2010 Annual Report

advertisement

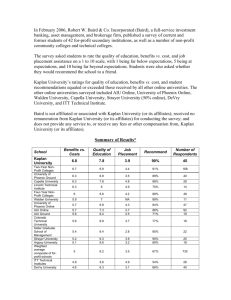

the Baird difference At Baird, we’re committed to continuity our clients can count on. Values that endure. Great outcomes. Done well. 2010trusted. Annual Report Advice that’s Teamwork that delivers. Every single day. In every type of market. 2 Focus 4 Expertise 6 Culture 8 A Message from Paul Purcell 12 Businesses at a Glance 14 Private Wealth Management 2010 Annual Report 18 Equity Capital Markets 24 Private Equity 28 Fixed Income Capital Markets 32 Asset Management 36 Our Community 38 Financial Information 40 Managing Directors 42 Corporate Offices We believe that great outcomes begin with a clear focus on the best interests of clients and associates, every day, in every type of market. That trust grows from deep expertise and objective advice. And that strong partnerships are built when a culture is dedicated to real teamwork and enduring values. That’s the Baird Difference. Baird 2010 Annual Report 1 Success Middle Market Focus Continuity 2 Baird 2010 Annual Report Clients Partnership Long Term We’re focused on what our clients value most. Like creating a strong partnership that centers on their needs for deep expertise and objective advice. One with a clear emphasis on their long-term goals. A partnership defined by continuity in relationships and disciplined execution they can count on year after year. Staying focused means staying true to our core strengths. That’s why Baird is financially conservative, committed to the middle market and always guided by the values that form the bedrock of our client relationships. . “What attracted me to Baird was its focus on building the whole business around the best interests of clients. Associates across Baird support me so that I can provide truly customized wealth management solutions to my clients.” Karen Ogard, Financial Advisor Quintin Lai Associate Director of Research Mike Liang Partner, Baird Venture Partners Karen Ogard Financial Advisor, Denver Baird 2010 Annual Report 3 Collaborative Trusted Solutions Expertise Performance 4 Baird 2010 Annual Report Objective Accessible We believe that objective advice is trusted advice. That means expert advice rooted in rigorous analysis and aligned to the needs of clients. It means developing solutions that are effective and appropriate as well as creative. At Baird, expertise is also accessible. From managing directors to senior portfolio managers, from industry conferences to white papers, Baird’s experts are readily available to provide the depth of insight that contributes to great outcomes. “Our advice comes from years of experience and a deep understanding of each client’s needs. We’re thoughtful and disciplined in our approach, so we can make recommendations best suited to their goals.’‘ Gary Elfe, Director of Research, Baird Advisors Laura Thurow Co-Director of Private Wealth Management Research Gary Elfe Director of Research, Baird Advisors Steve Janaszak Fixed Income Institutional Sales Baird 2010 Annual Report 5 Authentic Community Culture Teamwork 6 Baird 2010 Annual Report Dedicated Integrity Caring For the past eight years, Baird has been recognized as a great place to work through some of the best, and the most challenging, market conditions our clients and industry have ever experienced. That’s because the values we share as Baird associates are the heart of everything we do. Our values drive honest communication, caring and real collaboration on behalf of clients, each other and the communities in which we live. “How we do things – with integrity, teamwork and caring – is as important to us as the results we achieve for clients. The alignment of our practices with our values is the real strength of the Baird culture.” Leslie Dixon, Chief Human Capital Officer Sheryl Lenzke Best Practices Consultant, Private Wealth Management Peter Kies Co-Director, Equity Capital Markets Heidi Engelhardt International Partner, Human Capital Alan Bago New Accounts Representative, Operations Baird 2010 Annual Report 7 Paul Purcell Chairman, President & Chief Executive Officer “Because Baird is independent and employee-owned, we determine our own strategic priorities. We can take a conservative, long-term view of what is in the best interests of our clients and our businesses.” 8 Baird 2010 Annual Report A Message from Paul Purcell By many objective measures, 2010 was a dramatic improvement over the two preceding years of global economic decline. Investors’ confidence, however, remained challenged. Volatile equity markets, historically low interest rates and uncertainty about the sustainability of the economic recovery continued to raise concerns for many clients. More than ever, they sought advice and perspective from Baird. We deeply appreciate the trust our clients place in us. Baird associates work hard to earn that trust every day, through a deep understanding not only of financial markets and investment banking transactions, but also of what matters most to each client. That is why, across all of our businesses, our goal is to provide expert advice and a long-term view of financial markets and clients’ objectives. Preserving that bond of trust is also why Baird’s first priority during the challenges of the last several years was to protect and serve the interests of our clients. We believed this required two forms of investment on our part. The first was to keep our teams together, not only to ensure continuity of service to clients, but also to maintain the partnership culture for which Baird is recognized. The second investment was to take advantage of the opportunity to hire many talented professionals who were looking for Baird’s combination of a collaborative, client-focused work environment and strong financial condition. Over the past three years, Baird has increased employment 15%, including many new associates who are senior-level industry veterans. Meanwhile, many competitors have restructured or downsized, and U.S. securities industry employment has dropped 6%. While expertise and relationships are important in hiring, they cannot trump values. The values we share both distinguish Baird in the marketplace and help make Baird a great place to work. That is why we are deeply honored to be recognized – for the eighth consecutive year – as one of the FORTUNE 100 Best Companies to Work For.® We placed No. 14 on the 2011 list, released in January, our third consecutive year among the top 15. Core strengths. Our ability to make a substantial commitment to hiring during some of the most difficult markets in 70 years speaks to our core strengths. These investments are made with our own money at stake. Because Baird is independent and employee-owned, we determine our own strategic priorities. We can take a conservative, long-term view of what is in the best interests of our clients and our businesses. What’s more, we are aligned behind that view as an organization. Nearly half of all Baird associates own shares in the firm, and those shares have grown in book value at a compound annual rate of 11% over the past decade. This growth is strong confirmation that working in our clients’ best interests is always in our own best interest. Baird 2010 Annual Report 9 A Message from Paul Purcell We can also afford to stay focused on what matters most because we have a strategic balance of complementary middle-market businesses – Private Wealth Management, Equity Capital Markets, Private Equity, Fixed Income Capital Markets and Asset Management. Terrific results from Fixed Income Capital Markets and Asset Management in 2009, for example, helped offset declines in other businesses. That balance of revenues gave us the leeway to hire top talent while maintaining Baird’s excellent financial condition. In 2010, the commitment we made to both maintain and deepen the team enabled Baird’s businesses and financial performance to rebound more quickly than many in the industry. All five businesses performed very well last year, and some, like Investment Banking and Private Equity, improved dramatically. Net revenues for 2010 grew 18% over 2009 results to a record $847 million. Operating income increased 35% to $84 million.* We ended the year as we began it: in excellent financial condition, with modest debt and a very strong capital base. Other important investments. During 2010, we also completed a record year of investment in Baird’s information technology capabilities. We not only expanded the team and expertise, we added momentum to the rollout of new systems and client capabilities across our businesses. This is an ongoing program of substantial, incremental investment in IT and a key component of Baird’s strategy to become the leading middle-market financial services firm in the world. *Financial results do not reflect the consolidation of certain private equity partnerships. 