Full Year Results

advertisement

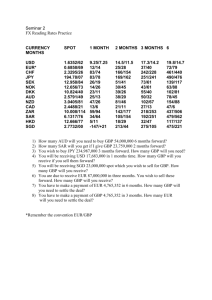

PRESS RELEASE Full year results Ageas UK, 12 February 2015 Ageas UK delivers profitable performance in 2014 Executive Summary Profitable performance despite challenging market conditions and first quarter weather impact Full year net profit of GBP 94.7 million compared to GBP 85.2 million in 2013. Combined ratio continued to deliver a sub 100% performance at 99.8% (FY 2013 97.8%). Total income flat reflecting lower market average premiums Total income of GBP 2,097.6 million (FY 2013: GBP 2,116.8 million). Total Non-Life Gross Written Premiums (GWP) of GBP 1,822.0 million (FY 2013: GBP 1,848.0 million). Total inflows from Retail business down 7.0% at GBP 164.7 million due to continued competitive environment. Retail strategy launched to build on market position. Protection GWP up 20.8% to GBP 110.9 million. Sale of Ageas Protect complete. Well capitalised business Strong capital positions maintained in Ageas Insurance and Tesco Underwriting. Announcing the full year results for 2014, Andy Watson, Chief Executive of Ageas UK commented: “In a year where the industry faced a number of challenges, I’m pleased to report that we’ve ended 2014 in good shape. We’ve made strong progress on the integration of our two insurance businesses, giving brokers a greater product choice in both Personal and Commercial lines. We continue to implement our growth and simplification strategy in our Retail business. The additional focus and investment in Partnerships has delivered the renewal and launch of significant deals in 2014, demonstrating that wellrespected brands trust Ageas to look after their clients. I’m immensely proud of the continued recognition we receive from the industry and our customers and look forward to building on this in 2015.” PRESS RELEASE | 011/15 1 Business Results As a result of the implementation of IFRS 10, from 1 January 2014 Ageas no longer consolidates Tesco Underwriting, but reports it as a non-consolidated partnership and therefore does not include the Tesco Underwriting result in the combined ratio. All historic data has been restated accordingly. The management and operation of the partnership remain unchanged. Ageas UK Ageas UK continues to focus on delivering profitable returns, reflecting a clear and consistent multidistribution strategy and partnership approach with brokers, affinities, intermediaries and through its own Retail business. The combination of high quality service and low cost delivery remains a strategic priority for all the Ageas UK businesses. At the end of 2014, Ageas UK reported a net profit of GBP 94.7 million (FY 2013: GBP 85.2 million), with the year on year increase including benefits from a legal settlement in Ageas Retail and the capital gain on the sale of Ageas Protect that more than offset the impact of storms and floods that hit the UK in the first quarter. Total income including Tesco Underwriting was broadly stable at GBP 2,097.6 million (FY 2013: GBP 2,116.8 million), reflecting a disciplined approach to pricing in a market where average premiums continue to be down, albeit there are signs of a slight upward trend in Motor. Ageas has around 9 million customers across its businesses in the UK and insures 3.6 million Motor policies. Its continued focus on service delivery and best practice performance was evidenced in a year of significant recognition from partnerships, the industry and its customers. Partnership renewals with Tesco Bank and John Lewis, and a new deal with Virgin Money as part of the company’s bancassurance strategy are testament to the trust that these brands place in Ageas to meet their clients’ expectations. Repeated achievement of significant awards such as the British Insurance Awards ‘General Insurer of the Year’; Insurance Times Awards ‘Personal Lines Insurer of the Year’ as voted by brokers; and Incisive Media’s ‘Gold Standard for Insurance’ and ‘Gold Standard for Protection’ evidences the strong performance of Ageas, while also managing significant business change. The achievement of the Investors in Customers’ ‘Exceptional’ rating for customer satisfaction demonstrates that the company is getting it right for customers too. PRESS RELEASE | 011/15 2 Non-Life: Ageas Insurance Ageas Insurance’s net result