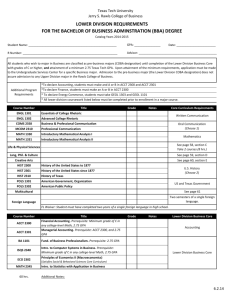

Course Requirements - Texas State Board of Public Accountancy

advertisement

Recognized Courses in Accounting/Tax Research and Analysis and Accounting/Business Communications February 4, 2016 The Texas State Board of Public Accountancy requires each candidate to complete a minimum of two semester hours in accounting research and analysis or tax research and analysis from a recognized college or university. The semester hours may be obtained through a discrete course or offered through an integrated approach. If the course content is offered through integration, the college or university must advise the Board which course(s) contain the research and analysis content. Courses identified through integration must dedicate 1 semester hour, or quarter hour equivalent, to research and analysis. Courses used to meet this requirement may not be used to meet the requirement for accounting or business communications described below. Course(s) identified by a university to meet the requirements for research and analysis in accounting or taxation should primarily address the identification, organization, and integration of diverse sources of information such as authoritative literature and pronouncements, to reach a conclusion or make a decision; and should analyze accounting and taxation issues by reviewing information, using empirical data and analytical methods, recognizing data in patterned activities, forecasting, and integrating data. CPAs may be asked to conduct research and analysis when providing attest services, professional accounting services, or professional accounting work for clients and/or employers. The Texas State Board of Public Accountancy requires each candidate to complete a minimum of two semester hours in accounting communications or business communications from a recognized college or university. The semester hours may be obtained through a discrete course or offered through an integrated approach. If the course content is offered through integration, the college or university must advise the Board which course(s) contain the accounting or business communications content. Courses identified through integration must dedicate 1 semester hour, or quarter hour equivalent, to accounting or business communications. Courses used to meet this requirement may not be used to meet the requirement for accounting or tax research and analysis described above. The AICPA provided the following definition for the accounting or business communications course from the Skills Specifications Outline (SSOs) for the CPA exam. Course(s) identified by a university to meet the requirements for accounting or business communications should include basic writing mechanics; effective business writing principles, including organization, clarity, and conciseness; ability to exchange technical information and ideas with co-workers and other professionals; prepare documents and presentations that are concise, accurate, and supportive of the subject matter; document and cross-reference work performed and conclusions reached in an accurate manner; assist clients in recognizing and understanding implications of critical business issues by providing recommendations and informed opinions; and prepare and present written work products in the form of memos, letters, opinions, and reports – such as audit reports – to others. The following listing shows the courses that have been vetted and are recognized by the Board as meeting the requirements described above. Courses with the same or similar names but offered at a different institution will not be recognized as meeting this requirement. University Accounting or Tax Research and Analysis Accounting or Business Communications Abilene Christian University MACC 619/640 Accounting Research - 2 hours ENG 326/526 Business & Professional Writing - 2 hours Angelo State University ACCT 6362 Tax