Statutory Financial Return Filings

advertisement

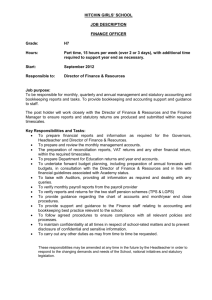

Statutory Financial Return Filings and Other Regulatory Requests Presented By: The Insurance Division of The Bermuda Monetary Authority Fall 2008 Agenda • Licensing & Authorizations Team Organizational Chart • Critical Legislation • Statutory Financial Return Filings • Section 56 Directions • Other Regulatory Requests • General Tips/New Items for 2008 2 Insurance - Licensing & Authorizations Team Shelby Weldon Director Keisha Pitt Senior Administrative Assistant Leslie Robinson Assistant Director Licensing Charlene Martin Principal Vacant Assistant Director Authorizations Charlene Martin Principal Shanai Swan Principal Mekeisha Hill Senior Analyst Winnette Trimm Assistant Shae-Tai Smith Senior Analyst Ramona Douglas Assistant Sakera Spence Assistant Shonette Wilson Principal Nicole Henneberry Senior Analyst Sharon Kutosi Senior Analyst Melissa Morton Senior Analyst Nicole Hypolite Senior Analyst Steven Ng’ganga Senior Analyst 3 Critical Legislation • Insurance Act 1978 & Related Regulations • Segregated Accounts Companies Act 2000 • Bermuda Monetary Authority Act 1969 4 Statutory Financial Return Filings 5 Statutory Financial Return Filing Requirements • • • • • • • • • • Auditors’ Report Cover Sheet General Business Solvency Certificate Long-Term Business Solvency Certificate Declaration of Statutory Ratios Statutory Financial Statements (Forms 1, 2 and 8) Notes to the Statutory Financial Statements Loss Reserve Specialist Opinion Actuarial Opinion Schedule of Ceded Reinsurance (Class 4 only) 6 Statutory Filings – Auditor’s Report – Ensure that the Auditor is approved by the BMA. – Ensure that the Auditor’s Report is an original and not stamped draft. – Ensure the correct legal name is used on the Auditor’s Report. – Ensure that the Auditor’s Report states the jurisdiction in which the Audit was conducted in accordance with the generally accepted auditing standards. – Ensure that the figures in the Audit Report agree to the figures throughout the Return. If certain figures do not agree, provide disclosure in the opening cover letter or within the Notes. 7 Statutory Filings – Cover Sheet – Ensure that the Conditions per the Company’s Certificate of Registration are listed on the Cover Sheet in accordance with the Insurance Returns & Solvency Amendment Regulation 2005. Further, ensure that the Company complies with those Conditions. – Ensure that the Company’s Section 56 Directions are listed on the Cover Sheet in accordance with the Regulation noted above. Further, ensure that the Company complies with any conditions of the Directions. – Ensure that the correct legal name is used on all documents. – Ensure that the Gross Premiums Written in item (v) on the Cover Sheet are clearly classified and separated per business line written. 8 Statutory Filings – General Business Solvency Certificate - Ensure that the correct service provider and address are included on the GBSC. - Ensure that the signatures on the GBSC are in accordance with the Insurance Returns and Solvency Regulations 1980, and are original signatures. - Ensure the signatures for the GBSC are on the same page as the information submitted. Signatures submitted on a separate page, are considered to be a control weakness as there’s no verification that the Directors and Principal Representative have seen the Statutory Financial Return. 9 Statutory Filings – Long-Term Business Solvency Certificate - Ensure that the correct service provider and address are included on the LTBSC. - Ensure that the correct legal name is used on the LTBSC. - Ensure that the signatures on the LTBSC are in accordance with the Insurance Returns and Solvency Regulations 1980, and are original signatures. 10 Statutory Filings – Declaration of Statutory Ratios - Ensure that the ratios agree to the ratios included in the Auditor’s Report. - Ensure that the correct legal name is used on the DSR. - Ensure that the signatures on the DSR are originals. - Ensure that the percentages and ratios are calculated accurately. 11 Statutory Filings – Statutory Financial Statements - Ensure that the figures in the Statutory Financial Statements agree to the figures throughout the Return. - Ensure that the correct legal name is used on the Statutory Financial Statements. - Ensure that the numbers from the prior year’s column agrees to the previous year’s filing. - Ensure that any significant and unexpected changes in the comparative numbers are discussed in the Notes to the Statutory Financial Statements. - Verify the clerical accuracy of the Financial Statements. 