F331: Applied Accelerated Corporate Finance

advertisement

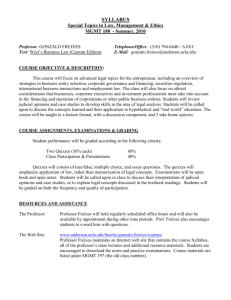

F331: Applied Accelerated Corporate Finance Ilya Strebulaev Stanford GSB Spring 2011 Course Syllabus Aims and Objectives The main aim of this course is to enable you to apply the fundamental ideas of financial economics to the problems in the area of corporate finance with all the complexities the real world entails. The main focus of this course is on the corporate financial manager and how he/she reaches decisions as to capital investments, dividends, and financing of all sorts. We will cover many issues that are important to a modern financial manager including such topics as international corporate finance, managing high growth, leveraged buyouts, hostile takeovers, private equity financing and venture capital, and financial distress. Through cases and discussions of topical issues, the course will give you the opportunity to analyze practical financial situations and problems, on the assumption that you are already familiar with basic concepts from the core course (valuation, CAPM, capital structure, option pricing). The course is thus applied, but within a rigorous theoretical framework. The cases will be used to motivate our discussion of how to bridge the gap between rigorous finance theory and its application to practical problems in corporate finance. The cases and our discussion will embrace both “the big picture” and rigorous financial analysis. Format and Teaching Methods Each session we will generally spend our time both on a case and on a discussion of finance theory and its applications. The discussion will usually focus on the application of theory to real-life complex situations. The cases will offer the opportunity to apply and master the quantitative skills in such topics as valuation and financing decisions. The stress in the discussion will be on qualitative issues and applications. All students are expected to participate in the discussion and students will be frequently (cold) called upon to illuminate their view on the topic, both theoretical underpinnings and application. Strebulaev F331: AA Corporate Finance Page 2 Students Responsibilities The course is intensive and will require students to carefully prepare all cases, read and understand a lot of materials, most of which are included in the course folder, and participate actively in class discussion. Constructive class participation constitutes a significant portion of the grade. Readings are important to understand applications and follow the lectures and class discussions. The class is demanding: On average, students in past years spent between 5 and 10 hours per week on the course, in addition to attending classes. As this course builds on prior sessions and is case oriented, regular class attendance is essential. You should expect intensive and demanding cold calling. You should come with a complete solution for each case and be ready to answer any questions related to the case and the solution. Should a student be required to be absent, notification of professor by e-mail would be appreciated. If you are not prepared for a given day, you should still attend. Your class participation grade will suffer for the day but not as much as if I cold call you and discover that you did not prepare. More than two absences during the quarter will have an adverse effect on your grade, even if excused. If you show up late for class, it will be counted towards two absences unless you inform professor in advance. Both home assignments (Airbus and RJR Nabisco) should be done in groups of students’ choice, between 1 and 6 people. Only one report from each group should be submitted before the start of the class on the day the assignment is due. The names of group members should be stated clearly on the first page. Each report should be printed and contain at most 8 standard pages, with standard margins and at least 11pt font. You should treat class as you would a professional meeting. Be on time. Tardiness of more than a minute is treated as an absence for the entire class unless you inform me in advance. Do not read extraneous material. Do not engage in side conversations. Put all cell phones/PDAs into silent mode. Laptops and PDAs could be used during class only to help with case discussions. Final Grade Break-down Class participation Turn-in assignments Mid term exam Final exam 20% 15% 30% 35% Strebulaev F331: AA Corporate Finance Page 3 Readings There will be a number of readings that students are expected to read before class. These readings are marked with F. The recommended textbook is: Berk and DeMarzo, Corporate Finance, 2nd ed., Prentice Hall, 2011. Other readings are included that are relevant and useful for the discussed topic but are not necessary to read before class. Some of these readings are at a more advanced level, and these are marked