Resource Capital Research

AVL.CN

Avalon Rare Metals Inc

C$ 7.49

Indicated resources in the Basal Zone of the world class Nechalacho REE

Project (Canada) were recently expanded by 181%. A Bankable Feasibility

Study is expected in 2Q12 and the project could be producing 10ktpa total

REO in 2015, along with Nb, Ta and Zr. Share price +177% over 12 months.

16 February 2011

Rare Metals

Canada

Bankable Feasibility Study (BFS)

Exchanges: TSX:AVL, NYSE-Amex:AVL

Capital Profile

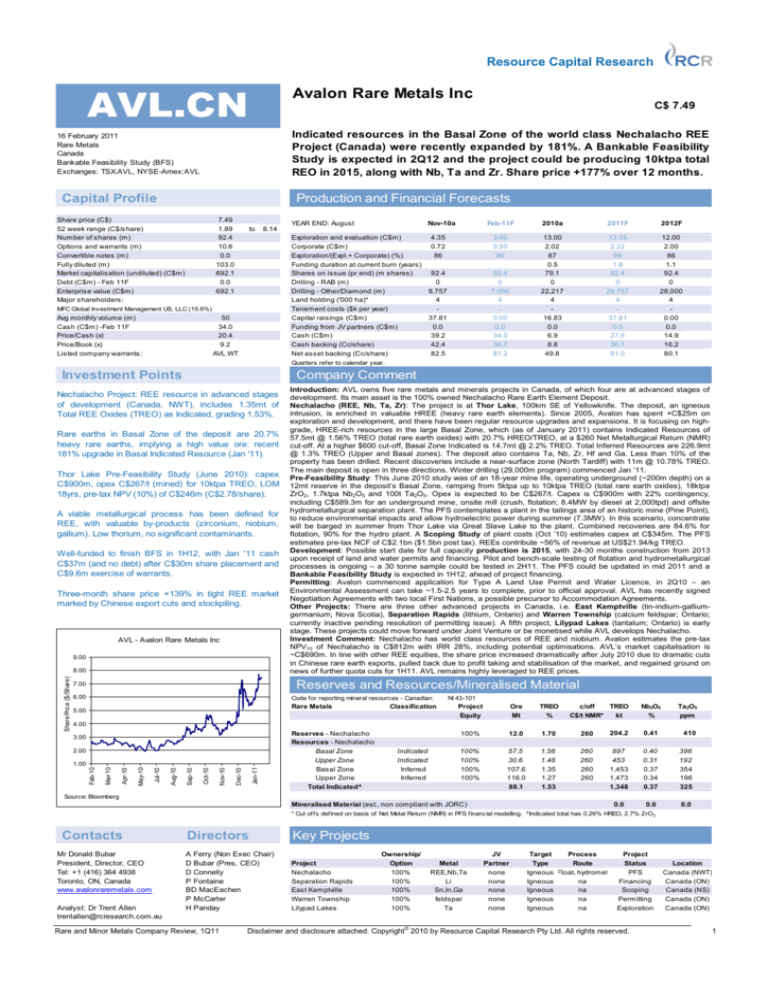

Production and Financial Forecasts

Share price (C$)

52 week range (C$/share)

Number of shares (m)

Options and warrants (m)

Convertible notes (m)

Fully diluted (m)

Market capitalisation (undiluted) (C$m)

Debt (C$m) - Feb 11F

Enterprise value (C$m)

Major shareholders:

7.49

1.89

92.4

10.6

0.0

103.0

692.1

0.0

692.1

to

8.14

Nov-10a

Exploration and evaluation (C$m)

Corporate (C$m)

Exploration/(Expl.+ Corporate) (%)

Funding duration at current burn (years)

Shares on issue (pr end) (m shares)

Drilling - RAB (m)

Drilling - Other/Diamond (m)

Land holding ('000 ha)*

Tenement costs ($k per year)

Capital raisings (C$m)

Funding from JV partners (C$m)

Cash (C$m)

Cash backing (Cc/share)

Net asset backing (Cc/share)

MFC Global Investment Management US, LLC (15.6%)

Avg monthly volume (m)

Cash (C$m) -Feb 11F

Price/Cash (x)

Price/Book (x)

Listed company warrants:

YEAR END: August

50

34.0

20.4

9.2

AVL.WT

Feb-11F

2010a

2011F

2012F

4.35

0.72

86

3.00

0.50

86

92.4

0

8,757

4

37.81

0.0

39.2

42.4

82.5

92.4

0

7,000

4

0.00

0.0

34.0

36.7

81.2

13.00

2.02

87

0.5

79.1

0

22,217

4

16.83

0.0

6.9

8.8

49.8

13.35

2.22

86

1.8

92.4

0

29,757

4

37.81

0.0

27.8

30.1

81.0

12.00

2.00

86

1.1

92.4

0

28,000

4

0.00

0.0

14.9

16.2

80.1

Quarters refer to calendar year.

