STAKEHOLDERS

EMPOWERMENT

SERVICES

PUBLICATION DATE: 11 FEBRUARY, 2014

CORPORATE GOVERNANCE RESEARCH – MARUTI SUZUKI

Stakeholders Empowerment Services (SES) is a not-for-profit Corporate Governance research and advisory firm. For more

information about us, please contact us at +91 22 4022 0322 or connect with us via e‐mail at: info@sesgovernance.com

Corporate Governance Research | Corporate Governance Score | Proxy Advisory | Stakeholders’ Education

Maruti Suzuki – Gujarat Expansion 2013

Table of Contents

Executive Summary...................................................................................................................... 3

Overview of the Deal ................................................................................................................... 4

SES Analysis ................................................................................................................................. 5

The Proposal .............................................................................................................................. 5

Analysis of the press release ...................................................................................................... 5

The expansion of facilities was kept on hold due to market conditions ...................... 5

The Suzuki subsidiary would always remain a 100% Suzuki owned Company............. 6

Expansion through a 100% Suzuki subsidiary ............................................................... 6

Production contract ...................................................................................................... 6

Transfer price between SMC subsidiary and MSIL ....................................................... 7

Leasing of Land by MSIL ................................................................................................ 8

Risk for MSIL in the structure ....................................................................................... 8

Assistance by MSIL in implementing the project .......................................................... 8

Marketing...................................................................................................................... 8

Financial benefits to MSIL ............................................................................................. 9

Royalty issue at MSIL ............................................................................................................... 10

What is there in it for SMC? ..................................................................................................... 11

Does the deal require shareholders’ approval? ...................................................................... 12

Evaluating alternative structure .............................................................................................. 12

Disclaimers ................................................................................................................................ 15

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 2 OF 15

CORPORATE GOVERNANCE RESEARCH

Conclusions ............................................................................................................................... 14

Maruti Suzuki – Gujarat Expansion 2013

The proposed arrangement is a related party transaction (RPT). SES recommends that a Company should

not resort to related party transactions unless they are unavoidable and are in the larger interest of the

Company. RPTs should only be partaken if they bring in some definitive advantage to the company and

their Impact can be measured in a holistic manner.

Present laws/regulations do not require shareholders’ approval for RPTs. However, Companies Act, 2013

interalia provides for approval of RPTs by majority of non-interested shareholders. Therefore, it is

desirable that as a good governance practice, the Company should seek shareholders’ approval for this

RPT notwithstanding legal position as on date. If the Company proceeds with the transaction without

seeking shareholders’ approval, it may indicate that the transaction has certain issues which the company

or its promoter “SMC” does not wish to bring to the notice of shareholders. Additionally, in case the

Company does not take approval for the RPT at this stage, there is a possibility that shareholders might

block this RPT in future, when relevant provisions of the Companies Act, 2013 become applicable.

Prima-facie, SES does not find any adverse issue for minority shareholders of MSIL, provided that all

statements made by the Company in its press release announcing the transaction are correct. However, a

lot would depend on the provisions in fine print of the deal and future actions that will determine whether

statements made were for real or only a ploy to circumvent investor approvals/ scrutiny.

In order to ensure that the RPT is at arm’s length and that there are no hidden anti minority-investor

issues, SES recommends that comments/commitments made by SMC in its press release should be a part

of agreement(s) between MSIL, SMC and the subsidiary company. If safeguards are not built to protect

minority investors’ interests, then it would be a clear case of enticing shareholders with high sounding

statements and putting wool over their eyes and hiding real intentions. In such a case, investors should

exercise all their powers to block the transaction.

In view of savings envisaged for investors on account of interest savings (amounting to EPS of `8/share),

SES would advise shareholders not to reject the transaction off-hand but to constructively engage with the

company and discuss each and every related party issue. If the management comes out clean on the

issues highlighted in the report and addresses all concerns in a positive manner, shareholders would

benefit from the proposed transaction. SES believes that governance can only be improved by

constructive engagement of all stakeholders with the company. An outright rejection might not be in the

interest of either party. Stakeholders exercising their rights and ensuring that all their issues are addressed

would ensure that any positive opportunity is not frittered away.

