Market sharing agreements and collusive networks

advertisement

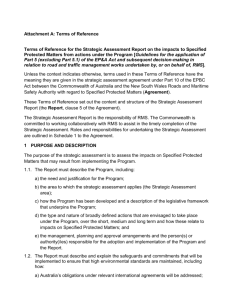

Market sharing agreements and collusive networks¤ Paul Belle‡ammey Francis Blochz March 18, 2003 Abstract We analyze the formation of reciprocal market sharing agreements by which …rms commit not to enter each other’s territory in oligopolistic markets and procurement auctions. The set of market sharing agreements de…nes a collusive network. We provide a complete characterization of stable collusive networks when …rms and markets are symmetric. Stable networks are formed of complete alliances, of di¤erent sizes, larger than a minimal threshold. Typically, stable networks display fewer agreements than the optimal network for the industry and more agreements than the socially optimal network. When …rms or markets are asymmetric, stable networks may involve incomplete alliances and be underconnected with respect to the social optimum. JEL Classi…cation Numbers: D43, D44 Keywords: market sharing, collusion, economic networks, oligopoly, auctions. ¤ We are grateful to Olivier Compte, Sanjev Goyal, Philippe Jehiel, Mike Riordan and Pierre Regibeau for helpful discussions on the paper. We have greatly bene…tted from the comments of two anonymous referees. We also thank seminar participants at Barcelona, Brown, Columbia, Essex, NYU, Penn, University College London, Warwick and the Vth SCAET (Ischia, 2001) for their comments. y CORE and IAG, Université catholique de Louvain, Belgium, belle‡amme@core.ucl.ac.be. z GREQAM and Ecole Superieure de Mecanique de Marseille (France), bloch@ehess.cnrsmrs.fr 1 1 Introduction Reciprocal market sharing agreements, whereby …rms refrain from entering each other’s territory, have long been held under suspicion by antitrust authorities. In one of the earliest cases litigated under the Sherman Act, the Addyston Pipes Case of 1899, the Supreme Court struck down a group of iron pipe producers which rigged prices on certain markets, and reserved some cities as exclusive domains of one of the seller. (Scherer and Ross, 1990, pp. 318-319.) In recent years, the globalization of markets and the deregulation of industries which used to be regulated on a territorial basis (airlines, local telecommunication services and utilities) have increased the scope for explicit or implicit market sharing agreements. The European Commission has been particularly aware of the potential risk of market sharing, as …rms which used to enjoy monopoly power in some territories seem reluctant to compete on the global European market. In a landmark case against Solvay and ICI, in 1990, the European Commission has established that the two companies had operated a market sharing agreement for many years by con…ning their soda-ash activities to their traditional home markets, namely continental western Europe for Solvay and the United Kingdom for ICI. It was also found that over many years, all the soda-ash producers in Europe accepted and acted upon the ‘home market’ principle, under which each producer limited its sales to the country or countries in which it had established production facilities.1 In the United States, the Telecommunications Act of 1996 was speci…cally designed to encourage regional operators to enter each other’s market. Five years later, it appears that both industries are still dominated by a handful of dominant companies, each with highly clustered regional monopolies.2 1 2 See O¢cial Journal L 152 , 15/06/1991, pp. 1-15. The major providers of cable and local phone service seem to have chosen to merge rather than compete. For example, thanks to a series of mergers, the Regional Bell Operating Companies have shrunk to seven companies in 1996 into just four today. The last of these mergers (between SBC and Ameritech) was subjected to a list of conditions requiring the merged company to open its in-region local markets to competition and to enter local markets outside its 13-state region. The conditions that the Federal Communications Commission imposed made clear how dissatis…ed the agency was with the progress of local competition 2 Antitrust authorities have also reacted to this trend, issuing new guidelines that emphasize market sharing agreements as an alternative form of collusion. For example, in its 1999 merger guidelines, the Irish Competition Authority states that: “As an alternative to a price-…xing cartel, …rms [...] may divide up the country between them and agree not to sell in each other’s designated area. [...] At its simplest, a market-sharing cartel may be no more than an agreement among …rms not to approach each other’s customers or not to sell to those in a particular area. This may involve secretly allocating speci…c territories to one another or agreeing on lists of which customers are to be allocated to which …rm.” (Irish Competition Authority, 1999). In spite of this increasing concern from antitrust authorities, market sharing agreements have not yet been studied in the theoretical literature. In this paper, our objective is to propose a model of market sharing in order to study the stability and welfare implications of market sharing agreements. We consider a uni…ed model, which encompasses di¤erent market settings including oligopolies and auctions. We suppose that each …rm is initially present on one market (its home market) and can enter all foreign markets. We model market sharing agreements as reciprocal agreements not to enter each other’s territory.3 The set of bilateral agreements gives rise to a collusive network among …rms and we draw on recent advances in the literature on strategic network formation (Bala and Goyal (2000), Goyal (1993) and Jackson and Wolinsky (1996)) to characterize stable and e¢cient networks of market sharing agreements. Our …rst contribution is to identify a general condition on pro…t functions, which guarantees that stable networks exist and can be characterized in a simple way. This condition – the log-convexity of pro…ts in the number of competitors on the markets – is satis…ed in most usual models of Cournot oligopoly and under the Telecommunications Act of 1996 (Wilmer, Cutler & Pickering, 1999). 3 In this paper, our focus is on the stability of market sharing agreements, and we assume that these agreements are enforceable. The issue of enforceability of market sharing agreements is an important one, which cannot be answered in traditional models of repeated oligopoly interaction. We leave it for further study. 3 in private value auctions. This condition is stronger than convexity. It states that the rate at which pro…ts decline with the entry of a new competitor is decreasing in the number of active …rms on the market. Our second contribution is to provide a complete characterization of the stable networks in a symmetric model where …rms and markets are identical. We show that in a stable network, …rms form complete components, of di¤erent sizes, and we give an explicit formula for the minimal size of a component. This formula can be applied to compute stable collusive networks in di¤erent oligopoly and auction models. This characterization stems from two general observations on the …rms’ incentives to form market sharing agreements. First, we note that because pro…ts are log-convex, a …rm’s incentive to form an additional agreement is increasing in the number of agreements it has already formed. This “convexity” e¤ect explains why …rms form market sharing agreements with all other …rms in an alliance. It also explains why alliances must reach a minimal size to be stable. Second, we observe that …rms have an incentive to free-ride on the formation of market sharing agreements by other …rms. Free-riding explains why alliances of di¤erent sizes may form, as …rms in smaller groups free-ride on the alliances formed in larger groups and have no incentive to form agreements with …rms in larger alliances. It is instructive to contrast these results with the results which would be