with } sign. Relevant financial information on cases requiring financial analysis will be made available in spreadsheet format on Coursework. Contacts Instructor: Ilya Strebulaev. Office: Littlefield L313, phone: 725-8239 e-mail: istrebulaev@stanford.edu Office hours: (Almost) any time if by prior arrangement. Assistant: Sandra Berg. Office: L318, phone: 723-4494 e-mail: berg sandra@gsb.stanford.edu Strebulaev F331: AA Corporate Finance Important Dates Tuesday April 12 Group assignment to be turned in: Airbus Wednesday April 27 Mid term examination Tuesday May 17 Group assignment to be turned in: RJR Nabisco. Friday June 3– Saturday June 4 Take home final examination Page 4 Strebulaev F331: AA Corporate Finance Page 5 Computer Worksheets for Cases Financial information for a number of the cases used in this course is available for use with Excel. This allows you to make numerical and graphical analyses without having to enter the income statement, balance sheet and certain other data yourself. Most of the numerical data found in the case exhibits is in the spreadsheets. However, not all such data are provided. The following is a list of the cases which will be made available on Coursework in the folder “Excel Files”: CASE NAME FILE NAME Arundel Partners ARUNDEL Polaroid Corporation POLAROID New Raggedly Bear Company NEWRAGGEDLY Iridium PLC IRIDIUM Delphi DELPHI Palamon Capital Partners PALAMON Red October, The Hostile Bid for REDOCT RJR Nabisco RJRNABISCO Strebulaev F331: AA Corporate Finance Page 6 Summary of Class Schedule Session 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Case Case of the Unidentified Industries Shurgard Kendle International, Inc. Airbus Arundel Partners Debt Policy at UST, Inc. Polaroid Corporation New Raggedly Bear Company Iridium LLC UAL Delphi RJR Nabisco RightNow Technologies Palamon Capital Partners The Hostile Bid for Red October Lecture/Discussion Course introduction Financing international expansion Managing growth Capital budgeting Real options Capital structure Leveraged recap, long-term financing Financial flexibility Risk management, international finance Financial ratios and short-term financing Financial distress The bankruptcy process Distressed restructuring Leveraged buyouts Venture capital Private equity / growth equity Mergers & Acquisitions Review and synthesis of the course Strebulaev F331: AA Corporate Finance Page 7 Session 1 Introduction to the Course Principles of Valuation Day: March 31 (Thursday) Preparation for class Refresh your core finance course notes. Read all required materials. Prepare the case of the Unidentified Industries. Case • The Case of the Unidentified Industries. (Read the case and come prepared to discuss the questions; no write-up required) 1. For each of the 11 sets of financial data, identify the industry represented. 2. Be prepared to explain the distinctive financial characteristics associated with each industry. Topic of lecture and discussion The world of the modern financial manager Valuation: • Value creation and destruction: NPV, IRR. • Multiple valuation • Free Cash Flows • Weighted Average Cost of Capital (WACC) Strebulaev F331: AA Corporate Finance Page 8 Readings for class Introduction F Graham, John R., and Campbell Harvey, “How Do CFOs Make Capital Budgeting and Capital Structure Decisions?”, Journal of Applied Corporate Finance, 2002, 15, Number 1, 8–23. } Kaplan, S. and Ruback, R., ”The Market Pricing of Cash Flow Forecasts: Discounted Cash Flow vs. the Method of ’Comparables’,” Journal of Applied Corporate Finance, Winter 1996, pp. 45-60. } Arbar, El, and G. Bennett Stewart III, “The EVA Revolution”, Journal of Applied Corporate Finance, 1999, 12, Number 2, 18–31. } Graham, John R., and Campbell Harvey, 2001, “The Theory and Practice of Corporate Finance: Evidence from the Field”, Journal of Financial Economics, 60, 187–243. Valuation and the Cost of Capital F Berk-DeMarzo, Ch. 6 (skim), 7, 9.3, 18,1–18.2 F Pettit, Justin, “Corporate Capital Costs: A Practitioner’s Guide”, Journal of Applied Corporate Finance, 1999, 12, 1, 113–120. } Cornell, B., J. I. Hirshleifer, and E. P. James, “Estimating the Cost of Equity Capital”, Contemporary Finance Digest. } Cooper, Ian, and Kjell Nyborg, “Discount Rates and Tax: A Teaching Note”, London Business School. } Bruner, R. F., K. M. Eades, R.S. Harris and R. C. Higgins, “Best Practice in Estimating the Cost of Capital”, Financial Practice and Education, Spring/Summer 1998. Strebulaev F331: AA Corporate Finance Page 9 Session 2 Financing International Expansion Day: April 5 (Tuesday) Case Shurgard Self-Storage. 1. What is your assessment of Shurgard and the self-storage business? 2. How has Shurgard performed in Europe to date? Will self-storage turn out to be a successful business in Europe? 