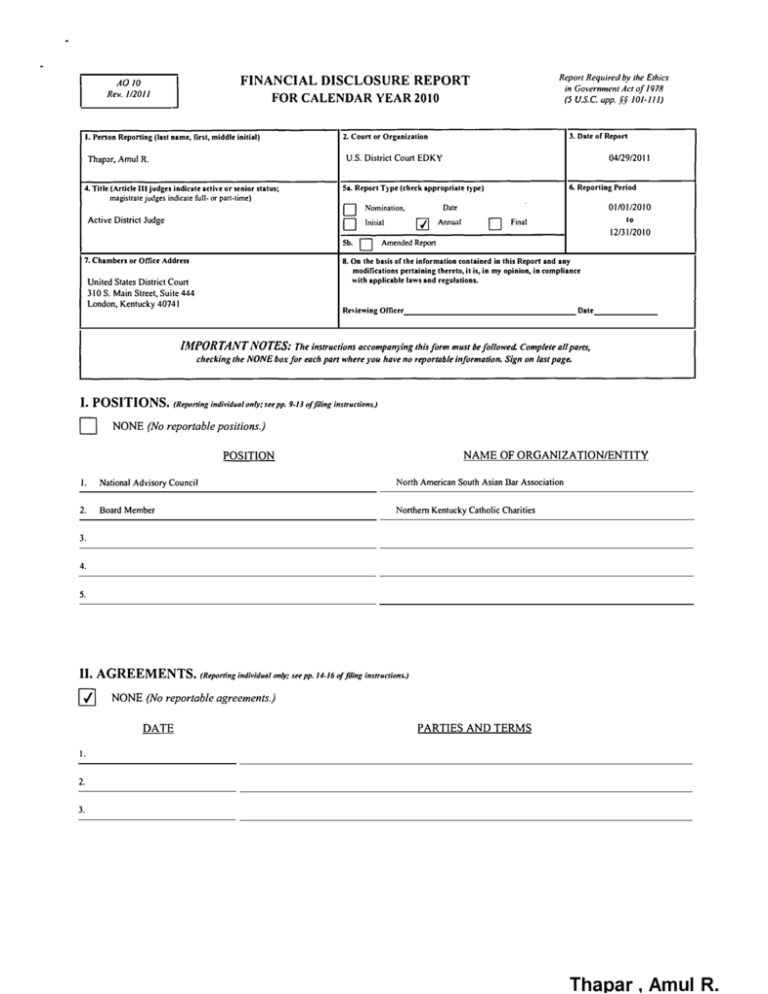

Amul R. Thapar – 2010

advertisement

Repor/ Required by /he E1hics

FINANCIAL DISCLOSURE REPORT

AO/O

Rev.

112011

in Governmenl Ac/ of 1978

FOR CALENDAR YEAR 2010

I. Penon RepoMing (last name, lirst, middle inilial)

(5

U.S.C. upp.

3. Dale of Report

2. CouM or Organizalion

04/29/2011

U.S. District Court EDKY

Thapar, Amul R.

4. Tille (Article Ill judges indicale aclive or senior status;

§§ 101-1I1)

6. Reporting Period

Sa. Report Type (check appropriale type)

magislrale judges indicate full- or part-lime)

D

D

Active District Judge

Sb.

7. Chambers or Office Address

[{]

Initial

D

01/01/2010

Date

Nomination.

D

Annual

to

Final

12/31/2010

Amended Report

8. On lhe basis of lhe information contained in I his Report and any

modifications pertaining thereto, it is, in my opinion, in compliance

,,·ith applicable laws and regulations.

United States District Court

310 S. Main Street, Suite 444

London, Kentucky 40741

Date

Re>·iewing Officer

IMPORTANT NOTES:

The instructions accompanying this form must /Je followed. Complete all parts,

checking /he NONE /Jox for each part where you have no reporta/Jle information. Sign on last page.

I. POSITI0NS,

D

NONE

(Reporting individual only: see pp. 9-13 offiling instructions.)

(No reportable positions.)

NAME OF ORGANIZATION/ENTITY

POSITION

I.

National Advisory Council

North American South Asian Bar Association

2.

Board Member

Northern Kentucky Catholic Charities

3.

4.

5.

II, AGREEMENTS.

llJ

NONE

(Reporting individual only: see pp. 14-16 offiling instructions.)

(No reportable agreements.)