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 3 OF 15

CORPORATE GOVERNANCE RESEARCH

Summary

Maruti Suzuki – Gujarat Expansion 2013

Overview of the Deal

On 28th January, Board of Maruti Suzuki India Ltd. (MSIL) issued following Press Release to announce the

decision of Suzuki Motor Corporation (SMC) setting up a Greenfield project for manufacture of cars in

Mehsana District of Gujarat on the land that was bought by MSIL for setting up a plant for expansion. SES has

examined the deal from governance and minority (non-controlling) shareholders point of view. SES has not

analysed financial implications of the deal except where it is necessary to highlight issues of governance.

Press Release: Maruti Suzuki Board Decision on Gujarat Project dated 28 Jan 2014

Maruti Suzuki Board Decision on Gujarat Project

th

New Delhi, October 29, 2011: The Board of Maruti Suzuki India Limited (MSIL) had, on 29 October

2011, approved the purchase of land in Mehsana District of Gujarat for further expansion of

manufacturing facilities. Following this decision, approximately 640 acres of land in Becharaji and

approximately 550 acres in Vithalapur was acquired. The expansion of facilities was kept on hold due

to market conditions.

Recently, the Board received an attractive proposal from Suzuki Motor Corporation (SMC) for

implementing the expansion project through a 100% Suzuki subsidiary. The Suzuki subsidiary would

always remain a 100% Suzuki owned Company.

The Board, today, decided that the time was now appropriate to expand production facilities in

Gujarat. It approved implementing the expansion through a 100% Suzuki subsidiary because it would

result in substantial financial benefits to MSIL, and its minority shareholders.

MSIL would enter into a contract with this subsidiary company under which all production in the

subsidiary company would be in accordance with the requirements of MSIL, and the vehicles would be

sold to MSIL. The Suzuki subsidiary would not sell vehicles to anybody else.

The price of the vehicles to MSIL would include only the cost of production actually incurred by the

subsidiary plus just adequate cash (net of all tax) to cover incremental capital expenditure

requirements. The return on this investment for SMC would be realized only through the growth and

expansion of MSIL’s business.

MSIL would be able to avoid all risk inherent in this investment. MSIL would also retain the option of

investing its own funds for strengthening its marketing network, product development, R&D or in any

other opportunity for growth or building strength for market leadership of the company

MSIL would render all required assistance to the subsidiary company for implementing this project on

an arms’ length basis.

The land for the project would be leased by MSIL to the subsidiary company to establish the production

and related facilities. The rent would be determined on an arms’ length basis.

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 4 OF 15

CORPORATE GOVERNANCE RESEARCH

MSIL would financially benefit from the interest earnings resulting from not investing its money in this

project. It would also benefit because the vehicles would be sold to MSIL by the Suzuki subsidiary

without any return on capital employed.

Maruti Suzuki – Gujarat Expansion 2013

SES Analysis

In absence of adequate details, SES has analysed the contents of press release of Maruti and to some extent

the interview of Mr R C Bhargava, Chairman of the Company.

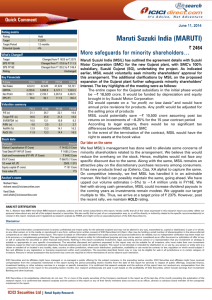

THE PROPOSAL

Suzuki Motor

Corporation

SMC

SMC

owns

56.21%

in MSIL

100% Initial

Investment to setup

plant

Dividends +

Royalty

Vehicles @

Cost Price

Maruti Suzuki

India Limited

MSIL

Gujarat

subsidiary

to be

100%

owned by

SMC

Gujarat

Subsidiary

1. Land

2. Cost of Production

3. Incremental

Capital Expenditure

ANALYSIS OF THE PRESS RELEASE

The expansion of facilities was kept on hold due to market conditions

The Company acquired land at Mehsana District in Gujarat at two locations measuring 640 acres and 550 acres

for expansion, but kept the expansion on hold due to (adverse) market conditions. Now that the company has

announced the proposed plan, it is inferred that the market conditions are now conducive for expansion.

SES recognises that the decision to expand or not is a long-term issue and is not impacted by decline of sales

in a month or quarter. However, a change of decision must be made based on certain information, data and

predictions. As a good Corporate Governance practice, the company should have disclosed the information

that impacted its decision-making to its shareholders. SES finds that the company has been rather conservative

on disclosures.

Further, SES has also noted certain inconsistencies in the statements made by the Company.

“Work on the Gujarat site has commenced and we expect to start production by the end of 2015-16.”