3. What is your view of the firm’s expansion plans in Europe? Is it realistic to plan for 133 to 170 stores by 2003? What challenges/opportunities will Shurgard’s management face? 4. The consortium is proposing to invest EUR122 million of equity by 2003 in return for 43.3% ownership. Is this a fair valuation? A detailed valuation of this real estate business is quite complicated, but one way to get a rough estimate is to follow the two steps below: (a) Exhibit 3 provides a pro forma income statement for the “minimum” plan of opening 133 stores by 2003. Assuming no new stores were built after 2003 and assuming these stores reach steady state profits in the next year or two, what would the consolidated EBITDA be for Europe? In answering this questions, use the following mature store operating margins (in %): Year Year Year Year 2 3 4 5 (2000) (2001) (2002) (2003) Belgium 40.6 66.3 66.6 66.8 Sweden 46.6 63.6 63.9 64.2 UK France 47.8 47.0 70.6 64.7 70.8 65.0 71.0 65.3 Netherlands 39.7 69.3 69.6 69.8 (b) Under these assumptions, what is a reasonable value for Shurgard Europe? Is 43.3% ownership reasonable for the consortium? 5. Review the terms and conditions, such as board membership, proposed by the consortium? Are these reasonable from the perspective of Shurgard? 6. Would you advise Shurgard to go ahead with the expansion plan and proposed financing? Strebulaev F331: AA Corporate Finance Topic of lecture and discussion • International Expansion • External financing • M&A Page 10 Strebulaev F331: AA Corporate Finance Page 11 Session 3 Managing Growth Day: April 7 (Thursday) Case Kendle International, Inc. 1. How does the CRO business work? How is Kendle doing? 2. What strategic choices does Kendle face? Can it survive as a privately owned domestic company or does it need to become a much bigger firm with operations outside the US? 3. Should Candace Kendle and Christopher Bergen sell their firm to another company in early 1997? How does the potential sales price of the firm compare to its underlying value as a stand-alone firm, using a discounted cash flow (DCF) analysis? 4. Do the acquisitions of U-Gene and gmi make sense? Are the proposed deals priced fairly? 5. What strategy would you recommend: Proceed with both acquisitions now or do one followed by an initial public offering (IPO) and the second acquisition later? Topic of lecture and discussion Managing growth. Harvest options. Strebulaev F331: AA Corporate Finance Page 12 Session 4 Capital Budgeting Day: April 12 (Tuesday) Group assignment to be turned in: Airbus A3XX: Building the World’s Largest Commercial Jet 1. Why is Airbus interested in building the A3XX? What are its objectives? 2. How many aircraft does Airbus need to sell in order to break even on the investment? Is this number greater or smaller than your estimate of total demand for very large aircraft (VLA) over the next 20 years Hint: Consider all capital providers as a single entity and calculate the break-even return to them collectively. To calculate the break-even number of planes, calculate the present value of the required investment and compare it to the present value of a growing perpetuity of cash flow from planes sales beginning in 2008. Please assume an equity risk premium of 6% in your analysis. 3. As Boeing, how would you respond to this situation? How does your answer depend on what you think Airbus is likely to do? 4. Should Airbus commit to building the A3XX? How many orders should Airbus have before committing to develop the plane? NOTE: Submit one report per group of students (between 1 and 5 people), to be handed in before the start of class. State the names of group’s members clearly on the first page. Each report should be printed and contain at most 8 standard, single-sided pages, with standard margins and at least 11pt font. Topic of lecture and discussion Capital budgeting Readings for class F Berk & DeMarzo, Ch. 7–9. Strebulaev F331: AA Corporate Finance Page 13 Session 5 Real Options Day: April 14 (Thursday) Case Arundel Partners. 1. Why do the principals of Arundel Partners think they can make profits buying movie sequel rights? 2. Comment on the proposed deal structure. For instance, why do they want to buy a portfolio of rights in advance rather than negotiating film-by-film? Does it make any difference to the value of the options if Arundel buys options from just one studio or from several? Would it make any difference to their value if Arundel were a large corporation rather than a small partnership? 3. Estimate the per-film value of a portfolio of sequel rights using several approaches, specifying the assumptions underlying each of them. Assume throughout that the nominal risk-free rate is 6% per annum. (a) First, simply compute the value the portfolio (i.e., at the time Arundel pays for the rights) using the traditional NPV approach, ignoring embedded options. Based on this method, how much should Arundel be willing to pay per sequel right? (b) Second, modify the NPV approach to try and account for the embedded option(s), explaining the nature of the option(s) you focus on. What is the implied value per right? (c) Third, use the Black-Scholes model, thinking carefully about the inputs. What is the implied value per right? 