protocol between the swiss federal council and the council of

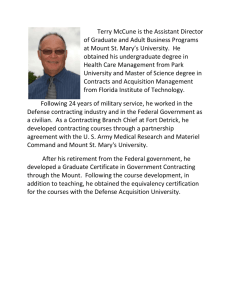

advertisement

PROTOCOL BETWEEN THE SWISS FEDERAL COUNCIL AND THE COUNCIL OF MINISTERS OF THE REPUBLIC OF ALBANIA AMENDING THE CONVENTION OF 12 NOVEMBER 1999 BETWEEN THE SWISS CONFEDERATION AND THE REPUBLIC OF ALBANIA FOR THE AVOIDANCE OF DOUBLE TAXATION WITH RESPECT TO TAXES ON INCOME AND ON CAPITAL The Swiss Federal Council and The Council of Ministers of the Republic of Albania Desiring to conclude a Protocol to amend the Convention of 12 November 1999 between the Swiss Confederation and the Republic of Albania for the Avoidance of Double Taxation with respect to Taxes on Income and on Capital (hereinafter referred to as “the Convention”), Have agreed as follows: ARTICLE I Subparagraph a) of paragraph 3 of Article 2 (Taxes covered) of the Convention shall be replaced by the following subparagraph: “a) in Albania: (i) the income taxes (tatimet mbi te ardhurat), including corporate profits tax (duke perfshire tatimin mbi fitimin e shoqerive), personal income tax (tatimin mbi te ardhura personale) and capital gains tax from the alienation of the movable or immovable property (tatimin e te ardhurave nga kapitali ose nga tjetersimi I pasurive te luajshme dhe te paluajtshme); 1 (ii) the tax on small business activities (tatimi i aktiviteteve te biznesit te vogel); and (iii) the property tax (taksimi mbi pasurine); (hereinafter referred to as “Albanian Tax”);” ARTICLE II Subparagraph b) of paragraph 1 of Article 3 (General definitions) of the Convention shall be replaced by the following subparagraph: “b) The term “Switzerland” means the territory of the Swiss Confederation as defined by its laws in accordance with international law;” ARTICLE III Clause (ii) of subparagraph h) of paragraph 1 of Article 3 (General definitions) of the Convention shall be replaced by the following clause: “(ii) in the case of Switzerland, the Head of the Federal Department of Finance or his authorised representative;” ARTICLE IV Paragraph 1 of Article 4 (Resident) of the Convention shall be deleted and replaced by the following paragraph: “1. For the purposes of this Convention, the term “resident of a Contracting State” means any person who, under the laws of that State, is liable to tax therein by reason of his domicile, residence, place of management or any other criterion of a similar nature, and also includes that State and any political subdivision or local authority thereof. This term, however, does not include any person who is liable to tax in that State in respect only of income from sources in that State or capital situated therein.” 2 ARTICLE V 1. The existing paragraphs 3 to 6 of Article 11 (Interest) of the Convention shall be renumbered as paragraphs 4 to 7. 2. The following Paragraph 3 shall be added to Article 11 (Interest) of the Convention: “3. Notwithstanding the provisions of paragraph 2, interest arising in a Contracting State and paid to a resident of the other Contracting State who is the beneficial owner thereof shall be taxable only in that other State to the extent that such interest is paid a) b) to a pension scheme; or to the Government of that other State, a political subdivision or local authority thereof or to the central bank of that other State.” 3. The renumbered paragraph 6 of Article 11 (Interest) of the Convention shall be deleted and replaced by the following paragraph: “6. Interest shall be deemed to arise in a Contracting State when the payer is a resident of that State. Where, however, the person paying the interest, whether he is a resident of a Contracting State or not, has in a Contracting State a permanent establishment or a fixed base in connection with which the indebtedness on which the interest is paid was incurred, and such interest is borne by such permanent establishment or fixed base, then such interest shall be deemed to arise in the State in which the permanent establishment or fixed base is situated.” ARTICLE VI Paragraph 5 of Article 12 (Royalties) of the Convention shall be shall be deleted and replaced by the following paragraph: “5. Royalties shall be deemed to arise in a Contracting State when the payer is a resident of that State. Where, however, the person paying the royalties, whether he is a resident of a Contracting State or not, has in a Contracting State a permanent establishment or a fixed base in connection with which the liability to pay the royalties was incurred, and such royalties are borne by such permanent establishment or fixed base, then such royalties shall be deemed to arise in the State in which the permanent establishment or fixed base is situated.” 