The Predictability of Aggregate Stock Market Returns

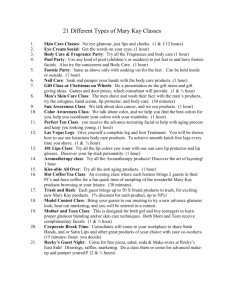

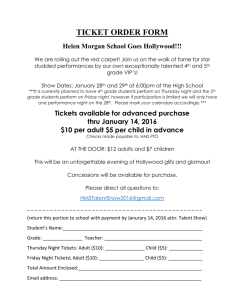

advertisement

The Predictability of Aggregate Stock Market Returns: Evidence based on Glamour Stocks Venkat R. Eleswarapu Assistant Professor of Finance Southern Methodist University Edwin L. Cox School of Business Dallas, TX – 75275. Marc R. Reinganum Mary Jo Vaughn Rauscher Chair in Financial Investments Southern Methodist University Edwin L. Cox School of Business Dallas, TX – 75275. The Predictability of Aggregate Stock Market Returns: Evidence based on Glamour Stocks1 Abstract We find that annual excess returns on the stock market index are negatively related to the returns of glamour stocks in the previous 36-month period. In contrast, neither returns of value stocks nor aggregate stock market returns, purged of glamour stock effects, have any predictive power. In addition, the excess returns on the aggregate market are negatively skewed when the prior returns of glamour stocks are high. Finally, the inclusion of term premium, default premium, aggregate dividend yield, and the consumption-to-wealth ratio (CAY) as control variables do not materially alter the predictive power of prior glamour stock returns. 1 We gratefully acknowledge the comments and suggestions by Michael Brandt, J.B. Chay, Alison Fox, Harrison Hong, Rex Thompson, Kumar Venkataraman as well as an anonymous referee. This paper was presented in the 2001 American Finance Association meetings, New Orleans. Naturally, all remaining errors are ours. 2 Introduction The predictability of aggregate stock market returns, particularly over longer investment horizons, is now well documented.2 The interpretations of this evidence have divided into two views. The first, typified in Fama and French (1989), is that conditional expected returns (discount rates) vary with the business cycles as rational agents smooth consumption over time. In this framework, predictability of stock returns is consistent with time-varying inter-temporal marginal rates of substitution. The alternate view explains the existing empirical evidence in terms of excessive stock price variability. Expected stock market returns vary too much to be rationally explained (Shiller (1981), Campbell and Shiller (1988), Poterba and Summers (1988)). In the second framework, a possible implication is that the stock market is periodically prone to “animal spirits” or an irrational investor sentiment3, which causes “speculative bubbles” that get reversed over time. We add to this debate by presenting empirical evidence that aggregate stock market returns can be predicted using the prior returns on the “glamour” stocks. Specifically, we find that the annual excess returns (over risk-free rate) on the stock market are negatively related to the returns on the glamour stocks in the prior 36-month period. Furthermore, past glamour portfolio returns, orthogonalized by the corresponding market returns, continue to predict future 2 One set of papers find stock market index returns are negatively auto-correlated at long horizons (Fama and French (1988a), Poterba and Summers (1988) Summers (1986)). Another set of papers use other price-based variables such as dividend yields (Keim and Stambaugh (1986), Fama and French (1988b)) and aggregate book-to-market ratio (Kothari and Shanken (1997), Pontiff and Schall (1998)) to predict the market returns. 3 There are some papers (Neal and Wheatley (1998), Siegel (1992), Solt and Statman (1988)) that study the relation between various measures of investor sentiment such as discounts on closed-end funds, ratio of odd-lot sales, etc., and the returns on the stock market. 3 market excess returns. In contrast, past stock market returns, which are orthogonalized by the corresponding glamour stock returns, do not have any predictive power to explain future market excess returns. Also, the past returns of value stocks do not have any explanatory power in predicting aggregate stock market excess returns. One might expect that shocks to the market-wide discount rate (risk-premium), that induce negative autocorrelation in aggregate returns, would be reflected in all groups of stocks. Our evidence of the unique predictive ability of glamour stocks is at odds with this simple view, refining our understanding of the nature of the negative autocorrelation in market returns. We also find that conditional excess returns on the aggregate market are negatively skewed when prior returns of glamour stocks are high. Specifically, the monthly excess returns on the market portfolio are negatively skewed when the prior 36-month return on the glamour stocks is in the top quartile of the overall sample distribution. That is, the probability of a large decline in the stock market increases following periods in which glamour stocks have performed particularly well. Perhaps, the evidence suggests that the aggregate market, and glamour stocks in particular, experience a “correction” following periods of rapid price appreciation among glamour stocks. While our evidence does not rule out a rational model, it appears consistent with some implications of “behavioral” models (Barberis, Sheifer and Vishny (1998), Daniel, Hirshleifer and Subrahmanyam (1998), Hong and Stein (1999)) in which overconfident investors and trend-chasing noise traders4 affect 4 There are psychology-based explanations of how certain traders extrapolate a positive trend by over-weighting recent news or attention-grabbing irrelevant news (Kahneman and Tversky (1973), Tversky and Kahneman (1974), and Debondt (1993)). 4 equilibrium prices. The noise traders can affect equilibrium prices, since the existence of fundamental risk and the chance that the mis-pricing can persist and increase over time deters rational speculators from betting too aggressively (Campbell and Kyle (1993), DeLong, Shleifer, Summers, and Waldmann (1990a)). Also, as Shleifer and Vishny (1997) point out, the arbitrageurs,5 who are usually in an agency relationship, may be constrained to have a short-term horizon in their speculative positions. The arbitrageurs may find it difficult and costly to maintain a short position for a sustained period of time, with the result that the excessive buying pressure of the noise traders on glamour stocks may be hard to counter. As a result, the entire stock market, and in particular glamour stocks, can be overpriced for a while before experiencing a correction. This may explain our finding of the conditional negative skewness of the market returns following a large price run-up of the glamour stocks. This is in the spirit of the theoretical predictions of negative skewness by Hong and Stein (1999b). Our evidence, that the expected returns of the aggregate stock market are negatively related to the prior performance of the glamour stocks, may also be consistent with the theoretical model in Barberis and Huang (2001). Relying on the idea of “loss aversion” in prospect theory, their model predicts a decrease in investors’ degree of risk aversion when the prior returns of the stocks are high – because the investors feel they are “gambling with the house money” (Benartzi and Thaler (1995) and