10 Baird 2010 Annual Report Among the 2010 highlights to be found throughout this report: For the seventh consecutive year, Baird ranked No. 1 for “most trusted” research in Greenwich Associates’ annual survey of U.S. small-cap and mid-cap fund managers. Baird Financial Advisors managed or oversaw $63 billion in client assets at the end of 2010. As a firm, we managed or oversaw more than $82 billion in client assets. Investment Banking completed a record number of financings and M&A advisory transactions, which had a combined value of $26 billion. Baird Capital Partners was again named a top “Consistent Performer” in Private Equity Intelligence’s 2010 survey, moving up to No. 7 in the global ranking of buyout managers. For the second straight year, Baird ranked No. 1 in the United States for the number of municipal bond issues it lead-managed during the year, according to Thomson Reuters. Strong inflows to our bond mutual funds during the past two years drove Baird Funds’ assets under management to $4.7 billion at the end of 2010, a 142% gain since the end of 2008. “Baird associates have proven that their commitment to ensuring the best possible outcomes for clients can help transcend some of the most challenging economic conditions in the history of our business.” Our diversity efforts continue to get a great deal of attention at all levels of the firm, and deservedly so: they remain a key priority. Our four associate resource groups – women’s issues, African-American perspective, community involvement and the environment – are doing a terrific job of furthering their mandates, as well as giving additional voice and leadership opportunities to more associates throughout the organization. We’re strengthening our talent acquisition strategies and continuing to develop our robust internship and scholarship programs to create more opportunities for women and people of color. As I have said in the past, the gains do not come quickly enough, but we are making progress toward achieving a workforce that, over time, will be more representative of the clients and communities we serve. I am privileged, and proud, to lead a remarkable team of associates at Baird. Our associates have proven beyond any doubt that their commitment to ensuring the best possible outcomes for clients – and for each other – can help transcend some of the most challenging economic conditions in the history of our business. They have also shown that, while markets may redefine how great outcomes are measured at times, they will remain focused on delivering outcomes that are done well – with expert advice, honest communication and genuine caring. That will always be the Baird Difference. Paul E. Purcell Chairman, President & Chief Executive Officer Baird 2010 Annual Report 11 Structured for Success Baird’s independence and employee ownership give us the freedom to do what we believe is in the best Private Wealth Management Equity Capital Markets Equity Research – Institutional Equity Services – Investment Banking long-term interests of our clients. Despite extremely challenging markets in recent years, we have made significant investments in our team and global reach, while maintaining substantial capital and a strong balance sheet. Nearly half of all Baird associates own shares in the company, which promotes a very strong alignment with the interests of our clients. Baird’s Private Wealth Management professionals provide comprehensive wealth management strategies and solutions for high-net-worth individuals and their families across the United States. • $63 billion in client assets overseen or managed by 680 highly skilled Financial Advisors and their teams • More than 60 in-house specialists provide advice for all aspects of wealth management, retirement planning, charitable giving and wealth transfer • Serves clients coast to coast from 71 locations in 23 states • Barron’s Top Wealth Managers list, 2007–2010 Private Wealth Management Revenues Financial Advisors Our Equity Capital Markets team delivers expertise in research and sales and trading to domestic and international institutions. Baird’s Investment Banking group provides equity underwriting and mergers and acquisitions advisory services to middle-market companies. • 633 companies under research coverage • Ranked No. 1 once again for “most trusted” and “most important” research firm in 2010 Greenwich small/mid-cap survey* • Advised on more than 125 financing and global M&A transactions in 2010 with a total value of $26.4 billion • A Top 10 U.S. underwriter of initial public offerings in 2010, according to Dealogic Equity Capital Markets Revenues Institutional Shares Traded ($ millions) (billions) ($ millions) 339 298 3.2 3.3 352 320 660 680 255 591 592 600 296 224 188 183 06 Baird’s culture is a true competitive advantage. In January 2011, we were recognized as one of the FORTUNE 100 Best Companies to Work For® for the eighth consecutive year. Ranked No.14, we celebrated our third straight year among the top 15. FORTUNE is a registered trademark of Time Inc. and is used under license. From FORTUNE Magazine, February 7, 2011 © 2011 Time Inc. FORTUNE and Time Inc. are not affiliated with, and do not endorse products or services of, Licensee. 12 12 Baird 2010 Annual Report Baird 2010 Annual Report 07 08 09 10 63 06 07 08 2.9 09 10 billion dollars in client assets 06 07 08 2.1 173 09 No. 10 1 06 2.3 07 08 09 10 most trusted research in 2010 Greenwich survey* *Greenwich Associates U.S. Equity Investors – Small/Mid-Cap Funds, April 2010. Surveys conducted with 93 U.S. small-cap and mid-cap fund managers. Rankings based on top 10 research firms in survey. Baird is a privately held, employee-owned financial services company that oversees or manages more than $82 billion in client assets. Over our 91-year history, we’ve built a strong platform of five complementary businesses that help diversify and balance revenue through all types of market conditions. These advantages give us the financial strength to make ongoing investments in the professional expertise and distinctive culture that make Baird a trusted partner for corporations, institutions and individuals across the United States, Europe and Asia. Private Equity Fixed Income Capital Markets Asset Management Baird Capital Partners – Baird Venture Partners – Baird Capital Partners Europe – Baird Capital Partners Asia Fixed Income Sales and Trading – Public Finance Baird Advisors – Baird Investment Management – Baird Public Investment Advisors Baird Private Equity makes venture capital, growth equity and buyout investments in lower middle-market companies in the Manufactured Products, Business Services and Healthcare/Life Sciences sectors. Baird’s Fixed Income Sales and Trading team provides investment ideas and trade execution for institutional clients in the United States and Europe. Our Public Finance professionals meet the debt underwriting and advisory needs of public- and private-sector clients. Baird’s experienced fixed income and equity portfolio managers offer disciplined investing and outstanding service to institutional investors and high-net-worth individuals through customized portfolios and mutual funds. • $2.7 billion in capital raised since inception and investments made in 244 portfolio companies • Baird Capital Partners ranked as a Top 10 “Consistent Performer” in 2010 Preqin survey of 570 private equity funds worldwide • 61 investment and operating professionals in the United States, Europe and Asia • 15 operating professionals in Beijing, Hong Kong, Shanghai and Bangalore support our portfolio companies • 100+ institutional sales, trading and analytics professionals in 25 offices • $233 billion in face value of taxable and tax-exempt bonds traded in 2010 • 30 Public Finance bankers in 11 offices nationally • A leading U.S. municipal underwriter: in 2010, No. 1 in issues of $50 million or less and No. 5 in competitive underwritings of all sizes, based on par value, according to Thomson Reuters Private Equity Revenues Cumulative Capital Raised and Managed Fixed Income Capital Markets Revenues ($ millions) ($ billions) ($ millions) 47 2.4 2.5 2.6 2.7 Sales Professionals, Traders and Bankers 128 211 1.8 90 23 Asset Management Revenues Total Assets Under Management ($ millions) ($ billions) 29 105 170 30 28 133 • $15.2 billion in institutional fixed income portfolios and mutual funds under management by Baird Advisors • Nearly $1.1 billion under management for municipalities and school districts by Baird