3 ARTICLE VII Paragraph 3 of Article 24 (Non-discrimination) of the Convention shall be deleted and replaced by the following paragraph: “3. Except where the provisions of Article 9, paragraph 7 of Article 11, or paragraph 6 of Article 12, apply, interest, royalties and other disbursements paid by an enterprise of a Contracting State to a resident of the other Contracting State shall, for the purpose of determining the taxable profits of such enterprise, be deductible under the same conditions as if they had been paid to a resident of the first-mentioned State. Similarly, any debts of an enterprise of a Contracting State to a resident of the other Contracting State shall, for the purpose of determining the taxable capital of such enterprise, be deductible under the same conditions as if they had been contracted to a resident of the first-mentioned State.” ARTICLE VIII The following paragraphs 5 and 6 shall be added to Article 25 (Mutual agreement procedure) of the Convention: “5. Where, a) under paragraph 1, a person has presented a case to the competent authority of a Contracting State on the basis that the actions of one or both of the Contracting States have resulted for that person in taxation not in accordance with the provisions of this Convention, and b) the competent authorities are unable to reach an agreement to resolve that case pursuant to paragraph 2 within three years from the presentation of the case to the competent authority of the other Contracting State, any unresolved issues arising from the case shall be submitted to arbitration if the person so requests. Unless a person directly affected by the case does not accept the mutual agreement that implements the arbitration decision or the competent authorities and the persons directly affected by the case agree on a different solution within six months after the decision has been communicated to them, the arbitration decision shall be binding on both States and shall be implemented notwithstanding any time limits in the domestic laws of these States. The competent authorities of the Contracting States shall by mutual agreement settle the mode of application of this paragraph. 4 6. The Contracting States may release to the arbitration board, established under the provisions of paragraph 5, such information as is necessary for carrying out the arbitration procedure. The members of the arbitration board shall be subject to the limitations of disclosure described in paragraph 2 of Article 26 with respect to the information so released.” ARTICLE IX The existing Articles 26, 27 and 28 of the Convention shall be renumbered as Articles 27, 28 and 29. ARTICLE X The following Article 26 (Exchange of information) shall be added to the Convention: “Article 26 Exchange of information 1. The competent authorities of the Contracting States shall exchange such information as is foreseeably relevant for carrying out the provisions of this Convention or to the administration or enforcement of the domestic laws concerning taxes of every kind and description imposed on behalf of the Contracting States, or of their political subdivisions or local authorities, insofar as the taxation thereunder is not contrary to the Convention. The exchange of information is not restricted by Articles 1 and 2. 2. Any information received under paragraph 1 by a Contracting State shall be treated as secret in the same manner as information obtained under the domestic laws of that State and shall be disclosed only to persons or authorities (including courts and administrative bodies) concerned with the assessment or collection of, the enforcement or prosecution in respect of, or the determination of appeals in relation to the taxes referred to in paragraph 1, or the oversight of the above. Such persons or authorities shall use the information only for such purposes. They may disclose the information in public court proceedings or in judicial decisions. Notwithstanding the foregoing, information received by a Contracting State may be used for other purposes when such information may be used for such other purposes under the laws of both States and the competent authority of the supplying State authorises such use. 5 3. In no case shall the provisions of paragraphs 1 and 2 be construed so as to impose on a Contracting State the obligation: a) to carry out administrative measures at variance with the laws and administrative practice of that or of the other Contracting State; b) to supply information which is not obtainable under the laws or in the normal course of the administration of that or of the other Contracting State; c) to supply information which would disclose any trade, business, industrial, commercial or professional secret or trade process, or information the disclosure of which would be contrary to public policy (ordre public). 