Thaler and Johnson (1990)). This causes the discount rates of these stocks to go down after a price run-up. In their model, the investors are prone to a phenomenon called “individual stock accounting,” where prior 5 Of course, true risk-less arbitrage will not be possible when the price levels of the entire market 5 outcomes of individual stocks (such as glamour stocks) can affect the riskaversion of the investors. Our evidence perhaps suggests that such changes in the degree of risk aversion caused by prior outcomes of glamour stocks also affect the expected returns of the aggregate stock market. The rest of the paper is structured as follows: Section I describes the data, while our methodology and empirical design are elaborated in section II. Section III discusses our results. Our conclusions and a summary of our findings are contained in section IV. I. Data The basic data consist of stock returns, prices and shares outstanding of the firms obtained from the Center for Research in Security Prices (CRSP) NYSE /AMEX/ NASDAQ monthly file, over the period January 1948 to December 1997. Each month the market capitalization (size) of every stock is computed by multiplying the month-end stock price and the shares outstanding. The valueweighted monthly market return for the NYSE/ AMEX/ NASDAQ index is obtained from the CRSP files. The one-month T-bill returns from the CRSP SBBI files are used as the risk-free rates. EXMKTt is the excess return on the market over the one-month risk-free rate in the corresponding month. The accounting data are obtained from the 1998 COMPUSTAT annual tape.6 For each stock, we collect the net annual sales (item 12), annual operating or a whole group of stocks (such as in an entire industry) deviate from the fundamental values. 6 Prior researchers have noted a possible look-ahead bias in the COMPUSTAT data for the 1950’s and the early years of the Nasdaq data. That is, the COMPUSTAT information was added only for the surviving firms. This would obviously bias the expected returns of these surviving firms. We believe our analysis and results will not be affected by such a bias, since we are trying to 6 cash-flow defined as the Earnings before Interest, Depreciation and Taxes (item 13), and the fiscal year-end book value of equity (item 60). The information on net sales and operating cash-flow start in 1950, while the book-value data are from 1963 onwards. In many of the prior studies glamour and value stocks are defined in terms of the ratio of the book to market value of equity. However, this would constrain the study to the post-1963 time period because of the data availability on the COMPUSTAT. We choose to characterize stocks as value or glamour stocks using two other definitions as well: (i) the ratio of the Operating Cash-flow to Market Capitalization, and (ii) the ratio of Net Sales to Market Capitalization. This allows us to conduct our analysis over a longer sample period and, use three different metrics to identify value and glamour stocks. For each ratio, we are taking a ratio of the market value of equity and a proxy for cash-flows. This ratio gives us a proxy for expected returns and may also indicate the likely level of mis-pricing. The operating cash flow and sales are likely to be more stable over time, and hence be a better proxy of expected cash-flows, than say net income which may have a larger transitory component. Each month the market capitalization data for all NYSE/AMEX/NASDAQ stocks are combined with the most recently available fiscal-year-end accounting data. However, to ensure that the financial information has been released to the market, we require a minimum four-month gap between the fiscal year-ends and the use of the accounting information in the portfolio formation. In such cases, we use the relevant information from the predict the excess returns on the market and not in general the portfolio returns of the value and glamour stocks in the post portfolio formation period. Also, such a look-ahead bias affects the 7 previous fiscal year. Each month our sample contains all stocks for which the relevant data are available on both the CRSP and the COMPUSTAT tapes.7 Every month starting in January 1951, the stocks are ranked and assigned to five equal groups based on their Cash-flow to Market Capitalization ratio (CMRATIO) and independently using the Sales to Market Capitalization ratio (SMRATIO). Of course, the portfolio formation using the Book-to-Market ratio (BMRATIO) starts only in January 1963. In all the three cases, we use the data in the portfolio assignment only when the relevant ratio has a positive value. For example, a firm with a negative book-to-market ratio in a particular month is discarded from the sample in that month. This is consistent with the prior studies such as Lakonishok, Shleifer and Vishny (1994). Stocks in the lowest (highest) quintile of CMRATIO, the SMRATIO, or the BMRATIO are called glamour (value) stocks. Note that these portfolio assignments and the subsequent analyses are conducted independently using the three different ratios. Thus we will have three sets of results corresponding to the three different definitions of value and glamour stocks. After we assign the stocks to a portfolio in each month, we compute the compounded return of the stock over the prior 36 months (including that month’s return). We require the stock to exist over this prior 36-month period, even though we do not require it to trade every month over this period. We compute these 36-month returns for all stocks in the glamour and value portfolios each month. Next, we compute an equal-weighted average of these returns each month distressed value stocks. It should not be an issue for the glamour stocks, which is our main variable of interest. 7 Of course, we discard ADRs and other special stocks such as preferred stock, etc. 8 for all the stocks in the glamour portfolio (GLARET-36) and in the value portfolio (VALRET-36). We also compute the difference between the returns of the glamour and value portfolios in the prior 36 months, GMVRET-36. To conserve space, the descriptive statistics for just the portfolios formed using the cash-flow to market variable is presented in Table 1.8 Panel A presents the sample statistics describing the portfolios. The pair-wise correlations between the variables, and the selected autocorrelations of the portfolio returns are reported in panels B and C, respectively. EXMKT1 is the excess return (over the risk-free rate) on the market in the month following the portfolio formation. EXMKT12 compounds the one-month excess returns over the following twelve months. The annual excess returns are computed on an over-lapping basis each month. Over our sample-period of 19511997, the mean monthly and annual excess returns are 0.64% and 7.85%, respectively. The corresponding averages over the 1963-97 time-period are 0.52% and 6.13%, respectively. Panel A in Table 1 contains the univariate statistics for the glamour and value portfolios formed using cash-flow to market value ratios. On average, there are 436 firms in the glamour and value portfolios each month. The average cashflow to market value ratios (CMRATIO) for the glamour and value