Measure Private Equity Performance

advertisement

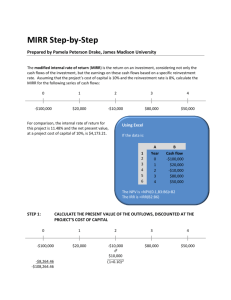

An Alternative Way to Measure Private Equity Performance Peter Todd Parilux Investment Technology LLC Summary Internal Rate of Return (IRR) is probably the most common way to measure the performance of private equity investments. It is widely recognized that there are problems with IRR. One problem is that IRR uses a discount factor (the IRR itself) that may have no relation to the relative discounted values that rational investors would assign to cash flows that occur at different points in time. When IRR is high the discounted values of later cash flows can be too low, and so earlier distributions can be unreasonably preferred over much larger but later distributions. Conversely, if IRR is low the discounted values of later cash flows are exaggerated. Another measure of private equity performance is Modified IRR (MIRR). While we believe that MIRR is an improvement over IRR in some ways, we show that it has a potentially serious problem. Another common measure of performance for private equity investments is the Investment Multiple (or TVPI, for Total Value over Paid In) which is simply the ratio of total distributions1 divided by total investment. The problem with Investment Multiple is that it does not consider the timing of cash flows—a payout of $10 in year 2 or year 10 is treated the same. Here we propose two new alternative measures of private equity performance: Discounted Investment Multiple (DIM) is similar to the standard Investment Multiple except that cash flows are discounted using appropriate discount rates. We believe DIM can provide investors with a more reliable indicator of private equity investment performance. Annualized Equivalent Return ( ) is quite similar to MIRR but solves a significant problem with MIRR. The calculation of also produces an additional useful statistic, Equivalent Years ( ), which gives the average length of time that capital was invested. When is presented along with investors can get a more complete understanding of investment performance. Problems with Existing Measures of Performance Problems with IRR The various problems with IRR are well recognized. Wikipedia gives a good description of these problems2. Here are some quotes from the Wikipedia article: 1 Any residual value is treated like a final distribution. We assume this treatment of residual values throughout this paper. 2 See http://en.wikipedia.org/wiki/Internal_rate_of_return#Problems_with_using_internal_rate_of_return. 1 “As an investment decision tool, the calculated IRR should not be used to rate mutually exclusive projects…” (i.e., should not used to compare investment alternatives). “…IRR overstates the annual equivalent rate of return for a project whose interim cash flows are reinvested at a rate lower than the calculated IRR.” “Since IRR does not consider cost of capital, it should not be used to compare projects of different duration.” “Despite a strong academic preference for NPV [net present value], surveys indicate that executives prefer IRR over NPV.” Despite such advice to the contrary the wide use of IRR to compare private equity investments apparently persists. We believe that one reason for this is that the common explanation of the main problem with IRR—“IRR assumes reinvestment of interim cash flows in projects with equal rates of return”—may not sufficiently resonate with investors. An alternative way to look at the problem is that IRR uses a discount factor (the IRR itself) that may have no relation to the preferences of a rational investor. Consider the following example cash flows for two private equity investments: Example 1. Year 0 1 2 3 4 5 Sum Investment A Cash Flow Cash Flow Discounted by IRR -10 -10.00 21 10.00 11 110.0% 2.10 0.00 Investment B Cash Flow Cash Flow Discounted by IRR -10 -10.00 20 9.51 20 30 110.2% 4.00 0.49 0.00 The difference in the cash flows for the two investments is that Investment A gets an extra dollar in year 1, whereas Investment B gets an extra twenty dollars in year 5. The IRRs are nearly identical. However, would actual investors see these two investments as equally desirable? Maybe with hyperinflation! The problem is that by definition the IRR is being used to discount the cash flows so that the sum of the discounted cash flows is zero. Given the high IRR, the $20 in year 5 gets a nearly negligible present value of 49 cents. The Problem with Modified IRR Modified IRR3 (MIRR) has been suggested as an improvement to IRR. The calculation of Modified IRR (MIRR) is actually very different than IRR. It uses two pre-specified discount rates: a finance rate (FR) 3 See http://en.wikipedia.org/wiki/Modified_internal_rate_of_return. 