4. If information is requested by a Contracting State in accordance with this Article, the other Contracting State shall use its information gathering measures to obtain the requested information, even though that other State may not need such information for its own tax purposes. The obligation contained in the preceding sentence is subject to the limitations of paragraph 3 but in no case shall such limitations be construed to permit a Contracting State to decline to supply information solely because it has no domestic interest in such information. 5. In no case shall the provisions of paragraph 3 be construed to permit a Contracting State to decline to supply information solely because the information is held by a bank, other financial institution, nominee or person acting in an agency or a fiduciary capacity or because it relates to ownership interests in a person.” ARTICLE XI 1. The existing paragraph 4 of the Protocol to the Convention shall be renumbered as paragraph 6. 2. The following new paragraph 4 shall be added to the Protocol to the Convention: “4. ad Articles 10, 11, 12 and 21 a) The provisions of Articles 10, 11, 12 and 21 shall not apply to an item of income paid under a transaction, a part of a transaction, or series of transactions, or derived by an entity, if the main purpose of its conclusion or its establishment was to obtain the benefits under Articles 10, 11, 12 and 21, and if – leaving aside the transaction, the part of the 6 transaction, the series of transactions, or the entity – the item of income were assigned to a person who is not resident of either Contracting State. b) The provisions of subparagraph a of paragraph 2 of Article 10 shall not apply to dividends paid under a transaction, a part of a transaction, or series of transactions, or derived by an entity, if the main purpose of its conclusion or its establishment was to obtain the benefits of subparagraph a of paragraph 2 of Article 10, and if – leaving aside the transaction, the part of the transaction, the series of transactions, or the entity – those dividends were assigned to a person who does not fulfill the conditions of subparagraph a of paragraph 2 of Article 10 in respect of those dividends. c) If – leaving aside the transaction, the part of the transaction, the series of transactions, or the entity – the item of income were assigned to a person who, under a convention for the avoidance of double taxation between the State in which the person is resident and the State in which the income arises, or under another agreement, would be entitled to benefits in respect of that item of income which are equivalent to, or more favourable than, those available under this Convention to a resident of a Contracting State, the main purpose of the transaction, of the part of the transaction, of the series of transactions, or of the entity shall not be considered to be obtaining benefits under Articles 10, 11, 12 and 21.” ARTICLE XII The following paragraph 5 shall be added to the Protocol to the Convention: “5. ad Article 11 It is understood that the term "pension scheme" as used in this Article means any plan, scheme, fund, foundation, trust or other arrangement established in a Contracting State which is regulated by and generally exempt from income taxation in that State and operated principally to administer or provide pension or retirement benefits or to earn income for the benefit of one or more such schemes, and includes the following: a) in Albania, any pension scheme covered by: (i) Law no. 10197 dated 10.12.2009 for Funds of Voluntary Pensions; (ii) Law no. 7703 dated 11.05.1993 for Social Insurance in the Republic of Albania; (iii) Law no. 10142 dated 15.05.2009 for Supplementary Social Insurance for Military of the Armed Forces, Employees of the State Police, of the National Guard, of the 7 (iv) (v) (vi) b) in Switzerland, any pension schemes covered by: (i) (ii) (iii) (iv) (v) c) Intelligence Service, of the Penitentiary Police, of the Fire Police, of the Rescue Police, and of the Internal Audit Services in the Republic of Albania; Law no. 8097 dated 21.03.1996 for Supplementary State Pensions to Persons who performed Constitutional Functions and to State Employees; Law no. 10139 dated 15.05.2009 for Supplementary State Pensions of Employees of Universities, High Education Institutions, Center for Albanian Studies, Academy of Science and all other Public Research Institutions in the Republic of Albania who do have Academic Titles; Law no. 150/2014 for Pensions of Miners; the Federal Act on old age and survivors’ insurance, of 20 December 1946; the Federal Act on disabled persons’ insurance, of 19 June 1959; the Federal Act on supplementary pensions in respect of old age, survivors’ and disabled persons’insurance, of 6 October 2006; the Federal Act on old age, survivors’ and disabled persons’ insurance payable in respect of employment or self-employment of 25 June 1982, including the nonregistered pension schemes which offer occupational pension plans; and the forms of individual recognised pension schemes comparable with the occupational pension