INVESTMENT INSIGHTS FOR YOUR ADVANTAGE

Fidelity

MAY 2004

www.fidelity.com

Estate Planning

for Blended Families

Keep the harmony

intact by following

these simple steps

8

February 2008 Fidelity.com

A New

World View

Experts examine the global economy

and its impact on your portfolio

4

Exclusively for Private Access Clients

32577OFC.indd_p1 1

Take It to

the Limit

The ins and outs

of stop-loss and

stop-limit orders

16

Fi

de

re lit

op y ®

e

Se ns M

e to ag

Fi n e

d e

f

in or elit w lla

fo m y in n ®

rm o Fo ve

at re rum sto Fu

io

rs n

n.

.

d

I N V E S T M E N T I N S I G H T F O R YO U R A D VA N TAG E

1/10/08 4:06:24 PM

Fidelity forum

In his 2005 bestseller The World Is Flat, Thomas L. Friedman marvels at how technological, social, and economic

forces have toppled barriers around the globe: “… [W]hat the

flattening of the world means,” he writes, “is that we are now

connecting all knowledge centers on the planet together into

a single global network, which—if politics and terrorism do

not get in the way—could usher in an amazing era of prosperity, innovation, and collaboration…”

This month’s cover feature, “Taking a World View,” is a

virtual roundtable discussion with three experts—Bruce

Johnstone, Wilfred Chilangwa, Jr., and Mark Yockey—who

offer their perspectives on this new global network and how

it is changing the nature of investing and commerce forever.

Getting a little closer to home, our second feature takes a look at estate planning for today’s multifaceted families. In “Blending Family Values Into an Estate

Plan,” you’ll get ideas from experts and investors who have successfully navigated

the challenges of planning a legacy when parents and siblings reconfigure due to

divorce and remarriage.

As always, thanks for spending time with the magazine. Please write to us at

Fidelity+mag@fmr.com with your thoughts on the current issue, articles you’d

like to see in future issues, and whatever else is on your mind. We’re eager to

make Fidelity+ a publication that continues to respond to your investing needs.

Fidelity+ magazine helps Fidelity customers become

more knowledgeable, confident, and successful investors by providing educational articles about investing,

planning, and market trends, plus news on Fidelity

products and services.

Contact Fidelity+: 82 Devonshire Street, R4C,

Boston, MA 02109; Fidelity+mag@fmr.com

PUBLISHER

EDITOR IN CHIEF

MANAGING EDITOR

CREATIVE DIRECTOR

PRODUCTION MANAGER

COPY EDITOR

LEGAL REVIEWER

LIST PROJECT MANAGER

Bill Fox

Polly Walker

Amy Barry

Charles Venancio

Loriann Gough

Joseph Sefter

Shane-Lea Langone

Kim Addison

Editorial services provided by

Bull’s-eye Communications

Custom publishing services provided by

FIDELITY+ EDITORIAL TEAM

MANAGING EDITOR

ART

ACCOUNT SUPERVISOR

Brian Bertoldo

Kevin Miller

George Lee

Jessica Fidgeon

Fidelity+ magazine is mailed to Fidelity customers in

February, May, August, and November.

IMPORTANT INFORMATION ABOUT CONTENT:

© 2008 FMR LLC. All rights reserved. Although carefully verified, data are not guaranteed for accuracy or completeness.

Fidelity Investments disclaims any liability for any direct or

incidental loss incurred by applying any of the information

in this publication. The statements and opinions reflect

those of the individuals noted herein and are not the opinions or recommendations of Fidelity Investments.

Polly Walker

Editor in Chief

P.S. I’m delighted to report that the Fidelity® Magellan® Fund (FMAGX) was

reopened to new investors on January 15. Please visit Fidelity.com/MagellanFund

or call 1.800.FIDELITY to learn more.

YOUR LETTERS

Dear Fidelity+: We have been receiving your

magazine for some time now, and find it very

educational. It would be helpful if you could

create a chart that summarizes tax law requirements and other changes affecting investors,

particularly as they pertain to individual

retirement accounts (IRAs). A few of the items

might include:

• The age at which minimum required distributions (MRDs) from an IRA must begin.

• The maximum annual contribution to an IRA.

• The age at which the money can be withdrawn from an IRA without penalty.

• What time period constitutes short- and

long-term gains.

I know there are many more items that

should be included, such as the “catches” that

Uncle Sam puts on IRAs, investment gains, gift

taxes, etc. If you kept all this information in

one location, this would be an extremely valuable resource for readers.

Keep up the fine work on the magazine!

Gary Rieck, Hampshire, Tenn.

Editor’s reply: Thanks for the feedback, Gary.

Fortunately, we now have an excellent answer to

your request with the recent launch of the new

IRA Center on Fidelity.com, where you can find

the information you are looking for. Please visit

Fidelity.com/IRA or call 1.800.FIDELITY.

Tax information contained herein is not intended or

written to be used, and it should not be used, by taxpayers for the purposes of avoiding penalties. The tax

information and any estate planning information herein

is provided for informational and educational purposes

only, and should not be construed as legal or tax advice.

Fidelity does not provide legal or tax advice. Fidelity cannot guarantee that such information is accurate, complete,

or timely. Laws of a particular state or laws that may be

applicable to a particular situation may have an impact

on the applicability, accuracy, or completeness of such

information. Federal and state laws and regulations are

complex and are subject to change. Changes in such laws

and regulations may have a material impact on pre- and/or

after-tax investment results. Fidelity makes no warranties

with regard to such information or results obtained by its

use. Fidelity disclaims any liability arising out of your use

of, or any position taken in reliance on, such information.

Always consult an attorney or tax professional regarding

your specific legal or tax situation.

The mention of individual securities is for informational purposes only and should not be construed as a recommendation

for any security.

The third-party trademarks and service marks appearing herein

are the property of their respective owners. All other trademarks

and service marks appearing herein are the property of FMR LLC

or its affiliated companies.

Brokerage products and services discussed in this publication are

available through Fidelity Brokerage Services, Member NYSE,

SIPC, 100 Summer St., Boston, MA 02110. Fidelity mutual

funds are distributed by Fidelity Distributors Corporation, 82

Devonshire St., Boston, MA 02109. Fidelity Retirement Reserves

(NRR-96100), Fidelity Income Advantage (FVIA-92100 and

FVIA-99100), and term insurance (FTL-96200 and FTL-99200)

are issued by Fidelity Investments Life Insurance Company. For

New York residents, Retirement Reserves, Income Advantage, and

term insurance are issued by Empire Fidelity Investments Life

Insurance Company, New York, N.Y. Fidelity Brokerage Services

and Fidelity Insurance Agency, Inc., are the distributors.

contents

FEBRUARY 2008

Exclusively for

Pr ivate Access Clients

Departments

SECTOR DYNAMICS

11 Elections and the Markets

Read why presidential election years

typically yield strong results.

16

SELECT PORTFOLIOS UPDATE

12 Industrial-Strength Potential

Why the Industrial sector may offer some of

today’s most vibrant investment opportunities.

WASHINGTON WATCH

15 Late-Breaking Tax Relief

4

A review of the reforms that may benefit

investors in 2007 and beyond.

TRADING STOCKS

8

16 Order Protection

for Your Portfolio

Learn how stop-loss and stop-limit

orders can protect you from losses.

Features

FOCUS ON FUNDS

4 Taking a World View

18 Balancing Act

Fidelity Balanced Fund may help

steady your portfolio when the

markets are shaky.

We asked three experts how globalization is affecting both the

economy and your portfolio.

8 Blending Family Values Into

an Estate Plan

Focus on Fidelity

2

Families with children from previous marriages face unique

challenges when it comes to estate planning. Learn how to

avoid the pitfalls and find possible solutions.

Get the most out of charitable giving; wealthy investor survey results;

and Fidelity debuts a new fee

schedule for bond trading.

