EXPLORING YOUR BENEFIT OPTIONS

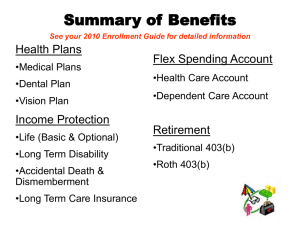

advertisement

2012 Benefit Summary for Bargained New Hires EXPLORING YOUR BENEFIT OPTIONS Please direct questions about your enrollment to the Benefit Office at: 513-397-5999 866-655-0557 Benefitoffice@cinbell.com Enrollment in the Company healthcare and life insurance programs is conducted through MyHR. Enrolling in the Savings Plan: Enrollment in the Savings and Security Plan cannot occur until you have elected your benefits through MyHR and they have been processed. Information is sent to Fidelity on a bi-weekly basis in accord with payroll processing. Once your account has been created, you will make your savings plan contribution and investment elections by contacting Fidelity by phone at (800) 835-5095 or www.401k.com Please see the applicable section of this document for more information. You will also receive information directly from Fidelity. This is a summary of the terms of the plans. It does not describe the benefits in detail. Details are provided in plan documents, which govern the operation of the plans. If there is a discrepancy between this summary and the official plan documents, the official documents prevail. Cincinnati Bell reviews its benefit plans regularly and except to the extent limited by the collective bargaining agreement applicable to active bargaining unit employees, continues to reserve the right to modify, suspend or eliminate any plan at any time for any reason. Under no circumstances shall participation in this or any other Cincinnati Bell benefit plan create or be construed to create a contract or a guarantee of employment. 1 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 2012 Benefit Summary Note: This bulletin provides an overview of some of the benefits that may be available to bargained-for full time employees of the Company who were hired or rehired February 1, 2008 or after. Part-time employee benefits may be different. Benefit Plan Overview Benefit Medical Prescription Drugs Dental Vision Who pays and how The Company pays the majority of this cost. You pay your portion through before-tax payroll deductions. Claims Processor/Insurer Anthem Page Number 4 Medco 5 Anthem 6 EyeMed/ LensCrafters 6 Employee Basic Life & Accidental Death and Dismemberment (AD&D) Company Prudential 6 Supplemental Life & AD&D You - After-tax Prudential 7 Dependent Life You - After-tax Prudential 7 Flexible Spending Accounts Dependent Care Healthcare Parking Legal You - Before-tax You - Before-tax You - Before-tax Chard Snyder Chard Snyder Chard Snyder You - After-tax Hyatt 8 You – Before-tax and After Tax – Basic and Supplemental Company matches basic Fidelity Investments 9 Savings Plan Allotments Match 8 HEALTH and INSURANCE You are eligible for and can select the health and life insurance benefits you need immediately upon hire. You have 31 days from your hire date to enroll. The benefits you elect will remain in effect for the duration of the year. You can make changes in your selections annually during open enrollment (effective January 1). You can make some changes during the year if you have an eligible life event. Life events include, but are not limited to, marriage, divorce and birth of a child. You must report your changes to the Benefit Office within 31 days by going to the MyHR Homepage and then click on the Benefit Home Page (Family Status / Spending Account link). You can choose from four levels of medical, dental and vision coverage: Participant only Participant plus spouse Participant plus child(ren) or Participant plus family. 2 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 Your spouse and your unmarried children are considered dependents. Children include: Natural children Legally adopted children Stepchildren Children for whom you or your spouse are legal guardian, if they live with you. Your dependent child(ren) can be covered under the healthcare, dental and vision plans through the end of the month in which he/she turns age 26. The Company reserves the right to conduct periodic or random verification audits at any time. It is your responsibility to notify the Benefit Office if your covered dependent is no longer eligible for coverage. This includes notifying the Company when your adult dependent turns age 26. It also includes notification of the ineligibility of a former spouse in the event of divorce or dissolution. Medical, Dental and Vision – COST SHARING The Company pays a portion or all of the cost of dental and vision coverage. If you enroll in the PPO Plus healthcare