portfolios are 0.0790 and 0.5226, respectively. Not surprisingly, these two portfolios, formed using cash-flow to market value ratios, also differ in terms of their sales to market capitalization ratios (SMRATIO) and book-to market value ratios (BMRATIO). The average SMRATIO is 1.1286 and 5.7236 for glamour and value portfolios, 9 respectively. Similarly, the average BMRATIO for these two portfolios is 0.4853 and 1.4654, respectively. Stated differently, glamour and value portfolios formed using cash-flow to market value ratios look like glamour and value portfolios based on SMRATIO and BMRATIO. The average of the market capitalizations of stocks in the glamour (SIZEGL) and value (SIZEVA) portfolios systematically differ. On average, the glamour stocks have a market capitalization of $687 million; the average capitalization of the value stocks is $275 million. Glamour stocks experience a higher past sales growth rates as compared to value stocks on average. For example in table 1, the sales growth rates in the year preceding the portfolio formation (SLSGRO-1) for glamour and value stocks are 36% and 29%, respectively. In the year following the portfolio formation, the sales growth rate (SLSGRO+1) for glamour stocks far outpace those of value stocks on average. The sales of glamour stocks grew by 32% whereas value stocks experienced a sales growth of just 4%. Thus, the instrument that measures glamour and value is highly correlated with both past and future sales growth rates. Finally, and perhaps not surprisingly, glamour stocks have experienced much greater returns over the previous 36 months relative to value stocks. In Table 1, the average 36month return of the glamour stocks is 114%, while it is 31% for value stocks. Of course, part of the reason for this relationship is that glamour and value portfolios are created using a price variable. Panel B in Table 1 contains the simple correlations between future excess market returns and the past returns of these glamour and value portfolios. The past returns of the glamour stock portfolio (GLARET-36) are negatively correlated 8 The authors will gladly provide the descriptive statistics for the other two definitions of glamour 10 (-0.31) with the future excess market returns (EXMKT12). The correlation between past returns of the value portfolio (VALRET-36) and the future excess market return is also negative but much closer to zero (-0.12). The correlation of the difference in the past returns of the glamour and value portfolios (GMVRET36) with future excess market returns is also negative (-0.28). These correlations also reveal that the past return of the glamour stock portfolio is highly correlated (0.86) with the differential return between the glamour and value portfolios. On the other hand, the past returns of value stocks are virtually uncorrelated with the past differential returns between glamour and value stocks (-0.06). That is, the differential return in the past 36 months between glamour and value portfolios is essentially driven by the performance of the glamour stocks. Panel C of Table 1 presents the autocorrelations of the portfolio returns at lags up to 60 months. The tendency for the autocorrelation to be positive over shorter horizons is not surprising since we are using monthly over-lapping observations. At the 60-month lag, all the return variables are negatively autocorrelated. In this table, the negative autocorrelation of glamour stocks at the 60-month lag is –0.345, whereas the negative autocorrelation of the value stocks is just –0.036. This evidence clearly suggests that the time-series properties of value and glamour stocks differ. In short, glamour stocks are larger than value stocks as measured by market capitalization. Glamour stocks possess higher past and future sales growth rates relative to value stocks. During the prior 36 months, glamour stocks experienced higher stock returns than did value stocks. Finally, the negative upon request. 11 autocorrelation in returns over longer investment horizons is most pronounced for the glamour portfolios. In the next section, we formally test whether past returns of glamour and value stocks yield differential information about the future excess market returns. II. Empirical Methodology The main focus of this research is to study the information content of different portfolios of stocks for predictions of aggregate excess stock market returns. In particular, we examine the unique predictive ability of glamour stocks. To test for the predictive ability of glamour stocks, we first estimate the following regression: EXMKT12 = αG + βG GLARET-36 + ε. (1) That is, the return on the glamour stocks over the past 36 months is used to predict the excess return on the market portfolio over the following 12 months. We also examine the predictive ability of the glamour portfolios that are orthogonalized by the corresponding returns on the market portfolio. Specifically, ORTHGLA-36 is the residual from the regression of the returns on the glamour portfolio in the past 36 months on the corresponding excess returns on the stock market, that is, ORTHGLA−36 = GLARET−36 − ( αˆ + βˆ × EXMKT−36 ) (2) ORTHGLA-36, is purged of any market-wide information and hence reflects information exclusive to glamour stocks. 12 We also investigate the predictive ability of market returns that are orthogonalized by the glamour portfolio returns. That is, we examine the predictive ability of market returns purged of any information contained in glamour stocks. MKTXGLA-36, is the residual from the regression of the excess returns on the stock market in the past 36 months on the corresponding glamour portfolio returns, MKTXGLA−36 = EXMKT−36 − ( αˆ + βˆ × GLARET−36 ) (3) We use both these orthogonalized returns from equations (2) and (3) as regressors separately to explain the future excess market returns, EXMKT12. That is, we examine whether past returns of glamour stocks have any unique predictive ability. We additionally contrast the predictive power of glamour stocks with that of value stocks. Specifically, we estimate the following regression using the returns on the value stocks, VALRET-36, as an independent variable. EXMKT12 = αV + βV VALRET-36 + ε. (4) Under a simple discount rate story, we expect the slope coefficients in both these regressions to be negative. Shocks to the market-wide discount rate that induce negative autocorrelation in stock market returns should be reflected in all groups of stocks simultaneously. Finally, we examine the information content in the differential return between glamour and value stocks in the prior period (GMVRET-36), using the following regression, 13 EXMKT12 = αD + βD GMVRET-36 + ε. (5) There are a couple of econometric issues that arise in the empirical design of the regressions described above. First, the portfolios are formed, and all the variables are measured, on a monthly basis. So the dependent variable EXMKT12 will have over-lapping observations. This makes the use of the O.L.S. standard errors for the coefficients inappropriate. Secondly, the coefficients will be affected by the small-sample bias noted by Stambaugh (1986). The independent variables (the 36-month portfolio returns) in