Redefining the Monetary Aggregates - Fraser

advertisement

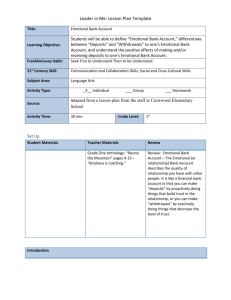

July 1979 REDEFINING THE MONETARY AGGREGATES by Stuart C. Hoffman Recent financial innovations and regulatory changes have eroded the usefulness of current monetary aggregate definitions as guides to monetary policy. New definitions, proposed by the staff of the Fed's Board of Governors, are designed to remedy some of the shortcomings of current money measures. In an article in the January Federal Reserve Bulletin, the Board of Governors staff proposed new definitions for the monetary aggregates. To promote better public awareness and understanding of this important issue, this article highlights those proposals and the factors necessitating a major overhaul of the current monetary measures. W h e n a pathologist wants to e x a m i n e an organism, he slices it o p e n and peers k n o w i n g l y , usually t h r o u g n a m i c r o s c o p e , at the slices. In a w a y , e c o n o m i s t s do m u c h the same w h e n p e e r i n g at the e c o n o m y . R e c e n t l y , h o w e v e r , o n e of their e c o n o m i c lenses has b e c o m e a bit c l o u d y . Since they w e r e i n t r o d u c e d in 1960, monetary aggregates have b e e n effective v i e w i n g devices for e c o n o m i s t s e x a m i n i n g monetary policy. Today's monetary aggregates, h o w e v e r , are b e c o m i n g inadequate for clear v i e w i n g . N e w definitions and n e w aggregate arrangements are called for. T h e Federal Reserve presently uses five monetary aggregates, i n c l u d i n g the familiar M i a n d M 2 that n e w s p a p e r a n d television c o m m e n t a t o r s sometimes refer to, to measure " m o n e y . " Five different measurements are necessary because, to an e c o n o mist, " m o n e y " exists in different forms. WHAT IS MONEY? A n asset must possess two essential qualities to be characterized as F E D E R A L RESERVE BANK O F A T L A N T A Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis " m o n e y . " First, the asset must serve as a m e d i u m of e x c h a n g e , a generally acceptable means of settling transactions. If the asset qualifies in this regard, it is a transactions balance. C a s h , bank c h e c k i n g accounts, a n d travelers c h e c k s all qualify as e x a m p l e s of transactions balances. S o m e assets, w h i l e not themselves media of e x c h a n g e , can be q u i c k l y a n d easily c o n v e r t e d to transactions balances with almost no risk of capital loss. T h e s e highly liquid assets are r e f e r r e d to by e c o n o m i s t s as " n e a r - m o n i e s . " Passbook savings accounts a n d time deposits are e x a m p l e s of n e a r - m o n i e s . M o n e y ' s s e c o n d important auality is that it serves as a store of value. Tnis is simply its p u r c h a s i n g p o w e r in f u t u r e transactions. O b v i o u s l y , tnis ability to store value is inversely related to the rate of inflation. M e a s u r i n g all forms of m o n e y and nearm o n e y is the f u n c t i o n of the monetary aggregates. THE M O N E T A R Y A G G R E G A T E S . Economists have w a t c h e d the m o v e m e n t of all forms of m o n e y by w a t c h i n g the five traditional monetary aggregates, M i t h r o u g h M 5 . T h e different aggregates are simply c o n v e n i e n t groupings of c u r rency a n a deposits, w h i c h together m a k e up the m o n e y stock of our e c o n o m y . T h e Federal O p e n M a r k e t C o m m i t t e e ( F O M C ) closely monitors the t h r e e most 79 July 1979 important aggregates, M-i, M 2 / and M 3 . These are listed in C h a r t 1. T h e M-, definition includes c u r r e n c y a n d d e m a n d deposit holdings of the p u b l i c . ( " P u b l i c " here means e v e r y o n e and e v e r y t h i n g except banks and the Federal Government.) Mt is the traditional measure of the a m o u n t of transactions balances held by the general public. Since t i m e and savings deposits are c o n s i d e r e d as n e a r - m o n i e s , they are c o u n t e d in the broader aggregate of M 2 . T h e M 2 d e f i n i t i o n of m o n e y adds the public's time a n d savings deposits held at c o m m e r c i a l banks to M-j. T h e M3 definition is a parallel of M 2 . It adds the public's time and savings deposits at