Public Investment Advisors • $550 million in mid-cap and largecap equity portfolios and mutual funds managed by Baird Investment Management • Minority interest in RiverFront Investment Group, which manages $2.5 billion 23 96 16.6 16.9 29 24 25 13.8 15.3 15.0 110 15 06 07 08 09 10 2.7 06 07 08 09 10 billion dollars raised and managed 54 57 06 07 08 No. 09 10 1 06 07 08 09 10 municipal bond underwriter nationwide* *Based on number of issues, according to Thomson Reuters 06 07 08 09 10 16.9 06 07 08 09 10 billion dollars in assets under management Baird 2010 Annual Report 13 In Private Wealth Management, sound advice begins with active listening by our Financial Advisors. Because genuine caring backed by deep expertise is the foundation of comprehensive solutions for high-net-worth clients. Jim Furletti Financial Advisor and Associate Branch Manager Baltimore 14 14 Baird 2009 2010 Annual Report Baird 2009 Annual Report Ana Ebaugh Administrative Office Manager Baltimore Mike Levin Financial Advisor Baltimore Private Wealth Management Responding to real concerns and changing priorities Several years of equity market volatility and low interest rates, combined with uncertainty over income tax and estate tax legislation, have caused significant concern for many investors. That has led them to not only question their ability to meet long-term goals, but also to re-evaluate their tolerance for risk in their investment portfolios. Baird Financial Advisors have actively engaged clients to deepen their understanding of clients’ changing preferences and reaffirm long-term goals for retirement, charitable giving and wealth transfer. Our Financial Advisors are well qualified to do so. Half have earned at least one professional designation or qualified as a Baird Senior Investment Consultant through our program at the University of Chicago Booth School of Business, which focuses on the specialized needs of high-net-worth families and business owners. As the planning needs and asset-allocation concerns of our clients become more complex, we continue to deepen the advice we provide to help them achieve their financial goals. Baird Financial Advisors have ready access to a highly skilled, in-house team of more than 60 specialists in areas such as investment research, tax and estate planning, and riskmanagement strategies, as well as services for business owners and corporate executives. It is a fully cross-functional team that brings a broad understanding of the complex wealth management issues facing many of our clients. “The talent pool at Baird is very deep. We get quality service from people who are bright, motivated and experienced, and who really want to help us and our clients. Coming from a much larger firm, it was a very pleasant surprise.” Jim Furletti, Associate Branch Manager, Baltimore Katie Schoen Todd Parrish Research Analyst Research Analyst Private Wealth Management Baird 2010 Annual Report 15 Private Wealth Management The Epstein Calvelli Group, Milwaukee Chris Calvelli Senior Investment Consultant Monica Mullen Registered Client Relationship Associate Elizabeth Kendall Registered Client Relationship Associate David Epstein Financial Advisor Baird Financial Advisors managed or oversaw $63 billion in client assets at the end of 2010, a 13% increase over the prior year. Half of all Financial Advisors work on teams to leverage each other’s expertise and broaden the service they provide clients. Advice and solutions for today’s markets Baird’s in-house specialists continue to garner national media attention from publications such as The New York Times, The Wall Street Journal, USA Today and BusinessWeek for their insights into tax, estate and investment planning. 16 Baird 2010 Annual Report Just as our Financial Advisors seek to understand the needs of their clients, Private Wealth Management’s team of products and services specialists continues to expand resources available to our Financial Advisors. Our specialists operate as an integrated team to communicate, for example, how legislative changes or market conditions will impact wealth management strategies. Their mandate is to provide timely, client-centered advice on broad issues, as well as thoughtful solutions for individual investors, so that Financial Advisors can help clients achieve their long-term goals. Baird Financial Advisors are skilled at customizing the allocation of assets to meet clients’ specific wealth management objectives through the many stages of their financial lives. During 2010, Baird continued to expand its product offerings beyond traditional asset classes to include investments that have the ability to be effective in dynamic market conditions. Our advisory programs also have been enhanced to include tactical portfolio and alternative strategies, as well as traditional asset classes. • Select Baird Financial Advisors and Branch Managers were included in 2010 rankings of “Top 100 Financial Advisors” and “Branch Manaagers of the Year” by Barron’s and On Wall Street. • Baird is very committed to increasing the number and role of women advisors. The Baird Network of Women Financial Advisors provides a forum to connect, share best practices and promote the profession as an attractive career choice. Barbara Griffin Senior Investment Consultant Grand Rapids Kim Haws Falasco Financial Advisor Akron 18 Our Financial Advisors average more than 18 years of industry experience, and half have earned at least one professional designation or qualified as a Baird Senior Investment Consultant. Approximately 75% of our Client Relationship Assistants are licensed professionals. Mike Schroeder President, Private Wealth Management, talks with Baird’s Network of Women Financial Advisors Expanding our platform In Private Wealth Management, as in all Baird businesses, we place great importance on the continuity of our relationships with clients. In contrast to many larger firms in recent years, we enjoy strong retention of senior Financial Advisors with long service at Baird. We have also had continuing success in attracting experienced advisors who appreciate Baird’s entrepreneurial approach, distinctive culture and financial stability. During 2010 – our second-best recruiting year ever – we hired 62 Financial Advisors and Branch Managers. Almost all are industry veterans overseeing substantial client assets. We are selectively growing our national presence as well. Private Wealth Management opened six new offices in 2010 in the Mid-Atlantic and Midwest regions and Texas. Designing and implementing a complex wealth management strategy requires ready access to useful information. Baird Financial Advisors and their clients are supported by a wide array of world-class account management tools. Baird HouseholdView, for example, provides clients a comprehensive look at their investment assets across multiple generations, up to the previous business day. This information positions clients to work with their Financial Advisors to make timely, informed investment decisions. Baird client statements also achieved a ranking of “excellent” in the 2010 review by DALBAR, a leading firm analyzing the financial services industry. Private Wealth Management Baird 2010 Annual Report 17 In Equity Capital Markets, great outcomes are founded on best-in-class research and deep expertise in trading, capital markets and advisory services. Great relationships are built by a strong, stable team and an unrelenting focus on our clients’ interests. Bob Graham Institutional Investment Officer 18 18 Baird 2009 2010 Annual Report Baird 2009 Annual Report Bill Walker Managing Director, Mason Street Advisors Co-Portfolio Manager, Small Cap Portfolios Dan Steffes Institutional Trader Erika Maschmeyer Senior Research Analyst Equity Capital Markets Committed to being the best for clients Baird has made substantial investments in recent years to deepen the expertise and broaden the skills we provide our Equity Capital Markets clients. We dramatically expanded our research coverage while many firms were decreasing theirs. We added to the strength of our trading desks, the breadth of our market making and the scope of our electronic execution capabilities. Throughout a challenging business downturn, we kept our global Investment Banking team intact and active to ensure that clients received the advice and continuity that are essential for strong partnerships and great outcomes. Our commitment to providing trusted, objective advice and best execution again earned important third-party recognition for our Equity Capital Markets teams in 2010. Research and Institutional Equity Services once again achieved No. 1 rankings for “most trusted” and “most important” research firm in Greenwich Associates’ 2010 survey of small-cap and mid-cap fund managers.