Procter & Gamble Company Profile Swot Analysis

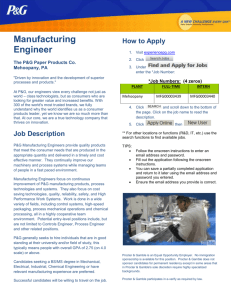

advertisement

PROCTER & GAMBLE COMPANY PROFILE – SWOT ANALYSIS October 2012 SCOPE OF THE REPORT Scope All values expressed in this report are in US dollar terms, using a fixed exchange rate (2011). 2011 figures are based on part-year estimates. All forecast data are expressed in constant terms; inflationary effects are discounted. Conversely, all historical data are expressed in current terms; inflationary effects are taken into account. Oral Care US$39.7 bn Microwaves Refrigeration Home 60,669 Appliances Laundry Large Cooking Home Laundry Confectionary 144,010 121,107 Appliances Appliances 132,745 121,107 US$185,477 mn Beauty and Personal Care US$425.7 bn Microwaves 60,669 Deodorants US$20.4 bn Small Appliances Jewellery 1,724,022 Bath and Shower US$37 bn Baby Care US$13.6 bn Hair Care US$73.7 bn Men’s Grooming US$32.7 bn © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE Disclaimer Much of the information in this briefing is of a statistical nature and, while every attempt has been made to ensure accuracy and reliability, Euromonitor International cannot be held responsible for omissions or errors. Figures in tables and analyses are calculated from unrounded data and may not sum. Analyses found in the briefings may not totally reflect the companies’ opinions, reader discretion is advised. Procter & Gamble is the global leader in beauty and personal care. Its key brands here include Olay, Gillette and Pantene. The company has however underperformed some of its rivals including Unilever and L’Oréal, which have made significant gains in the Chinese market to Procter & Gamble’s detriment. Procter & Gamble may suffer from being too mid range for premium-focused China, while too premium for lesser developed emerging markets such as India. PASSPORT 2 STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY AND GEOGRAPHIC OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS STRATEGIC EVALUATION Procter & Gamble grows despite erosion of market share Procter & Gamble was the number one ranked player in beauty and personal care in 2011 at the global level underpinned by first place ranking in hair care, depilatories and men’s grooming following its 2005 acquisition of Gillette. The company's share of BPC products has declined since 2006 as it faces competition in both Western and emerging markets. L’Oréal toppled Procter & Gamble from the leading position in skin care in China owing to a wider range of products across various price points. In Western markets, the company’s product launches in some of the categories have not been as frequent as some of its rivals. Procter & Gamble at the corporate level boasts 24 billion dollar brands including Gillette and Olay which have been the ongoing focus for its investment and marketing. The company pursues premiumisation of its brands, but it could consider increasing its coverage in the more economy range particularly in emerging markets in addition to tapping into the less traditional distribution channels. © Euromonitor International Procter & Gamble Co, The Headquarters: Cincinnati, USA Regional involvement: Global Category involvement: Hair care, men’s grooming, oral care, skin care World BPC value share 11.5% (2011): World BPC value growth (2011): BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE 5% PASSPORT 4 STRATEGIC EVALUATION Price increases help to drive net sales but hit volumes in 2012 Procter & Gamble’s beauty sales increased 2%, while grooming increased 1% between 2012 and 2011 financial years, mainly on the back of volume growth and price increases. Although a positive growth trend, sales growth was partly dampened by unfavourable geographic and product mix. This was more prominent in Q4, when these segments reported negative growth rates over Q4 2011. Despite economic recession, the company has been initiating price increases on the back of value addition contributing to its overall annual sales growth in 2012. Although price increases enabled the company to overcome the impact of unfavourable geographic and product mix during the financial year, it was unable to do so in Q4, which could indicate the company needs to increase its focus on innovation to justify its premium pricing strategy and/or increase its coverage in the economy price range to boost volume sales growth. Procter & Gamble’s objective to invest in the 20 most profitable innovations is a move in the right direction in light of its financial results. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 5 STRATEGIC EVALUATION SWOT: Procter & Gamble Co, The STRENGTHS Leading brands WEAKNESSES Global exposure Procter & Gamble has Procter & Gamble has strong brands to its wide global exposure. name. The company Its products are sold in boasts 24 billion dollar 180 countries through brands. It also claims 50 wide-ranging distribution leadership brands that channels including mass contribute 90% to its merchandisers and overall sales and profit. grocery stores. OPPORTUNITIES Emerging markets The company continues to rely heavily on mature markets. The emerging markets will outperform mature markets over the forecast period putting Procter & Gamble in a vulnerable position. Market share erosion The company has seen its market share eroded in a number of key categories. Unilever in particular has been pulling ahead in bath and shower and deodorants. This trend will need to be reversed. THREATS High-growth markets Emerging markets are Procter & Gamble is well positioned to take expected to produce strong growth in beauty advantage of growth in hair care and skin care and personal care. where it has a strong Procter & Gamble can position and which will benefit from the shift of lead growth in absolute consumption to the value terms. emerging markets. © Euromonitor International Mature market reliance Global/local competition Chinese skin care Unilever remains a significant threat in the developing markets in some categories such as bath and shower. Local players will also compete fiercely with Procter & Gamble. L’Oréal threatens to overthrow Olay as the number one brand in Chinese skin care. China is set to lead globally in skin care growth and this would be a major setback for the company. BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 6 STRATEGIC EVALUATION Procter & Gamble: Focuses on core businesses Focus on core operations To accelerate growth Procter & Gamble is implementing three key changes which it refers to as 40/20/10. The company aims to focus resources on the 40 largest and most profitable businesses, accounting for 50% of sales and 70% of net earnings. Next change includes focusing on the 20 most profitable innovations accounting for most of the portfolio revenue and the third change involves investing in 10 emerging markets most critical to the company’s growth. Brand rationalisation Instead of launching new brands or making acquisitions, the company focuses on extending existing brands into sub-ranges, eg Gillette Fusion as part of its “billion dollar” brand strategy. It has discontinued Max Factor in the US market. This rationalisation may save on costs but may limit the company from pursuing opportunities at both the premium and economy ends as the company crowds into the mid-range price segment. © Euromonitor International Focus on billion dollar brands Procter & Gamble’s objective has been to focus on billion dollar brands. The company has 24 billion dollar brands spanning across a number of categories including skin care, laundry care and so on with a strong global presence. The billion dollar brands each generate between US$1 billion and over US$10 billion in revenue. According to the company, investing in the already well-established billion dollar brands has a greater potential to generate returns than brands with limited presence and less familiarity. Improving productivity Procter & Gamble has announced a US$10 billion productivity programme to enhance the company’s performance. The programme includes funding topline growth, ensuring consumer value propositions are superior, overcoming macro headwinds and delivering better bottom line growth. BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 7 STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY AND GEOGRAPHIC OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS COMPETITIVE POSITIONING Procter & Gamble retains number one position © Euromonitor International 11.5 L'Oréal Groupe 2 2 2 2 2 2 9.7 Unilever Group 3 3 3 3 3 3 7.8 Colgate-Palmolive Co 4 4 4 4 4 4 3.8 Avon Products Inc 6 7 7 5 5 5 3.2 Beiersdorf AG 7 6 5 6 6 6 3.1 Estée Lauder Cos Inc 5 5 6 7 7 7 2.9 Johnson & Johnson Inc 9 9 8 8 8 8 2.8 Shiseido Co Ltd 8 8 9 9 9 9 2.5 Kao Corp 1 1 1 1 1 1 0 0 0 0 0 0 2.1 BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE 2010 1 1 1 1 1 1 2009 Procter & Gamble Co, The Company 2008 % company share 2011 2007 2011 Beauty and Personal Care: Top Global Companies by Value 2006-2011 2006 While Procter & Gamble has seen its market share decline over the 2006-2011 period, it remained the number one ranked player in beauty and personal care in 2011. L’Oréal Groupe has seen its share increase in large part due to strong growth in some developing markets, notably China. Unilever was an early mover into emerging markets. Acquisition of the Alberto-Culver brands including TRESemmé in 2011 has helped to drive growth as well. The company had previously added the TIGI brand to its hair care portfolio in 2009. As a result of organic and acquisition-led growth, Unilever was strongest performer among the top 10 BPC companies in CAGR terms over the review period. Procter & Gamble has been comparatively quiet in terms of acquisitions with no major ones to report over the review period. It has instead focused on building its billion dollar brands which in beauty and personal care include Gillette, Pantene, Head & Shoulders and Olay. PASSPORT 9 COMPETITIVE POSITIONING Procter & Gamble falls below global