thrift institutions (savings and loans, mutual savines banks, a n a credit unions) to the M 2 d e f i n i t i o n . W H Y ARE THE M O N E T A R Y A G G R E G A T E S I M P O R T A N T ? C h a r t 2 illustrates a close historical relationship b e t w e e n the growth / \ of M i a n d the s u b s e q u e n t rate of inflation in c o n s u m e r prices. T h e average M-i g r o w t h in any year has its primary effect o n the inflation rate up to two years later. In the m e a n t i m e , that same M-, growth affects p r o d u c t i o n and e m p l o y m e n t , d e p e n d i n g u p o n the a m o u n t of excess or idle capacity in the economy. T h e F O M C has placed g r o w i n g emphasis o n the a m o u n t of m o n e y in the e c o n o m y due to the k n o w l e d g e that m o n e y growth has a heavy i n f l u e n c e o n price stability, u n e m p l o y m e n t , and sustained real econ o m i c g r o w t h . T h e monetary aggregates are essential for the F O M C to track the g r o w t h of m o n e y . In 1970, first r e f e r e n c e was made to t h e F O M C ' s plans for m o n e y growth. By 1974, the C o m m i t t e e had d e v e l o p e d explicit n u m e r i c a l t o l e r a n c e ranges for the growth of m o n e y over a t w o - m o n t h p e r i o d . In M a y 1975, e x p e c t e d g r o w t h ranges for a longer p e r i o d of f o u r quarters ahead a p p e a r e d as F O M C policy. T h e n , in February 1979, t h e C o m m i t t e e a d o p t e d monetary growth ranges for an entire CHART 1 TABLE 1 CURRENT MONEY DEFINITIONS REGULATORY CHANGES CREATING NEW TRANSACTIONS ACCOUNTS Negotiable Order of Withdrawal Accounts (NOW) • New Hampshire and Massachusetts for mutual savings banks (1972) and commercial banks and S&Ls (1974) Savings and Small Time Deposits at Nonbank Thrifts Savings and Small Time Deposits • Connecticut, Maine, Rhode Island, and Vermont for depository institutions except CUs (1976) * New York State for depository institutions except CUs (1978) Credit Union (CU) Share Drafts # Federal CUs on experimental basis (1974) and permanent basis (1978) - M3 at Banks - M2 Demand Deposit Accounts at Thrifts *New York State for thrifts except CUs (1976) * Nationwide for Federal-chartered S&Ls (proposed) Automatic Transfer Service Accounts (ATS) Private Demand Deposits at Banks -M, Currency \ 80 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis y • Nationwide for commercial banks (1978) J U L Y / A U G U S T 1979, E C O N O M I C REVIEW July 1979 CHART 2 MONEY AND INFLATION % CHG. FROM YEAR Consumer Prices' EARLIER — 12 — '61 4 '79 '66 ' C o n s u m e r P r i c e I n d e x l a g g e d 24 m o n t h s . Note: B e g i n n i n g N o v e m b e r 1978, M is a d j u s t e d for A T S a n d N O W a c c o u n t s in N e w Y o r k S t a t e . calendar year, with a midyear r e v i e w in a c c o r d a n c e with congressional legislation. W H Y C H A N C E THE A G G R E G A T E S ? Since 1970, w h e n the F O M C first began applying greater i m p o r t a n c e to t h e aggregates, the c o m p l e x i o n of m o n e y and n e a r - m o n e y has c h a n g e d . In 1972, t h e r e began a series of regulatory changes and creations of n e w financial instruments that have r e d u c e d the a c c u r a c y of M n as a measure of the public's transactions balances. A d d i t i o n a l l y , certain assets have e m e r g e d as n e w n e a r - m o n i e s that are not presently inc l u d e d in either M 2 or M 3 , c l o u d i n g the a c c u r a c y of those aggregates as w e l l . For c o n v e n i e n c e , the regulatory changes and financial innovations that have occ u r r e d in the past five years are g r o u p e d into t h r e e categories: (1) n e w Mq-type transactions a c c o u n t s ; (2) liquidity changes of existing n e a r - m o n i e s ; and (3) n e w near-monies. NEW TRANSACTIONS A C C O U N T S . Table 1 lists four n e w transactions accounts a u t h o r i z e d d u r i n g the past several years: F E D E R A L RESERVE BANK O F A T L A N T A Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis negotiable o r d e r of w i t h d r a w a l ( N O W ) a c c o u n t s , credit u n i o n share drafts, d e m a n d deposits at thrifts, a n d bank automatic savings-to-demand deposit transfer (ATS) accounts. In A p r i l 1979, these accounts totaled $13 billion—$6.5 billion