option, you pay a portion of the cost on a before-tax basis each pay. Benefit deductions are taken from the first two pay periods of each month for a total of 24 deductions per year. Participant Only PPO Plus HSAP Dental Vision Participant Participant Plus Plus Spouse Child(ren) Medical (Cost per month) $58 $0 $125 $113 $0 $0 Dental and Vision (Cost per month) $0 $0 $0 $0 $0 $0 Participant Plus Family $180 $0 $0 $0 Coordinating Benefits (PPO Plus Medical Option, Dental, Vision ) If you are covered under another health plan, you cannot participate in the Health Savings Account Plan. If your spouse works at another company and has benefit coverage. If your spouse has coverage through another employer, and both of you cover your children, our PPO Plus, dental and vision plans will coordinate with the other coverage using the birthday rule. The birthday rule uses as primary the plan of the parent with the earlier birthday in the calendar year. When coordinating benefits between two plans our medical, dental and vision plans will pay no more than would have been paid in the absence of the other plan. For example, your spouse incurs dental charges of $100, the primary plan (your spouse's plan) paid $80, our plan (which is secondary) would have paid $50; no benefit is payable from our plan since the primary plan's benefit was greater than our plan benefit. If both you and your spouse work for Cincinnati Bell If both you and your spouse are eligible for any Company-sponsored medical, dental or vision coverage as either an employee or a retiree, you (or your spouse) cannot be covered as both an employee/retiree and a dependent under those plans. Also, only one of you can cover your eligible children. 3 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 MEDICAL (including prescription drug coverage) The Company offers two very different healthcare plans: the HSAP and the PPO Plus. Both medical options are provided through Anthem Blue Cross and Blue Shield. Prescription drugs are processed through Medco. Both medical options use the Anthem Blue Access network of providers. You can access the network of providers at Anthem’s website www.anthem.com or by calling Anthem. See Contact Information. It is not necessary to select a primary care physician (PCP) under either of these options. It is also not necessary for you to obtain a referral from your PCP to see a network specialist. You can elect to waive medical coverage if you have coverage elsewhere. Additionally, if you are covered under another health plan, you cannot participate in the Health Savings Account Plan. There are no exclusions for preexisting conditions under either of these options. 1. Health Savings Account Plan (HSAP) In 2012, you may choose our Health Savings Account Plan (HSAP) and the Company will not charge a monthly premium to participate. Eligible in-network covered services and supplies are subject to the deductible and 20% coinsurance – including prescription drugs. Eligible preventive care is covered at 100% and is not subject to the deductible. In concert with this plan design, is a Health Savings Account (HSA) that links to your HSAP. The custodian for this account is Fifth Third Bank. Having an HSA allows you to pay for medical expenses tax-free. You can use it for any expense approved by the IRS. You don’t pay taxes on the money you put into your account, the interest it earns or the funds you withdraw for eligible expenses. a. Understanding your health savings account (HSA) A Health Savings Account or HSA is a special type of savings account regulated by the IRS that is allowed to earn interest tax-free. In order to participate, you have to be in a medical plan that meets the IRS definition of a high deductible health plan – like the HSAP. In order to contribute, you may not “effectively reduce” your deductible below the minimum level for that year by electing secondary coverage (thru a spouse, for example) under a plan with a lower deductible. In addition, you are not eligible to contribute to an HSA if you or a covered dependent are eligible for Medicare. In either of these situations, you are limited to participating in the PPO Plus. b. Contributing to Your HSA You may contribute to an HSA if you are a participant in the HSAP. In 2012, participants may contribute up to $3,100 for an individual and $6,250 to an individual “plus” HSA. In addition, individuals 55 and older may make a $1,000 catch-up contribution in 2012. As an active employee, you may choose to contribute through pre-tax payroll deductions. If you enroll in the HSA and then select a different plan in subsequent years or terminate your employment, while you may no longer contribute to your HSA, you can continue to use your remaining funds until they are exhausted – tax-free if you use them for eligible healthcare expenses. See IRS Publication 502 for a complete list of eligible expenses. 