Investment Points

Company Comment

Nechalacho Project: REE resource in advanced stages

of development (Canada, NWT), includes 1.35mt of

Total REE Oxides (TREO) as Indicated, grading 1.53%.

Rare earths in Basal Zone of the deposit are 20.7%

heavy rare earths, implying a high value ore: recent

181% upgrade in Basal Indicated Resource (Jan '11).

Thor Lake Pre-Feasibility Study (June 2010): capex

C$900m, opex C$267/t (mined) for 10ktpa TREO, LOM

18yrs, pre-tax NPV (10%) of C$246m (C$2.78/share).

A viable metallurgical process has been defined for

REE, with valuable by-products (zirconium, niobium,

gallium). Low thorium, no significant contaminants.

Well-funded to finish BFS in 1H12, with Jan '11 cash

C$37m (and no debt) after C$30m share placement and

C$9.6m exercise of warrants.

Three-month share price +139% in tight REE market

marked by Chinese export cuts and stockpiling.

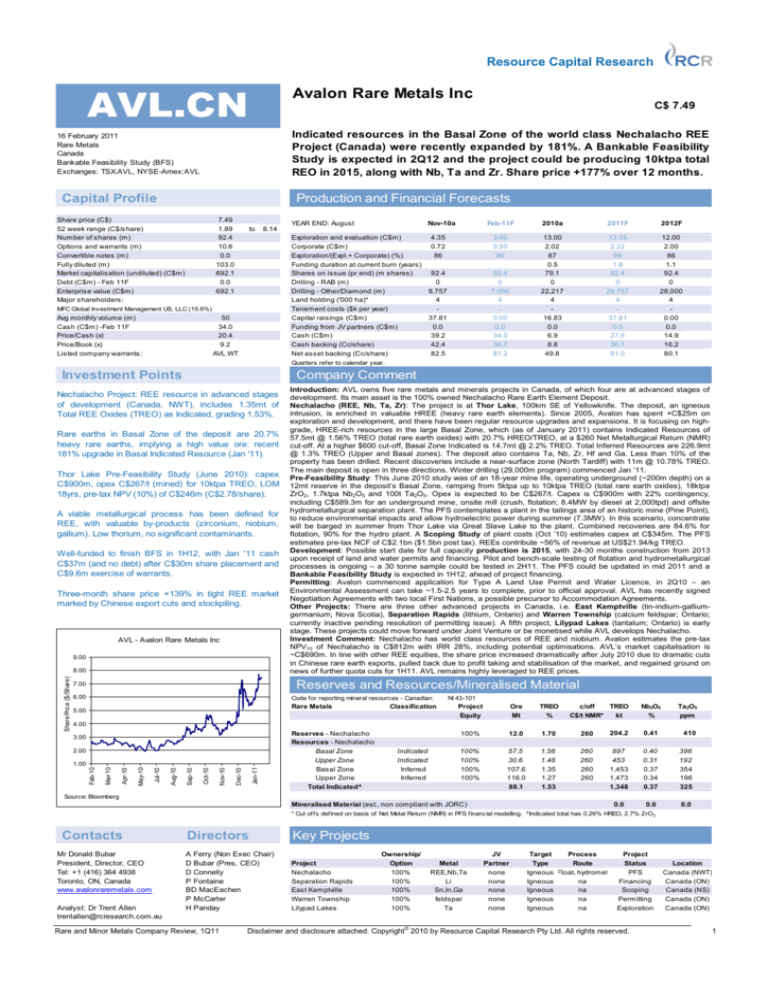

AVL - Avalon Rare Metals Inc

9.00

Share Price ($/Share)

8.00

Introduction: AVL owns five rare metals and minerals projects in Canada, of which four are at advanced stages of

development. Its main asset is the 100% owned Nechalacho Rare Earth Element Deposit.

