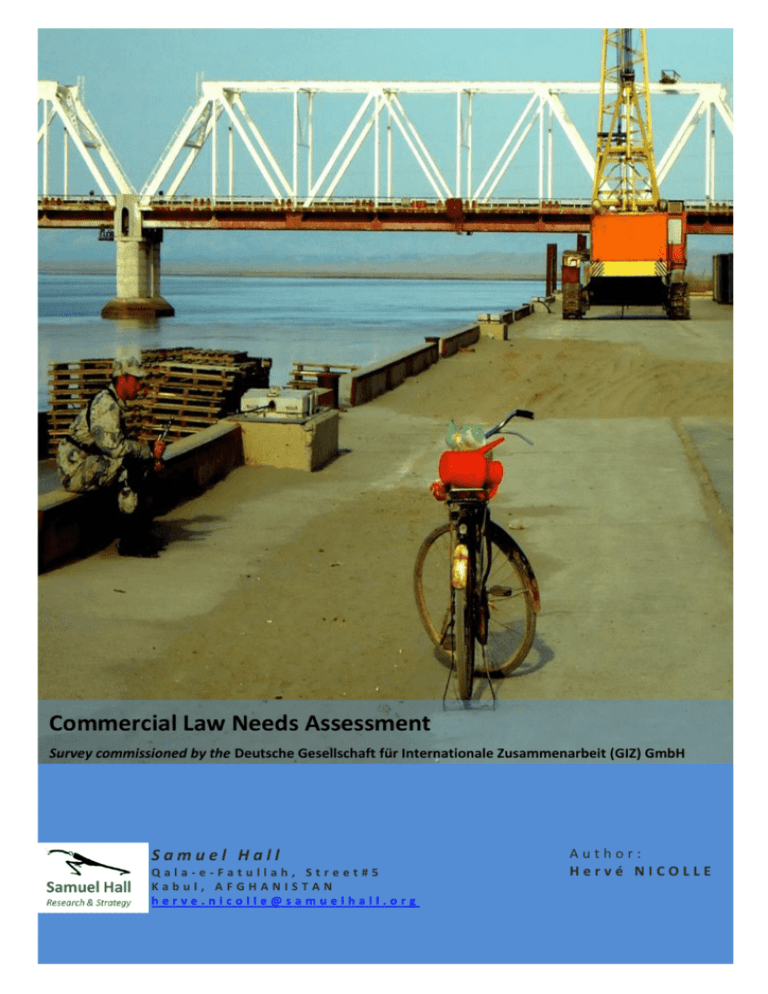

Commercial Law Needs Assessment

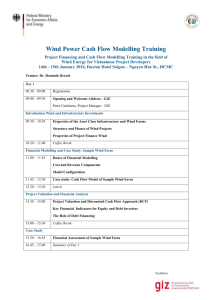

advertisement