obtained if …rms formed multilateral cartel agreements. Because stable networks are formed of complete components, the additional richness of the network structure (enabling …rms to enter di¤erent agreements with di¤erent …rms) is not exploited in our analysis. However, it is important to note that the completeness of network components is an endogenous result of our analysis – as opposed to an exogenous assumption in the traditional cartel literature. Furthermore, our analysis indicates that it may be easier to sustain collusion through bilateral agreements than through multilateral agreements, because a …rm’s incentive to delete a link in the network is weaker than its incentive to leave the cartel and delete all its links at once. Our third contribution is to study the e¢ciency of stable collusive networks. In our model, the e¢cient network from the industry point of view is the complete network, where all markets are local monopolies, while the socially e¢cient 4 network is the empty network, where all …rms participate on all markets. Not surprisingly, because of the …rm’s free-riding incentives, stable collusive networks are under-connected with respect to the e¢cient network from the …rms’ point of view, but over-connected with respect to the socially e¢cient network. This last result indicates that antitrust authorities should strike down market sharing agreements in order to improve social welfare. Our last contribution is to extend the model to asymmetric …rms and markets. While we are unable to obtain a complete characterization of stable networks in that case, we discuss several examples. The …rst example supposes that markets are of di¤erent sizes, and shows that a stable network exists where the …rm on a smaller market forms links to …rms on larger markets, but …rms on larger markets compete with one another. The second example assumes that …rms face an entry cost on foreign markets, and the …nal example considers transportation costs to foreign markets. In both these examples, private incentives to enter may be excessive, and the formation of market sharing agreements may improve welfare by discouraging entry on foreign markets. We now discuss the relationship of our paper with the existing literature. Starting with Stigler (1950)’s seminal contribution, the stability of price-…xing cartels has been extensively studied in the literature. (See Selten (1973) and d’Aspremont et al. (1983) in the case of Cournot oligopolies, Deneckere and Davidson (1985) for a Bertrand model with di¤erentiated commodities and Nocke (1999) for a recent contribution discussing the earlier literature.) In auctions, the study of the stability of bidding rings is much more complex, as it requires the analysis of auctions with asymmetric bidders. Mailath and Zemsky (1991) study stability of bidding rings in the simpler context of secondprice auctions, and Mac Afee and Mac Millan (1992) provide an example in the case of …rst-price auctions.4 The stability of collusive networks bears a close resemblance to the stability of bidding rings and price-…xing cartels. The “convexity e¤ect” in the formation of links is reminiscent of a similar e¤ect found in some models of cartel stability.5 Moreover, as …rms bene…t from the 4 In general …rst-price auctions, Pesendorfer (2000) presents partial characterization results on the equilibrium of an auction with a bidding ring and independent bidders. However, the issue of stability of the bidding ring is not addressed in the model. 5 Mailath and Zemsky (1991) for instance show that in a second price auction, the game in 5 formation of collusive agreements by other …rms, free-riding incentives threaten in the same way the stability of price-…xing cartels, bidding rings and collusive networks. As in the case of cartels and bidding rings, our characterization of stable collusive networks results from the balance between free-riding incentives and the bene…ts of collusion. Recent papers by Goyal and Joshi (2000a) and (2000b), Goyal and Moraga (2001) and Konishi and Furusawa (2002) also apply the theory of economic networks to models of oligopoly. Goyal and Joshi (2000a) and Goyal and Moraga (2001) study the formation of bilateral agreements by which …rms bene…t from synergies and lower their production costs. Goyal and Joshi (2000b) and Furusawa and Konishi (2002) analyze the formation of bilateral trade agreements in an international oligopolistic market. Trade agreements can be interpreted as the converse of maket sharing agreements – trade agreements open up foreign markets by abolishing tari¤s while market sharing agreements lead to the closure of foreign markets. The analyses in Goyal and Joshi (2000b) and Furusawa and Konishi (2002) are not directly comparable to ours, as the objective functions – and hence the values of the network– are di¤erent in the two models. In trade agreement models, a country’s objective function is the sum of consumer and producer surplus and tari¤s, whereas the objective function in our model is simply the …rm’s pro…t. The rest of the paper is organized as follows. In the next section, we describe the general model of market sharing and introduce some basic de…nitions. In Section 3, we fully characterize the stable collusive networks in the symmetric model with identical …rms and markets. In Section 4, we extend our analysis to asymmetric markets and …rms. Section 5 discusses e¢ciency of stable collusive networks, both from the industry and the social point of view. In the last section, we conclude and discuss the limitations of our model. 2 The Model We consider N …rms indexed by i = 1; 2; ::N. We associate to each …rm a market. In the oligopolistic context, the market of …rm i is interpreted as its characteristic function form generated by the formation of bidding rings is convex. 6 home market, and in the context of procurement auctions as a market to which bidder i has priviledged access. For any market i, we denote by ni the number of active …rms on the market. We consider a reduced form pro…t function on each market, which could arise either from oligopolistic interaction or from bidding competition, and which only depends on the number of active …rms on the market. We let ¼ji (ni ) denote the pro…t of …rm j on market i. We suppose that every …rm has an incentive to enter all foreign markets. The only barrier to entry stems from reciprocal market sharing agreements, whereby each …rm refrains from entering on the other …rm’s market. These pairwise agreements are captured by binary variables, gij 2 f0; 1g. If gij = 1; …rms i and j are linked by a market sharing agreement and are not active on each other’s market, and if gij = 0, …rm i is present on market j and …rm j on market i. Total pro…ts of …rm i are given by the sum of the pro…ts …rm i collects on its home market and on all foreign markets for which it has not formed agreements: ¦i = ¼ii (ni ) + X ¼ij (nj ): (1) j;gij =0 2.1 Properties of Pro…t Functions We impose three properties on the pro…t functions. Property 1 Individual pro…ts are decreasing in the number of …rms active on the market, ¼ij (nj ) · ¼ij (nj ¡ 1): Property 2 Individual pro…ts are convex in the number of …rms active on the market, ¼ij (nj ¡ 1) ¡ ¼ij (nj ) ¸ ¼ij (nj ) ¡ ¼ ij (nj + 1): Property 3 Individual pro…ts are log-convex in the number of …rms active on h i h i the market, ¼ij (nj ¡ 1) ¡ ¼ij (nj ) =¼ij (nj ) ¸ ¼ij (nj ) ¡ ¼ij (nj + 1) =¼ij (nj + 1): Property 1 is a very intuitive condition, which guarantees that an increase in the number of competitors reduces the pro…t of each …rm. Property 2 states that this decline in pro…t (measured as a positive number) is a decreasing function of the number of competitors. In other words, as the total number of active …rms on a market increases, adding a new competitor leads to a smaller reduction in 7 pro…t. Property 3 is a stronger condition than Property 2: it indicates that the rate of decline of pro…ts is decreasing in the