these regressions will have high persistence at the monthly lag as shown in panel C of Table 1. The innovations in these variables every month will be contemporaneously related to the monthly returns on the market. This induces a bias in the estimates of the coefficients in the above regressions in small samples. To account for both these problems and to make proper inferences, we use a bootstrap procedure, following Nelson and Kim (1993) and Pontiff and Schall (1998), to get an empirical distribution of these regression coefficients. The exact procedure is explained in the appendix of the paper. The p-values from this bootstrapping procedure are used in making inferences in the results that follow. III. Results A. Predictions of Excess Market Returns The results from the three sets of regressions predicting the excess market returns under the three definitions of value/glamour stocks are reported in Tables 2, 3 and 4. The results using the portfolios formed over 1951-1997 using the 14 Cash-to-Market ratio and Sales-to-Market ratio are in Tables 2 and 3, respectively, while those using the Book-to-Market ratio over the 1963-1997 period are in Table 4. In Table 2, the prior 36-month return on glamour stocks is negatively related to the future 12-month excess market return (see regression (i)). Furthermore, this negative relationship is reliably different from zero as indicated by a p-value of 0.035 computed from the bootstrapping procedure. The adjusted R-squared is 9.66%. This means that prior returns on glamour stocks can predict future excess market returns. The regression coefficient (-0.0659) implies that a one standard deviation shock in the 36-month glamour stock returns would translate into a 500 basis point change in the excess return of the market. Regression (i) in Table 2 suggests that the relationship between the past returns of glamour stocks and the future excess return on the market are both statistically and economically significant. We orthogonalize the glamour portfolio returns by the market returns (as described in equation (2) in the previous section) to determine if glamour stocks contain unique information not contained in other stocks. This orthogonalization process purges the glamour stock returns of any market wide effects. Regression (ii) shows the relationship between the prior 36-month orthogonalized glamour portfolio return and the future 12-month market excess return. The coefficient in this regression (-0.0616) is nearly the same as the coefficient in regression (i). The adjusted R-squared is 7.65%. This evidence suggests that glamour stocks contain unique information over and above that contained in the market. The 15 unique information contained in past glamour stocks returns can help predict future excess market returns. Interestingly, when one removes the information of glamour stocks from past market excess returns, past excess market returns do not help to predict future excess market returns. As regression (iii) shows, when orthogonalized market returns are used as the explanatory variable, the adjusted R-square is virtually zero and the p-value of the regression is 0.513. Without glamour stocks, past stock market excess returns cannot predict its future values even in part. Regression (iv) includes both GLARET-36 and MKTXGLA-36 so that one can test directly whether the orthogonalized market returns can have any predictive power after controlling for past glamour returns. The evidence shows that the past returns on the glamour portfolio have an exclusive predictive ability and past glamour returns subsume the information content of lagged market returns documented in other studies such as Fama and French (1988a). Not surprisingly, there is no improvement in adjusted R-square in regression (iv) compared to regression (i). Regression (v) in Table 2 defines the independent variable as the 36month prior return on value stocks. Unlike the evidence from regression (i), the prior 36-month return on value stocks is not reliably related to the subsequent market excess return. The p-value of the regression is 0.277 and the adjusted Rsquared is merely 1.23%. The evidence suggests that the value stocks do not have predictive ability. We also model future excess market returns as a function of the differential returns between glamour and value stocks in the prior 36-month 16 period (GMVRET-36). This result is contained in regression (vi) in Table 2. Regression (vi) suggests that subtracting the value portfolio return from the glamour portfolio return isolates the unique information content of glamour stocks. The adjusted R-square of this regression, 7.85%, is similar to that obtained when modeling future excess market returns as a function of the orthogonalized glamour returns as in regression (ii). The glamour stocks seem to contain unique information that is not contained in value stocks. This can be seen directly in regression (vii) that includes the past returns of both glamour and value stocks. In Table 3, the glamour and value portfolios are formed using sales to market value ratios. The regression results, however, are qualitatively and quantitatively similar to those reported in Table 2 where portfolios are formed using cash-flow to market value ratios. The evidence in Table 3 once again shows that glamour stocks have a unique ability to predict future excess market returns. Further, past stock market returns, purged of glamour stock effects, cannot predict future excess market returns. The results in Table 4 are based upon portfolios formed with book-tomarket ratios. The results in Table 4 are generally consistent with those in Tables 2 and 3 – future excess market returns are negatively correlated with the past returns of glamour stocks. The coefficients on the glamour stock portfolio returns are negative. But the results are weaker. None of the coefficients are statistically significant at the 0.05 level. The tests in Table 4 have less statistical power than those Tables 2 and 3, which contain 12 additional years of data. 17 While this research finds that past glamour returns predict future excess market returns, previous research of Fama and French (1989) and Lettau and Ludvigson (2001) suggests that other variables, reflecting macroeconomic conditions, may also predict future excess returns. Table 5 explores the question of whether past glamour returns continues to predict future excess market returns after controlling for these macroeconomic influences. In particular, we test whether the relationship between past glamour returns and future excess market returns remains stable in the presence of regressions that include the term premium (TRMPREM), default premium (DFLTPREM), aggregate market dividend yield (ADIVYLD) and the aggregate consumption to wealth ratio (CAY). In Table 5, the first nine columns present regressions that include past glamour returns (using the three definitions of glamour) along with each of the Fama-French macro variables (TRMPREM, DFLTPREM, ADIVYLD). In general, the results from Tables 2, 3 and 4 are not materially altered by the inclusion of the macro variables. Past glamour returns and future excess market returns are still negatively related. The p-values on the glamour return variables in Table 5 are slightly higher than those reported in Tables 2, 3 and 4 but they still suggest a reliable relation. Furthermore, the p-values associated with the past glamour return variables are typically lower than the p-values associated with the control variables, TRMPREM, DFLTPREM, and ADIVYLD. In columns x, xi and xii, the regressions include both past glamour returns and the CAY variable. The glamour returns remain statistically significant with the anticipated sign; the CAY variable is also significant. 