PMS 288 Blue or CMYK = C100-M85-Y0-C43

PMS 1255 Ochre / Yellow or CMYK = C0-M35-Y85-C30

Revenue Agent’s Report (RAR)

Compliance Services

The Federal Revenue Agent’s Report (RAR) provides an excellent opportunity for

companies to evaluate their past state and local tax returns for overpayments and missed

credit opportunities. However, the administrative and compliance requirements for filing

amended returns can present a significant challenge for the tax department.

Ryan’s RAR Compliance Services help clients overcome the challenges of managing

increased compliance requirements and reduced resources. Our seasoned State Income

and Franchise Tax professionals accurately amend state and local income tax filings to

address jurisdictional requirements. We examine our clients’ federal audit reports to

proactively identify opportunities to minimize their tax liabilities. We ensure that all returns

are statutorily accurate and include the necessary forms and documentation required by

the taxing jurisdiction. And, we provide added value and expertise by sharing knowledge

and best practices for total tax performance.

Comprehensive RAR Review, Compliance, and Planning Services

Ryan will ensure that clients take full advantage of state and local tax savings

opportunities resulting from a federal income tax audit by providing a suite of RAR

compliance and planning services that include:

Review and strategic planning

Ryan’s RAR amended return and review process identifies refund opportunities and

areas of potential exposure. In many cases, the savings identified actually offset the

cost of Ryan’s compliance solutions. Throughout the entire review process, our clients

are informed of their eligibility for any state or local amnesty or voluntary compliance

initiatives that further reduce interest and/or penalties.

Compliance management, return preparation, and filing

We provide return preparation services that leverage state-of-the-art software to produce

thorough, timely, and accurate amended state and local filings, as well as a complete

compliance package for current and subsequent audit cycles. We substantiate all filing

positions and comprehensively manage the amended returns through the approval process.

