Topic 3

advertisement

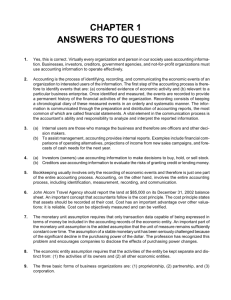

Topic X 3 The Accounting Cycle LEARNING OUTCOMES By the end of this topic, you should be able to: 1. Identify the steps involved in the accounting cycle; 2. Explain the basic accounting equation; 3. Analyse transactions; and 4. Demonstrate the effect of transactions on an accounting equation X INTRODUCTION By now, you should be wondering how to prepare the financial statements discussed earlier. Can you recall the definition of accounting or recall the four components of accounting process? You need to be able to collect, identify, measure and record before communicating the information to users in the form of financial statements. This process describes the accounting cycle of a business. In this topic, we will begin by introducing the accounting cycle to you. These are the steps that will be repeated at every accounting period. We will then look at the accounting equation, which is Assets equal Liabilities plus OwnerÊs Equity. This equation will always remain in balance at all times. This is the basis of all accounting as every transaction will have certain effects on the accounting equations. MYOB (Mind Your Own Business) is one of the many computer-based accounting systems available in Malaysia. Many companies rely on an accounting system to generate reports. An accounting package is an integral part of a business in completing an accounting cycle, as highlighted by a chartered accountant. TOPIC 3 THE ACCOUNTING CYCLE W 41 „Having the right accounting system is essential for any business. It can save time and money. Having the wrong one, however, can cost you hours in inefficiencies and eat into your profits‰. Tanya Parkyn Chartered Accountant and the Director of Innovative Accounting Systems Pty. Ltd 3.1 THE ACCOUNTING CYCLE The accounting process begins with a transaction and ends with closing the books at the end of a period. These steps are repeated at every accounting period and are called the accounting cycle. It begins with the occurrence of the transaction itself, analysing and recording the transactions in journals, posting it to the ledgers and then preparing trial balance. At the end of the period, adjusting entries are made, adjusted trial balance and financial statements are prepared and then closing entries is done to prepare the temporary accounts for the next periodÊs accounting cycle. Figure 3.1: The accounting cycle In this section, we will begin by looking at all of the steps in the accounting cycle briefly. 3.1.1 Source Documents At this stage information is gathered, generally in the form of source documents, about transactions or events. Source documents are documents that provide 42 X TOPIC 3 THE ACCOUNTING CYCLE proof that a transaction had actually occurred, and this is the basis of accounting records. Examples of source document are sales invoice, purchase invoice, debit note, credit notes, cheque and receipts. Controls on source document are important to ensure accounting information is accurate and reliable. At a minimum, each source document should include the data, the amount and a description of the transaction. During an audit, source documents are used as evidence that a particular business transaction occurred. ACTIVITY 3.1 Look at a sample of sales or purchase invoice. Can you list down the information is documented in this source document? 3.1.2 Transactions Analysis Transactions are analysed; how each transaction affects the accounting equation is looked into. At this stage the accounts affected by the transaction and how it is affected (increased or decreased) will be identified. 3.1.3 Journalising These transactions are then recorded in journals. A journal is also known as the book of prime entry. It is a chronological record of transactions. Journal entries will facilitate the posting of transactions to ledgers. 3.1.4 Posting Records from the journal are then posted (transferred) to ledgers. Posting should be done on timely basis, to ensure ledger is up to date. 3.1.5 Preparation of Unadjusted Trial Balance At end of accounting period, the balance of all accounts of a business will be listed in the trial balance. TOPIC 3 3.1.6 THE ACCOUNTING CYCLE W 43 Adjusting Entries At the end of an accounting period, adjusting entries are prepared to assign revenues and expenses to the periods they are earned and incurred. 3.1.7 Preparation of Adjusted Trial Balance Listing of all businessÊ accounts balances after adjustment entries are made. 3.1.8 Preparation of Financial Statements The result of the business is communicated to users through financial statements. Can you recall the financial statements that you have learned in Topic 1.6 earlier? Income statement is prepared in order to report the financial performance of the business. Balance sheet is prepared to report the financial position of the business. 