Research Methodology - 2 hours ACCT 4303 Auditing – 1 hour ACCT 6325 - Financial Statement Analysis - 2 hours ENG 3352 Business Communications - 1 hour ACCT 6303 Auditing – 1 hour MGT 6313 Strategies & Policies - 1 hour Austin Community College ACNT 1393 Special Topics in Taxation: Federal Tax Research - 2 hours ETWR 2377Advanced Business Communication - 2 hours ACNT 2375 Advanced Theory and Problems in Accounting 2 hours Baylor University Brigham Young University Dallas Baptist University ACC 3310 Accounting Research & Communication - 2 hours (If course is used to meet the research requirement it cannot be used to meet the communications requirement.) ACC 5370 Tax Research - 2 hours ACC 5355 Cases in Accounting – 2 hours ACC 402 Management Accounting – 1 hour ACC 405 Principles of Taxation – 1 hour ACCT 4332 Financial Accounting Theory - 2 hours BUS 3315 Integrated Business Writing - 2 hours ACC 3310 Accounting Research & Communication - 2 hours (If course is used to meet the communications requirement it cannot be used to meet the research requirement.) MCom 320 Communications in Organizational Settings-2 hours MANA 3306 Management Communications - 2 hours ACCT 6330 Tax Planning and Research - 2 hours ACCT 6355 Case Studies in Advanced Accounting Topics 2 hours DeVry/Keller University ACCT 440/540 Accounting Research - 2 hours MGMT 330 Business Communications-2 hours MGMT 550 Managerial Communications-2 hours Florida State University TAX 5065 – Research in Federal Taxation – 2 hours MAN 5716 – Business Conditions Analysis – 2 hours Hardin Simmons University ACCT 4319/5319 Accounting Research, Analysis & Theory 2 hours BSAD 3302 Business Communications - 2 hours Houston Baptist University ACCT 4322/5322 Advanced Auditing - 1 hour BUSA 4399 Global Business Strategy - 1 hour ACCT 4314/5314 Taxation for Corporations and Other Entities – 1 hour ACCT 4181 Accounting Research – 1 hour ACCT 4281 Accounting Research – 2 hours ACNT 1391Accounting Research - 2 hours ACCT 4322/5322 Advanced Auditing - 1 hour Houston Community College BMGT 2305 Advanced Communication in Management - 2 hours ACNT 1391 Tax & Accounting Research - 2 hours ACNT 1491Technical Writing and Research for Accountants - 2 hours ACNT 1491Technical Writing and Research for Accountants - 2 hours Howard University Payne ACCT 4391 – Accounting Research – 2 hours Indiana University A440/A455 Applied Professional & Empirical Research in Accounting & Auditing – 2 hours Lamar University ACCT 5330 Advanced Auditing - 2 hours ACCT 4331 – Auditing – 1 hour MGT 5321 Organizational Communication – 1 hour BCOM 3350 Business Communications - 2 hours ACCT 5310 Financial Accounting Research & Procedures 2 hours ACCT 5361 Financial Statement Analysis – 2 hours LeTourneau University ACCT 3403 Federal Income Tax - 1 hour ACCT 4403 Auditing - 1 hour Lone Star College Louisiana State University Louisiana Tech University Lubbock Christian University McMurray University Midwestern State University Mountain View College ACNT 1393 Special Topics in Taxation - 2 hours ACNT 2337 International Financial Reporting - 1 hour ACNT 2333 Advanced Accounting - 1 hour ACNT 2335 Financial Statement Analysis – 2 hours ACCT 4021 Cases in Accounting Policy – 2 hours ACCT 7201 Tax Aspects of Business Entities – 1 hour ACCT 7210 Tax Research, Planning & Business Decision Making – 2 hours ACCT 7250 Current Topics in Federal Income Taxation – 2 hours ACCT 521 Cases & Problems in Income Taxes – 2 hours ACC 5301 Accounting Research – 2 hours ACCT 3103 Intermediate Accounting I - 1 hour ACCT 3113 Intermediate Accounting 2 - 1 hour ACNT 2345 Technical Writing for Accountants - 2 hours ACCT 3222 Auditing – 2 hours BSCM 305 Business Communications – 2 hours ACCT 507 Contemporary Accounting Theory – 1 hour ACCT 508 Advanced Managerial Accounting – 1 hour COM 3340 Communication for the Professional - 2 hours ACC 4223/5223 Accounting Research & Communications 2 hours ENG 3308 Technical Writing – 1 hour ACC 4308 Auditing – 1 hour BA 3299 Integrated Business Writing - 2 hours ACC 4223/5223 Accounting Research & Communications - 1 hour BUAD 3223 Business Communications - 2 hours ACNT 2347 Accounting Research & Analysis – 2 hours OR ACCT 4063 Auditing - 1 hour ACNT 2345 Technical Writing for Accountants – 2 hours ACCT 4365 Federal Tax Research – 2 hours ACC 3633 Financial Analysis - 2 hours ACNT 1393 Tax Research – 2 hours Effective Fall 2015 semester two of the following courses may be used to meet the research requirement ACNT 1374 – Financial Accounting Standards II – 1 hour ACNT 2339 – Advanced Auditing – 1 hour ACNT 2343 – Accounting Theory – 1 hour New Mexico State University ACNT 2374 – Fund Accounting Measurement & Reporting – 1 hour ACNT 2378 – Financial Statement Auditing Theory – 1 hour ACNT 2379 – Mergers, Acquisitions & Investments – 1 hour ACCT555 – Tax Research – 2 hours ACCT 510 Technical & Professional Communication for Accountants – 2 hours ACCT564 – Financial Accounting Research Northwood University ACC 4070 Federal Tax Research – 2 hours MGT 3200 –Management Communications – 2 hrs Oklahoma State University ACCT 5013 Tax Research – 2 hours BCOM 3113 Business Communications – 2 hours ACCT 5113 Financial Accounting Research – 2 hours ACCT 4930/5840 Professional Accounting Communications–2 hr BADM 3361 – Business Communications – 2 hours Our Lady of the Lake University ACC 8350 – Federal Tax Research – 2 hours ACC 8320 – Contemporary Issues in Accounting – 2 hours Prairie View A&M University Ouachita Baptist University Sam Houston State University Schreiner University Southern Methodist University ACCT 3333 Federal Income Tax 1 - 1 hour BCOM 3303/5203 Business Communications - 2 hours ACCT 4223 Auditing - 1 hour ACCT 5143 Accounting Theory - 1 hour ACCT 5153 Tax Consulting - 1 hour ACCT 4813 Accounting & Tax Research – 2 hours ACCT 5311 Advanced Topics in Financial Reporting - 1 hour BUAD 3335 Business Communications - 2 hours ACCT 5352 Corporate & Pass-Through Entity Taxation - 1 hour BUAD 5310 Research Writing in Business - 2 hours ACCT 5399 Advanced Auditing, Theory & Practice - 1 hour BUAD 5310 Managerial Communications – 2 hours ENGL 3303 Technical Communication - 1 hour ACCT 3305 Fundamentals of Individual Income Tax - 1 hour ACCT 3306 Corporate & Partnership Taxation - 1 hour ACCT 4303 Auditing, Theory & Practice - 1 hour ACCT 6239 Tax Research - 2 hours BLI 3302 Business Communications & Leadership Development - 2 hours ACCT 6214 Mergers & Acquisitions - 1 hour ACCT 6246 Non-Corporate Entity Accounting - 1 hour ACCT 6244 Audit Research - 2 hours ACCT 5317 Accounting Theory - 1 hour Southwestern Adventist University ACCT 316 Intermediate Accounting I – 1 hour ACCT 418 Federal Income Tax – 1 hour BUAD 317 International Business Communication – 2 hours Southwestern University ACC 36-324 – Federal Tax – 1 hour ACC 36 – 524 – Auditing – 2 hours ACC 36 – 994 – Accounting Capstone – 2 hours St. Edward’s University ACCT 6309 Accounting Theory & Practice - 2 hours BUSI 6312 Business Communications - 2 hours MGMT 6302 Organizational Behavior & Communications – 2 hours BUSI 3330 Business Communications – 2 hours St. Mary's University AC 4355/5355 Tax Research - 2 hours AC 4344/5344 Corporate Accounting & Governance - 1 hour AC 8361Financial Accounting Research & Communications - 1 hour Stephen F. Austin State University Tarleton State University ACC 512 Seminar in Accounting Research and Analysis - 2 hours ACC 4305 Federal Tax Accounting - 1 hour ACC 4301 Financial Accounting - 1 hour AC 4355/5355 Tax Research - 1 hour AC 4344/5344 Corporate Accounting & Governance - 1 hour AC 8361Financial Accounting Research & Communications - 1 hour AC 8315 Auditing II - 1 hour IB 3321 Business in an Interdependent World – 1 hour (acceptable through December 2012) MN 3320 Communication in a