4. Is the selling of packages of sequel rights a good way to finance film production? What are in your view its main pros and cons? What problems or disagreements would you expect Arundel and a major studio to encounter? What contractual terms and provisions would you suggest Arundel insist upon? Topic of lecture and discussion Real options. Strebulaev F331: AA Corporate Finance Page 14 Readings for class F Berk & DeMarzo, Ch. 22. } Luerhman, T. A., “Investment Opportunities as Real Options: Getting Started on the Numbers”, Harvard Business Review, July/Aug 1998, 51–67. Strebulaev F331: AA Corporate Finance Page 15 Session 6 Capital Structure Day: April 19 (Tuesday) Case There is no case to prepare for this session (Relax!). We will be discussing a number of examples during the class. The case for next class (Debt policy at UST) and other cases in the following classes use many of the concepts we will be discussing today. Topic of lecture and discussion Capital Structure. Raising external financing. IPOs, SEOs, 144a. Bank vs public debt. Short-term vs long-term debt. Credit lines, commercial paper, and cash management. Static trade-off and pecking order explanations of capital structure. Financial innovations and their effects on capital structure. Readings for class 6 and 7 F Berk & DeMarzo, Ch. 14 (skim), Ch. 15.5, 16.4–16.8 F Carow, K. A., “A Survey of US Corporate Financing Innovations: 1970–1997”, Journal of Applied Corporate Finance, 2003, 111-119. } Patrick, Steven C., “The Balanced Capital Structure”, Journal of Applied Corporate Finance, 1998, Number 1, 111-119. } Heine, Roger, and Frederic Harbus, “Towards a More Complete Model of Optimal Capital Structure”, Journal of Applied Corporate Finance, 2002, 15, Number 1, 33–45. Strebulaev F331: AA Corporate Finance Page 16 Session 7 Long-term financing Day: April 21 (Thursday) Case Debt Policy at UST Inc. Your job is to analyze the effect of leverage on UST, and to propose a recapitalization plan (or not). Throughout, ignore the effect of personal taxes. 1. Describe briefly UST’s business, putting particular emphasis on the potential sources of risk, and your evaluation thereof. How well is UST doing? 2. Describe briefly UST’s current capital structure. In your view, is it a good capital structure for UST? If yes, what are its main benefits? If not, what might explain why UST has such a capital structure? 3. From the standpoint of credit analysts and potential bondholders, what are factors of importance when analyzing UST? What credit rating would you assign for a moderate addition of debt? NOTE: Total interest expense on existing debt is $7.3 million. 4. Analyze the effects of $0.5 billion and $1.0 billion in new debt and concurrent share repurchase (and subtraction of equity). What happens to Earnings per share (EPS) in case of addition to debt? Why? Which leverage ratio maximizes EPS? 5. Decision time: Summarize the likely costs and benefits of leveraging UST. Articulate and defend an ”optimal” capital structure for UST. Should UST undertake a major recapitalization of the company? Topic of lecture and discussion Optimal capital structure and financial flexibility. Readings for class See previous session and F Berk & DeMarzo, Ch. 15.1–15.3 Strebulaev F331: AA Corporate Finance Page 17 Session 8 Financial Flexibility Day: April 26 (Tuesday) Case Polaroid Corporation. 1. What are the main objectives of the debt policy that Ralph Norwood must recommend to Polaroid’s board of directors? 2. What financing requirements do you foresee for the firm in the coming years? What are the risks associated with Polaroid’s business and strategy? In your view, what are Polaroid’s peer firms? 3. Drawing on the financial ratios in case Exhibit 9, how much debt could Polaroid borrow at each rating level? What EBIT coverage ratios would result from the borrowings implied by each rating category? 4. Using Hudson Guaranty’s estimates of the costs of debt and equity in case Exhibit 11, which rating category has the lowest overall cost of funds? Do you agree with Hudson Guaranty’s view that equity investors are indifferent to the increases in financial risk across the investment grade debt categories? 5. Is Polaroid’s current maturity structure of debt appropriate? 