3.1.9 Closing Entries At the end of an accounting period, all temporary accounts are closed. Revenues and expenses are closed to income summary. Profit or loss is then transferred to capital account. Drawings are also closed to capital account too. The above mentioned stages are depicted in Figure 3.2 for quick reference. 44 X TOPIC 3 THE ACCOUNTING CYCLE Figure 3.2: The stages involved in preparing the financial statement Adapted from: Horngren (2004) You will learn in detail all the steps of the accounting cycle. However, let us first, look at the accounting equation. This is the most basic concept of the double entry book keeping. TOPIC 3 3.2 THE ACCOUNTING CYCLE W 45 ACCOUNTING EQUATION Before we look at the accounting equation, you need to understand that all economic events can be classified into three categories which are assets, liabilities and ownerÊs equity. Assets are resources that are owned by the entity. Land, properties, equipment, motor vehicle, cash, receivables (debtors) are examples of assets. These assets are expected to provide future economic benefits to the entity. Liabilities are debts or obligation of the entity. Loans, bank overdrafts and payables (creditors) are examples of liabilities. The liabilities are expected to be cleared off by sacrificing the entityÊs assets. OwnerÊs equity is the residual claim (rights) of entity assets. LetÊs say you purchase a car using your own money and the car belongs to you. You can do whatever you want with the car, even selling it. However, if you take a loan to purchase a car, although you have the right to use the car, the ownership is not yours, and the car is not yours until you pay off your loan. If you sell the car, the loan amount will be deducted (settled) and the difference (the residual) will be refunded to you. To illustrate, let us look at this situation. You have decided to start a new business. You only have RM5,000. So you asked your friend to lend you another RM5,000. The business now has an asset (cash) of RM10,000 whereby only RM5,000 belongs to you, and another RM5,000 belongs to your friend. If you were to stop your business immediately, the business asset (cash) of RM10,000 is not yours alone; you have to pay off your borrowings, and only the balance belongs to you (residual claim). The accounting equation is the fundamental of accounting. The equation presents the resources of a business and the claim against those resources. 46 X TOPIC 3 THE ACCOUNTING CYCLE Can you see the relationship between the assets of the business with liabilities of the business and the ownerÊs equity interest? The relationships are presented in the following basic accounting equation. Figure 3.3: The basic accounting equation All economic transactions in an entity will affect the equation, meaning they will affect assets, liabilities or ownerÊs equity. Although the items in the equations are affected (increased or decreased), the equation will remain in balance at all times. The basic accounting equations can be expanded to include items of ownerÊs equity. There are four items that can affect the ownerÊs equity, and they are: Capital investments: they will increase ownersÊ equity. Drawings: they will decrease ownersÊ equity Revenues: they will increase the ownersÊ equity. Expenses: they will decrease the ownersÊ equity. TOPIC 3 THE ACCOUNTING CYCLE W 47 Figure 3.4: Transactions effect on ownerÊs equity Hence the equations can be rewritten as: Figure 3.5: The expanded accounting equation The next section will look at the second step in the accounting cycle, analysing transaction to determine how it affects the accounting equation. ACTIVITY 3.2 You have a personal wealth of RM100,000, comprising of RM10,000 cash and a car worth RM90,000. You had borrowed RM40,000 from your parents to purchase the car. Can you write your accounting equation? 48 X TOPIC 3 3.3 THE ACCOUNTING CYCLE TRANSACTION ANALYSIS It is important for you to remember that the accounting equation must be in equilibrium at all times. Business transactions must be analysed to see their effects on the components of the equation. The following are the steps that you can use to help you analyse business transactions. STEP 1: Read and think about the transaction STEP 2: Identify components in the equations that are affected. Is it Asset, Liability or OwnerÊs Equity? STEP 3: Identify the accounts and the effects. Decreased? Increased? STEP 4: Check the equation; it has to be balanced. It is important for you to understand this analysis as it is the basis for preparing journal entries for all transactions. Spend more time learning this section before proceeding to another level. We will see in detail how transaction analysis works by looking into the following transactions of a service based business. Table 3.1: Transactions of a Company Date Transactions 1st Sept. 2008 Sonic invested RM50,000 cash to start a photography business. 