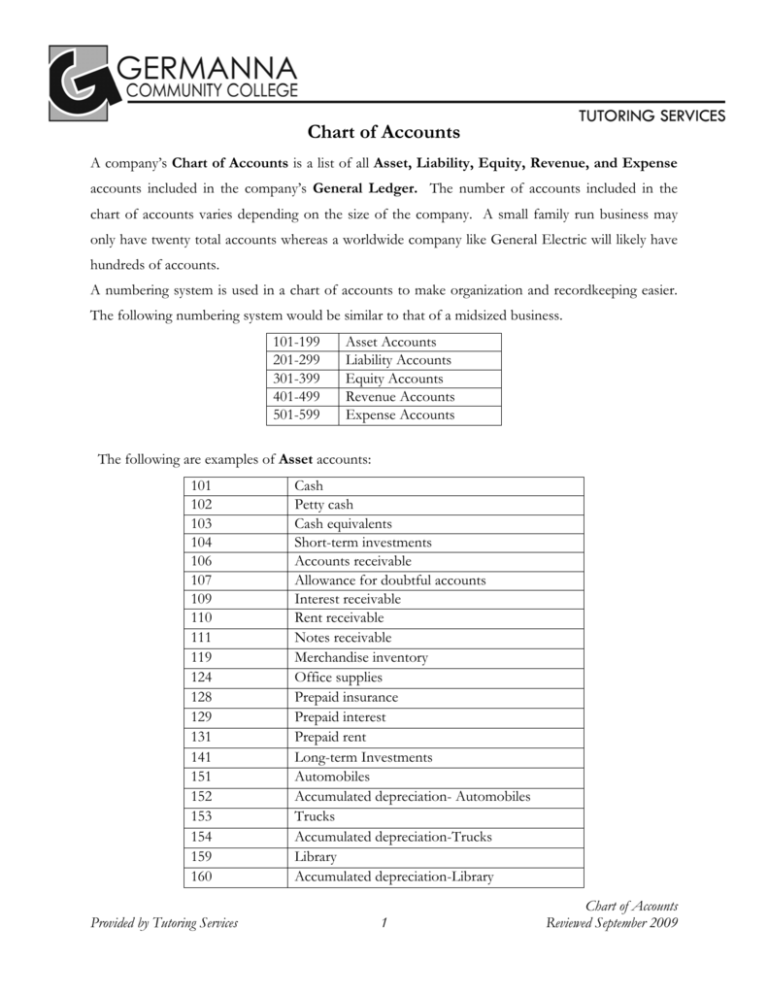

Chart of Accounts

advertisement

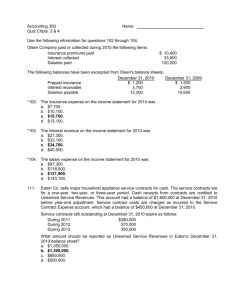

Chart of Accounts A company’s Chart of Accounts is a list of all Asset, Liability, Equity, Revenue, and Expense accounts included in the company’s General Ledger. The number of accounts included in the chart of accounts varies depending on the size of the company. A small family run business may only have twenty total accounts whereas a worldwide company like General Electric will likely have hundreds of accounts. A numbering system is used in a chart of accounts to make organization and recordkeeping easier. The following numbering system would be similar to that of a midsized business. 101-199 201-299 301-399 401-499 501-599 Asset Accounts Liability Accounts Equity Accounts Revenue Accounts Expense Accounts The following are examples of Asset accounts: 101 102 103 104 106 107 109 110 111 119 124 128 129 131 141 151 152 153 154 159 160 Provided by Tutoring Services Cash Petty cash Cash equivalents Short-term investments Accounts receivable Allowance for doubtful accounts Interest receivable Rent receivable Notes receivable Merchandise inventory Office supplies Prepaid insurance Prepaid interest Prepaid rent Long-term Investments Automobiles Accumulated depreciation- Automobiles Trucks Accumulated depreciation-Trucks Library Accumulated depreciation-Library 1 Chart of Accounts Reviewed September 2009 161 162 163 164 169 170 175 176 179 180 183 185 186 191 192 193 194 195 196 197 Furniture Accumulated depreciation-Furniture Office Equipment Accumulated depreciation-Office equipment Machinery Accumulated depreciation-Machinery Building Accumulated depreciation-Building Land improvements Accumulated depreciation-Land improvements Land Mineral deposit Accumulated depreciation-Mineral deposit Patents Leasehold Franchise Copyrights Leaseholds improvements Licenses Accumulated amortization The following are examples of Liability accounts: 201 202 Accounts payable Insurance payable 203 Interest payable 204 Legal fees payable 207 Office salaries payable 208 Rent payable 209 Salaries payable 210 Wages payable 211 Accrued payroll payable 214 Estimated warranty liability 215 Income taxes payable 216 Common dividend payable Provided by Tutoring Services 2 Chart of Accounts 217 218 219 221 222 223 224 225 226 230 231 232 235 238 240 245 251 253 255 258 Preferred dividend payable State unemployment taxes payable Employee federal income taxes payable Employee medical insurance payable Employee retirement program payable Employee union dues payable Federal unemployment taxes payable FICA taxes payable Estimated vacation pay liability Unearned consulting fees Unearned legal fees Unearned property management fees Unearned janitorial revenue Unearned rent Short-term notes payable Notes payable Long-term notes payable Long-term lease liability Bonds payable Deferred income tax liability The following are examples of Equity accounts: 301 302 307 308 309 310 311 312 313 314 315 316 318 319 Provided by Tutoring Services Owner’s Capital Owner’s Withdrawals Common stock, par value Common stock, no par value