number of …rms. The percentage of pro…t lost after the addition of a new competitor gets smaller as the number of active …rms on a market increases. The three properties give a precise description of the e¤ects of entry on individual pro…ts: …rms su¤er from the entry of new competitors but competition becomes less harmful, both in absolute and in relative terms, as the number of …rms increases. Figure 1 depicts a pro…t function satisfying the three properties and outlines the di¤erence between convexity and log-convexity.6 π(n) 45° π(1) π(2) π(3) π(1)/π(2) π(n) π(1) π(2) π(3) 1 2 3 n π(2)/π(3) Figure 1: Log-convex pro…t function How restrictive are these three properties? We show below that Property 1 is satis…ed in most familiar models of oligopolies and symmetric auctions. We 6 It is apparent on the right panel of Figure 1 that pro…ts are decreasing and convex in the number of …rms (clearly, ¼ (1) ¡ ¼ (2) > ¼ (2) ¡ ¼ (3) > 0). On the left panel, which maps the function ¼ (n) against itself, we are able to measure the ratio between successive values of the function; as ¼ (1) =¼ (2) > ¼ (2) =¼ (3), we observe that pro…ts are log-convex in the number of …rms. 8 also provide su¢cient conditions on oligopoly models under which the convexity properties are satis…ed, and show that pro…ts are always log-convex in private value procurement auctions. 2.1.1 Cournot Oligopoly with Homogeneous Products Consider a symmetric Cournot oligopoly with homogeneous products. Letting P qi denote the quantity produced by …rm i (i = 1; 2; :::; n) and Q = qi market demand, the Cournot oligopoly is de…ned by an inverse market demand P (Q) and individual cost functions c(qi ): Each …rm’s pro…t on the market is given by ¼i = qi P (Q) ¡ c(qi ): We de…ne the elasticity of the slope of the inverse demand function, E(Q); as E(Q) = QP 00 (Q) : P 0 (Q) Proposition 2.1 In a symmetric Cournot oligopoly with homogeneous products, (i) if costs are increasing and convex and E(Q) > ¡1, individual pro…ts are decreasing in the number of active …rms on the market; (ii) if costs are lin- ear, E(Q) > ¡1 and E 0 (Q) ¸ 0, individual pro…ts are log-convex in the number of active …rms on the market. Proof. See Appendix 7.1. The …rst statement of the proposition is a classical comparative statics result on Cournot oligopolies (termed “quasi-competitiveness” in Amir and Lambson, 2000). Vives (1999, pp. 105-107) gives early references to this result. Statement (ii), providing su¢cient conditions for the log-convexity of individual pro…ts, is a new result. While the conditions are clearly very restrictive, they are satis…ed by speci…c families of inverse demand functions, as shown in Section 3.2. 2.1.2 Auctions Consider now a set of …rms, i = 1; 2; :::; N; participating in procurement auctions. For each auction, …rm i draws a cost parameter ci distributed according to the common distribution function F (ci ) with continuous density f (ci ) over the support [0; C]: Furthermore, suppose that the function J(c) = c + (F (c)=f (c)) 9 is increasing in c for any c 2 [0; C]: For the sake of simplicity, we assume that the buyer sets a reservation price at C, and we consider any auction setting which allocates the contract to the lowest bidder. By the revenue-equivalence theorem (see, e.g., Riley and Samuelson, 1981, Proposition 1, p. 383), the ex ante expected payo¤ of every …rm is independent of the auction rule, and is equal to ¼(n) = 1 (E(c2n ) ¡ E(c1n )); n where cin denotes the i-th order statistic among n draws from the common distribution F . By a simple application of the theory of order statistics (see Mac Afee and Mac Millan, 1988, Lemma 1, p. 103), E(c2n ) = E(J(c1n )): Hence, µ ¶ Z C F (c1n ) 1 = (1 ¡ F (c))n¡1 F (c)dc: ¼(n) = E n f(c1n ) 0 Proposition 2.2 In a private value procurement auction, ex ante individual pro…ts are strictly decreasing and strictly log-convex in the number of active …rms on the market. Proof. See Appendix 7.2. The comparative statics e¤ect of an increase in the number of bidders on individual pro…ts is well-known in auction theory (see Mac Afee and Mac Millan (1987, p. 711) and the references therein). The log-convexity of individual profits in the number of bidders is an original result, providing a strong structural condition on the e¤ect of entry on individual pro…ts. 2.2 Incentives to Form Agreements As a preliminary step, we consider …rms’ incentives to form reciprocal market sharing agreements. Using expression (1), we compute …rm i’s incentive to form an agreement with …rm j as 2 X ¢¦i = 4¼ ii (ni ¡ 1) + k6=j;gik =0 3 2 ¼ik (nk )5 ¡ 4¼ii (ni ) + ¼ij (nj ) + £ ¤ = ¼ii (ni ¡ 1) ¡ ¼ii (ni ) ¡ ¼ij (nj ) ´ Fji (ni ; nj ) : 10 X k6=j;gik =0 3 ¼ik (nk )5 (2) A market sharing agreement between …rms i and j leaves all markets k 6= i; j una¤ected. Hence, …rm i’s incentive to form an agreement with …rm j only depends on the characteristics of markets i and j. Two con‡icting e¤ects are at work: by reducing competition on its home market, …rm i increases its pro…t by ¼ii (ni ¡1)¡¼ii (ni ) ; by losing access to foreign market j, it decreases its pro…t by ¼ij (nj ): The balance between these two e¤ects, noted Fji (ni ; nj ), depends on the number of active …rms on the two markets, ni and nj : As the pro…t function ¼ii is convex, Fji is a decreasing function of ni ; as the pro…t function ¼ij is decreasing, Fji is an increasing function of nj . We conclude that …rm i’s incentive to form an agreement with …rm j is increasing in the number of agreements …rm i has already formed and decreasing in the number of agreements formed by …rm j: The formation of a bilateral agreement requires the approval of both …rms. Hence, an agreement between …rms i and j can only emerge if both incentives are positive: Fji (ni ; nj ) ¸ 0; Fij (nj ; ni ) ¸ 0: These inequalities imply ¼ii (ni ¡ 1) > ¼ij (nj ) and ¼jj (nj ¡ 1) > ¼ji (ni ): (3) When …rms and markets are symmetric (¼ii = ¼ij = ¼jj = ¼ji = ¼), inequalities (3) yield a striking conclusion. If ¼(ni ¡ 1) > ¼(nj ) and ¼(nj ¡ 1) > ¼(ni ), as ¼ is monotonically decreasing, we must have ni = nj : Hence, in a symmetric model, a market sharing agreement can only be concluded among two …rms with the same number of competitors on their home markets! This result is easily understood. If one market had a smaller number of competitors, the …rm on the other market would have no incentive to form an agreement, as the pro…t it makes on the foreign market would already be larger than the pro…t it makes on its home market. If …rms i and j are symmetric ( ¼ii = ¼ji = ¼i and ¼ij = ¼jj = ¼j ) and one market is more pro…table than the other (for example, ¼i (n) > ¼j (n) for all n), inequalities (3) also result in a surprising conclusion. If ¼i (ni ¡ 1) > ¼j (nj ) and ¼j (nj ¡ 1) > ¼ i (ni ); as ¼i and ¼j are monotonically decreasing, the second inequality can only be satis…ed if nj · ni : This result is easily interpreted. A 11 …rm on a less pro…table market only has an incentive to enter into an agreement with a …rm on a more pro…table market if the pro…t it makes on the foreign market is smaller than the pro…t it makes on the home market. Hence, the number of competitors must be larger on the more pro…table market. 