* Prominent industry publications also recognized our Investment Banking team with numerous major awards for innovative advisory transactions on behalf of middle-market clients. We were recognized for the sixth year in a row by The M&A Advisor, earning four awards. In Europe, Acquisitions Monthly called out our bankers’ expertise for the fourth consecutive year with its “Support Services Adviser Award.” *Greenwich Associates U.S. Equity Investors – Small/Mid-Cap Funds, April 2010. Surveys conducted with 93 U.S. small-cap and mid-cap fund managers. Rankings based on top 10 research firms in survey. In October 2010, Baird served as lead book runner for the $202 million initial public offering of Vera Bradley, Inc., a leading designer and retailer of accessories for women. The transaction was one of the top-performing IPOs of a U.S.-based company during 2010. Patricia Miller Vera Bradley Co-founder Chris Sciortino Investment Banker Michael Ray Vera Bradley CEO Equity Capital Markets Barbara Bradley Baekgaard Vera Bradley Co-founder Baird 2010 Annual Report 19 Equity Capital Markets Peter Lisnic Senior Research Analyst Tristan Gerra Senior Research Analyst For the seventh consecutive year, Baird ranked No. 1 for “most trusted” research in the 2010 Greenwich Associates’ survey of small-cap and mid-cap fund managers – a testament to our commitment to provide expert, objective advice. Research Three Baird analysts received “Best on the Street” awards in The Wall Street Journal’s 2010 survey. Our analysts also garnered 13 awards for earnings accuracy and stock picking in the StarMine awards published by the Financial Times. During the past five years, Baird has expanded its research coverage by 40%. Our 112 analysts followed 633 companies at the end of 2010 – representing 37% of the total U.S. market capitalization – and published more than 12,000 reports during the year. We continue to deepen our expertise to serve clients better. In late 2010, we added three senior research analysts and a senior associate to broaden our Energy sector coverage to master limited partnerships and Exploration and Production companies. This new group also adds depth to our Clean Technology and Energy and Environmental Policy research and banking teams. The durability of our partnership with clients can be seen in third-party rankings. In the 2010 Greenwich Associates’ survey of small-cap and mid-cap fund managers, our Research and Institutional Equity Sales team ranked No. 1 for the seventh consecutive year for “greatest knowledge of companies and industries.” We also extended our record of providing “best direct access” to company management. In 2010, we held five major investor conferences – including our largest-ever, hallmark Industrial Conference and an inaugural Clean Technology Conference – at which more than 490 companies presented. Baird also hosted more than 475 corporate management trips, including 100 to Europe. 20 Baird 2010 Annual Report Research: Companies Covered • Our institutional sales team based in London has continued to expand coverage to institutional investors in Europe, Australia and Asia, increasing revenues by 22% in 2010. 616 633 506 497 06 07 535 08 09 10 Steve Holt Institutional Investment Officer 16 • In early 2010, Baird was named the No. 1 firm in the United States – and had the No. 1 salesperson worldwide – in First Coverage’s “2009 Top Performer Rankings.” The survey recognizes the best institutional equity salespeople and sell-side firms worldwide. Great ideas, continuous coverage and quality execution are driving strong market share gains in the domestic and international markets that Baird serves. Institutional Equity Services posted its 16th consecutive year of record revenues in 2010. Greg Gaynor Institutional Trader Gregory Greenhouse Institutional Trader Institutional Equity Services Our consistency of focus on the needs of clients and the continuity of experienced personnel on our desks – even when market volumes are down – have made Baird a trusted partner for domestic and international institutional investors around the world. For eight consecutive years, U.S. small-cap and mid-cap fund managers surveyed by Greenwich Associates have ranked Baird’s Institutional Equity Services team as No. 1 for “overall sales quality” and “provides best insights that generate alpha” – a strong endorsement of our belief that great outcomes begin with solid investment ideas geared to clients’ portfolios and backed by quality trade execution. During 2010, we experienced strong client adoption of our expanded execution capabilities available on the Baird trading platform. Our strategic partnership with Fox River Execution provides institutional clients with a top-performing – and conflict-free – suite of customizable execution products for algorithmic and electronic trading solutions. Our desks offer program trading that combines buy-side and sell-side perspectives and an agency model to fulfill clients’ orders. In addition, we offer CSA/soft dollar execution services. Our desks traded 3.3 billion shares for institutional clients in 2010, a 75% increase in volume during the past five years. Baird currently makes a market in more than 2,000 stocks. Equity Capital Markets Baird 2010 Annual Report 21 Equity Capital Markets Chris McMahon Head of Global M&A During 2010, we completed a record 76 financing transactions, raising $14.2 billion. We advised on a record 51 M&A transactions with a total value of $12.2 billion. Investment Banking Baird ranked among the top 10 most-active underwriters of initial public offerings for U.S.-based companies, according to Dealogic, based on priced or pending transactions for 2010. We managed three of our largest book-run IPOs ever in 2010. Baird’s Investment Banking group brings an intense rigor and discipline to the needs of middle-market clients. We provide a full range of advisory, equity financing and restructuring services through an integrated, cross-border team based in the United States, Europe and Asia. We have deep expertise in nearly a dozen major industry verticals, with dedicated industry bankers supported by top-rated equity research. Baird made a substantial investment in keeping its Investment Banking team together, which allowed us to serve clients well during the business downturn of 2008 and 2009. In fact, since the beginning of 2008, we have added 15 managing directors and directors and expanded our global footprint to 13 offices. We continued to expand our team during 2010, adding 30 banking professionals, including a well-respected Energy team focused on Oil and Gas Exploration and Production companies and master limited partnerships. Throughout the recent downturn, our Investment Banking professionals maintained close contact with clients to provide advice on their strategic options. The group’s increased interaction with U.S. and European middle-market financial sponsor firms led to a substantial increase in transaction volume. As markets improved in 2010, our long-term corporate and financial sponsor relationships helped drive strong gains in market share. That led to a record year for the number of financing transactions and initial public offerings we managed or co-managed and M&A transactions on which we advised. 22 Baird 2010 Annual Report • In late 2010, Baird served as co-manager for the $147 million initial public offering of American Depositary Shares for Xueda Education Group, which came to Baird for the quality of our research coverage of the sector. It was our first underwriting for a China-based company. Maria Watts Investment Banker 245 More robust markets and strong client relationships helped drive a dramatic increase in the value of M&A advisory assignments during 2010. Baird’s average transaction size was $245 million, a three-fold increase over the prior year. Chris Coetzee Investment Banker • Nearly a third of all Baird M&A transactions involved an international component over the past five years. We have completed transactions with companies based in 21 countries during that period. Trisha Hansen Investment Banker The global capabilities of Baird’s Investment Banking teams – and our commitment to provide expert, objective advice – represent a strong value proposition for middle-market banking clients. So does our experience. We have advised on 365 M&A transactions over the past 10 years, with a total value of more than $50 billion. That experience has enabled us to forge strong relationships with major financial and strategic buyers around the world and accrue a deep understanding of the specific