EBF comments on ESMA future guidelines on UCITS Exchange

advertisement

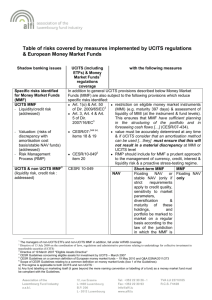

EBF Ref.:D0481D Brussels, 30 March 2012 Launched in 1960, the European Banking Federation is the voice of the European banking sector from the European Union and European Free Trade Association countries. The EBF represents the interests of almost 5000 banks, large and small, wholesale and retail, local and cross-border financial institutions. Together, these banks account for over 80% of the total assets and deposits and some 80% of all bank loans in the EU only. EBF comments on ESMA future guidelines on UCITS Exchange-Traded Funds (UCITS ETFs) and other UCITS-related issues Key points: • The EBF welcomes ESMA’s approach of awaiting the outcome of MiFID in relation to the issue of complexity. • As there might be other ETFs, which are not compliant with UCITS, the “UCITS-brand” should appear in the name in order to avoid confusion. • The term “exchange-traded” makes it clear that units can only be bought and sold on an exchange. Therefore secondary market investors should not have a right to direct redemption of ETF units by the issuer. • Regarding EPM, the EBF suggests the application of reconciliation with the counterparty of trades that are collateralized. Furthermore, it points out that it is usual for this third party to seek re-imbursement through a fee sharing arrangement rather than charging a flat fee. • The EBF does not believe that incorporating collateral with other assets to calculate compliance with UCIT diversification rules is practically achievable or necessary. • The EBF is of the view that a high correlation requirement should not be applied for EPM techniques. • Limiting the proportion of the portfolio that can be lent, by counterparty or at portfolio level would limit the opportunities for UCITS in securities lending and lead to reduced competitiveness. • It remains unclear to us who may qualify as an independent valuation agent. Involving a third party would cause high costs while the added value compared with an affiliated valuation agent is questionable. • • Contact Person: Joe McHale (j.mchale@ebf-fbe.eu) Related documents: http://www.esma.europa.eu/system/files/2012-44_0.pdf EBF a.i.s.b.l ETI Registration number: 4722660838-23 10, rue Montoyer B-1000 Brussels +32 (0)2 508 37 11 Phone +32 (0)2 511 23 28 Fax www.ebf-fbe.eu Introduction The European Banking Federation (EBF) welcomes the opportunity to comment on the draft future guidelines on UCITS Exchange-Traded Funds (UCITS ETFs) and other UCITS-related issues. It recalls the messages of its in September 2011 response to ESMA and is happy to see that the authority has decided to await the outcome of MiFID in relation to the issue of complexity. That said it is now very unclear what the purpose of the proposed guidelines is. This confusion unfortunately makes it rather difficult to give a comprehensive answer to the individual questions. The EBF has therefore focused on the issues which clearly present some challenging obstacles to market participants. General Remarks The EBF would like to raise a technical point with respect to transitional provisions for collateral posted to Structured UCITS which were launched prior to publication of CESR 10-788. ESMA correctly stipulates that pre-existing Structured UCITS with pre-defined payout terms should be exempt from any of their new guidelines that would have an economic impact requiring a change in their payout terms. However, CESR 10-788 included no such transitional provisions. ESMA later issued supplementary paper ESMA/2011/112 which explicitly exempted pre-existing Structured UCITS from Boxes 1-25 of the guidelines on global exposure in CESR 10-788, due to their potentially detrimental impact on the fund payout. The EBF believes the same principle is equally applicable to Box 26 of CESR 10-788, and the same exemption should apply to Box 26 for Structured UCITS launched before CESR 10-788 was published. Structured UCITS payout terms are designed based on collateral costs for specific collateral assets, with such costs fixed for the life of the fund. Any post-launch change to the collateral rules would impact the predefined payout terms set out in the fund documentation, which would not be a good outcome for investors. This is purely a technical point to address the apparent anomaly between the CESR and ESMA provisions in respect of transitional arrangements. Box 3 - Definition of UCITS ETFs and identifier With regards to the issue of a potential ETF identifier, the EBF thinks that the purpose of the definition (including the effects besides the demand for labeling) needs to be clear, before the identifier is decided. That said it seems that the definition now includes all the features which make them safe for the investor to invest in. In order to take account of jurisdictions with tailor made marketplaces where trades take place on the basis of NAV and restrictions apply to the activity of market makers, the EBF suggests the following minor underlined amendments to the ETF definition: 1. A UCITS exchange-traded fund (UCITS ETF) is a UCITS at least one unit or share class of which is continuously tradeable on at least one regulated market or multilateral trading facility (MTF) with at least one market maker which takes action to ensure that the stock exchange value of its units or shares does not significantly vary from its indicative net asset value without being restricted by the UCITS in this action. 