Vol. 10, No. 250 December 28, 2012

The University of Illnois’ farmdocDaily (Click here to go to

the website) predictions of 2013 prices were part of the recent

2012 Farm Economics Summit. Dr. Darrell Good presented the

group’s outlook for 2013 crop and livestock prices. Some highlights

from the published paper are:

Crop prices will remain very volatile due to production uncertainty

and continued turmoil for broader economic issues. A transition to

lower prices is anticipated and the extent of the price decline will

be largely determined by the size of 2013 crops.

Smaller corn crops in other parts of the world and continuing

strong demand will reduce overseas inventories — on top of the

obvious reductions in U.S. stocks that have resulted from the poor

2012 crop. Argentine corn production, which, at 827 million bushels, was down 17% yr/yr last year, is expected to improve to 1.102

billion bushels this year — a gain of 33%.

“Stable” U.S. acreage and a return to a trend yield (which Dr.

Good’s slides indicate would be about 163 bu. per acre) would

result in a U.S. corn crop in excess of 14 billion bushels, “allowing

a substantial rebuilding of inventories.” Where average U.S. farm

prices will average above $7 for the ‘12-’13 marketing year, prices

for the ‘13-’14 marketing year could be from $4,75 to $5.50.

Sharply higher late-2012 soybean prices were driven by small

crops in both South America and the U.S. Current expectations

are for a record-large South American harvest. “Stable” acreage

and a return to trend soybean yield (which appears to be about 44

bushels/acre from Dr. Good’s slides) would put the 2013 crop very

near the 2009 record. Larger crops in both major growing areas

would expand world inventories and push the U.S. average farm

price for beans into the $11 to $12/bushel range, sharply lower

than the expected “12-’13 average of $14.50.

U.S. wheat production rebounded nicely in 2012 but output in the

rest of the world fell, improving U.S. export demand. High corn

prices helped wheat by driving more wheat feeding but year-end

stocks will be adequate. Good expects U.S. wheat acreage to

expand to roughly 56 million acres in 2013 but the big concern

remains drought conditions in the hard red wheat growing areas of

the U.S. Prices will remain high for the first half of 2013 but will

decline into the range of $6 to $7 in the second half of the year.

U.S. pork production is expected to decline from 23.26 billion

pounds in 2012 to 22.94 billion pounds (-1.4%) in 2013. The U of I

economists expect exports to remain stable near 2012 levels, lowering U.S. per capita pork supplies from this year’s 45.7 pounds to

just 44.9 pounds in 2013. Live prices of $64/cwt ($85.33/cwt carcass) are expected for the coming year. Those compare to $61

live ($81.33 carcass) in 2012 and $66 live ($88 carcass in 2011.

Beef production is forecast to decline from 25.7 billion to 24.6 billion pounds in 2013. Lower production will limit 2013 exports to

about 2.45 billion pounds, down slightly from this year’s 2.47 billion

pounds. Domestic per capita availability will be 54.8 pounds in

2013, a full 2 pounds lower than the 56.8 pounds available to U.S.

consumers in 2012. The U of I team has fed cattle prices pegged

at $125 in 2013, $3 higher than the 2012 average.