in A T S accounts, $5.0 billion in N O W accounts, $0.6 billion in share drafts, a n d $0.9 billion in d e m a n d deposits at thrifts. All but the last pay interest, w h i c h explains their increasing popularity with the general p u b l i c . U n f o r t u n a t e l y , the funds in these accounts are not i n c l u d e d in our c u r r e n t d e f i n i t i o n of M 1 # T h u s , today's M i understates the public's ability to settle transactions by $13 billion, and the u n d e r statement w i l l g r o w larger as these interesty i e l d i n g a c c o u n t s w i n m o r e and m o r e p u b l i c a c c e p t a n c e as substitutes for ordinary d e m a n d deposits. To r e m e d y the g r o w i n g o b s o l e s c e n c e of the c u r r e n t M-, d e f i n i t i o n , the staff of t h e Board of G o v e r n o r s in an article in 81 July 1979 the January Federal Reserve Bulletin has proposed a new M i definition. The p r o p o s e d M i will i n c l u d e N O W and A T S a c c o u n t s , share drafts, a n d d e m a n d deposits at thrifts, along with traditional c o m m e r c i a l bank d e m a n d deposits and c u r r e n c y held by the p u b l i c (see Table 2). 1 CHART 3 GROWTH RATES OF CURRENT AND PROPOSED M, PERCENT TABLE 2 PROPOSED M1 | Current ] Proposed Currency Demand Deposits )> Current at Commercial Banks. + NOW Accounts + Share Drafts + Demand Deposits at Thrifts + ATS Accounts - Demand Deposits of Certain Major Principle: Include all domestic transactions to remedy growing obsolescence current M1 definition. r M, — 6 Foreigners accounts of the 1975 1976 1977 1978* 1978-79** " F i r s t t h r e e q u a r t e r s , a n n u a l rate. The growth rates of current and proposed M-, w e r e very similar until A T S accounts w e r e i n t r o d u c e d in N o v e m b e r 1978 (see Chart 3). H o w e v e r , f r o m O c t o b e r 1978 t h r o u g h J u n e 1979, c u r r e n t M i g r e w at a 3.0-percent a n n u a l rate and the p r o p o s e d M i at a 6-percent a n n u a l rate. 2 In either case, this represents a m a r k e d deceleration in " m o n e y " growth d u r i n g the past nine months. Because the c u r r e n t M n is really an i n c o m p l e t e picture of transactions balances, it overstates the d e g r e e of slowd o w n . Empirical analyses suggest that the relationship b e t w e e n G N P a n a the growth of the p r o p o s e d M-i is marginally closer than the GNP's relationship with tne current M v T h e r e f o r e , the p r o p o s e d definitional c h a n g e s h o u l d e n h a n c e the F O M C ' s k n o w l e d g e of h o w its policy actions affect f u t u r e e c o n o m i c activity. ' T h e staff h a s a l s o p r o p o s e d to e l i m i n a t e f r o m M , c e r t a i n d e m a n d d e p o s i t s h e l d by f o r e i g n c o m m e r c i a l b a n k s a n d official institutions, a s r e c o m m e n d e d in 1976 by a n o u t s i d e a d v i s o r y c o m m i t t e e . S e e " I m p r o v i n g the M o n e t a r y A g g r e g a t e s : R e p o r t of t h e A d v i s o r y C o m m i t t e e o n M o n e t a r y S t a t i s t i c s " ( B o a r d of G o v e r n o r s , J u n e 1976). ' O n l y a s m a l l part of t h i s differential is d u e to t h e e x c l u s i o n of c e r t a i n foreign-owned demand deposits from proposed M,. 82 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis • • O c t o b e r 1 9 7 8 - J u n e 1979, a n n u a l rate. L I Q U I D I T Y C H A N G E S IN EXISTING NEARM O N I E S . T h e recent regulatory changes a n d financial innovations have c o m b i n e d to increase the liquidity of existing nearmonies, particularly regular passbook savings a c c o u n t s . Today's regulatory climate permits t e l e p h o n i c transfers f r o m bank savings to bank c h e c k i n g accounts and n o n n e g o t i a b l e third-party payments f r o m savings accounts at both c o m m e r c i a l banks a n d S&Ls (see Table 3). A p p a r e n t l y , the p u b l i c is r e s p o n d i n g to tnese a c c o u n t f r e e d o m s . E v i d e n c e suggests that debits to savings accounts per dollar of deposit, a m e a s u r e of their "transactions a c t i v i t y , " have increased over the past several years. As these permissive regulations have increased t h e liquidity of savings a c c o u n t s , other rule changes w e r e installed