View a PDF of all CPCU 540 assignments

advertisement

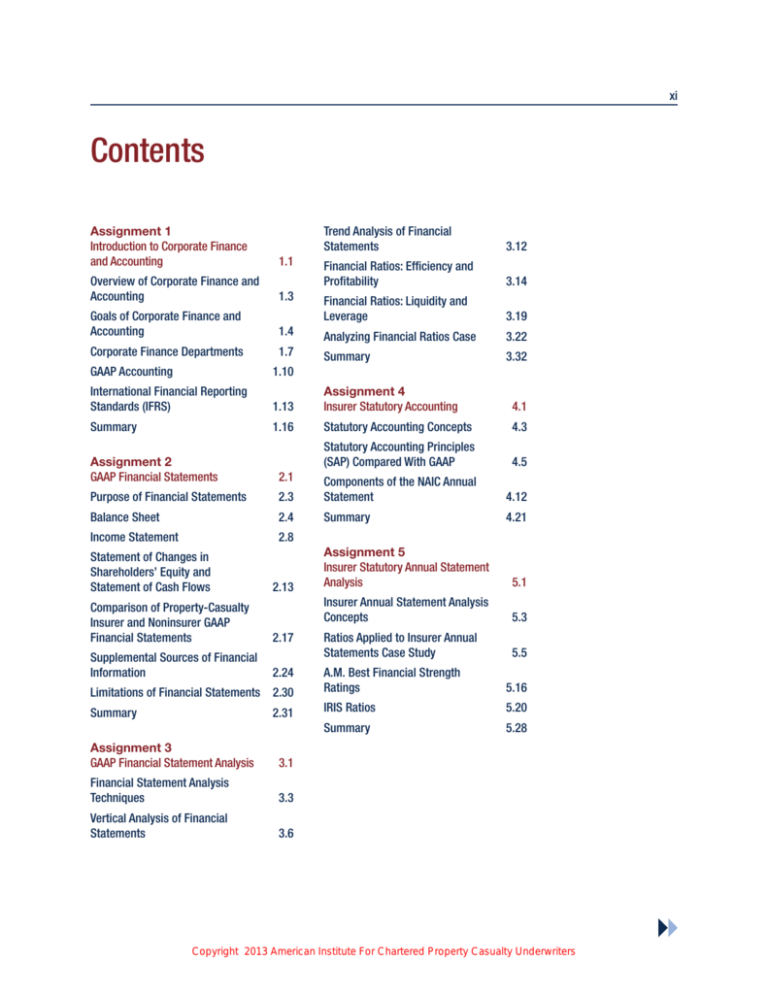

xi Contents Assignment 1 Introduction to Corporate Finance and Accounting 1.1 Overview of Corporate Finance and Accounting 1.3 Goals of Corporate Finance and Accounting 1.4 Corporate Finance Departments 1.7 Trend Analysis of Financial Statements 3.12 Financial Ratios: Efficiency and Profitability 3.14 Financial Ratios: Liquidity and Leverage 3.19 Analyzing Financial Ratios Case 3.22 Summary 3.32 GAAP Accounting 1.10 International Financial Reporting Standards (IFRS) 1.13 Assignment 4 Insurer Statutory Accounting 4.1 Summary 1.16 Statutory Accounting Concepts 4.3 Assignment 2 GAAP Financial Statements 2.1 Statutory Accounting Principles (SAP) Compared With GAAP 4.5 Purpose of Financial Statements 2.3 Components of the NAIC Annual Statement 4.12 Balance Sheet 2.4 Summary 4.21 Income Statement 2.8 Statement of Changes in Shareholders’ Equity and Statement of Cash Flows 2.13 Assignment 5 Insurer Statutory Annual Statement Analysis 5.1 Comparison of Property-Casualty Insurer and Noninsurer GAAP Financial Statements 2.17 Insurer Annual Statement Analysis Concepts 5.3 Supplemental Sources of Financial Information 2.24 Ratios Applied to Insurer Annual Statements Case Study 5.5 Limitations of Financial Statements 2.30 A.M. Best Financial Strength Ratings 5.16 Summary 2.31 IRIS Ratios 5.20 Summary 5.28 Assignment 3 GAAP Financial Statement Analysis 3.1 Financial Statement Analysis Techniques 3.3 Vertical Analysis of Financial Statements 3.6 Copyright 2013 American Institute For Chartered Property Casualty Underwriters xii Assignment 6 Cash Flow Valuation 6.1 Assignment 9 Insurer Capital: Needs and Sources 9.1 Future Value and Compounding 6.3 Insurer Capital Needs 9.3 Effective Annual Interest Rate 6.7 Internal Methods Used to Meet Insurer Capital Needs 9.5 Present Value and Discounting 6.8 Rate of Return on an Investment 6.11 Future and Present Values of an Ordinary Annuity 6.13 Annuities Due 6.17 Perpetuities 6.20 Present Value of Unequal Payments 6.21 Net Present Value 6.23 Summary 6.25 External Methods Used to Meet Insurer Capital Needs 9.9 Shareholder Dividends 9.16 Summary 9.21 Assignment 10 Capital Management 10.1 Capital Structure 10.3 Financial Leverage 10.5 Insurance Leverage 10.8 Insurer Cost of Capital 10.14 Assignment 7 Bonds and Stocks 7.1 Risk-Based Capital Requirements 10.19 Financial Markets 7.3 Economic Capital 10.24 Classifications of Bonds 7.7 Summary 10.29 Bond Characteristics 7.11 Determinants of a Bond’s Yield of Maturity and Price 7.15 Assignment 11 Mergers and Acquisitions 11.1 Characteristics of Stocks 7.20 Changes in Ownership and Control 11.3 Understanding Common Stock Prices 7.22 Reasons for Acquisitions 11.6 Annual Rate of Return for a Security 7.26 Mechanics of Acquisitions 11.12 Valuing Bonds and Stocks 7.27 Acquisition Gains and Costs 11.9 Takeover Defenses for Mergers and Acquisitions 11.14 Financial Reporting of Bonds and Stocks 7.31 Summary 11.16 Summary 7.35 Assignment 12 The Underwriting Cycle 12.1 Assignment 8 Insurer Investment Portfolio Management 8.1 The Insurance Underwriting Cycle 12.3 Quantitative Measures of Risk 8.3 Effects of Supply and Demand on the Underwriting Cycle 12.11 Investment Portfolio Management Concepts 8.8 Financial Factors Influencing the Underwriting Cycle 12.8 Summary 12.18 Bond Portfolio Management 8.13 Statutory Investment Restrictions 8.18 Summary 8.19 Copyright 2013 American Institute For Chartered Property Casualty Underwriters