Industrial Market Snapshot

San Diego County • Second Quarter 2013

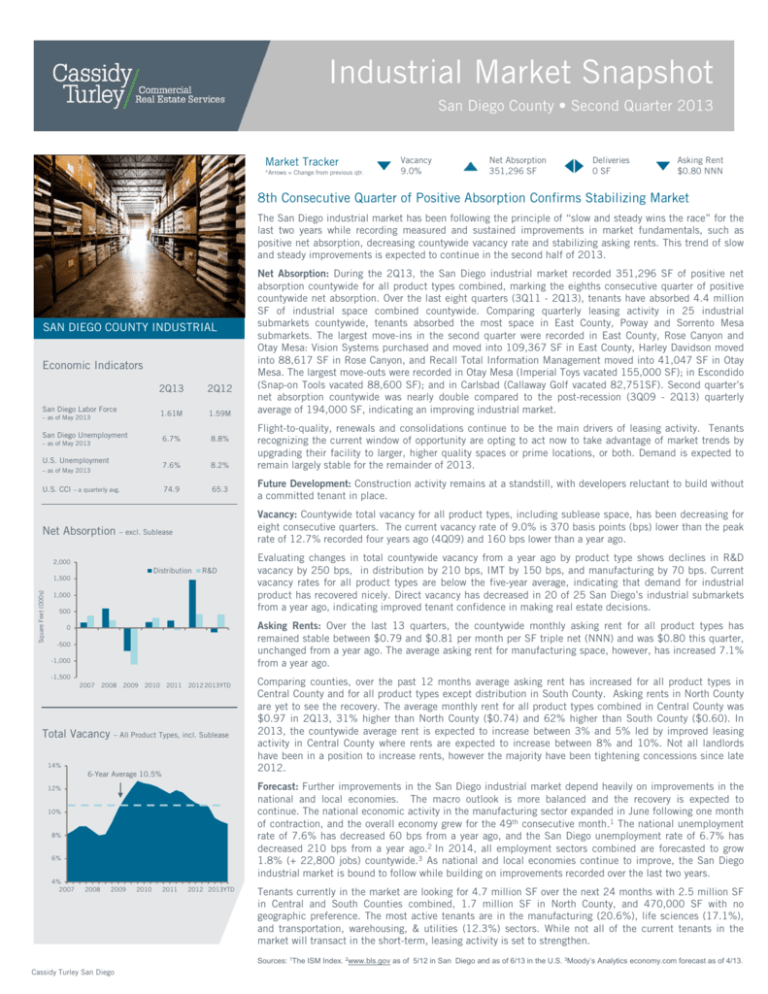

Market Tracker

*Arrows = Change from previous qtr.

Vacancy

9.0%

Net Absorption

351,296 SF

Deliveries

0 SF

Asking Rent

$0.80 NNN

8th Consecutive Quarter of Positive Absorption Confirms Stabilizing Market

The San Diego industrial market has been following the principle of “slow and steady wins the race” for the

last two years while recording measured and sustained improvements in market fundamentals, such as

positive net absorption, decreasing countywide vacancy rate and stabilizing asking rents. This trend of slow

and steady improvements is expected to continue in the second half of 2013.