2.3 Stable Collusive Networks We now consider the entire set of market sharing agreements among …rms. Market sharing agreements can be interpreted as bilateral links, giving rise to an undirected network g on the set of …rms.7 To study this network, we need to introduce some notations and terminology from graph theory. De…nition 2.1 (i) A network is complete if all …rms are linked (gij = 1 8 i; j; i 6= j) and empty if no …rms are linked (gij = 0 8 i; j): (ii) A …rm i is isolated if gij = 0 8 j 6= i: (iii) A network g is connected if there exists a path linking any two …rms in g. (iv) A component g0 of g is a maximally connected subset of g. We let m(g 0 ) denote the size of a component g 0 , i.e., the number of …rms belonging to g 0 . A component is complete if all …rms inside the component are linked. We borrow our …rst concept of stability from Jackson and Wolinsky (1996)’s general study of strategic networks. Formally, let g ¡ gij (respectively g + gij ) denote the network obtained from g by deleting (adding) the link between …rms i and j. De…nition 2.2 (Jackson and Wolinsky, 1996) A network g is (pairwise) stable if and only if (i) 8i; j 2 N s.t. gij = 1; ¦i (g) ¸ ¦i (g ¡ gij ) and ¦j (g) ¸ ¦j (g ¡ gij ); and (ii) 8i; j 2 N s.t. gij = 0; if ¦i (g + gij ) > ¦i (g) then ¦j (g + gij ) < ¦j (g): Jackson and Wolinsky (1996) do not speci…cally model the process of network formation but propose instead a test of stability in order to eliminate unstable networks. Condition (i) states that whenever an agreement is formed, both parties prefer to keep the agreement in place. Condition (ii) states that there does not exist a pair of unlinked …rms which both have an incentive to 7 We require therefore gij = gji . 12 form an agreement. In our model, the two conditions for pairwise stability rewrite as: (i) 8i; j s.t. gij (ii) 8i; j s.t. gij 8 < F i (n + 1; n + 1) ¸ 0 i j j = 1; j : F (nj + 1; ni + 1) ¸ 0; i 8 < if F i (n ; n ) > 0 i j j = 0; : then F j (nj ; ni ) < 0: (4) (5) i The stability notion of Jackson and Wolinsky (1996) is a local criterion, which considers pairwise links in isolation. It cannot be implemented as an equilibrium of a well-de…ned game of network formation because …rms can only create or sever links one by one. Furthermore, as …rms’ deviations are severely constrained, this concept results in a very weak stability criterion. In order to obtain a stronger stability concept, we allow …rms to form and delete an arbitrary number of links. The concept we propose retains the intuition of Jackson and Wolinsky (1996) while resting on a simple noncooperative model of network formation. We consider the simultaneous linking game introduced by Myerson (1991). Each …rm i chooses the set si of …rms with which it wants to form a link. A link gij is formed if and only if i 2 sj and j 2 si . We let g(s1 ; :::; sn ) denote the graph formed when every …rm i chooses si : The linking game typically admits a large number of Nash equilibria, re‡ecting coordination failures between agents who would bene…t from forming a link but do not form it. In order to eliminate this coordination failure, we adopt a simple re…nement. We say that an equilibrium is (pairwise) strong if it is immune to deviations by coalitions of two …rms. De…nition 2.3 A strategy pro…le fs¤1 ; :::; s¤n g is a pairwise strong Nash equilibrium of the linking game if and only if it is a Nash equilibrium of the game and there does not exist a pair of …rms i; j and strategies si and sj such that ¦i (g(si ; sj ; s¤¡i;j )) ¸ ¦i (g(s¤i ; s¤j ; s¤¡i;j )) and ¦j (g(si ; sj ; s¤¡i;j )) ¸ ¦j (g(s¤i ; s¤j ; s¤¡i;j )) with a strict inequality for one of the two …rms. A network g is strongly (pairwise) stable if and only if there exists a pairwise strong Nash equilibrium of the linking game, fs¤1 ; :::; s¤n g, such that g = g(s¤1 ; :::; s¤n ): Lemma 2.1 Any strongly pairwise stable network is pairwise stable. 13 Proof. The proof is immediate. Suppose that network g is not stable. If gij = 1 and ¦i (g) < ¦i (g ¡ gij ) for some i; j, …rm i would bene…t from a unilateral deviation, choosing si = s¤i nfjg: If gij = 0 , ¦i (g + gij ) > ¦i (g) and ¦j (g + gij ) ¸ ¦j (g), then g is not immune to a joint deviation by the two …rms, si = s¤i [ fjg; sj = s¤j [ fig: 3 Symmetric Firms and Markets In order to characterize stable collusive networks, we focus on the simplest model of competition where …rms and markets are symmetric: ¼ ji (ni ) = ¼(ni ) 8i; j: In this context, it is intuitive to require that monopoly pro…ts exceed total duopoly pro…ts. We thus assume Property 4 ¼ (1) ¸ 2¼ (2) : We …rst derive a general characterization of stable and strongly stable networks. We then apply our results to speci…c examples of oligopoly and procurement auctions. 3.1 General Model As we noted in the previous section, when two …rms have an incentive to form a market sharing agreement, they must have the same number of competitors on their home market. Hence, in a stable network, for any pair of linked …rms i and j, ni = nj . Furthermore, if ni = nj = n, F (n + 1; n + 1) ¸ 0 implies that ¼ (n) ¸ 2¼ (n + 1). By log-convexity of pro…ts, ¼ (n) =¼ (n + 1) is a decreasing function of n. Hence, if F (n + 1; n + 1) ¸ 0, then F (n0 + 1; n0 + 1) ¸ 0 for all n0 < n. It follows that, for any pair of linked …rms, the incentive to form additional agreements is increasing in the number of agreements already formed. We conclude that, in a stable collusive network, if a set of …rms is linked through market sharing agreements, they must all form bilateral agreements among themselves. In other words, components in a stable collusive network have to be complete. 14 Because ¼ (1) ¸ 2¼ (2) and pro…ts are log-convex, there exists a maximal value n¤ for which ¼ (n¤ ) =¼ (n¤ + 1) ¸ 2. We associate to that number n¤ of active …rms on the market the number m¤ of market sharing agreements generating a market of size n¤ : m¤ = N ¡n¤ . Clearly, …rms only have an incentive to form an agreement if they have already formed at least m¤ agreements. Hence, there exits a lower bound on the size of complete components in a stable network. Components in a stable network have to be of size greater than or equal to m¤ + 1. Finally, if di¤erent components exist in a stable network, they must involve di¤erent numbers of …rms. If two components had the same size, by log-convexity of pro…ts, they would have an incentive to merge. Di¤erent components in a stable network must be of di¤erent sizes. The preceding remarks provide necessary conditions on stable collusive networks. The next proposition shows that these conditions are also su¢cient. Proposition 3.1 Let m¤ be the minimal integer such that ¼(N ¡ m¤ )=¼(N ¡ m¤ + 1) ¸ 2. A network g is stable if and only if it can be decomposed into a set of isolated …rms and distinct complete components g1 ; g2 ; :::; gL such that m(gl ) 6= m(gl0 ) 8l 6= l0 ; m(gl ) ¸ m¤ + 1 8l. Furthermore, if m¤ = 1, there is at most one isolated …rm. Proof. We only consider the su¢ciency part. Suppose that the network g can be decomposed into isolated …rms and complete components of di¤erent sizes, with m(gl ) ¸ m¤ + 1 8l. Clearly, as long as m¤ > 1, isolated players have no incentive to create new links. We now consider a link between two players i and j belonging to two components gl and gl0 with m(gl ) < m(gl0 ). Player i, belonging to the smallest component, refuses to form a new link. Finally, as m(gl ) ¸ m¤ + 1 8l, no player inside a component has an incentive to cut a link, and the network is thus stable. If m¤ = 1, any two isolated …rms have an incentive to form a link. Hence, there can be at most one isolated …rm in a stable network. Proposition 3.1 provides a full characterization of the pairwise stable networks when …rms and markets are symmetric. In this simple context, the complete network is always stable. Full collusion can always be sustained through 15 bilateral market sharing agreements. However, note that if m¤ > 1, the empty network is also stable. Hence, while existence of a pairwise stable collusive network is always guaranteed, uniqueness will typically not be obtained. In fact, our characterization puts no restrictions on the number of isolated …rms, free-riding on the formation of agreements by other …rms. Our characterization shows that stable collusive networks exhibit three properties: (i) in a collusive network, all alliances must reach a minimal size; (ii) alliances must involve complete sets of bilateral agreements; and (iii) di¤erent alliances must have di¤erent sizes. We now turn to the analysis of strongly pairwise stable networks. The main di¤erence between stability and strong stability stems from the …rms’ ability to delete multiple links in the linking game underlying