houzz renovation barometer

advertisement

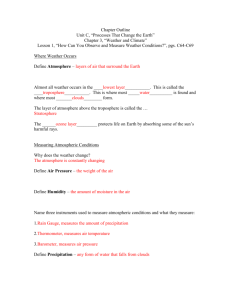

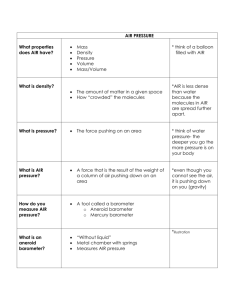

Q3 2015 HOUZZ RENOVATION BAROMETER October 2015 @Houzz © 2015 Houzz Inc. Big Ideas • Consistent with past Barometer findings, renovation-focused firms report widespread moderate-to-severe shortages of specialized trades and general labor, with carpenters being in the shortest supply. Labor shortages in the Northeast are reported to be less severe than in other regions. • Additionally, one in ten remodelers and design-build firms and twice as many architects and designers point to moderate-to-severe shortages of general contractors. One in four architects points to shortages of architects. One in five firms in the outdoor sector report shortages of landscape contractors. • Consistent with results for the first six months of 2015, the Houzz Renovation Barometer posted high Q3 readings across all industry groups (65-73 out of 100), reflecting widespread industry confidence in market improvement. These scores are lower compared to Q2 scores, likely to due to the start of a seasonal slowdown, as well as, the backlog of projects from the spring months, among other factors. • All industry groups are continuing to report widespread year-over-year improvements in the home renovation market in Q3 2015 (74-80 out of 100). Barometer reading exceeded 70 points for all three quarters of 2015, pointing to strong confidence in renovation market improvements in 2015 relative to 2014. U.S. Houzz Renovation Barometer | October 2015 2 © 2015 Houzz Inc. Contents Current Labor Shortages in the Renovation Sector 4-6 Q3 Houzz Renovation Barometer: Quarter-Over-Quarter 7-10 Q3 Houzz Renovation Barometer: Year-Over-Year 11-14 Methodology 15-16 Appendix: Q2 Findings - Are We Back to Normal? 17-21 U.S. Houzz Renovation Barometer | October 2015 3 © 2015 Houzz Inc. LABOR CONDITIONS U.S. Houzz Barometer Highlights | October 2015 4 © 2015 Houzz Inc. Shortage of Building/Renovation Trades & General Labor Consistent with past Barometer findings, GCs, remodelers and design-build firms that specialize in home renovations report moderate-to-severe labor shortages across a wide range of specialized trades. Carpenters are reported to be in the shortest supply across the U.S. (cited by 45% of firms), followed by framers (25%), tile (22%), and drywall (21%). Over a third of firms (36%) also report moderate-to-severe shortages of general laborers. In general, trade/labor shortages appear to be most prevalent in the Midwest and least prevalent in the Northeast. MODERATE-TO-SEVERE TRADES/LABOR SHORTAGES REPORTED BY GCS, REMODELERS, DESIGN-BUILD* Nationally Northeast Midwest Carpenter (finish) 45% Laborer (general) 36% Framer 25% 22% Tile Drywall 21% South West Carpenter (finish) 43% 54% 39% 46% Laborer (general) 25% 43% 36% 37% Framer 15% 33% 23% 29% Tile 18% 22% 18% 28% Drywall 15% 22% 18% 25% Concrete 19% Concrete 10% 22% 23% 19% Plumber 19% Plumber 15% 19% 18% 22% Masonry 19% Masonry 14% 17% 22% 19% Electrician 19% Electrician 12% 21% 16% 25% Painter 18% Painter 11% 20% 19% 21% Cabinetry 18% Cabinetry 11% 22% 17% 20% Flooring 11% Flooring 9% 14% 8% 13% HVAC 10% HVAC 11% 8% 10% 12% Roofer 10% Roofer 8% 11% 8% 14% Siding 10% Siding 8% 14% 9% 10% Other 5% 8% 5% 7% Other 6% *Percentages reflect proportion of GCs, remodelers and design-build firms who reported moderate-to-severe shortages of specialized trades and general laborers. U.S. Houzz Renovation Barometer | October 2015 5 © 2015 Houzz Inc. Some Shortages of Contractors and Architects In addition to shortages in trades and general labor, one in ten GCs, remodelers and design-build firms and twice as many architects and interior designers report moderate-to-severe shortages of general contractors. One in four architects also points to their own profession as being in short supply. Finally, firms in the outdoor sector report moderate-to-severe shortages of landscape contractors (18%), architects (11%) and designers (8%). OTHER MODERATE-TO-SEVERE