PARTIES AND TERMS

I.

2.

3.

Thapar

,

Amul R.

0412912011

Thapar, Amul R.

Page 2 of9

III. NON-INVESTMENT INCOME.

A.

Date or Report

Name or Penon Reporting

FINANCIAL DISCLOSURE REPORT

(Reponingindividualandspouu;supp.17-Uoffilinginstructions.)

Filer's Non-Investment Income

[{]

NONE (No reportable non-investment income.)

SOURCE AND TYPE

TNCOME

(yours, not spouse's)

I.

2.

3.

4.

B.

Spouse's Non-Investment Income

-

I/you were manied duringany portion of the reportingyear, complete this section.

(Dollar amount not required except for honoraria.)

[{]

NONE (No reportable non-investment income.)

SOURCE AND TYPE

I.

2.

3.

4.

IV. REIMBURSEMENTS

-transportation, lodging, food, entertainment

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

D

NONE (No reportable reimbursements.)

SOURCE

I.

University of Virginia Law

School Moot Court

2.

North American South Asian

Bar Conference

3.

Chicago Indian Amer. Bar

Assoc and Korean Amer. Bar

DATES

LOCATION

2/18/2010 to

2/2 l/20JO

Charlottesville, VA

6/24/20 JO to

6/27/2010

Boston, MA

9125120 JO to

9/26/2010

Chicago,

10118/2010

Columbus, OH

11/18/2010 to

11/21/2010

Los Angeles, CA

PURPOSE

Judged Moot Court at Law

ITEMS PAID OR PROVTDED

Travel, meals, hotel

School

Speaker, meetings, and

Travel, meals, hotel

moot court judge

IL

Speaker at both conferences

Travel, meals, hotel

Speaker

Travel and meal

Speaker and moot court

Travel, meals, hotel

Assoc

4.

Ohio State Asian American

Bar Association

5.

North American Pacific Asian

Bar Assoc

judge

FINANCIAL DISCLOSURE REPORT

Page 3 of9

V. GIFTS.

[{]

Name of Penon Reporting

Thapar, Amul R.

Date of Report

04/29/2011

(Includes those to spouse and dependent children: see pp. 18-31 offiling instructions.)

NONE (No reportable gifts.)

DESCRIPTION

SOURCE

VALUE

I.

2.

3.

4.

5.

VJ. LIABILITIES.

[{]

(Includes those ofspouse and dependent children; see pp. 31-33 offiling instructions.)

NONE (No reportable liabilities.)

CREDITOR

I.

2.

3.

4.

5.

DESCRIPTION

VALUE CODE

VII. INVESTMENTS and TRUSTS

NONE

0412912011

Thapar, Amul R.

Page 4 of9

D

Date or Report

Nam• or Person Reporting

FINANCIAL DISCLOSURE REPORT

-

income, va1ue, 1ransadions <Includes thou ofspouse and dependent children; m! PP· 1<1-60 offiling instrudions.J

(No reportable income, assets, or transactions.)

A.

B.

c.

D.

Description of Assets

Income during

Gross value at end

Transactions during reponing period

reponing period

of reponing period

( including trust assets)

Place "(X)" after each asset

exempt from prior disclosure

(I)

( 2)

(I)

(2)

( I)

(2)

Amount

Code I

Type (e.g.,

Value

Value

Type (e.g.,

Date

(3)

Value

(4)

Gain

(5)

Identity of

div., rent,

Code2

Method

buy, sell,

mm/dd/yy

Code2

Code I

buyer/seller

(A-H)

or int.)

(J-P)

Code3

redemption)

(J-P)

(A-H)

I.

ING Direct Accounts

A

Interest

K

T

2.

Vanguard Prime Money Market

A

Interest

J

T

3.

TD Bank USA (Ameritrade Money Market)

A

Interest

J

T

4.

Fifth Third Bank (Checking Acct.)

A

Interest

J

T

5.

Paypal Inc. (Money Market)

A

Interest

J

T

6.

Autozone Inc. (AZO) Common

None

7.

Under Armour (UA) Common

None

J

T

8.

Nuance Comm. Inc. (NUAN) Common

None

J

T

9.

Select Comfort Corp. (SCSS) Common

IO.

Sold

12/29/10

J

Buy

08/03/10

J

None

Sold

07/26/IO

J

Volcom Inc. (VLCM) Common

None

Sold

07/26/10

J

I I.

