A New Look at Uncertainty Shocks: Imperfect

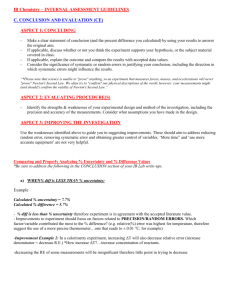

advertisement