growth A: Procter & Gamble marginally underperforms the global market for beauty and personal care owing to its relative reliance on the mature markets, notably North America where its sales in 2008/2009 contract by almost 2%. © Euromonitor International B: As the economy starts to show signs of recovery, Procter & Gamble’s sales begin to rebound. The company focuses on highmargin oral care, skin care and razors and blades to drive growth. Procter & Gamble is also driving strong sales growth in Latin America. . BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE C: Procter & Gamble’s global share of beauty and personal care declines in 2011 across most of its key categories. In mature markets, consumers trade down, while increasing competition in emerging markets means the company benefits less from growth here than some of its competitors. PASSPORT 10 STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY AND GEOGRAPHIC OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS MARKET ASSESSMENT Two speed global market in beauty and personal care North America followed by Western Europe were Procter & Gamble’s largest markets by value sales in beauty and personal care in 2011. These regions are expected to see CAGRs of 1.6% and 0.3%, respectively, over the forecast period. Latin America was the company’s third most important market by value sales and the outlook here is brighter with a 5.2% CAGR expected, meaning this region will lead growth in CAGR terms over the forecast period, although Asia Pacific will lead in absolute value terms. Procter & Gamble is trying to tap into the mature Western markets by introducing value-added products. For example, Procter & Gamble is targeting oral care in North America and Western Europe through a range of professionally-positioned products under Oral-B and Crest. In addition, it attempted to reverse the decline of Pantene sales in Western Europe and North America through the launch of the Nature Fusion range, positioning Pantene as a more premium product. Procter & Gamble enjoys a strong presence in emerging regions such as Latin America, Asia Pacific and Eastern Europe, but in each of these regions it has underperformed Unilever over the review period. Opportunity Zone © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 12 MARKET ASSESSMENT Procter & Gamble maintains number one position Procter & Gamble ranked number one in beauty and personal care globally in 2011. The company’s market performance in 2011 was undermined by competition from Unilever and Colgate-Palmolive in bath and shower. In skin care, another key category for the company, Olay’s market share fell in the US and China, two of its most important markets by value sales. A shift to premium products saw other brands out-perform Olay. In these markets, Clinique, Estée Lauder and Lancôme were some of the biggest winners. In men’s grooming, Procter & Gamble’s share fell marginally from 33.4% to 33.3%. Strong gains were made by Beiersdorf and Unilever in men’s toiletries in 2011, while Procter & Gamble’s share remained flat. Additionally the success of Gillette Fusion led to some cannibalisation of the Gillette Mach3 brand in razors and blades. In the US market, a shift towards premium colour cosmetics benefited L’Oréal and Estée Lauder over Procter & Gamble. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 13 STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY AND GEOGRAPHIC OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS CATEGORY AND GEOGRAPHIC CATEGORIES FURTHER SCOPE FOR GROWTH FOR THE WORLD’S LEADING COMPANY Procter & Gamble has a diverse global presence but there continues to be good growth opportunities. In terms of emerging market expansion, it suffers from lack of brand coverage in economy ranges where some of its rivals have an edge. In addition, it needs to tap into less developed, but high growth categories in its existing markets as well as tap into non-traditional channels such as digital media. CATEGORY AND GEOGRAPHIC OPPORTUNITIES More global opportunities for Procter & Gamble Procter & Gamble has a diverse geographic presence in beauty and personal care but the US market still accounts for almost one quarter of its sales. There are markets where it has the opportunity to further expand its presence. For example, in hair care, Brazil will lead growth in absolute value terms. Brazil made up only 6% of Procter & Gamble’s BPC sales in 2011. In hair care, while Procter & Gamble ranked number three in Brazil, it sits far behind leader Unilever. In skin care, Procter & Gamble has come up against a vibrant direct sales channel in Brazil where the two best-selling brands are both sold in this channel. This has undermined attempts to launch the Olay brand, but direct sellers are on the decline. Procter & Gamble’s main thrust has been behind its global brands. Its top 10 brands accounted for 73% of its sales in 2011 led by Gillette, which made up 24% of global sales, according to Euromonitor International’s Passport database. Gillette was the number three ranked brand in beauty and personal care globally in 2011. In pursuing a global brand strategy with a premium focus, arguably Procter & Gamble has lost out among lowerincome consumers in the developing world. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 16 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Unilever benefits from economy strength in emerging markets Top Five Brands: Unilever and Procter & Gamble, Price Positioning and Emerging Market Exposure Rexona Positioning/ Emerging Market Exposure Premium-Mid/High in Latin America and Asia Pacific only Economy/High Lux Economy/High Unilever Brand Dove Axe/Lynx/E Mid/High in Latin America only go Sunsilk Economy/High Procter & Positioning/ Gamble Emerging Market Brand Exposure Premium-Mid/Low with exception of Gillette Latin America Pantene Premium-Mid/High Premium-Mid/High in Olay Asia Pacific only Oral-B Premium-Mid/Low Head & Premium-Mid/High Shoulders Procter & Gamble’s closest competitor Unilever is clearly stronger at the economy end of the price spectrum, which gives it a broader reach into emerging markets. Among Unilever’s top 10 brands, a number are economy hair care and bath and shower brands including Rexona, Lux and Sunsilk. Procter & Gamble meanwhile has continued to focus on driving consumers farther up the value chain with premium launches such as Pantene Nature Fusion in 2011. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 17 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Catering products to regional taste Brazil will lead growth in hair care over the forecast period. The Pantene brand has made strong gains here in 2011 growing its market share from 3.5% in 2010 to 4.5% in 2011. This was in part the result of the November 2011 launch of Pantene Pro-V Fusão da Natureza (Fusion of Nature). Its company share rose from 9.6% to 10.7%. Unilever however remains the market leader and announced in 2011 its single largest investment in Brazilian hair care history launching 80 new products between November 2011 and December 2012. Keeping up to date with the latest trends is crucial in this fast-moving market. Argan oil has emerged as the latest trendy ingredient. Unilever quickly launched Dove with argan oil in 2011 to benefit from this trend. To date Procter & Gamble has shown less haste in bringing new products to market to respond to consumer demands. China is another key market and here Procter & Gamble leads with a 36.5% market share. The Head & Shoulders, Rejoice and Pantene brands underpin its presence here. Rejoice is a regional brand present almost exclusively in Asia Pacific, and China is by far its largest market by value sales. The regional focus for the brand has allowed new product development to be led by local tastes, such as Eva the Rejoice range inspired by Chinese herbal medicine. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 18 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Tap into high-growth, less-developed categories in existing markets Going forward conditioners will lead growth in absolute value terms. Much of this growth will come from the emerging markets as women adopt more complex hair care regimes and look beyond 2-in-1 and shampooonly regimes to include conditioners, styling agents and colourants. In conditioners, Brazil followed by India will lead global growth while in colourants these two countries will again lead growth. India remains a relatively underdeveloped market and one with considerable potential for a player such as Procter & Gamble. Unilever is the market leader here currently with an 18% market share but its share suffered in 2011 as it faced tougher competition from local players as well as L’Oréal. Procter & Gamble is not present in key categories such as colourants and conditioners and should rectify this immediately. The strongest growth prospects are in these categories and Procter & Gamble has Head & Shoulders and Pantene in the shampoo category already giving it a strong consumer profile. Focusing on trial sizes to keep retail prices down to capture share among the large rural population, through its large network of direct sellers in India (shakti women), has been Unilever’s key to success. Procter & Gamble will need to employ similar tactics to drive sales in conditioners. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 19 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Tap into more prospective distribution channels Procter & Gamble’s absence from the Brazilian market is notable given the strong growth anticipated here over the forecast period. However, Unilever has remained absent from this market as well. In part the difficulty here for foreign players is the strength of direct selling, driven by Natura Cosméticos and Avon. Procter & Gamble has focused on the parapharmacies/drugstores channel but has not managed to make significant in-roads. Direct sales as a proportion of skin care however has been in decline over the review period and this trend is expected to continue. One of the healthiest channels in Brazilian skin care is parapharmacies/drugstores. Procter & Gamble should consider developing variants of the Olay line which are suitable for this channel and invest in a marketing campaign to back a launch of Olay. There has been strong growth at the premium end of the spectrum in Brazil with premium skin care posting a 17% CAGR over the 2006-2011 period in contrast to a negative 1% CAGR for mass. As a masstige brand Olay could benefit from trading up in this market if it invests in a strong marketing campaign and develops products specifically with the Brazilian consumer in mind. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 20 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Diversifying distribution channel to help regain lead in China SC Procter & Gamble has begun to fall behind L’Oréal in the Chinese skin care market. Second-placed Procter & Gamble saw its share fall from 10.8% to 10.2% in 2011 while L’Oréal gained 60 basis points to reach 16.4%. Driving this divergent performance has been L’Oréal’s strength in facial moisturisers and anti-agers. These categories respectively made up 39% and 31% of total skin care sales in China in 2011. Procter & Gamble was also absent from body care, although this category is not a significant one in China. Premiumisation in skin care benefited L’Oréal disproportionately given its host of premium brands including Lancôme which performed strongly in 2011. SK-II, Procter & Gamble’s own premium skin care range gained 20 basis points but remained a modest brand in this market although in the wider Asian region the brand enjoys good consumer awareness. However, even the L’Oréal Paris brand, which is masstige like Olay, gained market share largely at Olay’s expense suggesting the loss of market share is not just due to trading up. The Olay brand will need to gain a stronger presence in growing channels; internet retailing and beauty specialist retailers should be priorities. L’Oréal also benefits from a wider choice of price points and a wider distribution network with Vichy in pharmacy, and its premium brands in department stores while Garnier enjoys a broad presence from hypermarkets to health and beauty retailers. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 21 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Well placed in men’s grooming but more room for growth Procter & Gamble performed well in men’s grooming, witnessing a very strong growth in the emerging markets. In Brazil its sales growth has remained in the double digits since 2008 and in China, sales growth reached 17% in 2010-2011. Both Brazil and China are projected to be the top two markets, respectively, to lead growth in the category. Even though the company has been performing well in emerging markets, there is room for more potential growth in men’s toiletries where its presence is relatively smaller. Procter & Gamble has managed to capture a large part of the Brazilian market through its brand Gillette in shaving, which remains the leading category in men’s grooming. Razors and blades are projected to drive growth in men’s grooming, but there is good growth scope for deodorants too, the second leading category projected to drive growth in Brazil in men’s grooming. In men’s deodorants in Brazil, there has been a clear trend towards the more expensive roll-on format. Procter & Gamble’s relationship with FIFA has been a long-standing and profitable one. It is likely and recommended that Procter & Gamble become a key sponsor of the 2014 World Cup, to be held in Brazil. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 22 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Invest to establish market for non-traditional men’s grooming Skin care remains a relatively small category in men’s grooming compared with razors and blades and deodorants, however the outlook is very positive with a CAGR of 6.8% expected over the 2011-2016 period. Growth in men’s skin care will be led by China where Procter & Gamble made a major push with the Olay brand capturing 4.2% of market sales in 2011 launching Olay Men in that year. That said, L’Oréal continues to dominate in Chinese men’s skin care. In Brazil, where Procter & Gamble enjoys a commanding lead in men’s grooming at 46.2% in 2011, men’s skin care sales remain negligible. This should not deter Procter & Gamble from pursuing this market however. The Gillette Fusion range has seen extensive growth in other markets well beyond razors and blades and includes skin care products including a facial moisturiser. The marrying of a well-accepted brand such as Gillette with skin care may go some way to overcome male reluctance to use skin care products. