Retirement

Put Your Tax Return to Work

You can instruct the IRS to deposit your refund directly into your OppenheimerFunds IRA or

any other OppenheimerFunds account when you file your tax return. This is an easy way to

build your retirement savings without taking money away from another part of your budget.

The maximum combined Traditional and Roth IRA contribution limit for 2015 and 2016

is $5,500 ($6,500 if you are age 50). Consult with your financial advisor to determine the

amount and the type of account that’s suitable for you.

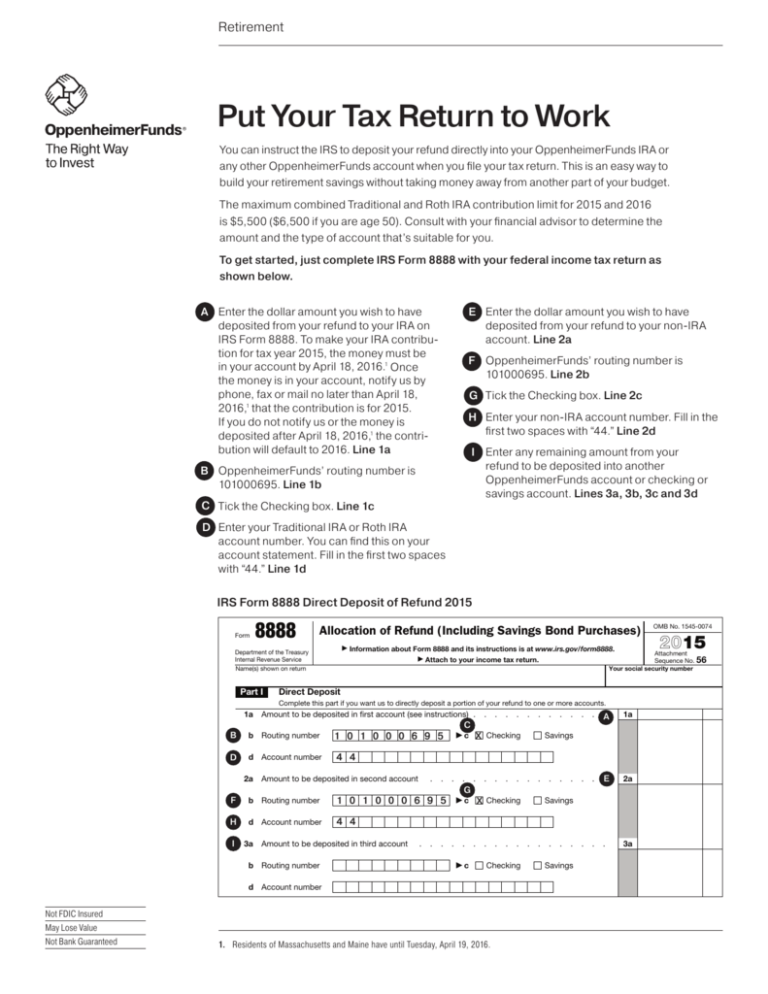

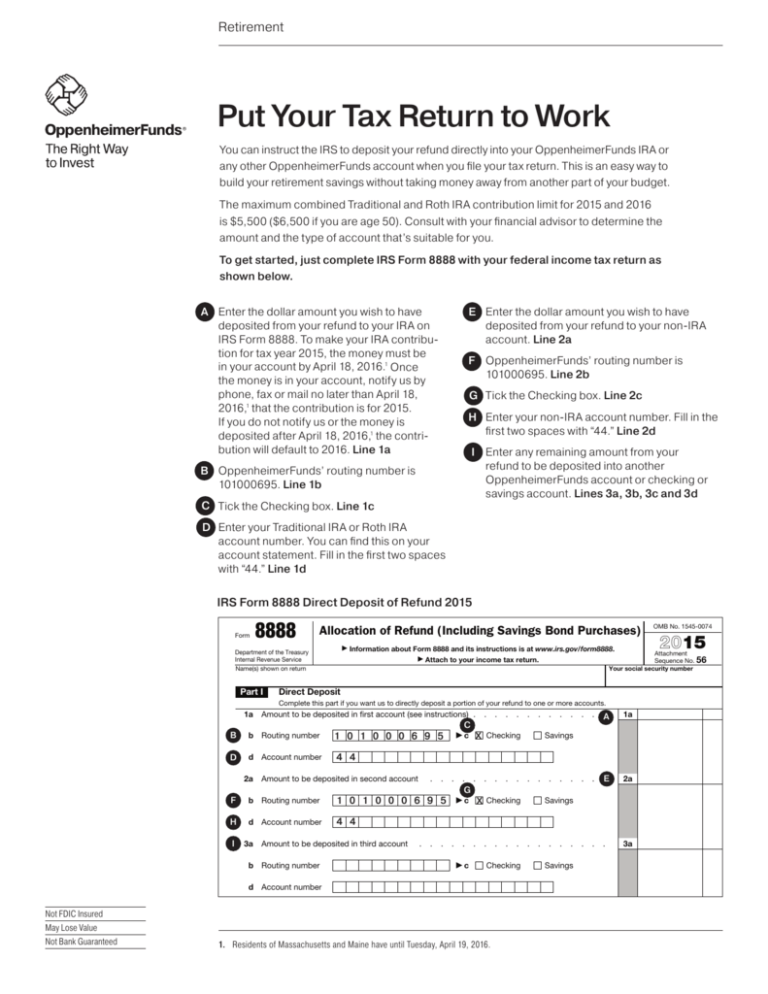

To get started, just complete IRS Form 8888 with your federal income tax return as

shown below.

