DUKE UNIVERSITY

The Fuqua School of Business

Business 350

Financial Management

Smith/Whaley

Spring 1989

TERM STRUCTURE OF INTEREST RATES*

The yield curve refers to the relation between bonds’ expected yield to maturity

and their terms to maturity, where the bonds have the same default risk, no imbedded

options such as callability, and no differential tax privileges. The Appendix to these

notes contains sample yield curves for U.S. Treasury securities for the past ten years.

Note that the use of Treasury securities assures a homogeneous degree of default risk

(i.e., none) and that callable issues are clearly distinguished from fixed maturity

issues.

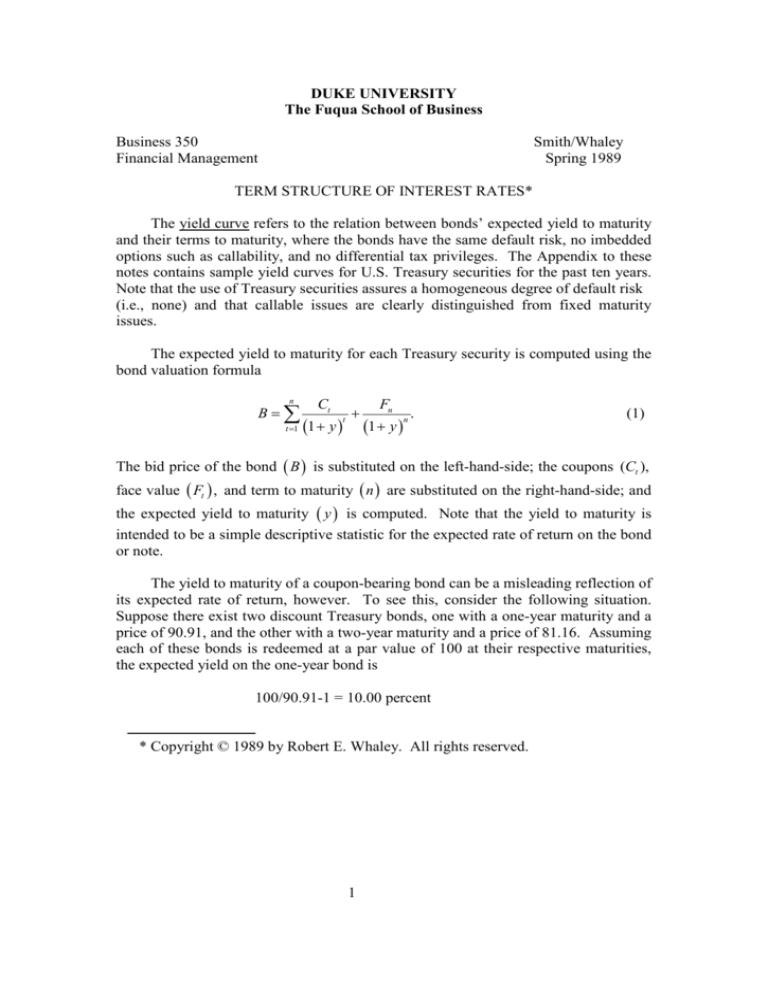

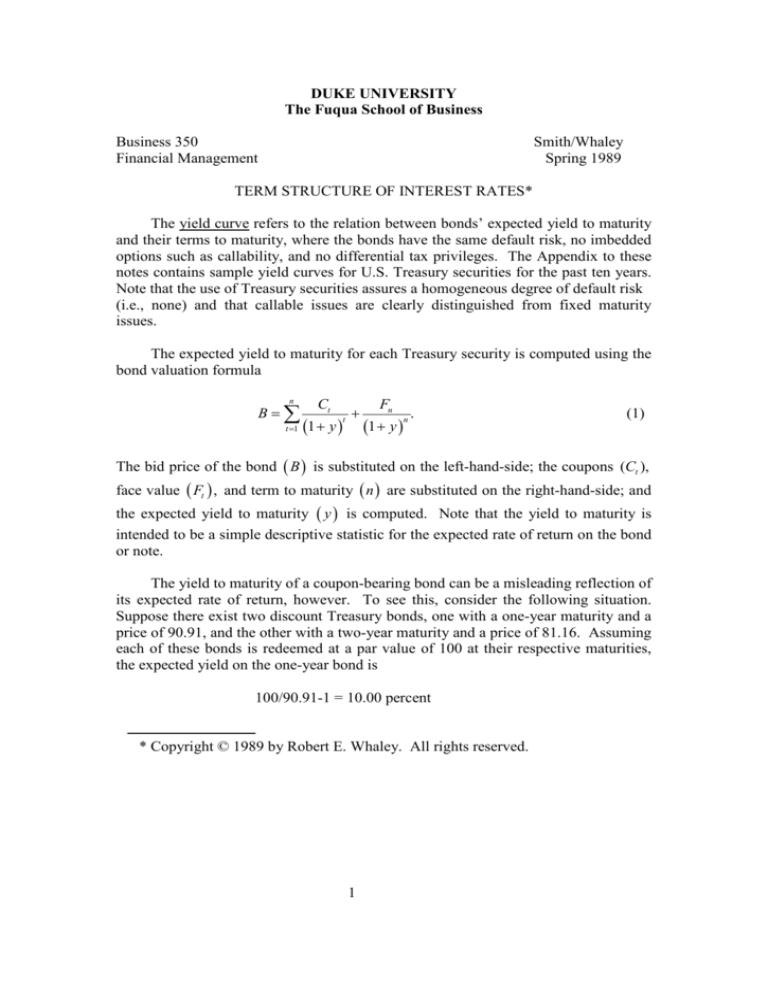

The expected yield to maturity for each Treasury security is computed using the

bond valuation formula

=

B

n

∑

t =1

Ct

(1 + y )

t

+

Fn

(1 + y )

n

.

(1)

The bid price of the bond ( B ) is substituted on the left-hand-side; the coupons (Ct ),

face value ( Ft ) , and term to maturity ( n ) are substituted on the right-hand-side; and

the expected yield to maturity ( y ) is computed. Note that the yield to maturity is

intended to be a simple descriptive statistic for the expected rate of return on the bond

or note.

The yield to maturity of a coupon-bearing bond can be a misleading reflection of

its expected rate of return, however. To see this, consider the following situation.

Suppose there exist two discount Treasury bonds, one with a one-year maturity and a

price of 90.91, and the other with a two-year maturity and a price of 81.16. Assuming

each of these bonds is redeemed at a par value of 100 at their respective maturities,

the expected yield on the one-year bond is

100/90.91-1 = 10.00 percent

* Copyright © 1989 by Robert E. Whaley. All rights reserved.

1

and the expected yield on the two-year bond is

(100 / 81.16 )

−1 =

11.00 percent.

12

Note that if the Treasury decided to issue other one-and two-year discount bonds they

would have to have the same prices as the existing issues, otherwise costless arbitrage

profits could be earned.

Now suppose that the Treasury issues a two- year, twelve percent coupon bond.

What will be its price? Well, the new twelve percent issue will pay 12 at the end of

the one-year, and 112 at the end of the two years. The discount rate to apply to a oneyear bond is 10 percent and the discount rate to apply to a two-year bond 11 precent,