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 23 CATEGORY AND GEOGRAPHIC CATEGORIES PRODUCT DEVELOPMENT DRIVES GROWTH IN ORAL CARE Procter & Gamble has benefited where it has been proactive in product development. It has made a number of key launches in oral care, which have seen good growth in the market. CATEGORY AND GEOGRAPHIC OPPORTUNITIES Strong performance in oral care from Procter & Gamble While local tastes shift, such as the renaissance of Chinese herbal medicine in the Chinese market, which benefited the Yunnan Baiyao brand in oral care in 2011, Procter & Gamble continues to see strong growth for both its Oral-B and Crest brands. Strong product development including Crest 3D in toothpaste has helped to propel growth for the brand in China. Braun Oral-B brand toothpaste including Oral-B Pró-Saúde Clinical Protection (gum line care), Oral-B Pró-Saúde Clinical Sensitive (sensitive teeth) and Oral B Pró-Saúde with seven benefits have helped to drive sales in the Brazilian market. Procter & Gamble’s oral care sales in the US were driven by Crest 3D White Line - a full oral care regimen consisting of an Oral-B pulsing toothbrush, a paste-gel hybrid toothpaste, an alcohol-free whitening mouth rinse and whitening strips. Lateral brand expansion through moving into related product categories has long been a cornerstone of Procter & Gamble’s strategy in oral care. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 25 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Trading up in power toothbrushes Procter & Gamble is a significant player in power toothbrushes, growth of which will be underpinned by trading up in mature markets. The US followed by Japan will lead here posting absolute growth of US$222 million and US$107 million, respectively, over 2011-2016. Oral-B is Procter & Gamble’s focus in power toothbrushes. Power toothbrushes are heavily promoted on the basis that they remove more plaque and tartar than manual toothbrushes and more closely approximate a professional clean. There has been a drive to continually upgrade in this category. One of the brand’s latest launches the Oral-B Professional Care Triumph 5000 uses wireless technology to advise users when they are not brushing correctly. Its strategy is working as the Oral-B brand grew its market share of power toothbrushes from 45.3% to 47.9% in 2011 consolidating its position as the number one brand in the category. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 26 CATEGORY AND GEOGRAPHIC CATEGORIES ROOM FOR POTENTIAL DIVESTMENT IN COLOUR COSMETICS Procter & Gamble has been streamlining its portfolio to release resources for its core assets. There is room to further streamline its portfolio. For example, it is operating in a very crowded colour cosmetics market. Divesting colour cosmetics could release resources for further expansion in other core categories. CATEGORY AND GEOGRAPHIC OPPORTUNITIES A new strategy called for in colour cosmetics Procter & Gamble may wish to reconsider its strategy in colour cosmetics. Its difficulty is a crowded marketplace and the strength of L’Oréal’s brands at both premium and mass levels. Following discontinuation of the Max Factor brand in the US market, its presence in the US is largely dominated by Cover Girl, which saw its market share fall in 2011 from 10.3% to 9.6%. A move towards more premium brands was in large part to blame. Those who did not migrate up to brands such as Mac or Lancôme remained with Maybelline. Cover Girl did not sufficiently excite the US buying public. The company’s premium presence is dominated by SK-II which enjoys a strong presence in Asia Pacific but which has never managed to gain much of a foothold in the North American market. Procter & Gamble may wish to consider divesting its mass colour cosmetics brands to more strongly back the SK-II brand in Asia Pacific or consider launching Cover Girl into new markets. While Brazil may be particularly competitive given the strength of direct selling, the Indian market shows considerable promise. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 28 CATEGORY AND GEOGRAPHIC OPPORTUNITIES Indian market has potential for colour cosmetics Unilever dominates in this market helped in part by its extensive distribution network in rural as well as urban India. Direct selling is also rapidly growing as a distribution channel with players including Oriflame India Pvt Ltd, Avon, Modicare and Amway all making strong gains. As a new entrant to this market Procter & Gamble would need to invest heavily in marketing campaigns and ensure it has a strong distribution network. Stand-alone kiosks in shopping malls are a new trend in colour cosmetics distribution with Future Capital Holdings Ltd, owner of the Faces brand, using these to drive sales. The SK-II brand currently has virtually no presence in this market and while the premium segment accounted for only 5.8% of colour cosmetics sales in 2011, it is rapidly growing with a 56% CAGR over 2006-2011. A wellbacked launch is recommended. Considerable work would have to go into either the Cover Girl or Max Factor brands if they are to be launched for an Indian audience including reformulating pigments and responding to local tastes and preferences. Although India offers potential for expansion, the