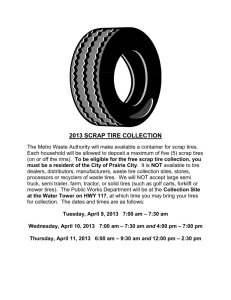

2000 annual report - Goodyear Corporate

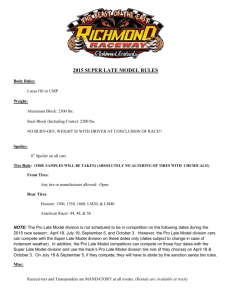

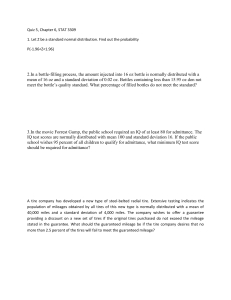

advertisement