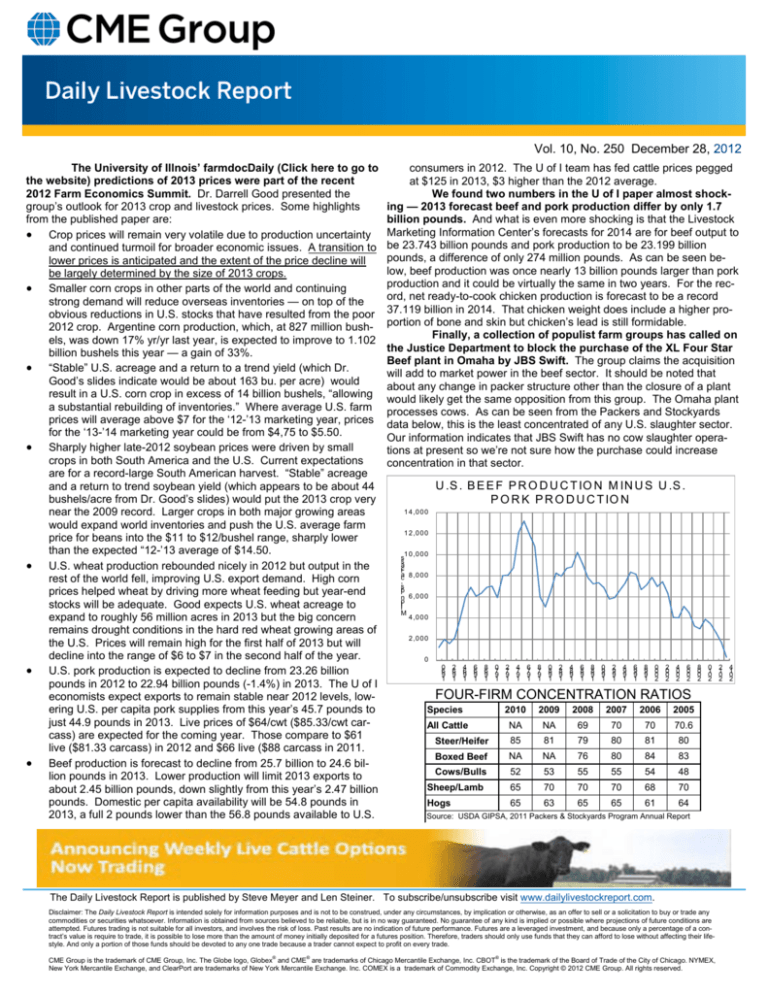

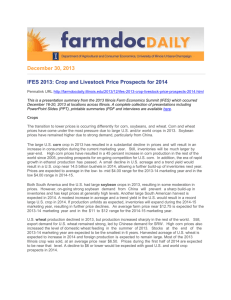

We found two numbers in the U of I paper almost shocking — 2013 forecast beef and pork production differ by only 1.7

billion pounds. And what is even more shocking is that the Livestock

Marketing Information Center’s forecasts for 2014 are for beef output to

be 23.743 billion pounds and pork production to be 23.199 billion

pounds, a difference of only 274 million pounds. As can be seen below, beef production was once nearly 13 billion pounds larger than pork

production and it could be virtually the same in two years. For the record, net ready-to-cook chicken production is forecast to be a record

37.119 billion in 2014. That chicken weight does include a higher proportion of bone and skin but chicken’s lead is still formidable.

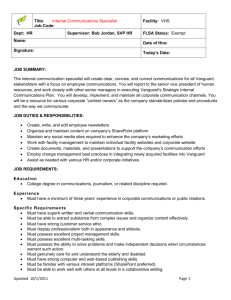

Finally, a collection of populist farm groups has called on

the Justice Department to block the purchase of the XL Four Star

Beef plant in Omaha by JBS Swift. The group claims the acquisition

will add to market power in the beef sector. It should be noted that

about any change in packer structure other than the closure of a plant

would likely get the same opposition from this group. The Omaha plant

processes cows. As can be seen from the Packers and Stockyards

data below, this is the least concentrated of any U.S. slaughter sector.

Our information indicates that JBS Swift has no cow slaughter operations at present so we’re not sure how the purchase could increase

concentration in that sector.

U .S . B E E F P R O D U C T IO N M IN U S U .S .

P O R K P R O D U C T IO N

1 4 ,0 0 0

1 2 ,0 0 0

1 0 ,0 0 0

s

s

a

c

r

a 8 ,0 0 0

c

.,

s

b

l

n 6 ,0 0 0

lio

li

M

4 ,0 0 0

2 ,0 0 0

0

0

6

9

1

2

6

9

1

4

6

9

1

6

6

9

1

8

6

9

1

0

7

9

1

2

7

9

1

4

7

9

1

6

7

9

1

8

7

9

1

0

8

9

1

2

8

9

1

4

8

9

1

6

8

9

1

8

8

9

1

0

9

9

1

2

9

9

1

4

9

9

1

6

9

9

1

8

9

9

1

0

0

0

2

2

0

0

2

4

0

0

2

6

0

0

2

8

0

0

2

0

1

0

2

FOUR-FIRM CONCENTRATION RATIOS

Species

2010

2009

2008

2007

2006

2005

All Cattle

NA

NA

69

70

70

70.6

Steer/Heifer

85

81

79

80

81

80

Boxed Beef

NA

NA

76

80

84

83

Cows/Bulls

52

53

55

55

54

48

Sheep/Lamb

65

70

70

70

68

70

Hogs

65

63

65

65

61

64

Source: USDA GIPSA, 2011 Packers & Stockyards Program Annual Report

The Daily Livestock Report is published by Steve Meyer and Len Steiner. To subscribe/unsubscribe visit www.dailylivestockreport.com.

Disclaimer: The Daily Livestock Report is intended solely for information purposes and is not to be construed, under any circumstances, by implication or otherwise, as an offer to sell or a solicitation to buy or trade any

commodities or securities whatsoever. Information is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are

attempted. Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indication of future performance. Futures are a leveraged investment, and because only a percentage of a contract’s value is require to trade, it is possible to lose more than the amount of money initially deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyle. And only a portion of those funds should be devoted to any one trade because a trader cannot expect to profit on every trade.

CME Group is the trademark of CME Group, Inc. The Globe logo, Globex® and CME® are trademarks of Chicago Mercantile Exchange, Inc. CBOT® is the trademark of the Board of Trade of the City of Chicago. NYMEX,

New York Mercantile Exchange, and ClearPort are trademarks of New York Mercantile Exchange. Inc. COMEX is a trademark of Commodity Exchange, Inc. Copyright © 2012 CME Group. All rights reserved.

2

1

0

2

4

1

0

2

![Bellringer Quiz May 18tha[2]](http://s3.studylib.net/store/data/006592480_1-fb41d0c53b12a24f299a4a7c8b3c022b-300x300.png)