Nechalacho (REE, Nb, Ta, Zr): The project is at Thor Lake, 100km SE of Yellowknife. The deposit, an igneous

intrusion, is enriched in valuable HREE (heavy rare earth elements). Since 2005, Avalon has spent +C$25m on

exploration and development, and there have been regular resource upgrades and expansions. It is focusing on highgrade, HREE-rich resources in the large Basal Zone, which (as of January 2011) contains Indicated Resources of

57.5mt @ 1.56% TREO (total rare earth oxides) with 20.7% HREO/TREO, at a $260 Net Metallurgical Return (NMR)

cut-off. At a higher $600 cut-off, Basal Zone Indicated is 14.7mt @ 2.2% TREO. Total Inferred Resources are 226.9mt

@ 1.3% TREO (Upper and Basal zones). The deposit also contains Ta, Nb, Zr, Hf and Ga. Less than 10% of the

property has been drilled. Recent discoveries include a near-surface zone (North Tardiff) with 11m @ 10.78% TREO.

The main deposit is open in three directions. Winter drilling (29,000m program) commenced Jan ’11.

Pre-Feasibility Study: This June 2010 study was of an 18-year mine life, operating underground (~200m depth) on a

12mt reserve in the deposit’s Basal Zone, ramping from 5ktpa up to 10ktpa TREO (total rare earth oxides), 18ktpa

ZrO2, 1.7ktpa Nb2O5 and 100t Ta2O5. Opex is expected to be C$267/t. Capex is C$900m with 22% contingency,

including C$589.3m for an underground mine, onsite mill (crush, flotation; 8.4MW by diesel at 2,000tpd) and offsite

hydrometallurgical separation plant. The PFS contemplates a plant in the tailings area of an historic mine (Pine Point),

to reduce environmental impacts and allow hydroelectric power during summer (7.3MW). In this scenario, concentrate

will be barged in summer from Thor Lake via Great Slave Lake to the plant. Combined recoveries are 84.6% for

flotation, 90% for the hydro plant. A Scoping Study of plant costs (Oct ’10) estimates capex at C$345m. The PFS

estimates pre-tax NCF of C$2.1bn ($1.5bn post tax). REEs contribute ~56% of revenue at US$21.94/kg TREO.

Development: Possible start date for full capacity production is 2015, with 24-30 months construction from 2013

upon receipt of land and water permits and financing. Pilot and bench-scale testing of flotation and hydrometallurgical

processes is ongoing – a 30 tonne sample could be tested in 2H11. The PFS could be updated in mid 2011 and a

Bankable Feasibility Study is expected in 1H12, ahead of project financing.

Permitting: Avalon commenced application for Type A Land Use Permit and Water Licence, in 2Q10 – an

Environmental Assessment can take ~1.5-2.5 years to complete, prior to official approval. AVL has recently signed

Negotiation Agreements with two local First Nations, a possible precursor to Accommodation Agreements.

Other Projects: There are three other advanced projects in Canada, i.e. East Kemptville (tin-indium-galliumgermanium; Nova Scotia), Separation Rapids (lithium, Ontario) and Warren Township (calcium feldspar; Ontario;

currently inactive pending resolution of permitting issue). A fifth project, Lilypad Lakes (tantalum; Ontario) is early

stage. These projects could move forward under Joint Venture or be monetised while AVL develops Nechalacho.

Investment Comment: Nechalacho has world class resources of REE and niobium. Avalon estimates the pre-tax

NPV10 of Nechalacho is C$812m with IRR 28%, including potential optimisations. AVL’s market capitalisation is

~C$690m. In line with other REE equities, the share price increased dramatically after July 2010 due to dramatic cuts

in Chinese rare earth exports, pulled back due to profit taking and stabilisation of the market, and regained ground on

news of further quota cuts for 1H11. AVL remains highly leveraged to REE prices.

