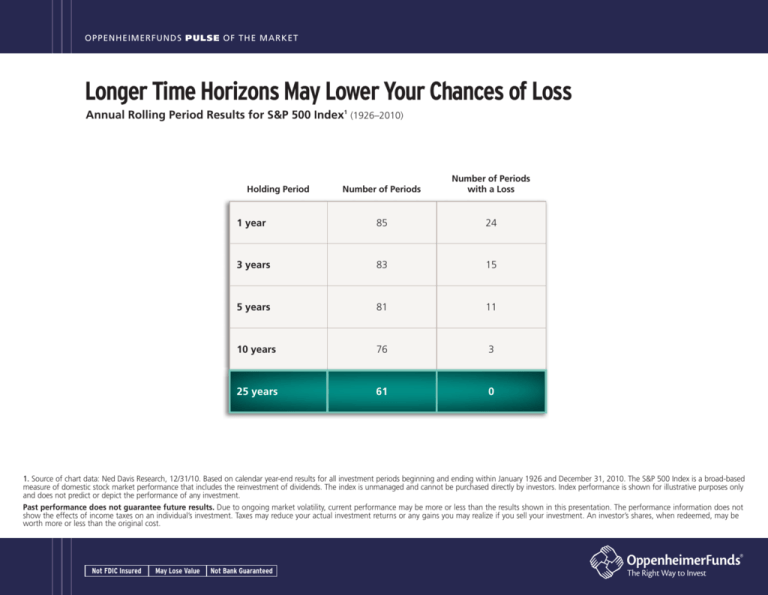

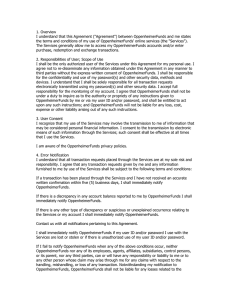

OPPENHEIMERFUNDS PULSE OF THE MARKET

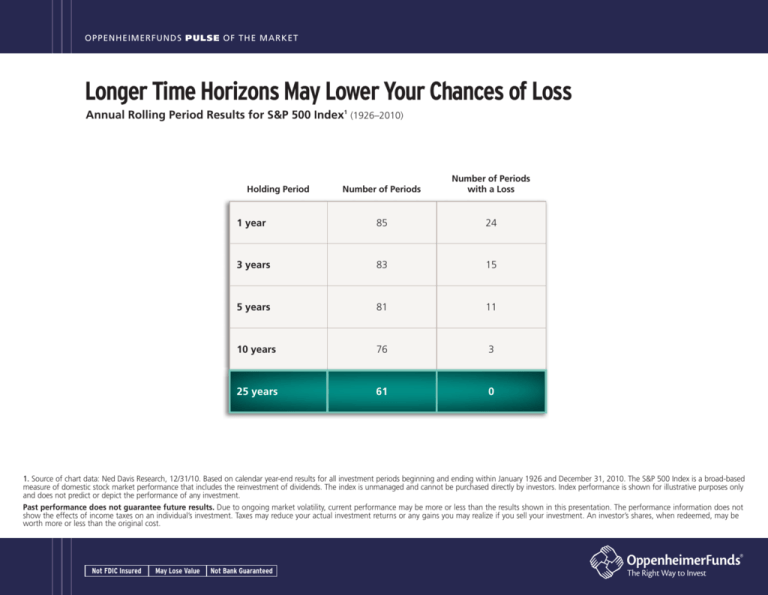

Longer Time Horizons May Lower Your Chances of Loss

Annual Rolling Period Results for S&P 500 Index1 (1926–2010)

Number of Periods

Number of Periods

with a Loss

1 year

85

24

3 years

83

15

5 years

81

11

10 years

76

3

25 years

61

0

Holding Period

1. Source of chart data: Ned Davis Research, 12/31/10. Based on calendar year-end results for all investment periods beginning and ending within January 1926 and December 31, 2010. The S&P 500 Index is a broad-based

measure of domestic stock market performance that includes the reinvestment of dividends. The index is unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only

and does not predict or depict the performance of any investment.

Past performance does not guarantee future results. Due to ongoing market volatility, current performance may be more or less than the results shown in this presentation. The performance information does not

show the effects of income taxes on an individual’s investment. Taxes may reduce your actual investment returns or any gains you may realize if you sell your investment. An investor’s shares, when redeemed, may be

worth more or less than the original cost.

Not FDIC Insured

May Lose Value

Not Bank Guaranteed

1234

OPPENHEIMERFUNDS PULSE OF THE MARKET

Historically, the longer your holding period for stocks, the lower your

chances have been of experiencing loss.

Looking at one-year rolling periods over 85 years, you would have experienced 24 periods of loss

Over a 10-year horizon, historically that would have dropped to three periods of loss, and over

a 25-year horizon, historically that would have dropped to no periods of loss

The financial advisor named above is

not affiliated with OppenheimerFunds

Distributor, Inc.

Investing in stocks has historically involved a relatively high amount of risk compared to fixed

income or money market investments. Even over a relatively long time horizon, stocks may

lose money

Note: The three (out of 76) 10-year holding periods in which stocks experienced a loss were the

10-year periods ended 12/31/38, 12/31/08 and 12/31/09

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of

the principal amount invested.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses

and, if available, summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting our website

at oppenheimerfunds.com or calling us at 1.800.CALL OPP (225.5677). Read prospectuses and, if available, summary prospectuses carefully before investing.

Oppenheimer funds are distributed by OppenheimerFunds Distributor, Inc.

Two World Financial Center, 225 Liberty Street, New York, NY 10281-1008

© 2011 OppenheimerFunds Distributor, Inc. All rights reserved.

IC0000.262.0211M February 15, 2011

qwer