12 Statutory Filings – Statutory Financial Statements Continued - Ensure that permission to use various line items has been received and balances are recorded on the correct lines. - Consider all Section 56 Directions and Line Approvals. Ensure that all approvals are current and have not expired. - Holders of both a general and long-term license need only submit one Form 8, Statutory Statement of Capital and Surplus. 13 Statutory Filings – Notes to the Statutory Financial Statements - Ensure that the Notes are presented in accordance and in a manner prescribed by the Insurance Accounts Regulations 1980. eg. Note 1, the beneficial owner must be detailed. - The insurer’s significant accounting policies disclosed under Part 1, Note 3, should also include reference to cash and cash equivalents. - Ensure that the correct legal name is used in the Notes. 14 Statutory Filings – Loss Reserve Specialist Opinion - Ensure that the figure(s) in the Opinion agree to the figure(s) in the Auditor’s Report, GBSC and the Statutory Financial Statements. - Ensure that the Loss Reserve Specialist is currently approved by the BMA. - Ensure that the Opinion is in accordance with the Insurance Guidance Note# 4. - This opinion is not required for Class 1 Insurers unless they are writing > 30% professional liability business or unless required by the BMA. - The Opinion is required every third year for Class 2 Insurers, beginning with the year after registration. 15 Statutory Filings – Loss Reserve Specialist Opinion Continued - If a Class 2 Insurer writes > 30% professional liability, they must file a Loss Reserve Specialist Opinion annually, or if otherwise required by the BMA. - Class 1 and 2 Insurers will be required to file a Loss Reserve Specialist Opinion if they are not meeting their margins on an undiscounted basis. - Class 3 and 4 Insurers must file an Opinion annually. - Ensure that the correct legal name is on the Opinion. 16 Statutory Filings – Actuarial Opinion - Ensure that the figure(s) in the Opinion agree to the figure(s) in the Auditor’s Report, the LTBSC and the Statutory Financial Statements. - Ensure that the Actuary is currently approved by the BMA. - Ensure that the Opinion is in accordance with the Insurance Guidance Note# 10. - Ensure that the Actuarial Opinion is on original letterhead with original signatures. - Ensure that this Opinion is provided on an annual basis for LongTerm Insurers and Composites. No exemptions are permitted. - Ensure that the correct legal name is on the Opinion. 17 Statutory Filings – Schedule of Ceded Reinsurance Premium - Ensure that the schedule is included with each Class 4 Statutory Financial Return Filing. - Ensure that for the 2008 year end, this schedule is included with Class 3A, 3B and Class 4 filings. 18 Questions?? 19 Section 56 Directions 20 Section 56 Directions - It provides a regulatory vehicle through which the Bermuda Monetary Authority can modify the provisions under Sections 1(4), 4 to 4F, 6, 15 to 18, 18B and 33 of the Insurance Act 1978. - It allows the Bermuda Monetary Authority to modify the provisions of the Insurance Accounts Regulations 1980 and the Insurance Returns and Solvency Regulations as they relate to the above sections to avoid contradictions. • • • • It can be Subject to conditions, Retroactive (i.e. apply to something that happened in the past), Varied, and Revoked at any time. 21 Section 56 Directions Modification of Sections 15-18 “Accounts and Audit” - Extended Period Filing - Statutory Filing Exemption - Deposit Accounting/Balance Sheet Accounting Modification of Section 18B “Opinion of Loss Reserve Specialist” - Loss Reserve Specialist Opinion Exemption Modification of Sections 6 and 33 “Margin of Solvency” - Minimum Solvency Margin Modification 22 Section 56 Directions Modification of Sections 15-18 Extended Period Filing Direction The Insurer requests approval to extend its reporting period in excess of the 53 week financial year as defined in the Act. Possible Reasons: - The Insurer recently changed its financial year end from 31st December to 31st March to correspond with its parent company, as a result a 15 month reporting period is created. - The Insurer was recently registered under the Act, that being prior to the year end, and has not transacted any business to date, as a result, a reporting period in excess of 53 weeks is created. 