P1

Fidelity Online and Fidelity AnywhereSM

ON THE COVER: MASTERFILE

LOG ON TO FIDELITY ANYWHERE* FROM YOUR MOBILE

DEVICE TO ACCESS:

• Market Updates • Quotes & Watch lists

• Accounts & Trade • Order Status & Account History

*For more information please visit Fidelity.com/wireless.

A08-FP1-002 TOC REV.indd 1

UPDATE

FIDELITY MUTUAL

FUND PERFORMANCE

Total return information for Fidelity

mutual funds and 529 college savings

plans, through Dec. 31, 2007.

ADDRESS CHANGES?

Fidelity+ is sent to the address of record on

your account. Changing your address for

Fidelity+ will also change where your account

information is sent. To change your address

online, go to Fidelity.com/goto/move. Or call

1.800.544.5704 to speak with your Private

Access Account Executive. Please allow up to

two issues of the magazine for the change to

take effect.

1/15/08 9:06:49 PM

®

News About Fidelity Products and Services

update

TAX-EFFICIENT GIVING

Maximize Your Charitable Giving in 2008

Americans are known the world

over as a generous people. In

fact, 83% of Americans give

annually to charity,1 with the

vast majority of all charitable

donations given in the form of

cash (74% of all donations).

But, a recent Fidelity Investments® report, Smart Giving:

Maximizing Your Charitable

Dollars Through Donations of

Appreciated Stocks and Mutual

Funds, reveals there is a more taxefficient way of giving that could

help millions of American households sustain—and perhaps

increase—their giving.

Fidelity reports that 10 million

to 20 million American households have the potential to realize

significant additional tax savings

by donating securities with longterm appreciation—such as

stocks, bonds, and mutual

funds—to a public charity or to a

public charity with a donoradvised fund program, instead of

giving cash. These savings are over and above the savings donors receive from lowering their income

taxes as a result of making the donation.

For more information, visit Fidelity.com/charitable.

1. A 2006 online survey of 2,939 U.S. adults conducted by Harris Interactive® from December 4 through December 6, 2006, for The Wall Street Journal Online.

CORBIS

The Fidelity Research Institute (FRI) is a Fidelity Investments organization. Although FRI is affiliated with Fidelity Brokerage Services, FRI is not engaged in the business of banking or acting as

broker-dealer, investment advisor, deposit broker, financial planner, credit counselor, or other advisor to you.

2 FIDELITY+ FEBRUARY 2008

A08-FP1-002 Update2.indd 1

1.800.544.5704

1/5/08 9:29:50 AM

WEALTH MANAGEMENT

Study: HNW Investors

Seek Advice and Service

Fidelity surveyed more than 2,500

wealthy households to find out exactly

what investors are looking for when

seeking the help of an advisor.1

According to the study, one of the

biggest reasons investors turn to an

independent advisor is for objective

recommendations on investments

(68%). Investors also said they look to

advisors for more personalized service

(58%), as well as access to unique

products and services (29%).

Whatever your investing needs

may be, Fidelity can help. By talking

to your Fidelity Representative or calling

your local Fidelity

Investor Center, we

can meet with you to

understand your

needs and help you

find the best solutions

for your portfolio,

including introducing you to an advisor in your area. Our network of

advisors can complement Fidelity’s

services by offering specialized services such as in-depth estate and tax

PRICING CUT

Fidelity Slashes Secondary

Bond Trade Concessions

Fidelity continues its push to simplify and make the bond-buying process

more affordable with the following concession schedule for bond trading:

planning, and specific investment

recommendations.

Advisors in Fidelity’s network are

prescreened for their investment experience, size, stability, and integrity.

What’s more, Fidelity continually

monitors these firms to help

ensure that you receive the high

quality of service you deserve.

For more information,

contact your Private Access

Account Executive at

1.800.544.5704 or visit

Fidelity.com/advice.

1. Fidelity commissioned a survey of U.S.

households with investable assets of at least

$1 million, excluding retirement accounts

and real estate holdings. The research analyzed millionaires’ investment attitudes and

behaviors on a variety of topics, including

financial concerns, use of a financial advisor,

and outlook for the economy. The survey,

which did not identify Fidelity as the sponsor,

was conducted by Burke Inc., an independent

firm that has been conducting research since

1931. The insight in this report is directly

from the analysis of the survey.

CORBIS

For detailed information regarding Fidelity’s new fixed income fee

schedule, visit Fidelity.com/newbondpricing.

Although bonds generally present less short-term risk and volatility than stocks, bonds do entail interest rate risk (as interest rates

rise, bond prices usually fall, and vice versa) and the risk of default, or the risk that an issuer will be unable to make income or

principal payments. Additionally, bonds and short-term investments entail greater inflation risk, or the risk that the return of an

investment will not keep up with increases in the prices of goods and services, than do stocks.

FIDELITY.COM

A08-FP1-002 Update2REV.indd 3

Conducted in December 2006, the survey received

completed responses from 2,507 U.S. households

and has a margin of error of ±2%.

Advice is provided by independent registered

investment advisors. The advisor charges fee-based,

asset based, or flat-rate investment advisory service

fees (which may include hourly fees).

Fidelity Brokerage Services, Member NYSE, SIPC.

FEBRUARY 2008 FIDELITY+ 3

1/9/08 10:38:01 PM

Taking a Wo

BRUCE

JOHNSTONE

WILFRED

CHILANGWA, JR.

MARK

YOCKEY

4 FIDELITY+ FEBRUARY 2008

A08-FP1-002 Feature1.indd 4

1.800.544.5704

1/11/08 1:30:45 AM

World View

Three experts examine globalization’s impact on the economy

and your portfolio. BY RUSSELL WILD

EVAN RICHMAN; JAY WATSON (YOCKEY)

C

hances are good that

the shirt and pants

you are wearing right

now were assembled

on another continent,

as were the chair you’re sitting in

and the television in your living

room. The fruit you nibbled for

breakfast may have come from

another country, and the wine and

cheese you’ll enjoy at the dinner

party Saturday night may have originated in yet another.

While globalization has greatly

affected our consumption habits,

some might argue that it has had a

more profound effect on our investments. Fidelity+ recently asked three

experts for their views on globalization,

its impact on our economy and financial markets, and whether adopting a

more worldwide view might help bolster U.S. investors’ long-term returns.

What follows are the opinions of:

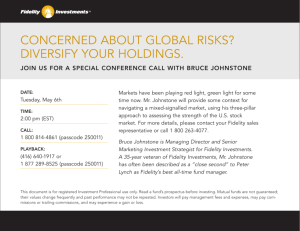

• Bruce Johnstone, CFA,® a

managing director and senior marketing investment strategist for

Fidelity Investments;

• Mark Yockey, portfolio manager

for the Artisan International Fund

and the Artisan International Small

Cap Fund; and

• Wilfred Chilangwa, Jr., CFA,®

an international portfolio manager

for Fidelity Strategic Advisers, Inc.1

FIDELITY.COM

A08-FP1-002 Feature1REV.indd 5

Fidelity+: We hear the term “globalization” a great deal these days––

how the world’s people and economies are becoming increasingly

interconnected. Is there any way to actually measure or quantify the

phenomenon?

Yockey: Absolutely. Statistics gathered by the World Trade Organization

tell us, for example, that from 1993 to 2005, world merchandise exports

grew from about $3.7 trillion to roughly $10.2 trillion. From 1995 to

2005, global capital flow rose from less than $2 trillion to over $6 trillion.

Johnstone: As those figures clearly indicate, international trade is

exploding, as is the flow of capital among nations. But that’s only part

of the globalization picture. We’re also seeing a sharp increase in the outsourcing of labor. And, of course, the Internet has revolutionized global

communications.

Fidelity+: For the U.S.-based portfolio holder, where has globalization

had the biggest impact, and what might increased globalization

mean in the future?

