Ownership Transfer Fee

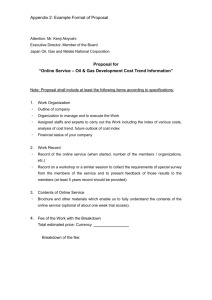

advertisement