2 2. A UCITS ETF should use an identifier, in its name and in its fund rules or instrument of incorporation, prospectus, KIID and marketing communications, which identifies it as an exchange-traded fund. The identifier should be ‘UCITS-ETF’. 3. A UCITS which does not fall under the definition of UCITS ETF in paragraph 1 of this Box should not use the ‘UCITS-ETF’ identifier in its name or in its fund rules or instrument of incorporation, prospectus, KIID or any marketing communications. Besides that, a further distinction between synthetic and physical ETFs is not necessary, as both ways of “rebuilding” the relevant index are common market practice and an identifier should be short and simple, it is not necessary to capture the technique in the identifier. Nevertheless, the distinction can be made and should be made in the prospectus (cf. Question 8). Box 5 – Secondary markets investors Q12: Which is your preferred option for the proposed guidelines for secondary market investors? Do you have any alternative proposals? Secondary market investors should not have a right to direct redemption of ETF units by the issuer. The term “exchange-traded” makes it clear that units can only be bought and sold on an exchange. A right of this kind would make it extremely difficult to differentiate between ETF products and products that can be either returned to the asset management firm or sold on the stock exchange. Therefore, EBF members prefer Option no. 1. Q13: With respect to paragraph 2 of option 1 in Box 5, do you think there should be further specific investor protection measures to ensure the possibility of direct redemption during the period of disruption? If yes, please elaborate. No. Due to the market-making obligation (Option 1) there is no necessity for a direct redemption. 3 Box 6 - Efficient Portfolio Management Techniques Q16: Do you agree with the proposed guidelines in Box 6? In particular, are you in favour of requiring collateral received in the context of EPM techniques to comply with CESR’s guidelines on Risk Measurement and Calculation of Global Exposure and Counterparty Risk for UCITS? The EBF would like to raise important points concerning paragraph’s 2 & 6 in box 6. For the other points, it agrees in general with the proposed guidelines with the exception of: • part of paragraph 3 • paragraph 7 In addition, the EBF suggests the application of reconciliation with the counterparty of trades that are collateralized. This is critical step which is often overlooked. Following the negotiation of the collateral agreement but before it is acted upon with margin calls being made; it is recommended that firms perform a detailed trade-by-trade position reconciliation. Reconciliation allows the two parties to agree on the number and exposure of any existing trades. If the portfolio has not been reconciled and agreed, any collateral that flows back and forth between the parties is based on what may be an estimate of true exposure. The frequency of reconciliation should depend on the turnover of the portfolios (stable portfolios being less subject to discrepancies than portfolios with high turnover) and there should be“practicality” criteria (access to industry utilities). Proposed guidelines in paragraph 2 It is important that investor information is not confined in technical terms to explaining the risks related to securities lending; the objective would be better achieved by applying clear concise language to disclose such risks to investors. Whilst we agree that information should be available to clients, there should be a more practical approach in displaying the collateral parameters, particularly as these can change frequently based on market conditions. Proposed guidelines in paragraph 3 In terms of disclosure the EBF agrees that fee arrangements should be disclosed in the prospectus of the UCIT. However, paragraph 3 suggests that “as a general rule” all fees should be returned to the UCIT. Securities Lending is a complex and costly activity which is usually undertaken by a third party specialist (this may be the asset manager, custodian or independent third party) who has invested in specialist systems and expertise to manage the process in a risk controlled manner. It is usual for this third party to seek re-imbursement through a fee sharing arrangement rather than charging a flat fee. This ensures that the UCIT only incurs costs when revenues are generated and aligns the interests of the third party to the UCIT in respect of ensuring that the activity is profitable for the UCIT. 4 Proposed guidelines in paragraph 6 Whilst the qualitative criteria set by Box 26 in the CESR Guidelines are helpful, appropriate controls at a firm/industry level would go much further in mitigating the concerns which the proposed policy aims to address: firms should apply an effective risk management framework, haircut policy and indemnification; once these are supplemented by the qualitative criteria set by policy, the overall policy objectives are likely to be achieved. However, one key exception applies: this concerns the criteria for reinvestment of cash collateral for stock lending: there should be more flexibility applicable to the reinvestment of collateral. Proposed guidelines in paragraph 7 The EBF does not believe that incorporating collateral with other