strongly stable networks. In our setting, it turns out that a …rm prefers to renege on all its agreements than on a single one. To see this, let h (k) denote a …rm’s incentive to delete k links in a complete component of size m + 1: h (k) = ¼ (N ¡ m + k) + k¼ (N ¡ m + 1) ¡ ¼ (N ¡ m) : We compute h (k + 1) ¡ h (k) = ¼ (N ¡ m + 1) ¡ ¼ (N ¡ m + k) + ¼ (N ¡ m + k + 1) > 0 8k ¸ 1. In a complete component, all …rms obtain the same pro…t. Hence, when deleting one additional link, a …rm gains access to a foreign market which is at least as pro…table as its home market. So, if a …rm initially has an incentive to renege on one agreement, it necessarily has an incentive to renege on all agreements. This implies that the criterion of strong stability typically selects a strict subset of stable collusive networks. Proposition 3.2 A network g is strongly stable if and only if it can be decomposed into a set of isolated …rms and distinct complete components g1 ; g2 ; :::; gL such that (i) ¼(N ¡ m(gl ) + 1) ¸ ¼(N) + (m(gl ) ¡ 1)¼(N ¡ m(gl ) + 2) for all l, and (ii) m(gl ) 6= m(gl0 ) for all l 6= l0 . Furthermore, if m¤ = 1, the network contains at most one isolated …rm. 16 Proof. See Appendix 7.3. The condition on component sizes in strongly stable networks is stronger than the condition for stable networks. In fact, suppose that m satis…es ¼ (N ¡ m + 1) ¸ ¼ (N) + (m ¡ 1) ¼ (N ¡ m + 2) : For m > 2, this implies that ¼ (N ¡ m + 1) > 2¼ (N ¡ m + 2) so that m ¸ m¤ + 1. Because ¼(N ¡ m) ¡ m¼(N ¡ m + 1) is not a monotonic function of m, the condition restricting component sizes in strongly stable networks does not determine an upper bound nor a lower bound on the sizes of components. However, our examples below suggest that components in a strongly stable network cannot be too large. The incentive to free-ride and delete all links at once seems to be higher in larger alliances. Note that if m¤ > 1, the empty network is always strongly stable, which guarantees existence. However, as shown in Example 3.2, a strongly stable network may fail to exist when m¤ = 1. 3.2 Examples Example 3.1 Cournot oligopoly with iso-elastic inverse demand function Let inverse demand be given by P (Q) = 1 ¡ Q® for ® > 0: (If ® = 1, demand is linear; if 0 < ® < 1, demand is convex, and if ® > 1, demand is concave.) Observe that E(Q) = ®¡1: As ® > 0; E(Q)+1 > 0 and furthermore, E 0 (Q) ¸ 0. The su¢cient conditions of Proposition 2.1 are thus satis…ed. Straightforward computations show that ¼(n) = ®n 1¡® ® (n + ®)¡ 1+® ® : In Appendix 7.4, we show that ¼ (n) =¼ (n + 1) ¸ 2 if and only if n = 1, so the only stable networks are the empty and complete networks for a Cournot oligopoly with isoelastic demand. The complete network is strongly stable if and only if ¼(1) ¸ ¼(N) + (N ¡ 1)¼(2): We show in Appendix 7.4 that the latter inequality can never be satis…ed. We conclude that the complete network is never strongly stable, and hence the only strongly stable network is the empty network. 17 In a Cournot market with iso-elastic inverse demand, incentives to share markets only emerge when the number of competitors goes from two to one. Hence, apart from the empty network, the only sustainable collusive network is the complete network where every …rm is a monopolist on its home market. This fully collusive network does not survive free-riding from individual …rms deleting all their links at once. Example 3.2 Cournot oligopoly with exponential inverse demand function Let inverse demand be given by P (Q) = e¡Q . Here, E(Q) = ¡Q, and the su¢cient conditions of Proposition 2.1 are not satis…ed. We can still show directly that the equilibrium pro…t functions are decreasing and log-convex in n. Each …rm’s pro…t function is given by ¼(q) = qe¡Q , which is strictly quasiconcave in q, and attains a maximum at q ¤ = 1: We compute the equilibrium pro…t as ¼(n) = e¡n . Clearly, ¼(n) is a decreasing function of n and log ¼(n) = ¡n is a convex function. Now note that ¼(n)=¼(n + 1) = e > 2; 8n: Hence, any two …rms have an incentive to form a link, and the set of stable networks is very large: any network with complete components of di¤erent sizes and at most one isolated …rm is pairwise stable. Consider now the condition characterizing strongly stable networks: ¼(N ¡ m + 1) ¡ ¼(N) ¡ (m ¡ 1)¼(N ¡ m + 2) ¸ 0: De…ne f (N; m) = e¡N+m¡1 ¡ e¡N ¡ (m ¡ 1)e¡N+m¡2 = e¡N (em¡1 ¡ 1 ¡ (m ¡ 1)em¡2 ): It is easy to check that f(N; m) ¸ 0 if and only if m = 2 or m = 3. We conclude that in strongly stable networks, the sizes of components is either equal to 2 or to 3: The following table characterizes strongly stable networks for N = 2; 3; 4; 5 and 6: For N ¸ 7; no network is strongly stable. 18 Number of …rms Component sizes 2 f2g 3 f3g; f2; 1g 4 f3; 1g 5 f3; 2g 6 f3; 2; 1g In a Cournot market with exponential inverse demand, the rate of decline of pro…ts is very high. Any pair of …rms has an incentive to form an agreement, resulting in an abundance of stable con…gurations. If …rms can renege on all their agreements at once, large alliances become unstable. In a strongly stable collusive network, alliances cannot contain more than three members. This implies that there does not exist a strongly stable network for N ¸ 7. Example 3.3 Procurement auction with uniform distribution Let F (c) = c for all c 2 [0; 1]: We obtain: ¼(n) = 1= [n(n + 1)]. It is easy to see that ¼(2)=¼(3) = 2. Hence, there are three stable network architectures: the complete network, the empty network and a network with one component of size N ¡1 and one isolated bidder. Straightforward computations show that the complete network is strongly stable if and only if N · 3 and that the network with one component of size N ¡ 1 is never strongly stable. Hence, for N > 3, the only strongly stable network is the empty network. In a procurement auction with a uniform distribution, market sharing agreements become pro…table when the number of competitors is reduced from three to two. This implies that apart from the empty network, there are two stable con…gurations: full collusion and a network with one free-rider and N ¡ 1 colluding …rms. For N > 3, these alliances become subject to free-riding of …rms deleting all their links at once. Example 3.4 Procurement auction with exponential distribution Let F (c) = 1 ¡ e¡c for c 2 [0; +1): We obtain ¼(n) = 1 for n > 1 and ¼(1) = +1: n(n ¡ 1) 19 By analogy with the previous example, we see that ¼(3)=¼(4) = 2. Hence, there are four stable network architectures: the complete network, the empty network and networks with components of sizes N ¡ 1 or N ¡ 2. Notice that the complete network is strongly stable, the network with a component of size N ¡ 1 is strongly stable if and only if N · 4 and the network with a component of size N ¡ 2 is never strongly stable. Procurement auctions have a similar structure with an exponential and a uniform distribution. In the exponential case, market sharing agreements become pro…table when the number of competitors is reduced from four to three. This gives rise to a larger number of stable con…gurations, adding one where N ¡ 2 …rms collude, facing two free-riders. Furthermore, when the distribution is exponential, the fully collusive network is immune to deviations by individual bidders reneging on all their agreements at once. 4 Asymmetric Markets and Firms In this section, we depart from the assumption that …rms and markets are symmetric. By extending the analysis beyond the simple symmetric case, we are able to cover more realistic situations but lose the ability to provide a full characterization of stable collusive networks. Instead, we discuss a collection of examples pertaining to situations where (i) …rms are symmetric and markets are not, and (ii) markets are symmetric and incumbent …rms enjoy an advantage. 