requirements of a mid-market transaction. Over the past five years, 60% of our advisory transactions have involved a financial sponsor, while half have involved a public company. For equity financing clients, we provide effective syndication and excellent distribution backed by Baird’s commitment to quality equity research. As a result, we have lead-managed or co-managed more than 370 financing transactions over the past decade, raising $86 billion for clients. Investment Banking has approximately 175 professionals operating through dedicated sector teams in the United States, London, Frankfurt and Shanghai. More importantly, as a fully integrated team, we are able to leverage deep, sector-specific strengths and the ongoing involvement of senior bankers to provide seamless execution for middle-market clients. Equity Capital Markets Baird 2010 Annual Report 23 Baird Private Equity uses deep sector knowledge, an experienced investment team and extensive global resources to drive growth in smaller, high-potential companies in the United States, Europe and Asia. That’s the basis of our consistent performance. Dennis Hall Portfolio Director Baird Capital Partners Europe 24 24 Baird 2009 2010 Annual Report Baird 2009 Annual Report David Fraser Operating Partner Baird Capital Partners Europe James Benfield Director Baird Capital Partners Europe Private Equity Capturing the potential of the lower middle market New economic realities demand a focused, proactive strategy for success. For Baird Private Equity, that means a focus on lower middle-market companies aligned with a deep understanding of the Healthcare, Manufactured Products and Business Services sectors across the United States, Europe and Asia. It involves an extensive global platform that enables us to accelerate revenue growth and drive operating efficiencies. And it means proven discipline, not only in how we invest, but in how we structure transactions, align interests and manage for the long term. For the third consecutive year, Baird Capital Partners – one of four fund families run by Baird Private Equity – was named one of the top “Consistent Performers” by Private Equity Intelligence Ltd. In its 2010 survey, Baird Capital Partners ranked No. 7 of the more than 570 international funds analyzed, making it the U.S. leader among all lower middle-market funds. The resumption of global economic growth in 2010 led to significant improvements in performance across our business. Revenues for Baird Private Equity nearly doubled to $29.6 million. It was also a much more active year for both new investments and exits. Across all funds, we invested a total of $82.0 million in six new investments and in add-on acquisitions, and we realized total proceeds of $44.6 million on the exit of six investments. Paddock Holdings, a portfolio company of Baird Capital Partners Europe, employed Baird Asia resources extensively to reduce manufacturing costs and develop its first sales into Asia. Initiatives like these drove a 2.7× gross return on investment. Martyn Ngo General Manager Baird Asia Derek Ooi Deputy General Manager Baird Asia Private Equity Janet Ni Deputy General Manager Baird Asia Baird 2010 Annual Report 25 Private Equity Tom Costello Vice President Baird Capital Partners Gordon Liao Vice President Baird Capital Partners Aaron Lillybridge Principal Baird Capital Partners Baird Private Equity’s global team includes 29 investment and 32 operating professionals, all of whom share a deep commitment to superior execution. The average tenure of our investment professionals is nearly 10 years. A global platform for growth The Baird Asia team has a rich mix of industry expertise, technical knowledge and project management experience. It has a proven track record of delivering value for Baird Private Equity portfolio companies. Baird Private Equity has developed a global investment platform that is among the most extensive in the lower middle market. Our experienced investment professionals operate in four discrete teams from offices in Chicago, London and Shanghai. We complement the skill set of our portfolio companies’ entrepreneurial management teams with talented senior executives who have extensive industry experience and operating expertise. Our Portfolio Management Program supports our investment teams and operating companies by implementing portfolio-wide programs such as global sourcing, supplier/vendor management, working capital reduction and acquisition integration. We also leverage Baird’s broad network of global contacts to provide our management teams access to industry relationships, management talent and strategic buyers and sellers in the United States, Europe and Asia. Our private equity platform is ideally positioned to take advantage of the increasing role of emerging markets in the global economy. With 15 professionals in Beijing, Hong Kong, Shanghai and Bangalore, India, we have one of the largest operating teams in Asia supporting a lower middle-market investment group. Baird Asia works extensively with our portfolio companies, leveraging its on-the-ground presence to develop and implement strategies such as creating sourcing relationships, building supply chains, establishing Asian operations and selling in Asia. 26 Baird 2010 Annual Report • Private Equity’s sectorfocused advisory boards, which provide strategic and operating advice to our portfolio companies in the United States, United Kingdom and Asia, include approximately 40 current and former senior executives of leading manufacturing, healthcare and business services companies. Jim Pavlik Benedict Rocchio PartnerPartner Baird Venture Partners Baird Venture Partners 244 Since Baird Private Equity’s founding in the 1980s, our partnerships have invested in 244 portfolio companies. At the end of 2010, the Funds held investments in 47 companies. Hock Goh Operating Partner Baird Capital Partners Asia • Cumulative capital raised and managed by Baird Private Equity totaled $2.7 billion at the end of 2010. During the year, Baird Capital Partners Asia closed fundraising on its first fund. Brett Tucker Partner Baird Capital Partners Asia Huaming Gu Partner Baird Capital Partners Asia Building value for companies and investors Baird Private Equity makes venture capital, growth equity and buyout investments through a series of limited partnerships. Each of our partnerships is supported by a strong investment team with complementary experience and skill sets and a powerful platform of resources to help execute our investment strategies. During 2010, we examined approximately 1,700 potential acquisitions for new or add-on investment in our funds. United States. baird capital partners makes buyout investments in lower middlemarket companies in the Business Services, Healthcare and Manufactured Products sectors. baird venture partners invests in early-stage and expansion-stage U.S. companies in the Business Services and Life Sciences sectors. Europe. baird capital partners europe makes buyout investments in lower middlemarket companies in the Business Services, Healthcare and Manufactured Products sectors in the United Kingdom. Asia. baird capital partners asia provides growth equity capital to smaller, highpotential companies in China or to those with substantial operations and growth opportunities in China. Private Equity Baird 2010 Annual Report 27 Our Fixed Income Capital Markets teams deliver investment expertise, financing solutions and quality execution, year after year. It’s a partnership that our clients have come to value in all types of markets. Jordan Chirico Asset-Backed Securities Trader 28 28 Baird 2009 2010 Annual Report Baird 2009 Annual Report Ariel Dorfman Mortgage Trader Alex Ketner Fixed Income Institutional Sales Fixed Income Capital Markets Committed to growing relationships Over the past five years, Baird’s Fixed Income Capital Markets group has emerged as a national powerhouse, while many competitors were contracting. As we expanded account coverage, analytical skills and product offerings, Fixed Income Sales and Trading has grown to 25 offices and 127 professionals. This growth has been augmented by additional capital in the business to ensure a consistent source of liquidity to meet clients’ needs. Over the same period, Public Finance expanded beyond its Midwestern base to 11 offices nationally and a team of 61 professionals. Baird’s 30 bankers have deepened their skills in advising on larger, more complex issues facing their clients and embraced new types of financings. Our commitment to long-term relationships and quality execution has enabled Public Finance to move steadily up the national ranks of municipal underwriters, ranking