executive summary - Mansfield District Council

MANSFIELD DISTRICT COUNCIL

RETAIL STUDY: EXECUTIVE SUMMARY, APRIL 2005

1.

2.

3.

4.

5.

EXECUTIVE SUMMARY

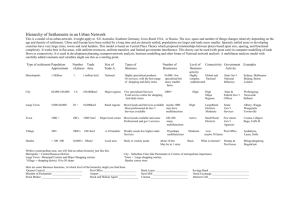

GVA Grimley was instructed in November 2004 to undertake the Mansfield Retail Study. The purpose of this study is to inform and guide retail planning in the District, and in particular, to input into the preparation of the forthcoming Local Development Framework (LDF). The key objective is to provide a robust assessment of retail needs in the District, with particular emphasis on Mansfield Town Centre, the main sub-regional centre, and the three district centres of Mansfield Woodhouse, Market Warsop, and Oak Tree, and to make provision to meet current and projected retail and related needs for the period up to 2011 and 2016. The study area is highlighted on Plan 1.

Our terms of reference are to:

Establish the extent to which the current retail provision in the District satisfies the level and nature of consumer demand within each catchment;

Estimate the scale and nature of any changes in this position that may arrive in the light of:

Potential increases in population;

Forecast changes in retail expenditure;

Changing forms of retail provision;

Possible increases or decreases in the trade draw from competing centres.

Identify the scale and nature of additional retail provision that may be appropriate in the District to the period 2011 and 2016;

Assess the scope for new retail development and the potential to accommodate this within the District.

Government guidance makes clear that sustainable development is the core principle underpinning planning.

Accordingly PPS1 sets out a range of overarching policies aimed at facilitating sustainable patterns of urban and rural development through a number of initiatives, including the need to ensure that new developments provide good access to jobs and key services for all members of the community.

PPS6 reaffirms the Government’s commitment to protecting/sustaining town centres. Accordingly the central objective of the guidance is to promote the vitality and viability of town centres by planning for the growth of existing centres and enhancing existing centres by promoting them as the focus for new development. Where growth cannot be accommodated in identified existing centres, local planning authorities should plan for an extension to the primary shopping area. It makes clear that where reversing the decline in centres is not possible, local authorities should consider reclassifying such centres within the retail hierarchy.

In allocating sites and assessing proposed development, PPS6 requires local planning authorities to assess the need for the development; identify the appropriate scale, apply the sequential approach, assess the impact on existing centres; and ensure locations are accessible and well served by a choice of means of transport. Local

MANSFIELD DISTRICT COUNCIL

RETAIL STUDY: EXECUTIVE SUMMARY, APRIL 2005

6.

7.

8.

9.

10.

11.

12.

13. planning authorities after considering these factors, should consider the degree to which other considerations such as physical regeneration, employment, economic growth and social inclusion are relevant.

RSS8 provides the planning framework for the region’s development over the next 16 years. Mansfield lies within the Northern Coalfields Sub-Area which has been subject to major industrial change and consequently is identified as a ‘Priority Area for Regeneration’. RSS8 highlights that it is crucial that the sub-area develops a viable new economic base that will support healthy and vibrant communities. Mansfield is defined as a Sub-

Regional Centre (SRC) below the Principal Urban Areas of Derby, Leicester, Lincoln, Northampton and

Nottingham. SRC’s have been identified for their ability to perform a complementary role to the PUA’s, and development should not prejudice the urban renaissance of the PUA’s. The economic, social and environmental regeneration of the Northern Sub-Area is a priority, with Mansfield identified as a priority town centre for support.

The Draft Joint Structure Plan identifies the retail hierarchy for the two authorities: Nottinghamshire County

Council and Nottingham City Council. Nottingham is the Regional Centre, while Mansfield is the only Major

Sub-Regional Centre in the Structure Plan area.

The Mansfield District Local Plan was adopted in November 1998, to guide development in the area to 2006.

Problems associated with industrial decline are acknowledged, as is the failure of Mansfield town centre to grow and expand at the same rate as competing centres. The Council consequently promotes the development of new comparison floorspace in the centre. The Four Seasons Shopping Centre is recognised as being outdated, and a number of further development opportunity sites are put forward. A number of these have since been implemented or have evolved and require updating in the LDF process.

National retail trends indicate a continued growth in incomes and expenditure, albeit not at such strong levels as in the last 15-20 years. The growth in expenditure is focused on comparison goods with virtually no increase in convenience goods expenditure.

Increased car ownership has resulted in greater household mobility and therefore the choices for shopping centres to visit and the distances that can be travelled are much greater. Internet shopping has grown phenomenally in the last few years and looks set to continue in certain sectors, it remains however only a very small percentage of overall spending.