Management Setting – 2 hours AC 4330 Auditing – 1 hour BCM 520 Managerial Communications - 2 hours ACC 4350 Management Information Systems (taken after Spring 08) - 1 hour GB 4359 Business Strategy – 1 hour GB 3312 Business Correspondence – 1 hour Texas A&M International University Texas A&M University - Central Texas Texas A&M University - College Station Texas A&M University Commerce Texas A&M University - Corpus Christi ACC 5392 Advanced Accounting Research-2 hours BA 3301 Professional Written Communications – 2 hours ACC 486/586 Problems - 2 hours ACCK 565 Seminar in Accounting Research – 2 hours GB 312 Business Correspondence - 2 hours ACCT 607 Audit Seminar - 1 hour ACCT 421/489 Accounting Communications - 2 hours ACCT 680 Tax Research - 1 hour ACCT 405 Income Tax - 1 hour ACCT 407 Auditing - 1 hour ACCT 521 Advanced Financial Accounting - 1 hour ACCT 538 – Individual Income Tax – 1 hour ACCT 595 Accounting Research & Communications - 2 hours ACCT 588 Independent Research – 2 hours ACCT 5371 Tax Consulting, Planning & Research - 2 hours MGMT 3315 Communicating in Business - 2 hours ACCT 3321 Federal Income Tax - 1 hour ACCT 5341 Advanced Auditing & Assurance Services - 2 hours ACCT 4311 Auditing Principles & Procedures - 1 hour ACCT 5381 Accounting Theory - 2 hours Texas A&M University Kingsville ACCT 4311 Auditing I - 2 hours ACCT 4311 Auditing I - 1 hour ACCT 4395 Tax Research – 1 hour Texas A&M University – San Antonio ACCT 4308 Income Tax Accounting – 1 hour ACCT 4395 Tax Research – 2 hours ACCT 4314 Business Combinations – 1 hour BCOM 3304 – Business Communications – 2 hours ACCT 4315 Advanced Accounting Problems – 1 hour ACCT 4318 Advanced Income Tax Accounting – 1 hour ACCT 5314 Advanced Accounting Problems – 1 hour ACCT 5316 Advanced Income Tax Problems – 1 hour ACCT 5317/5319 Special Problems Accounting and Tax Research – 2 hours – Seminar Texas A&M University – Texarkana ACCT 324 Income Tax Accounting – 1 hour Texas Christian University ACCT 40003 Senior Honors Research - 2 hours in ACCT 424 Corporate Income Tax – 1 hour ACCT 70153 Financial Statement Analysis - 2 hours Texas Lutheran University Texas Southern University MGT 439 Business Policy – 2 hours ACCT 536 Accounting Theory and Research – 2 hours ACCT 70410 Professional Communications for Accountants 1 hour ACCT 70270 Financial Reporting Research - 1 hour ACCT 70370 Tax Research - 1 hour BUSI 378 Business Communications - 2 hours ACCT 537 Contemporary Accounting Topics – 2 hours ACCT 536 Accounting Theory and Research – 1 hour ACCT 571 Advanced Auditing – 2 hours ACCT 537 Contemporary Accounting Topics – 1 hour ACCT 300 Accounting Information Systems – 2 hours BADM 630 Managerial Communication – 2 hours ACCT 438 Governmental and Not-for-Profit Accounting – 2 hours ACCT 445 Contemporary Topics in Accounting – 2 hours Texas State University ACCT 431 Advanced Accounting – 2 hours ACCT 436 Federal Income Tax II – 2 hours MBA 660 Advanced Topics in Accounting – 2 hours ACC 5350 Professional Accounting Research – 2 hours ACC 5372 Tax Research – 2 hours Texas Tech University ACCT 5305 Accounting Research and Communication – 2 hours MGT 3353 Business Communications – 2 hours ACC 5350 Professional Accounting Research – 1hour ACC 5372 Tax Research – 1 hour ACC 5320 Auditing – 1 hour MGT 3373 Managerial Communications – 2 hours ACCT 5318 Income Tax Research and Planning – 2 hours ENG 3365 Professional Report Writing – 2hours Texas Wesleyan University ACC 4307/5307 Accounting Theory – 2 hours BUA 3301 Business Communications – 2 hours Texas Women's University BUS 4413 Tax Research – 2 hours BUS 3163 Business Communications – 2 hours Trinity University BUS 5463 Advanced Tax Research – 2 hours BUS 5903A International Accounting – 1 hour BUS 5473 Financial Statement Analysis – 1 hour BUS 5493 Accounting Theory – 1 hour BUS 5903 – Accounting & Audit Research – 2 hours ACCT 5341 Accounting Theory– 