6. What should Ralph Norwood recommend regarding: • The target bond rating; • The level of flexibility of reserves; • The mix of debt and equity; • The maturity structure of debt; • And any other issues you believe should be brought to the attention of the CEO and board? Strebulaev F331: AA Corporate Finance Page 18 Topic of lecture and discussion Optimal capital structure and financial flexibility, the role of “slack”. Financial ratios and short-term financing, cash management. Readings for class } Barclay, Michael J., and Clifford W. Smith, “On Financial Architecture: Leverage, Maturity, and Priority,” Journal of Applied Corporate Finance, winter, 1996, 4–17. Strebulaev F331: AA Corporate Finance Page 19 Session 9 Corporate Finance Theory and Applications Day: April 28 (Thursday) Case We will be discussing a number of examples during the class. There is no case to prepare for this session (relax after your mid-term!!) Topic of lecture and discussion Corporate finance: most important ideas Perfect and imperfect markets Agency costs: adverse selection, moral hazard Agency costs: managers/equityholders, equityholders/debtholders, internal/external financing Executive compensation Applications to the current financial crisis Readings for class • Relax! • Come prepared to digest new ideas. Strebulaev F331: AA Corporate Finance Page 20 Session 10 Financial Ratios and Short-Term Financing Day: May 3 (Tuesday) Case New Raggedly Bear Company. 1. What does an analysis of the company’s financial ratios tell you? 2. If sales are $38.4 million in 2008, what will be company’s funds needs? 3. Will the additional bank loan solve the company’s problems? Is it appropriate? What is appropriate? Topic of lecture and discussion Short-term financing and financial ratios analysis. Readings for class F Berk & DeMarzo, Ch. 26, 27 & Ch. 19, pp. 629–636. Strebulaev F331: AA Corporate Finance Page 21 Session 11 Financial Distress Day: May 5 (Thursday) Case Iridium LLC. Your team of experts has been brought in to do a post-mortem on the Iridium experience. Prepare a discussion to address the following questions. 1. Describe briefly Iridium’s financial strategy. (No need to assess it at this point). How did Iridium justify its target debt-to-total book capitalization ratio of 60%? 2. Assess Iridium’s financial strategy. In your view, did it have the wrong target capital structure, issue the wrong kind of capital, or issue capital in the wrong sequence? 3. Based on DCF analysis and using the forecast in Exhibit 5, determine Iridium’s enterprise value, equity value and per share value. What are the important determinants of your DCF valuation of Iridium? How confident are you in your valuation? 4. What were the major factors that caused Iridium to fail? 5. What lessons for the financing of large green field projects do you draw from Iridium’s experience? NOTE: There is a typo in Exhibit 5: in 2000 Total Debt should be 3,437 not 4,437. Topic of lecture and discussion Financial distress. Corporate default, bankruptcy, reorganization. Readings for class F Berk & DeMarzo, Ch. 16.1–16.3 Strebulaev F331: AA Corporate Finance Page 22 Session 12 The Bankruptcy Process Day: May 10 (Tuesday) Case UAL: Pulling out of Bankruptcy in 2004. 1. Why did UAL file for bankruptcy protection in December 2002? 2. What is the rationale for allowing companies to restructure their debts and operations under Chapter 11 bankruptcy protection? • What is the role of the automatic stay, which prevents creditors from pursuing their claims to a defaulted borrowers assets outside of bankruptcy court? • Why do we allow debtor-in-possession financing for companies operating under Chapter 11 protection? Why are DIP loans granted seniority to firms pre-petition obligations? 3. What are the incentives of the different parties involved in restructuring UAL? What are the incentives of the firms management? Secured creditors? DIP lenders? Unsecured creditors? Employees? 4. What are the important costs of financial distress that UAL is facing? How would these costs of financial distress vary across different industries? 5. Why has leverage in the airline industry been high relative to other industries? 6. As UAL, would you continue making required contributions to your pension plans? Topic of lecture and discussion Corporate default and the bankruptcy process. Strebulaev F331: AA Corporate Finance Page 23 Readings for class F Gilson, Stuart, “Managing Default: Some Evidence on How Firms Choose Between Workouts and Chapter 11”, Journal of Applied Corporate Finance, 1991, 4(2), 62–70. } Weiss, Lawrence, “The Bankruptcy Code and Violations of Absolute Priority”, Journal of Applied Corporate Finance, 1991, 4(2), 71–78. } McConnell, John, and Henri Servaes, “The Economics of Prepackaged Bankruptcy”, Journal of Applied Corporate Finance, 1991, 4(2), 93–97. Strebulaev F331: AA Corporate Finance Page 24 Session 13 Distressed Restructuring Day: May 12 (Thursday) Case Restructuring at Delphi Corporation. 1. What key challenges does Delphi management need to address in the reorganization? 2. If you were advising Delphi management during its negotiations with GM and the UAW, what would you have considered your primary bargaining strengths or weaknesses in dealing with each party? 