Dreamworks Animation (DWA) Common

None

12.

Accenture Ltd (ACN) Common

Dividend

Sold

12/29/10

J

B

13.

Dawson Geophysical Co. (DWSN) Commor

None

Sold

12/29/10

J

A

14.

Hussman Strategic Growth Fund (HSGFX)

A

Dividend

Sold

12/29/10

J

15.

Lloyds TSB Group ADR (LYG)

A

Dividend

Sold

12/29/10

J

16.

Grupo Areoportuario Del Pac (PAC)

A

Dividend

Sold

12/29/IO

J

A

17.

Zumiez Inc. (ZUMZ) Common

None

Sold

12/29/IO

J

A

I. Income Gain Codes:

(Sec Columns BI and D4)

2. Yalu Codes

(Sec Columns Cl and DJ)

A

J

(Seo Column C2)

T

B =$1.001 -$2.500

c =$2.501 -$5.000

D =$5.001 - $15.000

F=$50.00l -$100.000

G =$I 00.00 I -$1.000.000

111 =St.000 .001 -$5.000.000

112 =More than $5.000.000

J =S 15.000 or less

K =SI 5.001 -$50.000

L =S50.00I - SI 00.000

N •S250.001 -$500.000

O =S500.00I

Pl •Sl.000 .001

Sl.000. 000

Q =Appraisal

R =Cost (Real Estate Only)

S ::Assessment

U

V =0thcT

W =Estimated

=

Hook Value

-

$5.000.000

M =SI 00.00 I - $250.000

P2 =$5.000.001 -$25.000.000

P4 =More than $50.000. 000

PJ =$25.000.001 -$50.000.000

3. V;:iluc Method Codes

c

A =$1.000 or less

-

(if private

transaction)

(Q-W)

T =Cash Martct

E =Sl5.00l -S50.000

Thapar, Amul R.

Page 5of9

VII. INVESTMENTS and TRUSTS

D

Date of Report

Name of Person Rrporting

FINANCIAL DISCLOSURE REPORT

04/2912011

-inc-ome, vu1ue, 1runsuc-tions r1nc-1udes those of spouse and dependent c-hirdren: see PP·

14-60 offilinc instructions.)

NONE (No reportable income, assets, or transactions.)

A.

B.

c.

D.

Description of Assets

Income during

Gross value at end

Transactions during reporting period

reporting period

of reporting period

(including trust assets)

(I)

(2)

(I)

(2)

(I)

(2)

(3)

(4)

(5)

Place "(X)" after each asset

Amount

Type (e.g.,

Value

Value

Type (e.g.,

Date

Value

Gain

Identity of

exempt from prior disclosure

Code I

div., rent,

Code2

Method

buy, sell,

mm/dd/yy

Code2

Code I

buyer/seller

(A-H)

or int)

(J-P)

Code3

redemption)

(J-P)

(A-H)

18.

Nintendo Corporation (NTDOY) Common

19.

Marvel Corp. (MVL) Common

None

Chipotle Mexican Grill Inc. (CMG/B)

None

20.

A

Dividend

J

T

Redeemed

01/04/10

J

Dividend

Sold

12/29/10

J

A

None

Sold

12/29/10

J

c

Dividend

Sold

08/03/10

J

None

Sold

12/29/10

J

A

Sold

12/29/10

J

A

J

(if private

transaction)

(Q-W)

T

Common

21.

Columbia Sportswear Co. (COLM)

A

Common

22.

Middelby Corp. (MIDD) Common

23.

Wexford TR Muhlenkamp FD (MUHLX)

24.

Portfolio Recovery Assoc. (PRAA)

A

Common

25.

Disney Corp (DIS) Common

A

Dividend

J

T

26.

Activision Blizzard, Inc. (ATV!) Common

A

Dividend

J

T

27.

Sun Hydraulics Corp. (SNHY) Common

A

Dividend

28.

Amazon (AMZN) Common

None

J

T

Buy

12/31/10

J

29.

Labcorp Holdings (LH) Common

None

J

T

Buy

12/31/10

J

30.

Fannie Mae (FNM) Common

A

Dividend

J

T

31.

Hasboro Corp. (HAS) Common

A

Dividend

J

T

32.

Home Depot Inc. (HD) Common

A

Dividend

J

T

33.

Montpelier Re Holdings Ud (MRH)

A

Dividend

J

T

A

Dividend

J

T

Common

34.