1 hour ACCT 4344 Auditing - 1 hour ACCT 5344 Advanced Auditing - 1 hour University of Alabama AC 532 Advanced Governance Risk Assessment & Assurance – 1 hour ACCT 5344 Advanced Auditing - 1 hour ACCT 5345 – Advanced Managerial Accounting – 1 hour GBA 300 Business Communications -2 hours AC 512 Advanced Financial Reporting & Analysis – 1 hour University of Arkansas ACCT 3843 Fundamentals of Taxation - 1 hour ACCT 4963 Audit and Assurance Services - 1 hour ACCT 4963 - Audit and Assurance Service - 1 hour ACCT 5433 Fraud Prevention and Detection - 1 hour University of Dallas ACCT 8380 Accounting Research Methods - 2 hours University of Denver ACTG 4240 Topics & Cases in Financial Accounting – 2 hours BUAD 6330 Business Communications - 2 hours BUS 3306 Communication in Business – 2 hours ACTG 4340 Cases in Managerial Accounting – 2 hours University of Houston - Clear Lake ACCT 4343 Understanding Financial Statements - 1 hour ACCT 4352 Advanced Financial Accounting - 1 hour ACCT 4353 Federal Taxation of Business Entities - 1 hour ACCT 4361 International Accounting - 1 hour WRIT 3312 Written Communications in Business - 2 hours ACCT 5335 Information Systems Audit and Security - 1 hour ACCT 5432 Accounting for Government and Not-for-Profit Organizations - 1 hour ACCT 6732 Seminar in Fraud Examination & Audit Risk – 1 hour ACCT 5234 Corporate and Pass Through Entity Taxation - 1 hour ACCT 5431 Advanced Accounting - 1 hour ACCT 5531 International Accounting - 1 hour ACCT 6731 Seminar: Financial Statement and Accounting Information Quality Analysis - 1 hour University of Houston Downtown University of Houston - Main Campus ACC 4325 Tax Research and Methodology - 2 hours ACC 4321 Financial Reporting Theory - 2 hours MBA 6314 Accounting Research & Writing – 2 hours ACCT 4377/7378 Government and Nonprofit Accounting - 2 hours ADM 4301 / BA 3350 Business Communications - 2 hours GENB 5303/7303 Professional Accounting Communications – 2 hours ACCT 7363 Contemporary Public Accounting Topics - 2 hours ACCT 4376/5376/7370 Advanced Auditing - 2 hours ACCT 7362 Tax Research - 2 hours ACCT 7365 Seminar Accounting Theory - 2 hours ACCT 7350 International Financial Reporting and Analysis 2 hours University of Houston - Victoria ACCT 6373 Contemporary Issues in Accounting- 2 hours ACCT 6372 Advanced Studies in Taxation - 2 hours MGMT 4300 Critical Thinking and Communication Skills for Managers - 2 hours COMM 3326/4300/ MGMT 4300 Business Communications–2 hours University of Iowa 6A:I47 Accounting Measurements: Research & Analysis – 2 hours University of Kansas ACCT722 Research Financial Accounting Issues – 2 hours University of Mary Hardin Baylor BACC 6252 Accounting Research - 2 hours BUS 3800 Business Writing – 1 hours BUS 3000 Business Communications & Protocol – 1 hour ACCT 710 Business Writing for Accountants – 2 hours ACC 3335 Accounting Communication - 2 hours BADM 6210 Managerial Communications - 2 hours University of Mississippi ACCY 310 Systems - 1 Hour ACCY 525 - Professional Report Writing - 2 hours ACCY 405 Income Taxes I - 1 hour ACCY 509 Income Taxes II - 1 hour ACCY 530 Information Technology Auditing - 2 hours ACCY 603 Seminar in Contemporary Taxation - 1 hour ACCY 609 Systems Seminar - 2 hours ACCY 612 Tax Research Seminar - 2 hours University of Missouri University of New Orleans ACCTCY 8423 Tax Research & Procedure – 2 hours MGT 3200 Business & Society – 2 hours University of North Texas ACCT 5110 Fundamentals of Accounting Research - 2 hours MGT 3330 Communicating in Business - 2 hours ACCT 5310 Tax Research & Administrative Procedure - 2 hours ACCT 5110 Fundamentals of Accounting Research – 1 hour ACCT 6151 Federal Tax Practice Procedures and Report Writing – 2 hours ACCT 5310 Tax Research & Administrative Procedure – 1 hour ACCT 4400 Auditing - Professional Responsibilities – 1 hour ACCT 3405 Professional Development – 1 hour ACCT 5120 Using Information