3. How well did the UAW fare in its negotiations with Delphi and GM? 4. How well did GM fare in its negotiations with Delphi? What justification is there for giving GM a $2.7 billion unsecured claim? 5. How well do the Appaloosa investors fare under the reorganization plan? Did Appaloosa’s involvement help or hinder the reorganization process? 6. In your judgment, is the plan of reorganization a good plan? How do you think the different classes of claimholders will vote? Topic of lecture and discussion Corporate default and the bankruptcy process. Readings for class See previous session. Strebulaev F331: AA Corporate Finance Page 25 Session 14 Leveraged Buyouts Day: May 17 (Tuesday) Group assignment to be turned in: RJR Nabisco 1. What was the value of RJR Nabisco under (a) The pre-bid operating strategy? (b) The Management Group’s operating strategy? (c) KKR’s operating strategy? 2. What accounts for any difference in the value of the three operating plans? 3. Evaluate the Special Committee’s use of an auction of RJR Nabisco. 4. Which bid should the Special Committee select, if any? What other actions should the Special Committee take? Topic of lecture and discussion Leveraged buyouts. Management buyouts. Readings for class F Berk & DeMarzo, Ch. 28, 18.3 Strebulaev F331: AA Corporate Finance Page 26 Session 15 Venture Capital Day: May 19 (Thursday) Case RightNow Technologies. 1. Evaluate the progress of the company and its situation at year end, 2003. 2. Based upon the data in the case, what is a fair value for RightNow? If the company hits its forecasts, what could the company be worth in the future? 3. As Gianforte, what is the lowest price you would sell at? As the venture capital (VC) investors? If these answers are different, how should Gianforte’s views and desires be weighed against the other board members / investors? 4. If the company does not accept this offer, what should it do? What is your assessment of RightNow’s future potential as an independent company, given its new strategy? Assess the option of going public - what are the advantages and disadvantages? Topic of lecture and discussion Venture capital. Financing start-ups and growth firms. Readings for class } Stromberg, Per, and Steven Kaplan, “Contracts, Characteristics, and Actions: Evidence from Venture Capitalist Analysis”, Journal of Finance, 2004, 59, 5, 2177–2210. Strebulaev F331: AA Corporate Finance Page 27 Session 16 Private Equity Day: May 24 (Tuesday) Case Palamon Capital Partners. You have been asked by Palamon Capital Partners (PCP) to provide an independent assessment of the proposed investment. 1. Describe briefly PCP’s investment strategy. In your view, what are the major attractive features of the fund? What are the major risks involved? 2. Discuss the proposed investment in TeamSystem. What are the major risks involved? 3. Determine the value of the 51 percent stake in TeamSystem. Explain the valuation results. 4. Discuss the sensitivity of your valuation results. What considerations should PCP take into account when making a decision? Are their non-price risks that should be considered seriously? 5. Deliver your advice to PCP. Should PCP invest in TeamSytem? Topic of lecture and discussion Mergers & Acquisitions. Readings for class } Block, Stanley B., “The Latest Movement to Going Private: An Empirical Study”, Journal of Applied Finance, 2004, Spring/Summer, 36–44. } Leeds, Roger, and Julie Sunderland, “Private Equity Investing in Emerging Markets”, Journal of Applied Corporate Finance, 2003, 113, 111–119. Strebulaev F331: AA Corporate Finance Page 28 Session 17 Mergers & Acquisitions Day: May 26 (Thursday) Case The Hostile Bid for Red October. 1. Strategically, does Red October fit with Koloss? Why is it an attractive target? What does it do for Menatep Bank? 2. Is the company undervalued at $5 per share, the ”rough” price before the takeover attempt? 3. Using Exhibit 8a projections and the equity cost calculated in Exhibit 8b, how would you value the shares? Is this cost of equity capital estimate reasonable? What would happen to the value if you were to use the 50 percent opportunity cost mentioned in the case? Are the projections reasonable? 4. What is Koloss? Menatep’s bidding strategy? Red October’s strategy in response? 5. What should management do now that K/M has raised the tender offer to $9.50 per share? Topic of lecture and discussion Discussion of corporate governance. Leveraged buyouts. Readings for class } Becht, Marko, Patrick Bolton, and Ailsa Roell, “Corporate Governance and Control”, Working paper, European Corporate Governance Institute, 2002. Strebulaev F331: AA Corporate Finance Session 18 Day: May 31 (Tuesday) Topic of lecture and discussion Review and synthesis of course. (Detailed) explanation of final examination. Final remarks. Readings for class There are no readings for this class. Relax! Page 29