PROFESSIONAL SHORTAGES REPORTED BY SPECIFIED INDUSTRY GROUPS* 24% 24% Moderate-to-Severe Shortages Reported by Outdoor Sector 21% 11% 7% 6% General contractor Architect 6% 8% 7% 18% Landscape Contractor 11% Landscape Architect 8% Landscape Designer Interior designer Reported by GCs, remodelers and design-build firms Reported by architects Reported by designers *Percentages reflect proportion of firms in specified industry groups who reported moderate-to-severe shortages of each professional category. U.S. Houzz Renovation Barometer | October 2015 6 © 2015 Houzz Inc. HOUZZ RENOVATION BAROMETER QUARTER-OVER-QUARTER U.S. Houzz Renovation Barometer | October 2015 7 © 2015 Houzz Inc. Continued Optimism Despite Seasonal Effects The Houzz Renovation Barometer, which tracks industry optimism in quarter-over-quarter market improvements, posted readings of 65-73 in the third quarter of 2015 (July-Sept.), reflecting continued high levels of confidence among industry professionals. Despite these high scores, the Barometer readings are 6%-11% lower in Q3 vs. Q2 across all industry groups, with the exception of firms in the outdoor sectors that report a decrease of 21%, likely due to stronger seasonal patterns. HOUZZ RENOVATION BAROMETER (QUARTER OVER QUARTER)* Architects Designers GCs & Remodelers Design-Build Specialty: Specialty: Building/Renovation Landscape/Outdoor 82 78 73 64 69 75 73 72 73 70 67 65 77 72 66 69 67 78 78 77 70 68 68 71 73 66 65 61 60 55 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 Q4E reflects expectations for the upcoming quarter. *A reading over 50 indicates that more firms are reporting business activity is higher than those reporting it is lower in a given quarter relative to the prior quarter. The greater the index value relative to 50, the greater the proportion of firms reporting increases in quarterly business activity than those reporting decreases. Business activity is measured as number of inquiries, number of new projects/orders, and size of new projects/orders. U.S. Houzz Renovation Barometer | October 2015 8 © 2015 Houzz Inc. Widespread Influx of New Business Significantly more firms are reporting quarter-over-quarter increases than decreases in the number of inquiries, and the number and size of new projects in the third quarter of 2015, as reflected in Barometer readings of 63-74, 66-74, and 60-69, respectively. These scores are lower in Q3 relative to Q2 across all three indicators of new business activity, likely to due to the start of a seasonal slowdown, as well as, the backlog of projects from the spring months, among other factors. COMPONENTS OF HOUZZ RENOVATION BAROMETER (QUARTER OVER QUARTER)* Architects Designers GCs & Remodelers Design-Build Specialty: Specialty: Building/Renovation Landscape/Outdoor NO. OF INQUIRIES 78 74 65 NO. OF NEW PROJECTS/ORDERS 76 66 72 67 61 67 62 69 69 76 75 76 SIZE OF NEW PROJECTS/ORDERS 60 66 64 60 57 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 72 67 67 71 69 68 66 75 79 79 68 75 74 80 82 74 74 65 70 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 64 70 73 69 68 70 77 69 65 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 78 68 70 73 81 80 69 70 67 71 72 72 79 69 72 76 68 67 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 66 68 73 74 74 69 80 67 63 53 57 80 68 65 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 84 84 66 53 61 65 73 79 66 58 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 *See footnote on p. 8 for interpretation of the scores. The Houzz Renovation Barometer is a simple average of the scores of the three components. U.S. Houzz Renovation Barometer | October 2015 9 © 2015 Houzz Inc. Greatest Seasonal Effects on Northern Outdoor Firms While outdoor specialty firms are feeling the seasonal slowdown earlier than other industry groups, Northeastern and Midwestern outdoor firms are hit the hardest, as reflected by the 36% and 30% quarter-over-quarter decreases in Barometer scores for the third quarter, respectively (vs. 21% and 10% decreases in the