issue to consider is the likelihood of greater returns on investment from other categories . © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 29 STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY AND GEOGRAPHIC OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS BRAND STRATEGY Gillette brand enjoys broad geographic reach Gillette is Procter & Gamble’s leading beauty and personal care brand and the world’s number three beauty and personal care label. It is one of the company’s billion dollar brands, with sales of US$11.6 billion in 2011. Gillette is among Procter & Gamble’s most diverse brands in terms of geographic profile. It ranked number one in every regional men’s grooming market in 2011. The US remains its single largest market by value sales. However, Brazil ranked a close second. Given that the Brazilian market will lead growth in men’s grooming this puts the Gillette brand in a very favourable position. The Gillette brand is positioned as mass, however Procter & Gamble has been branching out to premium men’s grooming with the Art of Shaving, which it expanded in 2011 and is considering launching in the UK. The Gillette brand itself has seen considerable expansion into new categories to create a “family brand” including skin care, hair care, deodorants and fragrance. Global growth for the brand reached 5.6% in 2010-2011. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 31 BRAND STRATEGY Procter & Gamble aims for more premium image for Pantene Pantene is Procter & Gamble’s leading hair care brand and the world’s number two hair care label. It is one of the company’s billion dollar brands, with sales of US$5.2 billion in 2011. Pantene has been something of a problematic brand for Procter & Gamble of late, thanks in part to an overweight portfolio and confusion over its positioning. Moves to push the mass brand upmarket have been undermined by significant price cuts in core markets. However, Procter & Gamble has relaunched the brand with improved formulation and packaging, which drove growth in shampoos. The Nature Fusion range has been rolled out in 2011 and 2012 to new markets including Thailand. The brand relies heavily on celebrity brand ambassadors including most recently US actress Zooey Deschanel. In keeping with Procter & Gamble’s global aspirations however it has enlisted Indian personalities such as Padma Lakshmi. In 2011, Procter & Gamble switched to plant-based PET for its Pantene Nature Fusion bottles to maintain a consistent “natural” image for the brand. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 32 BRAND STRATEGY Procter & Gamble looks to cross-category branding Olay is one of Procter & Gamble’s billion dollar beauty and personal care brands, with sales of US$4.1 billion in 2011. It generates almost 90% of its revenue in skin care, where it is the world’s number two brand underpinned by its number one position in facial skin care. Hence, the brand provides a strong base for innovation, and has met with notable success through antiageing extensions, such as Regenerist, Definity and Pro-X Intensive. Procter & Gamble has begun to leverage the strength of the Olay brand in other key brands. It launched the Venus & Olay razor in a high-profile marketing campaign. It also continued to extend Cover Girl with Olay as part of the Simply Ageless line. Olay however is coming under strong competitive pressure in key markets such as China, where its competitors are expanding their distribution coverage including pharmacies/drugstores. Procter & Gamble could consider launching a similar line and consider expansion into key markets such as India and Brazil. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 33 STRATEGIC EVALUATION COMPETITIVE POSITIONING MARKET ASSESSMENT CATEGORY AND GEOGRAPHIC OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS OPERATIONS P&G operates global distribution and manufacturing Procter & Gamble’s distribution strategy is extensive and multi-tiered. Procter & Gamble sells its products primarily through mass merchandisers, grocery stores, membership club stores, drugstores and “high frequency stores” - neighbourhood stores which serve many consumers in emerging markets. The company’s largest customer is Wal-Mart, which accounted for 15% of its sales in 2011 and 16% in 2010 and 2009. Procter & Gamble aims to extend its distribution to reach more consumers through underserved channels, such as e-commerce. Again, the investment in e-commerce is a significant feature of the company’s efforts to develop its operations in emerging markets, expansion in which is a central growth strategy. Packaging is a key distribution strategy and Procter & Gamble has recently launched eco-friendly packaging for the Pantene Nature Fusion range with plant-based PET bottles. The company has been engaging in a divestment programme which most recently included the sale of its Pringles brand to Kellogg’s. Previous divestments have included its global pharmaceuticals business to Warner Chilcott Plc in 