Common stock, stated value Common stock dividend distributable Paid-in capital in excess of par value, Common stock Paid-in capital in excess of stated value, No-par common stock Paid-in capital from retirement of common stock Paid in capital, Treasury stock Preferred stock Paid-in capital in excess of par value, Preferred stock Retained earnings Cash dividends 3 Chart of Accounts 320 321 322 323 Stock dividends Treasury stock, Common Unrealized gain-Equity Unrealized loss-Equity The following are examples of Revenue accounts: 401 402 403 404 405 406 407 408 409 410 413 414 415 Fees earned from product one* Fees earned from product two* Service revenue one* Service revenue two* Commissions earned Rent revenue Dividends revenue Earnings from investments in “blank” Interest revenue Sinking fund earnings Sales Sales returns and allowances Sales discounts *A firm will have a varying number of these accounts depending on the number of products or services the firm manufactures or offers. The following are examples of Expense accounts: 501 502 503 504 505 506 507 508 509 510 511 520 521 522 523 524 525 Provided by Tutoring Services Amortization expense Depletion expense Depreciation expense-Automobiles Depreciation expense-Building Depreciation expense-Furniture Depreciation expense-Land improvements Depreciation expense-Library Depreciation expense-Machinery Depreciation expense-Mineral deposit Depreciation expense-Office equipment Depreciation expense-Trucks Office salaries expense Sales salaries expense Salaries expense “Blank” wages expense Employees’ benefits expense Payroll taxes expense 4 Chart of Accounts 530 531 532 533 535 536 540 541 542 543 544 545 550 551 552 555 556 557 558 559 561 562 563 564 566 567 568 571 572 573 574 576 577 578 579 580 581 582 582 584 585 587 590 591 595 Provided by Tutoring Services Cash over and Short Discounts lost Factoring fee expense Interest expense Insurance expense-Delivery equipment Insurance expense-Office equipment Rent expense Rent expense-Office space Rent expense-Selling space Press rental expense Truck rental expense “Blank” rental expense Office supplies expense Store supplies expense “Blank” supplies expense Advertising expense Bad debts expense Blueprinting expense Boat expense Collection expense Concessions expense Credit card expense Delivery expense Dumping expense Equipment expense Food and drinks expense Gas and oil expense General and administrative expense Janitorial expense Legal fees expense Mileage expense Miscellaneous expense Mower and tool expense Operating expense Organization expense Permits expense Postage expense Property taxes expense Repairs expense Selling expense Telephone expense Travel and entertainment expense Utilities expense Warranty expense Income taxes expense 5 Chart of Accounts The journal entry rules for the accounts are as follows: For Asset accounts you debit increases and credit decreases. For Liability accounts you credit increases and debit decreases For Revenue accounts you credit increases and debit decreases For Expense accounts you debit increases and credit decreases Provided by Tutoring Services 6 Chart of Accounts