South and the West, respectively). Across all regions, industry optimism is on average higher among GCs, design-build and building/renovation specialty firms. REGIONAL HOUZZ RENOVATION BAROMETER (QUARTER OVER QUARTER)* Architects Designers GCs & Remodelers Design-Build Specialty: Specialty: Building/Renovation Landscape/Outdoor NORTHEAST 63 69 69 64 63 75 69 73 69 68 57 70 77 69 60 69 77 77 72 69 78 63 63 69 66 59 68 91 58 48 MIDWEST 63 74 69 65 53 65 70 71 66 69 82 64 75 70 67 69 79 78 88 74 72 70 67 67 69 65 69 68 71 58 59 73 62 42 SOUTH 63 71 68 64 58 78 76 70 72 69 75 78 73 69 67 76 70 74 66 71 70 77 77 75 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 68 75 79 79 75 71 79 82 WEST 65 76 72 65 62 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 65 63 62 84 70 78 75 72 76 69 72 72 77 73 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 65 65 77 69 57 Q4 Q1 Q2 Q3 Q4E ‘14 ‘15 ‘15 ‘15 ‘15 *Click on the links to see the Houzz Renovation Barometer by state and by major metro area. See footnote on p. 8 for interpretation of the scores. U.S. Houzz Renovation Barometer | October 2015 10 © 2015 Houzz Inc. HOUZZ RENOVATION BAROMETER YEAR-OVER-YEAR U.S. Houzz Renovation Barometer | October 2015 11 © 2015 Houzz Inc. Continued Year-Over-Year Gains The Barometer posted high year-over-year readings of 74-79 in the third quarter of 2015, a notch lower than last quarter’s readings of 75-83. Persistent year-over-year Barometer readings in excess of 70 points over the past three quarters are a strong indication of industry confidence in renovation market improvements in 2015 relative to 2014. HOUZZ RENOVATION BAROMETER (YEAR-OVER-YEAR)* Architects Designers GCs & Remodelers Design-Build Specialty: Specialty: Building/Renovation Landscape/Outdoor 83 80 74 76 76 75 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 76 74 75 78 80 79 79 79 80 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 77 74 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 80 76 77 79 77 79 77 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 *A reading over 50 indicates that more firms are reporting business activity is higher than those reporting it is lower in a given quarter relative to the same quarter of the prior year. The greater the index value relative to 50, the greater the proportion of firms reporting increases in quarterly business activity than those reporting decreases. Business activity is measured as number of inquiries, number of new projects/orders, and size of new projects/orders. U.S. Houzz Renovation Barometer | October 2015 12 © 2015 Houzz Inc. Strong Year-Over-Year Gains in All Business Metrics The aggregate scores of the year-over-year Barometer are bolstered by a strong showing of all three new business activity metrics. Across all sectors, firms are reporting widespread increases in inquiries and the number and size of new projects in Q3 2015 relative to the same period last year. COMPONENTS OF HOUZZ RENOVATION BAROMETER (YEAR-OVER-YEAR)* Architects Designers GCs & Remodelers Design-Build Specialty: Specialty: Building/Renovation Landscape/Outdoor NO. OF INQUIRIES NO. OF NEW PROJECTS/ORDERS SIZE OF NEW PROJECTS/ORDERS 81 82 81 81 82 81 80 81 78 81 78 80 80 82 78 82 79 77 80 82 78 81 79 81 79 77 75 78 76 77 77 77 74 75 75 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 81 78 78 76 77 76 77 75 77 78 79 78 78 77 76 76 76 77 76 75 76 70 68 70 69 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 70 74 71 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 71 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 79 72 86 86 81 80 78 76 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 *See footnote on p. 12 for interpretation of the scores. The Houzz Renovation Barometer is a simple average of the scores of the three components. U.S. Houzz Renovation Barometer | October 2015 13 © 2015 Houzz Inc. Midwestern Building Sector Showing Weaker Confidence Industry confidence in year-over-year market gains across regions is mostly in line with the national