23 Section 56 Directions Modification of Sections 15-18 Extended Period Filing Direction Continued - Ensure that the request letter includes the basis for the request with information to support why the application should be granted. - Ensure that if the request is due to a change in year end, a copy of the Board Minutes effecting this change are included. - Ensure that year end management accounts are provided, showing that the insurer has not transacted any business, or very minimal business. If the request is being made months after the year end has passed, yet prior to the filing deadline, ensure that the most recent management accounts are provided showing that the Insurer remains in compliance. 24 Section 56 Directions Section 56 – Modification of Sections 15-18 Extended Period Filing Direction Continued - Ensure that there are no current issues of non-compliance with the Insurer. - Ensure that when the Insurer eventually files its Statutory Financial Return, they report from the date of incorporation. - Ensure that the applicable fee is included. 25 Section 56 Directions Section 56 – Modification of Sections 15-18 Statutory Filing Exemption Direction The Insurer requests approval to waive the filing of its Statutory Financial Return for a specific year end. 26 Section 56 Directions Section 56 – Modification of Sections 15-18 Statutory Filing Exemption Direction Continued - Ensure that the request letter includes the basis for the request with information to support why the application should be granted. - If an Insurer no longer writes any business and no longer has insurance liabilities, please provide support for this (e.g. Commutation agreements, novation agreements, etc.). - Ensure that the most recent management accounts (3-6 months depending on the class) are included and are showing that the Insurer has not transacted any business, has no outstanding insurance obligations, and is in statutory compliance at the financial year end requested and at that specific time. 27 Section 56 Directions Section 56 – Modification of Sections 15-18 Statutory Filing Exemption Direction Continued - Ensure that the applicable fee is included. - Ensure that all prior years Statutory Financial Returns have been filed. - Ensure that there are no current issues of non-compliance with the Insurer. - Ensure that these applications are received prior to the Insurers required filing date. 28 Section 56 Directions Modification of Sections 15-18 Deposit Accounting The insurer requests permission to record specific insurance contract in accordance with US GAAP, based on the provisions of Financial Accounting Standard 113 (FAS 113). - Ensure that the request letter includes the basis for the request with information to support why the application should be granted. Ensure that GAAP Accounts are included with this application, if available. Copies of signed insurance contracts accompanied by an analysis by management of those contracts how the specific insurance contracts met the requirements of FAS 113. Ensure that these applications are received prior to the Insurer’s use of the preferred accounting treatment. 29 Section 56 Directions Modification of Sections 15-18 Balance Sheet Accounting The insurer requests permission to record contracts written in Segregated Accounts that are fully funded on the Balance Sheet versus via the income statement. - Risk transfer is not necessarily an issue in this case - Ensure that the request letter includes the basis for the request with information to support why the application should be granted. - Ensure details of how the contracts will be “fully funded” are included - Contracts should be fully funded to policy limits 30 Section 56 Directions Modification of Section 18B Loss Reserve Specialist Opinion Exemption The Insurer requests approval to waive the requirement to file a Loss Reserve Specialist Opinion. 31 Section 56 Directions Modification of Section 18B Loss Reserve Specialist Opinion Exemption Continued - Ensure that the request letter includes a detailed basis for the request with information to support why the application should be granted. - Ensure that an actuarial analysis/study is provided to support the assertions made in the application. - In the case of an Insurer in run-off, ensure that details of the runoff, including the stage of the run-off and how the Insurer rid itself of its insurance obligations, accompanies the application. 