Appendix A: Approach to Club Industry Statements of Activities

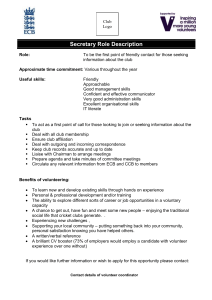

advertisement