4.1 Asymmetric Markets Suppose that markets can be ranked according to pro…tability. We have already observed in that setting that, whenever two …rms on asymmetric markets are linked, the …rm with the less pro…table market enters into more agreements than the other. This suggest that incomplete components may form in a stable collusive network, as illustrated in the following example. Example 4.1 Asymmetric markets and Cournot competition. Consider Cournot competition with homogeneous products on three di¤erent markets. Let inverse demand on market i be given by the exponential function 20 Pi (Q) = Ai e¡Q and assume A1 = 1 < A2 < A3 . The three markets can thus be ranked according to pro…tability as ¼ 1 (n) = e¡n < ¼2 (n) = A2 e¡n < ¼3 (n) = A3 e¡n for all n. To emphasize the e¤ects of asymmetric markets, let us …rst recall the results for the symmetric case described in Example 3.2. When the three markets are symmetric, a stable network always exists, and the two stable con…gurations are the complete network and the network with two linked …rms and one isolated …rm. With asymmetric …rms, not only might the latter con…gurations not be stable, but also other con…gurations might be stable; moreover, a stable network might also fail to exist. 1. The complete network is stable only if markets are ‘not too asymmetric’. The precise condition is A3 · e ¡ 1, which ensures that …rm 1 does not want to renege on its agreement with …rm 3. Note that strong stability calls for even less asymmetry: the complete network is strongly stable ¡ ¢ provided that A3 · e2 ¡ 1 =e ¡ A2 < e ¡ 1. The three networks with two linked …rms and one isolated …rm are stable for di¤erent combinations of the parameters. For instance, the network with a single agreement between the …rms on the larger markets (…rms 2 and 3) is stable if and only if A3 · A2 (e ¡ 1). 2. The empty network is stable when markets are ‘su¢ciently asymmetric’. More precisely, one needs (i) A2 > e ¡ 1, and (ii) A3 > A2 (e ¡ 1). These conditions ensure that there is relatively enough pro…t to be made on foreign markets, so that a …rm on a small market does not wish to form an agreement with a …rm on a larger market. 3. An incomplete collusive network might be stable. In particular, if (i) A2 ¸ e= (e ¡ 1) and (ii) A2 (e ¡ 1) < A3 · e (e ¡ 1), the following network is stable: the …rm on the smallest market (…rm 1) forms an agreement with each of the other two …rms, while those two do not form a reciprocal agreement. This network is strongly stable if, in addition, A2 +A3 · e2 ¡1. 4. A stable network might fail to exist. It can be checked that if (i) A2 < e¡1, (ii) A3 > e (e ¡ 1), and (iii) A3 < A2 e (e ¡ 1), then no network is stable. 21 4.2 Incumbency Advantage Firms involved in market sharing agreements often justify market sharing by the presence of large entry costs into foreign markets. In order to analyze the validity of this argument, we consider two models where incumbents bene…t from an advantage in their home market. In the …rst model, …rms face an entry cost in foreign markets. In the second model, …rms incur a unit transportation cost when selling in a foreign market. Entry Costs. Let K denote the entry cost in foreign markets. Suppose K < ¼(N), so that entry costs are not high enough to generate entry barriers. Firm i’s pro…ts on home and foreign markets are given by ¼ii (n) = ¼ (n) and ¼ij (n) = ¼ (n) ¡ K. Hence, …rm i’s incentive to form an agreement with …rm j is equal to Fji (ni ; nj ) = [¼(ni ¡ 1) ¡ ¼(ni )] ¡ ¼(nj ) + K: We …rst note that the presence of entry costs makes market sharing agreements more attractive to …rms. We thus expect that agreements are easier to sustain when …rms bene…t from an incumbency advantage on their home market, and that stable collusive networks exhibit a denser set of links. Second, it is easy to see that if both …rms i and j have an incentive to form an agreement (Fji (ni ; nj ) ¸ 0; Fij (nj ; ni ) ¸ 0), they must have the same number of competi- tors on their home markets: ni = nj : (The presence of a symmetric cost of entry does not modify our earlier observation in the symmetric case.) Finally, we note that even if the gross pro…t function ¼(n) is log-convex, there is no guarantee that net pro…ts on foreign markets be log-convex. The following example illustrates this point, and shows that, when entry costs on foreign markets are high and log-convexity fails, stable collusive networks may have a very di¤erent structure than in the symmetric case. Example 4.2 Linear Cournot model with entry costs Consider a Cournot oligopoly with zero marginal cost and a linear inverse demand P = 10 ¡ Q. In this example, pro…ts on foreign markets are given by ¼(n) ¡ K = 100 ¡ K: (n + 1)2 22 A direct computation shows that @ 2 log[¼(n) ¡ K] @n2 ³ ´ 200 100 ¡ 3K (n + 1)2 =³ : ´2 100 ¡ K (n + 1)2 (n + 1)2 Hence, the pro…t function on foreign markets is not necessarily log-convex, and we cannot characterize stable collusive networks generally. Instead, the following table lists stable and strongly stable collusive networks for di¤erent values of K and N = 6: Fixed cost Stable networks Strongly stable networks K=0 f6g; f1; 1; 1; 1; 1; 1g f1; 1; 1; 1; 1; 1g K = 0:5 f6g; f1; 1; 1; 1; 1; 1g f1; 1; 1; 1; 1; 1g K=1 f6g; f1; 1; 1; 1; 1; 1g K = 1:5 f6g; f5; 1g; f2; 2; 2g f1; 1; 1; 1; 1; 1g K=2 f6g; f5; 1g; f4; 2g; f3; 2; 1g f3; 2; 1g f2; 2; 2g This table re‡ects the fact that market sharing agreements are easier to sustain when the entry cost increases. For low values of the entry cost, stable networks are either complete or empty, and the only strongly stable network is the empty network, as in the baseline model with no entry cost. By contrast, for high values of the entry cost (K = 2), any market sharing agreement is pro…table, and stable networks can be formed with any combination of components of di¤erent sizes. In that case, the strong stability criterion imposes an upper bound on the sizes of components, and only one network survives this criterion. Interestingly, there exists an intermediate case, K = 1:5, where, in a stable collusive network, …rms may form di¤erent components of the same size. This is due to the failure of log-convexity and stands in sharp contrast to the baseline model with no entry cost. Transportation costs. We assume now that …rms incur a unit transportation cost, denoted t > 0, when selling on a foreign market. Example 4.3 Linear Cournot model with transportation costs Consider a homogeneous Cournot market with inverse demand given by P (Q) = 1 ¡ Q, and assume t < 1=2 so that there is no exogenous barrier to entry: The 23 pro…t levels for domestic and foreign …rms are respectively µ ¶ µ ¶ 1 + (n ¡ 1) t 2 1 ¡ 2t 2 ¼d (n) = and ¼f (n) = : n+1 n+1 There exists no general method to compute pairwise stable collusive networks in this example. (In particular, two …rms may be linked but have di¤erent numbers of competitors on their home markets.) We note that, as in the case of …xed entry costs, collusion is easier to sustain when …rms face transportation costs in foreign markets. In our example, this is re‡ected by the following two facts. ² The complete network is always stable. Stability of the complete network requires ¼d (1) ¸ ¼d (2) + ¼f (2) () (1=36) (10t + 1) (1 ¡ 2t) ¸ 0, which is satis…ed since, by assumption, t < 1=2. ² The empty network is stable if and only if transportation costs are low enough: ¼d (N ¡ 1) < ¼d (N) + ¼f (N) () t < N 2 ¡2N¡1 2(2N 2 ¡N¡1) < 1=2: Moreover, in the presence of transportation costs, the sets of stable and strongly stable collusive networks are likely to enlarge. This is illustrated in the simple case with four …rms. In the absence of transportation costs, the situation is as described in Example 3.1: the empty and complete networks are the only stable networks, and the only strongly stable network is the empty network. Simple computations establish two major di¤erences due to positive transportations costs. ² The network with a complete component of three …rms and one isolated …rm is stable if and only if (i) ¼d (2) ¸ ¼d (3) + ¼f (3) () t ¸ 1=14 ' 0:07, and (ii) ¼d (4) + ¼f (2) > ¼d (3) () t < 319=998 ' 0:32; this network is strongly stable if, in addition, ¼d (2) ¸ ¼d (4) + 2¼f (3) () t ¸ 97=674 ' 0:14. ² The complete network is stable for all t and is strongly stable if and only if ¼d (1) ¸ ¼d (4) + 3¼f (2) () t ¸ 37=254 ' 0:15. 