricing when choosing which farms to buy from. Often, contractual agreements are made based on expected harvest of a farm which is then adjusted to meet an actual budget at the time of the harvest. Competition for raw materials exists in the food manufacturing industry which in turn causes the supplier to have more pricing power. Additionally, packaging materials for foods is important to consider as part of raw materials. These suppliers are a necessity for all food manufacturers and their role in the industry is vital to operations. Thus, even though a lack in supply of materials such as corrugated boxes and cartons is less likely, these suppliers still have some pricing power due to their specialized services. Barriers to Entry – Very High The food manufacturing industry is one of the most completive industries. Brand loyalty is one of the most powerful drivers for obtaining revenues. Thus, new entrants to the market may have a hard time growing enough awareness and brand loyalty in the market. Additionally, if a new entrant cannot create brand loyal customers on a rapid basis, the costs of maintaining 5 General Mills university of oregon investment group http://uoig.uoregon.edu their business will likely drive the new company to bankruptcy or the possibility of being bought out by a larger company. The only real threats to current companies in the market are new entrants that offer specialty goods. It is difficult and costly for large food manufacturers to create large varieties of specialty goods. Thus, new entrants who specialize in these types of goods may have a better chance penetrating the market. Buyer Power - High While suppliers have some power due to the amount of demand for goods they offer, the buyers of these raw materials are not completely powerless when establishing a buying price. Farms may be able to negotiate contracts with buyers that preset a price. However, a large amount of suppliers sell their goods as lots and if they require too high of a price, the manufacturers can choose to find other suppliers. The only way a farmer generates income is through the sale of his or her harvest. Thus, they are dependent on the food manufacturers to maintain a living. While they may be able to barter with large manufacturers, ultimately it is the buyer who has the pricing power when purchasing agricultural goods. One should assume that if a farmer does not sell his or her harvest, they forego all potential profit from that harvest as their harvest is perishable. Threat of Substitutes – Very High Substitute goods are always a looming threat in the food manufacturing industry. For a mid priced company like General Mills, if the economy turns sour, then consumers will likely purchase more generic brands. If the economy grows stronger, people may choose more expensive brands or decide to go out to restaurants instead. Substitutes are unavoidable in this industry, but General Mills can rely on brand loyalty and awareness to help deter consumers from choosing alternate brands. Degree of Rivalry – High The amount of competition in the food manufacturing industry results in rivalries amongst companies. This is mostly due to the threat of substitutes, but it also expands into suppliers as well as retailers. One characteristic that defines the industry is the constant concentration found in the industry. Brand acquisitions such as General Mills’ recent sale of Pop Secret have led to higher concentration in the industry. Smaller companies are often bought out by larger ones or even conglomerates. Mergers are common within the industry and small cap companies are generally acquired by larger ones. CATALYSTS Upside Increased supplier production and lower cost of raw materials Increased economic welfare of developing nations Foresight of market trends resulting in higher sales forecasts Higher brand awareness resulting in brand loyalty Economic stability in the United States and other major international customers Downside Economic downturn resulting in customers