Retail planning policy has become much more focused on promoting and protecting town centres. Although new forms of retailing, such as purpose built out of centre regional shopping centres, factory outlet centres and retail warehouse parks have emerged, where these are out of centre, they are now largely restricted by planning policy.

The foodstore operators have continued to evolve their formats and offer. With restrictions on out of centre stores growing and changing socio-economic trends several large operators have returned to the high street with small convenience stores. Operators are also seeking to extend their comparison goods offer, turning stores into variety or mini department stores. This trend poses a threat to smaller centres, where the large out of centre stores become one stop shopping destinations negating trips to the town centres.

There has been a continued polarisation towards larger centres and the provision of larger stores in these larger centres. Where smaller centres have been unable to diversify their offer or create niche markets they have

MANSFIELD DISTRICT COUNCIL

RETAIL STUDY: EXECUTIVE SUMMARY, APRIL 2005

14.

15.

16.

17.

18.

19.

20.

21.

22. suffered. The focus on urban renewal has increased demand for town centre sites for a wider range of land uses.

Since the mid-90’s, despite higher rents, there has been a steady trend, driven by central government policy, towards building new leisure schemes in town/edge of centre locations. Mixed-use retail and leisure development has proved to be a real growth area in town centres.

These trends present significant opportunities and challenges to Mansfield. It is well placed to benefit from forecast spending growth but the centre needs to expand and adapt if it is to capitalise on these opportunities, and maintain and enhance its position within the wider region.

Mansfield faces competition from Nottingham, Sheffield, Derby and Meadowhall, which are amongst the strongest shopping destinations in the UK. In terms of trade draw, our findings highlight Chesterfield,

Nottingham and Sutton-in-Ashfield as the key competing centres, closely followed by Meadowhall.

The strongest shopping destinations are set to enhance their retail offer still further. Sheffield will shortly implement the new Retail Quarter and Carmel House; Nottingham is redeveloping the Broadmarsh Centre, improving the Victoria Centre and implementing new retail floorspace at Trinity Square; Derby is extending the

Eagle Shopping Centre and developing the River Lights leisure based scheme; and Meadowhall is implementing a two storey extension. The cumulative impact of such schemes will impact on Mansfield, unless it is able to enhance its retail offer.

Chesterfield and Sutton-in-Ashfield have no proposals for major retail schemes in the pipeline that may impact upon Mansfield. Newark and Worksop have little influence on shopping patterns in the study area, and have no plans to consolidate their position in the near future.

Collectively, the level of investment planned in the competing sub-regional centres will strengthen their role in the retail hierarchy, and increase their market share from the Mansfield catchment area. In these circumstances, it is critical for Mansfield to improve its retail offer even in order to maintain its market share and retain its position as a ‘sub-regional’ centre as envisaged in Revised RPG8 (July 2004). Without investment in the town centre and improvements to its retail offer, Mansfield will decline.

Mansfield town centre appears to be performing adequately but is showing signs of vulnerability, performing poorly against some health check indicators. The centre will need to consolidate, grow and expand if it is to retain its market share in the shadow of improving centres in the wider Sub-Region.

Primary Shopping Frontages are performing well. They have a high proportion of national multiple retailers, low vacancy rate and high pedestrian flows. There are good links between the bus station and the Four Seasons

Shopping Centre and West Gate – the two principal shopping areas. While this is positive for the town centre it also illustrates the physical constraints and the centres inability to offer new/alternative premises for key multiple retailers. In order for Mansfield to compete more effectively as a shopping destination, it will be necessary for the centre to identify new opportunities for creating additional retail space.

At present, the role of the Primary Shopping Frontages appears to be functioning in accordance with its designation in the adopted Local Plan and we do not consider it necessary to reduce frontages. There is, however, a need to expand the Primary Shopping Frontages, but we do not consider it appropriate to upgrade

MANSFIELD DISTRICT COUNCIL

RETAIL STUDY: EXECUTIVE SUMMARY, APRIL 2005

23.

24.

25.

26.

27.

28.

29. units within Secondary Shopping Frontages – these are under-performing and evidence highlights the limited size and configuration of units unattractive to new key retailers. Mansfield requires larger accommodation to improve retailer representation from key retails, variety stores and even department store operators.

In contrast, Secondary Shopping Frontages are performing poorly throughout the town centre. While there have been a small number of new quality retailers, vacant units have more than doubled over a four year period and pedestrian footfall is well below the town centre average. The constrained location of the Four Seasons

Shopping Centre, West Gate and the bus station focuses the majority of shopper activity in one small location to the detriment of the secondary shopping areas. As vacancy rates have risen, the pull of shoppers to more secondary areas has fallen. The new Wilkinson store on Clumber Street is the consequence of a quality development enhancing this area of the town centre and benefiting from an associated car park.