2. PPO Plus There is a monthly premium to participate in this option. Once you meet the deductible for this plan, you pay 20% and Cincinnati Bell pays 80% of your eligible in-network health care expenses – plus 100% of eligible preventive care is covered after you pay the applicable office visit copay. There is a separate outof-pocket maximum for prescription drugs under this plan. 4 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 Deductibles work differently depending on which plan you elect. Under the PPO Plus Plan, the individual and family deductibles are not tied together. Under the HSAP, they are. 1. PPO Plus 2. Susan and her family enroll in the PPO Plus plan. the annual cost of her son’s care is $1,400. Under this option, once her son meets the individual $450 deductible the PPO Plus plan begins paying his eligible expenses at 80% (even though her family does not satisfy the $900 family deductible) HSAP Susan and her family enroll in the HSAP. As in Example 1, her son incurs $1,400 in annual expenses. Under the HSAP, Susan’s family must satisfy the $2,400 family deductible before the plan pays benefits. As a result, the full $1,400 in annual expenses applies to the deductible. Susan can use money in her HSA to pay any or all of her son’s eligible expenses. Prescription Drug coverage is provided by Medco. Some of Medcos strengths include: Retail Pharmacy Benefit – You and your dependents will have access to a nationwide network of nearly 60,000 chain and independent pharmacies. Mail Service Pharmacy Benefit –. You and your dependents can receive a 90-day supply of your maintenance medications through the mail service pharmacy to be delivered to your door. Medco’s Smart90TM program allows you and your dependents to obtain a 90-day supply of your maintenance medications at any of 7,000 local CVS pharmacies. Full suite of Internet services – including online prescription ordering. Round-the-clock access to pharmacists and specially trained Member Services representatives. Note: In 2012, use of Medco’s mail order pharmacy (or Smart90 thru CVS) will be required for maintenance medications. Drugs are handled differently between the HSAP and the PPO Plus. 1. PPO Plus Retail (30 day supply) generic brand formulary brand non-formulary Mail Order (90 day supply generic brand formulary brand non-formulary Out-of-Pocket maximum Individual Family In Network Out of Network $10 20% ($25 min. / $75 max) 20% ($40 min / $120 max.) 50% 50% 50% $30 20% ($75 min. / $225 max) 20% ($120 min / $360 max.) Not Covered Not Covered Not Covered $2,000 $4,000 2. HSAP (Health Savings Account Plan) With certain exceptions, prescription drugs are treated the same as any other medical expense. You will pay the actual cost of your medications until you meet your deductible and then covered drugs are paid at 80% when you use network pharmacies. Medications that are part of the Preventive Drug List (PDL) do not apply towards your deductible. You will be charged your applicable coinsurance for these medications. 5 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 DENTAL Dental coverage is provided through Anthem. Anthem Dental has established a network of dental providers that have agreed to charge specific rates for services. If you receive services from an in-network provider, you pay the difference between the reimbursement amount and the provider-contracted rate. If services are received out-of-network, you pay the difference between the reimbursement amount and the amount that the provider charges. YOU ARE NOT REQUIRED to use an Anthem network dentist for your dental services. To locate an in-network provider, see the On-line Provider Finder Instructions on Connections or contact Anthem directly (see the Anthem Dental Service Information sheet also on Connections for contact information). The chart at the end of this document provides highlights of the dental plan. VISION You choose whether to use EyeMed network providers or other providers. If you use EyeMed network providers, you pay fixed amounts for services. If you use other providers, you may be reimbursed a fixed amount upon submission of a claim. Network services are generally available once every 12 months. Service/ Supply