choosing generic brands Catastrophes that reduce overall supply of raw materials and thus increase input costs Higher fuel costs which increase transportation costs of raw materials and finished goods COMPARABLES ANALYSIS I used four comparable companies based on similar debt structure as well as vulnerability to similar risk and economic factors. The four companies used were: Kraft Foods, Heinz, Sara Lee Corp., and Del Monte. I used three metrics to measure implied price, these included EV/EBITDA (50% weighting), EV/Revenue (20% weighting), and EV/OCF (30% weighting). The implied price from the comparables analysis was $55.01 per share. This translates into the stock being 14.61% overvalued. Companies were weighted based on their similarity to General Mills based upon the metrics used. Sara Lee and Del Monte experienced losses in their trailing-twelve month’s income which caused them to be less weighted than Kraft Foods and Heinz. 6 General Mills university of oregon investment group http://uoig.uoregon.edu Kraft Foods – KFT (50%) Kraft Foods was created by James L. Kraft whose roots were in wholesale cheese sales in 1903. The company’s origins were set in Chicago, Illinois and it opened its first plant in 1914. Currently, Kraft owns rights to large brands such as Ritz, Kraft Macaroni and Cheese, Oscar Meyer, Philadelphia Cream Cheese, Nabisco, and Oreo. Kraft employees over 103,000 and distributes products worldwide to over 150 countries. The company generated $40,998 million in 2008 and has a current price of $27.91. Heinz – HNZ (25%) Heinz is a leader in the ketchup industry bottling over 650 million bottles of ketchup annually. The company was started by a man named Henry John Heinz and is currently headquartered in Pittsburgh, Pennsylvania. Heinz focuses on 15 Power Brands which account for over 70% of their sales in 200 countries worldwide. If one were to calculate how much ketchup they sale, it is equivalent to about two single-size packets of ketchup for every person in the world. Last year, the company generated $10,406 million in revenue and has a current price of $44.57. Sara Lee Corp. – SLE (15%) Sara Lee has its origins through a man named Nathan Cummings’ who purchased a small coffee distributor in Baltimore in 1939. The company went public in 1946 and later acquired Kitchens of Sara Lee in 1956. Sara Lee is a large food manufacturer that has created brands such as Hillshire Farm, Jimmy Dean, Kiwi, and Sanex. In fiscal year 2008, Sara Lee Corp. generated $13,212 million in revenue and has a current price of $11.24 Del Monte – DLM (10%) Del Monte originated in 1886 and became publicly traded as Del Monte Foods in 1916 in San Francisco, California. Currently, the company is struggling against their retailers’ alleged use of a cartel between 2000 and 2002. The retailers Dole Food Co. and Weichert are being fined $62.7 million and $20.2 million, respectively. However, as one of the largest produce vendors in the world, Del Monte excels at delivering fresh food to consumers. Last year the company generated $3709.5 million in revenues and is currently trading at a price of $6.15 per share. DISCOUNTED CASH FLOW ANALYSIS DCF Synopsis The Discounted Cash Flows statement used projections based on future revenue growth and percentage of sales. Each line item has been projected out ten years and reflects the most reasonable estimate of growth in future years based on assumptions made in the following explanations. The DCF has been created to show conservative growth estimates to display a more accurate presentation of possible risks that may act as barriers to the company in the future. The price implied by the DCF was $133.38, and undervaluation of 107.05%. Beta The final beta calculated was 0.62 through use of a Hamada formula. This seems reasonable in a market that is influenced by overall markets but at the same time maintains a strong position due to the commodity products it serves. Comparable companies generally have a beta ranging between 0.3 and 0.9. The