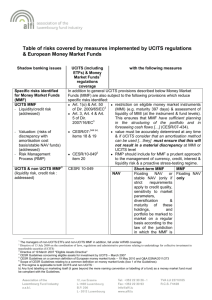

ALFI Risk Management guidelines

advertisement