as the No. 1 lead manager of issues of $50 million or less in 2010, based on both number and par value of the issues, according to Thomson Reuters. This combination of knowledgeable professionals and continuous commitment to fixed income markets has enhanced our national presence and ability to provide innovative solutions to clients. As trading and credit markets normalized in 2010, Sales and Trading posted its second-best year of results, while Public Finance set a new high-water mark for both revenues and number of transactions. Our Institutional Sales and Trading team has grown 56% in the past five years. It is supported by our Portfolio Strategies and Analytics group, which provides comprehensive portfolio analysis and risk profiles for institutional clients. Tommy Wammack Portfolio Strategy & Analytics Manager Sang Woo Park Fixed Income Portfolio Analyst Fixed Income Capital Markets Kirill Krylov Portfolio Products & Integration Group Manager Baird 2010 Annual Report 29 Fixed Income Capital Markets Brian Kelso Public Finance Banker Yoon-Sook Moon Financial Analyst Brian Colon Public Finance Banker Baird ranked as the No. 1 municipal bond underwriter in the nation in 2010, based on the number of competitive and negotiated issues, according to Thomson Reuters. We also ranked among the top 10 underwriters of issues of $100 million or less, based on the par value of these issues. Fixed Income Sales and Trading 233 Baird fixed income desks traded $233 billion in face value of taxable and tax-exempt bonds for institutional and individual clients in 2010. The substantial investment we have made in recent years to build our trading desks, analytics group, institutional sales team and national network of offices continues to drive impressive results in Fixed Income Sales and Trading. While many competitors downsized in 2008 and 2009, we increased our commitment to fixed income markets. More than simply providing liquidity for transactions, however, we used our expanded expertise to deepen our coverage of accounts. Our professionals stayed focused on growing relationships through quality ideas and took a long-term approach to understanding and meeting clients’ objectives. This commitment to the fixed income markets has built a strong bond of trust among Baird and our clients and syndicate partners – a trust we work hard every day to earn. Today, Baird has 77 institutional sales professionals serving clients across the country and 26 traders on our institutional trading desks. These sales and trading professionals have an average of 15 years of experience. This includes a senior team of traders and underwriters who have built Baird into a strong national presence in negotiated and competitively bid syndicates for municipal underwritings. 30 Baird 2010 Annual Report • Fixed Income Sales and Trading has added 11 locations across the United States since 2006, bringing the total to 25 offices and 127 highly skilled sales, trading and analytics professionals. Holly Powell Administrative Lead Brian Lefler Public Finance Banker • Baird has an experienced team of 11 dedicated traders who work closely with Private Wealth Management Financial Advisors to provide analysis and execution on fixed income securities for individual investors. Michael DiPerna Public Finance Banker Public Finance In 2010, Baird served as the advisor, underwriter or placement agent on municipal bond transactions valued at more than $36 billion, 40% higher than our previous firm record. The cumulative value of these transactions over the past five years exceeds $110 billion. In the past five years, Baird has dramatically enhanced its Public Finance capabilities. We doubled our banking team to more than 60 bankers and analysts, adding experienced professionals in new areas of financing and new markets. During 2010, we focused on collaborating across offices to advise on complex financing challenges facing our clients, which include public, private and non-profit entities. With new types of financings that can be structured with taxable, tax-exempt and tax-credit components, clients look to Baird for expert advice on how to structure offerings to best meet their individual funding needs. In both 2009 and 2010, for example, Baird was the No. 1 underwriter nationwide of stimulus bonds authorized by the American Recovery and Reinvestment Act, based on the number of transactions, according to Thomson Reuters. This included an $80 million underwriting for the Michigan Strategic Fund, which used Recovery Zone Facility Bonds that enabled The Kroger Co., the nation’s largest traditional grocery retailer, to build and rehabilitate stores in Detroit’s tri-county metropolitan area. The project will create more than 250 jobs. Providing value-added advice remains the core of our Public Finance business. Our clients look to Baird not only for financing new projects but also for creative solutions to deal proactively with new fiscal realities. Fixed Income Capital Markets Baird 2010 Annual Report 31 The Baird difference in Asset Management rests on a proven combination – deep experience, disciplined strategy and consistent performance against benchmarks, backed by unparalleled service and direct access to senior portfolio managers. Meg Dean Portfolio Manager Baird Advisors 32 32 Baird 2009 2010 Annual Report Baird 2009 Annual Report Charlie Groeschell Senior Portfolio Manager Baird Advisors Asset Management Baird Advisors Baird Advisors has built a very consistent and successful approach to fixed income portfolio management. The team augments its investment approach with direct access to senior portfolio managers and quality service that is among the most respected in the industry. This compelling combination of performance and service has resulted not only in a steady increase in new clients but also client relationships that span more than 14 years on average. Assets under management totaled $15.2 billion at the end of 2010. Baird Advisors has a proven investment approach. Beginning with a duration-neutral strategy, we focus on adding value over benchmark returns through yield-curve positioning, sector allocation, security selection and competitive execution. This disciplined – and risk-controlled – approach has generated consistent, competitive performance over complete market cycles. The five Baird Bond Funds are managed with the same discipline, strategy and service commitment that institutional clients’ portfolios receive, and at very competitive costs. The funds’ strong value proposition and solid performance continued to attract robust inflows of assets from both individual and institutional investors. Assets under management in the bond funds grew 32% in 2010, contributing to a 142% increase over the past two years. The Baird Advisors team and three of the funds celebrated their 10th anniversaries in 2010. Baird Advisors’ senior portfolio managers have more than 28 years of experience working together. Across the entire team, our portfolio managers average more than 20 years of industry experience that includes numerous fullmarket cycles. Warren Pierson Senior Portfolio Manager Baird Advisors Sharon deGuzman Portfolio Manager Baird Advisors Asset Management Baird 2010 Annual Report 33 Asset Management Heidi Schneider Controller & Operations Officer Asset Management Jennifer Trowbridge Portfolio Manager Baird Public Investment Advisors Ryan Nelson Portfolio Manager Baird Public Investment Advisors As public officials are asked to do more with less, demand for Baird Public Investment Advisors’ services has grown rapidly. Assets under management have grown to more than $1 billion since the group was formed three years ago. Asset Management initiatives The BPIA team has extensive experience in managing investment portfolios for public entities. Our portfolio managers work directly with client administrative teams to develop a portfolio of investments that seeks to maximize interest earnings while maintaining safety and liquidity. Baird Public Investment Advisors is an innovative and highly successful joint venture launched in 2007 by Baird Advisors and Baird’s Public Finance banking team. With municipalities and school districts experiencing ongoing revenue challenges, prudent investment of public funds is essential for their operations. Baird Public Investment Advisors provides rigorous analysis of investment policy, risk tolerance, and historical and expected cash flows. We also conduct investment reviews and provide comprehensive investment reporting and analysis. Since our sole focus is managing funds for public entities, we have a thorough knowledge of state investment statutes and client-specific investment parameters. That enables us to customize investment and fund allocation strategies for individual circumstances. RiverFront Investment Group, an employee-owned, independent investment advisor, was formed in 2008 with Baird as a minority investor. RiverFront offers numerous asset allocation and exchange-traded fund portfolios designed to address an array of needs for investment type and risk tolerance. These portfolios are available in a combination of mutual funds and separately managed accounts. RiverFront also provides indexes for two exchangetraded funds. The performance and flexibility of the RiverFront family of funds have proven to be very attractive to investors and their advisors. The group has experienced substantial growth in assets since inception, ending 2010 with $2.5 billion in assets under management. 