Systems in Accounting – 1 hour MBCM 60420/60421 – Management Writing – 2 hours University of North Texas - Dallas ACCT 5310 Tax Research & Administrative Procedure - 2 hours University of North Carolina – Chapel Hill MAC 840 Taxation Research – 2 hours University of Notre Dame ACCT 70611 Tax Research – 2 hours ACCT 70601 Taxes & Business Strategy – 2 hours MGT 3330 Communicating in Business - 2 hours MAC 832 Financial Research – 2 hours ACCT 40770 Advanced Writing for Accounting Professionals – 1.5 hours MBCM 60771 Advanced Writing for Accounting Professionals – 2 hours ACCT 70131 Topics in Accounting Measurement & Disclosure – 1 hour MGT 30220 Management Communication – 1 hour MBCM 60420/60421 – Management Writing – 2 hours University of Oklahoma University of Phoenix University of St. Thomas ACCT 6553 Seminar in Accounting Theory - 2 hours ACCT 6553 Seminar in Accounting Theory - 1 hour ACCT 5613 Tax Research and Practice - 2 hours ACCT 5613 Tax Research and Practice - 1 hour ACCT 5353 Financial Statement Analysis - 2 hours ACCT 5352 or 5353 Financial Statement Analysis - 1 hour ACCT G5352 Financial Statement Analysis Theory and Methods - 1 hour ACCT G5351 Applied Financial Statement Analysis Lab - 1 hour ACC 497 Advanced Topics in Accounting Research - 2 hours ACCT 3603-Income Tax Accounting – 1 hour ACCT 4543 Auditing – 1 hour ACC 541 Accounting Theory & Research - 2 hours ACCT 5331 Financial Accounting Theory - 2 hours ACCT 5314 Contemporary Issues in Finance & Accounting – 2 hours COM 530 Communications for Accountants - 2 hours MGT 3320 Business Communications - 2 hours ACCT 5333 Auditing - 1 hour ACCT 5366 Comparative Accounting Practices - 1 hour ACCT 5362 Taxation of Business Entities – 2 hours University of Southern California – Los Angeles University of Texas Arlington University of Texas Austin ACCT 585 Professional Responsibilities in Accounting: Concepts, Research & Policies – 2 hours ACCT 4321/5321 Research in Accounting Issues - 2 hours BCOM 3360 Effective Business Communications - 2 hours ACCT 5339 Tax Planning and Research - 2 hours BCOM 5375 Advanced Business Communication Theory - 2 hours ACC 384.1 Tax Research Methodology - 2 hours BA 324/324H Business Communications; Oral and Written - 2 hours MAN 374/374H General Management and Strategy - 2 hours MAN 385 Business Communications - 2 hours ACC 383K.2 Management Auditing and Control - 2 hours ACC 356 Accounting Concepts and Research - 1 hour ACC 355 Intro to Taxation - 1 hour ACC 380K.11 Intro to Taxation - 1 hour University of Texas – Brownsville – This entry will be removed on 1-12017. Refer to UTRGV University of Texas Dallas ACC 358C Intro to Assurance Services - 1 hour ACC 384.4 Tax Planning for Business Entities - 2 hours ACC 380K.4 Intro to Assurance Services - 1 hour ACC 384.6 International and Interstate Tax - 2 hours ACC 380K.2 Financial Accounting Standards & Analysis II (Advanced) - 1 hour ACC 383K.1 Studies in Auditing - 1 hour ACC 362 Auditing and Control - 1 hour ACC 380K.7 Financial Statement Analysis - 1 hour ACCT 4331 Accounting Research or Accounting Report Writing - 2 hours ACCT 4331 Accounting Report Writing - 2 hours ACCT 6315 Accounting and Financial Analysis - 2 hours ENG 3222 Business Communications - 2 hours ACCT 4334/6334 Auditing - 1 hour ACCT/BCOM 3310 Business Communications- 2 hours ACCT 3350/6350 Fundamentals of Tax I - 1 hour ACCT 6373 – Advanced External Auditing – 1 hour ACCT 6203/6388 Accounting Communications - 2 hours University of Texas El Paso ACCT 6356 Tax Research - 2 hour ACC 6333 – Advanced Financial Reporting – 1 hour ACCT 6382 – Advanced Internal Auditing – 1 hour ACCT 5322 Tax Research and Writing - 2 hours ACCT 5302 Advanced Accounting 1 hour ACCT 5323 Advanced Auditing - 2 hours ACCT 5335 International Accounting - 1 hour ACCT 5335 International Accounting - 1 hour ACCT 5320 Taxation of Partners, Partnerships and S Corporations 1 