Sanderson Farms Inc. (SAFM) Common

I. Income Gain Codes:

(Sec Columns BI

2. Vain

and

D4)

Codes

(S..c

- Columns Cl and DJ)

A =$1,000 or less

B =$1,001 -$2,500

c =$2.50t - $5,000

D=S5.00t -St5.000

F =$50.001 - $100.000

G =$100.00 I - $1.000.000

Ill =Sl.000.001 -$5.000.000

112 =More than $5.000.000

J =Sl5.000 or less

K =SI 5.001 - $50.000

L =$50.001 - SI00.000

M =SI00.001 -$250.000

N =$250.001 -$500.000

0 =$500.001 -Sl,000.000

Pl =Sl.000.001 -$5.000.000

P2 =$5.000.001 -$25.000.000

Q =Appraisal

R =Cost (Real E.stalC Only)

S ""Assessment

U =!look Value

V =Other

W =Estimated

P4 =More than $50.000. 000

P3 =$25.000.001 -$50.000.000

3. Value Mc1hod Codes

(Sc.: Column C2)

T =Cash Market

E =S 15.00 I

-

$50.000

VII. INVESTMENTS and TRUSTS

NONE

04/2912011

Thapar, Amul R.

Page 6of9

D

Date of Report

Name of Person Reporting

FINANCIAL DISCLOSURE REPORT

-

income, value, transactions <Includes those of spouse and dependent children; see PP· 14-60 offilinc instructions.)

(No reportable income, assets, or transactions.)

A.

B.

c.

D.

Description of Assets

Income during

Gross value at end

Transacti ons during reporting period

reporting period

of reporting period

(including trust assets)

( I)

(2)

(I )

(2)

(1)

(2)

(3)

(4)

(5)

Place "(X)" after each asset

Amount

Type (e.g.,

Value

Value

Type ( e.g.,

Dale

Value

Gain

Identity of

exempt from prior disclosure

Code 1

div., rent,

Code2

Method

buy, sell,

mm/dd/yy

Code2

Code 1

buyer/seller

(A -H)

or int.)

(J-P)

Code 3

redemption)

(J-P)

(A-H)

35.

United Fire

& Casualty Company (UFCS)

A

Dividend

J

T

(if private

transaction)

(Q-W)

Common

36.

Apple Inc. (AAPL) Common

None

J

T

37.

Berkshire Hathaway Inc. Del Class B

None

K

T

(BRK.B) Common

38.

Costco Wholesale Corp. (COSD Common

A

Dividend

J

T

39.

Cryptologic Inc. (CRYP) Common

A

Dividend

J

T

40.

Exxon Mobil Corp (XOM) Common

A

Dividend

J

T

41.

Flame! Tech Spon ADR (FLML) Common

None

J

T

42.

Intel Corp. (INTC) Common

Dividend

J

T

43.

Markel Corp. (MKL) Common

None

J

T

44.

Microsoft Corp. (MSFT) Common

Dividend

J

T

45.

Buffalo Wild Wings (BWLD} Common

None

J

T

46.

CTRIP.com International (CTRP} Common

Dividend

J

T

47.

Forrnfactor Inc. (FORM) Common

None

J

T

48.

lnventiv Health Inc. (VTIV) Common

None

49.

Southwest Airlines (LUY) Common

None

J

T

Rofin-Sinar Technologies Inc. (RSTI}

None

J

T

Dividend

J

T

50.

A

A

A

Sold

04/26/10

J

Buy

04/26110

J

Common

51.

United Health Group Inc. (UNH) Common

I. Income Gain Codes:

(See Columns Bl and 04)

2. Value Codes

(Sec Colwnns CI and 03)

A

A =$1.000 or less

ll =$1.001 - $2.500

c =$2.501 - $5.000

D=$5.00l -$15.000

F =$50.001 - $100.000

G =$100.001 -$1.000.000

Ill =$1.000.001 -$5.000.000

112 =More than $5.000.000

J =S 15.000 or less

K =$15.001 -$50.000

L =$50.001 - SI00.000

M =SI00.001 -$250.000

N =$250.001 - $500.000

0 =$500.001 -SI.000. 000

Pl =Sl.000.001 -$5.000.000

P2 =$5.000.001 - $25.000.000

r.t =More than S50.000.000

P3 =$25.000.001 -$50.000.000

3. Value Method Codes

(Sec Column C2)

Q =Appraisal

R =<"ost (Real Estalc Only)

S =Assessment

U :Hook Value

v =Oth<"r

W =Estimated

T =Cash Marl.:ct

E =$15.001 -$50.000

VII. INV ESTMENTS and TRu ST s

NONE

. 04/29/2011

Thapar, Amul R.