2 that is applied to investments (negative cash flows) and a reinvestment rate (RR) that is applied to distributions. All investments are discounted back to the time of the initial cash flow to obtain a “present value” (PV). All distributions are discounted forward to the ending time to obtain a “future value” (FV). The MIRR is then calculated from the formula (1) where is the number of years. This seems like a sensible way to calculate return, so what’s the problem? Example 2 illustrates that MIRR can be overly sensitive to small changes in cash flows. Example 2. Cash Flows Investment Investment Year A B 0 -1 1 0 2 -20 -21 3 40 42 4 0 5 2 Sum 21 21 76.0 100.0 2.00 2.00 23.5% 100.0% * *FR=10%, RR=10% Here investments A and B are actually very similar. However, the small changes in cash flows result in a big change in MIRR because for investment A the number of years ( ) is 5, whereas for investment B it is 1. Probably it is not possible to develop a single annualized return number that can reliably distinguish preferable investments when those investments can be over very different time periods. For example, 50% sounds better than 35%, but is it better to get 50% for 1 year or 35% for 3 years? Problems with the Investment Multiple (TVPI) Investment Multiple (or TVPI, for Total Value over Paid In) is simply the ratio of the total value of distributions divided by the total investment. For example, if $100 is paid in, and $175 is eventually paid out, then TVPI is 1.75. The problem with TVPI is that it does not consider the timing of cash flows—a payout of $10 in year 2 or year 10 is treated the same. Since cash flows from private equity investments can occur over many years it is simply not reasonable to ignore the timing of such flows when considering investment performance. 3 Proposed Alternative Measures of Performance Discounted Investment Multiple (DIM) Net Present Value4 (NPV) is a widely accepted method to evaluate the value of investments based on associated cash flows. With NPV all cash flows are discounted to “the present” (the beginning of the investment) and summed. Different rates might be used to discount investments and distributions. The result is the gain or loss of value (in dollars) associated with the investment. While fundamentally sound, NPV in dollars is probably not the most convenient statistic for evaluating investment performance. Fortunately it is easy to convert this to a ratio similar to the Investment Multiple. We just need to separate the positive and negative cash flows and discount both to the beginning of the investment to obtain the Present Value of Investments (PVI) and Present Value of Distributions (PVD). NPV is the sum of PVI (which is negative) and PVD. Discounted Investment Multiple (DIM) is defined as (2) This ratio is conceptually similar to Investment Multiple but a much better indicator of investment performance since it considers the timing of cash flows. If it is desired to have just one number to compare the desirability of private equity investments, then we would suggest that DIM is superior to either IRR or MIRR. Annualized Equivalent Return (AER) We can convert DIM to the form of a return by simply subtracting one, which yields the percentage increase in present value resulting from the investment. However, this is not an annualized (or maybe monthly) return like IRR or MIRR. Since investors are accustomed to per-period (typically annualized) returns we have also developed an annualized return statistic called Annualized Equivalent Return (AER), which we believe has advantages over IRR and MIRR. MIRR discounts all investments to the time of the first investment, and discounts all distributions to the time of the last distribution. MIRR is then calculated as if a single investment had been made at the very beginning, and a single distribution received at the very end. This definition of the number of years ( in equation 1) is what causes the over-sensitivity to small changes in cash flows illustrated in example 2. Instead we propose to calculate the Average Time of Investments (ATI) as the (weighted) average time of discounted investments, and the Average Time of Distributions (ATD) as the average time of discounted distributions5. We then use ATI and ATD as the equivalent beginning and ending dates of the investment. For example 2A this results in an ATI of 1.886 years, and an ATD of 3.079 years. We then proceed similarly to MIRR as follows: Discount investments to ATI (1.886 years) at finance rate (10%), to obtain 4 . See http://en.wikipedia.org/wiki/Net_present_value. For the purpose of calculating the weight-average time of investments and distributions it does not matter what time the investments and distributions are discounted to, since it does not affect their relative weighting. Therefore, for simplicity we discount to “time zero”. 