was GBP 59.1 million (FY 2013: GBP 69.5 million) reflecting some large losses in Motor and costs linked to the integration of its two insurance businesses. The result also includes a tax credit from previously unrecognised tax losses arising from the acquisition of Groupama Insurance Company Limited in 2012. Gross Written Premiums (GWP) during 2014 remained broadly flat at GBP 1,393.1 million (FY 2013: GBP 1,405.0 million). Motor (Private Car and Commercial Vehicle) income was stable at GBP 817.2 million (FY 2013: GBP 814.3 million), with growth in Ageas’s specialised private car book offsetting the current market trend of lower average premiums. Ageas Insurance continues to maintain its pricing discipline with price increases being applied to address the performance of the private car book. Household income was down at GBP 334.8 million (FY 2013: GBP 343.6 million), due to competitive market conditions. Despite the weather impact in the first quarter, Ageas’s average premiums for Household has remained flat, against the background of lower rates in the market. Commercial and Special Risks inflows saw an increase of 3.0% to GBP 182.4 million (FY 2013: GBP 177.2 million) due to the additional capability of Ageas Insurance and growth in scheme business. Growth is expected to continue with refreshed focus on growing business in Commercial Motor, schemes and e-trading business. The combined ratio for Ageas Insurance continued to deliver a sub 100% performance and by the end of the year was 99.8% (vs. 97.8% FY 2013). The Motor ratio ended the year at 99.7% (FY 2013: 96.9%) 1 with a higher frequency of accident claims linked to increased traffic volumes . Benign weather for the remaining three quarters of 2014 contributed to a good performance of the Household ratio at 94.3% (FY 2013: 93.8%). Following ongoing developments to deliver a profitable Commercial book, the total Commercial lines ratio including Commercial Motor also delivered a sub 100% performance at 99.3% (FY 2013: 101.9%). 1 Department for Transport, Quarterly Road Traffic Estimates: Great Britain Quarter 3 2014 – all motor traffic increased by 2.2% to 77.9bn vehicle miles when compared to the same quarter in 2013. This is the highest quarterly total recorded since 2008. PRESS RELEASE | 011/15 3 Tesco Underwriting Tesco Underwriting, the Motor and Household insurance partnership with Tesco Bank, of which 50.1 per cent is owned by Ageas, generated GWP of GBP 428.9 million during the period (FY 2013: GBP 443.0 million). Against competitive conditions in Motor, Tesco Underwriting has seen 1.8% volume growth, but continues to maintain firm pricing to improve the book’s risk profile. The net result of Ageas’s interest in Tesco Underwriting made a loss of GBP 1.8 million (FY 2013: positive GBP 7.0 million) reflecting the market wide weather impact earlier in the year and the continuing pressure of the competitive market in Motor. Following a five year partnership, which now serves 1.2 million customers, Ageas UK and Tesco Bank signed an agreement at the end of the year to extend the deal. Life Protection: Total GWP inflow increased by 20.8% to GBP 110.9 million (FY 2013: GBP 91.8 million) driven by the company’s award-winning approach to underwriting and technology, high levels of service and product innovation. New Annual Premiums increased by 19.8% to GBP 36.1 million (FY 2013: GBP 30.1 million). Ageas Protect’s post tax result was a loss of GBP 2.4 million compared to a loss of GBP 1.8 million for the same period last year due to a Deferred Acquisition Cost (DAC) write off, as a result of historically low yields in the latter part of 2014 influencing the valuation of expected future cash flows. On 6 August 2014, Ageas announced the sale of Ageas Protect to AIG as part of its strategy to focus on its core non-life business. The transaction was approved by the regulator and completed at the end of 2014 for a total consideration of GBP 197 million. Ageas Protect was launched in the UK in July 2008 and now has over a 5% market share in the UK protection market. Other Insurance Activities: Within Ageas UK’s Other Insurance activities, the net profit was GBP 39.8 million (FY 2013: GBP 10.5 million) including the proceeds of a legal settlement and the capital gain on the sale of Ageas Protect. The