18 The last six columns of Table 5 present regressions with the final combination of variables specified in Fama and French (1989) and past glamour returns. Again, the past glamour return variables hold up well. The magnitudes of the coefficients on the past glamour return variables and their statistical significance are not materially altered in the presence of the Fama-French specifications. In short, the macroeconomic variables do not destroy the explanatory power of past glamour returns. The fact that past glamour returns predict future excess market returns raises an intriguing question. Are past glamour-stock returns really only forecasting future glamour stock returns or do past glamour stock returns also forecast the future returns of other stocks such as value stocks? That is, is the negative correlation between past glamour returns and future stock market returns primarily a reflection of a reversal effect that exists exclusively among glamour stocks? To answer this question, the predictive ability of the past glamour stock returns for the future twelve-month excess (over risk-free returns) returns on both glamour (EXGLA12) and value portfolios (EXVAL12) is investigated. The relevant regression results are presented in Table 6. The evidence does suggest a negative relationship between past glamour returns and future excess returns of glamour stocks. Depending on the classifying variable for glamour, the bootstrapped pvalues of the slope coefficients range between 0.05 and 0.11. Thus, the evidence seems persuasive that past glamour returns predict future excess glamour returns. The adjusted R-squares are smaller in Table 6 than in Tables 2, 3 and 4 in large part because the dependent variables in Table 6 have a standard deviation about 1.7 times as great as the standard deviation of the excess market return. 19 The relationship between the past returns of glamour stocks and future value stock excess returns is harder to ascertain from our tests. The coefficient values are all negative and nearly the same magnitude as those for the glamour stock regressions, but the p-values only range from about 0.10 to 0.26. To a large extent, the predictability of the market is driven by the reversals among glamour stocks. But the evidence is not so strong as to support the hypothesis that the predictability of market returns is driven exclusively by the reversals among glamour stocks. B. Skewness of Stock Market Excess Returns and Prior Glamour Returns The regression evidence in Tables 2, 3 and 4 suggests that when glamour stocks have experienced high returns in the prior 36-months, the conditional expected excess returns on the market are lower over the next twelve months. That is, a “boom” period for glamour stocks implies a future weakness in the overall market. Tables 2, 3 and 4 document this future weakness in terms of conditional means. We also investigate the future weakness in the overall market using a conditional skewness measure as in Hong and Stein (1999b). In particular, we test whether the monthly excess returns on the market are conditionally skewed when the prior returns on the glamour portfolio are high. We also examine the conditional skewness of monthly glamour returns and the excess market returns orthogonalized by corresponding glamour returns. In Table 7, the monthly 20 excess returns on the market portfolio are negatively skewed9 when prior 36month return on the glamour stocks is in the top quartile of the overall sample distribution. In other words, we sort all of the 36-month returns of glamour portfolios from high to low. Next, we select those time periods that are in the top quartile of this distribution. We then examine the excess market return in the month following each of these periods. We find that the distribution of excess market returns from these months is negatively skewed. That is, the probability of a large decline in the stock market increases following periods in which glamour stocks have performed particularly well. In contrast, when prior glamour returns have been low (in the bottom quartile), the skewness in excess market returns is slightly positive. This may suggest that the stock market is likely to have a “correction” following large price run-ups in glamour stocks. Is this “correction” driven solely by the behavior of glamour stocks within the market? Using the cash flow to market value definition of glamour (Panel A, Table 7), one might be tempted to conclude that this is the case because the negative skewness for the market returns purged of glamour return effects (-0.23) cannot be reliably differentiated from zero (p-value = 0.13). In contrast, the skewness coefficients for the market with glamour and glamour by itself are both negative when the prior returns on glamour stocks are high and have highly significant p-values of 0.01. However, using the other definitions of glamour, the answer is not so clearcut. Clearly, the behavior of glamour stocks is an important component of our finding of conditional negative skewness in the market. 9 The p-value is for the null hypothesis that the skewness is zero (that is, the underlying distribution is a normal distribution). The test statistic for skewness is based on equation 12.91 of Stuart and Ord (1994). 21 IV. Summary and Conclusions We investigate the predictability of aggregate stock market returns using the past returns of glamour stocks, value stocks, and the overall market. We find the relationship of glamour stocks with future stock market returns is unique. In particular, we find that annual excess returns on the stock market index are negatively related to the returns of glamour stocks in the previous 36-month period. Past returns on the stock market, purged of the effects of the glamour stocks, do not have any reliable predictive power in explaining future stock market returns. On the other hand, the glamour portfolio returns, even orthogonalized by the corresponding market returns, have predictive power. In contrast, the past returns of value stocks do not have any explanatory power in predicting aggregate stock market excess returns. We also find that the explanatory power of past glamour returns is in general robust to the inclusion of term premium, default premium, aggregate dividend yield, and the consumptionto-wealth ratio (CAY) as control variables. This unique predictive ability of glamour stocks extends our understanding of the previously documented negative autocorrelation in stock market returns. Our evidence suggests the predictability of the aggregate stock market returns arises from some information that is exclusive to glamour stocks. We also find that