10 Giant ETF Holdings

advertisement

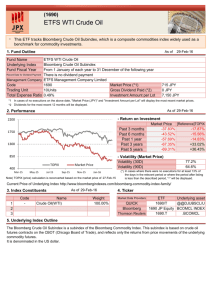

10 Giant ETF Holdings Ten of the most widely held ETF components with above-average dividend rank http://www.etfchannel.com/ ETF Channel tracks the top most widely held ETF components by total dollar amount held across the entire coverage universe of ETFs, and has paired that list with Dividend Channel's proprietary DividendRank formula, to bring you this list of 10 "dividend giants" — stocks with staggeringlylarge dollar amounts of stock held by ETFs, and which also pay aboveaverage dividends and have a strong DividendRank. XOM — Key Stats Company Name: Website: Sector: Number of ETFs Holding XOM: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: XOM — 2.5% Yield Exxon Mobil Corp. www.exxonmobil.com Oil & Gas Refining & Marketing 81 $12.33B $421.11B 2.93% Exxon Mobil Corp. XOM Dividend History Exxon Mobil's principal business is energy, involving the exploration for, and production of, crude oil and natural gas, manufacture of petroleum products and the transportation and sale of crude oil, natural gas and petroleum products. Co. is a manufacturer and marketer of commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics and a variety of specialty products. Co. also has interests in electric power generation facilities. Co. has a number of divisions and affiliates, with names that include ExxonMobil, Exxon, Esso or Mobil. As of Dec 31 2011, Co. had 24.90 billion barrels of oil-equivalent proved reserves. CVX — Key Stats Company Name: Website: Sector: Number of ETFs Holding CVX: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: CVX — 3.1% Yield Chevron Corporation www.chevron.com Oil & Gas Refining & Marketing 89 $8.29B $228.71B 3.62% Chevron Corporation CVX Dividend History Chevron is engaged in petroleum, chemicals, and mining operations, power generation and energy services. Co. markets petroleum products under the principal brands of Chevron, Texaco and Caltex throughout several parts of the world. Co. also markets a range of lubricant and coolant products under the brand names Havoline, Delo, Ursa, Meropa and Taro. In addition, Co.'s Oronite brand lubricant and fuel additives business is a developer, manufacturer and marketer of performance additives for lubricating oils and fuels. As of Dec 31 2011, Co. had 6,455.0 million of net proved reserves of crude oil, condensate, natural gas liquids and synthetic oil. TSM — Key Stats TSM — 2.6% Yield Taiwan Semiconductor Manufacturing Co., Ltd. www.tsmc.com Website: Semiconductors Sector: Number of ETFs Holding TSM: 16 Total Market Value Held by ETFs: $2.64B Total Market Capitalization: $76.30B % of Market Cap. Held by ETFs: 3.46% Taiwan Semiconductor Manufacturing Co., Ltd. Company Name: TSM Dividend History Taiwan Semiconductor Manufacturing and its subsidiaries are engaged in manufacturing, selling, packaging, testing and computer-aided design of integrated circuits and other semiconductor devices and manufacturing of masks. Co. also engages in the researching, developing, designing, manufacturing and selling of solid state lighting devices and related applications products and systems, and renewable energy and efficiency related technologies and products. Co.'s products include logic semiconductors, mixed-signal/radio frequency semiconductors, memory semiconductors, complementary metal oxide silicon (CMOS) image sensor semiconductors and high voltage semiconductors. INTC — Key Stats Company Name: Website: Sector: Number of ETFs Holding INTC: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: INTC — 3.9% Yield Intel Corp www.intc.com Semiconductors 101 $5.22B $116.84B 4.47% Intel Corp INTC Dividend History Intel designs and manufactures integrated digital technology platforms. Co.'s platforms are used in a range of applications, such as personal computers (including Ultrabook systems), data centers, tablets, smartphones, automobiles, automated factory systems, and medical devices. Co. also develops and sells software and services primarily focused on security and technology integration. As of Dec 31 2011, Co.'s operating segments included: PC Client Group; Data Center Group; Intel Mobile Communications; Intelligent Systems Group; Netbook and Tablet Group; Ultra-Mobility Group; McAfee; Wind River Software Group; Software and Services Group; and Non-Volatile Memory Solutions Group. T — Key Stats Company Name: Website: Sector: Number of ETFs Holding T: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: T — 4.7% Yield AT&T Inc www.att.com Communications Services 87 $6.17B $220.09B 2.81% AT&T Inc T Dividend History AT&T is a holding company. Through its subsidiaries and affiliates, Co. is a provider of telecommunications services. Co. has four segments: Wireless, which uses its nationwide network to provide wireless voice and data communications services; Wireline, which uses its regional, national and global network to provide landline voice and data communications services, AT&T U-verse® TV, broadband and voice services, and managed networking to business customers; Advertising Solutions, which publishes Yellow and White Pages directories and sells directory advertising, Internet-based advertising and local search; and Other, which includes customer information services such as operator services. PG — Key Stats Company Name: Website: Sector: Number of ETFs