- Chairman’s statement, Annual report 2012-13

“During the year, the Company signed an agreement with the Gujarat government and acquired 700

acres of land near Mehsana for future capacity expansion. Work is likely to start there shortly.” Management Discussion and Analysis, Annual report 2012-13

“The Board, today, decided that the time was now appropriate to expand production facilities in

Gujarat.” – Press release, October 29, 2011

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 5 OF 15

CORPORATE GOVERNANCE RESEARCH

The decision of the board, especially the timing coupled with proposed structure, indicates that the board

must have mulled over and decided that the time was ripe for setting up the plant. However, the Company has

not substantiated this statement with any figures. MSIL itself reported lower sales both in volume and money

terms for third quarter and reported a 10% dip in sales in month of January 2014.

Maruti Suzuki – Gujarat Expansion 2013

These statements indicate that although work had started earlier and project was being executed under MSIL,

a change has been made now. However, the press release does not give the same impression. SES

recommends that the Board should explain what led to change of decision especially the parameters which led

to the change.

The Suzuki subsidiary would always remain a 100% Suzuki owned Company

The statement gives an impression that the subsidiary will remain 100% SMC owned unconditionally and

perpetually. SES recommends that both MSIL and SMC should state conditions, if any, under which this

decision might change. Else SMC will be able to exit the business only through liquidation of the subsidiary, as

it can neither be sold wholly or partly to MSIL or any third party. Even merger with MSIL or any other company

is not allowed; therefore effectively risk of future dilution is ruled out if the statement is taken at face value.

Expansion through a 100% Suzuki subsidiary

The Company has stated that expansion through a 100% Suzuki subsidiary will result in substantial financial

benefits to MSIL, and its minority shareholders.

Major assertions in the Press Release are as under

1.

2.

3.

4.

The subsidiary will always remain 100% Suzuki subsidiary.

All sales will be made to MSIL.

All sales will be at cost plus just adequate cash to cover incremental capital expenditure requirements.

No return on investment will be realised.

SES is of the opinion that with the stringent conditions self-imposed by SMC, it can be inferred that there will

be no dividend transfer from subsidiary to SMC, and only initial capital brought in by SMC will be repatriated.

To give comfort to MSIL and its shareholders against any other interpretation, the contract between MSIL/SMC

and subsidiary should not only confirm above observations but may also include an option for MSIL to buy out

subsidiary at book value at any point of time in future.

Production contract

1.

2.

3.

4.

MSIL would enter into a contract with SMC subsidiary

All production in the subsidiary would be in accordance with the requirements of MSIL

All Vehicles would be sold to MSIL

Suzuki subsidiary would sell vehicles to MSIL at the cost price plus just adequate cash to cover incremental

capital expenditure requirements.

Plain reading of the above statements suggest that the subsidiary would be a captive unit and its 100%

revenue will come from MSIL. Production programme will also be in accordance with MSIL requirements.

Understanding the impact and meaning of these statements is very important. Concerns have been raised by

various analysts that it may happen that capacity utilisation of MSIL may drop, and that of the subsidiary will

go up. SMC may be in driver’s seat at MSIL being the major and controlling shareholder. SES is of the opinion

that if the decision to expand production facility is commercially correct, then it will be immaterial which unit

produces, operates at what capacity utilisation, subject to following being true.

1.

The entire output will be sold to MSIL.

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 6 OF 15

CORPORATE GOVERNANCE RESEARCH

Press Release has further emphasised on following points:

Maruti Suzuki – Gujarat Expansion 2013

2.

SMC, through its subsidiary, will not earn any return on its capital employed/invested. As discussed

previously, this statement means that there will be no dividend from subsidiary to SMC at any point of

time in future and at the most it will be repatriation of original investment.

3.

It may be argued that the subsidiary will dump its production to MSIL and will continue to produce more

vehicles and put MSIL to disadvantage. More so, as SMC is controlling MSIL it may do favours to subsidiary

being 100% owned. SES does not agree to this view because subsidiary or SMC may resort to this, only if

the subsidiary could earn and give any return to SMC. In the absence of any returns to SMC from

subsidiary, there is no reason for subsidiary to do anything that will hurt SMC and MSIL as well.

4.