the probability of a large decline in the stock market value increases in the periods following large price run-ups in glamour stocks. Specifically, the monthly excess returns on the aggregate market are negatively skewed when the returns on the glamour stocks in the prior 36-months are high. 22 This evidence may be consistent with an investor sentiment explanation of predictability, in which the stock market in general and the glamour stocks in particular become over-priced periodically. A subsequent correction causes a decline in the stock market in general, and among glamour stocks in particular. One may be reluctant to embrace an investor sentiment explanation of the predictability of aggregate stock market returns. Any theory, however, will need to explain why future stock market returns are negatively correlated with past glamour stock returns and why the probability of a large decline in the stock market increases following periods in which glamour stocks have performed particularly well. 23 Appendix Bootstrap Procedure We estimate the following auto-regressive model for all our independent variables using the monthly observations in our sample: Xi,t = a + b Xi,t-1 + ei,t (1) Since the small-sample bias arises from the correlation between the monthly innovations in the independent variable (ei,t) and the corresponding excess market returns, we retain the estimates of the residuals from the above regressions and the contemporaneous monthly excess market returns. These pairs of excess market returns and ei,t are then randomized by drawing with replacement from the original data. Next, using these randomized series we create pseudo independent variables and excess market returns that have time-series properties just as in the original data, but yet satisfy the null hypothesis of no predictability. Each pseudo independent variable is created by using the randomized series of residuals along with the parameters from regression equation (1). The starting values for Xi,t-1 are randomly chosen from the actual data. The corresponding pseudo series of monthly excess market returns are used to compute a pseudo dependent variable EXMKT12. We then estimate all the regressions just as in Tables 2, 3 and 4 using these pseudo data and save the coefficients. This process is repeated 1000 times, to obtain an empirical distribution for each of the coefficients. The p-values are based on the proportion of times the bootstrapped coefficient is lower than the coefficient from the actual data series. 24 References Barberis, N., and Huang, M. 2001. Mental Accounting, Loss Aversion, and Individual Stock Returns. Journal of Finance 56 (August): 1247-1295. Barberis, N., Shleifer, A., and Vishny, R. 1998. A model of investor sentiment. Journal of Financial Economics 49 (September): 307-343. Benartzi, S., and Thaler, R. 1995. Myopic loss aversion and the equity premium puzzle. Quarterly Journal of Economics 110: 73-92. Black, F. 1986. Noise. Journal of Finance 41 (July): 529-543. Campbell, J.Y., and Shiller, R. 1988. The dividend price ratio and expectations of future dividends and discount factors. Review of Financial Studies 1 (Fall): 195-228. Campbell, J.Y., and Kyle, A. S. 1993. Smart Money, Noise trading, and stock price behaviour. Review of Economic Studies 60 (January): 1-34. Daniel, K., Hirshleifer, D., and Subrahmanyam A. 1998. Investor Psychology and investor security market under- and overreactions. Journal of Finance 53 (December): 1839-1886. Daniel, K. D., and Titman, S. 1999. Market Efficiency in an irrational world. Financial Analysts Journal 55 (November/December): 28-40. Debondt, W. 1993. Betting on trends: Intuitive forecasts of financial risk and return. International Journal of Forecasting 9: 355-371. DeLong, J.B., Shleifer, A., Summers L.H., and Waldmann, R. J. 1990a. Noise trader risk in financial markets. Journal of Political Economy 98: 703-738. 25 DeLong, J.B., Shleifer, A., Summers L.H., and Waldmann, R. J. 1990b. Positive feedback investment strategies and destabilizing rational speculation. Journal of Finance 45 (June): 379-395. Fama, E. F., and French, K. R. 1988a. Permanent and temporary components of stock prices. Journal of Political Economy 96 (April): 246-273. Fama, E. F., and French, K. R. 1988b. Dividend yields and expected stock returns. Journal of Financial Economics 22 (October): 3-25. Fama, E. F., and French, K. R. 1989. Business Conditions and expected returns on stocks and bonds. Journal of Financial Economics 25 (November): 23-49. Fama, E. F., and French, K. R. 1993. Common risk factors in the returns on bonds and stocks. Journal of Financial Economics 33: 3-56. Hong, H., and Stein, J. 1999a. A unified theory of under-reaction, momentum trading and overreaction in asset markets. Journal of Finance 54 (December): 2143-2184. Hong, H, and Stein, J. 1999b. Differences of Opinion, Rational Arbitrage and Market Crashes. Working Paper, Stanford University. Jegadeesh, N., and Titman, S. 1993. Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance 48 (March): 65-91. Kahneman, D., and Tversky, A. 1973. On the psychology of prediction. Psychological Review 80: 237-251. Keim, D. B., and Stambaugh, R.F. 1986. Predicting returns in the stock and bond markets. Journal of Financial Economics 17 (December): 357-390. 26 Kothari, S. P., and Shanken, J. 1997. Book-to-market, Dividend yield, and expected market returns: A time-series analysis. Journal of Financial Economics 44 (May): 169-203. Lakonishok, J., Shleifer, A., and Vishny, R. 1994. Contrarian investment, extrapolation, and risk. Journal of Finance 49 (December): 1541-1578. Lee, C., Shleifer, A., and Thaler, R. 1991. Investor sentiment and closed-end fund puzzle. Journal of Finance 46 (March): 75-109. Lettau, M., and Ludvigson, S. 2001. Consumption, Aggregate Wealth, and Expected Stock Returns. Journal of Finance 56 (June): 815-849. Neal, R., and Wheatley, S. M. 1998. Do measures of investor sentiment predict returns? Journal of Financial and Quantitative Analysis 33 (December): 523-547. Nelson, C.R., and Kim, M. J. 1993. Predictable stock returns: the role of small sample bias. Journal of Finance 48 (June): 641-661. Pontiff J., and Schall, L. D. 1998. Book-to-market ratios as predictors of market returns. Journal of Financial Economics 49 (August): 141-160. Poterba, J.M., and Summers, L.H. 1988. Mean Reversion in stock prices: Evidence and Implications. Journal of Financial Economics 22 (October): 27-59. Shiller, R. 1981. Do stock prices move too much to be justified by subsequent changes in dividends? American Economic Review 71 (June): 421-436. Shleifer, A., and Vishny, R. 1997. The limits to Arbitrage. Journal of Finance 52 (March): 35-55. 27 Siegel, J.J. 1992. Equity risk premia, corporate profit forecasts, and investor sentiment around the stock market crash of October 1987. Journal of Business 65: 557-570. Solt, M.E., and Statman, M. 1988. How useful is the sentiment index. Financial Analysts Journal 44 (September): 45-55. Stambaugh, R. 1986. Bias in regressions with lagged stochastic regressors. CRSP Working paper 156, The University of Chicago. Stuart, A., and Ord, K. 1994. Distribution Theory: Kendall’s Advanced Theory of Statistics, Edward Arnold, 6th Edition. Summers, L.H. 1986. Does the stock market rationally reflect fundamental values? Journal of Finance 41 (July): 591-601. Thaler, R., and Johnson, E. 1990. Gambling with the house money and trying to break even: the prior outcomes on risky choice. Management Science 36: 643-660. Tversky, A., and Kahneman, D. 1974. Judgement under uncertainty: heuristics and biases. Science 185: 1124-1131. 