2009 and its coffee business through the merger of its Folgers coffee subsidiary into The J.M. Smucker Company. Procter & Gamble plans to add 20 new manufacturing facilities, almost all of which will be multi-product category facilities, to its production infrastructure by 2014. Notably, almost all the company’s new facilities will be in emerging markets, enabling the company to lower costs and facilitate its efforts to make its brands more available and affordable to low-income consumers in such markets. There are plans for new plants in China, Colombia, Malaysia, Vietnam and Ukraine, and it began operation at a new plant in the Philippines in 2012 producing nappies. Plans are also in place to expand its Missouri, US plant in a project worth US$300 million. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 35 OPERATIONS P&G emerging market manufacturing sites by country 2011 Western Europe: Turkey Eastern Europe: Russia, Czech Republic, Romania Asia Pacific: China, India, Philippines, Vietnam Middle East & Africa: Egypt, Lebanon, Morocco, Saudi Arabia Latin America: Argentina, Colombia, Mexico, Brazil, Guatemala, Peru, Venezuela © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 36 STRATEGIC EVALUATION COMPETITIVE POSITIONING CATEGORY AND GEOGRAPHIC OPPORTUNITIES BRAND STRATEGY OPERATIONS RECOMMENDATIONS RECOMMENDATIONS Procter & Gamble needs to reconsider emerging markets strategy Tap into non-traditional distribution channels Reconsider colour cosmetics strategy Procter & Gamble is at risk of allowing L'Oréal to topple its skin care brand Olay from the leading position in skin care in China. This is a strategic market as it will be the leading market to drive growth in beauty and personal care. In addition, Shiseido is also increasing the pressure. Both L'Oréal and Shiseido are developing a presence across different distribution channels and Procter & Gamble could consider doing the same. Colour cosmetics is one of its smaller operations, but needs immense resources as competition is driven by companies with a dedicated focus. Investing resources in colour cosmetics can divert resources from its larger categories where it holds industry-leading positions. Alternatively it will need to consider expanding the Cover Girl and/or Max Factor brand to the emerging markets, eg India. However this will require considerable financial resources and commitment. Products to match affordability in emerging markets In order to succeed in emerging markets, Procter & Gamble will need to adopt successful strategies employed by its competitors including Unilever. Procter & Gamble’s current focus may be too premium to gain a broad presence in markets such as India. The company has already begun to offer sachets to keep prices down in this market. However, further work will be required to build a distribution network. Procter & Gamble remains overly reliant on conventional retailers and has not gained sufficient penetration in rural areas. Expand into new categories in emerging markets © Euromonitor International Procter & Gamble has scope to expand into new product categories. While present in hair care it is absent from colourants and conditioners in India. It should also launch its Gillette Fusion range more fully in Brazil and attempt to build a market for men’s skin care. Its Gillette brand has the potential to overcome male reluctance to use these products. BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE PASSPORT 38 Experience more... This research from Euromonitor International is part of a global strategic intelligence system which offers a complete picture of the commercial environment. Also available from Euromonitor International: Global Briefings Timely, relevant insight published every month on the state of the market , emerging trends and pressing industry issues. Interactive Statistical Database Complete market analysis at a levels of detail beyond any other source. Market sizes, market shares, distribution channels and forecasts. Strategy Briefings Executive debate on the global trends changing the consumer markets of the future. Global Company Profiles The competitive positioning and strategic direction of leading companies including uniquely sector-specific sales and share data. Country Market Insight Reports The key drivers influencing the industry in each country; comprehensive coverage of supply-side and demand trends and how they shape the future outlook. © Euromonitor International BEAUTY AND PERSONAL CARE: PROCTER & GAMBLE Learn More To find out more about Euromonitor International's complete range of business intelligence on industries, countries and consumers please visit www.euromonitor.com or contact your local Euromonitor International office: London +44 (0)20 7251 8024 Chicago +1 312 922 1115 Singapore +65 6429 0590 Shanghai +86 21 6372 6288 Vilnius +370 5 243 1577 Dubai +971 4 372 4363 Cape Town +27 21 552 0037 Santiago +56 2 915 7200 Sydney +61 2 9275 8869 Tokyo +81 3 5403 4790 Bangalore +91 80 49040500 PASSPORT 39