24 5 Industry Pro…ts and Social Welfare In this section, we discuss e¢ciency of stable networks. We focus on the symmetric model, and later extend our analysis to the two cases where …rms enjoy an incumbency advantage on their home market. De…ne total industry pro…ts on market i as T (ni ) = ni ¼(ni ) and social surplus as W (ni ). We assume Property 5 Total industry pro…ts are decreasing in the number of …rms active on the market, T (ni ) · T (ni ¡ 1): Property 6 Social surplus is increasing in the number of active …rms on the market, W (ni ) ¸ W (ni ¡ 1): We recall that these two properties are satis…ed in Cournot oligopolies with homogeneous products and symmetric procurement auctions. Proposition 5.1 In a Cournot oligopoly with homogeneous products, if costs are linear and E(Q) > ¡1, total industry pro…ts are decreasing in the number of active …rms on the market and social surplus is increasing in the number of active …rms on the market. In a symmetric procurement auction, total pro…ts are strictly decreasing in the number of active bidders and the expected social surplus is increasing in the number of active bidders. Proof. These results are well-known. References can be found in Vives (1999, pp. 107-109) for Cournot oligopoly models and in Mac Afee and Mac Millan (1987, p. 711) for symmetric auctions. Total industry pro…ts are thus maximized in the complete network, where all …rms are monopolies on their home market. Conversely, social surplus is maximized in the empty network, where all …rms are present on all foreign markets. As stable collusive networks always lie between these two extreme con…gurations, we observe that stable collusive networks are under-connected from the point of view of the industry and over-connected from the point of view of the society.8 8 In many examples, both the complete network (maximizing industry pro…ts) and the empty network (maximizing social surplus) are stable. Our point is that any stable collusive network is either under-connected from the point of view of the industry, or over-connected from the point of view of society, or maybe both. 25 Interestingly, this observation does not hold when …rms enjoy an incumbency advantage on their home market. In the presence of entry costs, it is well known that private incentives to enter may be higher than social incentives, resulting in excessive entry on the market. In Example 4.2, the optimal number of …rms on each market is equal to 6 for K = 0; 5 for K = 0; 5 and K = 1 and 4 for K = 1:5 and K = 2: Hence, in stable (or even strongly stable) collusive networks, the number of …rms on each market may be too large. A similar conclusion holds in the presence of transportation costs: in Example 4.3 with four …rms, the optimal number of …rms on each market is equal to 4 for 0 · t · 9=58, to 3 for 9=58 · t · 7=38, to 2 for 7=38 · t · 5=22, and to 1 for 5=22 · t < 1=2. This suggests that, when …rms enjoy a signi…cant incumbency advantage (through high entry or transportation costs), competition authorities should actually favor the formation of market sharing agreements as a way to discourage entry on foreign markets. 6 Conclusion This paper analyzes the formation of market sharing agreements among …rms in oligopolistic markets and procurement auctions. The set of agreements de…nes a collusive network, and the paper provides a complete characterization of stable collusive networks when …rms and markets are symmetric. Stable networks are formed of complete alliances, of di¤erent sizes, larger than a minimal threshold. Typically, stable networks display fewer agreements than the optimal network for the industry and more agreements than the socially optimal network. When …rms or markets are asymmetric, incomplete alliances can form in stable networks, and stable networks may be under-connected with respect to the social optimum. Our analysis sheds light on the recent wave of market sharing agreements in a number of industries. We …nd that, in order to be stable, alliances must reach a minimum size, and that an alliance grouping all …rms in the industry (as in the chemical industry) is more likely to be stable. When di¤erent alliances form (as in the airline industry), the market sharing agreements must be complete – all …rms in the alliance are linked by bilateral agreements – and di¤erent 26 alliances must have di¤erent sizes, with …rms in smaller alliances free-riding on the formation of agreements by other …rms. Our study also shows unambiguously that, in a symmetric setting, the formation of market sharing alliances is harmful and should be corrected by an adequate antitrust policy. On the other hand, when …rms face entry or transportation costs in foreign markets, the formation of market sharing agreements may be bene…cial, as it helps to correct excessive entry of …rms into foreign markets. While we believe that our analysis provides a useful application of recent developments in the theory of economic networks to a concrete problem in industrial organization, we are aware of two important shortcomings of our study. First, in order to keep the problem tractable, we assume a very simple form of market sharing, where …rms commit not to enter each other’s territory. In reality, market sharing agreements may take much more complex forms, with groups of …rms allocating a …xed set of markets among themselves. This form of market sharing seems to be prevalent in procurement auctions, as exempli…ed by Pesendorfer(2001)’s recent study of Texas school milk contracts. While we believe that our basic intuition on the trade-o¤ between reduction in the number of competitors and access to markets will carry over to more general models of market allocation, a complete analysis of market sharing agreements in more complex settings remains to be done. Second, and most importantly, we suppose that market sharing agreements are enforceable, without explicitly modelling a dynamic framework of interaction. The analysis of the enforceability of market sharing agreements seems to us to be a particularly promising area of research. By forming market sharing agreements, …rms can choose the number of markets on which they will compete, and hence endogenously determine the level of multimarket contact. Hence, as in Bernheim and Whinston (1990), the study of enforceability of market sharing agreements relies on the interplay between collusion and multimarket contact. We plan to tackle this issue in future research. 27 7 Appendix 7.1 Proof of Proposition 2.1 As the other result is well-known, we concentrate on the proof of statement (ii). Di¤erentiating individual pro…ts with respect to qi , we obtain the …rst-order condition: P 0 (Q)qi + P (Q) ¡ c0 (qi ) = 0: As all …rms are identical, we write qi = qj = q 8i; j, so that P 0 (Q)q + P (Q) ¡ c0 (q) = 0: (6) Treating n as a continuous variable and assuming linear costs, we obtain, by an implicit di¤erentiation of Equation (6): q QP 00 (Q) + nP 0 (Q) @q =¡ ; @n n QP 00 (Q) + (n + 1) P 0 (Q) (7) yielding (n ¡ 1) @q q QP 00 (Q) + 2nP 0 (Q) +q = : @n n QP 00 (Q) + (n + 1) P 0 (Q) (8) Rearranging, (n ¡ 1) @q Q (2n + E(Q) +q = 2 @n n (1 + E(Q) + n) Hence, Q2 P 0 (Q)(2n + E(Q)) d¼(n) = : dn n3 (1 + E(Q) + n) Di¤erentiating this expression again with respect to n, we get: d2 ¼(n) A(n) = 6 ; 2 dn n (1 + E(Q) + n)2 where · ¸ dQ dQ dQ2 P 0 (Q) 2 0 0 A(n) = [n (1 + E(Q) + n)] Q P (Q)(2 + E (Q) ) + (2n + E(Q)) dn dn dQ · µ ¶¸ dQ ¡[(2n + E(Q))Q2 P 0 (Q)] 3n2 (1 + E(Q) + n) + n3 1 + E 0 (Q) : dn 3 2 0 As costs are linear, c(q) = c0 (q)q. Hence ¼(n) = q(P (Q)¡c0 (q)) = ¡ Q n2 P (Q). We thus have: d2 ¼(n) ¼(n) ¡ dn2 µ d¼(n) dn ¶2 = ¡Q2 P 0 (Q)[A(n) + n2 (2n + E(Q))2 Q2 P 0 (Q)] : n8 (1 + E(Q) + n)2 (9) 28 Using Equation (9), in order to show that ¼(n) is log-convex, it su¢ces to establish A(n) + n2 (2n + E(Q))2 Q2 P 0 (Q) ¸ 0: Now, dQ dQ2 P 0 (Q) Q2 P 0 (Q)(2 + E(Q)) = : dn dQ n(1 + E(Q) + n) Hence, A(n) = Q2 P 0 (Q)[2n3 (1 + E(Q) + n) + n2 (2n + E(Q))(2 + E(Q)) ¡3n2 (1 + E(Q) + n)(2n + E(Q)) ¡ n3 (2n + E(Q))] dQ 3 [n (1 + E(Q) + n) ¡ n3 (2n + E(Q))] +Q2 P 0 (Q)E 0 (Q) dn = Q2 P 0 (Q)[¡n2 (6n2 + 6nE(Q) + 2E(Q)2 + E(Q)] dQ 3 ¡Q2 P 0 (Q)E 0 (Q) n (n ¡ 1): dn Rearranging, dQ A(n) + n2 (2n + E(Q))2 Q2 P 0 (Q) = ¡Q2 P 0 (Q)n2 [E 0 (Q) n(n ¡ 1) dn ¡ ¢ + E(Q)2 + (2n + 1) E(Q) + 2n2 ]: By assumption, E 0 (Q) ¸ 0. Furthermore, E(Q)2 + (2n + 1) E(Q) + 2n2 > 0 8n ¸ 2 and 8E(Q): Hence, as P 0 (Q) < 0 we obtain A(n) + n2 (2n + E(Q))2 Q2 P 0 (Q) > 0; showing that the pro…t function ¼(n) is log-convex. 