Johnstone: The impact has been huge. Of the collective earnings of the

S&P 500® Index 10 years ago, 30% was derived from activity outside

the United States; that figure is now 40%. Even if you hold nothing but

U.S. stocks, your portfolio returns are very much linked to foreign

economies.

Chilangwa: And largely for that reason, globalization has affected the way

investors must analyze opportunities. For the U.S-based portfolio holder,

the biggest impact of globalization is the fact that the performance of

U.S.-listed companies, as Bruce just pointed out, is increasingly influenced

by what happens overseas. For large U.S. companies in particular, more of

their earnings are derived from business overseas.

Yockey: Regardless of where you are based, globalization is creating a

higher level of competitiveness in many markets. This is fostering longoverdue fiscal reform, labor reform, and corporate consolidation. All of

those may positively impact corporate profitability, earnings growth,

and returns to shareholders. I believe that globalization is good for

investors.

FEBRUARY 2008 FIDELITY+ 5

1/15/08 9:16:58 PM

Even if

you hold

nothing

but U.S.

stocks, your

portfolio

returns are

very much

linked to

foreign

economies.”

— BRUCE

JOHNSTONE

As a result

of lessons

learned from

a decade

ago,

emerging

markets

are in

much

better

fundamental

shape

today.”

Regardless

of where you

are based,

globalization

is creating

a higher

level of

competitiveness in

many

markets.”

— MARK YOCKEY

— WILFRED

CHILANGWA, JR.

Fidelity+: Some investment gurus have argued that

increased globalization is leading to greater correlation

between the U.S. and overseas stock markets, lessening

the power of international diversification to help protect a portfolio. In other words, when U.S. stocks falter,

foreign stocks, thanks to globalization, are likely to falter as well. How justified is this argument?

Yockey: There is some support for that argument, but I

believe there is also significant evidence that the rest of

the world is decoupling from the United States. As wealth

rises in countries around the world and positive reform

continues, foreign economies are becoming more reliant

on domestic demand, versus exports, as a source of

growth. As a result, if consumption in the United States

were to trail off, there may be a greater likelihood that

foreign economies could sustain growth on their own.

Johnstone: I’ll add that correlation can be measured in

different ways. Look at return figures from the past five

years. All the world markets have gone in the same

direction—up, up, up. For example, the U.S. market, as

measured by the S&P 500® Index, returned 121% over

that period (10/9/02 to 10/9/07) in U.S. dollars and total

returns. For the same period, the MSCI EAFE (Europe,

Australasia, Far East) Index returned 165%, and the

MSCI Emerging Markets Index returned 441%. Are they

correlated in the same direction? Yes. But when you look

at the degree of change, there’s plenty of diversification.

Yockey: When the global economy is firing on all cylinders, as it has been, it’s reasonable to expect correlation

among global stock markets. However, when economic

growth diverges—and some economies are growing and

others are not—I would expect there to be lower correlation among markets. Those economies that can generate

a larger portion of their growth from domestic sources

may stay strong while others falter.

6 FIDELITY+ FEBRUARY 2008

A08-FP1-002 Feature1.indd 6

Fidelity+: Are investments in any particular area of

the world seemingly able to maintain their historical

lack of correlation to U.S. markets?

Johnstone: Emerging markets, so far. But the bears say

you don’t want to own them in a down market. Sooner

or later, we will see.

Chilangwa: Rather than focus on identifying the non-U.S.

area that experienced the least correlation to U.S. stocks

over the recent past, it is important for investors to be forward looking and build a well-diversified portfolio of

international funds that complements their U.S. holdings.

International markets are influenced by many moving

parts, such as regions, currencies, styles, and market caps.

A single international fund is unlikely to capture the benefits of being diversified across all these areas.

Fidelity+: Emerging-market stocks, regardless of their

correlation to the U.S. market, have had spectacular

returns in recent years. To what do you attribute this

enormous appreciation, and do you anticipate that it

will continue?

Yockey: I attribute most of the growth in emerging-market

stocks to the incredible progress made by these nations. For

example, over the last 10 years, U.S. gross domestic product

growth has averaged somewhere between 2% to 3% a year.

Over the same period, China’s economic growth has averaged 8% to 9%. Although it is hard to predict the future

pace of growth in emerging markets, I feel comfortable

with the assumption that it may continue to be greater than

that of the United States.

Johnstone: I certainly agree that the returns on emerging-market stocks have much to do with economic growth,

but it is important to remember that the valuations on

these stocks five years ago––when this incredible growth

began––were very low. Now, in some countries, such as

1.800.544.5704

1/11/08 1:31:36 AM

China and India, that is no longer true. Indeed, valuations

on them may be higher than those on countries in the

developed world. Still, I expect that overall emerging-market returns, even in China and India, will be handsome in

the long run.

Chilangwa: The growth should continue, although investors are likely to experience bumps along the way.

Fidelity+: Bumps indeed. Just how much risk is

involved in investing in these countries?

Chilangwa: A decade ago, emerging markets experienced

a severe crisis. This was caused by over-leverage financed

by external borrowing, overinvestment that led to a

decline in profitability, and overvalued currencies supported by fixed exchange rates. As a result of lessons

learned from a decade ago, emerging markets are in

much better fundamental shape today. They are net providers of capital to the rest of the world, inflation is low,

their finances are in great shape, their currencies are

strong and operate in floating-exchange-rate regimes,

and profitability is high. However, these markets are still

in a state of transition, and that brings unpredictability.

They are also extremely vulnerable to short-term speculation, panic, and knee-jerk reactions.

Yockey: The risks of investing in an emerging market

can vary widely by country. Political risk is a factor, as

are a number of other macroeconomic risks, such as

exchange-rate fluctuation, high levels of inflation, and

even ongoing economic reforms.

Johnstone: Risk is greater in the short term, but in the

long term emerging markets are less risky than they used

to be, compared to the U.S. market. The United States is

the one with institutions that have leveraged up and

invested in bad debt. We’re the ones with the poor national balance sheets, with the Federal Reserve constantly

jumping in to shore up the stock market!

Fidelity+: To what degree does the recent outperformance of foreign markets reflect the drop in the U.S.

dollar vis-à-vis other currencies? What expectation do

you have for future exchange rates?

Johnstone: Will that drop continue? Well, if you look at

purchasing-power parity, U.S. goods and services are

starting to look cheap, so you’d think the dollar would

have to bottom out soon. On the other hand, to the

extent that we are running both a federal deficit and a

trade deficit, that would argue for continued dollar weakness. On balance, I wouldn’t be surprised if the U.S.

dollar continues to weaken slowly in the coming years,

not so much against the euro and yen, but more so

against the currencies of emerging-market nations.

FIDELITY.COM

A08-FP1-002 Feature1.indd 7

Fidelity+: For the typical U.S. investor––if there

is such an individual––how might his or her stock

portfolio be reasonably divided between U.S. and

foreign investments? And of that foreign component, what might be a reasonable allocation to

emerging-market stocks?

Chilangwa: With more than half the world’s market

capitalization and more than two-thirds of listed

securities domiciled in non-U.S. markets that are

generally cheaper and offer superior growth potential,

investors’ portfolios should have a much larger allocation to international stocks than is typically the case.

Exactly how much depends on each individual investor’s

risk-and-return requirements.

Johnstone: I look at the world from a 21st-century point

of view. The United States accounts for only 42% of the

world stock market. If you were going to simply index—

which makes perfect sense—you’d have 58% of your

portfolio in non-U.S. holdings.2 And for a very long-term

portfolio—25 years or so—you’d have half of that in

emerging-market stocks. For shorter-term periods, you

need to consider volatility and adjust to a level at which

you can feel comfortable. •

Before investing, consider the funds’ investment objectives,

risks, charges, and expenses. Contact Fidelity for a prospectus

containing this information. Read it carefully.