so the price of this coupon- bearing Treasury bond should therefore be

12

112

B= +

=

101.81.

1.10 (1.11)2

But, what will be the bond’s yield to maturity? The yield is computed by solving

101.81

=

12

112

+

.

1 + y (1 + y )2

The solution is 10.94 percent.

So, what is happening? The two–year coupon bond has an expected yield to

maturity of 10.94 percent while the two-year discount bond has an expected yield to

maturity of 11 percent. Are arbitrage profits possible? No. The answer to the

dilemma is that the two-year coupon bond has an “actual” term to maturity of less

than two years. If you buy the coupon bond you will receive 12 at the end of one year

and 112 at the end of two years, so in essence you have a portfolio of two discount

bonds. The first discount bond is worth

=

Bd1

12

= 10.91,

1.10

and the second discount bond is worth

=

Bd2

112

= 90.90.

1.112

2

The average term to maturity of the bond portfolio (or the coupon-bearing bond) is

therefore

10.91 90.90

Average term to maturity =

1 +

2 =1.893 years.

101.81 101.81

We should not use the same interest rate to discount all cash flows of the bond,

as bond valuation formula (1) implies. The value of a coupon-bearing bond, when

viewed as a portfolio of discount bonds, may be written

=

B

n

∑

t =1

Ct

(1 + rt )

t

+

Fn

(1 + rn )

n

(2)

,

where rt is the spot rate of interest on a t period discount bond.

Is it fair to plot the yield to maturity as a function of term to maturity? No. The

term to maturity of the bond overstates its actual life. The actual life of the bond

should be the “average” life of the individual constituent bonds or

Ct

t

1 + rt )

(

Average term to maturity = ∑

B

t =1

n

Fn

n

t + (1 + rn )

B

n.

(3)

This average term to maturity is referred to as the bond’s duration. The relation

between expected return and term to maturity should be expressed by either (a)

plotting the yield to maturity as a function of average term to maturity, or (b) plotting

the spot rate of interest as a function of term to maturity; but not yield to maturity as a

function of term to maturity.

3

Spot Rates and Forward Rates

Spot rate of interest are rates observables today. The spot rate on a three-month,

default-free security is the rate of return promised three-month T-bill. The notation

that we use to describe the spot rate on a t period bond is rt .