34 Baird 2010 Annual Report • Assets under management by Baird Asset Management – Baird Advisors, Baird Investment Management and Baird Public Investment Advisors – totaled $16.9 billion at the end of 2010. Chuck Severson Senior Portfolio Manager Baird Investment Management 19 Our seven portfolio managers and research analysts have on average more than 19 years of industry experience. • Baird Investment Management’s MidCap Fund marked its 10th anniversary in 2010. The fund’s experienced management team continues to build on its track record, seeking high-quality companies with above-marketaverage growth and profitability. Randy McLaughlin Portfolio Manager Baird Investment Management Baird Investment Management Baird Investment Management is an experienced manager focusing on quality mid-cap and large-cap growth equities for mutual funds and separately managed accounts, as well as specialized portfolios for high-net-worth individuals. We pursue investment in the highest-quality businesses that can increase in strength and value. Our analysts and portfolio managers conduct detailed, bottom-up research to find companies with positive fundamentals, relevant industry trends and management quality. Risk management is also a key component of our process. Our proprietary Tier Board combines core fundamental and quantitative factors to assess portfolio allocations. This tool supports team dialogue to better position our portfolios to capture success, while mitigating potential downside. Our approach has created a long-term record of delivering consistent, competitive, risk-adjusted returns for clients. In addition to investment performance, we create value for our clients by providing access to our senior portfolio managers – a practice that has enabled us to build long-term partnerships with institutions, corporations and high-net-worth individuals who entrust their assets to us. Continuing strength in equity markets and growth with core clients increased Baird Investment Management’s assets under management to $552 million at the end of 2010. Asset Management Baird 2010 Annual Report 35 Our Community Communities are important beneficiaries of Baird expertise. Many of our associates have leadership roles in civic and charitable causes, bringing considerable experience and energy to helping these organizations achieve their goals. 36 Baird 2010 Annual Report Helping our hometowns United for United Way Organizing to lend a hand We encourage Baird offices to support their communities by forming relationships that help advance the objectives of local charities and not-forprofit organizations. Last year, Bill Sewell, our Raleigh Branch Office Manager, rappelled from an office tower to raise money for Special Olympics – a novel example of support for a worthy cause. In the Milwaukee area, associate participation in the 2010 United Way campaign topped 95% for the eighth consecutive year, and we raised more than $1 million for the first time. Chicago donations grew over 20% and Cincinnati achieved 100% participation for the third straight year. Baird managers in Milwaukee served lunch to fellow associates, as thanks for their generous contributions. Each month, members of our African American Associate Resource Group help out at area charities, including Hope House of Milwaukee. Our Community Involvement Associate Resource Group inaugurated Baird Gives Back in 2009 to encourage collaborative volunteering. We expanded the initiative to nine cities in 2010 and are planning a week of events across the country in 2011. The caring, service and teamwork that Baird associates share at work also define our commitment to the communities where we live and work. That’s a commitment we encourage through our Baird Cares program, which provides paid time off for volunteer activities. Through the Baird Foundation, we support associates’ charitable efforts with gifts in the areas of health, education, the arts and other quality-of-life causes such as diversity. Judy Villegas Operations Department Regina Thompson Operations Department Patrice Malone Investment Banking Baird 2010 Annual Report 37 Financial Information Baird Holding Company: Financial Highlights Baird Holding Company is the ultimate parent company of U.S.-based Robert W. Baird & Co. and London-based Robert W. Baird Group Ltd. Our primary businesses are wealth management, capital markets, asset management and private equity. Baird is fully independent and employee-owned. Operating Results Per Share Data Financial Position Capital Net Revenues (in millions) Book Value (fully diluted) Total Assets (in thousands) Total Capital (in thousands) Associates Financial Advisors Private Wealth Offices 2010 $ 847 $31.51 $2,414,331 $741,175 2,629 680 66 2009 $ 718 $28.60 $ $ 702,713 2,458 660 62 2008 $680 $26.89 $1,140,003 $699,444 2,407 600 58 2007 $ $24.84 $ 1,752,307 $613,806 2,282 592 58 2006 $624 $ $ 1,681,385 $ 556,335 2,191 591 60 2005 $ 588 $18.44 $1,311,486 $ 554,047 2,234 600 61 2004 $ 566 $16.10 $1,331,613 $ 475,106 2,309 632 64 2003 $ 502 $14.09 $ 1,129,875 $ 482,594 2,324 664 68 2002 $484 $ 12.65 $ 857,602 $ 446,707 2,402 713 69 2001 $494 $11.94 $ 1,204,285 $ 418,588 2,574 824 79 729 21.17 2,158,512 Financial results do not reflect the consolidation of certain private equity partnerships. Revenues have been restated for comparability as the result of three transactions: the 2002 transfer of the Northwestern Mutual Investment Program to Northwestern Mutual, affecting revenues for 2001; the 2005 sale of our UK equity capital markets business that focused on small-cap companies, affecting 2001-2005 revenues; and the completion of a correspondent clearing services contract with Northwestern Mutual Investment Services in 2006, affecting 2002-2006 revenues. Per share amounts have been restated to give effect for the NET REVENUES (millions) 10 09 08 07 06 38 Other Data Baird 2010 Annual Report $847 $718 $680 $729 $624 two-for-one stock split, effective February 19, 2008. Total Capital includes stockholders’ equity, consolidated noncontrolling interest in Baird Financial Corporation and Robert W. Baird & Co. (RWB) from associate ownership, consolidated subordinated debt and other consolidated debt having a maturity of at least one year. The regulatory net capital of RWB, the principal operating subsidiary of Baird Holding Company, was $279 million at the end of 2010, and RWB’s regulatory excess net capital was $274 million at the end of 2010, which is more than 50 times the requirement. OPERATING INCOME (millions) TOTAL CAPITAL (millions) 10 09 08 07 06 10 09 08 07 06 $84 $62 $71 $105 $94 $741 $703 $699 $614 $556 Baird Recommended Portfolio – Growth of $1,000 Invested An investment of $1,000 in the Baird Recommended Portfolio at inception on December 31, 1974, would have grown to $74,033 at the end of 2010, compared with $44,333 for the NASDAQ Composite Index, $18,788 for the Dow Jones Industrial Average and $18,345 for the Standard & Poor’s 500 Stock Index (S&P 500). In the 36 years since inception, the Baird Recommended Portfolio has achieved a 12.7% annualized return vs. 11.1% for NASDAQ, 8.5% for the Dow Jones index and 8.4% for the S&P 500. $80,000 $70,000 $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $1,000 74 80 84 Baird Recommended Portfolio 88 NASDAQ 92 Dow Jones All performance data for research recommendations have been calculated without commissions or dividends. Details will be provided upon request. There is no guarantee that future performance of Baird Research recommendations will meet or exceed past performance. Returns to clients will vary, depending on securities purchased or sold. Equity securities carry risks that should be considered prior to investing. Baird Recommended Portfolio: Since inception on December 31, 1974, to December 31, 2010, 1,300 issues were recommended in the Recommended Portfolio; 