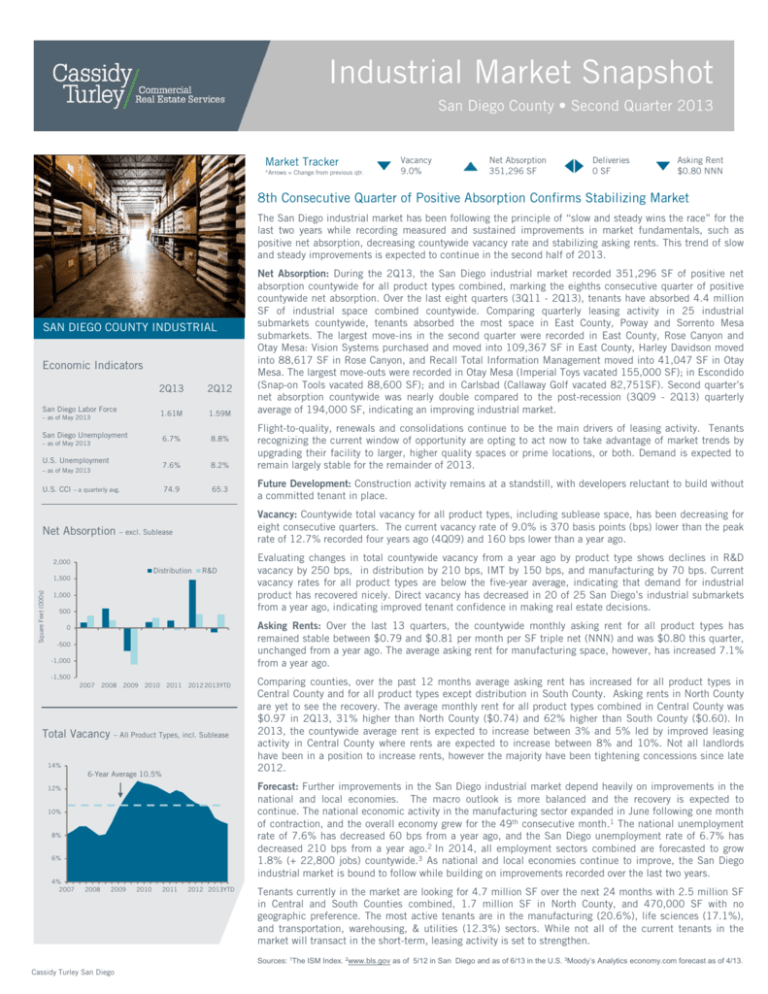

SAN DIEGO COUNTY INDUSTRIAL

Economic Indicators

2Q13

2Q12

1.61M

1.59M

6.7%

8.8%

7.6%

8.2%

74.9

65.3

San Diego Labor Force

– as of May 2013

San Diego Unemployment

– as of May 2013

U.S. Unemployment

– as of May 2013

U.S. CCI – a quarterly avg.

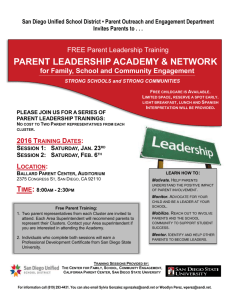

Net Absorption

Distribution

R&D

1,500

Square Feet (000s)

Flight-to-quality, renewals and consolidations continue to be the main drivers of leasing activity. Tenants

recognizing the current window of opportunity are opting to act now to take advantage of market trends by

upgrading their facility to larger, higher quality spaces or prime locations, or both. Demand is expected to

remain largely stable for the remainder of 2013.

Future Development: Construction activity remains at a standstill, with developers reluctant to build without

a committed tenant in place.

Vacancy: Countywide total vacancy for all product types, including sublease space, has been decreasing for

eight consecutive quarters. The current vacancy rate of 9.0% is 370 basis points (bps) lower than the peak

rate of 12.7% recorded four years ago (4Q09) and 160 bps lower than a year ago.

– excl. Sublease

2,000

1,000

500

Evaluating changes in total countywide vacancy from a year ago by product type shows declines in R&D

vacancy by 250 bps, in distribution by 210 bps, IMT by 150 bps, and manufacturing by 70 bps. Current

vacancy rates for all product types are below the five-year average, indicating that demand for industrial

product has recovered nicely. Direct vacancy has decreased in 20 of 25 San Diego’s industrial submarkets

from a year ago, indicating improved tenant confidence in making real estate decisions.

Asking Rents: Over the last 13 quarters, the countywide monthly asking rent for all product types has

remained stable between $0.79 and $0.81 per month per SF triple net (NNN) and was $0.80 this quarter,

unchanged from a year ago. The average asking rent for manufacturing space, however, has increased 7.1%

from a year ago.