32 Section 56 Directions Modification of Section 18B Loss Reserve Specialist Opinion Exemption Continued - In the case of short-tail business, provide a reconciliation or analysis of claims payments to loss reserves to demonstrate how trends are consistent. - Ensure that recent management accounts are provided showing that the Insurer is in statutory compliance. - Ensure the applicable fee is included. - Ensure that there are no current issues of non-compliance with the Insurer. - Ensure that these applications are received prior to the Insurers required filing date. 33 Section 56 Directions Modifications of Sections 6 and 33 Section 6 – Margin of Solvency and Section 33 – Margin of Solvency for General Business in Insolvency and Winding Up These solvency modifications are particularly important in that they allow certain companies which by definition are 3rd party writers but may in substance retain no risk, to be relieved of the more stringent minimum capitalization requirements of a typical Class 3 Insurer. S.33 modification provides flexibility as the section calls for a company to be wound up if they do not comply with the Regulations. 34 Section 56 Directions Modifications of Sections 6 and 33 Section 6 – Margin of Solvency and Section 33 – Margin of Solvency for General Business in Insolvency and Winding Up The Insurer requests approval to modify the calculation of its Minimum Solvency Margin. 35 Section 56 Directions Modifications of Sections 6 and 33 Section 6 – Margin of Solvency and Section 33 – Margin of Solvency for General Business in Insolvency and Winding Up - Ensure that the request letter includes a detailed basis for the request with information to support why the application should be granted. - If the basis is that the contract is fully funded, ensure that this is demonstrated in the application. - Ensure that where applicable, copies of signed insurance contracts, preference shareholders agreements and indemnification agreements, etc are provided. 36 Section 56 Directions Modifications of Sections 6 and 33 Section 6 – Margin of Solvency and Section 33 – Margin of Solvency for General Business in Insolvency and Winding Up - Ensure that there are no current issues of non-compliance with the Insurer. - Ensure that these applications are received prior to the Insurers required filing date. - Ensure that the most recent management accounts are included and are showing that the Insurer is in statutory compliance. - Ensure that the applicable fee is included. 37 Questions?? 38 Other Regulatory Requests 39 Regulatory Requests Regulatory Approval – Relevant Asset The Bermuda Monetary Authority has the ability to approve, on application, certain admitted assets (i.e. allowed on the Statutory Balance Sheet) as relevant assets (i.e. to be used in the calculation of the Liquidity Ratio). These generally include: Line 4 – Investment in and Advances to Affiliates Line 13 – Sundry Assets Line 14 – Letters of Credit, Guarantees and Other Instruments 40 Regulatory Requests Regulatory Approval – Relevant Asset - Ensure that the request letter includes the basis for the request with information to support why the application should be granted. - Ensure that the most recent management accounts are included with the application showing that this approval is required to maintain the Insurer’s statutory compliance. - In the case of a loan to an affiliate (parent), ensure that the affiliate’s (parent’s) most recent audited financial statements are included with the application. (to assess the recoverability of the asset) - Ensure that the signed and dated loan agreement is certified as a true copy of an original or provide an original signed and dated loan agreement, which can be returned if need be. 41 Regulatory Requests Regulatory Approval – Relevant Asset - Ensure that the loan (other instrument) is required in order to maintain the Insurer’s compliance. A loan is an admitted asset and is therefore allowed on the Statutory Balance Sheet, even when not required for Liquidity Ratio purposes. - Ensure that the loan (other instrument) agreement is effective / was effected as at the year end / period requested for approval. - Ensure that these applications are received prior to the expiry of the previous approval, prior to issues of non-compliance or immediately upon discovered non-compliance. - Ensure there are no other current issues of non-compliance. - Ensure that the applicable fee is included. 