3rd Sept. 2008 Sonic purchased a photo processing machine costing RM1,000 cash. 5th Sept. 2008 Sonic withdrew RM10,000 cash for personal use. 6th Sept. 2008 Sonic borrowed RM20,000 cash from Digi Bank. 25th Sept. 2008 Sonic paid off RM5,000 of the bank loan. 26th Sept. 2008 Sonic provided professional photography service for a wedding; RM2,000 cash was received and another RM1,000 will be received within 14 days. 28th Sept. 2008 Sonic paid RM500 cash for his employeeÊs salary, RM300 cash for utilities and RM200 cash for shop rental. TOPIC 3 3.3.1 THE ACCOUNTING CYCLE W 49 Transaction 1: Initial Investment by Owner Owner can contribute cash or other assets to the business as capital. For example owner can bring his own motor vehicle into the business and this will be considered as capital contribution by owner to the business. Capital contributions by owner will increase both the business assets and ownerÊs equity. Transaction Basic Analysis Accounting Equation Accounting Equation after Transaction 1 1st Sept 2008, Sonic invested RM50,000 cash to start a photography business Sonic Enterprise. The asset (cash) has increased by RM50,000. The ownerÊs equity (capital) has increased by RM50,000. Assets = Liabilities n Cash RM50,000 Assets = + OwnerÊs Equity n Capital RM50,000 Liabilities + OwnerÊs Equity = The equation remains in balance. Figure 3.6: Transaction 1 3.3.2 Transaction 2: Purchase of Non Current Asset To operate, most business must have non current assets (fixed assets) that will be used to generate revenues. For example, a delivery van is needed to deliver goods; a machine to produce products and so on. The purchase of such items can either be on cash term or credit term. Paying cash for your purchase of non current asset will see your cash asset decreases and your non current asset increases. Purchasing non current assets on credit will see your non current assets increased and your liabilities increased. 50 X TOPIC 3 Transaction Basic Analysis THE ACCOUNTING CYCLE 3rd Sept. 2008, Sonic purchased a photo processing machine costing RM1,000 cash. The asset (cash) has decreased by RM1,000. The asset (equipment) has increased by RM1,000. Accounting Equation Assets Accounting Equation after Transactions 1 &2 Assets = Liabilities + p Cash RM 1,000 = OwnerÊs Equity n Equipments 1,000 Liabilities + OwnerÊs Equity Cash + Equipment Capital 49,000 50,000 1,000 The equation remains in balance. Figure 3.7: Transaction 1 to 2 3.3.3 Transaction 3: Withdrawals by Owners It is normal for owner to take the business cash and use it for their personal purpose. Business and owners assets are two separate things and need to be accounted as so. If business cash are used for personal (owner) purposes, it is considered as drawings by the owner. Drawings will reduce the ownerÊs equity (capital) and asset (cash). It should be noted too, that any consumption of business assets such as office supplies or stationeries for personal usages must be recorded as drawings too. TOPIC 3 Transaction Basic Analysis THE ACCOUNTING CYCLE W 51 5th Sept. 2008, Sonic withdrew RM10,000 cash for personal use. The asset (cash) has decreased by RM10,000. The ownerÊs equity (capital*) has decreased by RM10,000. Accounting Equation Assets Accounting Equation after Transactions 1, 2&3 Assets = Liabilities + OwnerÊs Equity p Cash 10,000 = p Capital * 10,000 Liabilities + OwnerÊs Equity The equation remains in balance. Figure 3.8: Transaction 1 to 3 Note: * Withdrawals by owners are not recorded in the capital account directly but will be recorded in an account called drawings. Drawings represent a reduction in ownerÊs equity. 52 X TOPIC 3 3.3.4 THE ACCOUNTING CYCLE Transaction 4: Borrowing Money To finance business operations such as buying non current assets, office supplies, paying employees sometimes the cash capital from owner is not enough. Business can borrow money from another company, a person or a financial institution to increase its available funds. This borrowing represents an obligation to business to pay the principle amount plus interest charges. Borrowing increases both assets (cash) and liabilities of a business. Transaction Basic Analysis Accounting Equation Accounting Equation after Transactions 1, 2, 3 & 4 6th Sept, Sonic borrowed RM20,000 cash from Digi Bank. (In this example we will ignore the interest charges) The asset (cash) has increased by RM20,000. The liability (loan) has increased by RM20,000. Assets = Liabilities + n Cash 20,000 Assets = OwnerÊs Equity n