assets to calculate compliance with UCIT diversification rules is practically achievable or necessary. EBF members believe that this requirement will raise various issues depending of the nature of collateral: 1) Collateral received in transferable securities or money market instruments Collateral is designed to be liquidated as soon as possible. It is not designed to act as a substitute investment, and with a counterparty default it will need to be liquidated whereas the other assets will not. Market practice is that assets given as collateral must be suitable for both the collateral taker and the collateral giver (criteria for determining collateral eligibility, haircut rate). Consequently, the eligibility criteria does not depend on UCITS diversification rules that only apply to the collateral taker and that could change the nature of collateral at any time. The EBF believes that ESMA’s proposal (Box 6 – paragraph 6) is sufficient to provide an ensured recovery rate in the event of the counterparty default. 2) Collateral received in cash The holding of a deposit at a site held at the depositary may be justified to cover payments. Requiring that at any time a UCITS shall hold no more than 20 % of the portfolio composed of both its assets and of the collateral received in ancillary liquid assets and cash received as collateral and deposits with the depositary will lead to the transfer of cash collateral to third party agents .This will result in a credit exposure to these third party agents. Furthermore, if received collateral falls within the scope of custody under UCITS V the EBF believes that depositaries will not accept an obligation to return cash-reinvestment in assets held at a third party in case of loss of these assets by the third party . Therefore the EBF suggests: 5 i) that the review of UCITS V should lay down that UCITS are entitled to be preferred before other creditors of the depositary in case of bankruptcy of the depositary; ii) to raise the threshold of 20% in case the cash is held by the depositary. Q19: Would you be in favour of requiring a high correlation between the collateral provided and the composition of the UCITS’ underlying portfolio? Please explain your view. The EBF is of the opinion that this requirement would be useless and inefficient: - In the event of a default by the counterparty, what really matters with collateral received or securities purchased is to be able to quickly resell the assets. A high correlation criterion would be useless. Furthermore, in many cases it would be very difficult to find enough correlated securities. Basically, the only collateral which would be totally correlated to the securities lent would be the securities themselves. - A high correlation requirement may give rise to inefficiency, since any changes in the collateral or securities composition, required to ensure that the correlation criteria is enforced, would involve costs, ruining the initial purpose of securities lending/borrowing and repurchase agreements/reverse repurchase agreements as efficient portfolio management techniques and causing intermediaries to be paid with no upside for the investors. In the end, bearing in mind that correlation is a non trivial input (as a market parameter, it can vary over time and over maturities), a high correlation requirement between the collateral received or provided, or the securities purchased or sold, and the composition of the UCITS underlying portfolio would lead to non efficiency. The EBF is thus of the view that a high correlation requirement should not be applied for EPM techniques. Q20: Do you agree that the combination of the collateral received by the UCITS and the assets of the UCITS not on loan should comply with the UCITS diversification rules? Please refer to Q16 above Q21: With regards to eligibility of assets to be used as collateral, do you have a preference for a list of qualitative criteria (as set out in CESR’s guidelines on risk measurement) only or should this be complemented by an indicative list of eligible assets? 6 The EBF believes that the best approach would be defining qualitative criteria for eligible collateral without further expansion. This allows a level of flexibility for the UCIT to react to changes in market conditions without the need to amend regulations whilst ensuring that the quality of collateral is always maintained. Q24: Do you agree that entities to which cash collateral is deposited should comply with Article 50(f) of the UCITS Directive? The EBF agrees with this approach. Q25: Do you believe that the proportion of the UCITS’ portfolio that can be subject to securities lending activity should be limited? If so, what would be an appropriate percentage threshold? Limiting the proportion of the portfolio that can be lent, by counterparty or at portfolio level would limit the opportunities for UCITS in securities lending and lead to reduced competitiveness. Provided the risk management techniques are robust and appropriate collateral and haircuts are applied limits are not necessary and will be detrimental to the UCITS ability to ensure best pricing and to maximise returns. If limits were imposed on securities lending activity for UCITS the EBF would expect similar restrictions to apply to synthetic instruments that have a similar effect in other funds. Q30: In relation to the valuation of the collateral by the depositary of the UCITS, are