Unless otherwise noted, the opinions of the authors provided are not necessarily those of Fidelity

Investments. Views and opinions are subject to change at any time based on market and other

conditions.

1. Strategic Advisers, Inc., is a registered investment adviser and a Fidelity Investments company.

2. Fidelity Management & Research Company

S&P 500 is a registered service mark of the McGraw-Hill Companies, Inc., and has been licensed

for use by Fidelity Distributors Corporation and its affiliates. It is an unmanaged market-capitalization weighted index of 500 common stocks chosen for market size, liquidity, and industry group

representation to represent U.S. equity performance.

The Morgan Stanley Capital International Emerging Markets Index is an unmanaged, market capitalization–weighted index of equity securities of companies domiciled in various countries. The

index is designed to represent the performance of emerging stock markets throughout the world.

The Morgan Stanley Capital International Europe, Australasia, Far East Index is an unmanaged

market-capitalization weighted index that is designed to represent the performance of developed stock markets outside the United States and Canada.

Foreign investments involve greater risk than U.S. investments, including political, economic,

currency fluctuation risk, all of which may be magnified in emerging markets.

Diversification does not ensure a profit or guarantee against loss.

Stock values fluctuate in response to the activities of individual companies and general market

and economic conditions.

LEARN MORE

To learn more about international investing

with Fidelity, visit Fidelity.com/international

or call your Private Access Account Executive

at 1.800.544.5704.

FEBRUARY 2008 FIDELITY+ 7

1/11/08 1:31:49 AM

MORE THAN 26 YEARS

AGO, GEORGE AND LINDA

STEVENSON, of Evanston,

Illinois, created a new life

together, each marrying for the

second time and each bringing

two daughters from a previous

marriage to their newly

formed family. While George

and Linda’s immediate plan

was to create a happy and harmonious new household, as

their life together grew both in

terms of family (they now have

nine grandchildren) and financial assets, they focused on

creating an estate plan that was

fair and equitable to both sets

of children.

“Remarriage can be difficult

for everyone, and Linda and I

worked hard to ensure that

our daughters understood that

we were committed to building a life together,” says George

Linda and George

Stevenson, 65 and

68, respectively,

were able to create

a blended family

built on harmony,

respect, trust, and

fairness.

Blending Family Values

Into an Estate Plan

The blended family—created when remarriages form a new family

with children from both partners—has unique estate planning needs

and challenges. BY GRACE W. WEINSTEIN

8 FIDELITY+ FEBRUARY 2008

A08-FP1-002 Feature2REV3.indd 8

1.800.544.5704

1/16/08 9:36:57 PM

Stevenson. “That meant everyone

would be treated equally. All these

years later, we have truly built a blended

family that’s based on harmony,

respect, trust, and fairness. My daughters’ children now play with Linda’s

daughters’ children. We vacation

together and spend many holidays

together. The estate planning just seems

states each partner’s financial plans in

the event of death or divorce. “A prenuptial agreement can minimize

dissension,” says Steven J. Fromm, an

estate planning attorney in Philadelphia, Pennsylvania.

If it’s too late for a “prenup,” you

might consider a postnuptial agreement. These arrangements seek to

Trusting in Trusts

ne of the most common estate

planning vehicles for blended

families—a qualified terminable

interest property trust (known as a

“QTIP”)—protects both the surviving spouse and the children of the

first marriage.

With a QTIP, the surviving spouse

O

We vacation together and spend many holidays together. The estate

planning just seems a natural extension of this positive family environment we have created.” — GEORGE STEVENSON

ANDY GOODWIN

a natural extension of this positive

family environment we have created.”

While most blended families may

share similar goals, achieving them

can be another story. As estate planning attorney Martin Shenkman, of

Paramus, New Jersey, puts it, “The

Brady Bunch is not a reality show.

There are always issues, even if they

are hidden below the surface. When

one spouse dies, that’s when there’s a

possibility all the problems will come

crawling out.”

The Stevensons are not alone in

facing these challenges. The Stepfamily Foundation, a private company

that specializes in counseling stepfamilies, estimates that more than

half of U.S. families are remarried or

“re-coupled.” If you and your spouse

want to help ensure harmony among

your blended family members after

you are gone, you need to take the

appropriate estate planning steps

now. These generally include a

prenuptial or postnuptial agreement,

properly drawn trusts, life insurance,

and durable powers of attorney.

Till Death Do Us Part

efore saying “I do,” people who

are on their second or third marriages may first want to draft a

prenuptial agreement that clearly

B

FIDELITY.COM

A08-FP1-002 Feature2REV2.indd 9

accomplish similar goals by spelling

out how assets brought to the marriage and assets accumulated during

the marriage will be treated. There are,

however, some limitations. In most

states, a surviving spouse has a statutory right to a portion of the estate.

When entering into either a

prenuptial or a postnuptial agreement, each partner should have an

independent attorney, Fromm says.

Each should be completely open and

disclose both financial and family

details. “The attorney needs to know

if there were three kids from a first

marriage,” Fromm notes.

Like many remarried couples, the

Stevensons kept the property that

each spouse brought to the marriage

in their own names. George’s property

is held in a trust, to go to his children

upon his death. Everything accumulated during the marriage will go to

the surviving spouse and then, at the

survivor’s death, assets will be divided

equally among the four children.

Linda initially brought a larger

income to the marriage but fewer

assets. If Linda, who is 65, finds that

she needs more money—she hails

from a long-lived family, with a

grandfather who lived to 103—she

can sell the family vacation home

and invest the proceeds.

receives the income generated by the

trust assets during life, but has no say

in who gets the remaining balance at

death. That decision is made by the

trust’s grantor, who typically leaves

the balance to his or her own children from an earlier marriage.

Classic QTIPs, however, contain an

inherent conflict: In the interests of

the surviving spouse, trust assets are

Avoid These

Common Pitfalls

for Blended Families

X Skipping a prenuptial or postnuptial agreement, or failing to use

separate attorneys when drafting

agreements

X Neglecting to execute a durable

power of attorney that names a

trusted agent

X Failing to change beneficiary designations on retirement accounts

and insurance policies, so that

an ex-spouse is the unintended

recipient of proceeds

X Avoiding full disclosure of assets

and family issues to each other

and to estate planning attorneys

X Assuming that everyone will be

ethical and will get along, with

no hard feelings

FEBRUARY 2008 FIDELITY+ 9

1/12/08 7:26:33 AM

The Power of a Power of Attorney

WHETHER YOU’RE MARRIED OR SINGLE, you should consider executing a durable power of attorney that names someone to act on your behalf should you

become incapacitated and unable to manage your own financial affairs. “Most

people,” Shenkman says, “focus on wills, trusts, and divvying up assets and

forget this basic legal document, wreaking havoc on the best plans.”

For blended families, the critical issue revolves around who is named as

each partner’s agent. Naming a new spouse assumes that he or she will do

what’s right for the children. However, an unrestricted power of attorney can

be dangerous. Consider what could happen when the proceeds of an insurance policy are meant for one spouse’s children, while the other spouse gets

the house. If the second spouse holds a power of attorney, he or she could

change the beneficiary designation on the insurance policy. Similarly, if you

name an adult child from a first marriage as agent, he or she would be in a

position to take advantage of the second spouse. To resolve this dilemma,

consider either limiting the agent’s powers or choosing an independent party

as agent, such as a trusted friend or associate.

usually invested to produce income.

This may be at odds with the longterm interests of the children, who

may be looking to invest for growth,

according to Shenkman.

Shenkman’s solution to this conflict is a “unitrust,” which allows

assets to be invested for total return,

with a percentage of the total trust

assets paid out each year to the surviving spouse. Because the payout

rises as the value of the assets in the

trust increases, “the survivor will have

an inflation hedge on income and the

kids will get a meaningful sum of

money at the end,” Shenkman says.

Structuring it this way “takes the

judgment out of who gets what,” and

is fair to both the surviving spouse

and the children. Drawn properly, the

unitrust can also qualify as a QTIP.

