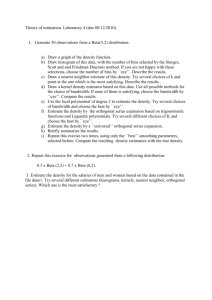

PWC Memorandum on Beta Relations

advertisement

Memorandum on beta relations In connection with unlevering and relevering of beta, we use a relation to describe the correlation between beta for an unlevered company β U and beta for the company with a specific capital structure β L. This memorandum will illustrate the problem that arises from the use of the common beta relation based on the work of Modigliani and Miller (M&M) in 1963 1 . We will argue that there is an alternative to solve these problems based on more realistic assumptions. Please note that irrespective of the beta relation used, it is an implicit assumption that the company is able to utilise the tax shield fully. It is often assumed that unutilised tax shields may be traded freely in the market. Furtermore, we have, to make the example as simple as possible, assumed that β d equals zero, meaning that the debt is risk-free and therefore has a required return equal to the risk-free interest rate, and no investor taxes have been included. M&M’s beta relation The use of M&M’s beta relation is based on the implicit assumptions that: 2 • • the actual amount of the debt is known and remains constant in perpetuity future cash flows remain constant in perpetuity. Our memorandum will illustrate the consequences if the above assumptions are not met. The beta relation may be described as: D β L = βU ⋅ 1 + (1 − Tc ) ⋅ E With: βL = Beta for the levered company βU = Beta for the fully equity- financed company Tc = Corporation tax rate D = Market value of debt E = Market value of equity We will value a company by means of two valuation methods: 1. The Adjusted Present Value (APV) method, under which the value is split into two parts. First the company is valued without taking into account the financing decision, and then the value of the interest tax shields resulting from the financing decision is calculated. The value estimated under the APV 1 2 See Modigliani & Miller (1963) M&M’s beta relation is also known as Hamada’s (1969) formula model is the correct value as the value is estimated based on the assumptions underlying the use of the beta relation in question. 2. A traditional DCF method, under which future cash flows are discounted at WACC. The value of the interest tax shield is therefore implicitly included in the discount rate. General assumptions: • • • • Risk- free interest rate 5% (Rf ) Market risk premium 4% (RP) Beta unlevered 1 (β U) Corporation tax rate 30% (Tc) The fictitious company has a life of 5 years. The free cash flows and the amount of net interest-bearing debt (NIBD) appear from the following table. Year FCF NIBD 0 300 1 120 250 2 150 200 3 160 150 4 170 100 5 200 0 Re. 1: The APV method As it is assumed that the amount of the debt is known in perpetuity, the interest tax shields may be considered risk-free payments and may therefore be discounted at the risk- free interest rate. Year 0 Interest tax shield Required return from a 100% equity-financed company PV (FCF) PV(interest tax shield) Market value from investment decision 610.31 Market value from financing decision 13.30 Market value of the company (EV) 623.62 Market value (EV) ultimo 623.62 1 4.50 9.00% 110.09 4.29 2 3.75 9.00% 126.25 3.40 3 3.00 9.00% 123.55 2.59 4 2.25 9.00% 120.43 1.85 5 1.50 9.00% 129.99 1.18 554.71 450.51 327.80 184.91 0.00 We have calculated below the value of the company by means of the APV model. The interest tax shield has been calculated as: Interest-bearing debt (opening) x Rf x Tc The required return from a fully equity- financed company has been calculated as: Rf + (β U x RP) The cash flow is discounted at 9%, and the interest tax shield is discounted at the riskfree interest rate of 5%. This results in an enterprise value of 623.62, with a value breakdown of 13.30 from the financing decision and 610.31 from the investment decision. Re 2: The DCF method The other method for calculating the company’s value is the traditional DCF model. As the capital structure does not remain constant over time, a variable required return must be applied. The following formula is used for calculating the debt ratio: Debt structure = Interest bearing debt primo Market Value ( EV ) primo Ex. Debt structuret =1 = 300.00 = 48.11% 623.62 The following formula is used for calculating WACC: WACC = Debt structure * (1 − Tc ) * R f + (1 − Debt structure) * ( R f * β L * RP ) Ex. WACCtid=1 = 48.11% * (1 − 30%) * 5.00 % + (1 − 48.11%) * ( 5.00% + 1.65 * 4.00%) = 7.70% We have calculated below the value of the company with β L in year 1 calculated as: β L = 1* (1 + (1 − 30%) * 92.70%) = 1.65 Year Debt structure D/E Beta (L) WACC PV(FCF) Market value (EV) ultimo 0 1 48.11% 92.70% 1.65 7.70% 111.42 2 45.07% 82.05% 1.57 7.78% 129.22 3 44.39% 79.84% 1.56 7.80% 127.86 4 5 45.76% 54.08% 84.36% 117.77% 1.59 1.82 7.76% 7.54% 126.06 137.91 632.46 You will note that the value estimate of the DCF model deviates 8.85 from the correct value calculated according to the APV model. The deviation is due to assumptions not being met: the company’s cash flows are not constant and infinite, and the company’s debt does not remain constant in perpetuity. The conclusion is that use of the DCF model will result in miscalculation when the assumptions underlying the beta relation applied are not met. The reason is that the WACC