Myth Money Multiplier

advertisement

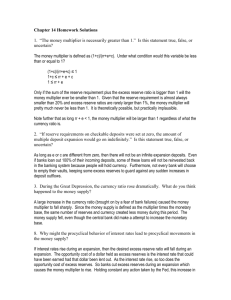

THIRD QUARTER 2012 VIEW OUR PERSPECTIVE ON ISSUES AFFECTING GLOBAL FINANCIAL MARKETS The of the yth M Money Multiplier The of the yth M Money Multiplier Concerns about hyperactive central bank activities and inflation have dominated media headlines. Will central bank “money printing” revive lending? Will the overworked printing presses lead to rampant inflation? These questions have anything but simple answers. Despite the complexity, academics and experts usually marshal a concept called the “money multiplier” to explain the relationships between the central bank’s balance sheet, commercial bank lending, the money supply and consumer prices (See Figure 1). Though it appears rudimentary, the money multiplier is not so simple. Examining the curious interplay between bank lending activity and reserve creation reveals that banks lend first and worry about reserves separately. fig. 1 TEXTBOOK MONEY MULTIPLIER MECHANICS Central Bank } Commercial Bank } Practically speaking, this means that the Federal Reserve, for example, can create as many reserves as it pleases (i.e. it can “print money”), but so long as banks are reticent lenders, lending will not increase—and by consequence, money supply growth and inflation will be modest. In fact, contrary to popular opinion, we suggest that the textbook money multiplier is a myth. The Fed creates bank reserves... What The Textbooks Teach Us Bank 1 receives new deposits and creates $3 in new loans. } Our textbooks tell us that the monetary authorities (central banks) create money in a mechanical, monetary sequence called “the money multiplier.” Put simply the money multiplier posits a relationship between the central bank’s balance sheet (on which “bank reserves” are a central bank liability) and lending activity (which has consequences for prices—more lending increases prices)—for more information see Did you know? on page 3. Proponents sell the story as simple, logical, mechanical, elegant and irrefutable. In the words of James Tobin, “the greatest moment of triumph for the elementary Banks 2,3 & 4 each recieve $1 on deposit and in turn create $3 each in new loans... Money Supply 1 “Ketchup Theory” in the words of James Tobin, “the greatest moment of triumph for the elementary economics teacher” is laying out the money multiplier. One theory popular among investors (and even a few FOMC members), is what we will call the Ketchup Theory. Think about a bottle of Heinz 57 sauce; as you labor to garnish your burger and fries, after a few shakes, nothing emerges from the stubborn ketchup bottle. So you shake again...and again...until...whoops! half the bottle’s contents discharge on the food. Dinner ruined. In other words, with the Fed enlarging the supply of reserves (pounding the ketchup bottle that is the banking system), banks will lend excessively (the ketchupy mess erupts), which will bring about hyperinflation and destroy the fixed income investors’ dinner (purchasing power). economics teacher” is laying out the money multiplier.2 Here is how it is supposed to work. First, the central bank issues reserves to commercial banks. Second, stocked with freshly-minted reserves, commercial banks create new loans that become eventually become deposits at still other banks. Third, this next set of “other” banks—to the extent they are not fully “loaned up”—engage in their own lending. As these banks loan to other banks and to customers, the amount of money in circulation increases. This advance in lending, so the theory goes, proceeds in snowball fashion until the money supply balloons and inflation is upon us (See Figure 1). As much as we enjoy hamburgers this explanation has proved inaccurate. First, consider the recent credit boom in the United States. The central bank’s balance sheet (“reserves”) did not constrain the banking system in the production and dispersion of money and credit. Indeed, on the eve of the financial crisis in 2007, banks held only $20 billion in reserves. Yet total credit in the US financial system exceeded $30 trillion. With a “t”. A rapid expansion of the central bank’s balance sheet did not set the conditions As a concept for understanding reserves, lending, and prices, the money multiplier makes sense to many. For example, in 2009, Princeton economist and expert Federal Reserve historian Allan Meltzer proclaimed: “...the enormous increase in bank reserves—caused by the Fed’s purchases of bonds and mortgages—will surely bring on severe inflation if allowed to remain.”2 Did you know? To better understand central bank balance sheet expansion, it is helpful to examine the asset and liability structure of a central bank. The central bank is a bank like any other-with one important distinction: its liabilities must be held to meet a) legal reserve requirements (e.g., 10% of deposits) and/or b) to meet clearing responsibilities at the central bank (settling accounts on behalf of customers). In fact, in the modern era, some central banks do not require a specific level of reserves (e.g., the Bank of England). But it has not. That is because there is a