A Enter the dollar amount you wish to have

deposited from your refund to your IRA on

IRS Form 8888. To make your IRA contribution for tax year 2015, the money must be

in your account by April 18, 2016.1 Once

the money is in your account, notify us by

phone, fax or mail no later than April 18,

2016,1 that the contribution is for 2015.

If you do not notify us or the money is

deposited after April 18, 2016,1 the contribution will default to 2016. Line 1a

E Enter the dollar amount you wish to have

deposited from your refund to your non-IRA

account. Line 2a

F OppenheimerFunds’ routing number is

101000695. Line 2b

G Tick the Checking box. Line 2c

H Enter your non-IRA account number. Fill in the

first two spaces with “44.” Line 2d

I Enter any remaining amount from your

refund to be deposited into another

OppenheimerFunds account or checking or

savings account. Lines 3a, 3b, 3c and 3d

B OppenheimerFunds’ routing number is

101000695. Line 1b

C Tick the Checking box. Line 1c

D Enter your Traditional IRA or Roth IRA

account number. You can find this on your

account statement. Fill in the first two spaces

with “44.” Line 1d

IRS Form 8888 Direct Deposit of Refund 2015

Form

8888

Allocation of Refund (Including Savings Bond Purchases)

▶

Department of the Treasury

Internal Revenue Service

Information about Form 8888 and its instructions is at www.irs.gov/form8888.

▶

2015

Attachment

Sequence No. 56

Your social security number

Attach to your income tax return.

Name(s) shown on return

Part I

OMB No. 1545-0074

Direct Deposit

Complete this part if you want us to directly deposit a portion of your refund to one or more accounts.

1a

Amount to be deposited in first account (see instructions) .

B

b Routing number

1 0 1 0 0 0 6 9 5

D

d Account number

4 4

2a

Amount to be deposited in second account

.

.

F

b Routing number

1 0 1 0 0 0 6 9 5

H

d Account number

4 4

I

3a

Amount to be deposited in third account

.

.

b Routing number

.

C

▶c

.

.

.

▶c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.A

1a

.

.

.E

2a

.

.

.

3a

Savings

.

.

X Checking

▶c

.

.

X Checking

G

.

.

.

.

.

Savings

.

Checking

.

.

.

.

Savings

d Account number

Not FDIC Insured

May Lose Value

Not Bank Guaranteed

Part II

U.S. Series I Savings Bond Purchases

Complete this part if you want to buy paper bonds with a portion of your refund.

!

▲

If a name is entered on line 5c or 6c below, co-ownership will be assumed unless the beneficiary box is checked.

See instructions for more details.

1. RCAUTION

esidents of Massachusetts and Maine have until Tuesday, April 19, 2016.

4

Amount to be used for bond purchases for yourself (and your spouse, if filing jointly) .

5a Amount to be used to buy bonds for yourself, your spouse, or someone else

b Enter the owner's name (First then Last) for the bond registration

.

.

.

.

.

.

4

.

.

.

5a

Take advantage of IRS Form 8888 for a faster,

easier way to build your savings.

• Talk to your advisor about contributing to your

Traditional or Roth IRA.

• Set up a direct deposit refund contribution

by downloading IRS Form 8888 from irs.gov.

Search for “Form 8888.”

http://www.irs.gov/pub/irs-pdf/f8888.pdf.

• For more information, visit

oppenheimerfunds.com or call the IRA

Resource Center at 800 783 7783.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the

FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

Visit Us

oppenheimerfunds.com

This material is provided for general and educational purposes only, and is not intended to provide legal, tax or investment advice, or for use to

avoid penalties that may be imposed under U.S. federal tax laws. Contact your attorney or other advisor regarding your specific legal, investment

or tax situation.

Call Us

800 783 7783

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s

investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses

contain this and other information about the funds, and may be obtained by asking your financial

advisor, visiting oppenheimerfunds.com or calling 1 800 CALL OPP (225 5677). Read prospectuses

and summary prospectuses carefully before investing.

Follow Us

Oppenheimer funds are distributed by OppenheimerFunds Distributor, Inc.

225 Liberty Street, New York, NY 10281-1008

© 2016 OppenheimerFunds Distributor, Inc. All rights reserved.

DS0000.024.0216 March 4, 2016