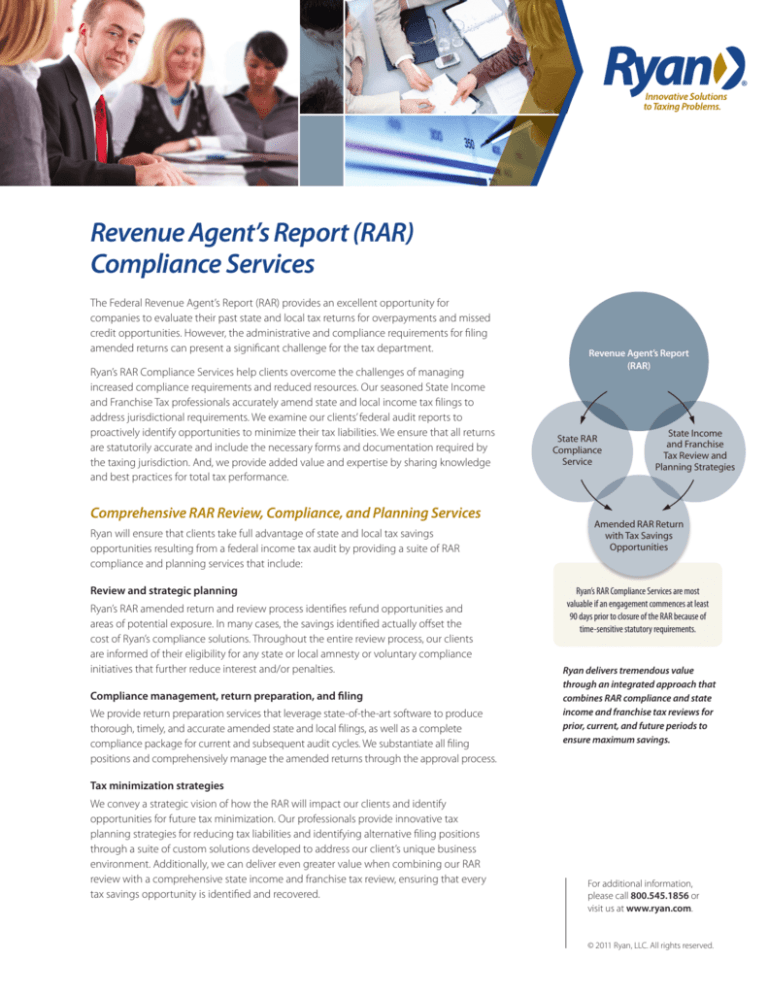

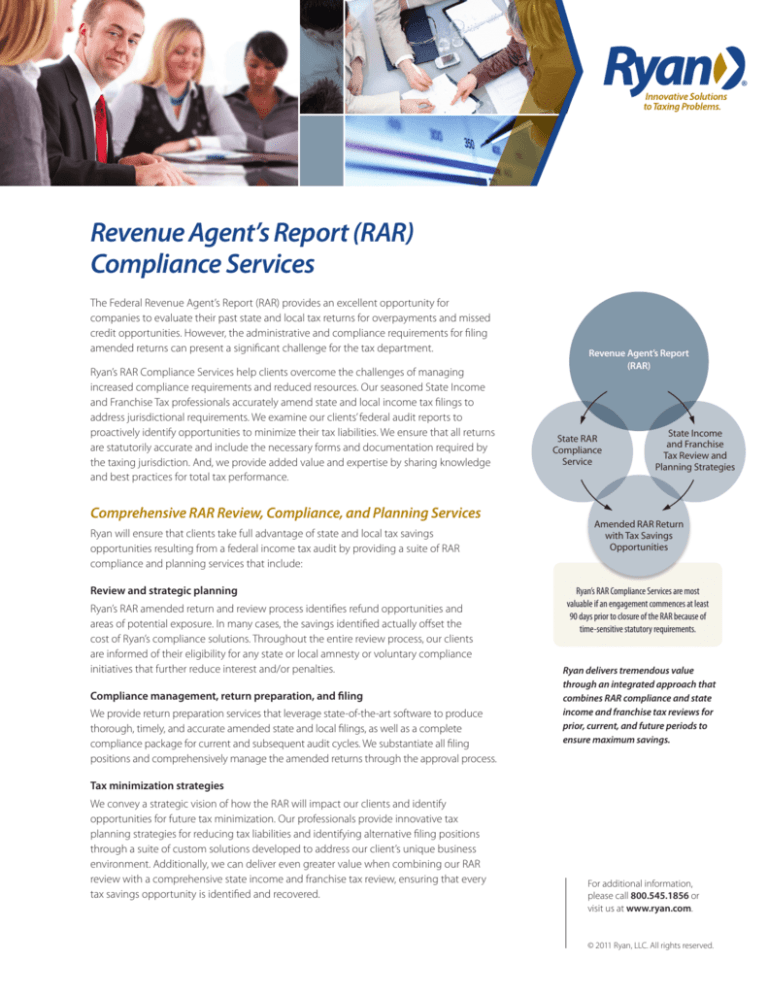

Revenue Agent’s Report

(RAR)

State RAR

Compliance

Service

State Income

and Franchise

Tax Review and

Planning Strategies

Amended RAR Return

with Tax Savings

Opportunities

Ryan’s RAR Compliance Services are most

valuable if an engagement commences at least

90 days prior to closure of the RAR because of

time-sensitive statutory requirements.

Ryan delivers tremendous value

through an integrated approach that

combines RAR compliance and state

income and franchise tax reviews for

prior, current, and future periods to

ensure maximum savings.

Tax minimization strategies

We convey a strategic vision of how the RAR will impact our clients and identify

opportunities for future tax minimization. Our professionals provide innovative tax

planning strategies for reducing tax liabilities and identifying alternative filing positions

through a suite of custom solutions developed to address our client’s unique business

environment. Additionally, we can deliver even greater value when combining our RAR

review with a comprehensive state income and franchise tax review, ensuring that every

tax savings opportunity is identified and recovered.

For additional information,

please call 800.545.1856 or

visit us at www.ryan.com.

© 2011 Ryan, LLC. All rights reserved.