Factually, if the subsidiary does not operate at full capacity or, hypothetically produces only a single car in

a year, even then the entire cost of subsidiary will have to be absorbed by MSIL. At the end of the year,

the subsidiary will have revenue equal to its cost returning NIL profit and loss. It may appear that this

structure brings a big risk for MSIL as lack of demand may result lower operation level at subsidiary. SES is

of the opinion that risks for this transaction should be the same as that of any expansion project, and

should not be seen as additional risk from the structure proposed. If the decision to expand is sound and

prudent, then profitability of MSIL on account of change in demand and supply position would be agnostic

to structure chosen for expansion as in all the cases entire costs would be absorbed by MSIL in its

consolidated account.

5.

Post the subsidiary becoming operational, MSIL’s financials will be akin to consolidating financials of the

SMC subsidiary with MSIL. For purpose of Profit and loss, the entire cost will be borne by MSIL. Therefore,

individual capacity utilisation will be immaterial. It will be the aggregate capacity utilisation that will

matter due to nature of contract.

6.

The above analysis would be incorrect if there is no control on the costs at subsidiary and SMC is able to

derive benefit through supply of spares, parts, technology etc. to subsidiary. As, such a situation is

practically possible, proper safeguards need to be built into the deal to ensure that import content at

subsidiary is at similar levels to that at MSIL at any given point of time. If the subsidiary sources all its

inputs through MSIL and direct import, if any, are equal to or less than MSIL and are at the same rates,

there is no issue with the structure.

SES is of the view that any transaction / agreement between proposed 100% subsidiary of SMC and MSIL will

be a related party transaction and would also be subject to applicable transfer pricing rules. The Press Release

mentions the following, about price of vehicles produced by proposed subsidiary:

1.

2.

The price of vehicles to MSIL would include the cost of production actually incurred

plus just adequate cash (net of all tax) to cover incremental capital expenditure requirements

Cost of production includes cash and non-cash cost. Depreciation and writing off of the preliminary expenses

are the only non-cash expenses. While rate of depreciation will impact the cost year by year, however it will be

immaterial in the long run as total cost recovered will be only the capital cost and if the agreement between

MSIL and SMC will provide for an option to MSIL to take over the proposed subsidiary at book value, rate of

depreciation at best will impact cash flow timing and nothing beyond that.

The potential issue could be with Incremental Capital Expenditure being adjusted and included as part of cost

of production. At this stage, there is no clarity about what could be this incremental capital expenditure. By

definition, incremental can mean only a small amount vis a vis the original investment. Initially, the plant is

being set up with a capacity of 100,000 vehicles (this is as per newspaper report and not confirmed hence SES

is not placing any reliance on this data). In case the incremental capex is beyond normal repair and

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 7 OF 15

CORPORATE GOVERNANCE RESEARCH

Transfer price between SMC subsidiary and MSIL

Maruti Suzuki – Gujarat Expansion 2013

replacement, for any contribution towards incremental capital expenditure by MSIL, the Company (MSIL)

should either get equity in the subsidiary or that portion of expenditure should not be a part of cost of

production.

However, if MSIL gets the option of buying out the subsidiary at any point of time in future by paying initial

cost fewer amounts repatriated to SMC, then even contribution for capex would not be an issue except for

taxation purposes.

In case incremental capex is provided by MSIL and the capex becomes part of the subsidiary with right to SMC

to take it back, it will be against the statement made by SMC that “The return on this investment for SMC

would be realized only through the growth and expansion of MSIL’s business“ because SMC would be getting

returns from subsidiary in the form of increased assets.

Leasing of Land by MSIL

As per Press Release, land will be leased by MSIL to the subsidiary and the rent payable by the subsidiary will

be determined at arms’ length. While it may be argued that MSIL, as owner of land, would be at a

disadvantage because SMC/ Subsidiary may not pay appropriate rent, SES is of the opinion that amount of rent

will not affect MSIL adversely in any manner. The amount of rent will be just a book entry. The revenue on

account of rent will be offset by equal amount that will be recovered by subsidiary as cost. Therefore, MSIL

needs to determine rent at fair value according to tax law in order to avoid transfer pricing issue.

The other important issue is that, one has to view the provision of land as capital contribution by MSIL; the

term lease is only for the purpose of accounting. The terms of the Lease deed should be stipulated in such a

manner that SMC cannot operate the plant if MSIL is not a willing partner. Further, it is not clear from the

Press Release whether both the parcels of land will be leased or only one of them will be leased.