that r e d u c e d the liquidity of t i m e deposits. T h e s e latter changes permit higher interest rates payable o n four-, six-, and eightyear certificates a n d , despite a r e c e n t J U L Y / A U G U S T 1979, E C O N O M I C REVIEW July 1979 TABLE 3 REGULATORY CHANGES INCREASE SAVINGS DEPOSIT LIQUIDITY AND REDUCE TIME DEPOSIT LIQUIDITY Increase Savings Deposit Liquidity * Telephone transfers from savings to checking accounts at member banks (1975) • Preauthorized nonnegotiable third-party payments from savings accounts at commercial banks and S&Ls (1975) Reduce Time Deposit Liquidity * Maximum interest rate raised on four-year (1973), six-year (1974), and eight-year (1978) certificates # Substantial interest penalty for early withdrawal (1973) • Liberalized interest penalty for early withdrawal (1979) liberalization, impose a stiff interest penalty on early w i t h d r a w a l s . Longer maturity and penalties m e a n a loss of liquidity in time deposits. H e r e again, the rule changes have resulted in a surge of activity in these accounts by the general public. As of O c t o b e r 1978, c o m m e r c i a l bank time deposits w i t h original maturities of at least four years a c c o u n t e d for 46 p e r c e n t of smalld e n o m i n a t i o n (less than $100,000) time deposits, up f r o m 4 p e r c e n t in mid-1973. At n o n b a n k thrifts, the b o o m in time deposits has been even more pronounced. From almost n o n e in mid-1973, four-yeara n d - o v e r original maturity certificates rose to 67 percent of small time deposits by S e p t e m b e r 1978. T h e c u r r e n t M 2 aggregate has b e e n materially affected by the regulatory changes a n d the public's positive response to the n e w rules. Just a f e w years ago, passbook savings accounts and time deposits at c o m m e r c i a l banks w e r e sufficiently similar in liquidity that it made sense to g r o u p t h e m in o n e monetary aggregate. This is no longer the case. Savings account deposits are m o r e liquid today, w h i l e time deposits (except large negotiable C D s at large banks) are less liquid. F E D E R A L RESERVE BANK O F A T L A N T A Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis T o c o r r e c t the g r o w i n g inaccuracy of M 2 , the Board staff proposes to r e d e f i n e M 2 to i n c l u d e the n e w M-i plus savings deposits at all depository institutions (see Table 4). This n e w definition recognizes that similar deposits (like savings accounts) should be c o m b i n e d regardless of the depository institution w h e r e they are held. TABLE 4 PROPOSED Proposed M7 + Savings Deposits at all Institutions Major Principles: M2 Depository Separate increasingly liquid savings deposits from less liquid time deposits. Group together similar types of deposits regardless of their depository institutional location. NEW N E A R - M O N I E S . In the w a k e of all the n e w rules and innovations are n e w highly liquid assets that did not exist a f e w years ago. Also, the doors to existing nearmonies have b e e n o p e n e d to previously e x c l u d e d groups. Table 5 lists these n e w financial instruments: m o n e y market mutual funds, bank r e p u r c h a s e agreements, m o n e y market certificates, a n d c o m m e r c i a l bank savings accounts for state a n d local governments and businesses. TABLE 5 FINANCIAL INNOVATIONS CREATE NEW LIQUID ASSETS New Highly Liquid Assets • Money market mutual funds (1974) • Repurchase agreements between banks and their business customers • Six-month money market certificates at depository institutions (1978) New Savings Account Authorizations • Commercial bank savings accounts authorized for state and local governments (1974) and partnerships and corporations (1975) 83 July 1979 Money Market Funds. M o n e y market mutual funds originated in the high interest rate e n v i r o n m e n t of 1974. T n e s e funds maintain a portfolio of high-yielding Treasury bills, c o m m e r c i a l paper, and large C D s . O w n e r s h i p shares in such funds are available at a lower m i n i m u m investment than r e q u i r e d for direct purchases of these instruments. Most m o n e y market funds offer an attractive c h e c k w r i t i n g option (usually a $500 m i n i m u m ) and same-day w i r e transfer service into a p r e a u t h o r i z e a