hour ACCT 5321 Advanced Topics in Federal taxation - 1 hour ACCT 5328 Federal Income Tax - Partnerships & Corporations - 1 hour ACCT 5310 Contemporary Accounting Issues - 1 hour ACCT 5322 Tax Research and Writing - 1 hour ACCT 5320 Taxation of Partners, Partnerships and S Corporations - 1 hour ACCT 5323 Advanced Auditing - 1 hour ACCT 5321 Advanced Topics in Federal taxation - 1 hour ACCT 5325 Estate and Gift Taxation - 1 hour ACCT 5325 Estate and Gift Taxation - 1 hour ACCT 5326 Advanced Corporate Taxation - 1 hour ACCT 5326 Advanced Corporate Taxation - 1 hour ACCT 5394 Current Issues in Accounting - 1 hour ACCT 5394 Current Issues in Accounting - 1 hour University of Texas Pan American - This entry will be removed on 1-12017. Refer to UTRGV University of Texas Permian Basin University of Texas – Rio Grande Valley MACC 6360 Tax Research Methodology - 2 hours MACC 6330 Accounting Theory - 2 hours MACC 6350 Information Technology - 1 hour ACC 6314 Accounting Research - 2 hours MGMT 3311 Business Communications - 2 hours MACC 6375 Financial Statement Analysis – 2 hours ACCT 6320 Accounting and Financial Analysis - 2 hours ACCT 4332 Accounting Research – 2 hours MACC 6360 Tax Research – 2 hours University of Texas San Antonio ACCT 5324 Computer Applications in Accounting & Auditing – 2 hours ACCT 5314 Professional Writing for Accounting – 2 hours ACCT 5394 Current Issues in Accounting – 2 hours MACC 6360 Tax Research Methodology - 1 hour ACC 3043 Federal Income Taxation - 1 hour ACC 4013 Auditing - 1 hour MNGT 6317 Advanced Professional Communication for Business – 2 hours MARK 3320 Personal Branding & Communications – 2 hours MACC 6360 Tax Research – 1 hour MACC 6350 Information Technology – 1 hour MGT 3043/3003 OR ACC 3043/3003 Business Communication and Professional Development - 2 hours ACC 6003 Managerial Accounting Theory - 1 hour ACC 6003 Managerial Accounting Theory - 2 hours ACC 6013 Financial Accounting Theory - 1 hour ACC 6013 Financial Accounting Theory - 2 hours ACC 6043 Tax Research - 1 hour ACC 6043 Tax Research - 2 hours University of Texas Tyler ACCT 5310 Problems in Federal Income Taxation - 2 hours MANA 3370 Business Writing and Oral Presentation - 2 hours ACCT 4320/5360 Advanced Accounting - 1 hour MARK 5320 Advanced Marketing Fundamentals - 1 hour ACCT 4370/5370 Special Topics in Accounting - Forensic Accounting - 1 hour MANA 5395 Strategic Policy Formulation - 1 hour ACCT 4370/5370 Special Topics in Accounting - Advanced Auditing - 1 hour ACCT 4370/5370 Special Topics in Accounting - Financial Analysis - 1 hour ACCT 4375/5375 International Accounting & Financial Reporting - 1 hour ACCT 5315 Accounting & Reporting Problems – 1 hour ACCT 4385 Accounting Theory - 1 hour ACCT 4398 Accounting Analysis and Regulations - 1 hour ACCT 5385 Research Accounting Theory – 2 hours ACCT 5345 Advanced Financial Analysis - 1 hour ACCT 4370/5380 Advanced Auditing – 1 hour ACCT 4370 Internal Auditing – 1 hour University of the Incarnate Word University of Tulsa ACCT 6345 Federal Tax: Corporate, Partnership, and Tax Research - 2 hours ACCT 3310/6339 Business Communications - 2 hours ACCT 6348 – Advanced Audit Research – 2 hours BMGT 3380 Business Communications-2 hours ACC 7073 Management Control Systems – 2 hours ACCT 4023/6023 Tax Planning & Personal Investments – 2 hours ACCT 5333/7333 Advanced Financial Reporting & Analysis – 2 hours Wayland Baptist University ACCT 3309 – Accounting Theory & Analysis – 2 hours MGMT 3310 Managerial Communications - 2 hours West Texas A&M University ACCT 6309 Seminar in Tax Research - 2 hours ACCT 6306 Seminar in Accounting Theory - 1 hour ACCT 6306 Seminar in Accounting Theory - 2 hours ACCT 6309 Seminar in Tax Research - 1 hour ACCT 6310 Seminar in Auditing - 2 hours ACCT 6310 Seminar in Auditing - 1 hour ACCT 4373 – Accounting Communications – 2 hours ACCT 6373 – Seminar in Accounting Communications – 2 hours END