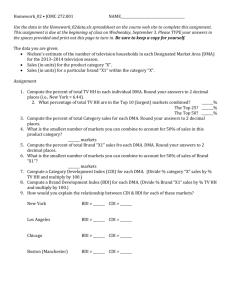

REVENUE AGENT REPORT COMPLIANCE

STATE INCOME & FRANCHISE TAX

DMA’s Revenue Agent Report (RAR) Compliance service provides you with a value-added resource to amend

the state income tax filings resulting from the settlement of a federal audit. Our seasoned tax professionals

relieve your tax staff from the cumbersome compliance burdens associated with a federal tax audit.

DMA’s tax professionals utilize a refined, proven process that ensures cost-effectiveness and maximizes your

tax benefits. We:

• Perform a comprehensive analysis of RAR issues to identify all potential tax savings opportunities;

• Identify additional tax minimization strategies unrelated to the federal changes;

• Monitor state amnesties and voluntary compliance initiatives;

• Prepare amended state income tax returns and notification letters; and

• Review all state adjustments and work with the Departments of Revenue to resolve any incorrect adjustments.

DMA’s RAR Compliance service can be provided as a stand-alone service or in conjunction with our State

Income & Franchise Tax Recovery service, thereby relieving your concerns over budget constraints and

maximizing all credit opportunities.

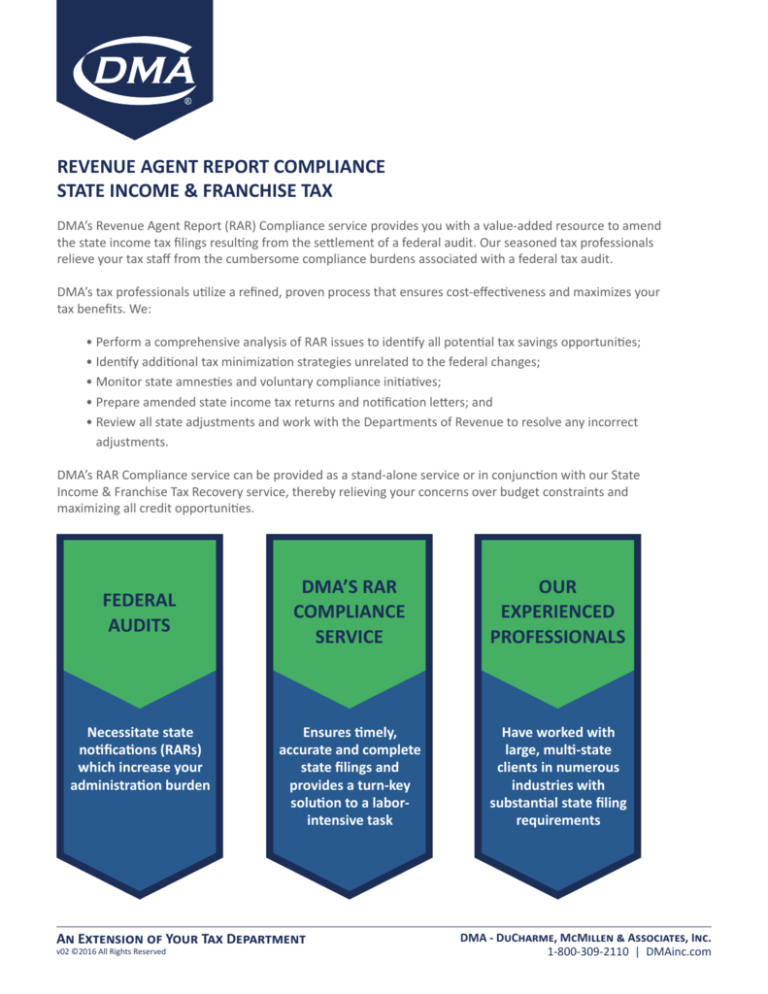

FEDERAL

AUDITS

Necessitate state

notifications (RARs)

which increase your

administration burden

DMA’S RAR

COMPLIANCE

SERVICE

OUR

EXPERIENCED

PROFESSIONALS

Ensures timely,

accurate and complete

state filings and

provides a turn-key

solution to a laborintensive task

Have worked with

large, multi-state

clients in numerous

industries with

substantial state filing

requirements

An Extension of Your Tax Department

v02 ©2016 All Rights Reserved

DMA - DuCharme, McMillen & Associates, Inc.

1-800-309-2110 | DMAinc.com