statement of additional information

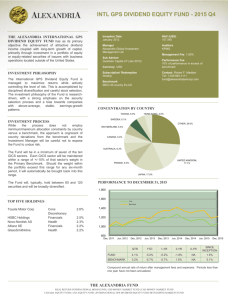

advertisement