companies used for comparison to derive this beta can be found in Appendix D. Revenue Many factors contribute to expectations of future revenue. First of all future expectations of growth are comprised of international expansion as well as maintaining sales volumes in the United States. Sales volumes in the United States have been fairly consistent with small growth due to product saturation in the markets. Pricing strategies have been able to increase revenues, but the rise in prices originated from higher input costs associated with raw materials. General Mills expects to maintain single-digit growth in the future. Sales in the United States grew 6.8% from 2007 to 2008 and 20.5% overseas in the same year. This resulted in a 9.73% sales growth from previous year. With continual growth in international markets, the company will likely experience relatively consistent growth in future years. However, as General Mills expands its business, it will also continue to saturate markets 7 General Mills university of oregon investment group http://uoig.uoregon.edu which in turn will cause the company to experience diminishing growth in long-term projections. Thus, it is likely the company will experience about 6-7% growth in the next five years which will then diminish to 3% by the tenth project year. Cost of Goods Sold COGS have remained consistent over the last few years due to gross margins remaining relatively consistent. General Mills takes a pricing strategy that increases price in direct relation to input costs. Thus, when prices of COGS go up, sales prices will rise as well. Future expectations are that COGS will increase as a percentage of sales due mainly to international expansion. Most raw materials are bought in North America, so transporting these materials to international markets is fairly costly and would increase future COGS as expansion continues. Therefore, while historical COGS have been about 61%, future COGS will likely rise to 66% of revenue because of this international sales growth. Depreciation and Amortization International growth will be a large factor effecting increase in depreciation in future years. General Mills is speculating opening additional plants in Europe and a plant in Asia in the next five years. Since the company uses an accelerated depreciation approach to depreciating assets, then they will likely have higher accumulated depreciation in the next five years. Thus, with opening of new plants internationally, General Mills will likely experience a spike in depreciation within the next five years followed by stabilization of depreciation that will return to its current percentage of sales. Research and Development In past years, research and development has been consistent due to General Mills mostly operating in the United States and Canada. However, international expansion will cause the company to increase research and development costs to meet different cultural food needs, especially in Asian countries. Thus, I expect a slight increase in growth of research and development costs due to international expansion and the need for products that align with cultural culinary norms. Effective Tax Rate Tax rates should remain fairly consistent in future years. However, international expansion (and the current presidential election) may raise the tax rate slightly in the future. I expect terminal tax rates to be around 35.30%. After-Tax Income from Joint Ventures Joint ventures have played an increasing role in General Mills’ profitability. There are currently many opportunities to leverage brand image by expanding joint venture operations. General Mills has successfully used their Green Giant character in Europe in conjunction with other products created by companies such as Nestle. General Mills expects continually high growth in this revenue division in the following years as they believe there are many opportunities, especially in the European markets, where brand image can be leveraged in joint ventures to generate additional profits. There