42 Regulatory Requests Regulatory Approval – Other Fixed Capital The Bermuda Monetary Authority has the ability to approve, on application, certain instruments as other fixed capital that are not normally included under GAAP. These may include letters of credit, Parental guarantees and subordinated notes. These are recorded on: Line 1c – Other Fixed Capital 43 Regulatory Requests Regulatory Approval – Other Fixed Capital - Ensure that the request letter includes the basis for the request with information to support why the application should be granted. - Ensure that the most recent management accounts are included with the application showing that the Insurer is in statutory compliance or requires this approval to maintain the Insurer’s statutory compliance. - Ensure that certified copies of the signed and dated instruments for approval have been included in the application. Originals received can be returned if requested. - Ensure there are no other current issues of non-compliance with the Insurer. 44 Regulatory Requests Regulatory Approval – Other Fixed Capital - Ensure that these applications are received prior to the previous expiry date or/and upon issues of solvency. - Ensure that the applicable fee is included. 45 Regulatory Requests Regulatory Approval – Reduction of Capital – Section 31C(4) The Insurer requests approval to reduce its Statutory Capital by more than 15% over the previous year’s ending Statutory Capital. Statutory Capital is that which is recorded on Lines 1a, b and c only. If it falls on Line 1a, b and c, it needs our approval to reduce it by more than 15%. Possible Reasons: - A reduction in the amount of shares a company wishes to issue. - A repayment of contributed surplus. - The cancellation of a Letter of Credit or parental guarantee. 46 Regulatory Requests Regulatory Approval – Reduction of Capital – Section 31C(4) - Ensure that the request letter includes a detailed basis for the request with information to support why the application should be granted. - Ensure the detailed letter includes why the reduction is required, when, where the funds are going, specifically where the funds are coming from, and the specific amount. - Ensure an actuarial analysis supporting the loss reserve figure (including information on development of reserves) is provided. - Ensure that the most recent management accounts are included with the application showing the Insurer’s current compliant position. - Ensure there are no other current issues of non-compliance with the Insurer. 47 Regulatory Requests Regulatory Approval – Reduction of Capital – Section 31C(4) - Ensure that proforma management accounts demonstrating the effect of the proposed reduction of capital are included, and showing that the Insurer will remain in compliance after the reduction. - Ensure the reduction is from Statutory Capital as opposed to Statutory Surplus (i.e. retained earnings), in which case the BMA’s approval is not required. - Ensure this application for approval is made prior to the reduction taking place. - Confirm that reduced Statutory Capital with Statutory Surplus can support the worst case scenario. - Ensure the applicable fee is included. 48 Regulatory Requests Regulatory Approval – Reduction of Capital – Section 31C A Class 4 Insurer requests approval to reduce its Statutory Capital by more than 15% over the previous year’s ending Statutory Capital. Statutory Capital is that which is recorded on Lines 1a, b and c only. If it falls on Line 1a, b and c, it needs our approval to reduce it by more than 15%. Possible Reasons: - A reduction in the amount of shares a company wishes to issue. - A repayment of contributed surplus. - The cancellation of a Letter of Credit or parental guarantee. 49 Regulatory Requests Regulatory Approval – Reduction of Capital – Section 31C - Ensure that the request letter includes a detailed basis for the request with information to support why the application should be granted. - Ensure the detailed letter includes why the reduction is required, when, where the funds are going, specifically where the funds are coming from, and the specific amount. - Ensure an actuarial analysis supporting the loss reserve figure (including information on development of reserves) is provided. - Ensure that the most recent management accounts are included with the application showing the Insurer’s current compliant position. - Ensure there are no other current issues of non-compliance with the Insurer. 