Risk for MSIL in the structure

Assistance by MSIL in implementing the project

The Press Release states that MSIL would extend all help in implementation of the project at arms’ length

basis. The issue arises as to how MSIL will price its services. Although, in the long run it may not matter as

ultimately MSIL will have to reimburse the same to SMC subsidiary in form of cost of vehicles. Yet as the two

entities are separate legal entities it will be desirable to keep transaction at arms’ length basis and to disclose

the same to shareholders. Once again in view of nature of agreement the amount will be immaterial as

ultimately it will be recovered in cost over a period, indicating at best an issue of cash flow only.

Marketing

MSIL will continue its marketing activities as it is. All the production of subsidiary of SMC will be sold through

MSIL and all the profits would be parked in MSIL. The Company in its Annual Report of 2012-13 had provided

following information related to exports.

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 8 OF 15

CORPORATE GOVERNANCE RESEARCH

The Company has stated that “MSIL would be able to avoid all risk inherent in any investment.” SES is not in

agreement with the statement. In the opinion of SES, MSIL is placed in the same risk as it would have been if it

had undertaken expansion on its own. At best, it could be a matter of timing of cash flow and conserving its

cash. MSIL is exposed to operational risks e.g. in case of a slowdown and lower capacity utilisation, all the costs

of subsidiary will get reflected in MSIL books. Therefore, MSIL has all the risks inherent in this structure due to

commitment to buy entire production at cost.

Maruti Suzuki – Gujarat Expansion 2013

“Suzuki Japan has decided that India will now be responsible for the export markets of Africa, the Middle East and

our neighbouring countries. We have to ensure adequate sales and marketing arrangements in these countries,

with the help of Japan. We also have to determine the products to be manufactured for these markets and, if

necessary, establish assembly plants overseas. This decision will greatly help the growth of our exports.”

At face value, this appears to be a positive statement for MSIL and its shareholders since MSIL will become an

export hub for the territories. However, at this stage, the efforts and expenses required to develop the market

are not known. It is also not clear what will be the pricing policies for sales in the territories assigned. Will MSIL

be required to subsidize sales? It may happen that after spending time and money, SMC might decide to

export the vehicles directly, thus jeopardising MSIL interests and future potential gains. Therefore SMC and

MSIL should spell out the minimum period for which these export territories would be exclusive domain of

MSIL .What would be the parameters that will determine further extension? Will it be at the option of MSIL or

SMC or mutual?

Financial benefits to MSIL

The Company has stated that MSIL would financially benefit from the interest earnings resulting from not

investing its money in this project. It would also benefit because the vehicles would be sold to MSIL by the

Suzuki subsidiary without any return on capital employed.

SES is of the opinion that as long as vehicles are sold by the proposed subsidiary to MSIL at actual cost, MSIL

would stand to gain interest on the funds that MSIL otherwise would have invested in expansion.

CORPORATE GOVERNANCE RESEARCH

However, the Company has not given amount that would be invested by SMC in the new subsidiary. In

absence of this information, the expected financial benefits on this amount cannot be calculated. However

given tax free rate of 8.5% available in tax free bonds, for every `100 Cr invested by SMC, MSIL would save

`8.5 Cr tax free (interest saved by not investing MSIL’s own funds), which will belong to shareholders of MSIL

including SMC. There is an indication that SMC would invest close to `3,000 Cr in the subsidiary, which would

result in savings of nearly `255 cr for MSIL. With approximately 30 crore shares outstanding, the savings works

out to over `8 per share. Therefore, MSIL would avoid dilution of EPS to the extent of `8 per share on the

amount perpetually or till the arrangement continues.

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 9 OF 15

Maruti Suzuki – Gujarat Expansion 2013

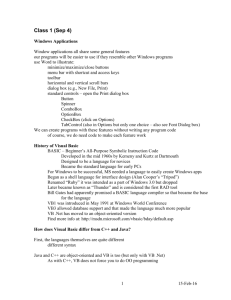

ROYALTY ISSUE AT MSIL

Over the last 5 years, royalty payments by MSIL to SMC have increased and presently account for more than

what SMC gets from its share

Total Payments to SMC

of profits.

8.7%

It is presumed that the

proposed structure will also

involve payment of royalty to

SMC by MSIL on vehicles

produced by subsidiary.