major problem with this line of thinking. In spite of his eminence, Mr. Meltzer appears to be missing something: the money multiplier is nowhere to be found. Despite the Fed’s gigantic money printing operation (its balance sheet grew from $800 billion in 2007 to nearly $3 trillion in 2012 financed by creating reserves), the M1 money multiplier, which hovered between 1.6 and 1.8 from 2000 until 2008, has collapsed. The story is similar in the euro area and the United Kingdom. Just like a regular bank, a central bank’s balance sheet also features assets, liabilities and equity capital. Its assets consist of domestic and foreign assets. Its liabilities comprise currency in circulation, bank reserves, central bank securities, government deposits, other non-monetary liabilities, and equity capital. Equity capital represents accumulated profits as well as paid-in capital. Policies that increase the size of central bank assets entail corresponding increases in liabilities – which can have important implications for the financial system. What happened? 2 to spark the credit boom; the private system took care of that itself. between several central bank balance sheets and consumer price inflation. Second, according to empirical evidence, the key outside constraint on bank lending seems to be capital requirements, not reserves. Indeed, banks could have always borrowed an unlimited amount of reserves at the fed funds rate (which the Fed pledged to maintain at a given rate), from the Fed’s discount window or from other banks to meet reserve requirements.3 Our conclusion: there is no direct link between reserves and money and credit creation and there does not appear to be a relationship between reserves and consumer price inflation (See Figure 2 again). Why? The lending or credit creation activity precedes reserve creation. Yes, you read that correctly. Based on econometric research, data over the last 20 years suggest banks make loans first and worry about reserve needs later.4 Beyond the reserves-to-loans connection, the reservesto-inflation connection is suspect at best. By taking several decades worth of data between central bank balance sheets and inflation as measured by core CPI, we ask the reader to identify the relationship in Figure 2 fig. 2 The narrow textbook theory fails. See a Relationship Between Central Bank Balance Sheets and Inflation? A. UPWARD SLOPING B. DOWNWARD SLOPING C. VERTICAL D. HORIZONTAL United Kingdom Year-over-Year Percent Change Core CPI Year-over-Year Percent Change Core CPI United States 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% -50% 0% 50% 100% Fed Balance Sheet Assets Year-over-Year Percent Change 150% Year-over-Year Percent Change Core CPI Year-over-Year Percent Change Core CPI Euro Area 2.5% 2.0% 1.5% 1.0% 0.5% 0% 20% 40% 60% European Central Bank Balance Sheet Assets Year-over-Year Percent Change 4.5% 4.0% 3.5% 3.0% 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% -100% 200% 3.0% 0.0% -20% E. NO PATTERN 100% 200% 300% 400% 500% Bank of England Balance Sheet Assets Year-over-Year Percent Change 600% 700% 0% 20% 40% 60% 80% 100% Swiss National Bank Balance Sheet Assets Year-over-Year Percent Change 120% Switzerland 2.5% 2.0% 1.5% 1.0% 0.5% 0.0% -0.5% -1.0% -1.5% -40% 80% 0% -20% SOURCE: Bank of England, ECB, SNB, Federal Reserve and Na tional Statitical Agencies 3 As the Bank of England’s Paul Tucker acknowledged, “banks extend credit by simply increasing the borrowing customer’s current account, which can be paid away to wherever the borrower wants by the bank ‘writing a cheque on itself’”. That is, banks extend credit (make loans) by creating money, not by waiting for reserves to then make a loan. running back to the goldsmith to get hard currency for transactions. Instead, the goldsmith would issue certificates that were redeemable on demand and much more convenient. Further, by issuing banknotes to borrowers, the goldsmiths financed economic activity. Governments and economists, however, never much liked this concept. Laws and regulations over the past 400 years reflect efforts to stamp out private banknotes and enshrine one organization (the central bank or monetary authority) as the monopoly issuer of notes. This put in place the second major notion of the goldsmiths era: that the monetary authority controlled the money supply by restricting note issuance. Some central bankers know this, but others seem to miss what is in plain sight. Where did the theory go off track?? Your Friendly Neighborhood Goldsmith Tracing the intellectual lineage of an idea is a bit like detective work. But, one place the money multiplier myth may begin is with the London goldsmiths of the 17th century. Such a notion quickly proved to be false. Goldsmiths and more recently, banks, circumvented this by issuing bank deposits and other forms of credit money rather than physical notes. The results are unequivocal: the banking system found ways to economize on note issuance, by continuing to create money and credit despite legal prohibition. Lending created deposits—not the other way around. That’s because 400 years ago in London, a discerning consumer opted