levels. Midwestern GCs, design-builds, and building specialty firms report a somewhat lower optimism relative to other regions, evidenced by Barometer readings of 73-75 (vs. 75-77 in the Northeast, 78-79 in the South, and 79-82 in the West). Other industry groups in the Midwest report confidence more in line with other regions. REGIONAL HOUZZ RENOVATION BAROMETER (YEAR-OVER-YEAR)* Architects Designers GCs & Remodelers Design-Build Specialty: Specialty: Building/Renovation Landscape/Outdoor NORTHEAST 72 MIDWEST 69 79 75 84 80 73 74 77 72 73 74 77 77 78 77 76 77 79 80 73 80 76 81 78 72 75 71 72 71 67 71 79 76 77 85 81 75 SOUTH 76 75 69 71 74 74 78 72 WEST 78 80 80 77 78 76 77 75 79 79 80 82 81 78 82 81 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 80 79 76 72 79 75 78 78 73 86 80 73 73 76 68 73 83 80 79 82 79 84 81 82 83 83 81 76 78 79 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 79 75 83 83 Q4 Q1 Q2 Q3 ‘14 ‘15 ‘15 ‘15 *Click on the links to see the Houzz Renovation Barometer by state and by major metro area. See footnote on p. 12 for interpretation of the scores. U.S. Houzz Renovation Barometer | October 2015 14 © 2015 Houzz Inc. METHODOLOGY U.S. Houzz Renovation Barometer | October 2015 15 © 2015 Houzz Inc. Methodology The Houzz Renovation Barometer tracks quarterly fluctuations in business activity related to renovation of owner-occupied existing homes. The study is conducted quarterly and presents an analysis of responses to an online survey sent out to a national U.S. panel of architects, interior designers, general contractors/remodelers, design-build firms, and building/renovation and landscape/outdoor specialties.1 The Houzz Renovation Barometer survey for the current quarter was fielded September 27-October 12, 2015. N = 2688 (351 architects; 614 interior and building designers; 539 general contractors/remodelers; 355 design-build firms; 550 building/ renovation specialties; and 279 landscape/outdoor specialties). Index Construction Method: The Houzz Renovation Barometer survey asks professionals to indicate whether certain business activities increased, decreased, or stayed about the same in a given quarter; changes in activity are measured quarter-over-quarter and year-over-year. “Business activity” refers to number of inquiries, number of new projects/orders, and average size of new projects/orders. The final Houzz Renovation Barometer is constructed as a diffusion index that 1) sums up the proportion of firms reporting increases in a given business activity and one-half of the proportion of firms reporting no change in the activity; and 2) averages the sums across the three components, with equal weights assigned to each component. Diffusion indices are a widely accepted method for tracking turning points in the market. For more information on the methodology, see U.S. Houzz Barometer Study, February 2015. 1 Building/renovation specialties include replacement contractors (e.g., carpenters) and product installers/manufacturers/resellers (e.g., cabinetry). Landscape/outdoor specialties include landscape architects, designers, and contractors; outdoor replacement trades (pavers), and outdoor product installers/manufacturers/resellers (e.g., pools and spas). U.S. Houzz Renovation Barometer | October 2015 16 © 2015 Houzz Inc. APPENDIX: ARE WE BACK TO NORMAL? FINDING FROM Q2 RENOVATION BAROMETER U.S. Houzz Renovation Barometer | Originally reported in July 2015 17 © 2015 Houzz Inc. Revenues & Profits Back to ‘Normal’ for Most Over two-thirds of firms are reporting that gross revenues and profits so far this year are at or above levels they considered to be normal before the recent recession. Furthermore, a fifth to a quarter of firms are reporting that revenues and profits are significantly above the normal levels, while a quarter to a third are reporting that they are somewhat above normal. This sentiment is relatively consistent across all industry sectors, although there is significant regional variation (see Appendix). FIRMS (%) REPORTING GROSS REVENUES