d e m a n d deposit a c c o u n t . C o n s e q u e n t l y , these funds are highly liquid assets that c o u l d serve as a m e d i u m of e x c h a n g e . H o w e v e r , survey e v i d e n c e indicates that the turnover of such a c c o u n t s is substantially lower than that of transactions accounts. A b o u t one-half of m o n e y market f u n d assets is held by institutional investors, about half of w h i c h is held as investments by trust accounts. Part of the reason for e x c l u d i n g m o n e y market funds f r o m the c u r r e n t and proposed aggregates is the lack of timely, reliable data verified by Federal Reserve reporting p r o c e d u r e s . A n interesting perspective, h o w e v e r , is available f r o m an industry s o u r c e that reports m o n e y market f u n d assets totaling $26 billion at the e n d of June 1979. Just a year earlier, they w e r e $6 3/4 billion. 3 Repurchase Agreements. R e p u r c h a s e agreements (RPs) w e r e originally created in the 1930s but have g r o w n very rapidly in the past five years. A r e p u r c h a s e agreement is typically an overnight loan of immediately available funds secured by U. S. Treasury securities. O n the f o l l o w i n g day, the funds are r e t u r n e d to the lender with interest. Large nonfinancial corporations have learned to m i n i m i z e their end-of-day d e m a n d deposit holdings by arranging RPs with their c o m m e r c i a l b a n k s . RPs are a c o n v e n i e n t and low cost cash m a n a g e m e n t tool. W h i l e an RP, itself, is not a m e d i u m of e x c h a n g e , it is a highly liquid alternative t o d e m a n d deposits. Yet, like m o n e y market funds, RPs will not be i n c l u d e d in the Board's r e d e f i n e d monetary aggregates. 3 D o n o g h u e ' s Money Fund Report, Holliston, M a s s a c h u s e t t s , v a r i o u s i s s u e s . 84 Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis A g a i n , like m o n e y market f u n d s , this is partly because of data limitations. W h a t R P data that are available s h o w a b u r g e o n i n g growth. Estimates of c o m m e r c i a l bank RPs with the n o n b a n k p u b l i c are available back to late 1969. 4 At that time, outstanding RPs averaged about $4 1/2 billion. By the t i m e of .the r e c o r d high m o n e y market yields in mid-1974, the a m o u n t outstanding had g r o w n to nearly $17 1/2 billion. At the e n d of M a y 1979, RPs outstanding at all c o m m e r c i a l banks totaled over $47 billion. In recognition of this g r o w i n g use of RPs, the Board staff intends to publish a separate RP series as a c o m p a n i o n to the r e d e f i n e d monetary aggregates. Money Market Certificates. M o n e y market certificates ( M M C s ) w e r e a u t h o r i z e d on June 1, 1978, for all depository institutions. (Credit u n i o n s r e c e i v e d authority slightly later.) T h e s e are six-month certificates of deposit issued in m i n i m u m d e n o m i n a t i o n s of $10,000, with an initial yield tied to the w e e k l y auction rate o n six-month Treasury bills. Like other time deposits, t h e r e is a substantial interest penalty for early withdrawal. This feature gives M M C s a lower d e g r e e of liquidity than passbook savings deposits. But the relatively short six-month maturity makes t h e m m o r e liquid than other time deposits. In the Board staff's proposed monetary aggregates, m o n e y market certificates will b e i n c l u d e d in M 3 , w h i c h is d e f i n e d as the n e w M 2 plus all time deposits at all depository institutions. M M C s have b e e n a big hit with the general p u b l i c because of t h e high and rising yields they've o f f e r e d since their introduction. W h e n first o f f e r e d in June 1978, M M C s y i e l d e d 7 3/4 percent at thrifts (one-fourth point higher than banks), inc l u d i n g daily c o m p o u n d i n g of interest. In late July, these six-month certificates yielded about 9 1/4 p e r c e n t , with daily c o m p o u n d i n g no longer a l l o w e d . By the e n d of M a y 1979, M M C s stood at a r o u n d $158 billion at all depository institutions, up f r o m z e r o just one year earlier. T h e y a c c o u n t for 13 1/2 percent " E s t i m a t e s of all c o m m e r c i a l b a n k R P s with t h e n o n b a n k p u b l i c