used for discounting in the DCF model does not treat the interest tax shield consistent ly with the assumption of risk-free interest tax shields. In practice, we very rarely see situations where cash flows are an infinite annuity and the debt remains constant in perpetuity, which must apply in order to use M&M’s beta relation. We will introduce below an alternative beta relation that is not based on the assumption of a constant debt level and cash flows being an infinite annuity. The alternative beta relation has been described by Harris & Pringle (H&P) 3 . H&P’s beta relation The use of H&P’s beta relation is based on the implicit assumption that: • it is the company’s goal to maintain a constant debt ratio, i.e. that the company continuously rebalances the debt in order for the debt to constitute a constant share of the company’s value 4 . The future debt level will therefore not be known but will depend on operations; accordingly, the correct discount rate must reflect the operating risk of the company. On this assumption, the beta relation will look as follows 5 : D β L = β U ⋅ 1 + E Again the value of the company is calcualted by means of the two methods. The notation remains the same as previously. Re 1: The APV method Year 0 Interest tax shield Required return from a 100% equity-financed company PV (FCF) PV(interest tax shield) Market value from investment decision 610.31 Market value from financing decision 12.17 Market value of the company (EV) 622.48 Market value (EV) ultimo 622.48 1 4.50 9.00% 110.09 4.13 2 3.75 9.00% 126.25 3.16 3 3.00 9.00% 123.55 2.32 4 2.25 9.00% 120.43 1.59 5 1.50 9.00% 129.99 0.97 554.01 450.12 327.63 184.86 0.00 As it is assumed that both cash flows and interest tax shields carry the operating risk, both are discounted at 9%. It should be noted that only the value of the financing decision has been changed from the previous calculation. 3 See Harris & Pringle (1982). The constant debt ratio is only decisive if a constant WACC is to be used, the crucial thing is that the amount of the debt is subject to uncertainty. 5 If the beta for loan capital is not zero, the beta relation will be: β L = β U + ( β U − β D ) ⋅ D E 4 Re 2:The DCF method As in the previous calculation, we may by using H&P’s beta relation estimate the required owner’s return and therefore WACC. As the capital structure varies over time, we will as in the previous calculation operate with a variable WACC. The formulas for calculating the debt ratio and WACC are identical to those used in the calculation based on the M&M assumption. The DCF model results in the following value. Year Debt structure D/E Beta (L) WACC PV(FCF) Market value (EV) ultimo 0 1 2 3 4 5 48.19% 45.13% 44.43% 45.78% 54.09% 93.03% 82.24% 79.96% 84.45% 117.84% 1.93 1.82 1.80 1.84 2.18 8.28% 8.32% 8.33% 8.31% 8.19% 110.827 127.889 125.921 123.523 134.322 622.48 You will note that there is consistency between the APV and DCF models. Empirical survey In September 2001 we asked a number of players in the financial sector and major consulting firms in Denmark which beta relation they use 6 . 40% of the respondents use a beta relation based on the assumption that the interest tax shield is risk- free. It should also be noted that 27% do not use any type of beta relation. The responses are summarised in the following table: Beta relations Percentage of responses Number of responses Harris & Pringle Miles & Ezzell Miller & Modigliani No relation Other relation 7% 13% 40% 27% 13% 1 2 6 4 2 In addition to the beta relations mentioned above, our survey included another beta relation described by Miles & Ezzell (1980) (M&E). This beta relation is based on annual rebalancing of the debt ratio to the effect that the first interest tax shield is known for certain, and the remaining interest tax shields are unknown. The beta values arrived at by using M&E are very close to the values reached by using H&P, and we will therefore not describe this relation in further detail. Conclusion It is remarkable that the most commonly used beta relation is based on assumptions that are so restrictive that they will rarely be met in practice. Furthermore, it intuitively feels wrong that all future interest tax shields are risk-free. In our opinion, 6 This was one of several questions asked in relation to “cost of capital”. it is a problem that consistency beetween the APV and DCF models cannot be achieved when using the M&M beta relation. We will therefore not be able directly to demonstrate the value that we attribute to the interest tax shield. Michael B. Hansen/ PricewaterhouseCoopers Jacob Erhardi/ PricewaterhouseCoopers Bibliography: Chambers, D.R. & Harris, R.S. & Pringle, J.J. (1982) Treatment of Financing Mix in Analyzing Investment Opportunities Financial Management 11 (Summer 1982) Genoptrykt i Parum, C. (1999) Miles, J.A. & Ezzell, J.R. (1980) The weighted Average Cost of Capital, Perfect Capital Markets and Project Life The journal of Financial and Quantitative Analysis, Vol 15, nr. 3 Genoptrykt i Parum, C. (1999) Modigliani, F. & Miller, M.H. (1963) Corporate Income taxes and the cost of Capital: a correction The American Economic Review, Vo l LIII, no. 3 Genoptrykt i Parum, C. (1999) Taggart, R.A. (1989) Consistent Valuation and cost of Capital expressions with Corporate and Personal taxes NBER Working Paper #3074 August 1989