Exam Standard Plastic Lenses Single Vision Bifocal Standard Progressive Trifocal Frames Contacts Conventional Disposable EyeMed ProviderCopay $5 Non-EyeMed ProviderReimbursement Up to: $40 Up to: $40 $60 $60 $75 $0 $0 $40 $15 $0 up to $100 80% of balance over $100 Up to: $65 Up to: $20* $20** $90 $90 *Conventional: individual pays $20, $115 allowance, 15% off balance over $115. **Disposables: individual pays $20, $115 allowance, no discount on amount over $115. EyeMed and its partner, LCA-Vision, offer a 15% discount on the usual and customary charges for LASIK and PRK procedures performed by providers in the U.S. Laser Network. Go to www.eyemedvisioncare.com for provider and other information 6 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 EMPLOYEE BASIC LIFE / ACCIDENTAL DEATH AND DISMEMBERMENT (AD&D) INSURANCE Upon meeting the Actively At Work requirement, the Company pays for life and accidental death and dismemberment insurance coverage equal to 1x your base pay rounded to the next higher thousand. You can also elect and pay for supplemental life insurance equal to: 1x basic life 2x basic life 3x basic life 4x basic life Life Insurance is provided through Prudential. No Evidence of Insurability is required for any level of coverage at hire, however, future increases will require proof of good health. The cost of supplemental life is based on your age as shown in this chart and is calculated for you on your enrollment worksheet. Age Under 25 25-29 30-34 35-39 40-44 45-49 50-54 55-59 60-64 65-69 70-74 75+ Monthly Rate Per $1,000 $0.041 $0.049 $0.066 $0.074 $0.082 $0.123 $0.189 $0.353 $0.541 $1.041 $1.689 $1.689 DEPENDENT LIFE You can choose from the following options of coverage for your spouse and/or your children: Spouse Child $25,000 $10,000 $5,000 $10,000 None $4,000 $2,500 $1,500 None $4,000 Cost Per Month $6.94 $2.91 $1.49 $2.56 $0.57 The cost is the same whether you are covering only your spouse, only your child, or more than one child. No Evidence of Insurability is required for any level of coverage at hire. Enrolling in or increases in coverage after initial eligibility may require Evidence of Insurability (EOI). Prudential has the right to approve or deny coverage based upon the information provided Note: Evidence is not required for coverage for dependent children. However, if you later request a higher level of spousal coverage that includes coverage for your dependent children and your spouse is denied, the coverage option returns to the option in effect before the request for increase was made. 7 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 You can cover your unmarried child until the earlier of: the end of the calendar year in which he/she turns 19 years of age and is no longer a full-time student at an accredited high school, college, university or educational institution or the end of the calendar year in which he/she is no longer a full-time student at an accredited high school, college, university or educational institution but in no event later than the end of the calendar year in which he/she turns age 24. your unmarried disabled child of any age (may require approval) FLEXIBLE SPENDING ACCOUNTS These accounts allow you to reimburse yourself on a before-tax basis for expenses you incur and pay for on an after-tax basis. If you elect to be covered under the Health Savings Account Plan, and you elect to participate in the Health Care Flexible Spending Account so that you have both the HSA and Healthcare FSA, your use of the FSA is considered to be “limited purpose.” This means the FSA is generally available for eligible dental and vision expenses only, since the HSA is used for eligible healthcare expenses. Find a list of eligible healthcare expenses by visiting www.irs.gov and entering keyword: “Publication 502 You can participate in one or more of the following accounts: Health Care: $240 to $5,000 annually Dependent Care: from $240 to $5,000 annually Parking Expense Reimbursement: from $20 to $230 monthly Healthcare and Dependent Care flexible spending accounts are operated a calendar year basis and amounts leftover at year end cannot be carried over into the following year. Parking Expenses must be submitted within 6 months from the date they are incurred in order to be eligible for reimbursement. (This does not include expenses for riding mass transit.) In addition, you are permitted to change the amount of your parking expense election on a monthly basis as long as your election is made in advance of the month in which the change is effective. LEGAL