2013/2014 Catalogue

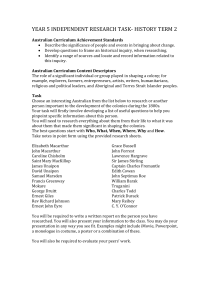

advertisement