8.6%

7.5%

6.7%

6.0%

3.3%

3.3%

6.3%

5.2%

4.9%

3.5%

4.5%

5.0%

3.5%

3.1%

2.5%

2009

NPM

2010

5.5% 5.5%

2011

2012

2013

SMC's share in Profit as % of Sales

SMC Royalty Payments as % of Sales

SMC Total Pay as % of Sales

Royalty Payment to SMC

10.0%

9.0%

8.0%

7.0%

6.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

200.0%

180.0%

160.0%

146.4%

136.4%140.0%

120.0%

100.0%

4.1%

3.5%

80.0%

2.7%

60.0%

40.0%

20.0%

0.0%

2011

2012

2013

Royalty as % of PAT from Operations

185.4%

However, MSIL should ensure

128.0%

6.2%

that the royalty is not doubly

paid i.e. included in the cost of

the subsidiary and again in sales

2.6%

of vehicles to MSIL. SES maintains

55.7%

that present royalty payments by

MSIL to SMC are unfair and nontransparent and are enriching

2009

2010

SMC at the cost of minority

NPM from Operations

shareholders of MSIL. One of the

main reasons for this is that the shareholders do not have any say in the matter. Shareholders may note that

this will change soon when provisions of Companies Act, 2013 in respect of related party transactions are

made effective and SEBI decides to implement new Corporate Governance Code based on its Consultative

paper issued in Jan, 2013.

NPM = Total Profit as percentage of Sales

NPM from Operations = Profit from Operations as a percentage of sales

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 10 OF 15

CORPORATE GOVERNANCE RESEARCH

Royalty Payments increased

3.61 times from `680 Cr in

2007-08 to `2,454 Cr in 201213. During the same period,

sales rose by 2.15 times and

profit by approximately 2

times. This indicates faster

growth of royalty as compared

to sales and profits.

8.7%

8.3%

Maruti Suzuki – Gujarat Expansion 2013

WHAT IS THERE IN IT FOR SMC?

If we take the Press Release at face value, the questions that come to mind are that what’s in it for SMC? Why

should SMC shareholders consent to investing money on such terms?

This analysis can be done with principally two approaches:

1.

Indirect gains to SMC from Interest earning of MSIL that would be protected.

2.

To calculate extra profit that will be generated for SMC along with extra royalty.

Analysis 1

Benefit to SMC on account of interest earning of MSIL is explained in following diagrams, broken into two

steps for clarity. Step 1 depicts use of own cash by MSIL and the Step 2 creates proposed structure

Step 1 – Use of own cash by MSIL

Step 2 – Proposed structure

Increased

Royalty and

Dividends

Increased

Royalty and

Dividends

MSIL

(Minus Cash)

SMC

Sale of

production

at cost

Capital

investment

Gujarat

Expansion Project

MSIL

(Cash neutral)

Cash

Refund

SMC

(Minus Cash)

Sale of

production

at cost

Gujarat

Expansion Project

Subsidiary of

MSIL

In nutshell SMC is effectively deploying its surplus cash at 4.76% interest rate per annum against 0% available

in Japan and probably taking ¥ - ` exposure risk. (Details of which will only be known after details of funding of

the subsidiary can be revealed)

Analysis 2

For working out extra profit, few assumptions need to be made.

Assumptions:

Investment made is Rs 1,000 Million

Net profit margin remains the same as at MSIL, Royalty remains same.

Returns have been calculated at three different Assets turnover ratio. SES expects Assets Turnover Ratio

to be less than MSIL in subsidiary as it will be a new plant.

A

B

C

(In Rs Million unless otherwise mentioned)

Investment Made

Fixed Assets Turnover Ratio (assumed)

Net Profit Margin

Case 1

1,000

4

3%

Case 2

1,000

3

3%

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

Case 3

1,000

2

3%

PAGE 11 OF 15

CORPORATE GOVERNANCE RESEARCH

SMC pays cost for this by foregoing 44% of interest earnings to minority shareholders of MSIL. If Tax Free Rate

of 8.5% available on PSU bonds is taken, then tax free earnings of SMC will be 4.76% per annum (56% of 8.5%)

less dividend tax. However, the return earned by SMC in this case may still be more than the Interest earned

on its Yen balances.