AND PROFITS BELOW, AT, OR ABOVE PRE-RECESSION ‘NORMAL’ Gross Revenues Architect 12% 18% 18% Designer 12% 17% 16% GC & Remodeler 10% 16% Design-Build 7% 16% Specialty: Building/ Renovation 12% 16% Specialty: Landscaping/ 10% 14% Outdoor 20% 21% 17% 17% Significantly below U.S. Houzz Renovation Barometer | Originally reported in July 2015 Profit (Net Income) 27% 28% 34% 33% Architect 11% 21% 26% Designer 11% 19% 21% GC & Remodeler 9% 17% 32% 35% 25% 24% Design-Build 6% 16% Specialty: Building/ 21% Renovation Specialty: Landscaping/ 26% Outdoor Somewhat below About same 18 12% 16% 8% 17% 16% 13% 19% 20% 17% 17% Somewhat above 32% 33% 36% 36% 35% 32% 20% 24% 19% 21% 20% 25% Significantly above © 2015 Houzz Inc. Stronger Market for Larger Architects & Designers A large majority of firms irrespective of firm size are reporting that year-to-date revenues and profits are at or above prerecession normal. Yet, year-to-date revenues of larger architecture and design firms (5+ employees) are much more likely to be significantly above normal than those of very small firms (2x and 1.5x, respectively). FIRMS (%) REPORTING GROSS REVENUES AND PROFITS BELOW, AT, OR ABOVE PRE-RECESSION ‘NORMAL’ Designers Architects Gross Revenues 16% 28% 13% 31% 25% 16% 24% Gross Revenues 22% 24% 32% 27% 24% Profits 30% 31% 14% 19% 18% 12% None 1-4 17% 19% 20% 17% 16% 4% 5+ None Number of Employees Significantly below 17% 7% 19% 24% 10% 7% 1-4 5+ Somewhat below U.S. Houzz Renovation Barometer | Originally reported in July 2015 27% 37% 18% 17% About same 19 27% 28% 15% 18% 16% 11% None 1-4 37% Profits 20% 31% 27% 13% 15% 8% 13% 20% 16% 5+ None Number of Employees Somewhat above 27% 31% 31% 37% 13% 20% 13% 9% 12% 8% 1-4 5+ Significantly above © 2015 Houzz Inc. Size Less of a Driver for GCs & Design-Build Firms In the GC and design-build sectors, larger firms are somewhat more likely to have reached pre-recession performance levels than very small firms. Yet, roughly a fifth of firms regardless of size are reporting revenues and profits significantly above pre-recession levels. FIRMS (%) REPORTING GROSS REVENUES AND PROFITS BELOW, AT, OR ABOVE PRE-RECESSION ‘NORMAL’ GC & Remodelers Gross Revenues 19% 24% 23% 33% 24% 17% 13% 19% 20% 32% 38% Profits 16% 34% 18% 19% Design-Build 21% 33% 15% 36% Gross Revenues 20% 18% 21% 9% 7% 13% 7% 10+ None 1-4 Number of Employees 5-9 10+ 14% 25% 19% 13% 6% None 1-4 5-9 14% 6% Significantly below 20% 11% 36% 41% 19% 21% 17% 19% 19% Somewhat below U.S. Houzz Renovation Barometer | Originally reported in July 2015 About same 20 25% 25% 30% 32% 22% 17% 14% 17% 10% 11% None 1-4 23% 15% 4% Profits 19% 35% 35% 21% 15% 16% 16% 9% 10% 5+ None Number of Employees Somewhat above 24% 1-4 18% 38% 24% 16% 3% 5+ Significantly above © 2015 Houzz Inc. Better Conditions for Smaller Outdoor Firms Over a third of very small firms in the landscape/outdoor specialty sector are reporting year-to-date revenues and profits significantly exceeding pre-recession levels (44% and 37%, respectively). In contrast, only 20% and 23% of larger firms (5+ employees) in this sector are reporting peak revenue and profit conditions, respectively. The performance of the building/ renovation specialty sector is somewhat more conservative relative to pre-recession levels and more evenly distributed. FIRMS (%) REPORTING GROSS REVENUES AND PROFITS BELOW, AT, OR ABOVE PRE-RECESSION ‘NORMAL’ Specialty: Building/Renovation Gross Revenues 15% 19% 25% 26% Specialty: Landscape/Outdoor Profits 15% 18% 17% Gross Revenues 22% 26% 32% 35% 33% 19% 19% 16% 16% 15% 15% 14% 12% None 1-4 34% 38% 37% 38% 12% 23% 18% 11% 16% 17% 17% 19% 16% 13% 11% 6% 5-9 10+ None 1-4 Number of Employees 5-9 10+ 15% 13% 16% 7% Significantly below Somewhat below U.S. Houzz Renovation Barometer | Originally reported in July 2015 19% 11% About same 21 23% 30% 26% 39% 16% 16% 20% 44% 34% Profits 50% 19% 23% 16% 17% 15% 9% 16% 10% 5% None 1-4 17% 26% 18% 11% 12% 5% 1-4 5+ 16% 7% 5+ None Number of Employees Somewhat above 42% Significantly above © 2015 Houzz Inc.