Strategic Management in Banking - Executive Education

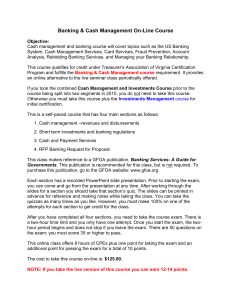

advertisement

Finance & Banking Programmes 2011/2012 Strategic Management in Banking Executive Education Expand your horizon. Make an impact. Strategic Management in Banking 2011/2012 01 Strategic Management in Banking Developing a strategic mindset in the fast changing environment of banking Strategic Management in Banking is addressed to senior bankers, including board members, who want to re-assess the future of banking and strategy in the context of a fast changing environment: the outcome of the global banking crisis, new Basel 3 regulations on capital and liquidity, or opportunities/ threats given by information technology. As the banking industry has its own needs, the Strategic Management in Banking programme has been developed to enhance some key bank-specific management skills. Three examples will illustrate the banking focus of the programme: — A special module on Asset and Liability Management, i.e. profit and risk control which is unique to the banking industry — New technologies raise strategic issues for the delivery of financial services: a module on Customer Relationship Management (CRM), is developed by a world expert in the field — The creation of synergies in universal banks, with interest in commercial banking, investment banking and insurance, and the resolution of conflicts of interest are addressed in a specific module. Key benefits — Gain expertise in strategic positioning, including the choice of a bank model (specialised or universal, domestic or international) — Develop new ideas to reach clients with new technology and deepen your customer relation — Enhance, with the help of a simulation, your skills in asset and liability management Faculty Programme Director Jean Dermine Professor of Banking and Finance Founder of the Centre for International Financial Services Strategic Management in Banking 2011/2012 02 Programme content The Strategic Management in Banking programme draws on more than 25 years of research organised by the Centre for International Financial Services, a partnership launched in 1987 between selected financial institutions and INSEAD. The programme develops your management skills in the following areas: Strategic analysis of the financial services industry — Competitive analysis of the banking industry — Basel 3 The ALCO Challenge The ALCO Challenge is a computer simulation designed at INSEAD. It recreates an international banking environment, allowing you to perfect your skills in value creation and risk control. Participants perform the simulation in teams, each team forming an Asset-Liability Committee. The ALCO Challenge incorporates the latest financial techniques in profitability and risk management. It is entirely accurate, taking into account the effects of taxation and BIS capital regulations. — Optimal corporate structure: specialisation vs. universal banking The educational objectives of the ALCO Challenge are fivefold: — Organic growth vs. acquisition — Value Creation Asset-liability management — Value-based management — Strategic Pricing — Profit centre, performance evaluation and rewards (RAROC, economic profit) — Negotiation — Risk Management — Team Work. — Control of credit and market risks — Business portfolio and diversification Strategy and marketing of financial services — Customer Relationship Management (CRM) — Product/client portfolio strategies — New product acceptance Technology — Recent applications, such as direct banking or banking on the Internet — Competition between alternative delivery systems — Outsourcing — Re-engineering Asset management — Product design and performance — Private banking. All the issues discussed in the programme are illustrated with case studies on financial institutions. Participant profile Strategic Management in Banking is designed specifically for senior bankers, including board members, responsible for profit centres in retail, corporate and capital markets. They will have about 20 to 25 years’ working experience in domestic or international operations. Strategic Management in Banking 2011/2012 Some of our past participants have included Senior Executive Deputy Head of Personal Financial Services HSBC Hong Kong 03 Head of Strategic Analysis Banco Espanol de Credito Spain Head Corporate Banking Credit Risk Nedbank South Africa Manager Management Accounting ING The Netherlands CEO Westpac Banking Corporation Australia Senior Vice President Santander Brazil Managing Director Easy Asset Management Bulgaria Managing Director Commerzbank Germany CFO and COO Group Treasury Royal Bank of Scotland Group The United Kingdom Director Head of Operations Group Commercial International Bank Egypt CFO Scotiabank Mexico Head of Group Credit Nordea Bank Finland Chairman of the Management Board LHV Bank Estonia General Manager Rothschild Switzerland Shareholder / Private Banker Ahli Investment Group Lebanon Deputy General Manager Skye Bank Nigeria President Omran M. Al Omran Corporation Saudi Arabia Managing Executive ABSA Bank South Africa “The increased understanding I gained of the global financial services market and the emerging trends has had a positive impact on the way I run my business. The calibre of the faculty at INSEAD is first rate. I also learnt a great deal from working with the group of bankers in attendance. It was a unique and valuable learning experience.” Vice President Bangkok Bank Thailand Senior Vice President Canadian Imperial Bank of Commerce, Canada Global Head Trade and Commodity Finance Rabobank International The United Kingdom “A truly refreshing experience. The course provided a great opportunity to ventilate one’s thoughts of the developments in the international banking industry. I also made new acquaintances with whom I still share experiences.” COO Barclays Bank France Head of Debt Capital Markets Nordea Bank, Finland 04 Strategic Management in Banking 2011/2012 Region Africa 19% Asia 3% Eastern Europe 8% Middle East 10% Northern Europe 23% Oceania Pacific 