will likely be high doubledigit growth in the next few years followed by a sharp decline due to limited opportunities to create additional joint venture operations in long-term projections. Capital Expenditures As previously stated in Depreciation and Amortization, there will be capacity growth in the next few years due to plans to build plants in Europe and Asia. Although purchase prices have not been established yet, the DCF has been adjusted for expected increases as a percentage of sales for capital expenditures. Thus, capital expenditures should increase as a percentage of revenue by about 0.5% in the long term due to buyouts of factories in Europe and Asia, installation of fixtures and machinery, and maintenance. The reason why the increase is not more than 0.5% is because General Mills actually plans to sell some factories in the United States and Canada due to increased automation processes and obtaining salvage value funds from current machinery. RECOMMENDATION General Mills is a company that has had strong growth in international markets and continues to thrive in domestic markets. The company has built a positive image by effectively promoting its brands to end-users. Iconic images such as the Pillsbury Doughboy have allowed General Mills to become a household name in the Consumer Goods Industry. Continual expansion and growth through joint ventures will contribute to the future profitability of the company. Although my comparables 8 General Mills university of oregon investment group http://uoig.uoregon.edu analysis shows overvaluation of 17.42%, this only shows a snapshot of comparisons in this currently unstable market. Thus, the weighting of my comparables analysis was only 30% of total valuation. My DCF portrays a possible future for General Mills and shows that the company will remain competitive in the industry. The DCF calculated shows a 45.37% undervaluation of the company. I gave the DCF a 70% weighting as it shows expected future growth. Prices DCF Implied Price Comparable Implied Price Weighted Implied Price Current Price Undervalued $ $ $ $ Weight 91.93 70% 52.22 30% 80.02 100% 63.24 26.53% I recommend a BUY for General Mills in all portfolios due to my evaluation that the company is 26.53% undervalued. It should also be noted that return through dividends had a 2.70% yield last year (issuance date of dividends this year is on November 3rd). Therefore, it is with confidence that I recommend the University of Oregon Investment Group to take holdings in General Mills (GIS). 9 General Mills university of oregon investment group http://uoig.uoregon.edu APPENDIX A – COMPARABLES ANALYSIS Weight Current Price Beta Market Cap Shares Outstanding Long-term Debt Enterprise Value Revenue (ttm) EBITDA (ttm) Net Income (ttm) Operating Cash Flows Preferred Stock Multiples EV/EBITDA EV/Revenue EV/Operating Cash Flows $ $ $ $ $ $ $ $ $ General Mills 0% 63.24 0.62 21,084,216,000 333,400,000 4,465,000,000 25,549,216,000 14,077,400,000 2,649,880,000 1,284,300,000 2,027,680,000 General Mills 9.6417 1.8149 12.6002 $ $ $ $ $ $ $ $ $ Kraft Foods 50% 26.37 0.33 40,032,641,208 1,518,113,053 19,348,000,000 59,380,641,208 40,998,000,000 5,741,000,000 2,521,000,000 4,593,000,000 - Heinz 25% $ 41.76 0.51 13,042,049,147 312,309,606 5,106,636,000 18,148,685,147 10,405,701,000 2,566,378,000 868,595,000 2,175,831,000 - $ $ $ $ $ $ $ $ Kraft Foods 10.3433 1.4484 12.9285 Heinz 7.0717 1.7441 8.3410 $ $ $ $ $ $ $ $ $ Sara Lee Corp. 15% 10.25 0.91 7,239,647,775 706,307,100 2,340,000,000 9,579,647,775 13,212,000,000 872,000,000 (79,000,000) 671,000,000 Sara Lee Corp. 10.9858 0.7251 14.2767 Del Monte 10% $ $ $ $ $ $ $ $ $ 5.87 0.93 1,159,613,687 197,549,180 1,843,100,000 3,002,713,687 3,709,500,000 430,100,000 119,500,000 369,300,000 Del Monte 6.9814 0.8095 8.1308 $ $ $ $ $ $ $ $ $ Weighted Average 100% 21.06 0.52 24,478,741,425 962,834,911 11,485,969,000 35,964,710,425 25,453,175,250 3,685,904,500 1,477,748,750 2,978,037,750 Weighted Average 9.2856 1.3499 11.5041 Summary of