0

-500

-1,000

-1,500

2007

2008

Total Vacancy

2009

2010

2011

2012 2013YTD

– All Product Types, incl. Sublease

14%

6-Year Average 10.5%

Comparing counties, over the past 12 months average asking rent has increased for all product types in

Central County and for all product types except distribution in South County. Asking rents in North County

are yet to see the recovery. The average monthly rent for all product types combined in Central County was

$0.97 in 2Q13, 31% higher than North County ($0.74) and 62% higher than South County ($0.60). In

2013, the countywide average rent is expected to increase between 3% and 5% led by improved leasing

activity in Central County where rents are expected to increase between 8% and 10%. Not all landlords

have been in a position to increase rents, however the majority have been tightening concessions since late

2012.

Forecast: Further improvements in the San Diego industrial market depend heavily on improvements in the

national and local economies. The macro outlook is more balanced and the recovery is expected to

continue. The national economic activity in the manufacturing sector expanded in June following one month

of contraction, and the overall economy grew for the 49th consecutive month.1 The national unemployment

rate of 7.6% has decreased 60 bps from a year ago, and the San Diego unemployment rate of 6.7% has

decreased 210 bps from a year ago.2 In 2014, all employment sectors combined are forecasted to grow

1.8% (+ 22,800 jobs) countywide.3 As national and local economies continue to improve, the San Diego

industrial market is bound to follow while building on improvements recorded over the last two years.

12%

10%

8%

6%

4%

2007

Net Absorption: During the 2Q13, the San Diego industrial market recorded 351,296 SF of positive net

absorption countywide for all product types combined, marking the eighths consecutive quarter of positive

countywide net absorption. Over the last eight quarters (3Q11 - 2Q13), tenants have absorbed 4.4 million

SF of industrial space combined countywide. Comparing quarterly leasing activity in 25 industrial

submarkets countywide, tenants absorbed the most space in East County, Poway and Sorrento Mesa

submarkets. The largest move-ins in the second quarter were recorded in East County, Rose Canyon and

Otay Mesa: Vision Systems purchased and moved into 109,367 SF in East County, Harley Davidson moved

into 88,617 SF in Rose Canyon, and Recall Total Information Management moved into 41,047 SF in Otay

Mesa. The largest move-outs were recorded in Otay Mesa (Imperial Toys vacated 155,000 SF); in Escondido

(Snap-on Tools vacated 88,600 SF); and in Carlsbad (Callaway Golf vacated 82,751SF). Second quarter’s

net absorption countywide was nearly double compared to the post-recession (3Q09 - 2Q13) quarterly

average of 194,000 SF, indicating an improving industrial market.

2008

2009

2010

2011

2012 2013YTD

Tenants currently in the market are looking for 4.7 million SF over the next 24 months with 2.5 million SF

in Central and South Counties combined, 1.7 million SF in North County, and 470,000 SF with no

geographic preference. The most active tenants are in the manufacturing (20.6%), life sciences (17.1%),

and transportation, warehousing, & utilities (12.3%) sectors. While not all of the current tenants in the

market will transact in the short-term, leasing activity is set to strengthen.

Sources: 1The ISM Index. 2www.bls.gov as of 5/12 in San Diego and as of 6/13 in the U.S. 3Moody’s Analytics economy.com forecast as of 4/13.

Cassidy Turley San Diego

Cassidy Turley San Diego Industrial Market Snapshot

San Diego County • Second Quarter 2013

CURRENT

ABSORPTION

SF

YTD

ABSORPTION

SF

UNDER

CONSTRUCTION

AVERAGE ASKING

RENT

(All Types)

9.3%

62,801

157,929

0

$0.74

5,468,009

7.7%

463,419

784,777

0

$0.97

218,514

3,369,380

11.9%

(174,924)

(273,818)

0

$0.60

164,517,677

1,423,938

13,380,072

9.0%

351,296

668,888

0

$0.80

865

33,601,007

424,414

3,464,169

11.6%

246,829

417,470

0

$1.12

MFG

2438

66,229,320

346,251

4,263,197

6.9%

(10,309)

153,239

0

$0.75

IMT

610

21,057,621

88,469

1,698,348

8.5%

203,964

224,624

0

$0.86

DIST

973

43,629,729

564,804

3,954,358

10.4%

(89,188)

(126,445)

0

$0.59

TOTAL

4886

164,517,677

1,423,938

13,380,072

9.0%

351,296

668,888

0

$0.80

TOTAL

BLDGS.