there situations (such as when the depositary is an affiliated entity of the bank that provides the collateral to the UCITS) which may raise risks of conflict of interest? If yes, please explain how these risks could be mitigated? The question is also valid for collateral received by the UCITS in the context of total return swaps. It is permitted under the AIFM Directive that, provided it has functionally and hierarchically separated the performance of its depositary functions from its other tasks as a services provider, a depositary may also provide: • services to finance or execute transactions in financial instruments as counterparty , securities lending, customised technology and operational support facilities if the 7 potential conflicts of interest are identified, managed, monitored and disclosed to the investors in the fund. • Nav calculation and valuation of individual assets (including collateral). It is recognised that AIFMD establishes a stringent regulatory framework addressing risks in relation to investors. The EBF therefore believes that the AIMFD provisions are sufficient to mitigate these risks. Box 7 - Total Return Swaps Most of questions raised by ESMA in this box for Total Return Swaps are similar to those for Box 6 - EPM techniques. Consequently the EBF’s comments are the same as those mentioned for EPM. Box 8 - Strategy indices The proposed guidelines on strategy indices are an important step towards enhanced quality and standardised requirements of index-tracking UCITS. The EBF appreciates these developments as they will ideally further improve the stability and transparency of the fund market. Nevertheless, EBF members would like to comment on some of the guidelines as stated on page 29 of the consultation paper as follows: Proposed guidelines in paragraph 6 In our view, this criterion is too narrow as it effectively limits the world of indices in which investors may participate. For example, in regard to portfolio diversification indices with intraday balancing can contribute significant value as an additional asset class in investors' portfolios. Clients may request products that are linked to indices which rebalance more frequently as they appreciate those as investment opportunities that are otherwise not accessible to them. Furthermore, indices which are oriented on shorter terms are also capable of representing their respective markets appropriately. For instance, FX indices can require intra-day rebalancing in order to capture FX market movements reliably. In this regard, the fact that intra-day rebalancing does not meet this requirement appears somehow random. Therefore, the EBF suggests deleting it completely. Proposed guidelines in paragraph 12 The EBF agrees that a standard due diligence on the quality of the index is a must. As a result the overall quality of funds should increase. 8 Proposed guidelines in paragraph 13 The EBF understands that an independent assessment of the underlying index may enhance the quality of the valuation of the fund. However, it is yet unclear to us what independent assessment means or what the requirements are. The workload as well as costs and time spent on this assessment depend greatly on these requirements. In our view, a feasible solution would be a plausibility check by the management company of the fund. In this way, additional costs could be limited. Proposed guidelines in paragraph 14 It remains unclear to us who may qualify as an independent valuation agent. In our view, a third party valuation agent would genuinely go too far. Again, involving a third party would cause high costs while the added value compared with an affiliated valuation agent is questionable. In our view, the costs involved with an independent valuation of the financial index would cause the extinction of strategy indices. Therefore, this matter appears somewhat disproportionate. The process of pricing the underlying index is of high importance and a key quality criterion. Besides, the valuation is a mandatory element in the due diligence on the quality of the index. The EBF suggests mentioning in the fund prospectus if an independent valuation of the financial index will be carried out. Especially, it seems important to outline the relationship between the index sponsor and the valuation agent, whether they are external third parties or affiliated. Q40: Do you think that further consideration should be given to potential risks of conflict of interest when the index provider is an affiliate of the management company? In many cases, the index sponsor, valuation agent and management company will be affiliated, and may even operate as different departments of the same legal entity. By law, these entities are obliged to implement appropriate control measures to prevent conflicts of interest. Regulation authorities are supervising these measures and ascertain that the entities comply with these requirements on an ongoing basis. In the context of this control setup the EBF suggests that a proper disclosure of the relationship between the index sponsor, valuation agent and management company in the relevant fund prospectus is sufficient. By including this matter as an additional risk factor the EBF considers the disclosure as an appropriate form of disclosure to investors that there may be potential risks of conflict of interest. Therefore, further consideration is not required from our point of view. 9