Loan 20,000 Liabilities + OwnerÊs Equity = The equation remains in balance Figure 3.9: Transaction 1 to 4 3.3.5 Transaction 5: Repayment of Borrowings Borrowings must be paid off. Repayment methods and amount varies according to the loan agreement. For example borrower might pay only monthly interest charges over the period of the loan and the whole principle at the end of loan term or borrower might pay equal monthly sum which includes interest and principle amount over the period of the loan. Repayment of borrowing will reduce both assets (cash) and liabilities of the business. TOPIC 3 Transaction Basic Analysis Accounting Equation Accounting Equation after Transactions 1, 2, 3, 4 & 5 THE ACCOUNTING CYCLE W 53 25th Sept. 2008, Sonic paid off RM5,000 of the bank loan. The asset (cash) has decreased by RM5,000. The liability (loan) has decreased by RM5,000. Assets = p Cash 5,000 Liabilities Assets Cash + Equipment 54,000 1,000 = + Liabilities Loan 15,000 OwnerÊs Equity p Loan 5,000 +OwnerÊs Equity Capital 40,000 The equation remains in balance. Figure 3.10: Transaction 1 to 5 3.3.6 Transaction 6: Earning Revenues The main objective of business is to make profit. In order to make profit, business must earn revenues. Revenues can be in many forms, a service provider provides services to customers, a merchandiser sells goods to customer and a manufacturer sells manufactured goods to a wholesaler. A business can earn sales commission revenues, interest revenues from cash deposits in bank or event rental revenues for renting out office space to clients. Most of the time, customer will pay cash for service rendered or goods delivered to them, but some will pay later (credit term). Regardless whether cash has been received or not, as long as you have earned the revenue it should be recorded as such. Revenues will increase assets (cash or receivables) and ownerÊs equity. 54 X TOPIC 3 Transaction Basic Analysis THE ACCOUNTING CYCLE 26th Sept. 2008, Sonic provided professional photography service for a wedding, RM2,000 cash was received and another RM1,000 will be received within 14 days. The asset (cash) has increased by RM2,000. The asset (account receivable) has increased RM1,000. The ownerÊs equity (photography fees) has increased by RM3,000. Accounting Equation Assets = Liabilities n Cash 2,000 Assets = Cash + AR 56,000 1,000 + Equipment 1,000 OwnerÊs Equity n OE through n Account Receivable 1,000 Accounting Equation after Transactions 1, 2, 3, 4, 5 & 6 + photography fees 3,000 Liabilities + Loan 15,000 = The equation remains in balance. Figure 3.11: Transaction 1 to 6 OwnerÊs Equity Capital 43,000 TOPIC 3 3.3.7 THE ACCOUNTING CYCLE W 55 Transaction 7: Paying for Expenses In generating sales, business will incur expenses. Examples of such expenses are paying for shop rentals, wages and salary, utilities, insurance, advertising, office supplies, motor vehicle maintenance, repairs and many more. You might pay the expenses with cash as they incurred or you pay it later. Nonetheless, expenses will reduce your assets (cash) if pay by cash, or increase your liabilities (if no cash is paid) and reduce ownerÊs equity. Transaction Basic Analysis Accounting Equation 28th Sept 2008, Sonic paid RM500 cash for his employeeÊs salary, RM300 cash for utilities and RM200 cash for shop rental. The asset (cash) has decreased by RM1,000. The owner equity (expense n) has decreased by RM1,000. Assets = Liabilities + p Cash 1,000 OwnerÊs Equity p OE by 1,000 through n in expenses Accounting Equation after Transactions 1, 2, 3, 4, 5, 6 & 7 Assets = Liabilities Cash 55,000 Loan + 15,000 Equipments 1,000 + AR 1,000 + OwnerÊs Equity Capital 42,000 The equation remains in balance. Figure 3.12: Transaction 1 to 7 There are many transactions other than the examples given above. All will have an effect on the accounting equation. However, the accounting equation will always remain balanced at all time. 56 X TOPIC 3 THE ACCOUNTING CYCLE SELF-CHECK 2.1 Can you give examples of a business transaction that will have the following effects to accounting equation? 1. Increase in an Asset and increase in a Liability. 2. Increase in an Asset and decrease in another Asset. 3. Decrease in an Asset and increase in a Liability. 4. Increase in an Asset and increase in OwnerÊs equity. 