When a Spouse Is

Significantly Younger

n some blended families, a large

age gap can exist between the partners. In some instances, a second

spouse may be decades younger than

the first one—not much older, if at

all, than the adult children from the

first marriage. This age gap poses

I

10 FIDELITY+ FEBRUARY 2008

A08-FP1-002 Feature2REV.indd 10

potential issues when it comes to

estate planning.

“It sets up a terrible dynamic in

families when the children of the

first marriage are waiting for the

stepparent to die to get any benefit,”

says Mary H. Schmidt, an estate and

family law attorney with Packenham,

Schmidt & Federico in Boston.

Life insurance may provide a solution, Schmidt says. The older spouse

can buy life insurance for the children

and leave other assets to the new

spouse. This strategy can be particularly effective in resolving problems

involving ownership of real estate. For

example, consider a couple that purchases a house together during a

second marriage. Dividing that property and putting it into a trust might

be impractical, especially when the surviving spouse wants to continue living

in the home. One solution is to leave

the house to the surviving spouse and

an equivalent amount to the children

in the form of life insurance. The policy can be owned outright by the

children or by an irrevocable life insurance trust. This enables the surviving

spouse and the children to inherit

roughly the same amount of assets.

Clarity Is Key

ne way to reduce potential

estate planning problems for

blended families is to be clear about

your intentions. Schmidt suggests

making a videotape in which you

speak to members of your blended

family, telling them that you tried to

balance everyone’s interests, and

how you went about doing so. A

signed letter of explanation can

serve the same purpose.

George and Linda Stevenson, who

will celebrate 30 years of marriage in

a few years, want their children to

know that they have done their best

to treat all of them as fairly as possible. They have tried to be transparent

by sharing information with their

daughters. When they helped one

daughter with a down payment on a

house last year, they told the others

that a similar amount would be

available to them if they needed it.

“If it isn’t evened out during our

lives, we would rely on the kids to

even it out in our estate,” says George,

who is 68. “There’s a lot of trust and

faith in all of this.” While “trust and

faith” are essential, attorneys also suggest that a carefully crafted estate plan

is necessary to meet your objectives

and keep family harmony. •

O

The estate planning information contained herein is

general in nature, is provided for informational purposes only, and should not be construed as legal or tax

advice. Fidelity does not provide legal or tax advice.

Fidelity cannot guarantee that such information is

accurate, complete, or timely. Laws of a particular

state or laws which may be applicable to a particular

situation may have an impact on the applicability,

accuracy, or completeness of such information.

Federal and state laws and regulations are complex

and are subject to change.

Always consult an attorney or tax professional regarding your specific legal or tax situation.

LEARN MORE

For more information, visit

the Stepfamily Foundation

at Stepfamily.org.

1.800.544.5704

1/9/08 10:39:41 PM

FIDELITY® MAGELLAN® FUND

Quarterly Market and

Fund Performance Update

has reopened to new investors. Visit

Fidelity.com/MagellanFund to learn more.

For the quarter ending December 31, 2007

MARKET RECAP: FOURTH QUARTER 2007

Subprime Mortgage Problems Weigh on Stocks

Average Annual Total Return %

(as of 12/31/07)

By William Ebsworth, Chief Investment Officer, Strategic Advisers, Inc.

12.8%

S

tocks gave back some of their gains from earlier in 2007 during an

extremely volatile fourth quarter, as both U.S. and international stock

markets declined. The financial sector absorbed the brunt of the sell

off, with securities tied to subprime mortgages suffering significant declines.

Furthermore, declining home prices and concerns about the potential

for a slowdown in consumer spending reduced 2008 growth expectations

To help ease the credit crunch, the Federal

Open Market Committee cut the target for

the federal funds rate 25 basis points on two

occasions, reducing it to 4.25%. Other central

banks across the world followed suit by lowering their benchmark interest rates.

U.S. Equity

U.S. equity markets generally registered negative returns for the fourth quarter, as the S&P

500® Index declined 3.3%. Financial stocks,

particularly banks and real estate companies,

suffered steep losses. Small-cap value stocks,

as measured by the Russell 2000® Value Index,

were the worst performers, falling 7.3% during the period. Large-cap growth stocks, as

measured by the Russell 1000® Growth Index,

were the best performers, declining only 0.8%.

International Equities

While international stocks declined 1.7%,

as measured by MSCI EAFE® Index, they

again managed to outperform U.S. stocks.

European markets, which account for almost

70% of the MSCI EAFE Index, fell just 0.4%

(MSCI Europe Index) amid slowing earnings

growth and uncertainty regarding consumer

spending. The Japanese market (MSCI Japan)

lagged other regions, dropping nearly 6.1%,

as the economy there continued to languish

amid a poorly performing banking sector.

On a more positive note, emerging markets,

FIDELITY.COM

A08-FI1-002 MrktRecap3REV.indd P1

8.6%

–3.3%

3 mos.

1 yr.

r

3 yr.

r

5 yr.

r

10 yr.

r

S&P 500®

as measured by the MSCI Emerging Markets

Index, managed to gain 3.7% for the quarter,

driven by exceptionally strong performance in

India and Russia.

Fixed Income

Investment-grade bonds easily outperformed

riskier high-yield bonds, as subprime and

credit concerns persisted. The Lehman

Brothers U.S. Aggregate Bond Index gained

3.0%, outpacing the Merrill Lynch U.S. High

Yield Master II Constrained Index, which

declined nearly 1.0%. Similar to the third

quarter, many investors continued to gravitate

toward high-grade investments with greater

liquidity, such as U.S. Treasuries, while eschewing higher-yielding bonds that carry more risk.

5.9%

5.5%

22.1%

17.3%

11.6%

9.0%

–1.7%

3 mos.

1 yr.

r

3 yr.

r

5 yr.

r

10 yr.

r

MSCI EAFE® (G)

7.0%

3.0%

3 mos.

1 yr.

r

4.6%

4.4%

3 yr.

r

5 yr.

r

6.0%

10 yr.

r

Lehman Brothers

Aggregate Bond Index

10.6%

Outlook

The ongoing fallout from the subprime mortgage mess has clouded the outlook for the

U.S. and global economies in 2008. As always,

it is difficult to predict in which direction the

markets will move over the short term. This

underscores the importance of taking a longterm approach by maintaining a diversified

portfolio that suits your risk tolerance.

5.6%

5.3%

–1.0%

2.5%

3 mos.

1 yr.

r

3 yr.

r

5 yr.

r

10 yr.

r

Merrill LLynch U.S. High Yield

Master II Constrained Index

16.2%

7.1%

6.8%

Strategic Advisers, Inc., is a registered investment adviser and a Fidelity

Investments company.

See footnote 2 on page P12 for all index definitions. You cannot invest

directly in an index.

The performance data represent past performance, which does not

guarantee future results.

–4.6% –1.6%

3 mos.

1 yr.

r

3 yr.

r

5 yr.

r

10 yr.

r

Russell 2000®

FIDELITY MUTUAL FUND PERFORMANCE THROUGH 12/31/2007 P1

1/18/08 5:52:36 PM

Quarterly Market and Fund Performance Update

For the quarter ending December 31, 2007

Approaches to Diversification:

Six Asset Allocation Strategies

How you invest in different asset classes should be based on an investment strategy

in line with your current circumstances and your short- and long-term goals. The six

target asset mixes shown below are for illustrative purposes only and should not be

considered investment advice. You should choose your own target asset mix based on

your particular time horizon, risk tolerance, and financial situation. Remember, you

may change how your account is invested. Be sure to review your portfolio periodically to make sure your investments are still consistent with your goals.

ASSET ALLOCATION DEFINITIONS

Short-Term: Seeks to preserve your capital and can accept

the lowest returns in exchange for price stability.

Conservative: Seeks to minimize fluctuation in market

values by taking an income-oriented approach with some

potential for capital appreciation.