28 Table 1 Descriptive Statistics for Glamour and Value portfolios formed using Cash-flow to Market value ratio over the period 1951-1997. EXMKT1 and EXMKT12 are the monthly and annual excess returns (in %), over the risk-free rate, on the value weighted market portfolio, respectively. They are measured on a monthly basis. Each month over the period 1951-1997, all the NYSE, AMEX and NASDAQ stocks are classified into quintiles based on the ratio of Cash-flow to Market value (CMRATIO). Cash-flow is the EBIDTA (item 13) in the preceding year. The stocks in the lowest and highest quintile each month are called ‘glamour’ and ‘value’ stocks respectively. SMRATIO is the Sales to Market value ratio, where Sales is the annual net sales (item 12) in the preceding year. BMRATIO is the ratio of Book to Market value of equity, where Book value of equity (item 60) is in the preceding year. SIZE is the average of the market capitalization (millions of dollars) of the stocks in each portfolio in a particular month. SLSGRO-1 (SLSGR0+1) is the average growth (%) in sales in the year preceding (following) the portfolio formation. N is the number of firms in the portfolios in a given month. GLARETCM,-36 and VALRETCM,-36 are the average compounded returns (in %) of the glamour and value stocks, respectively, in the 36 months preceding the portfolio formation. GMVRETCM,-36 is the difference between GLARETCM,-36 and VALRETCM,-36 each month of the sample period. The time-series statistics of the monthly portfolio observations are reported in Panel A below. 29 Table 1 (contd.) Panel A: Sample Statistics Mean Variable Glamour Std. Dev Value Glamour Q1 Value Glamour Median Value Glamour Q3 Value Glamour Value CMRATIO 0.0790 0.5226 0.0366 0.1810 0.0503 0.3778 0.0670 0.4973 0.1026 0.6243 SMRATIO 1.1286 5.7236 0.4609 2.3292 0.8173 4.1087 1.0085 4.9891 1.3051 6.9755 BMRATIO 0.4853 1.4654 0.1694 0.4720 0.3691 1.1776 0.4498 1.3227 0.5559 1.6992 SIZE (in $ mill.) 687 275 329 241 478 91 675 142 866 466 SLSGRO-1 (in %) 35.96 28.96 34.57 80.65 12.14 11.14 24.46 17.31 46.36 22.67 SLSGRO+1 (in %) 32.65 4.05 16.50 5.13 18.42 0.79 33.88 4.83 42.68 7.62 436 436 307 307 127 127 391 391 710 710 114.13 30.88 75.92 38.57 52.41 7.36 101.48 31.96 158.37 56.12 Number of firms in each portfolio (N) GLARETCM,-36 & VALRETCM,-36 (in %) EXMKT1 (in %) 0.6374 4.1297 -1.7860 0.9015 3.2660 EXMKT12 (in %) 7.8508 15.8447 -2.2100 8.8081 18.2199 Table 1 (contd.) Panel B: Correlations Variable EXMKT1 EXMKT1 EXMKT12 1.0000 EXMKT12 GLARETCM,-36 VALRETCM,-36 0.2836 -0.0876 -0.0472 -0.0709 1.0000 -0.3134 -0.1186 -0.2831 1.0000 0.4475 0.8620 1.0000 -0.0675 GLARETCM,-36 VALRETCM ,-36 GMVRETCM,-36 GMVRETCM,-36 1.0000 Panel C: Autocorrelations Lag Structure 1-month 3-month 6-month 12-month 36-month 60-month EXMKT1 0.0601 0.0053 -0.0501 0.0249 0.0079 -0.0376 EXMKT12 0.9230 0.7471 0.4353 -0.1896 0.0461 -0.0418 GLARETCM,-36 0.9570 0.8598 0.7238 0.5407 -0.0871 -0.3450 VALRETCM ,-36 0.9649 0.8932 0.7795 0.5906 0.0666 -0.0368 GMVRETCM,-36 0.9644 0.8888 0.7825 0.6303 -0.0704 -0.1869 Variable Table 2 Coefficients (p values) from regressions of twelve-month excess market returns on lagged returns on Glamour and Value portfolios formed using Cash-flow to Market value ratio over the period 1951-1997. EXMKT12, the excess returns on the value weighted market portfolio over the risk-free rate, in the 12 months following the portfolio formation, is the dependent variable. These annual returns are measured on a monthly basis. GLARETCM,-36 and VALRETCM,-36 are the average compounded returns of the Glamour and Value stocks, respectively, in the 36 months preceding (and including the month of) the portfolio formation. GMVRETCM,-36 is the difference between GLARETCM,-36 and VALRETCM,-36 each month of the sample period. Orthogonalized Glamour Returns, ORTHGLA-36, are the residuals from the regression of the returns on the Glamour Portfolios over the prior 36 months, GLARET-36, on the excess return on a value-weighted market portfolio, EXMKT-36, over the corresponding 36 months. Similarly, the Orthogonalized excess market return, MKTXGLA-36, are the residuals of the regression of the excess return on the value-weighted market portfolio, EXMKT-36, on the returns of the Glamour portfolios over the corresponding 36 months, GLARET-36. The p-values for the coefficients are obtained from a bootstrapping procedure as explained in the appendix. Variable (i) Intercept 0.1524 (0.084) GLARETCM,-36 -0.0659 (0.035) ORTHGLACM,-36 (ii) (iii) 0.0778 (0.562) 0.0784 (0.521) (iv) 0.1504 (0.103) (v) 0.0935 (0.366) 0.1328 (0.133) -0.0645 (0.048) (vii) 0.1519 (0.110) -0.0690 (0.060) -0.0616 (0.062) MKTXGLACM,-36 -0.0242 (0.513) -0.0309 (0.501) VALRETCM,-36 -0.0483 (0.277) GMVRETCM,-36 Adj. R2 (%) (vi) 0.0130 (0.369) -0.0669 (0.045) 9.66 7.65 -0.00 32 9.56 1.23 7.85 9.57 Table 3 Coefficients (p values) from regressions of twelve-month excess market returns on lagged returns on Glamour and Value portfolios formed using Sales to Market Value ratio over the period 1951-1997. EXMKT12, the excess returns on the value weighted market portfolio over the risk-free rate, in the 12 months following the portfolio formation, is the dependent variable. These annual returns are measured on a monthly basis. GLARETSM,-36 and VALRETSM,-36 are the average compounded returns of the Glamour and Value stocks, respectively, in the 36 months preceding (and including the month of) the portfolio formation. GMVRETSM,-36 is the difference between GLARETSM,-36 and VALRETSM,-36 each month of the sample period. Orthogonalized Glamour Returns, ORTHGLA-36, are the residuals from the regression of the returns on the Glamour Portfolios over the prior 36 months, GLARET-36, on the excess return on a value-weighted market portfolio, EXMKT-36, over the corresponding 36 months. Similarly, the Orthogonalized excess market return, MKTXGLA-36, are the residuals of the regression of the excess return on the value-weighted market portfolio, EXMKT-36, on the returns of the Glamour portfolios over the corresponding 36 months, GLARET-36. The p-values for the coefficients are obtained from a bootstrapping procedure as explained in the appendix. Variable (i) (ii) (iii) (iv) (v) (vi) (vii) Intercept 0.1502 (0.084) 0.0781 (0.545) 0.0783 (0.538) 0.1497 (0.086) 0.0885 (0.368) 0.1322 (0.145) 0.1508 (0.098) GLARETSM,-36 -0.0722 (0.032) ORTHGLASM,-36 -0.0713 (0.052) -0.0742 (0.077) -0.0673 (0.070) MKTXGLASM,-36 -0.0290 (0.502) -0.0347 (0.507) VALRETSM,-36 -0.0502 (0.280) GMVRETSM,-36 Adj. R2 (%) 0.0072 (0.419) -0.0676 (0.072) 8.80 6.95 0.05 33 9.21 1.35 6.16 8.66 Table 4 Coefficients (p values) from regressions of twelve-month excess market returns on lagged returns on Glamour and Value portfolios formed using Book to Market ratio over the period 1963-1997. EXMKT12, the excess