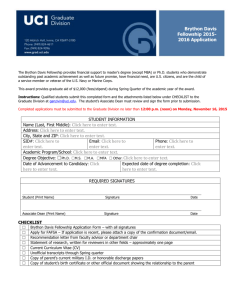

a toast to the - UC Davis Graduate School of Management

advertisement