to store his or her gold (or silver) with a goldsmith rather than braving the mean streets with a pocket full of coin. The goldsmith, in turn, provided a convenient service: issuing private promissory notes, or bank notes, that circulated as money. In short, goldsmiths engaged in money creation. Despite the Fed’s gigantic money printing operation the money multiplier has collapsed. However, in the annals of monetary history, historians’ portray goldsmiths as dishonest. This stems from the fact that goldsmiths allegedly used client “deposits” as the source for new lending to other clients. And, as a result, this is the beginning of the idea—which has gripped money and lending ever since—that deposits create new lending. In the case of the goldsmith the theory holds that, to increase lending, one must first increase deposits and surreptitiously use those deposits to finance lending. The modern theory of the money multiplier is an outgrowth of the early misconception: to increase lending, banks must first increase reserves. Tail Risks Ahead Investors may ask, “Why is the money multiplier still so enshrined in textbooks and the popular press?” Apart from its elegance as a pedagogical tool, it stands as structural pillar of the modern mainstream macroeconomic edifice. But, does this accurately portray the goldsmiths’ actions? What do we mean? A key assumption of the framework is that the “money supply” is exogenous: that is, determined by the monetary authority (central bank). In reality, goldsmiths economized on “coin” presented as deposits. Instead of lending out gold, they issued private banknotes. The banknotes circulated and fueled commerce. Indeed, a more thorough read of the historical record shows that the goldsmith provided a valuable service. By issuing promissory bank notes, depositors could trade and purchase without the hassle of always Instead, as we have laid out above, if credit is created endogenously by the financial system (in the modern era just as it was in the goldsmith era), the system does not depend on reserves to spark a credit boom. 4 Further, if the money multiplier does not explain how the financial system operates, would its absence imply that heightened inflation expectations driven by central bank “money printing” may be misguided? Has the time come to breathe a collective sigh of relief and dispel the inflation mania? Central bank policies around the world are unlikely to spark new lending nor will they alone ignite inflation. The money multiplier is a myth and a new explanation is a return to the roots of understanding money and the financial system: banks create money and credit. Unfortunately the answer is not that simple. If the Fedinitiated money multiplier does not control lending and inflation, it will not stop it either. 1 Tobin, James, “Commercial Banks as Creators of Money,” Cowles Foundation Paper 205, Banking and Monetary Studies, for the Comptroller of the Currency, U.S. Treasury, Richard D. Irwin, 1963. That means the Fed’s much vaunted and self-promoted inflation fighting power may be overestimated. Here is Federal Reserve Chairman Ben Bernanke on the subject: For controlling inflation, the key question is whether the Federal Reserve has the policy tools to tighten monetary conditions at the appropriate time so as to prevent the emergence of inflationary pressures down the road. I’m confident that we have the necessary tools to withdraw policy accommodation when needed, and that we can do so in a way that allows us to shrink our balance sheet in a deliberate and orderly way.5 SOURCES 2 Meltzer, Allan H. “Inflation Nation”. New York Times. 3 May 2009. 3 Tobin, James, “Commercial Banks as Creators of Money,” Cowles Foundation Paper 205, Banking and Monetary Studies, for the Comptroller of the Currency, U.S. Treasury, Richard D. Irwin, 1963. 4Seth B. Carpenter and Selva Demiral, “Money, Reserves, and the Transmission of Monetary Policy: Does the Money Multiplier Exist?” Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.C. 2010-41 5Ben Bernanke, “Five Questions about the Federal Reserve and Monetary Policy,” Speech at the Economic Club of Indiana, Indianapolis, Indiana, October 1, 2012. But without the money multiplier, this false defence does not hold. Reducing the Fed’s balance sheet (“removing reserves”) will have no effect on actual money and credit in the system. The best the Fed can do is hope to influence inflation expectations in the marketplace. Another supposed Fed method of reining in runaway prices is raising interest on excess reserves (IOER), an administrative rate of remuneration the Fed pays to reserve holders. The money multiplier myth again haunts this policy tool. The idea is that a higher rate of remuneration would entice banks to keep “cash parked at the Fed” rather than using the reserves to make new loans. But, again, if reserves do not cause new lending, then policymakers might have a problem on their hands. Once the credit boom begins it will not be enough to simply raise the rate of remuneration on reserves to stop inflation. Because banks are not reserve constrained the process is beyond central bank control. 5