PLAN This plan provides advice and consultation on almost any personal legal matter. You are reimbursed under a fee reimbursement schedule. Covered services include the following. However, you should review the Hyatt Legal Plan brochure on Connections prior to enrolling in this coverage to ensure you understand any exclusion. - preparation of deeds, wills or powers of attorney - legal review of documents in the sale or purchase of a home - separation or divorce proceedings The cost of this coverage is $6.98 per pay period. You may not drop your Legal Plan coverage during the year. After you are hired, you can only obtain or drop coverage at Open Enrollment. SAVINGS PLAN Savings & Security Plan (401K) You are eligible to enroll in this plan upon hire. The Plan’s recordkeeper is Fidelity Investments. You can save from 1% to 75% of pay on a pretax (up to IRS limits) or after tax basis in $5 increments. Catch up contributions are permitted once the pretax limit has been met 8 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 The Company matches 100% of the employee’s elected basic weekly contribution up to the maximum of the applicable band below. You are vested (have ownership) in your entire account balance including the Company match after you have completed three years of service. You can direct your contributions in both Fidelity and non-Fidelity investment options. Loans are available. If your weekly covered compensation is. . Up to $200 $200 up to $300 $300 up to $400 $400 up to $500 $500 up to $600 $600 up to $700 $700 up to $800 $800 up to $900 $900 up to $1,000 $1,000 up to $1,100 $1,100 up to $1,200 $1,200 and over Your weekly basic savings contribution can be. . $5 or $10 $5, $10 or $15 $5, $10, $15 or $20 $5, $10, $15, $20 or $25 $10, $15, $20, $25, $30 and $35 $15, $20, $25, $30, $35 and $40 $20, $25, $30, $35, $40 and $45 $20, $25, $30, $35, $40, $45 and $50 $20, $25, $30, $35, $40, $45, $50 and $55 $20, $25, $30, $35, $40, $45, $50, $55 and $60 $20, $25, $30, $35, $40, $45, $50, $55 and $60 $20, $25, $30, $35, $40, $45, $50, $55, $60 and $65 PAID TIME OFF HOLIDAYS There are eleven (11) paid holidays: New Year’s Day Martin Luther King Day President’s Day Fourth of July Labor Day Day after Thanksgiving Thanksgiving Day Memorial Day Christmas Day Good Friday Personal Holiday VACATION You are eligible for vacation as shown in the following schedule: Years of Service Less than 1 Annual Accrual 80 hours - prorated for Monthly Accrual Rate 10.00 completed months 1 through 6.99 7 through 14.99 15 and more 120 hours 160 hours 200 hours 10.00 13.34 16.67 Accruals begin on the first day of employment but you cannot take PTO before completing 90 days of employment. PTO is accrued on a monthly basis. Up to 2 weeks of unused vacation may be carried over. Vacation carried over must be taken before April 1 of the following year or it will be forfeited. Carry-over vacation weeks must be matched with current year vacation weeks. 9 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 SICKNESS & DISABILITY INCIDENTAL ABSENCE OFF-THE-JOB ILLNESS/ INJURY (First 7 calendar days per incident) You will receive full pay for absences of less than 8 consecutive days based on the following schedule: Years of NCS <1 year 1 to 2 2 to 8 8 or more Full pay for absence begins on: No incidental absence benefit available Third day of absence Second day of absence First day of absence If your illness/injury lasts more than 3 consecutive days, you may apply for a Family Medical Leave. If your injury/illness lasts more than 7 consecutive days, you must apply for disability. SICKNESS AND ACCIDENT DISABILITY OFF-THE JOB ILLNESS/INJURY (After 7th calendar day) You are eligible for this benefit after 6 months of service. You will receive 90% or half pay based on the following schedule: :Years of NCS .5 to 2 2 to 5 5 to 15 15 to 20 20 to 25 25 plus Weeks at 90% None 4 13 26 39 52 Weeks at 45% 52 48 39 26 13 none SICKNESS AND ACCIDENT DISABILITY ON-THE-JOB ILLNESS/INJURY (First day of absence) You are eligible upon hire. You receive 90% or half pay based on following schedule: Years of NCS Less than 15 15 to 20 20 to 25 25 or more Weeks at 90% 12 26 39 52 Weeks at 50% As long as totally disabled The Company benefit is reduced by Workers’ Compensation benefits. 