State of Wisconsin Investment Board Annual Report

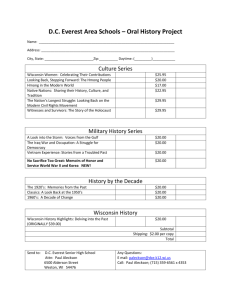

advertisement