Reserves and Resources/Mineralised Material

7.00

6.00

Code for reporting mineral resources - Canadian:

Rare Metals

5.00

Classification

NI 43-101

Project

Ore

TREO

c/off

TREO

Nb2O5

Ta2O5

Equity

Mt

%

C$/t NMR*

kt

%

ppm

100%

12.0

1.70

260

204.2

0.41

100%

100%

100%

100%

57.5

30.6

107.6

116.0

88.1

1.56

1.48

1.35

1.27

1.53

260

260

260

260

897

453

1,453

1,473

1,348

0.40

0.31

0.37

0.34

0.37

396

192

354

196

325

0.0

0.0

0.0

4.00

3.00

Jan-11

Dec-10

Oct-10

Nov-10

Sep-10

Aug-10

Jul-10

Apr-10

Mar-10

Feb-10

1.00

May-10

2.00

Reserves - Nechalacho

Resources - Nechalacho

Basal Zone

Upper Zone

Basal Zone

Upper Zone

Total Indicated^

Indicated

Indicated

Inferred

Inferred

410

Source: Bloomberg

Mineralised Material (est., non compliant with JORC)

* Cut offs defined on basis of Net Metal Return (NMR) in PFS financial modelling. ^Indicated total has 0.26% HREO, 2.7% ZrO2

Contacts

Mr Donald Bubar

President, Director, CEO

Tel: +1 (416) 364 4938

Toronto, ON, Canada

www.avalonraremetals.com

Analyst: Dr Trent Allen

trentallen@rcresearch.com.au

Directors

Key Projects

A Ferry (Non Exec Chair)

D Bubar (Pres, CEO)

D Connelly

P Fontaine

BD MacEachen

P McCarter

H Panday

Project

Nechalacho

Separation Rapids

East Kemptville

Warren Township

Lilypad Lakes

Rare and Minor Metals Company Review, 1Q11

Ownership/

Option

100%

100%

100%

100%

100%

Metal

REE,Nb,Ta

Li

Sn,In,Ga

feldspar

Ta

JV

Partner

none

none

none

none

none

Target

Process

Type

Route

Igneous Float, hydromet

Igneous

na

Igneous

na

Igneous

na

Igneous

na

Project

Status

PFS

Financing

Scoping

Permitting

Exploration

Disclaimer and disclosure attached. Copyright © 2010 by Resource Capital Research Pty Ltd. All rights reserved.

Location

Canada (NWT)

Canada (ON)

Canada (NS)

Canada (ON)

Canada (ON)

1

Resource Capital Research

Avalon Rare Metals Inc project location map: from a recent company presentation, this

graphic shows the main focus is on Thor Lake, where AVL has the Nechalacho and North T

Deposits. Total Indicated Resources include 1.4mt of Rare Earth Oxides (REO).

Thor Lake, schedule to production: Avalon plans to have the Nechalacho REE Deposit in

production in late 2015. The project is expected to progress along four lines: community

engagement, permitting, marketing and Bankable Feasibility Study (BFS).

Rare and Minor Metals Company Review, 1Q11

Disclaimer and disclosure attached. Copyright © 2010 by Resource Capital Research Pty Ltd. All rights reserved.

2

Resource Capital Research

Disclosure and Disclaimer

Disclosure and Disclaimer

Important Information

Resource Capital Research Pty Limited (referred to as “we”, “our”, or “RCR” herein) ACN 111 622 489 holds an Australian Financial Services Licence

(AFS Licence number 325340). General advice is provided by RCR’s Authorised Representatives Dr Tony Parry (Authorised Representative number 328842)

and Dr Trent Allen (Authorised Representative number 331960). The FSG is available at www.rcresearch.com.au. All references to currency are in Australian

dollars unless otherwise noted.

This report and its contents are intended to be used or viewed only by persons resident and located in the United States, Canada and Australia and

therein only where RCR’s services and products may lawfully be offered. The information provided in this report is not intended for distribution to, or use

by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject RCR or its

affiliates to any registration requirement within such jurisdiction or country.

This report and its contents are not intended to constitute a solicitation for the purchase of securities or an offer of securities. The information

provided in this report has been prepared without taking account of your particular objectives, financial situation or needs. You should, before acting on the

information provided in this report, consider the appropriateness of the purchase or sale of the securities of the companies that are the subject of this report

having regard to these matters and, if appropriate, seek professional financial, investment and taxation advice. RCR does not guarantee the performance of any

investment discussed or recommended in this report. Any information in this report relating to the distribution history or performance history of the securities of

the companies that are the subject of this report, should not be taken as an indication of the future value or performance of the relevant securities.