10 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 LONG TERM DISABILITY You are eligible for coverage under this plan after 6 months NCS. You can apply for benefits after you have used up your 52 weeks sickness and accident disability offthe-job illness/injury benefits. The benefit is equal to 50% of base pay less primary Social Security/Workers’ Compensation/pension/and other benefits. LEAVES OF ABSENCE A variety of leaves are available should you need additional time away from work for personal reasons, for family illness or for military service. OTHER BENEFITS TUITION AID You can be reimbursed for 100% tuition costs and authorized fees related to formal education in an acceptable field at pre-approved institutions. You must have attained 3 years of net credited service (NCS) to be eligible for reimbursement You must achieve a sufficient grade for the class to be eligible for reimbursement. The maximum reimbursement $5,250 per calendar year (before or after-tax) for full-time employees. Part-time employees are eligible for a 50% benefit. (Based on status at time of reimbursement.) TELEPHONE CONCESSION SERVICE You may be eligible for this benefit after 6 months NCS based upon the entity in which you are employed as a regular full time or part time employee. You must reside in the CBT operating area. The phone (and identification number) must be located at your primary residence and listed in your name (match your payroll records). Your account must remain in good standing for concession to be established and/or continued. You receive 100% discount on one-time charges related to installation of central office services. Benefits include a 40% discount on certain CBT services. Services must be “unbundled” before concession can be applied. Other discounts may be available for Cincinnati Bell Wireless, Fuse Internet and ZoomTown services. EMPLOYEE ASSISTANCE PROGRAM This program provides confidential counseling/referral on work/family-related issues, mental health issues, chemical dependency for you and your family. Services are provided through Anthem’ Employee Assistance Program. EMPLOYEE STOCK PURCHASE PLAN The Employee Stock Purchase Plan allows you to become a Cincinnati Bell shareholder by purchasing shares of Cincinnati Bell stock through the convenience of payroll deduction. You must be at least 18 years old to be eligible to participate. Automatic after-tax deductions can be as little as $1 per pay period or as much as $961 each pay period. 11 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 CREDIT UNION Employees of Cincinnati Bell or one of its subsidiaries, may choose to join Cintel Federal Credit Union. The credit union permits electronic deposit of your bi-weekly paycheck as well as traditional banking services. 12 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 Health Savings Account Plan / PPO Plus Plan Comparisons (eff 1/1/2012 – Tier II) In-network Medical Coverage Annual deductible (This is the amount you pay, HSAP $1,200 (applies if you elect coverage for yourself only) excluding preventive care, before the plan begins to pay) $2,400 (applies if you elect coverage (benefits begin for an individual who for yourself and one or more dependents; benefits begin only after the entire $2,400 deductible has been satisfied) Coinsurance (The portion of covered expenses PPO Plus $600 Individual $1,200 Family satisfies the $600 individual deductible, even if the family deductible has not been met.) Plan pays 80% after deductible Plan pays 80% after deductible Plan pays 80% after deductible Plan pays 100% (excluding ancillary svcs) after $25 copay ($50 copay for specialists) (Emergency Room $125 copay) 100% coverage for preventive services in network $1,950 Individual that are paid by the plan after you have satisfied the deductible) Physician office visits 100% coverage for preventive services in network Out-of-pocket maximum (Includes your deductible, this is the most an individual or family has to pay per calendar year out of their pocket for expenses that apply to the deductible and coinsurance after which the plan pays 100% of covered charges) Health Savings Account (HSA) Your voluntary contribution for 2012 (including Company contributions, if any) $3,200 (applies if you elect coverage for yourself only) $6,400 (applies if you elect coverage for yourself and one or more dependents; 100% benefits begin only after the entire $6,400 annual maximum has been reached.) Maximum Annual contribution is $3,100 individual or $6,250 family $3,900 Family (100% benefits begin for an individual who satisfies the $1,950 individual maximum, even if the family maximum has not been met) Note: You will continue to pay office visit copays even after you have met this maximum. Rx copays and coinsurance are subject to a separate out-of-pocket maximum. Not