Forward rates of interest are interest rates on loans in the future and are implied

from the current term structure of spot rates. A forward rate on a t period loan in

period n, denoted n ft , is computed using

(1 + r )

t

(1 + n ft ) =n+t n .

(1 + rn )

n +t

(4)

The forward rate on a one-year today, for example, is computed as

(1 + 0 f1 ) =+

(1 r1 )

1

1

,

and the forward rate on a one-year loan in three years is

(1 + r )

=3+1 3

(1 + r3 )

3+1

(1 + 3 f1 )

1

.

Example1:

Suppose the one-year spot rate of interest is 10 percent and two-year spot rate is 11

percent. What is the implied one-year forward rate in one year?

Substituting the parameters of the example into equation (4), we find that

(1.11)

(1 + r=

2)

(1 + r1 ) (1.10 )

2

1 +=

1 f1

or

f = 12.01 percent

1 1

4

2

_____________________________________________________________________

Example 2

What is the implied forward rate on a four-year loan in six years, if the current sixyear spot rate of interest is 12 percent and the current ten-year spot rate of interest is

15 percent?

Substituting the parameters of the example into equation (4), we find that

(1 + r10 )= (1.15)

6

6

(1 + r6 ) (1.12 )

10

(1 + 6 f 4=

)

4

10

or

6

f 4 = 19.65 percent

Theories of the Term Structure of Interest Rates

The term structure of interest rates refers to the relation between the spot rate of

interest and term to maturity. Theories of the term structure of interest rates attempt

to explain why the relation between the spot rates of interest and the terms to maturity

of various bond issues takes on particular shapes. In these notes, we discuss two of

the theories: (a) the unbiased expectations theory, and (b) the liquidity preference

theory.

Unbiased Expectations Theory:

The unbiased expectations theory of the term structure posits that the expected

spot rate on a t period loan in period n is equal to the current forward rate on a t

period loan in period n implied by the term structure of spot rates, that is,

E ( n rt ) = n ft ,

where E ( ⋅) is the expectations operator.

This result is driven by the assumptions that investors, at the margin, are riskneutral and hence make their portfolio decisions by maximizing expected rate of

return. For example, suppose that you know that the one-year spot rate of interest is

10 precent and that the two-year spot

5

rate of interest is 11 percent. (Recall that these were the values used in Example 1.)

Suppose further that you expect the one-year interest rate in one-year, E ( 1 r1 ) , to be

11.50 percent. If you have a two-year investment horizon and are faced with either

(a) buying a two-year bond now, or (b) buying a one-year bond now and buying a

second one-year bond in one year, which would you do?

Well, if you were risk neutral, you would prefer the alternative (a) to alternative

(b) because $100 invested in (a) would provide

$100 (1=

+ r2 ) $100 (=

1.11) $123.21

2

2

at the end of year 2, while $100 invested in (b) would be expected to provide

$100 (1 + r1=

1.10 )(1.115 ) $122.65.

) [1 + E ( 1 r1 )] $100 (=

In fact, what you have is a costless arbitrage opportunity in which you would buy (a)

and sell (b) earning an arbitrage profit of $.66.

Under the unbiased expectations theory, a costless arbitrage opportunity arises

whenever the expected future spot rate differs from the implied forward rate.

Assuming no costless arbitrage opportunities exist in the marketplace, the expected

future spot rate equals the implied forward rate, that is,

E ( n rt ) = n ft .

If the expected on-year spot rate of interest in one year was 12.01 percent in the above

example, no costless arbitrage opportunities could be earned because a $100

investment under alternative (b) would be expected to provide

$100 (1=

+ r1 )(1 +1 f1 ) 100 (1.10

=

) (1.1201) $123.21

at the end of year 2.

The unbiased expectations theory is not really a theory in the sense that it is does

not explain why the term structure of spot rates takes on particular forms. The theory

simply implies that the term structure contains certain predictions about where spot

interest rates will move. Simply stated, (a) if the term structure is upward sloping,

interest rates are expected to rise; and, (b) if the term structure is downward sloping,

interest rates are expected to fall.

Liquidity Preference Theory:

The liquidity preference theory of the term structure argues that lenders of funds (i.e.

buyers of bonds) prefer to hold short maturity instruments, while borrowers of funds

(i..e. sellers of bonds) prefer to issue long maturity instruments. If such is the case, the

only way to induce lenders of funds to buy longer maturity instruments is to offer

them higher and higher rates of return as the maturities get longer. If spot rates of

interest increase with term to maturity, implied forward rates also rise the further and

further they are in the future. The liquidity preference theory, therefore is best

summarized by the fact that

E ( n rt ) < n ft

where n ft − E ( n rt ) is the liquidity premium. The liquidity preference theory implies

that, in general, the term structure is upward sloping.

6