In preparing this report, RCR analysts have relied upon certain information provided by management of the companies that are the subject of this

report or otherwise made publicly available by such companies. The information presented and opinions expressed herein are given as of the date

hereof and are subject to change. We hereby disclaim any obligation to advise you of any change after the date hereof in any matter set forth in this

report. THE INFORMATION PRESENTED, WHILE OBTAINED FROM SOURCES WE BELIEVE RELIABLE, IS CHECKED BUT NOT GUARANTEED

AGAINST ERRORS OR OMISSIONS AND WE MAKE NO WARRANTY OR REPRESENTATION, EXPRESSED OR IMPLIED, AND DISCLAIM AND NEGATE

ALL OTHER WARRANTIES OR LIABILITY CONCERNING THE ACCURACY, COMPLETENESS OR RELIABILITY OF, OR ANY FAILURE TO UPDATE, ANY

CONTENT OR INFORMATION HEREIN.

This report and the information filed on which it is based may include estimates and projections which constitute forward looking statements that

express an expectation or belief as to future events, results or returns. No guarantee of future events, results or returns is given or implied by RCR.

Estimates and projections contained herein, whether or not our own, are based on assumptions that we believe to be reasonable at the time of publication,

however, such forward-looking statements are subject to risks, uncertainties and other factors which could cause actual results to differ materially from the

estimates and projections provided to RCR or contained within this report.

This report may, from time to time, contain information or material obtained from outside sources with the permission of the original author or links to web sites or

references to products, services or publications other than those of RCR. The use or inclusion of such information, material, links or references does not imply

our endorsement or approval thereof, nor do we warrant, in any manner, the accuracy of completeness of any information presented therein.

RCR, its affiliates and their respective officers, directors and employees may hold positions in the securities of the companies featured in this report and may

purchase and/or sell them from time to time and RCR and its affiliates may also from time to time perform investment banking or other services for, or solicit

investment banking or other business from, entities mentioned in this report. RCR may receive referral fees from issuing companies or their advisors in respect

of investors that RCR refers to companies looking to raise capital. Those fees vary, but are generally between 0 - 1% of the value of capital raised from referrals

made by RCR. RCR received referral fees in relation to recent capital raisings for Globe Uranium Limited, PepinNini Minerals Limited, Uranex NL and Toro

Energy Limited. At the date of this report, neither RCR, nor any of its associates, hold any interests or entitlements in shares mentioned in this report with the

exception that either or both of John Wilson (either directly or through Resource Capital Investments Pty Limited (RCI)) and associates, or RCI, as trustee of the

Resource Capital Investments Fund owns shares in BHP and Rio Tinto.

Analyst Certification: All observations, conclusions and opinions expressed in this report reflect the personal views of RCR analysts and no part of the

analyst’s or RCR’s compensation was, is, or will be, directly or indirectly related to specific recommendations or views expressed in the report. Officers,

directors, consultants, employees and independent contractors of RCR are prohibited from trading in the securities of U.S. companies that are, or are expected

to be, the subject of research reports or other investment advice transmitted to RCR clients for a blackout window of 14 days extending before and after the date

such report is transmitted to clients or released to the market.

Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated and Inferred Resources: RCR publishes mineral resources based on

standards recognized and required under securities legislation where listed mining and exploration companies make their exchange filings and uses the terms

“measured", "indicated" and "inferred" mineral resources. U.S. investors are advised that while such terms are recognized and required under foreign securities

legislation, the SEC allows disclosure only of mineral deposits that can be economically and legally extracted. United States investors are cautioned not to

assume that all or any part of measured, indicated or inferred resources can be converted into reserves or economically or legally mined. We recommend that

US investors consult Securities and Exchange Commission Industry Guide 7 – “Description of Property by Issuers Engaged or to Be Engaged in Significant

Mining Operations” for further information about the use of defined terms and the presentation of information included in this report.

Resource Capital Research

ACN 111 622 489

www.rcresearch.com.au

Rare and Minor Metals Company Review, 1Q11

Suite 1306

183 Kent Street

Sydney, NSW 2000

Tel: +612 9252 9405

Fax: +612 9251 2859

Email: johnwilson@rcresearch.com.au

Disclaimer and disclosure attached. Copyright © 2010 by Resource Capital Research Pty Ltd. All rights reserved.

3