Cathy`s Presentation Slides - Manchester Metropolitan University

advertisement

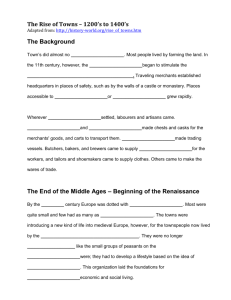

Professor Cathy Parker @placemanagement #HSUK2020 Our partner HSUK2020 towns: Alsager, Altrincham, Ballymena, Barnsley, Bristol (St George), Congleton, Holmfirth, Market Rasen, Morley and Wrexham Change in retailer location 2000-11 Out of town up 50 million square feet Town centre down 46 million square feet Department for Transport 2011 Online share of home retailing 2014 Poland France Europe av Germany UK 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% Centre for Retail Research 2013 Town centre share of retail spend 2000 49.4% 2011 42.2% 2014 39.8% Parliament 2014 An academic study. Why bother? People do not want to go into six different shops for six different articles; they prefer to buy the lot in one shop. The American Grocer, 1892 For better or worse this distributive revolution is carrying us away from shopkeeping to mass distribution McNair, 1931 What causes High Street Change? What influence do individual locations have? 10000 studies found 2345 after clean up 923 ‘retail’ highlighted 253 town centre/high st 173 studies reviewed Review parameters 1. 2. 3. 4. 5. 6. Type of study (empirical, exploratory, conceptual) Methodological evidence Data source (primary, secondary, tertiary) Dependent variable (retail area performance measure) Independent variables (factor affecting performance) Significance (major findings and statistical significance if available) 7. Limitations (flaws, weaknesses etc.) 8. Author, date, publisher 9. Geographical location (UK, US, Europe, e.g.) 10.Size of retail/shopping centre (Different geographical scales of place, e.g. city centre, town centre, high street, neighbourhood centre, district centre, suburban centre) 166 factors influence performance And if 166 factors were not enough….. • Partner towns identified 50 additional factors that influence the High Street • 33 additional studies reviewed • 201 factors finally identified, but: – how much influence does each one have? – what should towns be focussing on? The Delphi Technique The Delphi method is unique in its method of eliciting and refining group judgement as it is based on the notion that a group of experts is better than one expert when exact knowledge is not available. (Paliwoda, 1983). 22 Experts participated Practitioner Academic Major retailer Manchester Metropolitan University Shopping centres owner University of Leicester Urban consultant University of Dundee Retail letting agency University of Ulster Urban policy group Oxford University Trade association University of Manchester Professional body University of Liverpool University of Portsmouth University of Loughborough Consensus reached on 1. How much influence each factor has on the vitality and viability of the High Street 2. How much control a location has over the factor Amount of influence location has over factor 4 Child-minding centre 3.5 Opening hours Not worth it! Get on with it! Deliveries Leadership 3 2.5 2 Political climate Methods of classification 1.5 Forget it! Live with it! Spatial structure Location 1 2 2.5 3 3.5 4 4.5 5 Amount of influence factor has over vitality and viability Top 25 priorities 3.900 APPEARANCE How much town can influence factor 3.700 3.500 3.300 NECESSITIES PLACE MARKETING EXPERIENCE PLACE ASSURANCE NETWORKS & ACTIVITY HOURS ENTERTAINMENT AND PARTNERSHIPS MANAGEMENT LEISURE WITH COUNCIL RECREATIONAL MERCHANDISE Anchor stores SPACE VISION&STRATEGY RETAILERS WALKING DIVERSITY ADAPTABILITY Chain vs independent Safety/crime 3.100 LIVEABLE ATTRACTIVENESS Comparison/convenience Barriers to Entry 2.900 ACCESSIBLE 2.700 3.300 3.500 3.700 3.900 4.100 4.300 How much factor influences vitality and viability 4.500 4.700 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 Delphi Average RESULTS from #HSUK2020 towns Spatial Macro Meso Micro Partnerships have 64 % of potential influence they could have Impact Changing stakeholder attitudes and behaviours • Over 180 local stakeholders across 10 locations in England, Wales and Northern Ireland have been involved. • Over 25 different types of stakeholders, from major retailers to local residents have been engaged. In Wrexham, the High Street UK 2020 workshop was well attended,with more than 30 participants. As a direct result of the enthusiasm generated at the event, a new Business Group met on 2 September 2014 to look at how to build on the discussions and how to find champions for the 25 top priorities identified in the HSUK2020 research. This group meeting is seen as a forerunner for a town centre focused group drawn from businesses, the community and the public sector. New dialogue routes between the Council and the business community have been established. To date a lot of effort has been focused on new structures and partnerships but the group are very keen to start taking actions forward. The group says the HSUK2020 research has been ‘a catalyst for action’. Changing media perceptions • Over 80 media hits in the local press, on radio and online. • All positive, all report major findings and most have a ‘call to action’. • BBC Stoke ran a week-long ‘special’ on “All About Alsager” Barnsley Chronicle, 27th June 2014 Influencing research agenda • Findings have been presented to over 1,300 delegates at regional, national and international events. • A research agenda has been published reflecting research needs of high street stakeholders