5% Southern America 3% Southern Europe 5% Western Europe 24% Industry Function Accounting & Control 4% Business Consulting 4% usiness Dev. & B Corporate Plan. 6% Finance 26% General Management 21% anufacturing & M Operations 4% Sales & Marketing 11% Other 24% Banking 68% Consulting 5% Other Finance 18% Other Services 5% Other 4% Strategic Management in Banking 2011/2012 05 Bank Valuation & Value-Based Management: Deposit and Loan Pricing, Performance Evaluation and Risk Management Jean Dermine Published by McGraw-Hill, NY, September 2009 To create value in banking, one needs to understand first the drivers of value. A sound and explicit bank valuation model is, as shown in the book, a very powerful tool to evaluate decisions that enhance shareholder value. Anchored in the fields of economics and finance, it provides not only useful tools to value banks, but also an integrated framework to discuss managerial issues such as: fund transfer pricing, risk-adjusted performance evaluation, deposit pricing, capital management, loan pricing and provisioning, securitization, and the measurement of interest rate and liquidity risk. The US subprime crisis is unfolding with spillover effects felt around the world. No need anymore to raise the attention to the importance of sound bank management skills. Jean Dermine is Professor of Banking and Finance at INSEAD, Fontainebleau. Docteur es Sciences Economiques from the Université Catholique de Louvain and MBA from Cornell University, he was a Visiting Professor at the Wharton School, New York University, Dakar, Lausanne, Louvain, Luxembourg, and the Stockholm School of Economics. As a consultant, he worked with international banks, auditing and consulting firms, national central banks, European Central Bank, Bank for International Settlements, HM Treasury, the OECD, the World Bank, the European Commission, and the Mentor Forum for the US Supreme Court and the European Court of Justice. Jean Dermine is co-author of the ALCO Challenge, a banking simulation used on five continents. 06 Strategic Management in Banking 2011/2012 Campus Information As one of the largest of the world’s leading business schools – and certainly the most international – INSEAD is well placed to make an impact on your business. INSEAD is unique in having a three-campus structure – in Europe, Asia and Abu Dhabi. The campuses are equally diverse and all have world-class faculty in residence. Executive programmes run at one, two or even across all three of our main locations. Our Customised Programmes can also be held anywhere in the world. Europe Campus Fontainebleau, the home of INSEAD’s Europe Campus, is spread across 8 hectares. Nestled in the vast forest of Fontainebleau, the modern architecture of the campus blends harmoniously with the green and leafy surroundings. Facilities are of the highest standard and include 28 lecture theatres, 2 restaurants, a bar, a bookshop, extensive library resources and a fully equipped gym. Asia Campus The Asia Campus is situated in the greenery of the Buona Vista area, the country’s ‘knowledge hub’, and is just 25 minutes from the airport and 10 minutes from the financial district. It occupies a 2.8-hectare site and has 7 amphitheatres with a total capacity of 500 and an 85-room residence. Abu Dhabi Campus Abu Dhabi is the home of INSEAD’s third campus, which is just 25 minutes from the airport and 10 minutes from the ‘Corniche’. This new, 12-storey, 6,000 square-metre building, purposely designed for Executive Education, presents a whole new world of possibilities for management education in the Middle East. Europe Campus Strategic Management in Banking 2011/2012 Asia Campus Abu Dhabi Campus 07 Strategic Management in Banking 2011/2012 08 Practical information Calendar 2011/2012 Programme Date Location Length Fee* Strategic Management in Banking 6–16 March 2012 Fontainebleau 9 days €11,700 Level Board C-Level Experienced General Manager New General Manager Senior Functional Manager Application procedure Tuition fees* Places on the programmes are confirmed on a first-come, first-served basis, taking into consideration the applicant’s level, objectives and the diversity of the classes. The programme fee covers tuition, course materials and lunches on working days as well as the closing dinners. It does not include travel, accommodation and other incidentals. Participants will have to settle accommodation expenses and other incidentals before the end of the programme. We recommend that you submit your completed application form as early as possible, preferably 6 weeks prior to programme commencement. The Admissions Committee will review your application and advise you on the outcome as soon as possible. Please do not hesitate to contact us if you have any questions about which programme may best suit your objectives or for any additional information. Note: all our Open-enrolment Programmes are taught in English and participants should be able to exchange complex views, listen and learn through the medium of English. *Fee subject to change. For programmes delivered in France, VAT (19.6%) to be added for companies based in France, or for European companies where no VAT number is supplied. For programmes delivered in Singapore, GST (7%) to be added for Singapore-registered companies. Contact us For further information on Strategic Management in Banking programme, contact: INSEAD Europe Campus Clément Quessette Tel: +33 (0)1 60 72 40 27 Fax: +33 (0)1 60 74 55 13 E-mail: SMB_Contact@insead.edu Visit our website: http://executive.education. insead.edu/strategic_banking/ INSEAD Europe Campus Boulevard de Constance 77305 Fontainebleau Cedex, France Tel: +33 (0)1 60 72 42 90 Fax: +33 (0)1 60 74 55 13 Email:execed.europe@insead.edu INSEAD Asia Campus 1 Ayer Rajah Avenue Singapore 138676 Tel: +65 6799 5288 Fax: +65 6799 5299 Email:execed.asia@insead.edu INSEAD Abu Dhabi Campus Muroor Road Street N°4, P.O Box 48049 Abu Dhabi, United Arab Emirates Tel: +971 2 651 52 00 Fax: +971 2 443 94 61 Email:execed.mena@insead.edu http://executive.education.insead.edu