Maruti Suzuki – Gujarat Expansion 2013

D

E

F

G

H

I

(In Rs Million unless otherwise mentioned)

Sales (A x B)

PAT (C x D)

Royalty %

Royalty Amount (D x F)

Total to SMC (G + 56% x E)

Return to SMC as % of Investment Made (H / A)

Case 1

4,000

120

5%

200

267

27%

Case 2

3,000

90

5%

150

200

20%

Case 3

2,000

60

5%

100

134

13%

The above calculations show that SMC is going to earn a moderate to high return on its investments. However,

this return would have been there for SMC even if the expansion was done by MSIL at its cost.

What’s SMC gaining?

As discussed above, by undertaking this project, SMC would be able to redeploy its cash which may have been

earning low interest rate and bears the Yen-Rupee currency risk. Additionally, the holding company would gain

from the increased sales and royalty payments by MSIL.

DOES THE DEAL REQUIRE SHAREHOLDERS’ APPROVAL?

Taking into account laws and regulations existing presently in India, the deal does not require any approval

from the shareholders of MSIL. The deal can be viewed as two major related party transactions (RPTs) for MSIL

(i) Proposed lease of land and (ii) purchase agreement for vehicles produced by the subsidiary. These decisions

are ordinary business decisions and the board is empowered to take such decisions on behalf of the Company

in the ordinary course of business.

Since the transactions are with a related party, the Board and the Auditors’ need to confirm that the

transactions will be at arms’ length basis. This statement should also be disclosed by MSIL in the Annual Report

to its shareholders.

The current provisions, especially relating to related party transactions, are likely to change once the

Companies Act, 2013 is implemented. As a good governance practice, MSIL should obtain shareholders’

approval. The shareholders may note that once the provisions of the Companies Act, 2013 are implemented,

all related party transactions will have to be approved by majority of minority shareholders.

If MSIL intended to go for expansion, it could have gone for two alternative ways to implement it i.e. 1) Within

MSIL as a separate division or 2) as a 100% subsidiary of MSIL. However, the Company has gone for 100%

subsidiary of SMC, its promoter. SES has evaluated the three options in table below on various parameters of

evaluation.

Ownership of by SMC

Ownership by Minority Shareholders of MSIL

Business Risk for MSIL

Profit for SMC

Marketing Rights for MSIL

Interest Income of MSIL

Benefit of Increased Exports/ Domestic Growth

Royalty for SMC

Growth of MSIL business

MSIL - division

56%

44%

Yes

56% Directly

Neutral

Reduction

Neutral

Neutral

Neutral

MSIL subsidiary

56%

44%

Yes

56% Directly

Neutral

Reduction

Neutral

Neutral

Neutral

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

SMC subsidiary

100%

0%

Yes

56% Indirectly

Neutral

Unchanged

Neutral

Neutral

Neutral

PAGE 12 OF 15

CORPORATE GOVERNANCE RESEARCH

EVALUATING ALTERNATIVE STRUCTURE

Maruti Suzuki – Gujarat Expansion 2013

Related Party Issue

Investment Risk of SMC

Currency Exposure Risk of SMC

Strong

Strong

Shared

Shared

Same as at present Same as at present

Strongest

100%

Increased

CORPORATE GOVERNANCE RESEARCH

From the table above, we can see that there are minor differences between all three options and other than

loss of interest income to MSIL, in case expansion is by using its reserves, the only significant concern is the

related-party issue. The loss of income to MSIL in cases can be easily compensated by SMC, as discussed in

approach 1 above. Therefore, shareholders should be specifically concerned about the related party issues

that arise from current scenario and should urge the board/ management to implement strongest measures to

minimize any future risks.

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 13 OF 15

Maruti Suzuki – Gujarat Expansion 2013

Conclusions

Although not strictly required by present laws and regulations in India, the Company (MSIL) should get the

approval of the transaction from its shareholders as a good corporate governance practice.

If the statements made by the Company are taken at face value, there is no negative issue for minority

shareholders of MSIL. However, a lot would depend on the fine prints. In order to ensure that there are

no hidden issues that may surface in future, the Company should ensure and confirm to shareholders that

agreement(s) between SMC/MSIL and subsidiary would have the following safeguards:

o

o

o

o

o

o

o

o

There would be no dividend from subsidiary to SMC and subsidiary will at the most repatriate to

SMC only amount equal to its contribution.

MSIL will have option to buy back the subsidiary at book value or initial investment of SMC less

repatriation made by subsidiary to SMC.