plans, in accordance with article 82 of the Federal Act on old age, survivors’ and disabled persons’ insurance payable in respect of employment or self-employment of 25 June 1982; and any identical or substantially similar schemes which are established pursuant to legislation introduced after the date of signature of this Protocol as agreed between the competent authorities of the Contracting States.” ARTICLE XIII The following Paragraph 7 shall be added to the Protocol to the Convention: “7. ad Article 12 With reference to paragraph 2 of Article 12, should the Republic of Albania conclude an Agreement of whatever kind and nature or a Double Taxation Agreement, with a Member State of the European Union or of the European Economic Area, providing for any tax rate lower than the rate of 5 per cent provided in this Article 12, this lower rate will be automatically 8 applicable to this Convention as soon as it takes effect between the Republic of Albania and this Member State of the European Union or of the European Economic Area.” ARTICLE XIV The following paragraph 8 shall be added to the Protocol to the Convention: “8. ad Article 26 a) It is understood that an exchange of information will only be requested once the requesting Contracting State has exhausted all regular sources of information available under the internal taxation procedure. b) It is understood that the tax authorities of the requesting State shall provide the following information to the tax authorities of the requested State when making a request for information under Article 26: (i) the identity of the person under examination or investigation; (ii) the period of time for which the information is requested; (iii) a statement of the information sought including its nature and the form in which the requesting State wishes to receive the information from the requested State; (iv) the tax purpose for which the information is sought; (v) to the extent known, the name and address of any person believed to be in possession of the requested information. c) It is understood that the reference to “foreseeable relevance” is intended to provide for exchange of information in tax matters to the widest possible extent and, at the same time, to clarify that the Contracting States are not at liberty to engage in “fishing expeditions” or to request information that is unlikely to be relevant to the tax affairs of a given taxpayer. While subparagraph b) contains important procedural requirements that are intended to ensure that fishing expeditions do not occur, clauses (i) through (v) of subparagraph b) nevertheless are not to be interpreted in a way to frustrate effective exchange of information. d) It is understood that Article 26 does not require the Contracting States to exchange information on an automatic or a spontaneous basis. 9 e) It is understood that in case of an exchange of information, the administrative procedural rules regarding taxpayers’ rights provided for in the requested Contracting State remain applicable. It is further understood that these provisions aim at guaranteeing the taxpayer a fair procedure and not at preventing or unduly delaying the exchange of information process.” ARTICLE XV 1. Each Contracting State shall notify to the other, through diplomatic channels, the completion of the procedures required by its law for the bringing into force of this Protocol. The Protocol shall enter into force on the date on which the later of those notifications has been received. 2. The provisions of the Protocol shall have effect: a) in respect of taxes withheld at source on amounts paid or credited on or after the first day of January of the calendar year next following the entry into force of the Protocol; b) in respect of other taxes for taxation years beginning on or after the first day of January of the calendar year next following the entry into force of the Protocol; c) in respect to Article 25 paragraphs 5 and 6, to mutual agreement procedures that are d) (i) pending between the competent authorities of the Contracting States at the entry into force of the Protocol (in such cases the three year period under subparagraph b) begins with the entry into force of this Protocol), or (ii) initiated after that date; in respect to Article 26, to information that relates to fiscal years beginning on or after the first day of January of the calendar year next following the entry into force of the Protocol. In witness whereof the undersigned, duly authorized thereto, have signed this Protocol. 10 Done in duplicate at ……..……… this ……. day of ……..………… in the French, Albanian and English languages, all texts being equally authentic. In case there is any divergence of interpretation between the French and the Albanian texts the English text shall prevail. For the Swiss Federal Council: For the Council of Ministers of the Republic of Albania: 11