returns on the value weighted market portfolio over the risk-free rate, in the 12 months following the portfolio formation, is the dependent variable. These annual returns are measured on a monthly basis. GLARETBM,-36 and VALRETBM,-36 are the average compounded returns of the Glamour and Value stocks, respectively, in the 36 months preceding (and including the month of) the portfolio formation. GMVRETBM,-36 is the difference between GLARETBM,-36 and VALRETBM,-36 each month of the sample period. Orthogonalized Glamour Returns, ORTHGLA-36, are the residuals from the regression of the returns on the Glamour Portfolios over the prior 36 months, GLARET-36, on the excess return on a value-weighted market portfolio, EXMKT-36, over the corresponding 36 months. Similarly, the Orthogonalized excess market return, MKTXGLA-36, are the residuals of the regression of the excess return on the value-weighted market portfolio, EXMKT-36, on the returns of the Glamour portfolios over the corresponding 36 months, GLARET-36. The p-values for the coefficients are obtained from a bootstrapping procedure as explained in the appendix. Variable (i) (ii) (iii) (iv) (v) (vi) (vii) Intercept 0.1284 (0.180) 0.0617 (0.536) 0.0600 (0.572) 0.1286 (0.187) 0.0596 (0.586) 0.1374 (0.198) 0.1219 (0.305) GLARETBM,-36 -0.0456 (0.108) ORTHGLABM,-36 -0.0468 (0.114) -0.0414 (0.226) -0.0342 (0.238) MKTXGLABM,-36 -0.1041 (0.337) -0.1144 (0.298) VALRETBM,-36 -0.0921 (0.239) GMVRETBM,-36 Adj. R2 (%) -0.0174 (0.496) -0.0511 (0.137) 6.94 2.48 1.28 34 8.82 3.67 5.63 6.79 Table 5 Coefficients (p values) from regressions of twelve-month excess market returns on lagged returns on Glamour portfolios and macro-economic variables over the period 1951-1997. EXMKT12, the excess returns on the value weighted market portfolio over the risk-free rate, in the 12 months following the portfolio formation, is the dependent variable. These annual returns are measured on a monthly basis. GLARETCM,-36, GLARETSM,-36 and GLARETBM,-36 are the average compounded returns of the Glamour stocks, respectively, in the 36 months preceding (and including the month of) the portfolio formation, with portfolios formed using the three different metrics. TRMPREM, Term Premium, is the difference between the yields of AAA corporate bonds and the one-month T-bill. DFLTPREM, Default Premium, is the difference between the yields of BAA and AAA corporate bonds. ADIVYLD is the dividend yield for the market portfolio based on the dividends of the preceding 12 months and the most recent price-level . CAY is the aggregate consumptionwealth ratio from Lettau and Ludvigson (2001). The data for the CAY variable were obtained from their website at the Federal Reserve Bank of New York The p-values for the coefficients are obtained from a bootstrapping procedure as explained in the appendix. Panel A: Variable (i) (ii) (iii) (iv) (v) (vi) (vii) (viii) (ix) Intercept 0.0960 (0.454) 0.0951 (0.446) 0.0553 (0.645) 0.1166 (0.365) 0.1122 (0.365) 0.0683 (0.550) -0.0330 (0.361) -0.0436 (0.376) -0.0279 (0.550) GLARETCM,-36 -0.0567 (0.054) GLARETSM,-36 -0.0667 (0.033) -0.0620 (0.073) GLARETBM,-36# TRMPREM -0.0562 (0.055) -0.0757 (0.047) -0.0382 (0.172) 0.0209 (0.085) 0.0208 (0.089) -0.0678 (0.054) -0.0501 (0.099) 0.0259 (0.036) DFLTPREM 0.0387 (0.235) 0.0449 (0.204) 0.0640 (0.141) ADIVYLD Adj. R2 (%) # 12.93 12.42 -0.0470 (0.087) 14.29 10.45 Regressions with GLARETBM,-36 are estimated over the period 1963-1997. 35 10.40 10.70 0.0477 (0.242) 0.0521 (0.218) 0.0458 (0.374) 16.86 18.02 12.76 Table 5 (Contd.) Panel B: Variable (x) (xi) (xii) Intercept -3.9935 (0.006) -3.9898 (0.003) -4.0935 (0.006) GLARETCM,-36 -0.0563 (0.062) GLARETSM,-36 (xiii) (xiv) (xv) (xvi) (xvii) (xviii) 0.0891 (0.535) 0.0857 (0.530) 0.0310 (0.742) -0.1359 (0.200) -0.1415 (0.196) -0.1182 (0.366) -0.0581 (0.071) -0.0631 (0.056) GLARETBM,-36# -0.0451 (0.081) -0.0651 (0.075) -0.0464 (0.131) -0.0557 (0.093) -0.0418 (0.185) TRMPREM 0.0193 (0.090) 0.0183 (0.098) 0.0222 (0.081) DFLTPREM 0.0127 (0.390) 0.0192 (0.365) 0.0371 (0.291) ADIVYLD * CAY* 6.8269 (0.004) 6.8205 (0.003) 6.9751 (0.005) Adj. R2 (%) 25.89 25.62 25.78 12.87 The data for the regressions with CAY are measured on a quarterly basis. 36 12.49 15.18 -0.0392 (0.152) 0.0276 (0.043) 0.0272 (0.022) 0.0276 (0.042) 0.0559 (0.215) 0.0593 (0.179) 0.0495 (0.390) 22.80 23.80 20.81 Table 6 Coefficients (p values) from regressions of twelve-month excess return on Glamour and Value portfolios, respectively, on lagged returns on Glamour portfolios over the period 1951-1997. EXGLA12 and EXVAL12 are the excess returns over the risk-free rate on the Glamour and Value portfolios, respectively, in the 12 months following the portfolio formation. GLARET-36 is the average compounded returns of the Glamour stocks in the 36 months preceding (and including the month of) the portfolio formation. Value and Glamour portfolios are formed using three different metrics: Cash-flow to Market value ratio (CMRATIO); Sales to market value ratio (SMRATIO); Book to Market value ratio (BMRATIO). The p-values for the coefficients are obtained from a bootstrapping procedure as explained in the Appendix. Dependent Variable EXGLA12 EXVAL12 Panel A: Portfolios based on cash-flow to market value ratio Intercept 0.1598 (0.144) 0.2261 (0.199) GLARETCM,-36 -0.0707 (0.073) -0.0647 (0.097) Adj. R2 (%) 4.94 4.00 Panel B: Portfolios based on sales to market value ratio Intercept 0.1349 (0.120) 0.2188 (0.246) GLARETSM,-36 -0.0784 (0.053) -0.0648 (0.154) Adj. R2 (%) 6.13 2.51 Panel C: Portfolios based on book to market value ratioa Intercept 0.1398 (0.168) 0.2080 (0.510) GLARETBM,-36 -0.0682 (0.111) -0.0435 (0.259) Adj. R2 (%) a Over the period 1963-1997. 5.91 37 2.23 Table 7 Conditional Skewness (p-values) of the monthly excess market returns, EXMKT1, returns on glamour portfolios, GLARET1, and the market returns orthogonalized by glamour portfolios, MKTXGLA1, under different states of performance of the glamour portfolios in the prior 36 months, GLARET-36, over the period 19511997. GLARET-36 is the return on the Glamour portfolios over the prior 36 months of the portfolio formation. Glamour portfolios are formed using three different metrics: Cash-flow to Market value ratio (CMRATIO); Sales to Market value ratio (SMRATIO); Book to Market value ratio (BMRATIO). The skewness of EXMKT1, GLARET1 and MKTXGLA1 are measured for the sub-samples where GLARET-36 is in lowest quartile (<Q1) or the highest quartile (Q>3) of the overall sample distribution. Variable Skewness measures in the sub-sample when prior returns of the glamour portfolio are in bottom quartile Skewness measures in the sub-sample when prior returns of the glamour portfolio are in top quartile Panel A: Portfolios based on CMRATIO EXMKT1 0.0810 (0.350) -0.5165 (0.010) GLARETCM,1 0.2730 (0.090) -0.5171 (0.010) MKTXGLA1 -0.0551 (0.390) -0.2365 (0.130) EXMKT1 0.1749 (0.200) -0.3494 (0.050) GLARETSM,1 0.2543 (0.110) -0.2775 (0.090) MKTXGLA1 0.0411 (0.420) -0.2654 (0.100) EXMKT1 0.2818 (0.120) -0.3086 (0.100) GLARETBM,1 0.2182 (0.180) -0.2836 (0.120) MKTXGLA1 0.3168 (0.090) -0.3024 (0.100) Panel B: Portfolios based on SMRATIO Panel C: Portfolios based on BMRATIOa a Over the period 1963-1997. 38 39