The evening leisure economy is effectively focused in a ‘leisure quarter’ as recommended in draft PPS6.

Cultural leisure destinations, such as the theatre and museum are, however, located close to a number of pubs and bars resulting in management difficulties and a conflict of users. Local authorities are advised to consider the scale and quantity of leisure developments they wish to encourage and their likely impact on the character of the town centre and anti-social behaviour. A good practice guide on managing the evening economy will be produced to assist local authorities.

Retailer demand has fallen consistently in recent years, demonstrating the need for Mansfield to address its weaknesses, provide new development opportunities and retail space and improve its image as an attractive shopping destination in light of improving centres in the wider catchment. The Liveability Fund will be crucial in improving the public realm. Foodstore provision is weak, and this detrimental position will be enhanced following the recent consent for a new out-of-centre Tesco superstore and the likely closure of the key town centre anchor Tesco.

The District and Local Centres are the principal shopping centres outside Mansfield town centre and are substantially smaller in scale. Each centre has been assessed against a range of health check indicators drawing on data provided by Mansfield District Council and detailed on-site surveys undertaken by GVA

Grimley.

Mansfield Woodhouse and Market Warsop are both located to the north of the town centre, with traditional high street environments, both in conservation areas with a number of attractive historic buildings. Physical improvements to the environment are more evident in Mansfield Woodhouse. Mansfield Woodhouse is anchored by a Co-op foodstore with adjoining car park which appeared quiet on the day of our site visit. Market

Warsop is anchored by a small Kwik Save and Co-op foodstores. Both centres appeared healthy with few vacant units and a busy shopping environment. The range of convenience goods retailers is limited in

Mansfield Woodhouse highlighting the crucial role of the Co-op foodstore underpinning the health of the centre.

Oak Tree district centre located to the south east of Mansfield town centre has few signs of maintenance and investment in recent years. Recent consent has been granted, however, for its redevelopment to include a

Tesco food superstore and seven adjoining retail units for a range of retail uses.

The Local Centres are substantially smaller playing a top up local shopping role. The range of retail uses in

Newgate Lane is limited with a high proportion of service operators. There is no anchor foodstore, and the shop

MANSFIELD DISTRICT COUNCIL

RETAIL STUDY: EXECUTIVE SUMMARY, APRIL 2005

30.

31.

32.

33.

34.

35.

36.

37. frontages are fragmented with a high number of vacant units. The centre is potentially vulnerable to decline, although there are some key facilities including a Post Office and pharmacy.

Clipstone Road West local centre is located on a busy main road. The centre is compact with no vacant units and a good anchor foodstore and key facilities including a Post Office and pharmacy. Ladybrook Lane comprises a small purpose built open shopping precinct and, like Clipstone Road, has no vacant units a good anchor foodstore, Post Office and pharmacy. Overall, we consider these centres are performing well.

Our capacity projections indicate the total population of the survey area is forecast to decrease from 421,204 in

2004 to 418,650 by 2016 – a decrease of 1%. Convenience goods expenditure is expected to increase from

£627m in 2004 to £653m by 2016. In the comparison sector, higher growth rates suggest spending will increase from £955m to £1,538m by 2016 – an overall growth of £582.5m of comparison goods expenditure between 2004 and 2016.

In terms of convenience provision a number of stores are under performing compared to estimated company averages: Tesco, Stockwell Gate; J Sainsbury, Nottingham Road; Tesco, Oak Tree District Centre and Co-op,

Mansfield Woodhouse. Strong performing stores include Asda, Old Mill Lane; Morrisons, Sutton Road; and

Kwik Save, Market Warsop.

There are currently two commitments for new foodstores in the District. A new Tesco superstore will open on

Chesterfield Road South comprising 60% convenience goods floorspace; and the existing Tesco at the Oak

Tree District Centre will be redeveloped adding 1,475 sq m net of convenience goods retail floorspace.

In the base scenario, we estimate that there will be insufficient capacity for additional convenience goods floorspace over the period 2004 to 2016. Scenario 2, however, factors in the likely closure of the town centre

Tescos at Stockwell Gate. Within this scenario our assessment highlights minimal capacity for new convenience goods floorspace equating to an additional 411 sq m net by 2016, i.e. insufficient capacity to plan for new convenience goods superstores. Both scenarios disguise, however, low trade retention and the current qualitative deficiencies of foodstore provision in Mansfield town centre and Mansfield Woodhouse. We consider this further in Section 8.

Our capacity projections have identified the under performance of Mansfield Town Centre as a comparison goods shopping destination. The Portland Retail Park is trading adequately while the St Peters Retail Park and two B&Q freestanding retail warehouses are performing particularly well. Freestanding retail warehousing elsewhere in the District is not performing well, highlighted by their absence from the results of the Household

Telephone Survey, and reinforcing our qualitative conclusions.