Balanced: Seeks the potential for capital appreciation and some

income and can withstand moderate fluctuation in market value.

Growth: Has a preference for growth and can withstand

significant fluctuation in market value.

Aggressive Growth: Seeks aggressive growth and can tolerate

wide fluctuation in market values, especially over the short term.

Most Aggressive: Seeks very aggressive growth and can

tolerate very wide fluctuation in market values, especially over

the short term.

HIGH

Most Aggressive

Aggressive Growth

Growth

5%

Balanced

RETURN POTENTIAL

Conservative

30%

20%

80%

70%

60%

45%

40%

15%

25%

10%

20%

15%

10%

5%

Short-Term

50%

100%

KEY

LOW

Domestic Stocks

Foreign Stocks

Bonds

Cash

HIGH

RISK

R A N G E O F A N N UA L R E T U R N S F O R E AC H A S S E T M I X OV E R T H E P E R I O D O F 1 9 2 6 – 2 0 0 6

Highest

one-year return

Lowest

one-year return

Highest

five-year return

Lowest

five-year return

Average return

Short-Term

Conservative

Balanced

Growth

Aggressive Growth

Most Aggressive

15.20%

31.06%

76.57%

109.55%

136.07%

162.89%

–0.04%

–17.67%

–40.64%

–52.92%

–60.78%

–67.56%

11.13%

16.79%

22.06%

27.23%

31.91%

36.12%

0.06%

–0.37%

–6.18%

–10.43%

–13.78%

–17.36%

3.72%

6.14%

8.18%

9.25%

9.98%

10.54%

Generally, among asset classes, stocks may present more short-term risk and volatility than bonds or short-term instruments but may provide greater potential return over the long term. Although bonds generally present less short-term risk and volatility than stocks, bonds do entail interest rate risk (as interest rates rise, bond prices usually fall, and vice versa) and the risk of default, or the risk that an issuer will

be unable to make income or principal payments. Additionally, bonds and short-term investments entail greater inflation risk, or the risk that the return of an investment will not keep up with increases in the

prices of goods and services, than stocks. Finally, foreign investments, especially those in emerging markets, involve greater risk and may offer greater potential return than U.S. investments.

Data source: Ibbotson Associates, 2007 (1926–2006). Past performance is no guarantee of future results. Returns include the reinvestment of dividends and other earnings. Charts are for illustrative

purposes only and do not represent actual or implied performance of any investment option.

Stocks are represented by the Standard & Poor’s 500 Index (S&P 500® Index). The S&P 500® Index is a registered service mark of The McGraw-Hill Companies, Inc., and is a widely recognized, unmanaged index of 500 U.S. common stocks. Bonds are represented by the U.S. Intermediate-Term Government Bond Index, which is an unmanaged index that includes the reinvestment of interest income.

Short-term instruments are represented by U.S. 30-Day Treasury bills, which are backed by the full faith and credit of the U.S. government. It is not possible to invest directly in an index. Stock prices are

more volatile than those of other securities. Government bonds and corporate bonds have more moderate short-term price fluctuation than stocks but provide lower potential long-term returns. U.S. 30Day Treasury bills maintain a stable value (if held to maturity), but returns are generally only slightly above the inflation rate. Foreign stocks are represented by the Morgan Stanley Capital International

Europe, Australasia, Far East Index for the period from 1970 to the last calendar year. Foreign stocks prior to 1970 are represented by the S&P 500® Index. The purpose of the target asset mixes is to show

how target asset mixes may be created with different risk and return characteristics to help meet an investor’s goals. You should choose your own investments based on your particular objectives and

situation. Remember that you may change how your account is invested. Be sure to review your decisions periodically to make sure they are still consistent with your goals. These target asset mixes were

developed by Strategic Advisers, Inc., a registered investment adviser and Fidelity Investments company.

P2 FIDELITY MUTUAL FUND PERFORMANCE THROUGH 12/31/2007

A08-FI1-002 MrktRecapP2.indd 2

1.800.FIDELITY

1/17/08 8:37:19 PM

RetailPerfPages_4Q07

1/16/08

9:04 PM

Page 3

FIDELITY MUTUAL FUND PERFORMANCE

Quarter ending December 31, 2007

▲

Get Mutual Fund Performance Online

Looking to get mutual fund performance and the Market Recap closer to the quarter end?

Visit Fidelity.com/fidelityfundperformance.

This performance data represents past performance, which is no guarantee of future results. Investment return and principal value

of an investment or 529 plan will fluctuate; therefore, you may have a gain or loss when you sell your shares or units. Current

performance may be higher or lower than the performance data quoted. Please visit Fidelity.com/performance, Fidelity.com/college,

or call Fidelity for most recent month-end performance figures.

Domestic Stock Funds

Fund Name

Cumulative

Average Annual Total Return %

Total Return %

(as of 12/31/07)

(YTD as of 12/31/07) 1 Year

5 Year

10 Year/Life

Trading

Symbol

Fund

No.

Date of

Inception

FBCVX

FEQIX

FEQTX

FSLVX

FLVEX

01271

00023

00319

00708

01828

06/17/03

05/16/66

08/21/90

11/15/01

04/19/07

4.36

1.40

4.47

3.74

-4.20

4.36

1.40

4.47

3.74

——

——

13.19

12.61

14.91

——

FBMAX

FDEQX

FDGFX

FOHIX

FFIDX

FGRIX

FLCEX

FGRTX

FSMKX

FSMAX

FSTMX

FSTVX

FDSSX

FTXMX

FTRNX

01956

00315

00330

01846

00003

00027

01827

00361

00317

01519

00397

01520

00320

00343

00005

08/21/07

12/28/88

04/27/93

03/29/07

04/30/30

12/30/85

04/19/07

12/28/98

03/06/90

10/14/05

11/05/97

10/14/05

09/28/90

11/02/98

06/16/58

4.40

10.84

1.11

7.10

16.81

0.74

2.15

11.05

5.43

5.46

5.57

5.60

11.79

14.18

18.87

——

10.84

1.11

——

16.81

0.74

——

11.05

5.43

5.46

5.57

5.60

11.79

14.18

18.87

FBGRX

FDCAX

FCNTX

FEXPX

FFTYX

FNCMX

FTQGX

FDGRX

FDSVX

FDFFX

FSLGX

FLGEX

FLCSX

FMAGX

FOCPX

00312

00307

00022

00332

00500

01282

00333

00025

00339

00073

00763

01829

00338

00021

00093

12/31/87

11/26/86

05/17/67

10/04/94

09/17/93

09/25/03

11/12/96

01/17/83

03/31/98

03/25/83

11/15/01

04/19/07

06/22/95

05/02/63

12/31/84

11.83

6.86

19.78

15.29

12.63

10.50

17.03

19.89

26.84

29.54

2.06

3.40

13.09

18.83

26.14

FSMVX

FDVLX

00762 11/15/01

00039 12/01/78

2.66

2.21

Notes:

Expense

Ratio %13

Expense

Cap %

Turnover

Rate %8

Redemption

Fee (%/days)

12.339

6.70

6.97

9.119

-4.209

0.87

0.68

0.67

0.90

0.45

1.00ß

——

——

——

——

92

19

44

157

88

——

——

——

——

——

——

14.82

9.39

——

14.40

8.41

——

11.89

12.72

12.74

13.85

13.87

14.04

15.60

15.33

4.409

7.21

7.13

7.109

6.96

4.44

2.159

3.699

5.78

5.79

6.26

6.27

5.76

5.649

6.63

1.00

0.91

0.61

0.20

0.57

0.68

0.45

0.81

0.10

0.07

0.10

0.07

0.87

0.84

0.81

1.00ß

——

——

——

——

——

——

0.90ß

——

——

——

——

——

1.00ß

——

4

152

36

1

50

52

42

94

7

7

3

3

91

131

255

——

——

——

——

——

——

——

——

——

——

0.50/90

0.50/90

——

1.00/2 y

——

11.83

6.86

19.78

15.29

12.63

10.50

17.03

19.89

26.84

29.54

2.06

——

13.09

18.83

26.14

10.24

16.77

17.99

16.77

12.44

——

15.65

18.77

14.38

17.29

11.93

——

12.82

12.71

17.17

4.28

8.24

10.72

12.10

9.77

9.659

4.95

9.65

8.249

10.70

3.729

3.409

5.80

6.31

8.59

0.60

0.83

0.90

0.82

0.84

0.58

1.20

0.97

0.81

0.87

1.10

0.45

0.82

0.54

0.96

——

——

——

——

——

0.35Δ

1.00ß

——

——

——

1.00ß

——

——

——

——

87

135

67

47

236

17

343

46

199

187

481

47

117

42

121

——

——

——

0.75/30

——

0.75/90

——

——

——

——

——

——

——

——

——

2.66

2.21

16.80

16.98

11.919

10.12

0.84

0.70

——

——

199

44

0.75/30

——

Large Cap Value

.