Comparables Analysis Multiples EV/EBITDA EV/Revenue EV/Operating Cash Flows $ $ $ $ $ Implied Value 60.41 50% 43.61 20% 44.32 30% 52.22 Implied Price 63.24 Current Price 17.42% Overvalued 10 General Mills university of oregon investment group http://uoig.uoregon.edu APPENDIX B – DCF ANALYSIS in Millions Revenue % growth Cost of Goods Sold % of Revenue 1 Depreciation and Amortization % of Revenue Gross Profit Gross Margin SG&A % of Revenue 2 Research and Development % of Revenue Restructuring Costs % of Revenue Operating Income (EBIT) Operating Margin Interest Expense % of Revenue Subsidiary and Capitalized Interest % of Revenue Income Before Taxes % of Revenue Income Tax Expense Effective Tax Rate Taxed Income from Joint Ventures % growth Net Income % of Revenue Add Back: Depreciation Add Back: Interest Expense Cash Flow from Operations % of Revenue Current Assets % of Revenue Current Liabilities % of Revenue Net Working Capital % of Revenue Change in NWC Capital Expenditures % of Revenue Free Cash Flow Discounted Cash Flows $ $ $ $ $ $ 2006 11,711.3 3.57% 7,121 60.8% 424 3.62% 4,166.5 39.20% 1,999 17.07% 178 1.52% 29.8 0.3% 1,959.0 16.73% 367 3.13% 32.6 0.3% 1,559.4 13.32% 538.3 34.52% 69.2 -27.08% 1,090.3 9.31% 424 240 1,755 14.98% 3,041 25.97% 6,138 52.41% $ $ $ $ $ (3,097) -26.44% (1,968) 360 3.07% 3,363 $ 2007 12,441.5 6.24% 7,537 60.6% 418 3.36% 4,486.4 39.42% 2,198 17.67% 191 1.54% 39.3 0.3% 2,058.0 16.54% 397 3.19% 29.9 0.2% 1,631.3 13.11% 560.1 34.33% 72.7 5.06% 1,143.9 9.19% 418 261 1,822 14.65% 3,054 24.54% 5,845 46.98% $ $ $ $ $ (2,791) -22.44% 306 460 3.70% 1,056 $ 2008 13,652.1 9.73% 8,319.1 60.94% 459.2 3.364% 4,873.8 39.06% 2,420.3 17.73% 204.7 1.50% 21.0 0.15% 2,227.8 16.32% 432.0 3.16% (10.3) -0.1% 1,806.1 13.23% 622.2 34.45% 110.8 52.41% 1,294.7 9.48% 459.2 283.2 2,037.1 14.92% 3,620.0 26.52% 4,856.3 35.57% $ $ $ $ $ (1,236.3) -9.06% 1,555.1 522.0 3.82% (40.0) $ 2009 Q1 3,497.3 13.84% 2,194.0 62.73% 111.6 3.191% 1,191.7 37.27% 668.4 19.11% 50.7 1.45% 2.7 0.08% 469.9 13.44% 94.5 2.70% (5.5) -0.2% 380.9 10.89% 133.2 34.97% 30.8 37.50% 278.5 7.96% 111.6 61.5 451.5 12.91% 3,326.2 $ $ $ $ $ 4,465.0 (1,138.8) -32.56% 97.5 128.6 3.68% 225.4 $ $ 2009 Q234 E 11,200.0 5.59% 7,168.0 64.00% 380.8 3.400% 3,651.2 36.00% 1,904.0 17.00% 179.2 1.60% 11.2 0.10% 1,556.8 13.90% 336.0 3.00% (11.2) -0.1% 1,232.0 11.00% 426.3 34.60% 121.6 37.50% 927.3 8.28% 380.8 219.7 1,527.8 13.64% 3,900.0 $ $ $ $ $ 4,475.0 (575.0) -5.13% 563.8 421.0 3.26% 543.0 $ 515.0 1 Depreciation and amortization has been calculated once out of COGS, this is because 95% of depreciation derives from COGS 2 Research and Development has been calculated out of SG&A 2009E 14,697.3 7.65% 9,362.0 63.70% 492.4 3.350% 4,842.9 36.30% 2,572.4 17.50% 229.9 1.56% 13.9 0.09% 2,026.7 13.79% 430.5 2.93% (16.7) -0.1% 1,612.9 10.97% 559.5 34.69% 152.4 37.50% 1,205.8 8.20% 492.4 281.2 1,979.3 13.47% 3,900.0 26.54% 4,475.0 30.45% $ $ $ $ $ (575.0) -3.91% 661.3 549.6 3.74% 768.4 $ $ 2010E 15,726.1 7.00% 10,064.7 64.00% 566.1 3.600% 5,095.3 36.00% 2,752.1 17.50% 251.6 1.60% 31.5 0.20% 2,060.1 13.10% 471.8 3.00% 15.7 0.1% 1,572.6 10.00% 550.4 35.00% 202.6 33.00% 1,224.8 7.79% 566.1 306.7 2,097.6 13.34% 4,088.8 26.00% 4,403.3 28.00% $ $ $ $ $ (314.5) -2.00% 260.5 597.6 3.80% 1,239.6 $ 1,095.4 $ 2011E 16,826.9 7.00% 10,937.5 65.00% 656.3 3.900% 5,233.2 35.00% 2,860.6 17.00% 286.1 1.70% 33.7 0.20% 2,052.9 12.20% 521.6 3.10% 16.8 0.1% 1,514.4 9.00% 530.0 35.00% 263.4 30.00% 1,247.8 7.42% 656.3 339.1 2,243.1 13.33% 4,408.7 26.20% 4,543.3 27.00% $ $ $ $ $ (134.6) -0.80% 179.9 673.1 4.00% 1,390.1 $ 1,144.6 $ 2012E 17,836.6 6.00% 11,593.8 65.00% 695.6 3.900% 5,547.2 35.00% 3,032.2 17.00% 303.2 1.70% 35.7 0.20% 2,176.1 12.20% 552.9 3.10% 17.8 0.1% 1,605.3 9.00% 561.9 35.00% 321.4 22.00% 1,364.8 7.65% 695.6 359.4 2,419.8 13.57% 4,691.0 26.30% 4,815.9 27.00% $ $ $ $ $ (124.9) -0.70% 9.8 749.1 4.20% 1,660.9 $ 1,274.3 $ 2013E 18,906.7 6.00% 12,289.4 65.00% 718.5 3.800% 5,898.9 35.00% 3,214.1 17.00% 340.3 1.80% 37.8 0.20% 2,306.6 