INVENTORY

SF

SUBLET VACANT

SF

DIRECT VACANT VACANCY RATE

SF

%

North County

1,967

51,776,480

255,530

4,542,683

Central County

2,294

82,693,107

949,894

South County

625

30,048,090

TOTAL

4,886

R&D

Submarket

*Industrial monthly asking rates converted to triple net (NNN). Vacancy Rate includes direct and sublease. Net absorption excludes sublease.

Key Lease Transactions 2Q13

Industrial Submarkets

San Diego County

PROPERTY

SF

16550 W Bernardo Dr.

TENANT

160,000

Northrop Grumman Systems Corp.

102,320

Acushnet Company

56,140

Owens & Minor

2070 Las Palmas Dr.

32,551

Spy Optics

Montgomery Tech Center

30,592

Maxwell Technologies

Sycamore Vista

Business Park

Oceanview Hills Corporate

Center

TRANSACTION

TYPE

New

Renew

New

Renew

New

SUBMARKET

Rancho

Bernardo

Vista

Otay Mesa

Carlsbad

Kearny Mesa

Key Sale Transactions 2Q13

PROPERTY

3801, 3809, 3817

Ocean Ranch Blvd.

SF

SELLER/BUYER

PRICE

SUBMARKET

La Pacifica LP | SR Commercial

$19,800,000

Oceanside

($87.53/sf)

2350 Siempre Viva Ct. 103,904

GE Capital Corp | Hamann Companies

$5,410,000

($52.07/sf)

Otay Mesa

2293 Cosmos Ct.

47,762

Oceanside Glasstile | Focus Real Estate LP

$4,824,000

($101.00/sf)

Carlsbad

13000 Kirkham Way

34,843

Ravenwood Towers Inc. | Morrow Meadows

Corporation

$3,868,000

($111.01/sf)

Poway

31,302

Jacobs Investment Company LLC | Cire

Partners

$3,250,000

($103.83/sf)

Chula Vista

995 W Bay Blvd.

226,220

Jolanta Campion

Director of Research

Clark Rorbach

Research Analyst

About Cassidy Turley

Cassidy Turley is a leading commercial real estate services provider with more than 3,800 professionals

in more than 60 offices nationwide. Based in Washington, DC, the company represents a wide range of

clients—from small businesses to Fortune 500 companies, from local non-profits to major institutions.

The firm completed transactions valued at $22 billion in 2012, manages approximately 400 million

square feet on behalf of institutional, corporate and private clients and supports more than 23,000

domestic corporate services locations. Cassidy Turley serves owners, investors and tenants with a full

spectrum of integrated commercial real estate services—including capital markets, tenant

representation, corporate services, project leasing, property management, project and development

services, and research and consulting. Cassidy Turley enhances its global service delivery outside North

America through a partnership with GVA, giving clients access to commercial real estate professionals

in 65 international markets. Please visit www.cassidyturley.com for more information about Cassidy

Turley.

Cassidy Turley San Diego

Cassidy Turley San Diego

4350 La Jolla Village Drive, Suite 500

San Diego, CA 92122

T 858.625.5235

F 858.630.6320

CA License 01785014

The information contained within this report is

gathered from multiple sources considered to be

reliable. The information may contain errors or

omissions and is presented without any warranty

or representations as to its accuracy.

Copyright © 2013 Cassidy Turley.

All rights reserved.

cassidyturley.com/sandiego