.

.

.

.

.

.

.

.

.

.

.

Large Cap Blend

▼

CLOSED

▼

CLOSED

Blue Chip Value10

Equity-Income

Equity-Income II

Large Cap Value10

Large Cap Value Enhanced Index

Broad Market Opportunities

Disciplined Equity

Dividend Growth

Fidelity 100 Index Fund

Fidelity® Fund

Growth & Income Portfolio

Large Cap Core Enhanced Index

Mega Cap Stock

Spartan® 500 Index

Spartan® 500 Index21

Spartan® Total Market Index

Spartan® Total Market Index21

Stock Selector

Tax Managed Stock‡

Trend 32

(Formerly Growth & Income II Portfolio)

(Investor Class)

(Fidelity Advantage Class)

(Investor Class)

(Fidelity Advantage Class)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▼

CLOSED

▼

CLOSED

Large Cap Growth

Blue Chip Growth

Capital Appreciation

Contrafund®

Export and Multinational1

Fidelity Fifty®

Fidelity® Nasdaq Composite® Index

Focused Stock27

Growth Company

Growth Discovery32

Independence

Large Cap Growth

Large Cap Growth Enhanced Index

Large Cap Stock

Magellan®

OTC Portfolio11

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Mid Cap Value

Mid Cap Value10,14

Value10

.

.

.

‡ Return after taxes on distribution: 1 yr. 12.97%, 3 yr. 13.28%, 5 yr. 15.53%, 10 yr./Life of Fund 5.56%; Return after taxes on distributions and sale of fund

shares: 1 yr. 8.59%, 3 yr. 11.54%, 5 yr. 13.74%, 10 yr./Life of Fund 4.90%. Returns after taxes are calculated using the historical maximum federal individual marginal

income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through

tax-deferred arrangements such as IRAs or 401(k) plans. Return after taxes on distributions and sale of fund shares may exceed before-tax return as a result of an imputed

benefit received upon realization of tax losses. Tax-sensitive investing may not provide as high a return as other types of investing before consideration of federal income tax

consequences. Tax-sensitive investing can result in realized capital gains. You may have a gain or loss when you sell your shares.

FIDELITY.COM

FIDELITY MUTUAL FUND PERFORMANCE THROUGH 12/31/2007 P3

RetailPerfPages_4Q07

1/16/08

9:04 PM

Page 4

FIDELITY MUTUAL FUND PERFORMANCE

Quarter ending December 31, 2007

Domestic Stock Funds (continued from previous page)

Fund Name

Trading

Symbol

Fund

No.

Date of

Inception

FLVCX

FLPSX

FSEMX

FSEVX

FVDFX

FSLSX

00122

00316

00398

01521

00832

00014

12/19/00

12/27/89

11/05/97

10/14/05

12/10/02

12/31/83

FDEGX

FMEIX

FSMGX

FMCSX

FMILX

00324

02012

00793

00337

00300

FESCX

FSOPX

FSCRX

FSLCX

FCPVX

02011

01799

00384

00340

01389

FCPGX

FDSCX

Notes:

Cumulative

Average Annual Total Return %

Total Return %

(as of 12/31/07)

(YTD as of 12/31/07) 1 Year

5 Year

10 Year/Life

Expense

Ratio %13

Expense

Cap %

Turnover

Rate %8

Redemption

Fee (%/days)

▼

CLOSED

Mid Cap Blend

Leveraged Company Stock15

Low-Priced Stock11

Spartan® Extended Market Index

Spartan® Extended Market Index21

Value Discovery10

Value Strategies10,24,31

17.90

3.16

5.38

5.41

9.71

5.61

17.90

3.16

5.38

5.41

9.71

5.61

31.81

17.84

17.62

17.64

17.45

18.43

22.059

12.99

7.48

7.49

16.949

10.17

0.83

0.97

0.10

0.07

0.87

0.93

——

——

——

——

——

1.00ß

20

11

14

14

146

195

1.50/90

1.50/90

0.75/90

0.75/90

——

——

12/28/90

12/20/07

11/15/01

03/29/94

12/28/92

18.78

——

2.44

8.20

16.48

18.78

——

2.44

8.20

16.48

15.53

——

15.46

15.94

15.83

3.07

——

6.919

10.90

13.10

0.77

0.60

1.02

0.83

0.93

——

——

1.00ß

——

——

154

——

248

46

97

1.50/90

0.75/30

0.75/30

0.75/30

——

12/20/07

03/22/07

09/26/00

03/12/98

11/03/04

——

-6.95

-2.65

7.70

1.10

——

——

-2.65

7.70

1.10

——

——

12.46

16.80

——

——

-6.959

9.229

10.989

14.539

0.67

1.05

1.04

0.96

1.11

——

1.15ß

1.05ß

——

——

——

176

103

115

67

1.50/90

1.50/90

1.50/90

2.00/90

1.50/90

01388 11/03/04

00336 06/28/93

16.81

7.30

16.81

7.30

——

16.18

18.829

7.13

1.10

1.01

——

——

91

84

1.50/90

1.50/90

(Investor Class)

(Fidelity Advantage Class)

.

.

.

.

.

.

.

Mid Cap Growth

▼

CLOSED

NEW

Aggressive Growth11

Mid Cap Enhanced Index

Mid Cap Growth14

Mid-Cap Stock14

New Millennium Fund®

.

.

.

.

.

.

.

.

.

.

Small Cap Blend

▼

CLOSED

▼

NEW

Small Cap Enhanced Index

Small Cap Opportunities11

Small Cap Retirement11

Small Cap Stock11

Small Cap Value10, 11

.

.

.

.

.

.

.

.

.

.

.

Small Cap Growth

Small Cap Growth11

Small Cap Independence11

.

.

.

Foreign Stock Funds

Foreign investments involve greater risks and may offer greater potential returns than U.S. investments. These risks include

political and economic uncertainties of foreign countries, as well as the risk of currency fluctuations.

Fund Name

Trading

Symbol

Fund

No.

