Liability Management Policy

advertisement

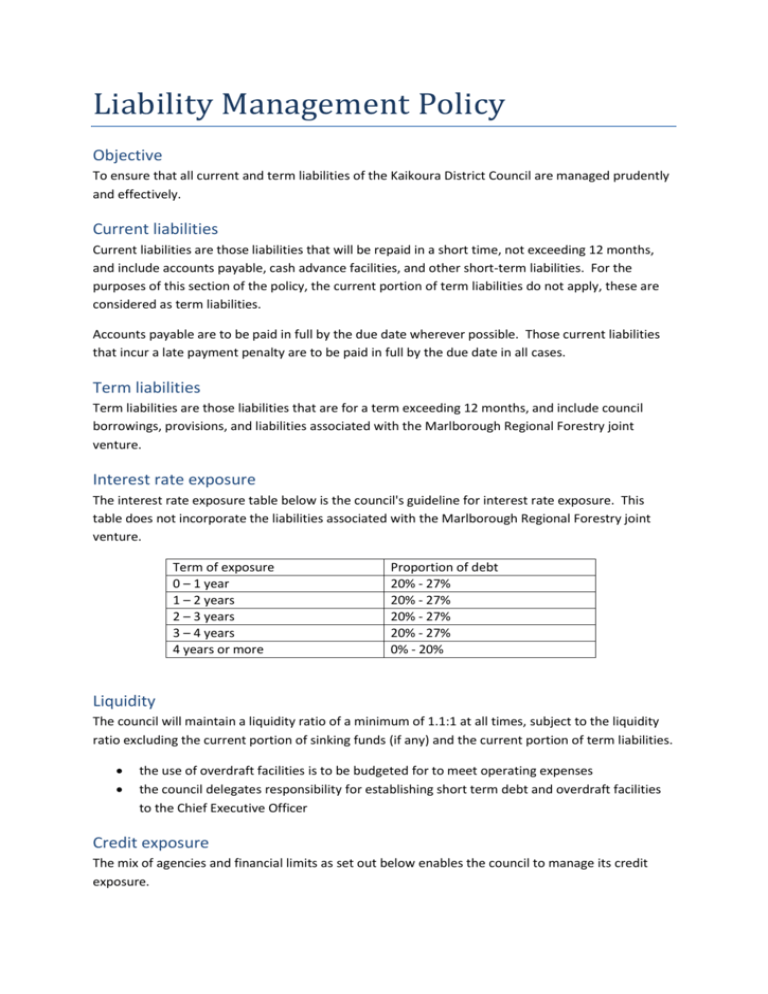

Liability Management Policy Objective To ensure that all current and term liabilities of the Kaikoura District Council are managed prudently and effectively. Current liabilities Current liabilities are those liabilities that will be repaid in a short time, not exceeding 12 months, and include accounts payable, cash advance facilities, and other short-term liabilities. For the purposes of this section of the policy, the current portion of term liabilities do not apply, these are considered as term liabilities. Accounts payable are to be paid in full by the due date wherever possible. Those current liabilities that incur a late payment penalty are to be paid in full by the due date in all cases. Term liabilities Term liabilities are those liabilities that are for a term exceeding 12 months, and include council borrowings, provisions, and liabilities associated with the Marlborough Regional Forestry joint venture. Interest rate exposure The interest rate exposure table below is the council's guideline for interest rate exposure. This table does not incorporate the liabilities associated with the Marlborough Regional Forestry joint venture. Term of exposure 0 – 1 year 1 – 2 years 2 – 3 years 3 – 4 years 4 years or more Proportion of debt 20% - 27% 20% - 27% 20% - 27% 20% - 27% 0% - 20% Liquidity The council will maintain a liquidity ratio of a minimum of 1.1:1 at all times, subject to the liquidity ratio excluding the current portion of sinking funds (if any) and the current portion of term liabilities. the use of overdraft facilities is to be budgeted for to meet operating expenses the council delegates responsibility for establishing short term debt and overdraft facilities to the Chief Executive Officer Credit exposure The mix of agencies and financial limits as set out below enables the council to manage its credit exposure. Approved counter-party credit limits Government / Local Government Funding Agency Banks with A+/A- or better long term rating, including (but not limited to) BNZ, ASB, National Bank, ANZ, and Westpac Trust. Other entities with A+/A- or better long term rating, including (but not limited to) local government stock/bonds Limits (percentage of the total borrowing portfolio) Unlimited Up to 100% subject to not more than $1 million in any one issue Up to 50% but no more than $500,000 with any single entity Debt repayment The council will ensure that loan principal budgeted amounts are set aside in a special fund established to repay specific borrowing, a tabled mortgage is used, or it will repay debt from special reserves or special funds associated with the activity for which the loan has been raised. From time to time, where investment funds are surplus, those funds may be used to reduce term debt as provided in the council’s Investment Policy. Borrowing limits The council's external borrowing limit for term debt will be set at the higher of the following limits: the gross interest expense of all external term borrowings will not exceed 10% of total revenues Total borrowings will not exceed $12 million except where; o The activity for which the loan has been raised will generate sufficient revenues to cover all costs including loan repayment (and therefore do not require rates input), or o The loan is required following a civil defence emergency to reinstate assets Security The council has in place a committed cash advance facility, and a customised average rate loan facility, both with the Bank of New Zealand and secured by negative pledge. The council will not pledge assets as security except where it has received a suspensory loan (as has been given for the housing for the elderly units).