12.20% 586.1 3.10% 18.9 0.1% 1,701.6 9.00% 597.3 35.10% 369.6 15.00% 1,473.9 7.80% 718.5 380.4 2,572.8 13.61% 4,991.4 26.40% 5,010.3 26.50% $ $ $ $ $ (18.9) -0.10% 105.9 794.1 4.20% 1,672.7 $ 1,195.8 $ 2014E 19,852.1 5.00% 12,903.9 65.00% 754.4 3.800% 6,193.9 35.00% 3,335.2 16.80% 357.3 1.80% 39.7 0.20% 2,461.7 12.40% 615.4 3.10% 19.9 0.1% 1,826.4 9.20% 641.1 35.10% 402.8 9.00% 1,588.2 8.00% 754.4 399.4 2,741.9 13.81% 5,241.0 26.40% 5,260.8 26.50% $ $ $ $ $ (19.9) -0.10% (0.9) 833.8 4.20% 1,909.1 $ 1,271.7 $ 2015E 20,844.7 5.00% 13,549.0 65.00% 750.4 3.600% 6,545.2 35.00% 3,501.9 16.80% 375.2 1.80% 41.7 0.20% 2,626.4 12.60% 667.0 3.20% 20.8 0.1% 1,938.6 9.30% 682.4 35.20% 431.0 7.00% 1,687.2 8.09% 750.4 432.2 2,869.9 13.77% 5,523.8 26.50% 5,419.6 26.00% $ $ $ $ $ 104.2 0.50% 124.1 896.3 4.30% 1,849.5 $ 1,148.0 $ 2016E 21,678.5 4.00% 14,307.8 66.00% 780.4 3.600% 6,590.3 34.00% 3,620.3 16.70% 411.9 1.90% 43.4 0.20% 2,514.7 11.60% 693.7 3.20% 21.7 0.1% 1,799.3 8.30% 633.4 35.20% 452.6 5.00% 1,618.5 7.47% 780.4 449.5 2,848.5 13.14% 5,744.8 26.50% 5,636.4 26.00% $ $ $ $ $ 108.4 0.50% 4.2 932.2 4.30% 1,912.1 $ 1,105.9 $ 2017E 22,545.6 4.00% 14,880.1 66.00% 789.1 3.500% 6,876.4 34.00% 3,765.1 16.70% 428.4 1.90% 45.1 0.20% 2,637.8 11.70% 721.5 3.20% 22.5 0.1% 1,893.8 8.40% 666.6 35.20% 470.7 4.00% 1,697.9 7.53% 789.1 467.5 2,954.5 13.10% 5,974.6 26.50% 5,749.1 25.50% $ $ $ $ $ 225.5 1.00% 117.1 969.5 4.30% 1,868.0 $ 1,006.7 $ 2018E 23,222.0 3.00% 15,326.5 66.00% 812.8 3.500% 7,082.7 34.00% 3,878.1 16.70% 441.2 1.90% 46.4 0.20% 2,717.0 11.70% 743.1 3.20% 23.2 0.1% 1,950.6 8.40% 688.6 35.30% 484.8 3.00% 1,746.9 7.52% 812.8 480.8 3,040.4 13.09% 6,153.8 26.50% 5,921.6 25.50% 232.2 1.00% 6.8 998.5 4.30% 2,035.1 1,021.9 APPENDIX C – DCF ASSUMPTIONS AND ANALYSIS Sales Growth Sales growth is expected to maintain a healthy trend with future expectations to remain in single digit sales growth. Most growth by price should be seen in the United States while sales growth by volume will be experienced internationally. Growth of first quarter is up 13.84% from last year due to increased ice cream sales of Haagen-Dazs in European markets as well as pricing increases. Assumptions (in millions except prices) Tax Rate 35.30% 10 Year Treasury 3.72% Cost of Debt 5.95% Return on Equity (CAPM) 8.06% Beta 0.62 Market Risk Premium 7.00% WACC 7.32% % Equity % Debt 82.54% 17.46% Terminal Growth Rate Terminal Value PV Terminal PV Free Cash Flow Long Term Debt Firm Value Implied Price Current Price Equity Value Shares Outstanding Undervalued $ $ $ $ $ $ $ $ 3.00% 48,516 24,362 10,780 4,465 35,142 91.93 63.24 30,677 333.7 45.37% 11 General Mills university of oregon investment group http://uoig.uoregon.edu APPENDIX D – BETA CALCULATION Hamada Formula Computations K CAG HNZ THS SLE CPB DLM Beta 0.33 0.68 0.51 0.44 0.91 0.33 0.93 D/E Ratio 3.79 1.41 4.29 1.24 2.74 3.90 2.10 SE 0.14 0.20 0.14 0.41 0.16 0.15 0.21 Weight 10.0% 15.0% 10.0% 10.0% 25.0% 7.5% 22.5% Mean Median 0.69 0.51 2.59 2.74 0.20 0.16 100% 100% Pure Business Beta Sample D/E Unlevered Busienss Beta GIS D/E GIS Beta 0.691 2.594 0.258 2.119 0.307 GIS Hamada Beta Hamada Formula 0.26((1+(1-0.35)2.119)) 0.62 APPENDIX E – BETA SENSITIVITY ANALYSIS Beta Standard Error WACC at Company Beta Error (-3σ) (-2.5σ) (-2σ) (-1.5σ) (-1σ) (-0.5σ) 0 0.5σ 1σ 1.5σ 2σ 2.5σ 3σ Beta 0.024 0.123 0.223 0.322 0.421 0.521 0.620 0.719 0.819 0.918 1.017 1.117 1.216 0.62 0.20 7.32% $ $ $ $ $ $ $ $ $ $ $ $ $ Price 519.81 306.92 214.93 163.64 130.94 108.28 91.65 78.93 68.89 60.77 54.06 48.43 43.63 12 General Mills university of oregon investment group http://uoig.uoregon.edu APPENDIX F – ADDITIONAL INFORMATION Sales Distribution APPENDIX E – SOURCES Yahoo Finance Wall Street Journal Business Wire St. Paul Business Journal Associated Press Factset Motley Fool Business Week S&P NetAdvantage General Mills Investor Relations Website Kraft Investor Relations Website Heinz Investor Relations Website Sara Lee Corp. Investor Relations Website Del Monte Investor Relations Website 13