a r e a v a i l a b l e f r o m the B a n k i n g S e c t i o n , D i v i s i o n of R e s e a r c h a n d S t a t i s t i c s , B o a r d of G o v e r n o r s of t h e F e d e r a l R e s e r v e S y s t e m . J U L Y / A U G U S T 1979, E C O N O M I C R E V I E W July 1979 a n d 17 1/4 percent of savings and small time deposits at c o m m e r c i a l banks a n d thrifts, respectively. New Accounts for Governments and Businesses. T w o regulatory changes in the mid-1970s made c o m m e r c i a l bank savings accounts available to state and local g o v e r n m e n t s and partnerships and corporations. Business savings accounts are limited to $150,000 per account. Because these savings accounts are linked by t e l e p h o n i c transfer to d e m a n d deposit accounts, they are highly liquid assets, estimated to have heavier activity than personal savings accounts. Like all other savings accounts, they are i n c l u d e d in the p r o p o s e d M 2 aggregate. At first, business and g o v e r n m e n t savings accounts grew rapidly as those groups took advantage of a n e w and attractive alternative to d e m a n d deposits. R e c e n t l y , h o w e v e r , these accounts nave stabilized at a r o u n d $4 1/2 billion for state and local g o v e r n m e n t s a n d $10 1/4 billion for Businesses. S U M M A R Y AND C O N C L U S I O N S . Recent financial innovations a n d regulatory changes have r e d u c e d the accuracy of the c u r r e n t M-i as a m e a s u r e of the public's transactions balances. At the same time, other d e v e l o p m e n t s have e n h a n c e d savings deposit liquidity w h i l e fostering growth of less liquid time deposits. In recognition of these events, the Board staff has p r o p o s e d n e w definitions of M-,, M 2 , and M 3 , restricted to liabilities of depository institutions. T h e n e w definitions are s u m m a r i z e d in Table 6. Proposed M i will presumably i n c l u d e all transactions balances, except to the extent that the p u b l i c uses its m o n e y market funds as a means of p a y m e n t . To those w h o v i e w RPs as quasi-transactions balances, a separate series will be available to use at their discretion. T h e p r o p o s e d M 2 will incorporate the r e d e f i n e d M i plus all savings deposits regardless of their institutional location. T h e r e will be no m i x i n g of time and savings F E D E R A L RESERVE BANK O F A T L A N T A Digitized for FRASER http://fraser.stlouisfed.org/ Federal Reserve Bank of St. Louis TABLE 6 NEWLY MONETARY PROPOSED AGGREGATES Proposed M1 Current M1 + NOW Accounts + Share Drafts + Demand Deposits at Thrifts + ATS Accounts — Demand Deposits of Certain Foreigners Proposed M2 Proposed M1 + Savings Deposits at All Depository Institutions Proposed M} Proposed M2 + Time Deposits (small and large) at All Depository Institutions deposits, w h i c h have recently b e c o m e dissimilar in liquidity. M o n e y market funds will not be i n c l u d e d in any aggregate, although they appear to be as liquid as savings deposits. Finally, the p r o p o s e d M 3 will i n c l u d e the n e w M 2 plus time deposits (both large and small) at all depository institutions. It w o u l d be a mistake to add m o n e y market funds to the n e w M 3 , since large C D s a c c o u n t for a large portion of the funds' portfolios a n d w o u l d i n v o l v e " d o u b l e c o u n t i n g . " To avoid this p r o b l e m , an M 2 + c o u l d be d e f i n e d as p r o p o s e d M 2 plus all small-denomination time deposits plus m o n e y market mutual funds. 5 T h e n e w monetary aggregates should give the F O M C a clearer lens t h r o u g h w h i c h to view the behavior of " m o n e y " in d e t e r m i n i n g monetary policy strategies.« S e p a r a t i n g small- and large-denomination time deposits would be advisable on its o w n m e r i t s , s i n c e they b e h a v e q u i t e differently d u r i n g p e r i o d s of h i g h a n d rising m a r k e t interest r a t e s . T h i s o c c u r s b e c a u s e large C D s a r e not s u b j e c t to interest r a t e c e i l i n g s . S e e T i m o t h y C o o k , " T h e I m p a c t of L a r g e T i m e D e p o s i t s o n t h e G r o w t h R a t e of M , , " E c o n o m i c Review, F e d e r a l R e s e r v e B a n k of R i c h m o n d , M a r c h / A p r i l 1978. 85