Our comparison capacity projections suggest there will be some scope for additional floorspace in the period up to 2016. On the basis it is able to maintain its current market share in the face of growing competition, we estimate capacity for circa 7,594 sq m net by 2011, rising to 17,357 sq m net by 2016.

Provided credible conclusions are made regarding claw back from competing centres, it may be possible to assume a higher market share through quality new retail development. If, for example, market share grew by

5% there would be theoretical capacity for circa 38,000 sq m gross by 2016.

MANSFIELD DISTRICT COUNCIL

RETAIL STUDY: EXECUTIVE SUMMARY, APRIL 2005

38.

39.

40.

41.

42.

43.

We consider there is some opportunity to enhance to Mansfield town centres trade retention if appropriate new schemes were implemented. Any further out of centre foodstore development may have serious implications for the vitality and viability of the town centre and other defined centres, while new town centre foodstore development and the importance of linkages with the core shopping area will warrant detailed consideration.

Driven by a strong forecast growth in retail expenditure, identified qualitative deficiencies and growing competition in the wider sub-region, we consider there is a need to increase, improve and consolidate retail floorspace in Mansfield town centre. In particular, there is a need to enhance and extend the primary shopping frontages whilst implementing significant improvements to secondary shopping frontages.

In order to accommodate the scale of additional comparison shopping floorspace likely to be required the core shopping area needs to be extended. At present the Stockwell Gate site offers the only current opportunity to expand the retail core and to provide larger retail accommodation to ensure a viable retail scheme to attract key multiple retailers. The potential drawback of the site is the current fragmented land use pattern. It is vital, however, to ensure a comprehensive approach whatever the final scale and composition of development on the site is decided. Piecemeal development will compromise a much needed comprehensive mixed use scheme necessary to realise the full development potential of the site and the significant benefits to Mansfield town centre. Short terms decisions should not prejudice the potential of the site in meeting the needs of the town centre as a whole.

Given the scale and form of new retail development likely to be needed over the next twelve years, we consider the Stockwell Gate area is likely to play a key role in meeting Mansfield’s strategic retail needs and accommodating other key town centre uses. Due to the strategic importance of the area we recommend the expansion of the core retail area onto the Stockwell Gate site is given appropriate weight and focus in the proposed town centre Area Action Plan to ensure development of an appropriate scale, mix and quality, providing the site with statutory development plan status. We recommend the important relationship between

Stockwell Gate and the Four Seasons Shopping Centre is considered in detail within the AAP to ensure optimum physical and visual linkages throughout the expanded core shopping area.

The Four Seasons Shopping Centre is now outdated and tired and in need of refurbishment/redevelopment over the period to 2016. A comprehensive scheme including Stockwell Gate and the Four Seasons will have significant benefits for the core shopping area, and phasing of development will not be an issue following the

Area Action Plan which will set out the composition and mix of development on the site. An integrated scheme should enable a new or relocated department store to the west of the Stockwell Gate site encouraging footfall throughout the Primary Shopping Frontages.

Secondary shopping frontages will be substantially enhanced following implementation of the townscape heritage initiative in the White Heart Street area. The scheme, funded from the heritage lottery, will refurbish buildings in this under utilised area, taking advantage of its historic buildings and prominent position fronting the market place. Orientated towards specialist retailing, the scheme will make a major contribution to quality of the townscape and help attract retailers and shoppers back to the secondary shopping areas.

Our assessment of Mansfield Woodhouse identifies a centre that is performing well in accordance with its intended role primarily as a convenience shopping destination, with some comparison shopping and a range of other services. The main anchor foodstore, Co-op, is trading adequately but struggling to some extent from competing foodstores. It will be crucial to the health of the centre to maintain an anchor foodstore, and given

MANSFIELD DISTRICT COUNCIL

RETAIL STUDY: EXECUTIVE SUMMARY, APRIL 2005

44.

45. the limitations of supplementary convenience provision the centre relies heavily on the representation of the Coop. The council should support and encourage the expansion/redevelopment of the store in this central location through the LDF strategy.

Our assessment of Market Warsop identified a good performing centre serving a distinct catchment area to the north of the District beyond the built up area of Mansfield. The centre is anchored by a small Kwik Save foodstore which is performing particularly well benefiting from its more distinct catchment area beyond

Mansfield’s urban area. The Council should encourage the enhancement of key foodstores, i.e. Kwik Save and

Co-op in the LDF strategy to 2016.

The outdated and under performing Oak Tree District Centre will shortly be upgraded following approval for redevelopment comprising a new Tesco food superstore and associated seven retail units. This development will meet the need for convenience and associated facilities in this location over the LDF period and we do not consider the LDF strategy should make provision for additional floorspace.