Date of

Inception

FIVFX

FDIVX

FGBLX

FIGRX

FIEFX

FIGFX

FISMX

FSCOX

FIVLX

FOSFX

FSIIX

FSIVX

FTIEX

FWWFX

00335

00325

00334

00305

02010

01979

00818

01504

01597

00094

00399

01522

01978

00318

11/01/94

12/27/91

02/01/93

12/31/86

12/20/07

11/01/07

09/18/02

08/02/05

05/18/06

12/04/84

11/05/97

10/14/05

11/01/07

05/30/90

00309

00352

00301

00341

00350

00360

00342

00302

11/17/87

11/01/95

10/01/86

12/21/93

09/15/92

11/01/95

11/01/95

10/01/86

Notes:

Cumulative

Average Annual Total Return %

Total Return %

(as of 12/31/07)

(YTD as of 12/31/07) 1 Year

5 Year

10 Year/Life

Expense

Ratio %13

Expense

Cap %

Turnover

Rate %8

Redemption

Fee (%/days)

▼

CLOSED

Broadly Diversified

NEW

CLOSED

▼

NEW

NEW

Aggressive International26

Diversified International

Global Balanced

International Discovery28

International Enhanced Index

International Growth

International Small Cap11

International Small Cap Opportunities11

International Value10

Overseas

Spartan® International Index

Spartan® International Index21

Total International Equity

Worldwide

5.20

16.03

13.77

18.98

——

-4.35

13.21

2.95

9.50

21.82

10.72

10.75

-5.45

18.49

5.20

16.03

13.77

18.98

——

——

13.21

2.95

9.50

21.82

10.72

10.75

——

18.49

16.83

23.21

15.80

24.49

——

——

31.32

——

——

23.46

21.37

21.39

——

19.67

8.02

13.39

9.35

12.45

——

-4.359

30.759

22.319

13.509

9.27

8.69

8.70

-5.459

9.20

0.85

0.93

1.14

1.04

0.62

1.17

1.19

1.30

1.03

0.95

0.20

0.17

1.12

1.04

——

——

1.25ß

——

——

1.25ß

——

——

1.25ß

——

0.10ß

0.07ß

1.25ß

——

138

51

169

56

——

——

70

107

59

87

3

3

——

128

1.00/30

1.00/30

1.00/30

1.00/30

1.00/30

1.00/30

2.00/90

2.00/90

1.00/30

1.00/30

1.00/90

1.00/90

1.00/30

1.00/30

35.02

46.26

16.41

14.76

-2.68

-12.35

23.22

25.23

35.02

46.26

16.41

14.76

-2.68

-12.35

23.22

25.23

30.18

28.64

26.68

23.54

14.92

13.85

29.75

24.99

15.82

14.47

10.28

11.67

8.07

13.02

15.15

13.22

0.96

1.08

1.06

1.05

1.08

1.02

1.06

1.19

——

——

——

——

——

——

1.25ß

——

42

173

100

161

158

76

62

91

1.50/90

1.50/90

1.00/30

1.00/30

1.50/90

1.50/90

1.50/90

1.50/90

.

(Investor Class)

(Fidelity Advantage Class)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▼

CLOSED

Regional/Country Specific

Canada

China Region25

Europe

Europe Capital Appreciation

Japan

Japan Smaller Companies11

Nordic

Pacific Basin

FICDX

FHKCX

FIEUX

FECAX

FJPNX

FJSCX

FNORX

FPBFX

P4 FIDELITY MUTUAL FUND PERFORMANCE THROUGH 12/31/2007

.

.

.

.

.

.

.

1.800.FIDELITY

RetailPerfPages_4Q07

1/16/08

9:06 PM

Page 5

FIDELITY MUTUAL FUND PERFORMANCE

Quarter ending December 31, 2007

Foreign Stock Funds

Foreign investments involve greater risks and may offer greater potential returns than U.S. investments. These risks include

political and economic uncertainties of foreign countries, as well as the risk of currency fluctuations.

Fund Name

Trading

Symbol

Fund

No.

Date of

Inception

FEMKX

FLATX

FSEAX

00322 11/01/90

00349 04/19/93

00351 04/19/93

Cumulative

Average Annual Total Return %

Total Return %

(as of 12/31/07)

(YTD as of 12/31/07) 1 Year

5 Year

10 Year/Life

Notes:

Expense

Ratio %13

Expense

Cap %

Turnover

Rate %8

Redemption

Fee (%/days)

Emerging Markets

Emerging Markets

Latin America

Southeast Asia

45.06

43.71

55.39

45.06

43.71

55.39

38.56

49.74

37.57

14.56

16.00

18.11

1.05

1.00

1.09

——

——

——

.

.

.

52

52

72

1.50/90

1.50/90

1.50/90

Specialty/Select Portfolios®

Because of their narrow focus, sector funds may be more volatile than funds that diversify across many sectors.

Date of

Inception

30-Day

Current Yield %

Ended 12/31/07/Notes

Cumulative

Average Annual Total Return %

Total Return %

(as of 12/31/07)

(YTD as of 12/31/07) 1 Year

5 Year

10 Year/Life

Trading

Symbol

Fund

No.

FCVSX

FIUIX

00308 01/05/87

00311 11/27/87

1.60

16.24

10.83

16.24

10.83

14.93

18.41

12.04

6.50

0.83

0.85

——

——

37

61

——

——

International Real Estate1,17

FIREX

Real Estate Income17

FRIFX

Real Estate Investment Portfolio17 FRESX

01368 09/15/04

00833 02/04/03

00303 11/17/86

1.77

6.43

2.64

-8.25

-6.45

-21.34

-8.25

-6.45

-21.34

——

——

16.59

19.169

7.819

10.20

1.07

0.88

0.83

——

——

——

144

45

47

1.50/90

0.75/90

0.75/90

-1.92

0.01

-21.18

2.65

-0.15

28.42

9.78

22.44

-13.87

-8.31

21.49

17.81

4.67

45.53

55.21

12.44

-13.59

24.93

12.45

-37.96

23.18

17.70

-4.35

11.54

4.19

29.21

16.86

17.87

-9.28

40.91

50.08

0.40

0.76

13.40

-1.92

0.01

-21.18

2.65

-0.15

28.42

9.78

22.44

-13.87

-8.31

21.49

17.81

4.67

45.53

55.21

12.44

-13.59

24.93

12.45

-37.96

23.18

17.70

-4.35

11.54

4.19

29.21

16.86

17.87

-9.28

40.91

50.08

0.40

0.76

13.40

17.82

11.35

5.64

11.48

19.38

22.17

17.87

17.01

13.32

7.60

15.35

22.57

13.50

32.52

30.42

13.49

9.38

21.28

11.69

0.04

19.83

20.87

11.74

14.42

16.00

24.56

22.94

15.60

10.49

31.29

33.08

10.73

5.82

11.72

11.03

5.17

3.79

8.93

12.42

11.05

7.27

8.63

9.16

3.97

8.53

13.73

7.42

16.99

14.44

1.69

6.50

15.89

8.54

0.78

9.10

11.04

10.49

10.709

9.00

12.34

10.33

15.289

7.89

17.83

17.30

-17.439

5.31

3.689

1.00

1.42

0.93

0.93

0.90

0.99

0.94

0.95

0.95

1.14

1.01

0.92

0.91

0.89

0.88

1.11

0.93

0.90

0.88

0.93

0.99

1.03

0.98

1.19

0.96

1.01

0.95

0.93

1.04

0.90

0.93

1.00

1.16

1.02

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

1.15ß

32

360

71

137

39

88

36

261

73

132

108

35

100

50

32

80

51

71

114

24

120

107

74

181

74

68

106

162

66

78

36

32

277

114

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

0.75/30

Fund Name

Expense

Ratio %13

Expense

Cap %

Turnover

Rate %8

Redemption

Fee (%/days)

Specialty

Convertible Securities

Utilities

.

.

.

.

Real Estate

.

.

.

.

.

Fidelity Select Portfolios®

Air Transportation22

FSAIX

Automotive23

FSAVX

Banking23

FSRBX

Biotechnology23

FBIOX

Brokerage and Investment Mgmt23 FSLBX

Chemicals23

FSCHX

Communications Equipment22 FSDCX

Computers23

FDCPX

Construction and Housing23

FSHOX

Consumer Discretionary22

FSCPX

Consumer Staples22

FDFAX

Defense and Aerospace23

FSDAX

Electronics23

FSELX

Energy23

FSENX

Energy Service23

FSESX

Environmental23

FSLEX

Financial Services23

FIDSX

Gold23

FSAGX

Health Care23

FSPHX

Home Finance23

FSVLX