Page 7of9

D

Date of Report

Name of Penon Reporting

FINANCIAL DISCLOSURE REPORT

-

income, •·alue, transactions (Includes thou of spouu and depmdmt children; SU pp.

34-60 offiling instructions.)

(No reportable income, assets, or transactions.)

A.

B.

c.

D.

Description of Assets

Income during

Gross value at end

Transactions during reporting period

(including trust assets)

reporting period

of reporting period

Place "(X)" after each asset

exempt from prior disclosure

(I)

(2)

(I)

(2)

(I)

(2)

(3)

(4)

(5)

Amount

Code I

Type (e.g.,

Value

Value

Type (e.g.,

Date

Value

Gain

Identity of

div., rent,

Code2

Method

buy, sell,

mm/dd/yy

Code 2

Code I

buyer/seller

(A-H)

or int.)

(J-P)

Code 3

redemption)

(J-P)

(A-H)

(Q-W)

52.

Altria Group Inc. (MO) Common

53.

Chesapeake (CHK)

54.

Federated Investors Inc. (Fil) Common

55.

Pfizer Inc. (PFE) Common

56.

Kraft Foods Inc.

57.

Medco Health Solutions (MHS) Common

58.

Phillip Morris International (PM)

59.

60.

Dividend

J

T

None

J

T

A

Dividend

J

T

A

Dividend

J

T

A

Dividend

J

T

None

J

T

A

Dividend

J

T

McDonalds (MCD) Common

A

Dividend

J

T

National Oilwell Varco, Inc. (NOV)

A

Dividend

J

T

None

J

T

A

Dividend

J

T

A

Dividend

J

T

(KFT) Common

A

Common

61.

Nokia Corp (NOK) Common

62.

Vanguard

63.

Vanguard Windsor Portfolio

500 Index Funds

I. Income Gain Codes:

(Sec Columns BI

and D4)

2. Value Codes

(Sec Columns Cl and DJ)

A =$1.000 or less

ll =$1.00t

F =$50.001 -$100.000

G =$100.00 I - $1.000.000

•

$2.500

J. Value Mc1hod Codes

(Sec Column C2)

Please see Section VIII

c 42.501 - $5,000

D =$5,001 -$15,000

Ill =$1.000.001 -$5,000 .000

112 =More 1han $5.000.000

J =S15.000 or IC'Ss

K =St5.00I -$50.000

L =$50.001 - $100.000

M =$100.00 1 -$250.000

N =$250.001 - $500.000

0 =$500.001 -$1.000.000

r1 =s1.ooo.001 -S5.ooo.ooo

P2 =$5.000.001 -$25.000.000

r =More lhan $50.000, 000

rJ =S25.ooo.001 -S5o.ooo.ooo

Q =Appraisal

){ =CoSI )Kcal ls1a1c Only)

S =Assessment

U =Book Value

v =Oth1..'f

W =Estimated

(if private

transaction)

T =Cash Market

E =$15.001 -$50.000

FINANCIAL DISCLOSURE REPORT

Page 8of9

Name of Penon Reporting

04/2912011

Thapar, Amul R.

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

The Vanguard Windsor Fund is part of a 529. We invest monthly

Date of Report

(lndicatepartofreport.)

I was not sure how to reflect this on the

statement. Also, we opened these in late 2008 and they became reportable in 2009 but I believe they were mistakenly Jell off my 2009 Report.

,

,

FINANCIAL DISCLOSURE REPORT

Name of Penon Reporting

Thapar, Amul R.

Page 9 of9

Date of Report

04/29/2011

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is

accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory

provisions permitting non-disclosure.

I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in

compliance with the provisions of 5 U.S.C. app. § 501 et. seq., 5 U.S.C. § 7353, and Judicial Conference regulations.

Signature:

s/ Amul R. Thapar

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL

AND CRIMINAL SANCTIONS (5 U.S.C. app. § 104)

Committee on Financial Disclosure

Administrative Office of the United States Courts

Suite 2-301

One Columbus Circle, N.E.

Washington, D.C. 20544