Retail business delivered a net profit of GBP 12.8 million (FY 2013: GBP 23.3 million), which was aligned with expectations due to the investment being made to grow the business while also responding PRESS RELEASE | 011/15 4 to competitive market conditions. Total inflows were down 7.0% to GBP 164.7 million (FY 2013: GBP 177.0 million) further reflecting the tough and highly competitive environment. As part of the new Retail strategy to build on its position as the fourth largest Personal lines intermediary and to respond to the continued challenges of a competitive market, actions have been taken to simplify the business model and build long term growth. The simplification of the retail businesses from seven legal entities into one has completed and investment in pricing, IT, data analytics and marketing capability is progressing well. Growth is already being seen in Kwik Fit Insurance Services as a result of the actions being taken combined with higher new business and renewal volumes. Over the course of the year Ageas has continued to provide additional focus and investment in its partnerships strategy which has successfully led to the renewal of significant deals and the recent announcement of a new arrangement with Virgin Money. Ageas UK Results Summary: Income Total Non-Life (inc. non-consolidated partnerships at 100%) Other Insurance including Retail Life Protection Net Profit Total Non-Life Other Insurance including Retail Life Protection Key Ratios (Ageas Insurance*) Total Combined ratio Non-Life Motor Non-Life Household Non-Life Accident & Health Non-Life Commercial & Special Risks** To end of December 2014 in £ millions To end of December 2013 in £ millions 2,097.6 1,822.0 164.7 110.9 2,116.8 1,848.0 177.0 91.8 94.7 57.3 39.8 (2.4) 85.2 76.5 10.5 (1.8) 99.8% 99.7% 94.3% 104.7% 110.3% 97.8% 96.9% 93.8% 110.5% 104.2% * Tesco Underwriting (TU) no longer consolidated from Q1 2014. Historic data restated accordingly. ** Commercial and Special Risks includes costs of integration. Commercial lines including Commercial Motor reported a total combined ratio of 99.3% (vs. 101.9% in 2013). - ENDS - PRESS RELEASE | 011/15 5 NOTES TO EDITORS Ageas UK is a leading provider of award-winning Personal and Commercial insurance solutions in the UK. Ageas UK distributes its products, underwritten by Ageas Insurance Limited, through a range of channels including brokers, IFAs, intermediaries, affinity partners and the internet, as well as through its wholly or partially-owned companies trading as Ageas Retail its brands which include Auto Direct, Castle Cover, Cover Direct, Done Deal, Kwik Fit Insurance Services, and RIAS. Ageas UK also holds a 50.1% share in Tesco Underwriting, providing Home and Motor insurance to Tesco Bank customers. Insuring around nine million customers and working with a range of partners, Ageas is recognised for delivering consistent and high-quality customer experiences. It employs around 6,000 people with offices based across the UK. Ageas is an international insurance group with a heritage spanning 190 years. Ranked among the top 20 insurance companies in Europe, Ageas has chosen to concentrate its business activities in Europe and Asia, which together make up the largest share of the global insurance market. These are grouped around four segments: Belgium, United Kingdom, Continental Europe and Asia and served through a combination of wholly owned subsidiaries and partnerships with strong financial institutions and key distributors around the world. Ageas operates successful partnerships in Belgium, the UK, Luxembourg, Italy, Portugal, Turkey, China, Malaysia, India and Thailand and has subsidiaries in France, Hong Kong and the UK. Ageas is the market leader in Belgium for individual life and employee benefits, as well as a leading Non-Life player through AG Insurance. In the UK, Ageas is the seventh largest Non-Life insurer with a number 3 position in cars insured and has a strong presence in the over 50’s market. Ageas employs more than 13,000 people in the consolidated entities and over 30,000 in the non-consolidated partnerships, and has annual inflows of more than EUR 23 billion. PRESS CONTACT Ageas UK: Paul Lynes, Director of Communications Tel: 023 8031 3152 / 07786 061537 Email: press.uk@ageas.co.uk PRESS RELEASE | 011/15 6