5. Decrease in an Asset and decrease in OwnerÊs equity. Summaries of how each of the above transaction affects the accounting equation are given in the following table. Go through this again to check your understanding. Table 3.2: Transaction Analysis Date (Sept. 2008) ASSETS Cash 1st Balance 3rd Balance 50,000 50,000 (1,000) 49,000 5th (10,000) Balance 6th Balance 25th Balance 26th 39,000 20,000 59,000 (5,000) 54,000 Balance 56,000 28th (1,000) Balance + + + + LIABILITIES + OwnerÊs Equity Equipment = Loan + Capital 1,000 1,000 = = = = 50,000 50,000 50,000 (10,000) Drawings 40,000 = + 1,000 + 1,000 + 1,000 2,000 55,000 Account Receivables = 1,000 + = = = = = 20,000 20,000 (5,000) 15,000 + 40,000 + 15,000 + 40,000 3,000 Revenues 43,000 (500) salaries (300) utilities (200) rentals 42,000 = 1,000 1,000 = = + 1,000 + 1,000 = 15,000 + TOPIC 3 THE ACCOUNTING CYCLE W 57 The accounting cycle begins with the occurrence of the transaction itself, analysing and recording the transactions in journals, posting them to ledgers and then preparing a trial balance. At end of the period, adjusting entries are made, adjusted trial balance and financial statements are prepared and then closing entries are done to prepare the temporary accounts for the next periodÊs accounting cycles. Basic accounting equation is Assets equal Liabilities plus OwnerÊs Equity. There are four items that can affect the ownersÊ equity, they are: (i) Capital investments; they will increase ownerÊs equity. (ii) Drawings; they will decrease ownerÊs equity (iii) Revenues; they will increase the ownerÊs equity. (iv) Expenses; they will decrease the ownerÊs equity. The expanded accounting equation can be written as Assets equal Liability plus OwnerÊs Equity plus Revenues minus Expenses and minus Drawings. All transactions will have an effect on the accounting equation; however, the accounting equation will remain in equilibrium at all times. Transactions are analysed to see the accounts affected and the effects they have on the accounting equation. Accounting Equation Asset Liability 58 X TOPIC 3 THE ACCOUNTING CYCLE 1. Calculate the missing figures. Assets Liabilities Owner's Equity Business A 79,500 45,000 ? Business B ? 23,000 45,600 Business C 163,700 ? 104,500 2. (a) (b) Indicate whether the following items are A (Assets), L (Liabilities), R (Revenues) or E (Expenses) (i) Cash (viii) Accounts Payable (ii) Bank Loan (ix) Accounts Receivable (iii) Equipment (x) Sales (iv) Notes Payable (xi) Supplies (v) (xii) Advertising Insurance (vi) Salaries (xiii) Salaries Payable (vii) Furniture and Fittings (xiv) Motor Vehicle Explain how the following transactions will affect the accounting equation. Identify the account affected. (i) Pay cash for postage. (ii) Buy furniture and fittings on credit. (iii) Bring own motor vehicle to be used for business purposes. (iv) Pay salaries to workers. (v) 1. (a) Receive rentals from tenants. Based on the following transaction analysis worksheet of Azwan Enterprise, describe the nature of each transaction (1 - 9). Azwan Enterprise provides printing services to its clients. TOPIC 3 Date Cash Opening Balance 1/1/2003 Trans 1 Trans 2 Trans 3 Trans 4 7,500 Trans 5 2,000 Trans 6 7,000 -1,000 2,000 -4,000 -1,000 Trans 7 Trans 8 Account Receivables 3,800 THE ACCOUNTING CYCLE W Supplies Land 400 38,000 Account payable 3,700 Bank Loan 10,000 Capital 36,000 1,000 -2,000 -4,000 -1,000 (Rent) -2,000 (Wages) 7,000 (Revenue) 1,500 1,500 3,500 Trans 9 Cash 59 Account Receivables -1,200 Supplies Land Account payable Bank Loan 3,500 (Revenue) -1,200 Capital Ending Balance, 31/1/2003 2. (b) Determine the balance of each account in the worksheet. (c) Show the accounting equation for Azwan Enterprise. (d) Based on information provided in the transaction analysis worksheet above, calculate Azwan EnterpriseÊs income. Che Wan opens a beauty salon on 1 February 2008. During the first month of operation the following transactions occurred: February 1 2 5 7 Che Wan invested RM150,000 of her own cash in the business and borrowed RM100,000 from a bank She paid cash for furniture and fittings for the shop costing RM25,000. Purchased on credit beauty supplies worth RM4,000. Performed makeup service for a wedding and billed the customer for RM5,000. 60 X TOPIC 3 THE ACCOUNTING CYCLE 10 Che Wan withdrew RM20,000 and invested it in a restaurant business. 12 Che Wan renovated her apartment, paying RM10,000 from her own funds. 15 Provided beauty consultation for a client and received RM3,000 cash for her service. 16 Purchase a second hand car for business use. She paid RM5,000 cash and borrowed another RM15,000 from a bank. 17 Received RM3,000 cash as partial payment for service rendered on 7th February. 25 Paid the full amount owed for beauty products purchased on 5th February. 27 Purchased beauty supplies worth RM5,000 for cash. 28 Paid the following expenses for cash: Electricity RM100 Rental RM1,500 Workers Salaries RM2,000 You are required to: (a) Analyse the effects (increase , decrease ) the above transactions have on accounting equations and identify the specific accounts affected; and (b) Analyse the effects of the above transactions to the accounting equations, by using the format similar to Table 3.1.