7.2 Proof of Proposition 2.2 We concentrate again on the log-convexity of pro…ts, as the other statement of the proposition can be obtained using well-known arguments. A direct computation shows that 0 ¼ (n) = Z C 0 log(1 ¡ F (c))(1 ¡ F (c))n¡1 F (c)dc < 0: To show that pro…ts are log-convex, compute Z C 00 ¼ (n) = (log(1 ¡ F (c))2 (1 ¡ F (c))n¡1 F (c)dc: 0 De…ne p(c) = (1 ¡ F (c))n¡1 F (c) and g(c) = ¡ log(1 ¡ F (c)): The function p is …nite and strictly positive over (0; C) and the function g is …nite and 29 nonnegative over the same set. Hence, we may de…ne, as in Hardy, Littlewood and Polya (1952, p.134), the weighted integral mean of the function g as Mr (g; p) = µR p(c)gr (c)dc R p(c)dc ¶ 1r : By a generalization of Schwartz’s inequality (Theorem 192, p. 143 in Hardy, Littlewood and Polya, 1952), if r < s, then Mr (g; p) < Ms (g; p): Applying this result to the special case r = 1; s = 2, we obtain: µZ ¶2 Z Z p(c)g(c) dc < p(c)dc p(c)g(c)2 dc: Replacing p and g with their expressions: µZ < Z 0 C 0 C log(1 ¡ F (c))(1 ¡ F (c)) n¡1 (1 ¡ F (c)) F (c)dc Z 0 C n¡1 F (c)dc ¶2 (log(1 ¡ F (c))2 (1 ¡ F (c))n¡1 F (c)dc: Hence, ¼0 (n)2 < ¼(n)¼00 (n); showing that individual pro…ts are strictly logconvex in n: 7.3 Proof of Proposition 3.2 Consider a pairwise strong Nash equilibrium s¤ . By Lemma 2.1, g(s¤ ) is a stable network, and can be decomposed into complete components of sizes greater than m¤ . Suppose, by contradiction, that some component gl does not satisfy the condition: ¼(N ¡ m(gl ) + 1) ¸ ¼(N) + (m(gl ) ¡ 1)¼(N ¡ m(gl ) + 2): Then we claim that s¤ cannot be a Nash equilibrium, as any …rm i in gl has a pro…table deviation by choosing s0i = ;: Conversely, suppose that the graph g can be decomposed into a set I of isolated …rms and disjoint complete components g1 ; g2 ; :::; gL such that m(gl ) 6= m(gl0 ) 8l 6= l0 ; and ¼(N ¡ m(gl ) + 1) ¸ ¼(N) + (m(gl ) ¡ 1)¼(N ¡ m(gl ) + 2) 8l. Consider the following strategies for the …rms: If …rm i belongs to a component gl , it announces s¤i = fjjj 2 gl ; j 6= ig: If i is isolated, it announces s¤i = ;. We show that these strategies form a pairwise strong Nash equilibrium. Clearly, no …rm i has an incentive to create a link to a …rm j in another component, as i2 = s¤j . Furthermore, as m(gl ) 6= m(gl0 ) 8l 6= l0 , no pair of …rms has an incentive to create an additional link. Now consider a …rm’s incentive to destroy some 30 links. As ¼(N ¡ m(gl ) + 1) ¸ ¼(N) + (m(gl ) ¡ 1)¼(N ¡ m(gl ) + 2); the …rm cannot bene…t from destroying all its links. By the argument we give in the text, this implies that it cannot bene…t from deleting any subset of links. 7.4 Iso-elastic Inverse Demand Function We claim that in a Cournot model with iso-elastic demand: ¼(1) ¼(2) >2> : ¼(2) ¼(3) The left inequality is immediately obtained as T (1) > T (2). The right inequality is equivalent to log 2 + log ¼(3) ¡ log ¼(2) > 0; which can be rewritten as ¶ µ 3+® > 0: f(®) ´ (2® ¡ 1) log 2 + (1 ¡ ®) log 3 ¡ (1 + ®) log 2+® Immediate computations show that f 00 (®) > 0 and f 0 (0) = 3 log 2 ¡ 2 log 3 + 1=6 > 0. Hence f(®) is a strictly increasing function and, as f(0) = 0, we conclude that f (®) > 0 for all ® 2 (0; +1). Hence, the only stable networks are the empty and complete networks for a Cournot oligopoly with isoelastic demand. Turning now to strongly stable networks, de…ne g(N) = ¼(N)+(N ¡1)¼(2). The second derivative is given by g00 (N) = ¼00 (N). As ¼ is log-convex, it is necessarily convex, so g 00 (N) > 0: Furthermore, evaluating g0 (N) at the lower bound N = 2, we obtain g0 (2) = ¼0 (2) + ¼(2) = ®(1 + ®)2 1¡2® ® (2 + ®)¡ 1+2® ® > 0: Hence g(N) is a strictly increasing function, and, if the complete network is strongly stable for some N ¸ 3; ¼(1) ¸ ¼(3) + 2¼(2): Furthermore, as ¼(3) > ¼(2)=2, we obtain: ¼(1) > (5=2) ¼(2). We …nally show that the latter inequality is never satis…ed. Rewriting it, we obtain: h(®) = ® log 5 + (1 ¡ 2®) log 2 ¡ (1 + ®) log µ 2+® 1+® ¶ < 0: It is easy to see that h00 (®) > 0 and h0 (0) = log 5¡ 3 log 2 + 0:5 > 0: Hence, h(®) is an increasing function and, as h(0) = 0, the inequality cannot be satis…ed for any value of ®. We conclude that the complete network is never strongly stable, and hence the only strongly stable network is the empty network. 31 References [1] Amir, R., Lambson, V.E. (2000). On the E¤ects of Entry in Cournot Markets. Review of Economic Studies 67, 235-254. [2] d’Aspremont C., Jacquemin, A., Gabszewicz, J.J., Weymark, J. (1983). On the Stability of Collusive Price Leadership. Canadian Journal of Economics 16, 17-25. [3] Bala, V., Goyal, S. (2000).A Noncooperative Model of Network Formation, Econometrica 68, 1181-1231. [4] Bernheim, D., M. Whinston (1990). Multimarket Contact and Collusive Behavior, Rand Journal of Economics 21, 1-26. [5] Deneckere, R., Davidson, R. (1985). Incentives to Form Coalitions with Bertrand Competition. Rand Journal of Economics 16, 473-486. [6] Furusawa, T. and Konishi, H. (2002). Free Trade Networks. Mimeo, Department of economics, Boston College. [7] Goyal, S. (1993) Sustainable Communications Networks. Tinbergen Institute Discussion Paper TI 93-250. [8] Goyal, S., Joshi, S. (2000a) Networks of Collaboration in Oligopoly. Working Paper. Erasmus University Rotterdam. [9] Goyal, S., Joshi, S. (2000b). Bilateralism and Free trade. Working paper. Erasmus University Rotterdam. [10] Goyal, S., Moraga, J. L. (2001). R&D Networks. Rand Journal of Economics 32(4), 686-707. [11] Hardy, G.H., Littlewood, J.E., Pólya, G. (1952). Inequalities. Cambridge: Cambridge University Press. [12] Irish Competition Authority (1999). Cartel Watch. Competition Authority Guidelines on Cartels: Detection and Remedies. Available at www.irlgov.ie/compauth/CARTEL.htm 32 [13] Jackson, M.O., Wolinsky, A. (1996). A Strategic Model of Social and Economic Networks. Journal of Economic Theory 71, 44–74. [14] Mailath, G., Zemsky, P. (1991). Collusion in Second Price Auctions with Heterogeneous Bidders. Games and Economic Behavior 3, 467-486. [15] McAfee, P.R., McMillan, J. (1987). Auctions and Bidding. Journal of Economic Literature 25, 699-738. [16] McAfee, P.R., McMillan, J. (1988). Search Mechanisms. Journal of Economic Theory 44, 99-123. [17] McAfee, P.R., McMillan, J. (1992). Bidding Rings. American Economic Review 82, 579-599. [18] Myerson, R.B. (1991). Game Theory: Analysis of Con‡ict. Cambride, MA: Harvard University Press. [19] Nocke, V. (1999).Cartel Stability under Capacity Constraints: The Traditional View Restored STICERD Discussion Paper EI/23, London School of Economics. [20] Pesendorfer, M. (2000). A Study of Collusion in First-Price Auctions. Review of Economic Studies 67, 381-411. [21] Riley, J., Samuelson, W. (1981). Optimal Auctions. American Economic Review. 71, 381-392. [22] Selten, R. (1973). A Simple Model of Imperfect Competition when 4 are Few and 6 are Many. International Journal of Industrial Organization 2, 141-201. [23] Stigler, G. (1950). Monopoly and Oligopoly by Merger. American Economic Review 40, 23-34. [24] Vives, X. (1999). Oligopoly Pricing. Cambridge, MA: MIT Press. [25] Wilmer, Cutler & Pickering (1999). Common Carrier Bureau tentatively agrees on conditions for SBC-Ameritech merger. Telecommunications Law Updates (July). 33