4/14/2010

Chapter 14

Determinants of

the Money Supply

• In Chapter 13, we learned about the simple money

multiplier that linked: ReservesÆDeposits

∆D = 1/r × ∆R

• In this chapter we will learn about the money multiplier

that links:

∆MBÆ∆Ms

• Define money supply as currency plus checkable

deposits: M1

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-2

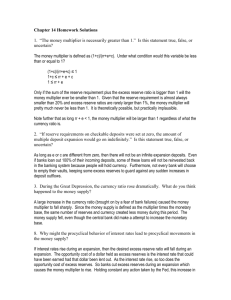

The Money Supply Model

• Link the money supply (M) to the

monetary base (MB) and let m be the

money multiplier

M = m × MB

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-3

1

4/14/2010

Deriving the Money Multiplier I

Assume the desired level of currency C and excess reserves ER

grows proportionally with checkable deposits D

Then

c = {C / D} = currency ratio

e = {ER / D} = excess reserves ratio

• c and e are constants in equilibrium

• Recall that in the simple deposit multiplier,

ER=0

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-4

Deriving the Money Multiplier II

The total amount of reserves (R ) equals the sum of

required reserves (RR) and excess reserves (ER).

R = RR + ER

The total amount of required reserves equals the required

reserve ratio times the amount of checkable deposits

RR = r × D

Subsituting for RR in the first equation

R = (r × D) + ER

The Fed sets r to less than 1

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-5

Deriving the Money Multiplier III

• MB = r×D + ER + C

• Multiple deposit expansion occurs due to the

r×D component where r < 1

each

h $1 iincrease iin reserves supports

t ad

depositit

expansion that is greater than $1)

• Any increase in MB that is due to C or ER will

not generate a multiplier effect

• For a given amount of reserves, an increase in

C or ER will decrease the multiplier effect

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-6

2

4/14/2010

Deriving the Money Multiplier IV

c = {C / D} ⇒ C = c × D and

e = {ER / D} ⇒ ER = e × D

Substituting in the previous equation

MB = (r × D) + (e × D) + (c × D) = (r + e + c) × D

Divide both sides by the term in parentheses

1

D=

× MB

r +e+c

M = D + C and C = c × D

M = D + (c × D) = (1+ c) × D

Substituting again

1+ c

× MB

r +e+c

The money multiplier is then

M=

m=

1+ c

r +e+c

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-7

• The money multiplier (m) shows how

much the money supply changes in

response to a change in the monetary

b

base

• m is a function of c, r, e (in the simple

multiplier, c=0, e=0)

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-8

Example

r = required reserve ratio = 0.10

C = currency in circulation = $400B

D = checkable deposits = $800B

ER = excess reserves = $0.8B

M = money supply (M1) = C + D = $1,200B

$

$400B

= 0.5

05

$800B

$0.8B

e=

= 0.001

$800B

1+ 0.5

1.5

m=

=

= 2.5

0.1+ 0.001+ 0.5 0.601

This is less than the simple deposit multiplier

c=

Although there is multiple expansion of deposits,

there is no such expansion for currency

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-9

3

4/14/2010

• In this example, an increase in the monetary

base by $1 increases money supply (M1) by

$2.5

• Under the simple deposit multiplier, an

increase in reserves (and hence monetary

base) by $1 would increase deposits (and

hence M1) by $10

• The money multiplier is smaller than the

simple deposit multiplier (1/r = 10) because

some of the increase in R is assumed to be

absorbed as currency and excess reserves.

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-10

Factors that Determine

the Money Multiplier

• Changes in the required reserve ratio r

The money multiplier and the money supply are negatively

related to r

when r increases banks need to hold a larger fraction of

customer deposits at CB

Æless loans & securities

Æless deposit expansion

Æ m declines

• Empirically, r has been declining over time. This

component is not used as a tool to affect money

supply

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-11

• Changes in the currency ratio c

The money multiplier and the money supply

are negatively related to c

when c increases less money will be held

on deposit, m declines

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-12

4

4/14/2010

• Changes in the excess reserves ratio e

The money multiplier and the money supply are negatively

related to the excess reserves ratio e

when e increases,less loans are given out, less deposit

expansion, m declines

• What determines e?

market interest rates (opportunity cost for holding ER):

• i (up), e (down): The excess reserves ratio e is negatively

related to the market interest rate

interest rate the Fed pays on ER (very recent development)

expected deposit outflows: The excess reserves ratio e is

positively related to expected deposit outflows

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-13

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-14

•Our model can help explain monetary contractions

following banking crisis

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-15

5

4/14/2010

•c and e increase following crisis

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-16

•Money supply declines

Copyright © 2007 Pearson Addison-Wesley. All rights reserved.

14-17

6