Holding PG: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: PG — 3.3% Yield Procter & Gamble Co. www.pg.com Consumer Goods 81 $6.17B $189.80B 3.25% Procter & Gamble Co. PG Dividend History Procter & Gamble provides branded consumer packaged goods. Co. has five segments: Beauty, which provides antiperspirant and deodorant, cosmetics, hair care, and hair color; Grooming, which provides blades and razors, electronic hair removal devices, hair care appliances, pre and post shave products; Health Care, which provides feminine care, gastrointestinal, incontinence, rapid diagnostics, respiratory, toothbrush, toothpaste, and vitamins/minerals/supplements; Fabric Care and Home Care, which provides laundry detergents, dishwashing liquids, batteries, and pet care; and Baby Care and Family Care, which provides baby wipes, diapers and pants, paper towels, tissues, and toilet paper. SPG — Key Stats Company Name: Website: Sector: Number of ETFs Holding SPG: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: SPG — 2.6% Yield Simon Property Group, Inc. www.simon.com REITs 73 $5.16B $49.03B 10.52% Simon Property Group, Inc. SPG Dividend History Simon Property Group is a self-administered and self-managed real estate investment trust. Co. owns, develops, and manages retail real estate properties, mainly regional malls, Premium Outlets®, The Mills®, and community/lifestyle centers. At Dec 31 2011, Co. owned or held an interest in 326 properties in the U.S., which consisted of 151 regional malls, 58 Premium Outlets, 66 community/lifestyle centers, 36 properties in the Mills Portfolio and 15 other shopping centers or outlet centers in 41 states and Puerto Rico. Co. also holds real estate interests in operating joint venture properties in Japan, South Korea, Mexico, and Malaysia. MSFT — Key Stats Company Name: Website: Sector: Number of ETFs Holding MSFT: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: MSFT — 2.6% Yield Microsoft Corporation www.microsoft.com Application Software 97 $10.18B $259.34B 3.92% Microsoft Corporation MSFT Dividend History Microsoft is engaged in developing, licensing, and supporting a range of software products and services. Co.'s products include operating systems for personal computers, servers, phones, and other devices; server applications for distributed computing environments; productivity applications; business applications; desktop and server management tools; software development tools; video games; and online advertising. Co. conducts its businesses through five reportable segments: Windows & Windows Live Division, Server and Tools, Online Services Division, Microsoft Business Division, and Entertainment and Devices Division. PFE — Key Stats PFE — 3.7% Yield Company Name: Website: Sector: Number of ETFs Holding PFE: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: Pfizer Inc www.pfizer.com Drugs & Pharmaceuticals 80 $4.87B $181.13B 2.69% Pfizer Inc PFE Dividend History Pfizer is a research-based biopharmaceutical company. Co.'s Primary Care segment includes products prescribed by primary-care physicians. Co.'s Specialty Care and Oncology segment includes products prescribed by physicians who are specialists. Co.'s Established Products and Emerging Markets segment includes products that have lost patent protection or marketing rights and those sold in emerging markets. Co.'s Animal Health and Consumer Healthcare segment includes products and services to address disease in livestock and companion animals and non-prescription products in several therapeutic categories. Co.'s Nutrition segment includes a range of infant and toddler nutritional products. JPM — Key Stats Company Name: Website: Sector: Number of ETFs Holding JPM: Total Market Value Held by ETFs: Total Market Capitalization: % of Market Cap. Held by ETFs: JPM — 2.9% Yield JPMorgan Chase & Co. www.jpmorganchase.com Banking & Savings 76 $3.94B $157.27B 2.51% JPMorgan Chase & Co. JPM Dividend History JPMorgan Chase is a financial holding company. Through its subsidiaries, Co. provides investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, asset management and private equity. Co.'s wholesale businesses comprise the investment bank, commercial banking, treasury and securities services, asset management segments. Co.'s consumer businesses comprise the retail financial services, and card services and auto segments. Under the J.P. Morgan and Chase brands, Co. serves a number of corporate, institutional and government clients. As of Dec 31 2011, Co. had total assets of $2.27 trillion and deposits of $1.13 trillion. Nothing in ETF Channel or Dividend Channel is intended to be investment advice, nor does it represent the opinion of, counsel from, or recommendations by BNK Invest Inc. or any of its affiliates, subsidiaries or partners. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. All viewers agree that under no circumstances will BNK Invest, Inc,. its subsidiaries, partners, officers, employees, affiliates, or agents be held liable for any loss or damage caused by your reliance on information obtained. By visiting, using or viewing this site, you agree to the following Full Disclaimer & Terms of Service. Video widget and dividend videos powered by Market News Video. Quote data delayed at least 20 minutes; data powered by Ticker Technologies, and Mergent. Contact Dividend Channel; Meet Our Editorial Staff.