Available Additional $1,000 catch up available if 55 or older. No Company Contribution for 2012 You Pay: $10 copay 20% ($30 min. / $90 max) 20% ($50 min / $150 max.) (Sep OOP max of $2,000 Individual and $4,000 Family) Out-of-network services are covered at a higher out-of-pocket cost to participants. Prescription drugs Generic Brand formulary Brand non-formulary Plan pays 80% after deductible (certain preventive prescriptions are not subject to the deductible) 13 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 Dental Blue Complete Cincinnati Bell Plan H – Active Employees Bargain Summary of Benefits Effective Date: 1/1/2012 Annual Deductible Individual/Family $35 individual/$105 family This deductible includes your in and out-of-network expenses. Annual Maximum $1,750 per covered person Lifetime Maximum/Orthodontic Covered Services Diagnostic and preventive – Type A Oral evaluations (periodic and Prophylaxis (cleaning) and fluoride X-rays Sealants Space maintainers $1,750 per individual In Network Dentists We will pay: Out of Network Dentists We will pay: 100% of Anthem Allowable Amount 100% of Anthem Allowable Amount Deductible waived Deductible waived 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible 100% of Fee Schedule Amount after deductible comprehensive) Minor restorative – Type B Palliative emergency treatment Amalgam restorations (fillings) Composite restorations (fillings) on front Sedative fillings teeth Oral surgery – Type B Simple extractions Surgical Extractions General anesthesia Endodontics – Type B Root canal therapy Therapeutic pulpotomy Direct pulp capping Periodontics – Type B Scaling and root planing Osseous Surgery Prosthodontics – Type B Crowns, inlays, onlays Complete and partial dentures Bridges Orthodontics – Type B Coverage is for dependent children to Repositioning (straightening) of the teeth age 19 Orthodontic Lifetime Maximum $1,750 per individual 14 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008 CONTACT INFORMATION Anthem Blue Cross and Blue Shield (HSAP or PPO Plus ) .…….…....(866) 606-6705 Hours 8:00 a.m. to 8:00 p.m. EST M - F Web Site for provider directory www.anthem.com Locating your in-network healthcare provider using www.Anthem.com Enter www.Anthem.com and you will see Anthem’s homepage. You do not need to register. Instead, click on “Find A Doctor” at the right-hand side of the screen in the box and then click “Go.” From the State/Directory Selection click on “Ohio” (or your preferred state for locating a doctor) and then “Next.” On the Select A Plan dropdown box, select Blue Access (PPO) and then select the Provider Type you are looking for. Continue to search selecting from the available options. Anthem Dental………………………………………………………… …..(866) 641-7762 Hours: 8:00 a.m. to 5:00 p.m. EST, M – F; Web Site for provider directory www.anthem.com Locating your in-network dental provider using www.Anthem.com To locate an in-network provider, log onto www.anthem.com. Click on “Find A Doctor” in the box on the right-hand side of the screen. Then click “GO.” From the list of options click on “Find A Dental Provider” (you do not need to click on a State) and click “Next.” Be sure to select the “Dental Blue 100/200/300” plan option from the drop down menu. Follow the site instructions from there. Benefit Office In Cincinnati……………………………………………………………..…… ..(513) 397-5999 Outside Cincinnati………………………………………………………..…….(866) 655-0557 Email Benefitoffice@cinbell.com Fax (513) 651-2890 Chard Snyder (Flexible Spending Accounts and COBRA Administration) Cincinnati area: (513) 573-4646 Toll Free: (888) 993-4646 Fax (513) 459-9947 Email: www.chard-snyder.com EyeMed/LensCrafters (Vision) Customer Service……………………………………………………………...(877) 226-1115 Web Site for directory of EyeMed vision providers : www.eyemedvisioncare.com Fidelity Investments (Savings and Security Plan) Web Site for NetBenefits and individual account access: (800) 835-5095 www.401k.com Fifth Third Bank (Health Savings Account Support Center) (888) 350-5353 Email: hsasupport@53.com Account Access www.53HSA.com The HSA Support Center operates with extended hours for account holders and can be reached toll-free at 1-888-350-5353. Hours of operation are M–F 7:00 AM – Midnight EST and Saturday 8:00 AM – 5:00 PM EST. Hyatt Group Legal Plan………………………………………………… Web Site www.legalplans.com …. (800) 821-6400 Medco, pharmacy vendor ………………………………………………… (866) 544-8659 Hours: 24 hours a day, 7 days a week Website: www.medco.com) 15 2012 Bargained Benefit Summary For Bargained Employees Hired on or after 2/1/2008