50 Regulatory Requests Regulatory Approval – Reduction of Capital – Section 31C - Ensure that proforma management accounts demonstrating the effect of the proposed reduction of capital are included, and showing that the Insurer will remain in compliance after the reduction. - Ensure the reduction is from Statutory Capital as opposed to Statutory Surplus (i.e. retained earnings), in which case the BMA’s approval is not required. - Ensure this application consists of an affidavit signed by at least two Directors of the Insurer, one of whom must be a Director resident in Bermuda, if the Insurer has a Director so resident and by the Principal Representative. 51 Regulatory Requests Regulatory Approval – Reduction of Capital – Section 31C - This affidavit must state that in the opinion of those signing, the proposed reduction of capital will not cause the Insurer to fail to meet its relevant margin. - Ensure this application for approval is made prior to the reduction taking place. - Confirm that reduced Statutory Capital with Statutory Surplus can support the worst case scenario. - Ensure the applicable fee is included. 52 Regulatory Requests Regulatory Approval – Share Transfers and Allotments This section allows for a new or existing person or entity to obtain a shareholder interest in a company. The shareholder interest can be obtained through a transfer from an existing shareholder to a new or existing shareholder or from a new share issuance. 53 Regulatory Requests Regulatory Approval – Share Transfers and Allotments - Ensure that the request letter includes a detailed basis for the request with information to support why the application should be granted. - Ensure that the most recent management accounts are included with the application showing the Insurer’s current compliant position. - Ensure there are no other current issues of non-compliance with the Insurer. - In cases of complex share transfers, (i.e. where there may be several subsidiary companies of a parent company involved in the transfer), it would be helpful if an organizational/structure chart is included in the application. 54 Regulatory Requests Regulatory Approval – Share Transfers and Allotments - For Share Transfers where notification and/or permission under the Insurance Act 1978 (“Act”) is being requested, please ensure that the relevant section(s) of the Act for such notification and/or permission, is/are quoted in the application. - Ensure that all Share Transfers involving notification and/or permission under the Act are addressed to both Corporate Authorizations and Licensing and Authorizations. - Where Share Transfer applications indicate ‘see appendix attached’, in many cases such appendices are not attached. Please ensure all enclosures/attachments are included with all applications, whether to Corporate Authorizations or Licensing and Authorizations. 55 Regulatory Requests Regulatory Approval – Share Transfers and Allotments - Consider whether the transaction is a transfer which falls under the Insurance Act prior to submitting it. - Ensure that when transferring the shares of a Class 1 Insurer to more than 1 owner, this will result in a change of Class if the requirements of the Class 1 definition are no longer met. 56 Regulatory Requests Regulatory Approval – Deregistrations The Insurer may, subject to the provisions of Sections 41 and 42 of the Act, request cancellation of the registration of an Insurer, or any Insurance Intermediary. Cancellation (deregistration) may be at the request of the Insurer or by order of the BMA. Possible Reasons: - The Insurer has terminated all contracts, commuted all remaining business, has no insurance premiums or liabilities outstanding and has no further need for the company. (Insurer’s request) - The Insurer is out of compliance with its statutory filing, annual business fees, its Directors and Officers and Principal Representative have resigned and it is not meeting its minimum solvency margin. ( By order of the BMA) 57 Regulatory Requests Regulatory Approval – Deregistrations - Ensure that the request letter includes the basis for the request with information to support the application to ensure processing in a timely manner. - Ensure that the most recent (closing) management accounts are included demonstrating that the Insurer has no insurance premiums or liabilities on its books. - Ensure that a Statutory Declaration signed by 2 Directors is included. - Ensure that signed and dated Commutation and/or Novation agreements are included with the application. 58 Regulatory Requests Regulatory Approval – Deregistrations - Ensure that the original Certificate of Registration (Insurance License) is included with the application. - If a dual class of Insurer, state which license is being cancelled. If both are being cancelled, return both licenses. - Ensure that you state the effective date when the insurer stopped writing business. - Ensure that there are no current issues of non compliance and that the Insurer is up-to-date with its statutory filings and fees. 59 Questions?? 