Incremental capital expenditure shall be treated as capital contribution of MSIL or as a loan from

MSIL. It shall not become part of subsidiary. However, this will not matter if MSIL gets the right to

buy back the subsidiary at cost. Incremental capital expenditure if any contributed by MSIL shall

not be counted as cost for pricing vehicle sales/ cost from subsidiary to MSIL.

Sourcing of components for subsidiary will be done either jointly by subsidiary and MSIL or by

MSIL.

Supplies from SMC to subsidiary shall be at arms’ length and in no case import percentage will be

more than what is at MSIL at any point in time.

There should be an agreement between MSIL and SMC spelling out duration for which export

territories are exclusively assigned to MSIL. This agreement shall specify role of MSIL and SMC

including support to be provided by SMC.

The land will always remain in the ownership of MSIL.

Subsidiary should voluntarily adopt disclosure norms as applicable to public listed company in

India

MSIL should have authority to get cost-audit of subsidiary done at any point of time and board of

MSIL shall certify to shareholders of MSIL that cost audit was done and board is satisfied.

MSIL is exposed to same operational risks it would have had, had it gone for in-house expansion because

of 100% sales, at cost, from subsidiary to MSIL.

SMC will be exposed to Yen-Rupee exchange-rate risk on its investment in subsidiary. No details are

available as to what will be the nature of SMC’s investment in subsidiary. In case it is part loan and part

equity, and loan is denominated in Yen, then risk will be limited to equity portion only.

MSIL will save interest cost on the amount brought by SMC to invest in subsidiary.

In a nut shell, SMC will gain only interest on its investment through MSIL conserving the cash and that too

after sacrificing 44% in favour of minority shareholders. It sounds reasonable return for SMC if seen in

backdrop of 0% rate of interest in Japan and with no visibility of improvement of these rates in near term.

SES would recommend the deal, if all the protection as suggested are built in and the management can

assert that the decision for expansion was in-house and not dictated by SMC. If the protections suggested

are not built in in the agreement(s), then shareholders may conclude that it was an attempt to put wool

over the eyes of investors/shareholders by making grand sacrificial statements.

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

PAGE 14 OF 15

CORPORATE GOVERNANCE RESEARCH

o

Maruti Suzuki – Gujarat Expansion 2013

Disclaimers

Sources

Contact Information

Only publicly available data has been used while making the report. Our

data sources include: BSE, NSE, SEBI, Capitaline, Moneycontrol,

Businessweek, Reuters, Annual Reports, IPO Documents and Company

Website.

research@sesgovernance.com

Analyst Certification

Company Information

The analysts involved in development of this report certify that no part of

any of the research analyst’s compensation was, is, or will be directly or

indirectly related to the specific recommendations or views expressed by

the research analyst(s) in this report.

Stakeholders Empowerment

Services

Disclaimer

While SES has made every effort and has exercised due skill, care and

diligence in compiling this report based on publicly available information,

it neither guarantees its accuracy, completeness or usefulness, nor

assumes any liability whatsoever for any consequence from its use. This

report does not have any approval, express or implied, from any

authority, nor is it required to have such approval. The users are strongly

advised to exercise due diligence while using this report.

This report in no manner constitutes an offer, solicitation or advice to buy

or sell securities, nor solicits votes or proxies on behalf of any party. SES,

which is a not-for-profit Initiative or its staff, has no financial interest in

the companies covered in this report except what is disclosed on its

website.

The report is released in India and SES has ensured that it is in accordance

with Indian laws. Person resident outside India shall ensure that laws in

their country are not violated while using this report; SES shall not be

responsible for any such violation.

All disputes subject to jurisdiction of High Court of Bombay, Mumbai

+91 22 4022 0322

A 202, Muktangan, Upper

Govind Nagar, Malad East,

Mumbai, 400097

Tel +91 22 4022 0322

www.sesgovernance.com

© 2013 - 2014 Stakeholders Empowerment Services Pvt Ltd | All Rights Reserved

CORPORATE GOVERNANCE RESEARCH

Copyright 2012 - 2013 Stakeholders Empowerment Services Pvt Ltd. All

Rights Reserved. This report or any portion hereof may not be

reprinted, sold, reproduced or redistributed without the written

consent of Stakeholders Empowerment Services Pvt. Ltd.

PAGE 15 OF 15