5 4 Discount distributions to ATD (3.079 years) at reinvestment rate (10%) to obtain Calculate the Equivalent Years (EY) as . We believe that EY can be a useful number to help evaluate a private equity investment, along with AER. Calculate AER from equation 3, which is nearly identical to equation 1. (3) This indicates that example 2A is similar to a single investment for 1.19 years and returning 78.8% annually. Rather than call this new calculation something like “improved modified IRR” we propose to call it Annualized Equivalent Return because as defined it results in an annualized number, and because it is calculated as the return of an equivalent investment with a single cash flow in and out. We propose that EY should be presented along with AER to give investors a better understanding of private equity investments. Annualized Equivalent Return Example Calculation Since this procedure for calculating AER may seem a little complex let’s work through an example in more detail: Example 3. Year 0 1 2 3 4 5 -100 -50 Discounted to year 0 -100.00 -45.45 200 150.26 150 93.14 Cash Flow Again we are using a discount rate of 10% for both finance and reinvestment. Though not needed for the calculation of AER, we can calculate DIM from these discounted cash flows using equation 2 as 5 The average time of investments is ATI P DCF Pi 0 i i DCF 0 (100) 1 (45.45) 0.3125 (100) (45.45) i Pi 0 The average time of distributions is ATD P DCF Pi 0 i i DCF i Pi 0 3 150.26 5 93.14 3.7653 150.26 93.14 Thus on average investments were made at time 0.3125 years, and distributions were received at time 3.7653 years. On average, capital was invested for 3.7654 ‒ 0.3125 = 3.4528 years (this is EY). Now we discount the cash flows to times ATI or ATD, as shown in the following table: Year Cash Flow 0 1 2 3 4 5 Total -100 -50 Discounted to ATI -103.02 -46.83 Discounted to ATD 200 215.13 150 133.35 348.48 -149.85 Finally, we calculate AER from While this is by no means a trivial calculation, it is actually much simpler than IRR. We can supply an Excel function to calculate this to anyone who is interested. Discussion of Discount Rates MIRR, DIM, and AER all allow for investments and distributions to be discounted at different rates. Investments should certainly be discounted at a rate that reflects the cost of financing. It may make sense to discount distributions at a higher rate. In the case of MIRR this was defined as the reinvestment rate, implying the rate available for reinvestment of distributions. This could also be viewed as a Required Rate of Return that in addition to finance cost includes a component to account for the extra return (risk premium) required by an investor to compensate for uncertainty and illiquidity. However, this approach has been criticized by some because the compounding of the risk premium over years may exaggerate the relative risk associated with later cash flows. In general this is a complex topic which we won’t at6 tempt to resolve here. We note that in the case of DIM, if a risk premium is included in the rate used to discount distributions then any multiple above 1.0 should be viewed as attractive. If no risk premium is included then a higher threshold of attractiveness would be warranted. In the case of AER we believe that it is better not to include any risk premium when discounting distributions. The resulting return then has no risk adjustment and is thus more conveniently comparable to other returns that typically are not risk adjusted. It can be compared to the return the investor expects to achieve with similarly risky investments. Summary of Examples The following table restates the results of examples 1-4 including all statistics we have discussed. Year 0 1 2 3 4 5 IRR TVPI MIRR DIM AER EY 1A -10 21 110.0%A 2.10 110.0% 1.91 110.0% 1.00 Cash Flows for Examples 1B 2A 2B -10 -1 20 0 0 -20 -21 0 40 42 0 0 20 2 110.2% 76.0% 100.0% 4.00 2.00 2.00 37.6% 23.5% 100.0% 3.06 1.79 1.82 68.5% 78.8% 100.0% 2.62 1.19 1.00 3 -100 -50 200 150 50.0% 2.33 36.5% 1.67 27.7% 3.45 Note that AER by itself does not pick example 1B as a preferable investment to 1A. However, with the additional information provided by EY (equivalent years) the investor can get a better picture and see that 1B is likely preferable. Conclusion We suggest that Discounted Investment Multiple (DIM) provides a better overall indicator of private equity performance than IRR or MIRR. It is closely based on the theoretically well-established Net Present Value, but rearranged in the form of a ratio that is more convenient for comparing investments. We also suggest that Annualized Equivalent Return (AER) provides a useful indicator in annualized return form that should always be preferable to the similar MIRR, and also has some advantages over IRR. When AER is presented together with the related Equivalent Years (EY) it should convey a better understanding of an investment than IRR or MIRR alone. 7