760 issues increased in value, while 531 declined and nine were unchanged. Performance BOOK VALUE (per share) 10 09 08 07 06 96 00 04 10 S&P 500 results assume each security was purchased when recommended and sold when removed from the list. The Standard & Poor’s 500 Stock Index, Dow Jones Industrial Average and NASDAQ Composite Index are unmanaged common stock indices used to measure and report value changes in the various stocks that comprise those indices. The companies included in the Baird Recommended Portfolio do not necessarily correlate to the companies comprising the various indices described above, either by industry sector, capitalization or other weightings. ASSOCIATES $31.51 $28.60 $26.89 $24.84 $21.17 10 09 08 07 06 2,629 2,458 2,407 2,282 2,191 Baird 2010 Annual Report 39 Managing Directors Leadership With an average of more than 18 years each at Baird, the 14 members of our Executive Committee represent an extraordinary continuity of leadership. Together, they have helped guide Baird through numerous business cycles as well as its transformation into an independent, associateowned firm. Each is a passionate advocate for the core values on which Baird has built its reputation. Managing Directors Baird Advisors Mary Ellen Stanek Director Ghansham Panjabi Christopher Raymond David E. Tarantino Gary A. Elfe Charles B. Groeschell Warren D. Pierson Jay E. Schwister Daniel A. Tranchita Fixed Income Capital Markets Patrick S. Lawton Director Baird Investment Management Reik W. Read Equity Research Robert J. Venable Director David L. AuBuchon Peter S. Benedict Bruce A. Bittles Eric W. Coldwell Richard C. Eastman David A. George Tristan Gerra J. Michael Horwitz, Jr. Craig R. Kennison Quintin J. Lai Jon A. Langenfeld David Loeb Christopher R. Lucas Mark S. Marcon Lawrence H. Neibor 40 Baird 2010 Annual Report Fixed Income Sales & Trading William S. Andersen Alexander B. Buchler Robert P. DeBastiani James P. Healy Drew A. Kanyer Kirill A. Krylov Charles D. Massaro Michael J. Redmond John J. Sangervasi Thomas E. Swift Tommy T. Wammack Glenn P. Willett Institutional Equity Services William W. Mahler Director James H. Herrick Director, Equity Trading Anthony Bond John F. Byrne Steven M. Dadmun Richard W. Dunn Joseph C. Gerlach Clare Hasler Steve Holt Terence P. Hoy John T. Kennedy III Barry L. Kneisel Ross J. Kopfer Todd C. Lombra Gregory J. Lutz John S. McGregor John S. McLandsborough Thomas S. O’Connor Daniel J. Renouard John R. Roesner, Jr. Brian C. Scheller Todd A. Simons Patrick H. Spencer Daniel J. Steffes Brian C. Timmis Investment Banking Steven G. Booth Director Joachim Beickler Leslie Cheek IV C. Christopher Coetzee Joel A. Cohen Richard P. Conklin Brian S. Doyal John A. Fordham Curtis H. Goot Stephen B. Guy Jonathan J. Harrison Gregory J. Ingram Peter S. Kies Thomas W. Lacy Executive Management Executive Committee Paul E. Purcell Steven G. Booth Chairman, President & Chief Executive Officer C.H. Randolph Lyon Richard F. Waid Vice Chairmen Director, Investment Banking Paul J. Carbone Director, Baird Private Equity Leslie H. Dixon William W. Mahler Mary Ellen Stanek Paul E. Purcell Robert J. Venable Co-Head, Global Equities Chief Human Capital Officer Glen F. Hackmann Mark A. Roble Patrick S. Lawton Michael J. Schroeder C. Andrew Brickman Andrew Ferguson Huaming Gu Simon W. Havers Randall A. Mehl Robert D. Ospalik Gordon Pan David P. Pelisek Michael J. O. Proudlock Peter K. Shagory Scott G. Skie Brett H. Tucker Laura H. Gough David A. Hackworthy Mark L. Hawthorne Stephen D. Hoch Leah H. Hoffman A. Hale Hooper III Lisa A. Keverian-Press Michael G. Klein Peter Klode Mark D. Laufman John B. Lewenauer Marcus C. Low, Jr. John J. Luy John M. Mabee Kenneth J. Meyers John Mockovciak III Timothy M. Moore J. Bary Morgan William B. Nicholson Michael H. Perrini Neil J. Pinsky Gary S. Pinsly Patrick W. Powell Robert C. Ramsey Kurt A. Rivard Sheldon L. Rosenberg Thomas F. Schmid James Schultz Paul G. Sittenfeld Gregory S. Smith Steven W. Stahlberg Paul Stscherban Steven C. Tews Donald D. Wallace Director, Fixed Income Capital Markets Private Equity Paul J. Carbone Director Russell P. Schwei Vice Chairman Chairman, President & Chief Executive Officer General Counsel Thomas E. Lange John R. Lanza W. Andrew Martin Brian P. McDonagh Christopher C. McMahon Mark C. Micklem John M. Moriarty T. Frank Murphy Nicholas Pavlidis Joseph A. Pellegrini Gary R. Placek Paul T. Rogalski Renee C. Ryan Breton A. Schoch Christopher J. Sciortino Nicholas R. Sealy Jeffrey M. Seaman David M. Silver Anthony Siu Andrew K. Snow Franklin M. Stokes William O. Suddath, Jr. Rodney L. Tyson Gary D. Vollen Peter G. Watson William G. Welnhofer David M. Wierman Michael Wolff C.H. Randolph Lyon Private Wealth Management Michael J. Schroeder President, PWM Randy R. Beeman Susan C. Bellehumeur Timothy P. Byrne Allen J. Campbell Larry J. Carter Gregory S. Collins Douglas P. Condon Anthony E. Consiglio Matthew S. Curley Erik C. Dahlberg Philip C. Dallman Christopher G. Didier David S. Epstein Gerald M. Falci Scott T. Falk Ronald E. Farley Lawrence A. Gellman Gerald L. Gerndt Matthew A. Glatz Director, Risk Management Chief Operations Officer Director, Asset Management Co-Head, Global Equities Dominick P. Zarcone Chief Financial Officer President, Private Wealth Management Michael J. Welch J. Eric Wightman Public Finance Keith A. Kolb Director Todd L. Barnes Leslie L. Bear James R. Blandford Brian H. Colon David J. Conley Michael R. DiPerna Thomas J. Gavin Ann E. Gifford William M. Hepworth Richard D. Layton Timothy P. Long John A. Mehan David W. Noack Wayne L. Workman Administration & Corporate Resources James D. Bell Leslie H. Dixon Jeffry F. Freiburger Timothy J. Fuhr Glen F. Hackmann Lori A. Lorenz Craig D. Peotter Mark A. Roble John D. Rumpf Paul L. Schultz Russell P. Schwei Charles M. Weber Dominick P. Zarcone Baird 2010 Annual Report 41 Corporate Offices UNITED STATES Robert W. Baird & Co. 777 East Wisconsin Avenue Milwaukee, Wisconsin 53202 414-765-3500 800-79-BAIRD rwbaird.com New York Philadelphia Red Bank Reston San Francisco St. Louis Winston-Salem Holland Kalamazoo Traverse City West Bloomfield EUROPE Robert W. Baird Limited Mint House 77 Mansell Street London E1 8AF +44-207-488-1212 PRIVATE EQUITY Chicago Hong Kong London Milwaukee Shanghai MISSOURI Kansas City ASIA Baird Investment Advisor Co., Ltd. Rm 42-022, 42/F Hang Seng Tower No. 1000 Lujiazui Ring Road Pudong Shanghai 200120, China +86-21-6182-0980 PRIVATE WEALTH MANAGEMENT ARIZONA Phoenix Scottsdale Select locations of our business groups and affiliates: CALIFORNIA Grass Valley Roseville Sacramento San Francisco ASSET MANAGEMENT Cincinnati Milwaukee COLORADO Boulder Denver EQUITY CAPITAL MARKETS Atlanta Boston Charlotte Chicago Frankfurt London Milwaukee Nashville Palo Alto San Francisco Shanghai St. Louis Stamford Tampa Washington, D.C. FIXED INCOME CAPITAL MARKETS Albany Atlanta Charlotte Chicago Columbus Dallas Denver Edina Houston Indianapolis Lansing Milwaukee Nashville FLORIDA Naples Orlando Palm Harbor Sarasota Tampa Winter Park GEORGIA Atlanta North Point ILLINOIS Chicago Peoria Rockford Winnetka INDIANA Indianapolis Mishawaka IOWA Cedar Rapids Quad Cities Sioux City West Des Moines MARYLAND Baltimore Easton MICHIGAN Birmingham Grand Rapids MINNESOTA Edina Minnetonka NEBRASKA Omaha NORTH CAROLINA Charlotte Raleigh Winston-Salem OHIO Akron Cincinnati Cleveland Columbus Dayton OREGON Portland PENNSYLVANIA Philadelphia SOUTH CAROLINA Charleston TENNESSEE Nashville TEXAS Dallas Fort Worth Houston UTAH Salt Lake City VIRGINIA Lynchburg Reston WISCONSIN Eau Claire Fox Valley Green Bay Janesville La Crosse Madison – Downtown Madison – West Milwaukee – Downtown Milwaukee – North Shore Oconomowoc Racine Sheboygan Sturgeon Bay Waukesha Wausau West Bend ©2011 Robert W. Baird & Co. Incorporated Member SIPC. “Baird” is the marketing name for Robert W. Baird & Co. Incorporated and its subsidiaries and affiliates worldwide. Robert W. Baird Limited and Baird Capital Partners Europe Limited are authorized and regulated in the United Kingdom by the Financial Services Authority (registered numbers are 124308 and 150154 respectively) and they have approved this information for distribution in the UK and Europe. Services or products may not be available in all jurisdictions or to all persons/entities. Interbrand For additional information please visit Important Disclosures at rwbaird.com. #7033.10 This report is printed on FSC certified paper. The fiber used in the manufacture of the stock comes from well-managed forests, controlled sources and recycled wood or fiber. Great outcomes. Done well. Chicago | Frankfurt | london | Milwaukee | ShanghAi