60 General Tips/New Items for 2008 - In order to have applications processed in a timely manner, please provide COMPLETE applications. - Call the BMA to confirm completeness or arrange a meeting to discuss complex application prior to submitting the application. - In order to have applications processed in a timely manner, please submit multiple application requests on separate letters. This will ensure that no applications are overlooked. - Pending legislation re new Annual Business Fees/Transaction Fees to be effective January 1, 2009 - Classes 3A and 3B will need to file a Schedule of Ceded Reinsurance. - Special Purpose Insurers will follow the filing requirements of Composite Insurers. 61 General Tips/New Items for 2008 - Check whether there is no approval given or approval has lapsed/expired for certain line items, such as, Line 4 – Investment in and Advances to Affiliates Line 13 – Sundry Assets Line 14 – Letters of Credit, Guarantees and Other Instruments Line 1c – Any Other Fixed Capital - Line 37 items on Form 1 – Letters of Credit, Guarantees and Other Instruments. Where these instruments do not relate to the Company’s insurance operations, and encumber the insurers assets, a liability shall be recorded and the Statutory Capital and Surplus decreased by a corresponding amount. These should be thoroughly discussed in the Notes. 62 General Tips/New Items for 2008 - Has the insurer changed service providers (e.g.. Auditor, Principal Representative, Loss Reserve Specialist, Actuary) without seeking the approval of the BMA. - No prior permission has been received for a reduction in Statutory Capital by more than 15%. (e.g.. Section 31C(4) – repayment of contributed surplus or cancellation of a Letter of Credit, parental guarantee, etc.) - The Company is not in compliance with the Conditions of its license or Section 56 Direction. (e.g.. Class 2 Insurer writing in excess of 20% unrelated business, effecting new contracts of Insurance when restricted from doing so, paying dividends when restricted from doing so, etc.) - Deposit Accounting treatment/Balance Sheet accounting is being used without the consent and approval of the BMA. 63 General Tips/New Items for 2008 - Inadequate or omitted Note disclosures: • Beneficial owner not detailed – Note 1 of Part 1 of Schedule II of the Insurance Accounts Regulations 1980. • Significant Accounting Policies not disclosed under Part 1 – matters to be set forth in the general note to the Statutory Financial Statements, Note 3, for cash and cash equivalents. • Commissions and brokerage – omitted note disclosure. • Form 2, Line 4 – Increase (decrease) in Unearned Premium – when the change does not agree with the difference between Form 1, Line 16 current and prior years, provide reconciliation 64 General Tips/New Items for 2008 • Loss and loss expense provisions – discount rates must be disclosed. • Sundry Assets/Liabilities, if material, should be disclosed. • Provide copies of contracts, not just a high level description of business written for all relevant applications. 65 Glossary • • • GBSC - General Business Solvency Certificate LTBSC – Long-term Business Solvency Certificate DSR – Declaration of Statutory Ratios 66 Additional Resources – BMA website www.bma.bm – www.bermudalaws.bm – Regulatory approvals: Licensing and Authorization – Compliance issues: Restoration, Run-Off & Monitoring (Compliance) 67 Licensing & Authorizations Contact Information Shelby Weldon Leslie Robinson Shonette Wilson Shanai Swan Charlene Martin Nicole Hypolite Melissa Morton, Nicole Henneberry Sharon Kutosi Shea Smith Mekisha Hill Stephen N’ganga Keisha Pitt Ramona Douglas Sakera Spence Winnette Trimm Director sweldon@bma.bm Assistant Director lrobinson@bma.bm Principal sawilson@bma.bm Principal sswan@bma.bm Principal cmartin@bma.bm Senior Analyst nhypolite@bma.bm Senior Analyst mmorton@bma.bm Senior Analyst nhenneberry@bma.bm Senior Analyst skutosi@bma.bm Senior Analyst ssmith@bma.bm Senior Analyst mhill@bma.bm Senior Analyst snganga@bma.bm Senior Admin Assistant kpitt@bma.bm Assistant rdouglas@bma.bm Assistant sspence@bma.bm Assistant wtrimm@bma.bm 68 278-0209 278-0277 278-0284 278-0283 278-0227 278-0328 278-0304 278-0292 278-0353 278-0320 278-0293 278-0366 278-0225 278-0240 278-0338 278-0242 Questions?? 69